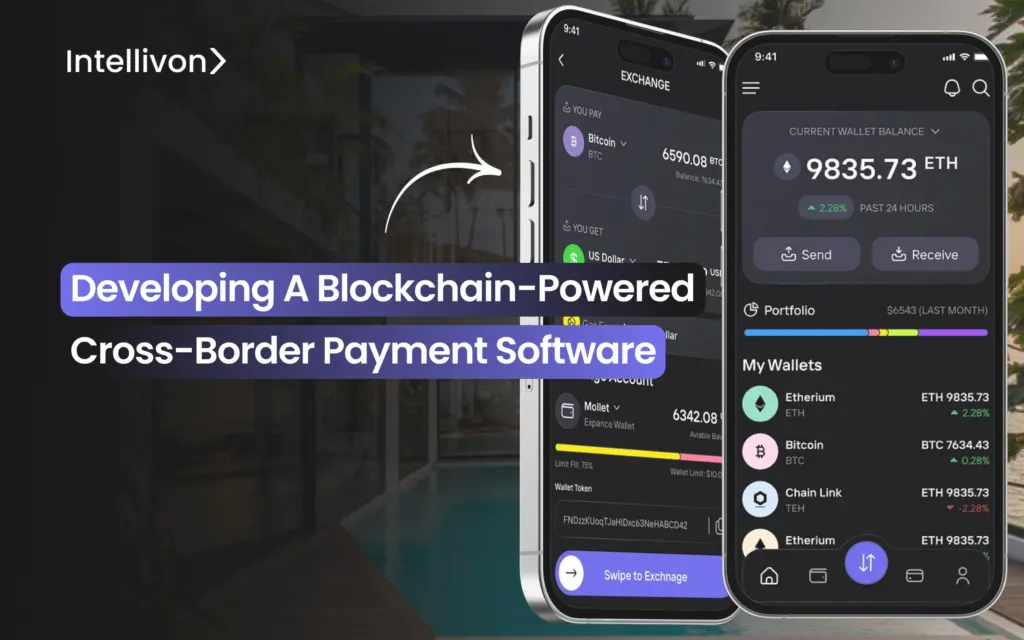

Developing a Blockchain-Powered Cross-Border Payment Software

Moving money across borders still feels slow and complicated when legacy systems take days to pass through multiple intermediaries, and pile on heavy compliance checks.

How to Build a Tokenized Real-Estate Investment Platform

Most real estate enterprises face the same issue of having their most valuable assets trapped in systems designed for yesterday’s problems. In these situations, raising