The fintech revolution has now turned into the foundation of modern finance. Instant payments, effortless user experiences, and airtight security have become the baseline. For enterprise leaders, this shift brings a pressing challenge: understanding the true cost of enterprise fintech software and making smart investment choices that balance innovation, compliance, and competition.

The reality is that building enterprise-grade fintech software goes far beyond coding an app. Costs are shaped by strict compliance requirements, complex integrations with legacy banking systems, impenetrable security, and the need to process millions of transactions without failure. One wrong decision during planning can set back an entire digital transformation.

At Intellivon, we partner with large enterprises to create fintech software where compliance, security, and scalability are built in from the start. In this guide, we’ll explore everything you need to know: cost breakdowns, development timelines, compliance challenges, emerging technologies, monetization strategies, and real-world case studies. By the end, you’ll have a clear, practical framework to plan your fintech investment with confidence.

Why You Should Invest in Building Enterprise FinTech Software Now

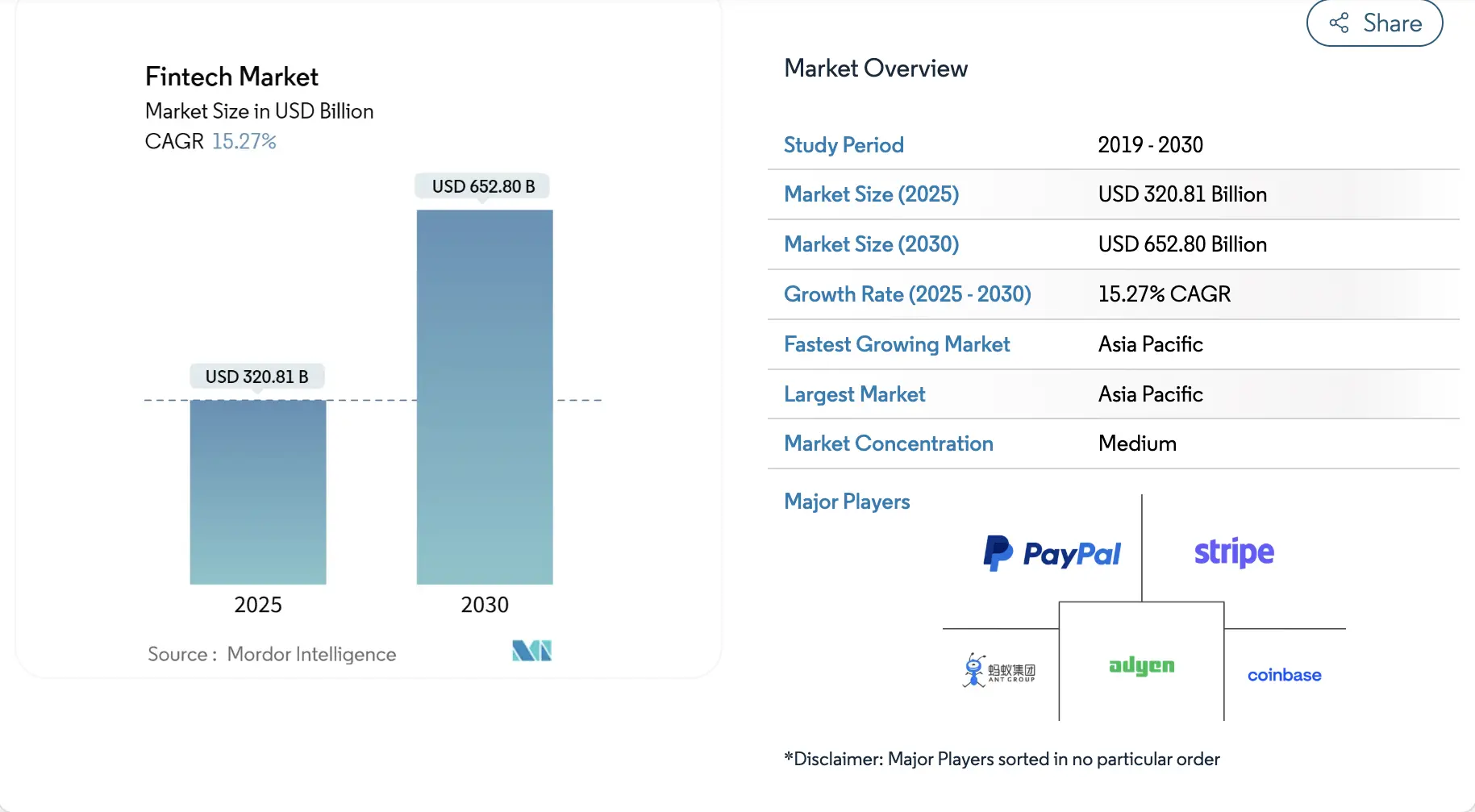

The enterprise FinTech market is scaling at record speed. It is set to grow from USD 320.8 billion in 2025 to USD 652.8 billion by 2030, at a 15.27% CAGR. By 2033, the industry could reach USD 1.5 trillion, with enterprise FinTech alone nearing USD 1 trillion by 2030.

Key Growth Drivers

- Embedded Finance & APIs: Open APIs integrate treasury dashboards, card issuing, and just-in-time financing into workflows, creating sticky enterprise revenue streams.

- Real-Time Payments: FedNow and SEPA Instant fuel cash-flow analytics and micro-lending; U.S. real-time transactions will hit 7.4 billion by 2025.

- Risk Management & Compliance: Banks spent USD 57.1 billion on risk tech in 2023; 75% plan higher investments by 2025 to govern AI-driven processes.

- Cloud-Native & AI Integration: Cloud-based BaaS, PaaS, and AI analytics streamline operations from loan origination to liquidity forecasting.

- Open Banking & Data Analytics: Standardized APIs enable cross-institution collaboration, while analytics deliver enterprise dashboards and risk-scoring models.

- Cybersecurity & Fraud Prevention: Enterprises upgrade with governance, real-time fraud detection, and blockchain verification. In 2025, 75% of large banks will already be running AI strategies.

