Risk management is no longer an option for enterprises to upgrade. Enterprise risk management, or ERM, in the modern data-driven space has crossed over the boundaries of finance to include operations, strategies, and reputation management. Moreover, the risk landscape can change within hours these days, which took months in the past. If a risk is not detected in time, it can lead to an unimagined crisis.

Take, for instance, Southwest Airlines reported that the December 2022 systems failure cost the company approximately $800 million in the fourth quarter, which led to a net Q4 loss of $220 million. Risk managers said that had they employed predictive analytics, they could have avoided this blunder. Overall enterprise AI adoption rose from 54% in 2023 to 64% in 2024 and will continue to skyrocket as more enterprises integrate AI-powered ERM systems, which are proactive rather than reactive. If modern risks demand modern AI ERMs, why does your risk team still fight tomorrow’s threats with yesterday’s tools?

In this blog, we will cover why AI-powered ERM’s outperform traditional approaches, how AI transforms ERM, key ERM-based AI tech stack, our framework for managing ERM, and some challenges to overcome. At Intellivon, we take into consideration the unique challenges your enterprise faces and align your KPIs to generate custom AI-based risk management solutions.

Why Leading Enterprises Are Using AI in Risk Management

The Enterprise Risk Management (ERM) market is expected to grow significantly, from USD 5.93 billion in 2025 to USD 9.36 billion by 2034. According to the Market Research Future report, this growth reflects a steady annual increase of 5.20% during the forecast period.

As more and more enterprises are using AI to guide their risk management strategies, take a look at these staggering numbers:

- By 2024, 64% of enterprises will have adopted AI, up from 54% in 2023, with many incorporating it into risk management.

- In financial services, 76% of executives prioritize AI for fraud detection and prevention, and 68% focus on it for compliance and risk management.

- 88% of global organizations are actively measuring the value of AI adoption, focusing on ROI and impact.

- 98% of CEOs believe AI in risk management will bring immediate business benefits, improving decision-making and risk mitigation.

AI is reshaping risk management frameworks, making them stronger and more proactive. Instead of merely reacting to crises, businesses can now predict potential risks, stop them from escalating, and make informed decisions that protect both their operations and reputation. The ability to anticipate risks is already giving organizations a competitive advantage as they move into 2025.

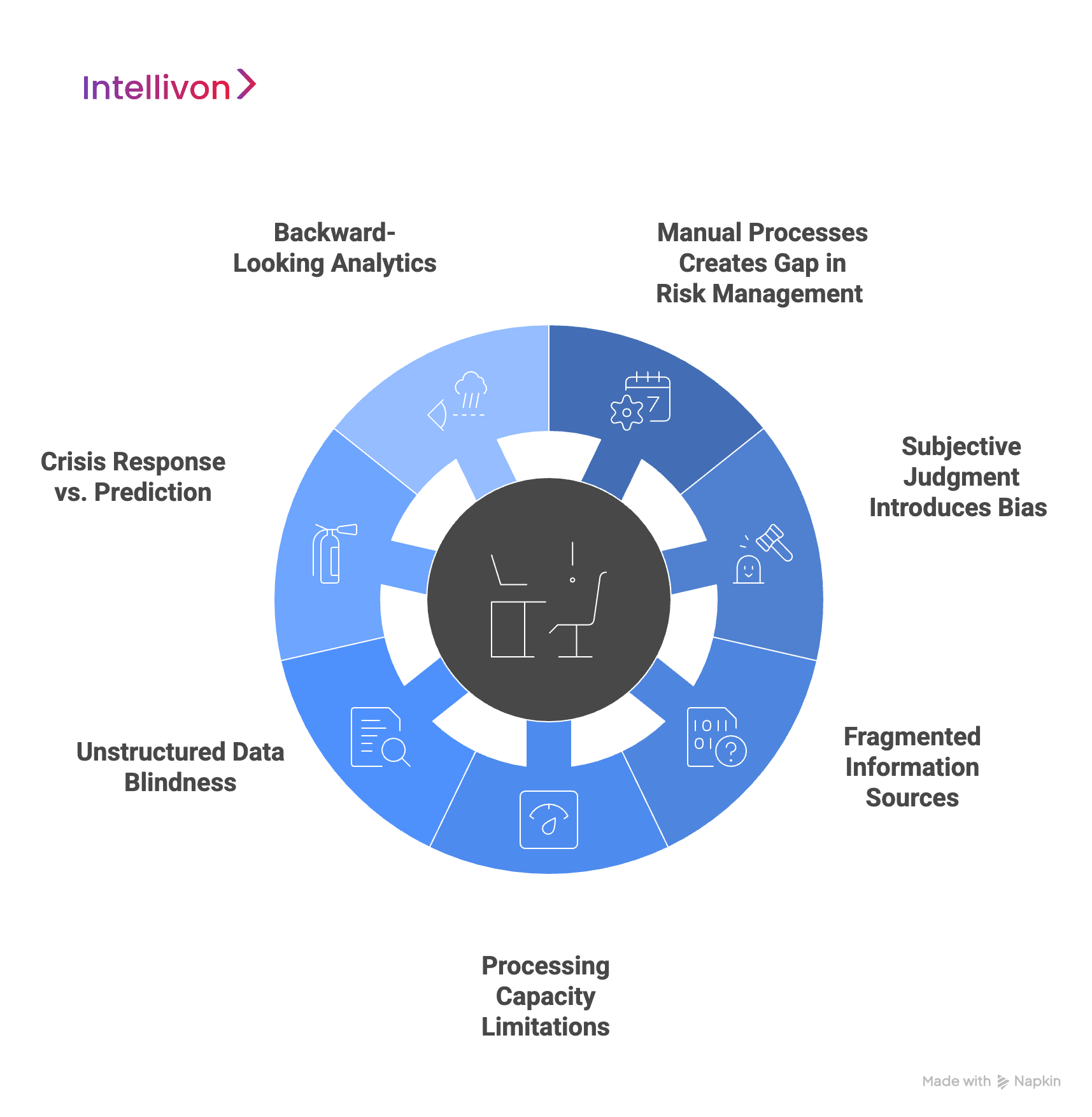

Limitations of Traditional Risk Management Approaches

In an era where data is vast and threats are more unpredictable, relying on outdated processes and rigid models leaves enterprises vulnerable to unforeseen risks. The limitations of traditional methods are becoming more apparent, exposing enterprises to the risk of blind spots, misallocated resources, and slow reactions to emerging challenges.

1. Manual Processes Create Gaps in Risk Management

Traditional risk management often relies on time-consuming manual processes and periodic assessments. Typically conducted quarterly or annually, these reviews leave businesses exposed to fast-moving threats that may evolve between evaluations. Risk managers must spend considerable time compiling data and generating reports, which means real-time risks can be missed, leaving gaps in the overall risk assessment.

