AI fraud in financial enterprises is becoming more sophisticated, thanks to fraudsters adopting emerging AI tech to find loopholes in traditional defenses like rule-based filters and manual monitoring systems. It is easier for them to penetrate these outdated detection systems. From identity theft and account takeovers to synthetic fraud and insider threats, attackers exploit every digital touchpoint. Legacy systems, while once effective, now struggle with false positives, slow response times, and limited adaptability.

Businesses worldwide lose $42 billion annually, with 60% facing fraud, averaging $1.3 million per case. The key is fighting AI with AI. These systems detect and stop fraud in minutes, outpacing fraudsters using AI themselves. The results speak for themselves. After American Express adopted generative AI and machine learning to improve credit card fraud detection, they spotted a potential $2 billion in fraud each year, stopping it before any losses happened.

By adopting AI-powered fraud detection, financial enterprises can significantly reduce risk, cut operational costs, and boost regulatory compliance. At Intellivon, we specialize in developing intelligent, enterprise-grade AI solutions tailored to large financial institutions. With deep experience across banking, insurance, and fintech, our AI fraud detection systems are designed to identify threats in real time, before damage occurs. We will break down exactly how to build a future-ready AI fraud detection system from the ground up.

Why Financial Enterprises Are Adopting AI Fraud Detection

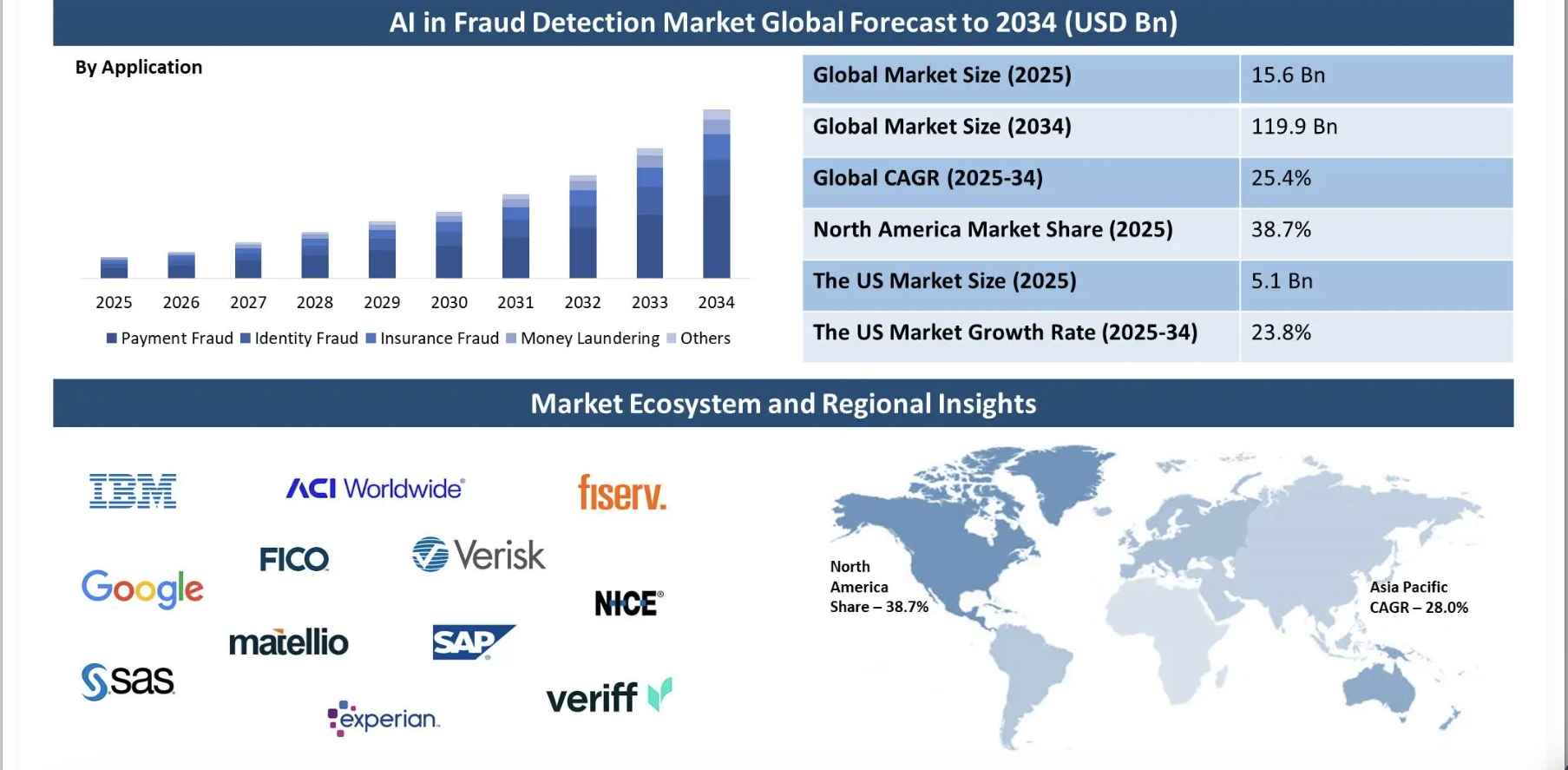

The AI fraud detection market is expected to grow from $12.1 billion in 2023 to $108–120 billion by 2033–34, with an annual growth rate of 24.5–25.4%. Leading financial institutions understand the implications of data breaches and financial information leaks. They are swiftly adopting future-proof AI fraud detection systems that blanket their delicate information in ironclad protection.

- Large enterprises represent 68% of AI fraud detection use, particularly in finance, insurance, and e-commerce.

- Rising digital payment fraud and cybercrime are driving the need for advanced fraud detection, with payment fraud accounting for nearly 50% of cases in 2023.

- More than half of financial institutions are planning to use AI-based solutions, such as machine learning and predictive analytics, to detect new types of fraud.

- AI-driven fraud detection lowers false positives, allowing teams to focus on actual threats while cutting operational costs.

- AI improves fraud detection by analyzing vast amounts of data in real time, enhancing both speed and accuracy.

- The Agentic AI in Prevention & Fraud Detection Market size was valued at USD 5.2 billion in 2024 and is expected to reach USD 109.9 billion by 2032, growing at a CAGR of 46.28% during 2025-2032.

- Advanced technologies like generative AI, agentic AI platforms, and AI agents are being integrated with traditional security systems to create a more robust fraud protection strategy.

Traditional VS Modern AI Fraud Detection Systems

For years, financial institutions relied on traditional fraud detection systems. These systems used static rules and manual checks to flag suspicious activity. While effective at first, they now fall short in the face of today’s complex, fast-moving fraud tactics.

Modern AI fraud detection systems take a smarter, more adaptive approach. Instead of waiting for fraud to happen, they predict and prevent it in real time. They learn from patterns, improve over time, and handle massive volumes of data with ease.