- Automation & Blockchain: RPA reduces operational costs by 30–50% with ROI in 12 months; 81% of financial institutions now explore blockchain, a market growing to USD 22.46 billion by 2026.

Enterprise FinTech software is a high-growth market powered by the urgent need for digital transformation in institutional finance. Key opportunities lie in embedded finance integrations, real-time payments, and AI-driven risk management, areas that are attracting significant investment and driving premium growth rates.

Types of Enterprise FinTech Software and Their Cost

Building enterprise fintech software typically costs between $300,000 and $500,000. The actual investment depends on the type of application, security requirements, integrations with legacy systems, and compliance needs. Below are the most common types of fintech solutions enterprises invest in.

1. Digital Banking Platforms

These include mobile banking apps, customer onboarding, account management, and secure transaction systems. Development costs usually range from $400K to $500K, depending on features and regulatory requirements.

2. Payment Gateways & Wallets

Enterprises use these systems for instant payments, multi-currency support, and fraud prevention. Building such platforms typically costs $300K to $450K, influenced by the level of security integration.

3. Wealth & Investment Platforms

These cover robo-advisors, portfolio tracking, and investment analytics. Costs average $350K to $500K, shaped by the complexity of compliance reporting and user dashboards.

4. InsurTech Solutions

Claims automation, digital policy management, and risk evaluation fall into this category. Development costs are generally $300K to $450K, especially when AI-driven features are included.

5. RegTech & Compliance Software

These solutions manage AML, KYC, GDPR, and cross-border reporting obligations. Costs are usually $350K to $450K, influenced by certification and integration complexity.

6. Lending & Credit Platforms

Loan origination, credit scoring, and automated decision-making engines make up this category. Enterprises spend around $350K to $500K to build scalable systems.

7. Treasury & Cash Management Systems

These solutions enable liquidity forecasting, enterprise treasury, and cross-border payments. Development costs range from $400K to $500K, depending on integrations with global banking networks.

In most cases, enterprises build customized solutions that combine multiple categories. While this can push the investment toward the higher end of the range, it ensures the software is tailored to enterprise needs.