2. Subjective Judgment Introduces Bias

Human biases can significantly skew risk assessments. Decision-makers may unintentionally prioritize risks they are most familiar with or that are more easily identifiable, while neglecting newer or less obvious threats. Cognitive biases like anchoring or availability heuristic can lead to improper risk allocations, leaving businesses vulnerable to underestimating potential dangers and misdirecting valuable resources.

3. Fragmented Information Sources

In many organizations, data is trapped in various silos across departments, making it difficult to get a comprehensive view of risks. Financial data, operational metrics, and compliance information often remain isolated, and risk managers struggle to piece together seemingly unrelated data points that could indicate systemic threats. This lack of connectivity hinders the ability to see the bigger picture and respond appropriately.

4. Processing Capacity Limitations

The sheer volume of data generated by modern enterprises is overwhelming. Traditional risk management systems are ill-equipped to handle this immense flow of information. They struggle to process and analyze data fast enough to detect patterns, correlations, or emerging risks in time to prevent damage. As a result, organizations can miss out on key insights that might have allowed them to respond proactively.

5. Unstructured Data Blindness

Traditional risk management systems also fail to analyze unstructured data effectively. Much of the most valuable risk-relevant information resides in emails, social media, news articles, and regulatory filings, formats that conventional tools cannot process. Without the ability to capture and analyze these data sources, risk managers risk missing early warning signs that could help prevent or mitigate damage.

6. Crisis Response vs. Prevention

While traditional risk management excels at responding to crises once they have materialized, it falls short when it comes to proactive prevention. By the time risks show up on conventional dashboards, the damage is often already done, and options for mitigation are limited. This reactive approach leaves businesses vulnerable to escalating threats that could have been avoided with earlier intervention.

7. Backward-Looking Analytics

Many traditional risk models rely on historical data to predict future risks. However, this backward-looking approach fails to account for unpredictable, unprecedented events, such as cyberattacks or supply chain disruptions, that do not follow past patterns. Relying solely on historical data models leaves organizations unprepared for the unique challenges posed by rapidly changing environments.

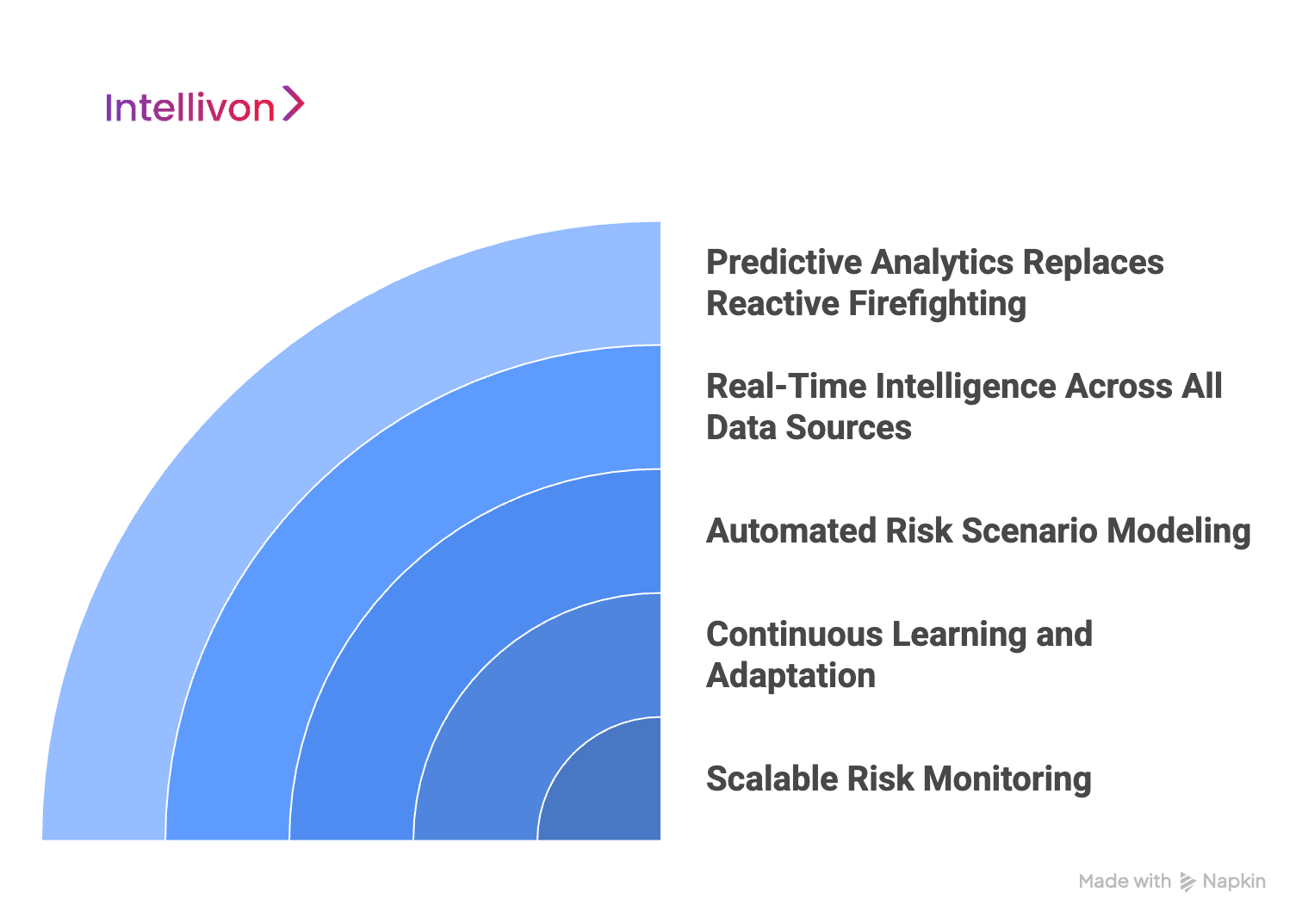

How AI Transforms Enterprise Risk Management

AI is revolutionizing the way businesses approach risk management. By integrating cutting-edge technology, companies can move beyond reactive strategies and develop proactive, data-driven approaches to mitigate potential risks. This transformation is reshaping traditional risk management methods, empowering organizations to anticipate threats and respond strategically.

1. Predictive Analytics Replaces Reactive Firefighting

AI shifts risk management from responding to crises to preventing them. Through machine learning algorithms, AI analyzes historical patterns, market trends, and operational data to forecast risks weeks or even months in advance.

This continuous flow of insights allows businesses to make informed decisions long before a potential threat becomes a crisis. Rather than waiting for quarterly reports, risk managers can now act proactively, turning them into strategic advisors who steer the company away from looming risks.

2. Real-Time Intelligence Across All Data Sources

AI systems break down traditional information silos by processing both structured and unstructured data from every department in the organization. NLP helps analyze external sources like news, regulatory updates, and social media, while machine learning models track internal metrics such as financial performance and operational data.

