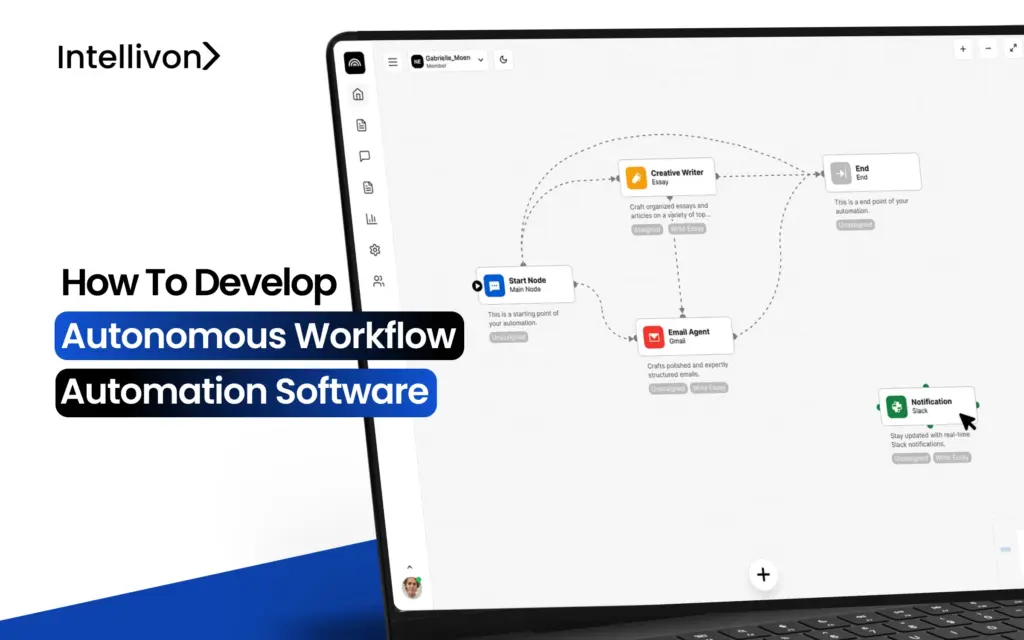

Develop Autonomous Workflow Automation Software for Large Enterprises

Operational complexity is at a breaking point right now. Global supply chains span multiple continents, and regulatory requirements demand constant real-time accuracy. Yet many companies

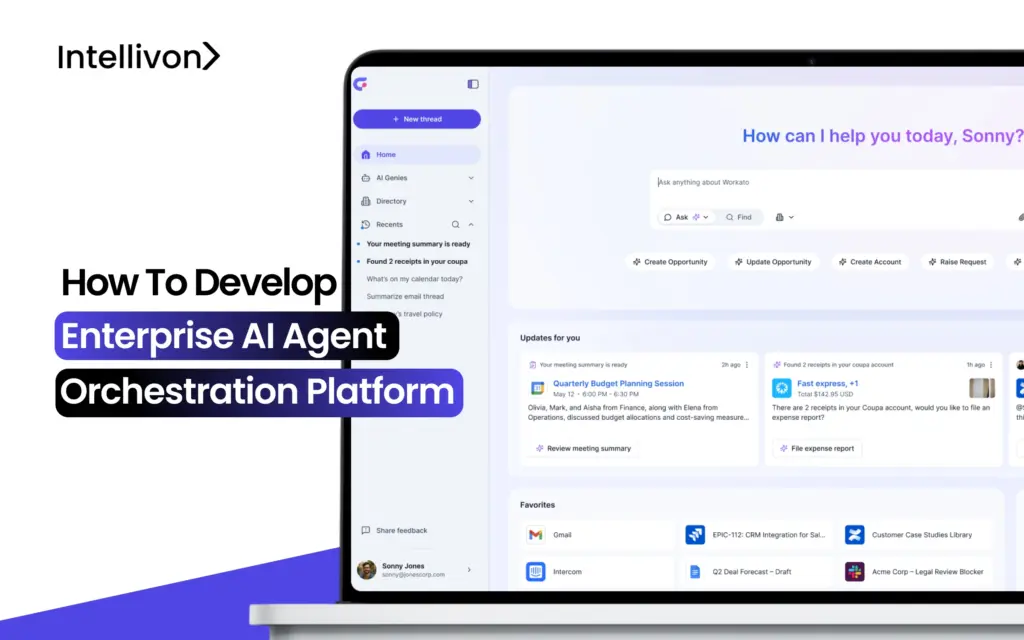

How to Develop an Enterprise AI Agent Orchestration Platform

AI adoption has become a double-edged sword for enterprises today. On one side, there’s pressure to launch chatbots, analytics tools, and automation systems. On the

Building Enterprise AI Agents: Features, Use Cases, and ROI

AI agents are quickly becoming essential for modern business operations. They provide a high level of efficiency, automation, and scalability. Unlike traditional tools that remain