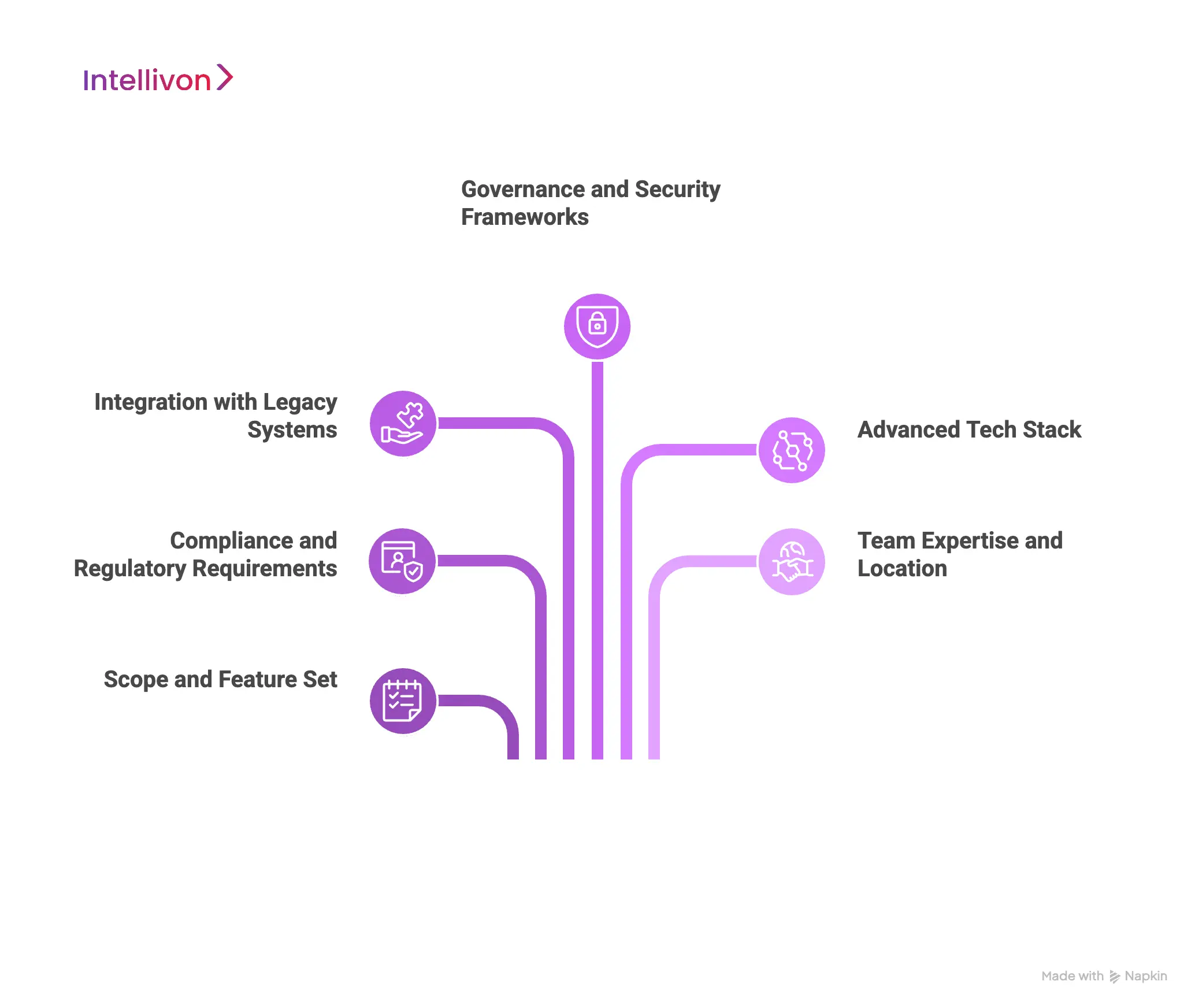

Factors Affecting the Cost of Building an Enterprise FinTech Software

Every enterprise fintech project has its own cost structure. While the average investment falls between $300,000 and $500,000, the exact number depends on a set of core factors. Understanding these helps leaders plan realistically and avoid surprises.

1. Scope and Feature Set

The size and complexity of your platform drive costs more than anything else. A basic payments app with limited features might stay near $300K, while a full-scale digital banking system with AI-driven dashboards, advanced analytics, and multi-currency support could push closer to $500K. Prioritizing features early helps prevent scope creep.

2. Compliance and Regulatory Requirements

Financial services are heavily regulated. Building software that meets standards like GDPR, HIPAA, PCI-DSS, and AML/KYC adds to cost through certifications, audits, and continuous compliance updates. Compliance efforts can raise budgets by 15–25%, meaning a $350K build may climb toward $430K–$450K.