By aggregating all of this information into a unified platform, AI ensures that businesses have a comprehensive, real-time view of their risk landscape, helping them stay ahead of emerging threats.

3. Automated Risk Scenario Modeling

AI enhances risk assessment by simulating thousands of potential scenarios based on real-time data. These advanced models consider how various factors like market fluctuations, supply chain issues, or regulatory changes, could combine to create compounded risks.

By providing probabilistic forecasts and mitigation strategies, AI supports decision-makers in allocating resources efficiently and planning more effectively for the future.

4. Continuous Learning and Adaptation

Unlike static traditional risk models, AI systems are adaptive and continuously improve. Each new data point or risk event helps the system learn and refine its predictions, making risk management more sophisticated over time.

As these systems learn from both internal company data and external global events, their predictive capabilities become more accurate, allowing businesses to respond faster to emerging risks.

5. Scalable Risk Monitoring

AI enables enterprises to monitor an expansive range of risk indicators simultaneously, without needing to add extra human resources. Automated alerts prioritize critical threats, allowing risk teams to focus on strategy rather than data analysis. This scalability ensures that risk management can keep pace with growing data volumes and increasing complexity.

Through AI, enterprises gain the ability not only to manage risks more effectively but to predict and prevent them, positioning themselves for greater stability and success.

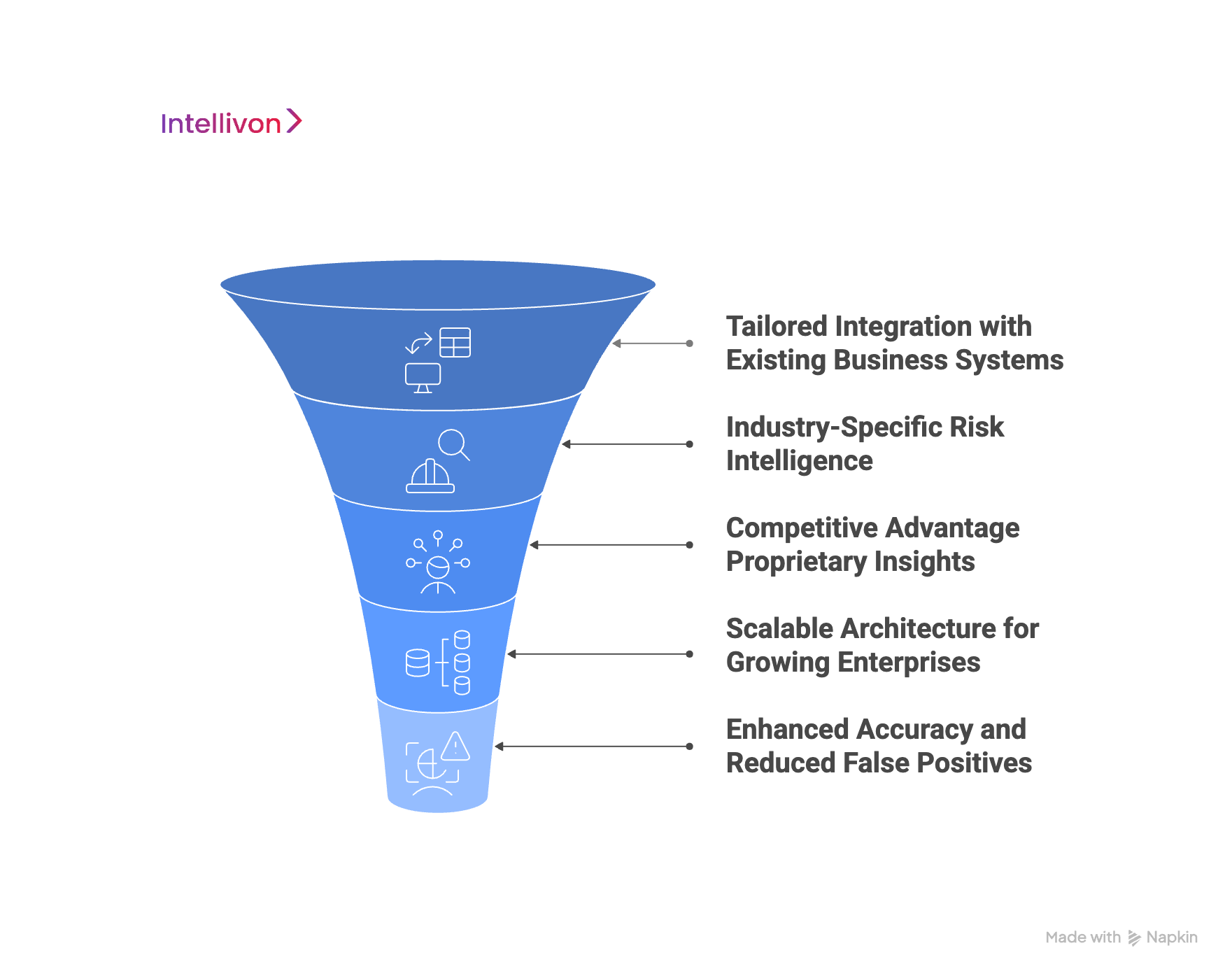

Benefits of Custom AI Solutions in Risk Management

Custom AI solutions offer businesses a tailored approach to risk management that goes far beyond generic, off-the-shelf software. By aligning with a company’s unique needs, these solutions enable more precise, effective, and scalable risk management. Here’s how custom AI can transform risk assessment and mitigation for your business.

1. Tailored Integration with Existing Business Systems

Custom AI solutions integrate smoothly with your existing business systems, from ERP platforms to compliance tools. Unlike generic software that often requires costly and disruptive overhauls, tailored AI adapts to your current workflows and data structures. This seamless integration ensures that your previous investments are preserved while expanding your capabilities. Moreover, the AI is fine-tuned to your specific industry, risk categories, and regulatory needs from the start, making it easier to implement and use effectively.

2. Industry-Specific Risk Intelligence

While generic risk management tools treat all industries the same, custom AI solutions are built with industry-specific data in mind. Whether you’re in healthcare, finance, or manufacturing, custom AI can identify the unique risk factors that apply to your sector. For example, a pharmaceutical company will have different compliance and regulatory risks compared to a financial institution. Custom AI solutions understand these differences, allowing for more accurate threat detection, fewer false positives, and more relevant recommendations based on your industry’s specific needs.

3. Competitive Advantage Through Proprietary Insights

One of the key benefits of custom AI is its ability to generate proprietary insights that give your business a competitive edge. By using your own data, combined with tailored algorithms, the AI creates unique risk intelligence that competitors cannot replicate. This proprietary knowledge helps improve decision-making, optimize resource allocation, and refine strategic planning, enabling your business to stay ahead of potential threats. While competitors may rely on generic solutions, your custom AI provides insights specific to your business context, giving you an advantage in the market.