Here’s how traditional and AI-driven systems compare:

| Feature | Traditional Systems | Modern AI Fraud Detection |

| Detection Method | Static, rule-based | Dynamic, data-driven (ML/DL models) |

| Speed of Detection | Delayed, often post-fraud | Real-time or near real-time |

| Accuracy | High false positives | Higher precision with fewer false alarms |

| Adaptability | Requires manual updates | Self-learning adapts to new fraud tactics |

| Data Handling | Limited to structured data | Handles both structured and unstructured data |

| Scalability | Hard to scale for large enterprises | Designed for scalability across systems and channels |

| Fraud Pattern Recognition | Reactive to known patterns | Proactive pattern discovery, including unknown anomalies |

| Integration with Legacy Systems | Often rigid and siloed | API-based, flexible integration into enterprise ecosystems |

| Compliance Support | Limited audit visibility | Includes explainability (XAI) and compliance tracking tools |

Why Enterprises Are Using Generative AI for Fraud Detection

The enterprise generative AI market, including fraud detection, was valued at $4.1 billion in 2024 and is expected to grow at over 33% annually from 2025 to 2034. This means more financial enterprises are looking to adopt generative AI-based fraud detection systems. Here is why:

- Smarter Pattern Recognition: Generative AI spots emerging fraud patterns in real time, adapting as attackers evolve. This boosts detection accuracy.

- Synthetic Data Improves Accuracy: AI-generated data helps train models on rare fraud scenarios while protecting privacy.

- Automated Compliance: AI automates audits and policy checks, reducing regulatory risks and human error.

- Faster, Fewer Errors: Mastercard’s AI reduced false positives by 200% and doubled fraud detection speed.

Why Enterprises Are Using Agentic AI for Fraud Detection

The Agentic AI fraud detection market is set to grow from $5B in 2024 to $110–207B by 2034, with a CAGR of 45–46%. Here is why:

- Real-Time, Adaptive Detection: Agentic AI uses deep learning and neural networks to monitor transactions and flag fraud as it happens, adapting to new tactics instantly.

- Massive Operational Efficiency: AI agents can analyze 100,000 alerts in 10 seconds, cutting analyst workload dramatically and reducing human error.

- Fewer False Positives: Adaptive learning lowers false alarms, improving accuracy and minimizing customer disruption.

- Built-In Regulatory Compliance: Agentic AI systems help navigate evolving data privacy and financial regulations with proactive monitoring and audit-ready tracking.

- Integration with Emerging Tech: Agentic AI blends seamlessly with blockchain, biometrics, and predictive analytics, creating a highly secure and future-ready fraud defense system.

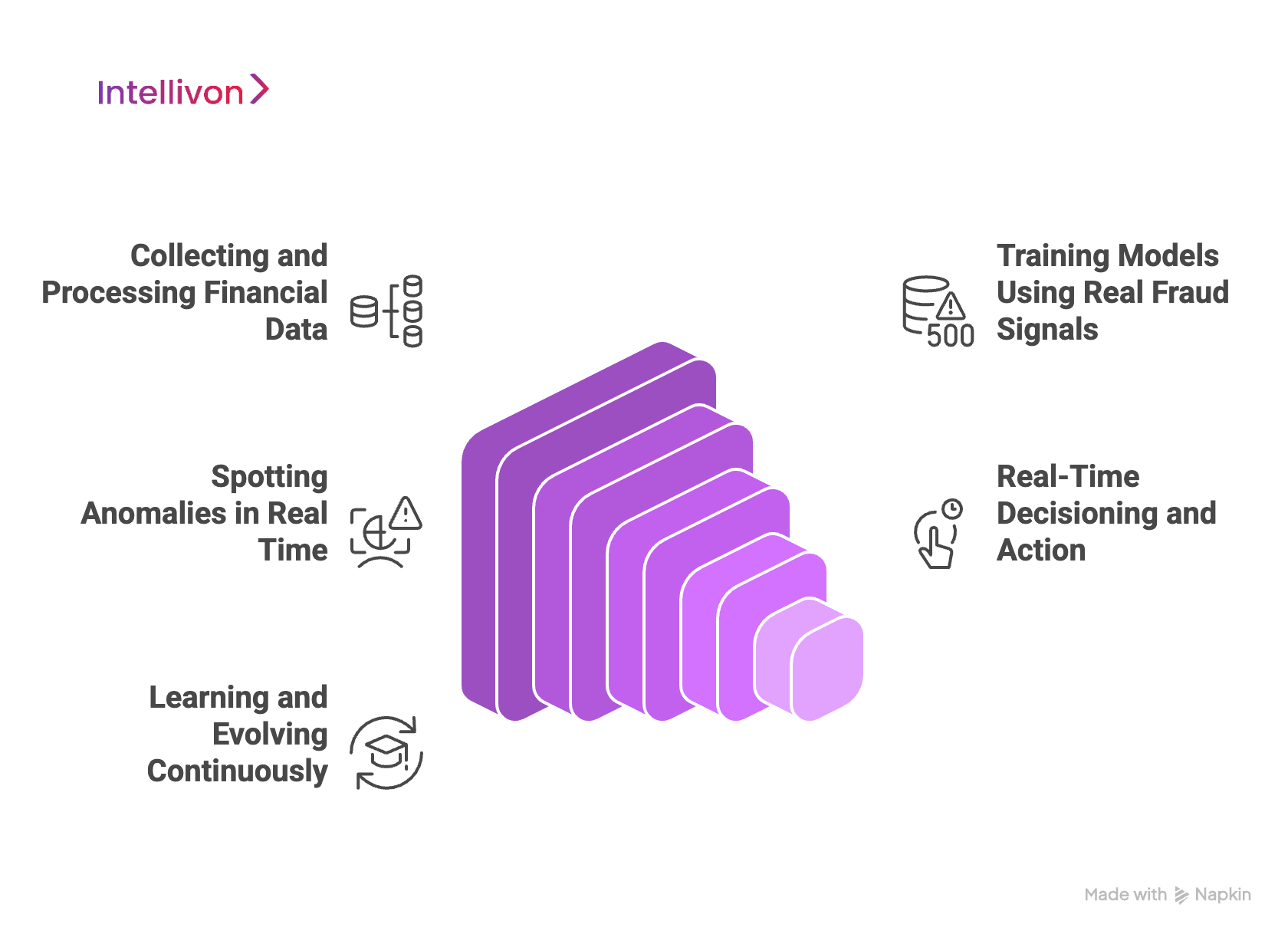

How AI Works in Fraud Detection for Financial Enterprises

AI-powered fraud detection transforms financial data into real-time defense. Here’s how it works behind the scenes to protect financial enterprises from fast-evolving fraud threats:

1. Collecting and Processing Financial Data

AI systems begin by collecting large volumes of data across multiple touchpoints, such as transactions, login sessions, device IDs, geo-locations, and customer profiles. This data helps create a “normal behavior baseline” for every user or transaction type.

By comparing real-time actions against this baseline, the system can spot what doesn’t belong.

2. Training Models Using Real Fraud Signals

Once key fraud indicators are identified, such as sudden location shifts, high transaction values, or mismatched IP addresses, AI models are trained on historical fraud cases. These models learn to separate genuine activity from red flags with increasing precision.

3. Spotting Anomalies in Real Time

AI uses deep learning and techniques like LSTM networks to detect small but meaningful deviations in behavior. These could include minor changes in how a form is filled or the speed at which a transaction is executed. The system raises alerts immediately, often before fraud is completed.

4. Real-Time Decisioning and Action

Once a transaction is flagged, the system may pause the payment, trigger multi-factor authentication, or notify fraud analysts instantly. This reduces response time from hours to seconds.

5. Learning and Evolving Continuously

With every new transaction and every confirmed fraud case, the system retrains itself. This continuous loop helps reduce false positives while adapting to new fraud techniques, staying a step ahead of fraudsters who also use AI to adapt to detection systems.

