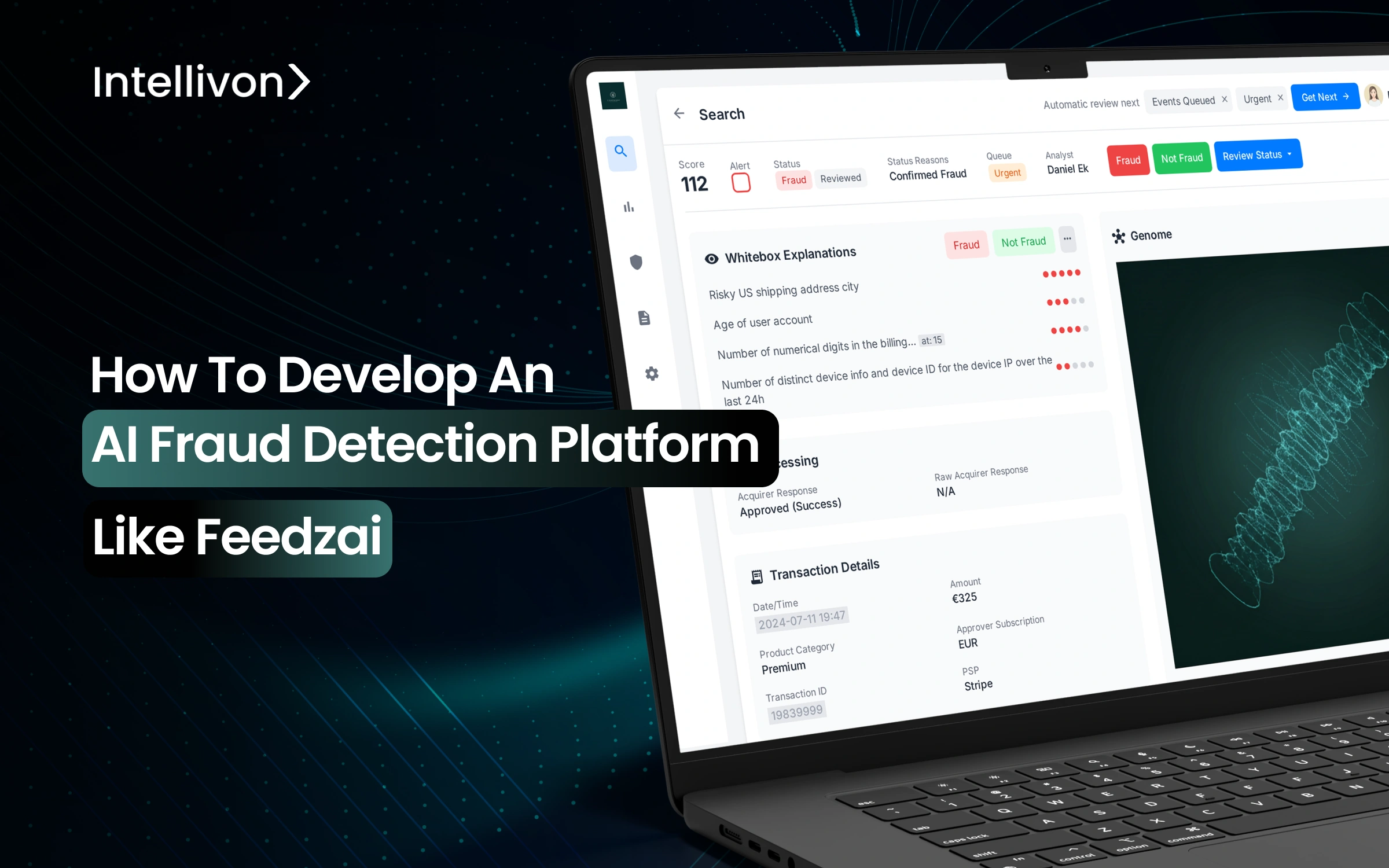

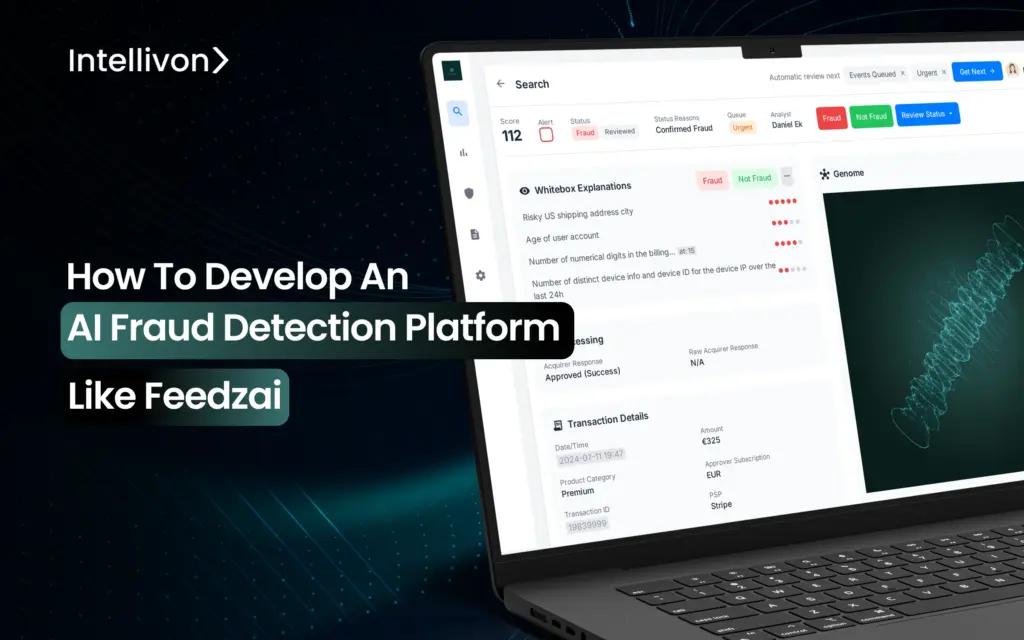

How to Develop an AI Fraud Detection Platform Like Feedzai

Fraud is now a business crisis, more than just a tech problem. Today’s fraudsters can build synthetic identities, hijack accounts in real time, and run mule networks that slip past traditional rule-based systems. This results in billions in losses, rising regulatory fines, and legitimate customers getting blocked. That’s why Feedzai became the gold standard by using machine learning, behavioral analytics, and real-time risk scoring. It processes millions of transactions per second and stops fraud before it happens, all with explainable AI that regulators can trust. That’s why tier-one banks, payment processors, and e-commerce platforms rely on it. At Intellivon, we help enterprises build AI fraud detection platforms tailored to their specific risks, integrated into their existing infrastructure, and designed to scale without breaking. In this blog, we’ll walk you through how Feedzai operates, what sets it apart, and how we develop a fraud detection system for your enterprise that becomes a strategic asset, driving trust, reducing friction, and protecting revenue. Key Takeaways of the AI-Powered Fraud Detection Market The AI in fraud management market has grown rapidly in recent years. Valued at $13.05 billion in 2024, it is projected to reach $15.64 billion in 2025, reflecting a strong CAGR of 19.8%. This growth shows how enterprises are prioritizing advanced fraud prevention as a core part of their digital strategy. 65% of businesses remain unprotected against even basic bot-driven fraud, making AI-based detection no longer optional but a core business requirement. Enterprises adopting AI-powered fraud systems report up to 4x higher detection rates while cutting false alerts by nearly 50%, driving measurable reductions in operational costs and direct losses. The broader AI fraud management market is projected to surpass $65.3 billion by 2034, growing at an 18% CAGR, which is a clear signal that fraud prevention technology is now a strategic enabler for enterprises. Investing in a fraud detection platform modeled after Feedzai is a growth strategy. Enterprises gain: Higher fraud detection accuracy with fewer false positives. Reduced financial losses and compliance exposure. Scalable architecture capable of supporting billions of transactions. Improved customer trust through seamless, low-friction fraud prevention. With fraud losses escalating globally and AI-powered scams growing more advanced, adopting a Feedzai-like platform positions enterprises ahead of both regulatory risk and market competition. The ROI is not only in fraud reduction but also in the ability to compete confidently in a trust-driven digital economy. Why Feedzai Became the Benchmark in AI Fraud Detection Feedzai is often cited as the industry standard in AI-driven fraud prevention. What sets it apart is not just the depth of technology, but how it translates into enterprise outcomes, including scalability, compliance, and measurable fraud reduction. 