4. Scalable Architecture for Growing Enterprises

As your business evolves, so too should your risk management capabilities. Custom AI solutions are designed to scale with your organization, adapting to new business lines, geographic expansion, and shifting risk landscapes. The flexible architecture can handle growing data volumes, additional risk categories, and changing regulatory requirements without requiring a complete system overhaul. This scalability ensures your risk management system remains aligned with your business needs and protects your technology investments in the long term.

5. Enhanced Accuracy and Reduced False Positives

Custom AI solutions deliver superior accuracy by learning from your organization’s specific data patterns. Unlike generic tools that may produce numerous false alarms, a custom system is trained to recognize your organization’s unique operating parameters. This results in fewer false positives and allows your risk management team to focus on legitimate threats. As a result, efficiency improves, response times are faster, and confidence in AI-driven decisions grows, making the entire process more effective.

Custom AI solutions provide businesses with tailored, precise, and scalable tools for better risk management. By adapting to your needs and industry, custom AI empowers you not only to manage risks effectively but also to stay ahead of emerging threats with actionable insights.

Key AI Technologies Revolutionizing Enterprise Risk Assessment

AI technologies are changing the landscape of enterprise risk management, offering businesses powerful tools to predict, detect, and mitigate risks with greater precision. Here’s how some of the leading AI technologies are transforming risk assessment practices.

1. Machine Learning Models for Risk Prediction

1. Supervised Learning Algorithms

Supervised learning algorithms rely on labeled historical data to predict future risks. These models are trained to recognize patterns from past incidents, making them particularly effective for forecasting risks like credit defaults, market fluctuations, and operational failures. By learning from specific examples, these models can predict similar threats that may arise in the future, helping businesses take proactive measures.

2. Unsupervised Learning Systems

Unsupervised learning systems can identify hidden patterns and anomalies in data without requiring pre-labeled examples. These algorithms are highly effective for detecting new or emerging risks, such as fraud or unusual behaviors, that have not been previously encountered. They help businesses stay ahead of risks that may otherwise go undetected using traditional methods.

3. Deep Learning Networks

Deep learning utilizes multi-layered neural networks to process complex, non-linear relationships within data. These networks are especially valuable when predicting compound risks, where multiple variables interact unpredictably. With their ability to handle vast amounts of data and intricate patterns, deep learning models provide superior accuracy in identifying and forecasting complicated risk scenarios.

2. Natural Language Processing for Risk Intelligence

1. Sentiment Analysis Engines

NLP models can analyze text from various sources, such as news, social media, and reports, to gauge market sentiment and potential threats. By detecting shifts in sentiment, these engines can uncover early warning signs of operational or reputational risks. Negative sentiment changes often precede significant business disruptions, allowing companies to act before a crisis emerges.

2. Document Intelligence Systems

AI-powered document intelligence tools can automatically extract risk-related information from contracts, regulatory filings, and internal communications. By identifying potential compliance gaps or contractual risks, these systems help businesses manage legal and regulatory challenges more effectively, reducing the risk of costly mistakes or penalties.

3. Real-Time News Monitoring

AI-driven systems continuously monitor global news feeds and social media platforms to identify emerging risks, such as geopolitical events, regulatory changes, or industry disruptions. By providing real-time alerts, businesses can respond swiftly to threats, helping them stay ahead of rapidly changing environments and reduce exposure to unforeseen risks.

3. Computer Vision for Operational Risk Monitoring

1. Manufacturing Process Surveillance

AI-powered cameras and computer vision systems monitor production lines for equipment malfunctions, quality defects, and safety violations. By identifying potential issues early, these systems prevent costly downtime and maintain operational continuity. Predictive maintenance alerts can also help avoid unplanned shutdowns and keep production running smoothly.

2. Workplace Safety Analytics

AI-driven computer vision systems are used to analyze employee behavior and workplace conditions to prevent accidents. These systems can identify unsafe practices, faulty equipment, or hazardous environmental conditions, enabling businesses to take corrective action before accidents occur and ensuring a safer workplace.

3. Infrastructure Integrity Assessment

AI systems can continuously monitor infrastructure for signs of wear and tear. Using visual AI, businesses can assess the integrity of buildings, equipment, and other physical assets for damage or maintenance needs. By scheduling predictive maintenance and identifying issues before they escalate, these systems prevent catastrophic failures and help businesses maintain operational efficiency.

4. Additional Key AI Technologies

1. Blockchain for Risk Transparency and Compliance

Blockchain technology ensures transparency, security, and traceability of transactions and records. By leveraging blockchain, enterprises can create immutable, tamper-proof logs of financial transactions, contracts, and compliance documents. This improves risk management by making it easier to track risks related to fraud, cybersecurity, and regulatory compliance. Blockchain’s decentralized nature also strengthens security, mitigating risks from data breaches and unauthorized access.

2. Robotic Process Automation (RPA) for Risk Mitigation

RPA helps streamline repetitive and time-consuming tasks, such as data entry, reporting, and compliance checks. By automating these routine processes, enterprises can minimize human error and reduce operational risks. RPA also frees up human resources to focus on more strategic aspects of risk management, allowing for faster and more accurate decision-making and risk mitigation.

3. Edge Computing for Real-Time Risk Monitoring

Edge computing processes data closer to the source, such as on IoT devices, instead of relying solely on centralized cloud systems. This enables real-time risk monitoring, especially in environments like manufacturing plants or field operations. Edge computing provides faster data processing and more immediate responses to potential threats, reducing delays and improving the speed of risk detection.

4. AI-Driven Cybersecurity Tools

As cyber threats grow increasingly sophisticated, AI-driven cybersecurity tools are becoming essential for managing digital risks. These tools use machine learning to identify unusual patterns in network traffic, detect potential cyberattacks, and respond to threats in real-time. AI-enhanced cybersecurity tools can autonomously react to risks, adapting to new, evolving threats, ensuring businesses are better equipped to protect their data and systems.

5. IoT (Internet of Things) for Risk Detection

IoT devices collect real-time data from physical assets, helping businesses detect operational risks before they escalate. For example, sensors on equipment can detect temperature changes, vibrations, or signs of wear and tear, triggering predictive maintenance alerts. By connecting IoT devices to AI-driven risk management systems, companies can monitor a wide range of risks, from equipment failures to environmental hazards, with greater accuracy and efficiency.