Advanced Techniques Powering Detection

- NLP detects phishing or scam attempts by analyzing messages or chat logs.

- Graph Neural Networks (GNNs) uncover fraud rings by mapping hidden connections.

- Automated responses help block high-risk actions instantly.

Real-World Impact

AI fraud detection now helps identify crypto theft, synthetic identity fraud, fake documentation, and irregular purchases. Banks also use it to monitor peer-to-peer payments and validate customer identities on the fly.

By combining speed, adaptability, and precision, AI fraud detection provides a powerful line of defense, thereby helping financial enterprises safeguard both money and trust.

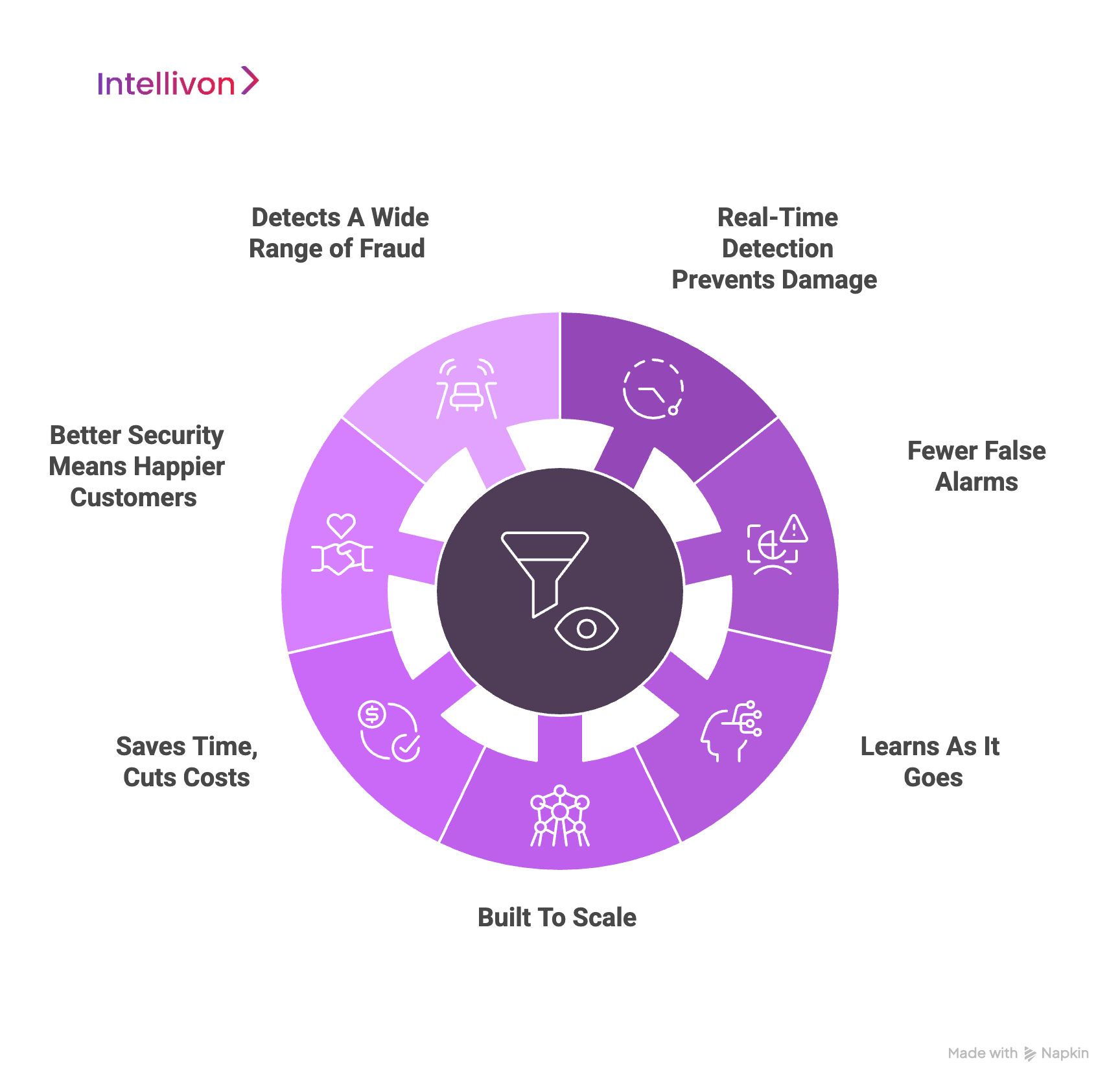

Benefits of AI Fraud Detection For Financial Enterprises

Fraud is evolving fast, and financial institutions need defenses that move even faster. AI fraud detection offers a powerful set of benefits that go beyond speed, delivering accuracy, cost-efficiency, and better customer experiences.

1. Real-Time Detection Prevents Damage

AI scans every transaction the moment it occurs. Suspicious activity is flagged instantly, often before money moves or data is compromised. This real-time action means fraud can be stopped before it causes harm.

2. Fewer False Alarms

Unlike rule-based systems that trigger on generic thresholds, AI uses patterns and context. It knows the difference between a high-value purchase by a frequent traveler and a fraudulent one. This precision reduces false positives and customer frustration.

3. Learns as It Goes

Every fraud attempt helps the system become smarter. As fraud tactics shift, AI keeps up, ensuring ongoing protection without needing constant manual updates.

4. Built to Scale

Whether your enterprise handles thousands or billions of transactions a day, AI can manage the volume. It processes large datasets without slowing down, giving consistent protection across all channels and platforms.

5. Saves Time, Cuts Costs

Manual fraud review takes time and people. AI automates most of that work. This reduces operational costs, speeds up investigations, and prevents losses from fraud-related disputes and chargebacks.

6. Better Security Means Happier Customers

When fraud is caught quickly, and genuine users aren’t blocked, it builds trust, which converts to higher ROIs. Customers enjoy smoother transactions and fewer disruptions, which keeps them loyal.

7. Detects a Wide Range of Fraud

From stolen credit cards to fake identities and crypto scams, AI sees it all. It draws from multiple data points, like location, device ID, and user behavior, to catch even complex fraud attempts that would slip past traditional tools.

AI fraud detection protects revenue, strengthens compliance, and delivers the kind of security today’s customers expect. In a world of increasing digital risk, that edge matters.

Real World Use Cases of AI Fraud Detection for Financial Enterprises

AI is redefining how financial enterprises defend against complex, fast-evolving threats. Below are practical, real-world use cases that show how AI is being used to stop fraud in its tracks across banking, payments, crypto, and more.

1. Real-Time Transaction Fraud Detection

AI systems monitor millions of transactions every second. Using ML models, they flag suspicious behavior like sudden high-value spending, location mismatches, or unusual device activity. These alerts allow banks to block transactions or trigger extra verification instantly. As a result, institutions can significantly reduce losses while speeding up fraud response.

Example:

Mastercard’s Decision Intelligence system uses AI to score every transaction in real time based on user behavior, device, and spending patterns. It enables instant fraud detection without blocking legitimate transactions, reducing false positives by up to 200%.

2. Fraud Risk Scoring and Prioritization

Not every suspicious transaction deserves equal attention. AI assigns real-time risk scores to each transaction by analyzing context, such as user behavior, transaction value, and time of day. This helps fraud teams prioritize high-risk cases efficiently, cutting down on manual workload and improving accuracy in fraud prevention.