Cost to Build an Enterprise Fintech Software

The fintech revolution has now turned into the foundation of modern finance. Instant payments, effortless user experiences, and airtight security have become the baseline. For

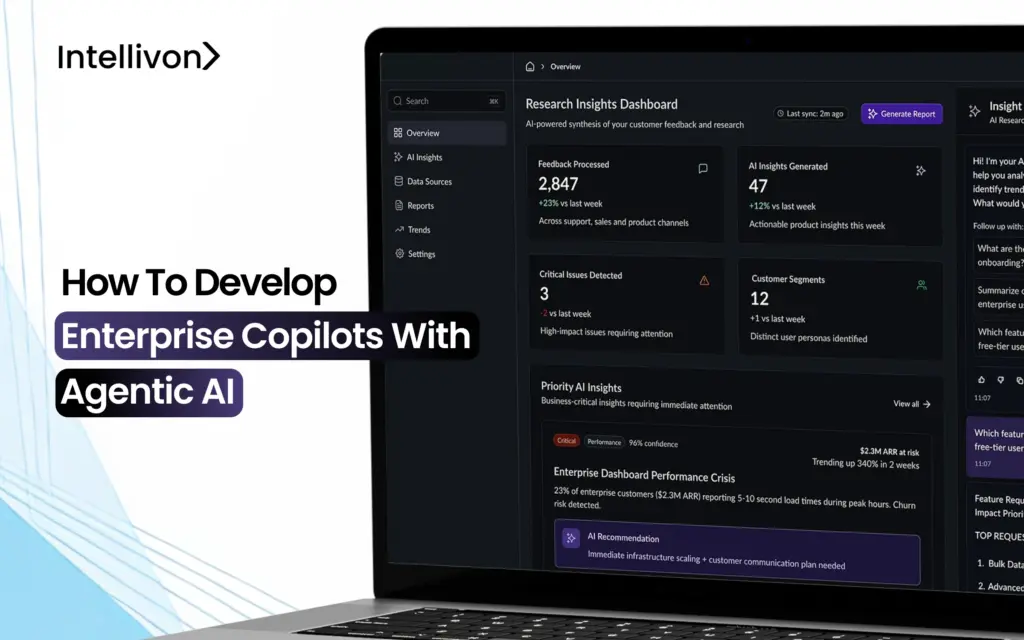

How to Develop Enterprise Copilots with Agentic AI

Enterprise copilots have quickly shifted from boardroom concepts to operational necessities. By 2026, Gartner predicts that 40% of large enterprises will run them as core

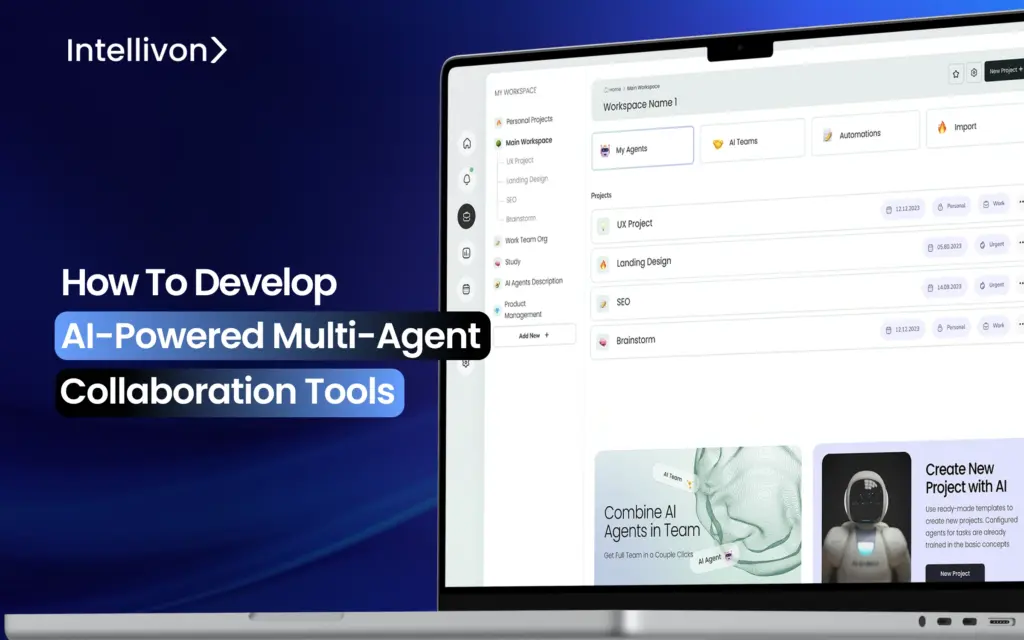

How to Develop AI-powered Multi-agent Collaboration Tools

As a business leader, you might have seen your teams spend hours on manual tasks, trying to interpret inconsistent data, and come up with incomplete