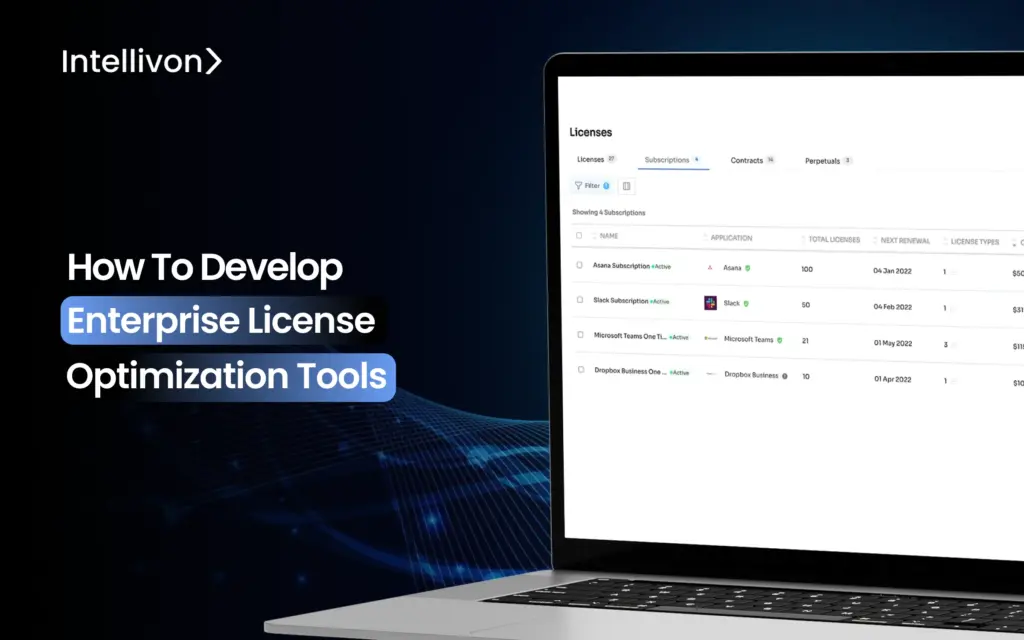

How To Develop Enterprise License Optimization Tools

In enterprises with multiple SaaS subscriptions, most licenses sit unused, and teams continue to request more seats. Nobody knows which tools overlap or who still

How to Develop an Enterprise Tokenization Solution

Legacy systems in enterprises are becoming too slow to manage important assets, contracts, and records, and are heavily dependent on intermediaries, which puts their privacy

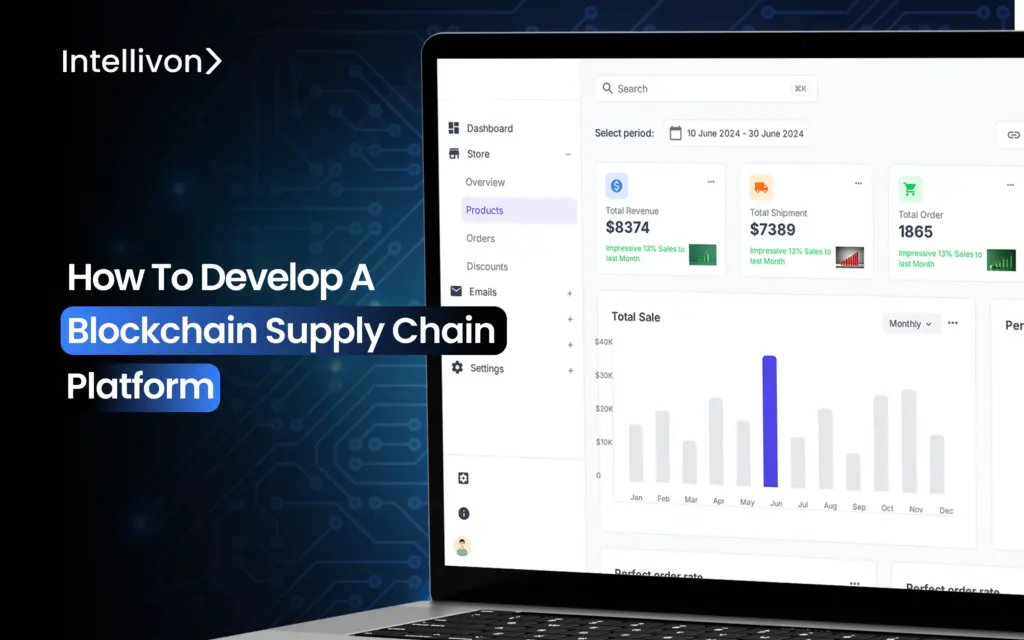

How to Develop a Blockchain Supply Chain Platform

It is hard to keep track of goods moving through a global supply chain. This is because when these products cross regions, data often gets

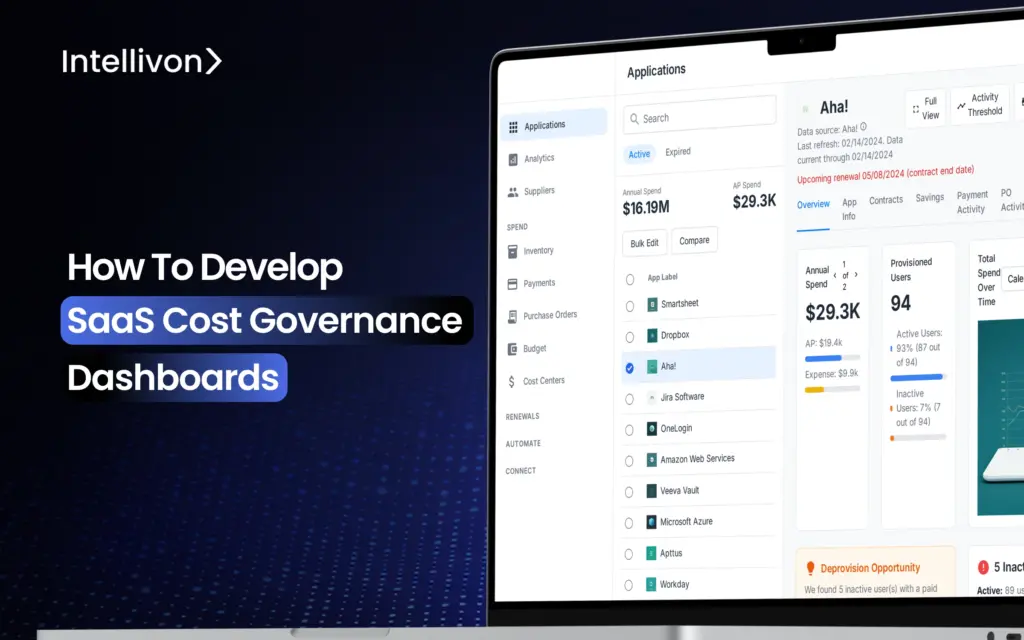

How To Develop SaaS Cost Governance Dashboards

Achieving complete visibility and control over SaaS spending is fundamental to the financial and operational stability of an enterprise. As they adopt hundreds of SaaS