1. Trusted by Global Financial Institutions Tier-one banks, payment providers, and digital commerce platforms use Feedzai to safeguard billions of transactions. Institutions like Citi, Lloyds, and Revolut rely on it because it can handle the complexity of modern fraud without slowing down customer experience. Trust at this scale signals reliability that few platforms can match. 2. Real-Time Decisioning at Scale Feedzai’s engine delivers risk scoring in under 50 milliseconds, even across millions of daily transactions. That speed matters. Delays can frustrate customers or create transaction drop-offs. Feedzai shows that real-time protection and customer convenience can co-exist when the architecture is designed for low-latency performance. 3. Hybrid AI Approach Fraud patterns evolve constantly. Feedzai uses a hybrid model of supervised, unsupervised, and reinforcement learning to cover both known and emerging fraud tactics. This adaptability minimizes blind spots and helps enterprises stay ahead of fraudsters without endless manual updates to rules. 4. Explainable and Regulator-Friendly Fraud detection cannot be a “black box.” Regulators and auditors demand clear explanations for every blocked or flagged transaction. Feedzai integrates explainable AI (XAI), making every decision traceable and auditable. This capability not only satisfies compliance frameworks like GDPR and PSD2 but also builds enterprise trust internally. 5. Analyst-Driven Case Management Technology alone cannot close every fraud case. Feedzai equips fraud teams with dashboards, alerts, and investigation tools. Analysts can review, escalate, or override decisions quickly. More importantly, their feedback loops back into the system, continuously improving model performance. Feedzai became the benchmark because it solved the two hardest challenges in fraud detection: scaling intelligence across billions of transactions while keeping regulators and customers satisfied. That combination is rare, which is why enterprises look to replicate its model when building their own platforms. Decoding Feedzai: How the Platform Works Feedzai is more than a fraud detection tool. It is an enterprise platform designed to handle scale, compliance, and continuous learning. Understanding how it works provides a clear blueprint for enterprises that want to build something similar. 