Example:

PayPal assigns a real-time risk score to every transaction. The system uses ML to identify which payments are most likely to be fraudulent and prioritizes them for human review, helping reduce losses while keeping the platform fast and user-friendly.

3. Identity Theft and Account Takeover Prevention

AI tracks login activity, device fingerprints, and user behavior patterns. When something unusual, like a new IP address or strange login time, appears, the system flags potential identity theft or account takeovers. Banks use this to protect digital banking platforms and maintain customer trust.

Example:

Capital One uses AI-powered behavioral analytics to monitor login habits, device usage, and geolocation data. When the system detects deviations, it initiates additional authentication steps to block unauthorized access and prevent account takeovers.

4. Phishing and Social Engineering Detection

With NLP, AI can analyze messages from emails, chats, and support systems. It identifies tone, keywords, and intent to flag phishing attempts or scam conversations before they escalate. This keeps customers safe from social engineering attacks.

Example:

HSBC has implemented NLP-powered tools to analyze customer service messages and emails for signs of phishing. These tools scan language patterns and intent to flag suspicious communications and warn customers before harm is done.

5. Credit Card Fraud Detection

Institutions such as Bank of America use AI models that evaluate more than 100 real-time signals per transaction. These include location, merchant type, and spending behavior. The result: fewer false positives, faster fraud detection, and expanded access to secure credit, especially for underbanked customers.

Example:

Bank of America uses AI-driven fraud detection systems that evaluate dozens of real-time signals, such as spending behavior, merchant category, and transaction location. This helps detect fraudulent credit card transactions swiftly while minimizing false positives, improving both fraud prevention and customer experience.

6. Check and Payment Verification Automation

AI automates the review of checks and payments by scanning for irregularities in signatures, amounts, and patterns.

Example:

Santander implemented AI-driven check verification systems. These tools automatically identify suspicious patterns in handwritten checks and validate against transaction history, saving millions in fraud prevention.

7. Cryptocurrency Fraud Monitoring

Crypto’s decentralized nature poses unique risks. AI monitors blockchain transactions for red flags like rapid fund transfers, use of flagged wallets, or mixing services. This enables financial institutions to spot potential laundering or fraud in real time.

Example:

Used by exchanges and law enforcement, Chainalysis provides AI-powered blockchain analysis to track illicit transactions. Banks use this platform to monitor crypto wallets for links to sanctioned entities or money laundering attempts.

8. E-commerce and Merchant Fraud Prevention

Banks and digital payment platforms use AI to review user behavior, device data, and purchase history. If a customer suddenly makes a high-value purchase from a new location or device, the transaction is flagged. This proactive monitoring stops fraudulent orders before they go through.

Example:

Stripe’s Radar system uses machine learning trained on billions of global transactions to identify fraudulent online purchases. It enables businesses to automatically block high-risk payments while ensuring smooth transactions for genuine customers.

These real-world examples show that AI fraud detection is already working at scale. Financial enterprises are using AI to reduce losses, improve speed, and protect customers in an increasingly complex threat environment.

Sector-Specific Use Cases

AI fraud detection isn’t one-size-fits-all. Its impact differs by sector, adapting to unique data flows, regulatory needs, and threat types. Here’s how AI transforms fraud prevention across five financial sectors:

1. Banking

Banks handle millions of transactions daily, making fraud detection a race against time. AI helps unify siloed data, like customer profiles, transaction logs, and risk indicators, to catch suspicious activity in real time. ML models flag identity theft, unauthorized transfers, and even insider threats. Automated systems also streamline compliance reporting, reducing delays and manual errors.

Example: Starling Bank

Starling, a digital-first UK bank, uses AI to monitor all customer transactions for fraud in real time. Their system integrates behavioral data with transaction history to flag suspicious activity, such as account takeover or abnormal fund transfers, while maintaining seamless user experience.

2. Investment Management

For asset managers and trading firms, AI monitors high-volume trades to catch signs of market abuse. It analyzes cross-market patterns to identify wash trading, pump-and-dump schemes, and insider leaks. By uncovering hidden correlations, AI enables faster regulatory alerts and protects firm reputations.

Example: Janus Henderson Investors

Janus Henderson uses AI tools to monitor trade patterns and detect potential market abuse. The firm leverages anomaly detection to ensure trade integrity, reduce insider risk, and comply with international AML directives.

3. Insurance

AI tackles fraud in claims processing, underwriting, and policy renewals. By comparing claims data with behavior patterns and third-party sources, AI flags inflated damages, staged accidents, or falsified medical documents, long before payouts occur. This reduces losses while speeding up genuine claims.

Example: Lemonade

Lemonade uses AI-based claims bots to screen insurance claims instantly. The AI flags suspicious claims based on patterns across customer behavior, submitted documents, and policy history, cutting processing times while preventing fraudulent payouts.

4. Accounting

Accounting firms use AI to scan financial statements and audit trails for red flags. Automated anomaly detection highlights unusual entries or patterns, supporting auditors in fraud investigations and ensuring compliance with evolving standards.

Example: Mazars

Mazars, a mid-sized global audit firm, employs AI-powered analytics to detect fraud in client financial records. The technology identifies unusual accounting entries, duplicate transactions, and hidden revenue manipulation, enhancing audit accuracy.

5. Venture Capital

VCs face risks from portfolio companies and founders. AI tracks fund movement, financial statements, and cap table changes to detect early signs of embezzlement or misreporting. This safeguards investor capital and aids due diligence.

Example: Anthemis Group

Anthemis uses AI platforms to monitor financial and operational signals across its portfolio startups. This includes analyzing irregular fund movement, compliance breaches, or manipulated growth metrics that may signal fraud or mismanagement.

