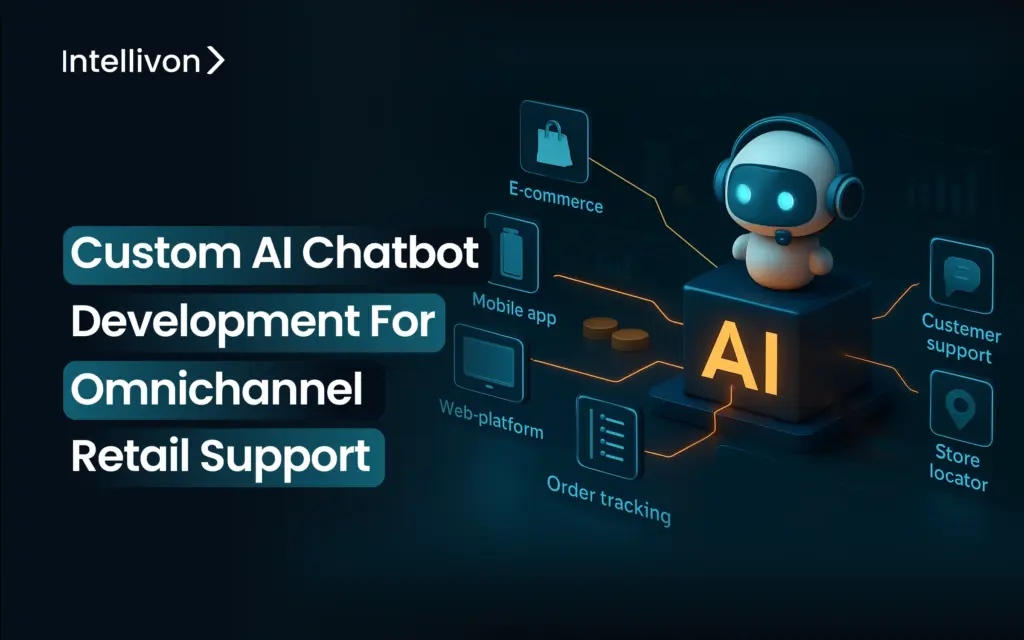

Custom AI Chatbot Development for Omnichannel Retail Support

Chatbots are taking over the global retail enterprise space as customer demands evolve and hyper-personalized product suggestions become prominent. In this changing retail landscape, retail

AI in Finance: Custom Risk Tools for Enterprise

Financial enterprises are entering a period dominated by fast-changing rules, more cyber threats, and a more complex dynamic market. Traditional standardized risk management tools no