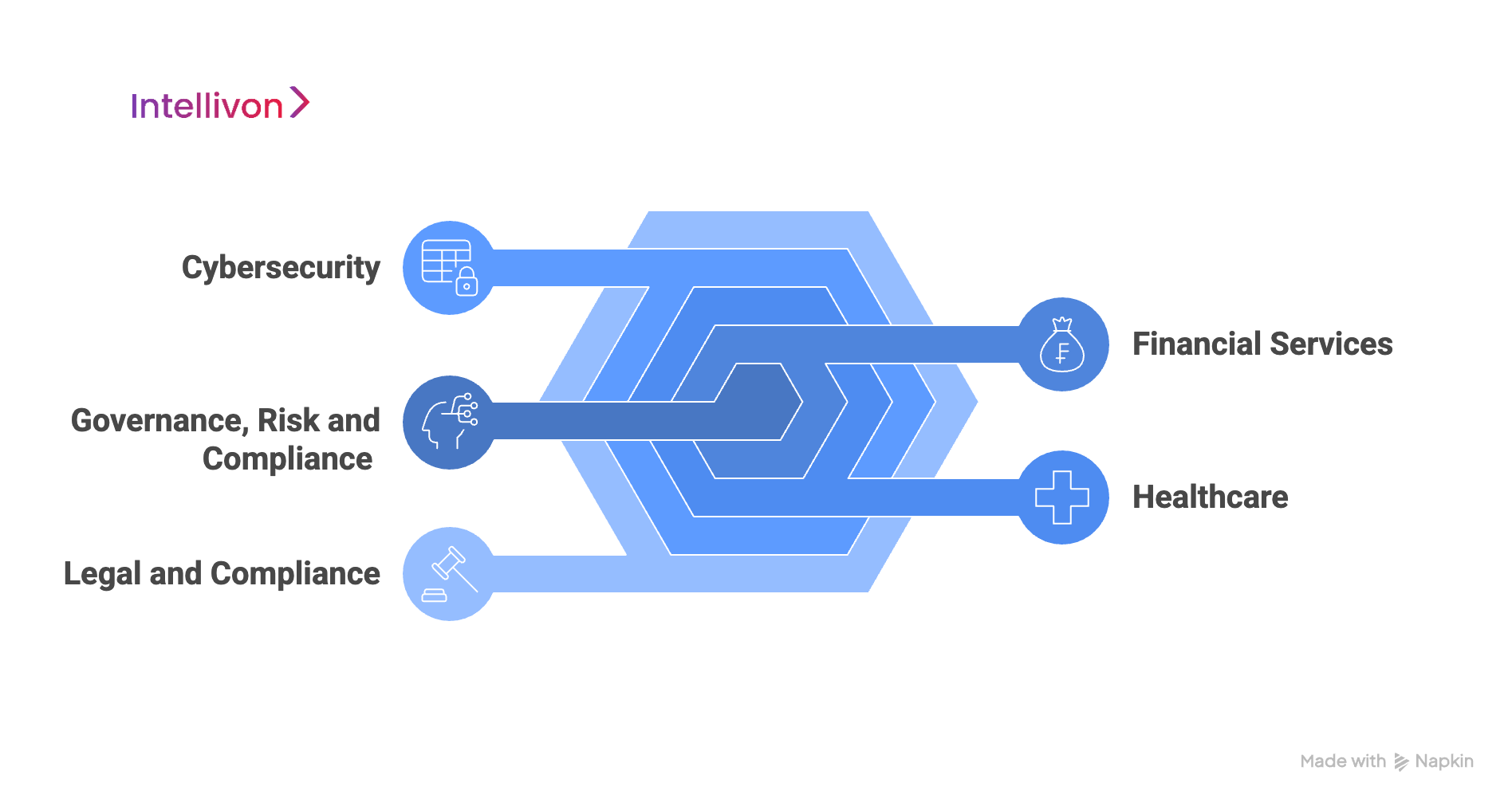

Industry-Specific AI Risk Management Applications

AI-powered risk management is transforming how industries identify, assess, and mitigate risks, offering tailored solutions that address unique sector challenges. Here’s how leading enterprises are leveraging AI in their risk management strategies:

1. Financial Services

1. Fraud Detection and Prevention

76% of financial services executives prioritize AI for fraud detection, using machine learning to analyze transaction data and identify suspicious patterns in real-time. AI systems can flag potentially fraudulent transactions before they cause harm, reducing financial losses and enhancing security.

2. Credit Scoring

AI-driven models assess a wider range of data points to provide more accurate creditworthiness evaluations. By incorporating alternative data like payment histories or social behavior, these models reduce lending uncertainty and default risk, offering a clearer picture of a borrower’s financial health.

3. Rogue Trading Prevention

AI-powered predictive analytics monitor trader behavior to identify anomalies that could signal rogue trading activities. These systems can intervene before unauthorized trades lead to significant financial losses, helping maintain stability and regulatory compliance within trading environments.

2. Healthcare

- Diagnostic Accuracy

AI-driven image recognition tools, such as those analyzing X-rays and scans, significantly reduce misdiagnosis risks. This technology ensures more accurate diagnoses, potentially saving the US healthcare system billions of dollars each year by avoiding costly mistakes.

- Personalized Risk Models

Machine learning algorithms create personalized risk assessments for patients, factoring in a range of medical history data and lifestyle factors. This enables healthcare providers to offer better preventive care and minimize liability for misdiagnoses, improving patient outcomes and reducing overall healthcare costs.

3. Cybersecurity

- Threat Intelligence and Prediction

AI systems process vast amounts of security logs and network data, identifying threats faster than traditional methods. Machine learning algorithms can adapt to new, evolving cyberattack strategies, enabling organizations to stay ahead of hackers and safeguard critical data.

- Automated Incident Response

AI-driven cybersecurity tools automatically detect security breaches and initiate responses to minimize damage. By automating incident responses, businesses can drastically reduce recovery time and the impact of data breaches, ensuring faster recovery and reduced costs.

4. Legal and Compliance

- Regulatory Risk Management

AI tools automate compliance monitoring to ensure that businesses stay up-to-date with shifting regulations. They flag potential non-compliance issues before they escalate, helping organizations avoid fines, legal risks, and operational disruptions associated with failing to meet regulatory requirements.

- Model Risk Management

AI systems are used to validate and stress-test financial and operational models, ensuring they comply with regulatory standards and reducing systemic risks. These tools allow companies to maintain confidence in their risk models while meeting compliance requirements set by regulatory bodies.

5. Governance, Risk, and Compliance (GRC)

1. Real-Time Monitoring

AI allows continuous risk assessment, automating control testing and predictive analytics. This dynamic approach helps organizations adapt to changing risk landscapes, making their risk management frameworks more resilient and responsive to emerging threats.

2. Centralized Governance Platforms

Emerging AI tools offer centralized governance of AI systems across the enterprise. These platforms track AI use cases, assess their risk impact, and ensure ongoing compliance with ethical standards and regulatory guidelines, providing greater transparency and accountability in AI-driven decision-making processes.

AI applications across industries are transforming how risks are managed. By using tailored AI tools, enterprises can identify, mitigate, and manage risks more effectively, helping improve decision-making, reduce operational disruption, and drive long-term growth.