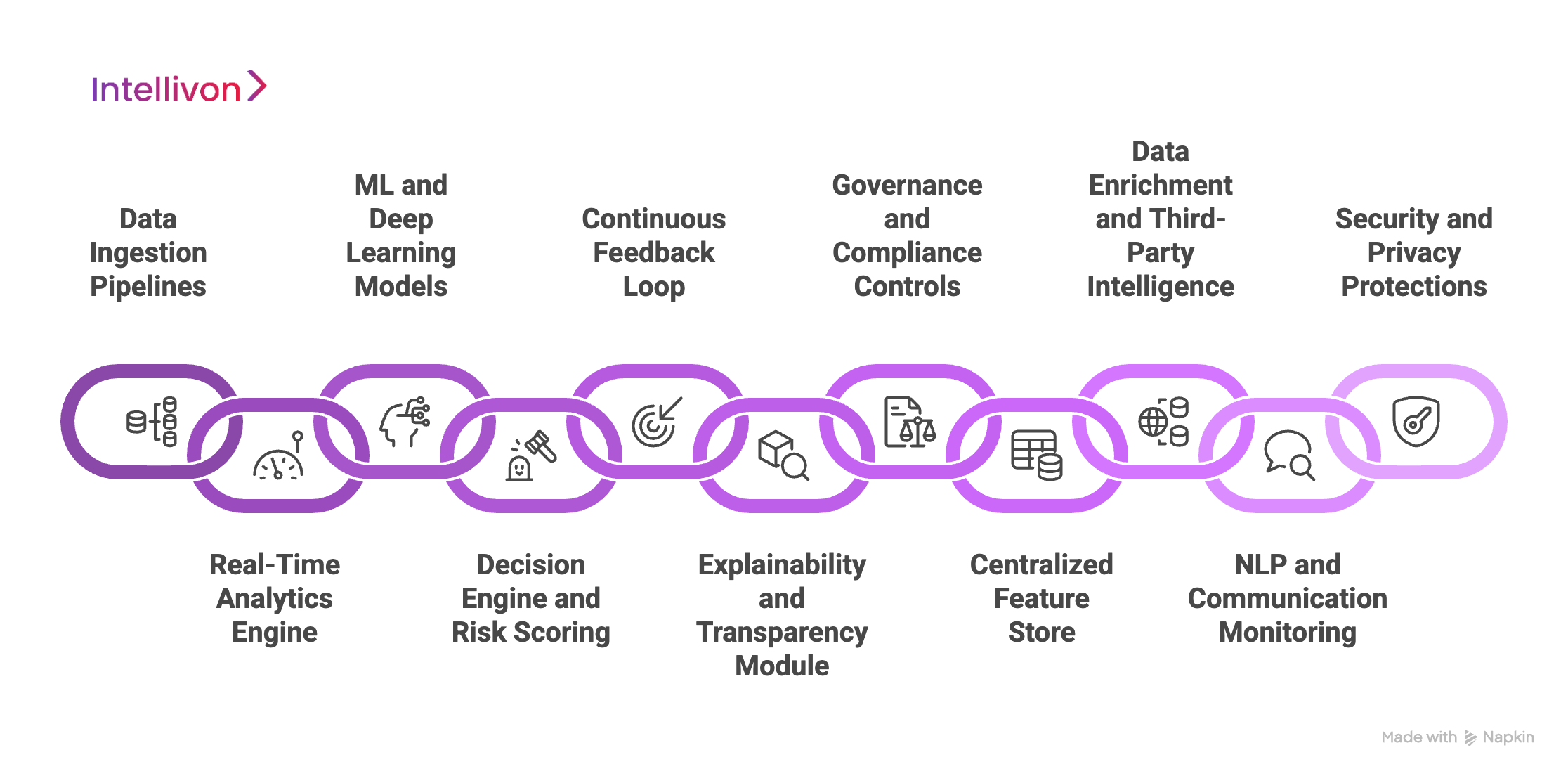

Core Components of an AI Fraud Detection System

An effective AI fraud detection system doesn’t rely on a single feature. Instead, it’s built from multiple moving parts that work together to monitor transactions, catch suspicious behavior, and adapt to evolving threats. Here’s what powers a scalable, enterprise-grade fraud detection solution.

1. Data Ingestion Pipelines

The system starts by collecting data from all directions, such as transaction records, KYC details, login history, emails, and even chatbot transcripts. Structured and unstructured data are cleaned and processed, making sure the system gets accurate, timely information. The broader the dataset, the better the fraud signal.

2. Real-Time Analytics Engine

Speed matters in fraud detection. Real-time engines process incoming data instantly. They track customer behavior, transaction velocity, and spending anomalies on the fly. This allows financial institutions to flag fraud as it’s happening, not hours later.

3. ML and Deep Learning Models

At the core are AI models trained on past fraud data. These include:

- Supervised learning to spot known fraud types

- Unsupervised learning to find outliers

- Deep learning to recognize hidden patterns

These models evolve continuously. With each case, they get smarter and more accurate.

4. Decision Engine and Risk Scoring

Once the model identifies something unusual, the decision engine takes over. It assigns a risk score based on thresholds and confidence levels. If the score crosses a set boundary, it triggers an alert, a block, or requests further verification. This component ensures a balance between customer convenience and fraud prevention.

5. Continuous Feedback Loop

The system doesn’t stop learning. Investigations, customer reports, and outcomes feed back into the models. This feedback retrains the AI, helping it adapt to new fraud tactics and minimize false positives over time.

6. Explainability and Transparency Module

Financial enterprises need to know why a transaction was flagged. This module shows what influenced the model’s decision, like an unusual IP address or mismatched device behavior. Visual dashboards support audits and help fraud analysts verify actions quickly and confidently.

7. Governance and Compliance Controls

AI must stay compliant with regulations like GDPR, AML, and OCC guidelines. Built-in governance tracks model performance, fairness, and version history. It ensures bias is flagged and controlled, while decisions remain explainable and justifiable.

8. Centralized Feature Store

This store’s engineered features include device fingerprints, login frequency, and merchant history. These features are shared across models to keep fraud detection consistent and accurate across departments or platforms.

9. Data Enrichment and Third-Party Intelligence

Fraud doesn’t happen in isolation. The system integrates external data sources, like blacklists, threat intel feeds, and regulatory databases, to cross-check transactions in a broader fraud landscape. This adds critical context that internal data alone may miss.

10. NLP and Communication Monitoring

Advanced systems use NLP to analyze customer messages, emails, and chatbot interactions. This helps identify signs of phishing, social engineering, or other scams that traditional data signals can’t catch.

11. Security and Privacy Protections

Every component is built with security in mind. Data is encrypted, access is tightly controlled, and privacy standards are enforced throughout the pipeline. This ensures customer information stays protected while still being usable for fraud detection.

Financial enterprises get the tools they need to stay ahead of fast-moving fraudsters, without compromising on compliance, customer trust, or system performance.

Choosing Between ML, DL, or Hybrid Models

Each model type serves a purpose:

- ML is great for spotting known fraud patterns with historical data. It’s fast and interpretable.

- DL works better for uncovering subtle, complex behaviors, like social engineering or synthetic identity fraud.

- Hybrid models combine the two, balancing speed and complexity.

Comparison Table: ML vs. DL vs. Hybrid Models in AI Fraud Detection

| Feature / Capability | Machine Learning (ML) | Deep Learning (DL) | Hybrid Models |

| Best at | Known fraud patterns | Complex, evolving fraud behaviors | Both known and unknown fraud scenarios |

| Speed | Fast | Slower due to high computation | Balanced performance |

| Interpretability | High (e.g., decision trees, logistic regression) | Low (black box models like neural networks) | Moderate, with tailored explainability |

| Data Requirement | Medium | High (needs vast labeled data) | Scalable, depending on model weighting |

| Maintenance | Easier | Complex, needs specialized teams | Moderate, flexible scaling |

| Adaptability | Moderate | High (with proper training) | High (leverages strengths of both ML and DL) |

| Enterprise Fit | Suitable for early-stage AI programs | Better for mature, data-rich environments | Ideal for scaling fraud programs in large enterprises |

Why the Hybrid Approach Wins

The hybrid model stands out because it blends the speed and simplicity of ML with the depth and nuance of DL. This gives financial enterprises a system that is both responsive and intelligent.

As fraud patterns grow more dynamic and harder to detect, hybrid models ensure coverage across the full spectrum. They offer greater precision, reduced false positives, and future-ready adaptability, making them the top choice for enterprise-grade fraud detection.