3. Integration with Legacy Systems

Most large enterprises run older core banking or ERP systems. Connecting new fintech apps to these legacy systems requires custom APIs, middleware, and extended testing. These efforts often add 10–20% to total costs, or roughly $40K–$80K, depending on complexity.

4. Governance and Security Frameworks

Enterprise fintech cannot compromise on security. Multi-factor authentication, role-based access, encryption, and real-time monitoring all come at a price. Security can account for 15–20% of total cost, which means even a $300K project could see $50K–$70K dedicated purely to data protection.

5. Advanced Tech Stack

Enterprises increasingly adopt AI, machine learning, blockchain, and cloud-native platforms. Each requires specialized developers and infrastructure, which adds 20–30% to costs. For example, AI-powered fraud detection could turn a $350K build into $420K–$450K.

6. Team Expertise and Location

Finally, where and who you hire matters. A U.S. or EU-based development team may cost 2x more than offshore teams. While nearshore or offshore options can trim 20–30% off budgets, enterprises must balance savings with quality, compliance oversight, and time zone challenges.

In short, the enterprise fintech software cost isn’t one-size-fits-all. The final figure is shaped by compliance, integrations, technology, and the expertise behind the build. Leaders who plan for these factors up front can manage budgets with confidence.

Time Required to Develop Enterprise FinTech Software

At Intellivon, we know enterprises can’t afford delays when building fintech platforms. That’s why we design development roadmaps that balance speed with compliance, security, and scalability. On average, enterprise fintech software takes 9 to 18 months from planning to launch. The exact timeline depends on scope, regulatory reviews, and integration needs. Cutting corners often leads to costly mistakes, while structured planning ensures stability and long-term success.

1. Assessment and Planning (1–2 months)

This stage covers requirement gathering, compliance checks, and defining the tech stack. Most enterprises spend 4–8 weeks here, and we help them avoid misaligned features or regulatory risks down the line.

2. MVP Development (4–6 months)

The Minimum Viable Product (MVP) is the foundation of the platform. It includes core features like payments, user onboarding, and dashboards. For most enterprises, this phase takes 16–24 weeks, depending on team size and integrations.

3. Feature Expansion (3–4 months)

After the MVP is tested, enterprises scale up with features like AI analytics, multi-currency support, or blockchain modules. This expansion phase typically lasts 12–16 weeks.

4. Infrastructure and DevOps (2–3 months, parallel)

Secure infrastructure and cloud-native systems are built alongside coding. Governance frameworks, CI/CD pipelines, and monitoring add 8–12 weeks, though much of this runs in parallel.

5. Compliance and Testing (1–2 months)

No enterprise fintech platform goes live without audits. Compliance reviews and security testing usually take 4–8 weeks, depending on regulations and legacy system complexity.

6. Ongoing Maintenance (Continuous)

Once deployed, platforms need quarterly updates to address new regulations, patch vulnerabilities, and improve performance. We guide enterprises in planning continuous maintenance as part of the long-term strategy.

In short, a well-scoped fintech project can be delivered in under a year, but enterprise-scale builds usually take 12–18 months. Intellivon ensures every phase is aligned with compliance and business goals, so projects launch on time and scale with confidence.