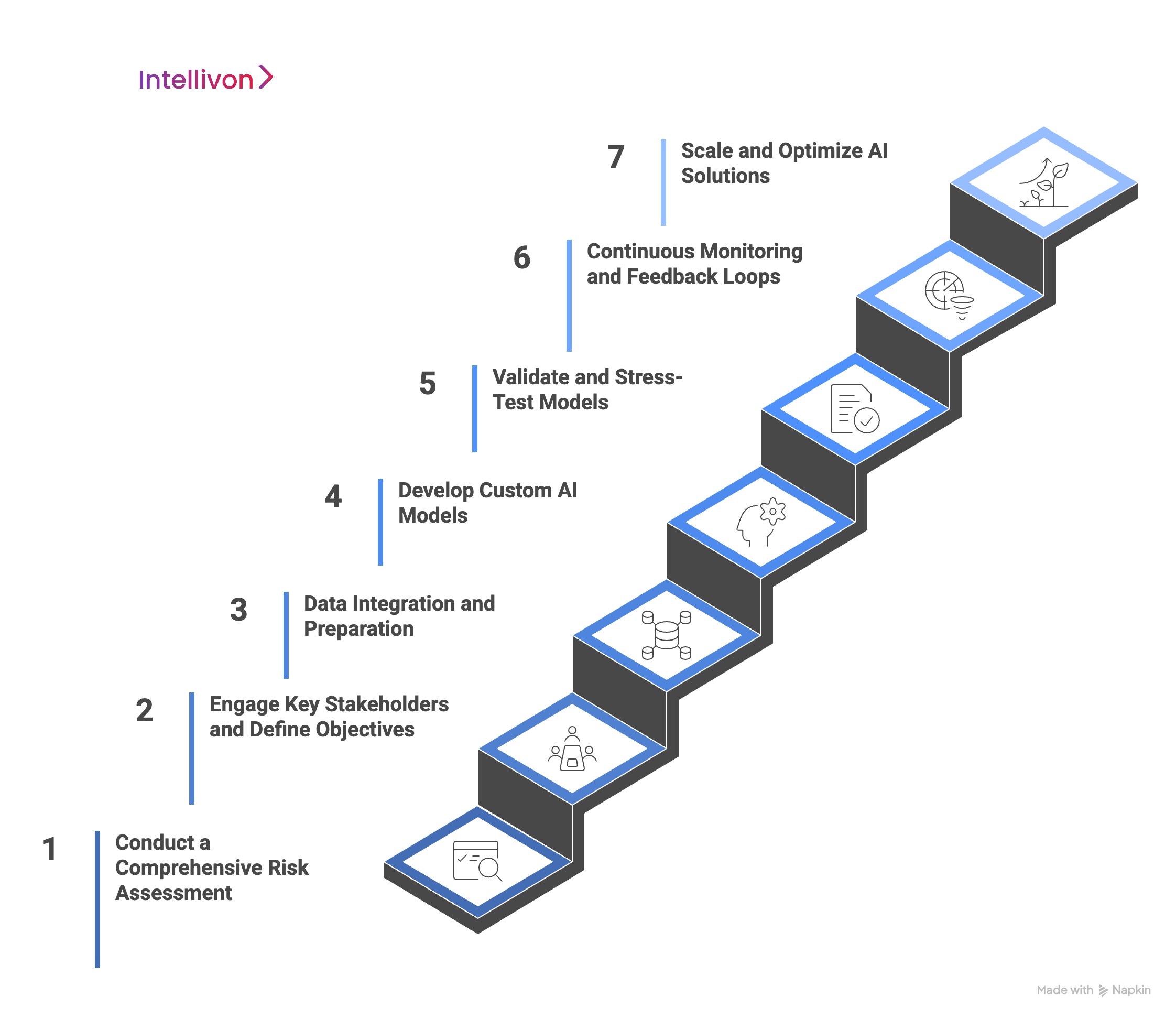

How We Build AI-Powered Risk Management Frameworks

Implementing an AI-powered risk management framework requires a structured approach to ensure it delivers measurable results while aligning with your business goals. At Intellivon, we partner with you every step of the way to help you successfully build and operationalize an AI-driven risk management strategy that enhances your organization’s risk detection, mitigation, and compliance.

Step 1: Conduct a Comprehensive Risk Assessment

We begin by evaluating your organization’s current risk management maturity. We map out your existing processes, identify pain points, and benchmark them against industry standards.

By conducting a gap analysis, we pinpoint exactly where AI can add value, whether that’s automating manual tasks, enhancing anomaly detection, or improving regulatory compliance. Our team helps you focus on the areas where AI will have the greatest impact.

Step 2: Engage Key Stakeholders and Define Objectives

We work closely with stakeholders across your risk, compliance, IT, and business units to ensure alignment. We define clear objectives for AI integration that directly support your organization’s risk management goals.

At Intellivon, we facilitate collaboration across teams, ensuring that everyone shares a common vision and that the AI framework is designed for long-term success.

Step 3: Data Integration and Preparation

We understand that high-quality, integrated data is the backbone of effective AI. Our team helps you catalog relevant data sources across your organization, including structured data (transaction logs, audit trails) and unstructured data (emails, contracts).

We also guide you through setting up strong data governance policies to ensure accuracy, consistency, and security. With our tools and expertise, we break down data silos and create a unified, reliable data environment, ensuring your data is ready for AI-driven risk insights.

Step 4: Develop Custom AI Models

Once we have your data in place, we move forward by developing custom AI models tailored to your specific risk scenarios. Our data scientists and risk experts collaborate with you to define the model objectives and select the most suitable algorithms.

At Intellivon, we specialize in building bespoke AI systems that integrate seamlessly with your existing operations, providing you with the most accurate and effective risk management tools for your unique needs.

Step 5: Validate and Stress-Test Models

We don’t just build AI models, we ensure they work effectively. Our team rigorously tests the models against historical data, conducting stress tests and evaluating performance metrics like accuracy, precision, and recall. We ensure that all models meet regulatory standards and are interpretable and auditable.

With Intellivon, your models are designed to provide reliable results and operate at the highest standard of compliance.

Step 6: Continuous Monitoring and Feedback Loops

Risk landscapes are always changing, and so are your AI models. We set up continuous monitoring systems and feedback loops to ensure that your AI models stay up-to-date and relevant.

At Intellivon, we don’t just implement AI solutions and walk away, we provide ongoing support, monitoring, and fine-tuning to adapt your models as new risks and business conditions emerge.

Step 7: Scale and Optimize AI Solutions

As your business grows, so should your AI risk management capabilities. We help you scale your AI solutions across the organization, ensuring they remain flexible and adaptable as new data comes in and your business expands.

At Intellivon, we make sure that your AI solutions are designed to scale with you, optimizing your risk management processes and ensuring you continue to stay ahead of potential threats.

Overcoming Implementation Challenges With Our Solutions

Implementing AI-powered risk management can be a transformative journey for enterprises, but it often comes with challenges, ranging from data silos and integration hurdles to talent shortages and regulatory concerns. At Intellivon, we recognize these challenges and have developed targeted solutions to help you overcome them, ensuring that you unlock the full potential of AI in your risk management strategy.