1. Data Ingestion and Orchestration The platform starts by unifying data streams. It pulls information from payment gateways, customer accounts, devices, biometrics, and even geolocation. By orchestrating these diverse inputs into a single data fabric, Feedzai eliminates blind spots that fraudsters exploit. For an enterprise, this means designing ingestion pipelines that capture both structured and unstructured data in real time. Tools like Apache Kafka or Flink often support these architectures. 2. AI and Machine Learning Models Feedzai applies multiple layers of AI. Supervised machine learning models that handle known fraud scenarios. Unsupervised models identify anomalies that don’t match past behavior. Reinforcement learning continuously adapts based on new threats. This multi-pronged approach allows the system to detect both established fraud patterns and emerging tactics that traditional systems miss. Enterprises seeking to replicate this must invest in diverse model stacks rather than relying on a single algorithm. 3. Real-Time Decisioning Speed is the difference between catching fraud and letting it through. Feedzai’s decisioning layer evaluates transactions in less than 50 milliseconds. Each event receives a risk score, which determines whether it is approved, flagged, or blocked. To achieve this, enterprises need low-latency infrastructure and microservices that can handle spikes in transaction volume without downtime. 4. Explainability and Compliance Alignment Every fraud decision must stand up to regulatory scrutiny. Feedzai integrates explainable AI, giving clear reasons why a transaction was flagged. This

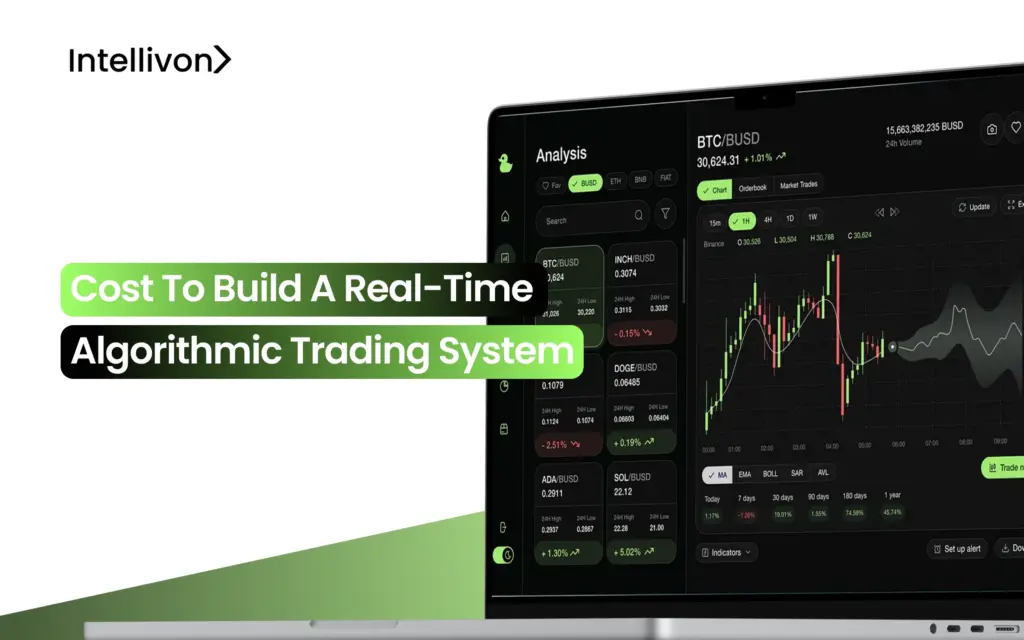

Cost to Build a Real-Time Algorithmic Trading System

Building a real-time algorithmic trading system is a high-stakes financial decision. What starts as a conversation about code and architecture quickly shifts to questions about capital allocation, risk tolerance, and competitive advantage. The real costs aren’t always obvious upfront. This is because, beyond the initial development sprint, you are looking at ongoing expenses that include ultra-low-latency infrastructure, live market data subscriptions, regulatory overhead, and 24/7 operational support. For leadership teams, the critical question rests with “Which investments will actually move the needle, and where are we at risk of burning budget on things that don’t?” At Intellivon, we’ve helped enterprises navigate exactly these kinds of decisions by building trading platforms that scale intelligently, stay compliant without bloat, and keep operating costs predictable over time. In this guide, we will break down the real cost drivers, flag the hidden expenses most people miss, and explain how we build these systems from the ground up. Key Takeaways of the Algorithmic Trading Market The global algorithmic trading market was valued at USD 21.06 billion in 2024 and is projected to nearly double, reaching USD 42.99 billion by 2030 at a CAGR of 12.9%. This growth reflects how critical