Step-by-Step Cost Breakdown of Building Enterprise FinTech Apps

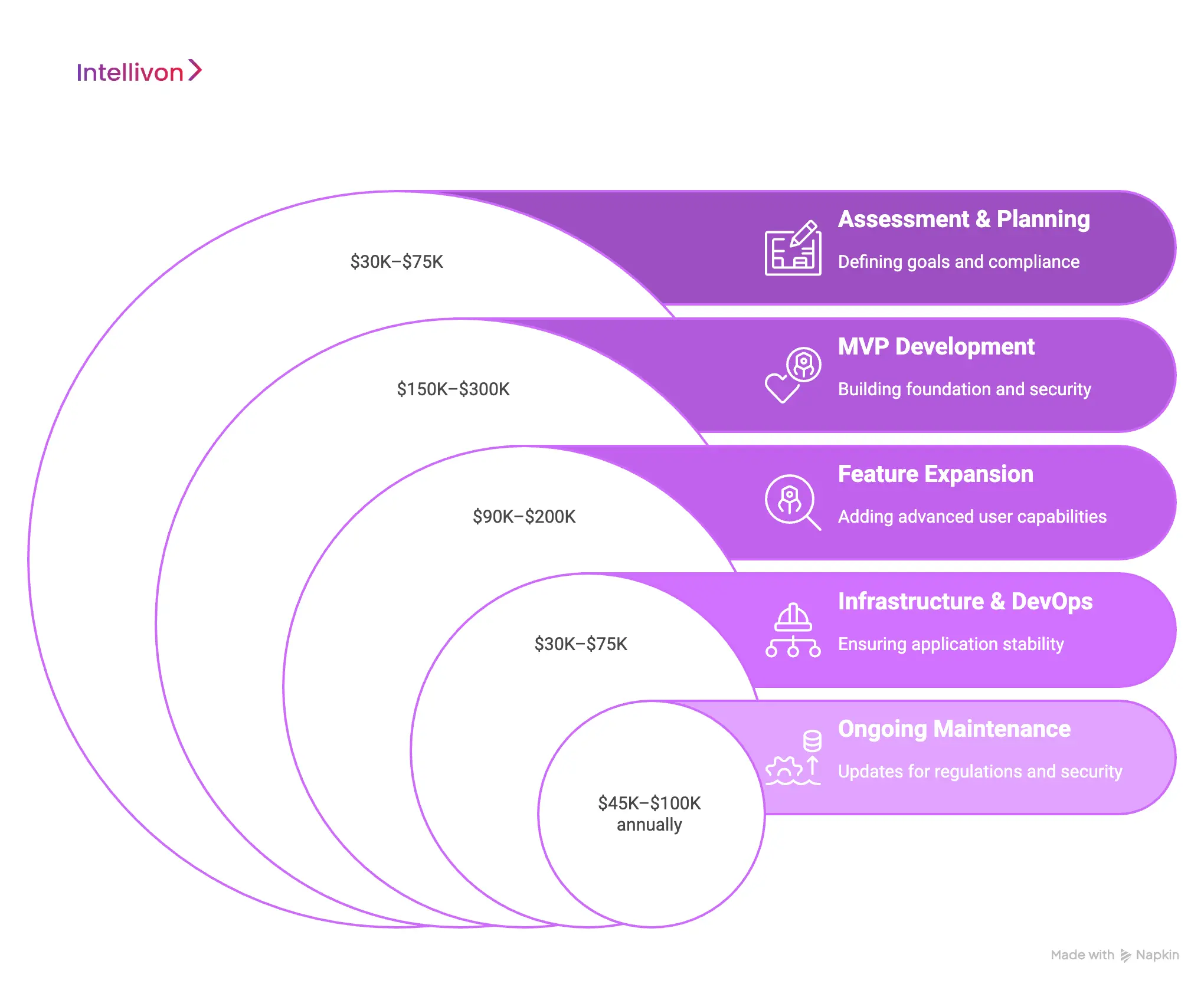

Understanding the enterprise fintech software cost means breaking it down into stages. Each phase contributes differently to the overall investment, which typically ranges between $300,000 and $500,000. Knowing where the money goes helps decision-makers plan budgets without hidden surprises.

Stage 1: Assessment & Planning Cost Breakdown

Every successful fintech project begins with a clear blueprint. The assessment and planning phase is where enterprises define goals, align stakeholders, and anticipate compliance hurdles. It may not feel as “visible” as coding, but skipping or rushing this stage often leads to costly overruns later. Typically, this phase accounts for 10–15% of the total budget, which translates to $30K–$75K on a $300K–$500K project.

What happens in this stage?

- Requirements gathering across business, technical, and compliance teams.

- Identifying regulatory frameworks like AML, KYC, GDPR, HIPAA, or PCI-DSS.

- Architecture design, including system diagrams, tech stack selection, and integration planning.

- Risk assessment and roadmap creation with milestones and delivery estimates.

What drives these costs?

- Regulatory complexity: Financial apps operating in multiple regions must account for diverse compliance standards.

- Scope of features: A simple payments MVP requires lighter planning than a full-scale digital banking platform.

- Legacy integrations: Mapping modern systems to aging core banking software requires more upfront design work.

Typical investment breakdown:

- Discovery workshops and stakeholder alignment: $10K–$20K.

- Regulatory and compliance scoping: $10K–$25K.

- Architecture design and solution roadmap: $10K–$30K.

