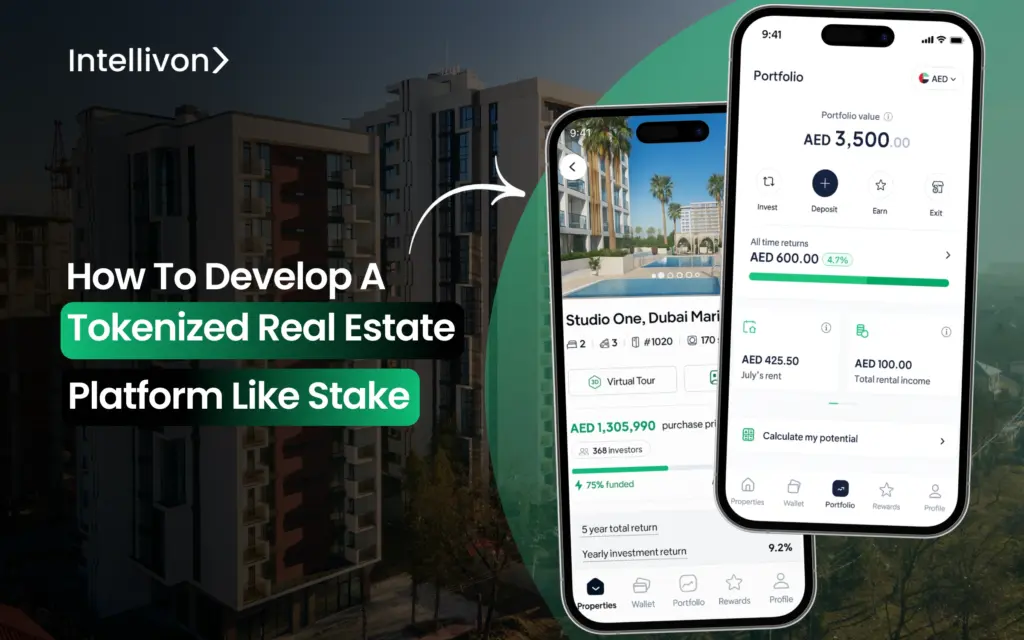

How To Develop A Tokenized Real Estate Platform Like Stake

Real estate has been an attractive asset class, but investing in it has always been complex. High entry barriers, limited liquidity, and endless paperwork make

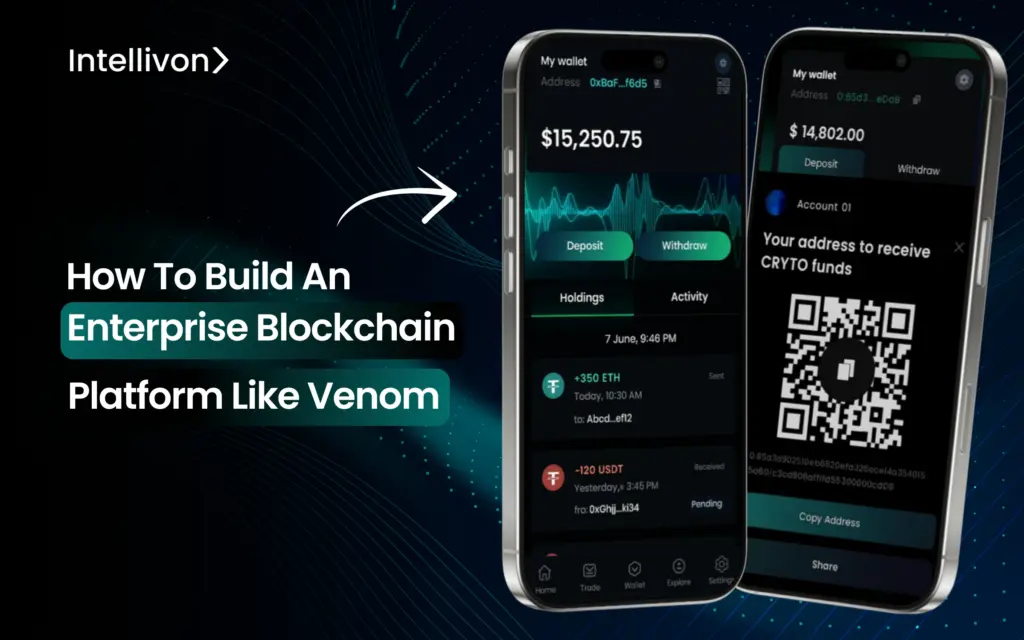

How to Build an Enterprise Blockchain Platform Like Venom

Businesses that explore blockchain encounter roadblocks such as platforms that promise scale but falter under real-world demand, solutions that deliver speed but compromise compliance, and