1. Data Silos and Quality Issues

Challenge:

One of the most common obstacles in AI adoption is fragmented data and inconsistent quality, which can severely affect the performance of AI models.

Our Solution:

To address this, we start with a thorough data audit and integration strategy. Our advanced ETL (Extract, Transform, Load) tools and automated data cleansing pipelines streamline data processing and ensure high-quality, accessible, and compliant data. We help you establish strong data governance frameworks, making sure your data is organized, accurate, and meets industry standards, forming a reliable foundation for your AI solutions.

2. Talent and Skills Gap

Challenge:

AI adoption often demands specialized skills that may not be available in-house.

Our Solution:

To bridge this gap, Intellivon combines expert consulting with hands-on training to help your team build the necessary skills. Our team of data scientists and engineers offers end-to-end support, ensuring that your AI integration is seamless and successful. Additionally, we provide user-friendly interfaces and automated workflows, enabling business users to access and act on AI-driven insights without requiring deep technical expertise.

3. Regulatory and Compliance Concerns

Challenge:

For industries with complex regulatory requirements, ensuring AI models meet these standards is crucial.

Our Solution:

At Intellivon, our solutions are designed with compliance at the forefront. We incorporate built-in audit trails, model explainability, and continuous monitoring to ensure that your AI systems remain transparent, traceable, and adaptable to regulatory changes. We work closely with your compliance teams to ensure that all AI models meet both current and emerging regulations, reducing risk and fostering trust within your organization and with stakeholders.

4. Change Management and Adoption

Challenge:

Resistance to change can be a significant barrier during the AI adoption process.

Solution:

At Intellivon, we address this by ensuring full stakeholder engagement from day one. We provide clear communication, customized training, and continuous support to ensure smooth adoption of AI-powered risk management. Our agile implementation methodology focuses on achieving quick wins and measurable ROI early in the process, demonstrating value and encouraging wider organizational buy-in. This approach guarantees a seamless transition and successful long-term adoption of AI solutions.

By addressing these implementation challenges head-on, Intellivon helps enterprises overcome barriers to AI integration and unlock the full potential of AI in risk management.

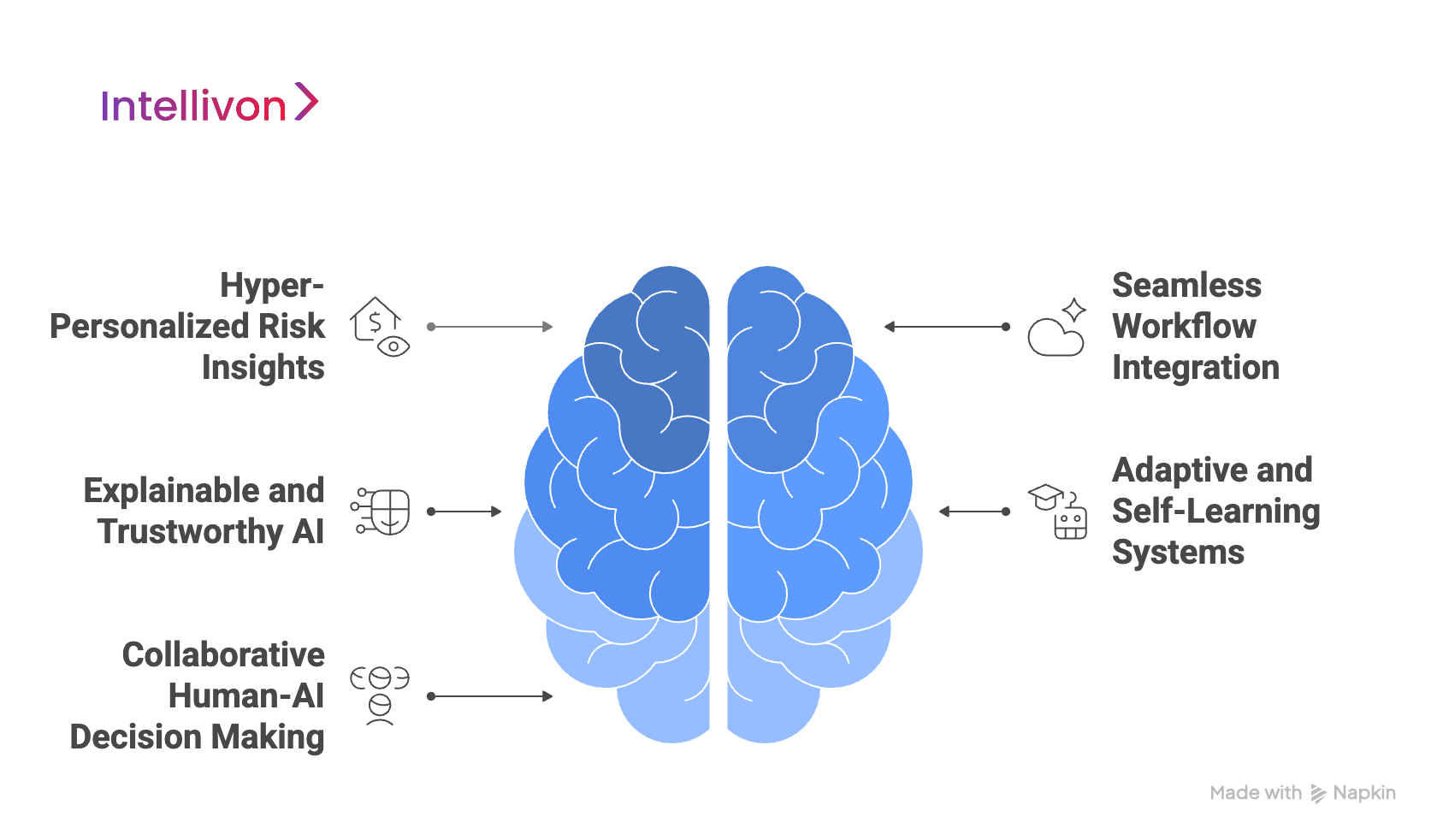

The Future of AI in Risk Management

As AI technologies continue to evolve, risk management will shift from reactive strategies to proactive, predictive, and even autonomous systems. Enterprises will rely on AI not just to detect and mitigate risks quickly, but to anticipate emerging threats and identify opportunities across various business functions.

1. Hyper-Personalized Risk Insights

AI will move beyond generic, one-size-fits-all risk models, enabling organizations to deliver hyper-personalized insights. These insights will be tailored to specific business units, geographies, and even individual transactions.

With these personalized recommendations, decision-makers will gain real-time, context-aware intelligence that boosts agility and strengthens business resilience. This will allow businesses to act with precision and foresight, making more informed decisions based on a deeper understanding of their unique risk landscape.