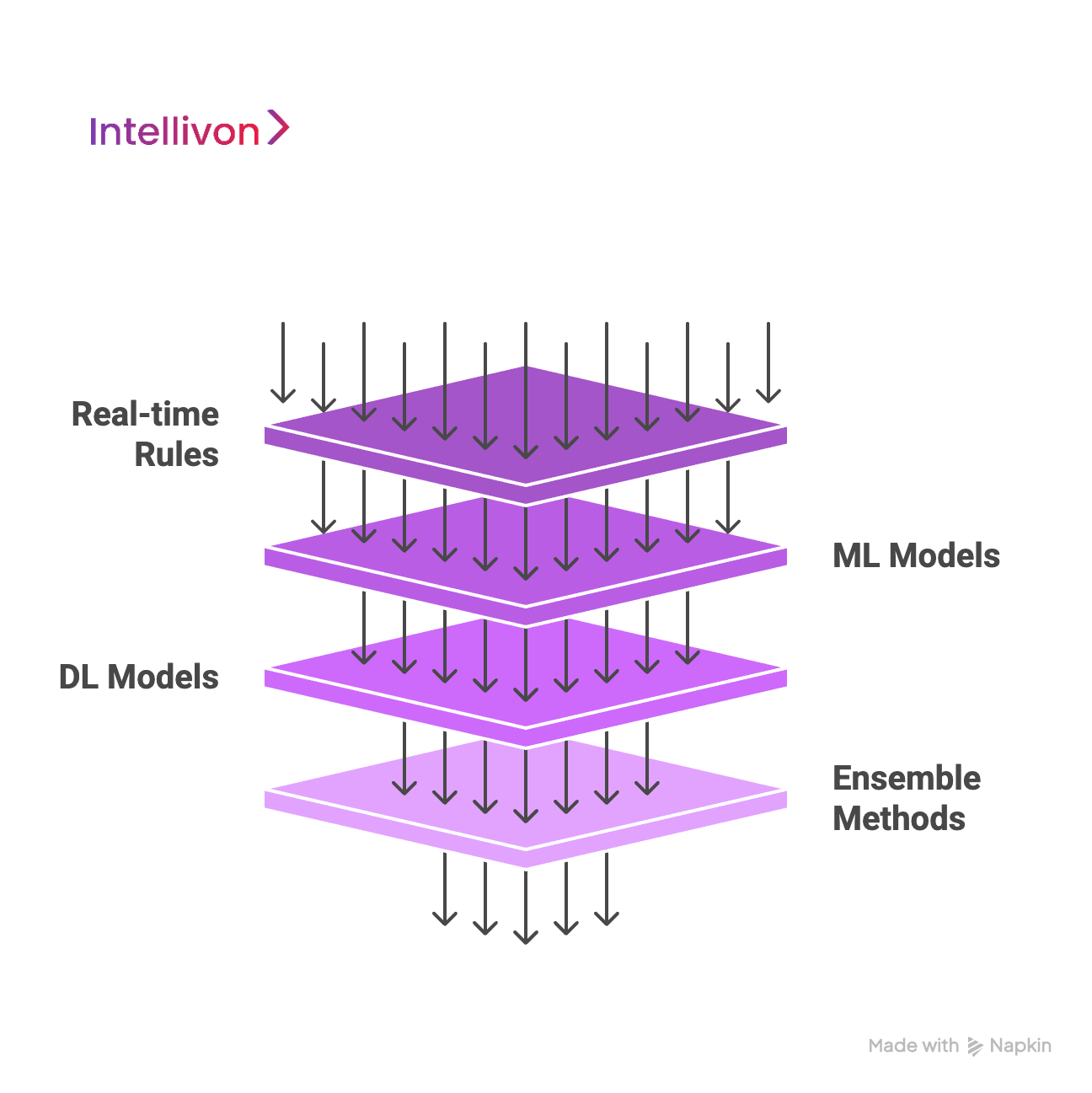

Deep Dive into Tech Architecture of AI Fraud Detection Systems

Building a reliable AI fraud detection system is about the full architecture working in sync. Intellivon’s cutting-edge tech stack includes real-time data pipelines to adaptive models, where each component plays a crucial role in delivering speed, accuracy, and scale for financial enterprises. We embed multi-layered fraud detection systems into financial enterprises, and this is how they work:

Layer 1: Real-time rules

This layer handles well-known fraud patterns using rule engines, such as repeated failed logins or impossible geolocation shifts. It acts as the first line of defense, flagging low-hanging threats instantly without slowing down user experience.

Layer 2: ML Models

ML models analyze transaction patterns, looking for subtle signs of fraud like unusual purchase combinations or login time deviations. This layer reduces false positives and helps identify fraud that rules can’t catch.

Layer 3: DL Models

DL models go deeper. They understand sequences, behavioral shifts, and correlations across multiple variables. These models can detect synthetic identities or coordinated fraud rings with minimal training data.

Layer 4: Ensemble Methods

By combining models from multiple layers, this ensemble approach increases precision. It weights each model’s confidence, ensuring the final fraud score reflects the best possible prediction, balancing risk with customer experience.

Data Infrastructure That Keeps Pace With Real-Time Fraud

1. Streaming Data

Tools like Kafka or Pulsar ensure high-speed, real-time data ingestion from multiple channels. Every transaction, login, or system event is captured instantly, giving your AI models the freshest possible signals.

2. Feature Engineering

Whether in real time or batch, feature pipelines extract relevant fraud signals, such as transaction velocity or mismatched device data. These features act as “clues” for the AI, improving accuracy without needing human intervention.

3. Data Lakes

Fraud patterns often hide in unstructured data, emails, voice transcripts, or chatbot logs. Integrated data lakes allow enterprises to unify these sources, enriching the fraud detection process with deeper context.

4. Privacy-Preserving Techniques

With federated learning and differential privacy, enterprises can train models without exposing sensitive customer details.

Model Strategies That Adapt to Real-World Risk

1. Supervised Learning

Techniques like gradient boosting or neural networks use historical fraud data to learn what real fraud looks like. These models improve with each labeled case, making them perfect for high-accuracy detection at scale.

2. Unsupervised Learning

Clustering and isolation forests detect outliers without needing labels. They are useful for spotting emerging fraud tactics and rogue behavior, especially where labeled fraud examples are scarce. Autoencoders help models learn by compressing data and detecting reconstruction errors, signaling potential fraud.

3. Reinforcement Learning

These models continuously adapt based on real-world outcomes, adjusting fraud thresholds or model choices depending on what’s working. This approach allows the system to evolve without constant manual tuning.

Our robust tech stack builds a fraud detection engine that improves itself, grows smarter with every case, and works invisibly behind the scenes to protect your bottom line. At Intellivon, we help enterprises integrate these technologies into scalable, privacy-first solutions that deliver real-world results from day one.

Integrating AI Fraud Detection Into Legacy Financial Systems

Legacy systems power many financial enterprises, but they also challenge innovation. That’s where Intellivon helps you integrate AI fraud detection smoothly, while keeping your core operations running reliably.

API Gateways, Message Brokers, and Model Serving

Most legacy platforms aren’t built to connect with modern AI models. Intellivon implements API gateways and message brokers to bridge these technologies. Our model-serving tools deploy ML/DL fraud models as scalable microservices, allowing instant fraud scoring without overhauling your core systems.

Integrate Without Disrupting Mission-Critical Systems

Downtime equals lost trust. Intellivon uses AI overlays, which are lightweight layers that sit on top of existing workflows, to deliver fraud detection with minimal disruption.

We design hybrid cloud solutions so you can keep sensitive operations on-premise, while leveraging scalable cloud models.

Phased rollouts and built-in fallback options ensure smooth, uninterrupted integration.

Aligning Tech + People

Implementing AI is cultural. Intellivon conducts cross-functional training, empowering your risk and compliance teams to interpret AI-generated alerts and validate decisions confidently. By aligning data, IT, and compliance units, we transform resistance into adoption.

With Intellivon’s unified data frameworks, privacy-first integration, and people-centric approach, your financial enterprise can adopt real-time AI fraud detection without disruption, compliance risk, or team resistance.