algorithmic systems have become for institutions seeking faster execution, deeper liquidity, and more competitive trading strategies. Algorithmic trading already accounts for over 60% of trading volume in major markets like the US and Europe. India saw 7.2 million trading app downloads in early 2024, up 47% year-over-year, showing retail adoption at scale. By 2027, cloud-based deployments are expected to make up 55% of implementations, enabling faster rollouts and lower costs. High-frequency algorithms now execute trades in milliseconds, exploiting inefficiencies that manual traders cannot capture. 80% of enterprises integrating AI and machine learning into strategies report improved accuracy and reduced risk. Compliance remains a rising cost, with audit expenses projected to grow 20% annually, increasing demand for automated, transparent reporting. Enterprises that invest strategically in real-time trading infrastructure have seen ROI payback periods as short as 18–24 months. Faster execution, fewer errors, and compliance readiness turn these platforms into not just technology upgrades, but long-term profit engines. What is a Real-Time Algorithmic Trading System? A real-time algorithmic trading system is a platform that uses advanced algorithms to execute trades in milliseconds. It processes live market data, identifies opportunities, and places orders faster than any human trader could manage. These systems are designed to make decisions automatically. Instead of relying on manual analysis, they apply pre-defined rules, statistical models, or machine learning to spot trading patterns and act instantly. For enterprises, the benefit lies in consistency, speed, and the ability to capture even the smallest market inefficiencies. Core Capabilities A real-time system typically includes: Market Data Ingestion: Capturing live price quotes, order book updates, and news feeds. Signal Generation: Algorithms that detect patterns and decide when to buy or sell. Order Execution: Direct connections to exchanges through protocols like FIX or native APIs. Risk Controls: Safeguards that enforce limits, stop trades, or flag anomalies. Monitoring Tools: Dashboards for P&L tracking, latency checks, and regulatory reporting. Together, these capabilities create a trading engine that runs continuously, adapting to market shifts with precision. For leadership teams, the value comes from turning speed and automation into measurable financial performance. How Does a Real-Time Algorithmic Trading System Work? A real-time algorithmic trading system follows a structured flow. Each layer of the system plays a critical role in transforming raw market data into profitable trades. The process starts with information capture and ends with execution, monitoring, and continuous feedback. 