2. Seamless Workflow Integration

Future AI solutions will seamlessly integrate into everyday enterprise workflows, automating risk assessments as part of regular business operations. Rather than being a standalone process, risk management will become an invisible, omnipresent layer, constantly monitoring and flagging anomalies without disrupting daily activities.

By being embedded directly into business processes, AI will provide continuous, real-time risk evaluation, helping organizations address potential issues before they escalate, ensuring operational efficiency and minimizing disruptions.

3. Explainable and Trustworthy AI

As AI becomes more integral to risk management, the demand for explainable and transparent AI will intensify, driven by increasing regulatory oversight.

Future risk management tools will prioritize clarity and interpretability, offering audit trails and explainable models that foster trust among regulators, auditors, and stakeholders. This will be essential for maintaining compliance, ensuring that AI-driven decisions can be explained, verified, and trusted, reducing uncertainty and improving accountability.

4. Adaptive and Self-Learning Systems

AI models will evolve to become more adaptive and self-learning, automatically updating themselves in response to new data, regulatory changes, and shifting risk environments. These systems will continuously refine their algorithms and improve their predictive capabilities, enabling enterprises to stay ahead of emerging risks.

This adaptability will be essential for managing the complexity of risks in industries that are fast-paced and subject to rapid change, ensuring that organizations remain resilient in the face of evolving challenges.

5. Collaborative Human-AI Decision Making

Rather than replacing human decision-makers, AI will augment the capabilities of risk professionals by providing actionable intelligence, automating repetitive tasks, and freeing up experts to focus on high-value analysis. AI will act as a collaborative partner in decision-making, enhancing human judgment with data-driven insights.

This collaboration will allow risk management teams to make more informed, strategic decisions, ensuring a more effective and efficient approach to risk mitigation.

As these trends unfold, enterprises that invest early in modular, customizable AI risk management solutions will be best positioned to navigate uncertainty, ensure compliance, and maintain a competitive edge in an ever-evolving business environment. At Intellivon, we are here to help you prepare for this future with AI solutions tailored to your unique needs.

AI Integration with Existing Enterprise Risk Systems

Integrating AI-powered risk management solutions with existing enterprise risk legacy systems is crucial for maximizing their effectiveness. At Intellivon, we ensure that AI seamlessly connects with your core platforms, such as ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management), to provide real-time, actionable insights that drive smarter business decisions.

1. ERP and CRM Integration

When AI is integrated into ERP systems, organizations can monitor key business operations in real-time. This allows early detection of anomalies like fraud or late payments, minimizing potential risks. Similarly, CRM systems benefit from AI by enhancing customer insights, prioritizing high-risk leads, and automating responses to potential risks. This ensures that sales and support teams can act swiftly and accurately, mitigating risk before it escalates.

The key is consolidating data from multiple functions into a unified system, which enables AI to recognize patterns and deliver timely risk alerts.

2. API-First Architecture for Scalability

By utilizing robust APIs, AI modules can easily connect with a range of enterprise software, including legacy systems, cloud platforms, and third-party applications. This approach ensures flexibility, allowing organizations to deploy AI in incremental phases, starting with targeted pilots and expanding as needed.

Real-time data exchange through APIs ensures that AI models always operate with the most up-to-date information, improving both the accuracy and responsiveness of risk management.

Cloud vs. On-Premises Deployment

Enterprises can choose between cloud-based and on-premises deployment based on their needs. Cloud solutions offer scalability, easier integration, and lower infrastructure costs, making them ideal for businesses seeking flexibility.

On-premises deployments, however, provide greater control over data security, making them a strong option for highly regulated industries. The choice between these deployment models depends on the enterprise’s risk profile, regulatory requirements, and IT strategy.

Conclusion

AI-driven risk management is transforming how businesses anticipate, identify, and mitigate risks. By seamlessly integrating AI into enterprise systems, leveraging scalable architectures, and ensuring compliance, organizations can stay ahead of emerging threats and capitalize on new opportunities.

This proactive approach enhances decision-making, improves operational efficiency, and strengthens resilience, enabling businesses to navigate an increasingly complex and dynamic risk landscape with confidence and agility.

Why Choose Intellivon for Your AI Risk Management Needs

With over 11 years of expertise in enterprise resource planning and AI-driven customer experience, Intellivon stands as the trusted AI Solutions Partner for ERM. Our proven track record, spanning more than 500 successful AI projects, demonstrates our commitment to delivering measurable business impact, from boosting productivity to enhancing customer satisfaction and cutting operational costs.

What Sets Intellivon Apart?

- End-to-End AI Expertise: We design, deploy, and scale AI-powered workflows tailored to your business, ensuring seamless integration with your existing ERP, CRM, and omnichannel systems.

- Cutting-Edge Technology: Leveraging the latest in machine learning and natural language processing, our solutions keep your business ahead of the competition by automating repetitive tasks, anticipating customer needs, and delivering personalized experiences.

- Seamless Integration: Our platforms connect effortlessly with your current enterprise software, optimizing real-time data flows and ensuring a unified customer view.

- Human-Centric Change Management: We provide comprehensive training and ongoing support, empowering your teams to adopt new technologies smoothly and confidently.

- Continuous Optimization: Our partnership doesn’t end at go-live. We continuously refine and optimize your AI workflows, adapting to evolving business needs and market trends.

Contact Intellivon today for a comprehensive evaluation of your current customer support landscape. Our AI experts will deliver:

- In-depth analysis of omnichannel opportunities

- Tailored ROI projections for your unique business

- A strategic roadmap for AI chatbot implementation and optimization

- Competitive analysis and market positioning insights

Book a strategy call with our AI risk experts.

FAQ’s

Q1. What is AI-driven risk management?

AI-driven risk management uses artificial intelligence technologies like machine learning, predictive analytics, and natural language processing to identify, assess, and mitigate potential risks in real-time. It enables businesses to manage risks by detecting anomalies and anticipating emerging threats proactively.

Q2. How does AI help in fraud detection?

AI helps in fraud detection by analyzing transaction data for unusual patterns and behaviors. Machine learning algorithms can identify suspicious activities in real-time, reducing the chances of fraud by enabling quick detection and response.

Q3. What are the benefits of AI in risk management?

AI enhances risk management by providing real-time, data-driven insights, improving accuracy in predicting and mitigating risks, automating routine tasks, and reducing human error. It also enables businesses to proactively address potential threats before they escalate.

Q4. Can AI help in regulatory compliance?

Yes, AI can assist in regulatory compliance by automating compliance monitoring, ensuring businesses stay up-to-date with changing regulations, and identifying potential compliance gaps. AI also offers transparent audit trails, which are crucial for demonstrating compliance to regulators.

Q5. How do AI models adapt to changing risks?

AI models are designed to continuously learn and adapt to new data, regulatory changes, and evolving threats. Machine learning algorithms update and refine their predictions based on real-time inputs, ensuring that risk management strategies remain effective in a dynamic business environment.