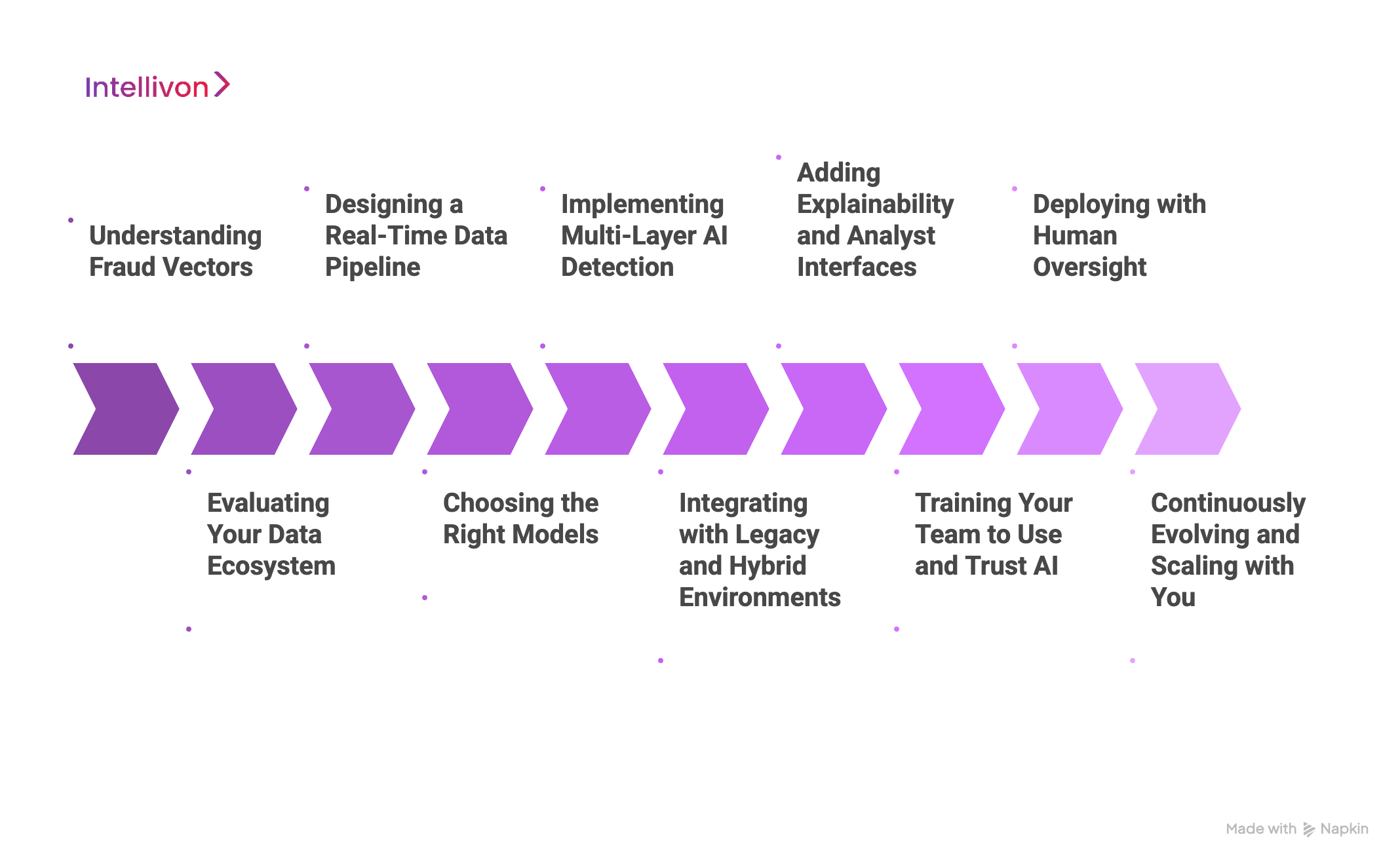

How We Build Your AI Fraud Detection Systems Step-by-Step

At Intellivon, we take pride in building fraud detection systems that are not only powerful and adaptive but also enterprise-ready from day one. We engineer a full-stack fraud intelligence system that understands your risks, integrates with your legacy environment, and evolves with emerging threats.

1. Understanding Fraud Vectors

We begin every engagement by deeply understanding the enterprise’s operational environment and specific fraud pain points.

Intellivon conducts a fraud threat modeling workshop to identify your highest-risk scenarios, from synthetic ID fraud to insider attacks or rapid account takeovers.

We also assess business KPIs like false positive rates, investigation costs, and time-to-resolution, ensuring the system we build addresses measurable goals.

2. Evaluating Your Data Ecosystem

Most financial institutions operate in siloed data environments. Our team audits your existing infrastructure to identify where transaction, customer, device, and behavioral data live.

We then design a unified data ingestion strategy that brings together structured datasets (account activity, KYC, CRM logs) and unstructured signals (emails, chatbot transcripts, call logs), while ensuring compliance with regulatory frameworks.

3. Designing a Real-Time Data Pipeline

To support instant fraud detection, we implement high-throughput streaming pipelines using tools like Apache Kafka or Pulsar.

These feed data into a centralized feature store, which calculates and stores engineered signals like transaction velocity, geolocation anomalies, device changes, and login irregularities. This infrastructure ensures the AI models are always operating with fresh, context-rich data.

4. Choosing the Right Models

Model selection is tailored to your specific fraud vectors and business constraints. We leverage:

- Supervised ML models (e.g., gradient boosting, random forests) for detecting known fraud patterns.

- Deep learning architectures (e.g., LSTM, autoencoders) for complex behavioral patterns like account takeovers.

- Unsupervised models (e.g., clustering, isolation forests) to detect new and unknown threats. When required, we deploy hybrid ensembles that balance precision and recall while adapting to evolving tactics.

5. Implementing Multi-Layer AI Detection

We don’t rely on a single fraud detection model. Instead, Intellivon implements a multi-layer AI architecture:

- Layer 1: Real-time rule engine for clear-cut red flags.

- Layer 2: ML classifiers for moderate risk scoring.

- Layer 3: DL models for high-dimensional behavior analysis.

- Layer 4: Ensemble layer to reconcile outputs and reduce noise.

This layered approach balances speed, accuracy, and explainability, improving decision quality across risk tiers.

6. Integrating with Legacy and Hybrid Environments

Our systems are built for integration. Using REST APIs, gRPC, and message brokers, we embed the fraud detection logic into your existing banking or ERP platforms without disrupting mission-critical functions.

Whether you’re on mainframes or transitioning to the cloud, Intellivon ensures secure, modular deployment using containerized services and microservices that sit beside your core systems, not inside them.

7. Adding Explainability and Analyst Interfaces

We build dashboards and risk explainability layers powered by XAI (Explainable AI) frameworks. These interfaces show your fraud and compliance teams:

- Why a transaction was flagged

- Which features triggered risk signals.

- Model confidence scores and thresholds crossed.

This helps investigators make faster, more informed decisions and strengthens audit compliance.

8. Training Your Team to Use and Trust AI

We don’t just hand off technology. Intellivon offers cross-functional training for fraud analysts, IT, and compliance leaders to understand how AI decisions work, how to escalate exceptions, and how to interpret model confidence levels. This builds organizational trust and accountability, increasing adoption rates.

9. Deploying with Human Oversight

We establish robust model monitoring frameworks that track:

- Drift in fraud patterns.