Enterprises that underinvest in planning usually face rework later. A misaligned feature set, overlooked compliance requirement, or unplanned integration can push costs up by 20–30% in later stages.

We bring compliance-first planning to the table. By running structured workshops, regulatory gap analyses, and architectural reviews early, we shorten timelines while ensuring nothing is overlooked. This approach helps enterprises enter development with confidence that the scope, budget, and compliance framework are rock-solid.

Stage 2: MVP Development Cost Breakdown

The Minimum Viable Product (MVP) is the heart of enterprise fintech software development. It’s where concepts turn into a working product that real users can interact with.

Because it involves building the foundation, which includes core features, security layers, and essential integrations, the MVP stage is the most resource-intensive. For most enterprises, this phase takes 4–6 months and consumes 50–60% of the total budget. That means roughly $150K–$300K on a $300K–$500K project.

What happens in this stage?

- Core feature development: payments, account creation, user onboarding, and role-based dashboards.

- Compliance basics: AML/KYC flows, secure authentication, and encrypted transactions.

- Initial integrations: payment gateways, banking APIs, or identity verification providers.

- Foundational security: audit trails, multi-factor authentication, and fraud detection rules.

What drives these costs?

- Scope of features: A payment wallet with simple transfers costs less than a banking MVP with dashboards, lending tools, and reporting.

- Tech stack choices: Building native iOS and Android apps doubles the effort compared to a single web platform.

- Integration complexity: Connecting to multiple banking APIs, data vendors, or legacy systems can add weeks of work.

- Security depth: Financial regulators often demand advanced measures like device binding and real-time fraud detection, which require specialized development.

Typical investment breakdown:

- UI/UX design for MVP: $20K–$40K.

- Frontend and backend development: $80K–$150K.

- Third-party integrations (payments, KYC, AML): $20K–$50K.

- Security and compliance features: $30K–$60K.

The MVP is the first real product. If it fails to win user trust or pass compliance reviews, scaling becomes difficult. Enterprises that invest wisely in this phase gain a strong foundation for expansion.

We accelerate MVP builds with prebuilt modules for onboarding, KYC, and payments while still tailoring them to each client’s compliance and branding requirements. This cuts time-to-market without compromising security or regulatory standards.

Stage 3: Feature Expansion Cost Breakdown

Once the MVP is live and stable, enterprises usually move into feature expansion. This phase focuses on adding advanced capabilities that improve user experience, broaden market reach, and strengthen compliance. It typically takes 3–4 months and accounts for 30–40% of the total budget, which is around $90K–$200K in a $300K–$500K project.

What happens in this stage?

- Adding advanced financial features such as AI-driven fraud detection, robo-advisors, or multi-currency support.

- Building analytics dashboards for customers and internal teams.

- Expanding integrations to cover credit bureaus, trading platforms, or cross-border payment systems.

- Enhancing compliance with advanced reporting and audit-ready logs.

What drives these costs?

- Advanced technology adoption: AI and machine learning models require more specialized talent and infrastructure.

- Integration depth: Multi-vendor connections and cross-border compliance add complexity.

- Market scope: Features like multi-language support or global transactions increase cost and time.

- Scalability needs: Enterprises often strengthen infrastructure here to handle higher transaction volumes.

Typical investment breakdown:

- Advanced analytics and reporting: $20K–$50K.

- AI-driven features (fraud detection, robo-advisory): $30K–$70K.

- Expanded third-party integrations: $20K–$40K.

- Compliance upgrades and advanced security: $20K–$40K.

This phase transforms a functional MVP into a competitive enterprise-grade product. Without these enhancements, enterprises risk falling behind rivals who offer more features and smoother user experiences.

We help enterprises prioritize feature rollouts based on ROI and compliance impact. Instead of building everything at once, our roadmap ensures high-value features like AI analytics or multi-currency support are delivered first, creating measurable business impact while keeping costs predictable.

Stage 4: Infrastructure & DevOps Cost Breakdown

Even the smartest fintech app won’t succeed without a strong backbone. That’s where infrastructure and DevOps come in. This stage ensures your application is stable, scalable, and secure from day one. It typically runs in parallel with MVP and feature development, lasting 2–3 months. The cost usually represents 10–15% of the budget, or about $30K–$75K in a $300K–$500K project.

What happens in this stage?