1. Market Data Acquisition The system begins by collecting live data feeds directly from exchanges. This includes prices, order book movements, and relevant news signals. Enterprises often pay for direct exchange feeds to cut latency, as even a few milliseconds can change profitability. 2. Signal Generation Algorithms process incoming data to identify opportunities. Strategies may use statistical models, technical indicators, or AI-driven prediction models. Once a signal is detected, the system decides whether to buy, sell, or wait. 3. Order Execution and Management The platform connects to exchanges through high-speed protocols like FIX or native APIs. Orders are routed instantly, with execution engines ensuring the lowest possible delay. Smart order routing and slicing techniques are used to minimize market impact. 4. Risk Management and Compliance Built-in safeguards enforce exposure limits and prevent runaway trades. Kill switches, margin checks, and pre-trade controls ensure the system stays within compliance frameworks. This protects enterprises from costly fines and reputational risk. 5. Feedback and Monitoring Finally, results are tracked in real time. Dashboards highlight profit and loss, latency performance, and exceptions. Continuous feedback loops allow strategies to adapt and improve without manual intervention. The flow is simple, which involves capturing data, generating signals, executing orders, managing risk, and monitoring results. Each step builds on the last, ensuring trades happen quickly and safely. With this flow in mind, the next step is to look at the key features that make such a system enterprise-ready. Key Features of a Real-Time Algorithmic Trading System in sync to deliver precision, scale, and compliance. Each feature addresses a different enterprise need, from rapid execution to transparent reporting. Together, they determine both the cost to build and the ROI potential. 1. Market Data Ingestion Every trading decision starts with data. The ingestion layer collects live price quotes, order book updates, and tick-by-tick movements from exchanges. Many enterprises pay for direct exchange feeds, which are faster but significantly more expensive than vendor data streams. The system must also handle alternative sources, such as news sentiment or macroeconomic feeds, that influence trading signals. Robust ingestion prevents delays because even milliseconds of lag can erode profits. 2. Strategy Execution Engine This is the decision-making brain of the platform, since it applies algorithms built on statistics, technical models, or machine learning. A well-architected engine ensures trades execute instantly when signals appear. Enterprises often require the flexibility to run multiple strategies at once, like equities, FX, derivatives, or crypto, without slowing performance. Scalability here drives costs upward,