- Model performance (recall, precision, F1 score).

- Real-time feedback from investigation outcomes.

These insights feed into continuous retraining pipelines, helping your system evolve without costly rebuilds.

10. Continuously Evolving and Scaling with You

Once deployed, our journey together doesn’t end. Intellivon provides ongoing support, retraining cycles, and strategic reviews. As fraud patterns change or your business expands, we scale your system to new use cases, channels, or geographies, ensuring your defenses stay ahead of attackers.

Our MCP Integration Makes Your AI Fraud Detection System Impenetrable

The real power lies in how these AI agents communicate in your fraud detection system, and that’s where Intellivon’s MCP expertise comes in.

MCP is a proprietary coordination protocol that aligns each fraud model (whether ML or DL) with live transactional context. It dynamically understands:

- Customer behavior and payment types

- Device data and geographic patterns

- Risk scores and real-time analytics

This enables multi-model collaboration, where AI systems talk to each other across data silos to deliver faster, more accurate decisions. No lag. No confusion. Just precision fraud prevention.

Intellivon’s MCP-based architecture is designed for real-world financial infrastructure. It supports:

- High-speed processing with low latency

- Modular integration via microservices and APIs

- Seamless compatibility with both legacy systems and cloud platforms

If you want an impenetrable, robust, and evolving AI fraud detection system for your enterprise, book a strategy call with us today. Let us help you take the next big financial step to secure your data.

How We Future-Proof AI Fraud Detection in Financial Enterprises

Future-proofing AI fraud detection is about adopting adaptive, transparent, and resilient systems that evolve with threats. At Intellivon, we focus on integrating emerging technologies, staying ahead of regulations, and building fraud detection frameworks that can thrive in the face of constant change.

Emerging Technologies That Are Reshaping Detection

To stay ahead of evolving fraud tactics, Intellivon integrates cutting-edge technologies that extend beyond conventional AI.

- Federated Learning allows financial institutions to train fraud models across decentralized datasets without compromising customer privacy. This enables smarter, more inclusive detection without data sharing.

- Quantum Computing, though still emerging, is poised to revolutionize fraud detection. Its ability to process and decrypt complex patterns at unmatched speed will soon detect threats beyond current capabilities.

- Edge Computing brings fraud analytics closer to where transactions happen, at ATMs, point-of-sale terminals, or mobile apps, reducing latency and boosting real-time response.

- Blockchain Integration provides tamper-proof records of fraud events and decisions, supporting compliance, investigation, and audit trails.

- NLP is enabling deeper fraud detection in emails, chats, and support interactions by flagging phishing and social engineering attempts that often go unnoticed.

Adapting to Evolving Compliance and Regulation

As global AI and data privacy laws tighten, financial enterprises must prepare for transparency and fairness in every fraud decision.

- Cross-border compliance is now essential, especially with fraudsters operating across jurisdictions. Intellivon builds adaptable frameworks to navigate global standards, including GDPR and AML.

- We embed explainability into every model, enabling risk teams and regulators to clearly understand how decisions are made, reducing legal and reputational risk.

Proactive, Transparent, Collaborative AI

Over the next decade, fraud detection will become more predictive than reactive. Intellivon is already building:

- Context-aware AI agents that anticipate fraud, not just flag it.

- Collaborative AI ecosystems that share threat insights across institutions securely.

- Quantum- and blockchain-ready systems to meet tomorrow’s challenges, today.

Our goal is to make fraud detection smarter, faster, and future-proof, without sacrificing trust, privacy, or compliance.

Conclusion

Financial fraud is growing more complex, and traditional systems can’t keep up. AI fraud detection provides financial enterprises with a powerful advantage, offering real-time insights, faster intervention, and improved accuracy.

By integrating intelligent, adaptive systems that learn and evolve, financial enterprises can reduce losses, stay compliant, and protect customer trust. As fraud tactics advance, the future belongs to those prepared with smarter, scalable solutions that stop threats before they happen.

Ready to Build a Future-Ready AI Fraud Detection System?

With 11+ years of enterprise AI expertise and over 500 successful implementations across 25 countries, Intellivon is your trusted partner in deploying intelligent, scalable fraud detection systems tailored for financial enterprises. From detecting fraud in real-time to aligning with complex regulatory frameworks, we help leading institutions transform security from reactive to proactive, without disrupting core operations.

What Sets Intellivon Apart?

- Domain-Trained Fraud Models: Our AI systems are trained on vast financial datasets to detect subtle and evolving fraud tactics across banking, insurance, and fintech ecosystems.

- Modular AI Architecture: We build flexible AI frameworks that seamlessly integrate with legacy systems, including core banking, ERP, and payment platforms, ensuring fast deployment and minimal friction.

- Agentic AI + MCP Technology: Our proprietary agent-based intelligence and Model-Context Protocol (MCP) enable dynamic, collaborative fraud prevention that adapts in real-time.

- Compliance-Ready by Design: Every deployment includes explainable AI, audit trails, and alignment with GDPR, AML, OCC, and other critical compliance mandates.

- End-to-End Support: From strategic planning to post-deployment retraining and optimization, our team ensures your fraud detection system continuously evolves with the threat landscape.

Contact Intellivon to schedule a full enterprise fraud detection assessment. Our AI consultants will deliver:

- A fraud landscape audit and AI-readiness report

- Custom architecture and integration roadmap

- Use-case modeling with ROI forecasts

- Competitive analysis and scalability blueprint

FAQs

Q1. What are the key components of an AI fraud detection system?

A1. A robust AI fraud detection system typically includes data ingestion pipelines that aggregate structured and unstructured data, a real-time analytics engine to process live transactions, and a model layer powered by machine learning or deep learning. A decision engine interprets risk signals and triggers alerts, while a continuous feedback loop allows the system to evolve with new fraud patterns. Additional components such as explainability modules and governance controls ensure transparency, fairness, and compliance.

Q2. How does AI detect financial fraud in real time?

A2. AI detects financial fraud in real time by continuously analyzing transaction data as it flows through the system. It compares current behavior against learned norms and anomaly thresholds using trained models. When deviations are detected, such as irregular spending patterns or login attempts from unexpected locations, the system can automatically block or flag the transaction for further review, often within milliseconds, allowing institutions to intervene before losses occur.

Q3. Can AI-based fraud detection systems comply with GDPR and AML laws?

A3. Yes, AI fraud detection systems can be built to fully comply with GDPR, AML, and other financial regulations. Techniques such as data minimization, federated learning, differential privacy, and audit logging help preserve customer data rights and security. Explainable AI features also ensure decisions can be understood and justified during regulatory audits, satisfying transparency and fairness requirements.

Q4. What machine learning models are best for fraud detection?

A4. The choice of model depends on the type of fraud being targeted. Gradient boosting models are effective for transaction classification, while neural networks and LSTMs are preferred for sequential and behavioral fraud. Autoencoders and isolation forests are commonly used for uncovering anomalies and rare events. Many enterprises adopt hybrid or ensemble models to combine the strengths of different approaches, improving accuracy and reducing false positives.

Q5. How do large enterprises integrate AI with legacy systems?

A5. Large enterprises typically integrate AI using API layers, microservices, or middleware that allow new fraud detection models to interface with existing banking or insurance platforms. AI overlays provide an added layer of intelligence without disrupting mission-critical operations. This phased, modular approach reduces integration risk, supports hybrid cloud environments, and enables real-time processing, even in legacy infrastructure environments.