- Setting up cloud hosting, virtual networks, and secure environments.

- Creating CI/CD pipelines for automated builds and faster releases.

- Building monitoring systems for uptime, fraud alerts, and transaction health.

- Designing backup and disaster recovery strategies to satisfy regulators.

What drives these costs?

- Cloud requirements: Multi-region deployment and zero-trust security frameworks cost more than single-region setups.

- Compliance needs: Systems must log activity for audits, increasing storage and monitoring costs.

- Scale expectations: Platforms designed to handle millions of daily transactions need stronger, more expensive infrastructure.

Typical investment breakdown:

- Cloud hosting setup and provisioning: $10K–$20K.

- CI/CD pipelines and automation: $10K–$15K.

- Monitoring and observability tools: $5K–$20K.

- Disaster recovery and security hardening: $5K–$20K.

Without proper infrastructure, apps crash under load, fail audits, or face costly downtime. Cutting corners here may save money short-term, but risks reputation and compliance penalties long-term.

We embed DevSecOps and RASP practices from the start, using policy-as-code and hardened cloud blueprints. This keeps infrastructure costs predictable while ensuring enterprises meet uptime, audit, and security standards without delay.

Stage 5: Ongoing Maintenance Cost Breakdown

Launching your fintech app is only the beginning. Enterprise platforms must evolve constantly to keep up with new regulations, changing user expectations, and security threats. That’s why ongoing maintenance is a permanent line item in the budget. Typically, enterprises spend 15–20% of the initial build cost every year, around $45K–$100K annually for a $300K–$500K project.

What happens in this stage?

- Regular updates to meet new compliance requirements like GDPR revisions, AML updates, or PCI-DSS changes.

- Security patches to address vulnerabilities and prevent fraud.

- Performance tuning as transaction volumes grow.

- Feature upgrades to refine user experience and stay ahead of competitors.

What drives these costs?

- Regulatory churn: Financial rules change frequently, forcing updates even if the product is stable.

- Evolving threats: New fraud tactics require constant upgrades in detection and prevention.

- Platform scale: As user numbers and transaction loads increase, infrastructure needs to grow with them.

- Third-party dependencies: Vendor APIs and SDKs update often, requiring code changes and retesting.

Typical investment breakdown:

- Compliance-driven updates: $15K–$25K per year.

- Security patches and monitoring: $10K–$20K per year.

- Infrastructure scaling and optimization: $10K–$30K per year.

- New features and usability improvements: $10K–$25K per year.

Enterprises that underfund maintenance quickly face compliance failures, security breaches, and unhappy customers. What looks like a saving today can become a million-dollar penalty or reputational loss tomorrow.

We deliver structured maintenance programs with proactive monitoring, quarterly compliance updates, and performance audits. This ensures enterprise fintech apps remain secure, scalable, and regulation-ready long after launch. At Intellivon, we help enterprises move through these stages with clarity, ensuring compliance, security, and scalability remain central.

Still, even with a clear cost breakdown, many enterprises underestimate the hidden costs that arise along the way. From compliance certifications to vendor fees, these expenses can quietly inflate budgets if they’re not planned for in advance. Let’s take a closer look at what those hidden costs are and how to anticipate them.

Hidden Costs of Building Enterprise FinTech Software

Even with a clear budget for planning, development, and maintenance, many enterprises encounter hidden costs that quietly inflate total spending. These are often overlooked in the early stages but can significantly impact your project if not accounted for upfront. On average, hidden expenses can add 10–20% to the overall budget, or roughly $30K –$80K on a $300K–$500K project.

1. Compliance Certifications

Enterprise fintech platforms must meet strict regulatory standards. Certifications like PCI-DSS, SOC 2, ISO 27001, or GDPR audits require external assessments and documentation. These activities can cost $10K–$25K per certification cycle. If your platform operates across multiple jurisdictions, expect costs to rise further.

2. Third-Party Vendor Fees

Fintech apps rely heavily on external services, such as payment gateways, KYC/AML providers, identity verification APIs, and data vendors. While integration costs are budgeted, ongoing licensing and usage fees often go unnoticed. For large enterprises, this can add $15K–$30K annually, depending on transaction volumes.

3. Cloud Hosting and Scaling

Cloud infrastructure is billed on consumption. As usage grows, so do costs for storage, compute, and data transfers. Enterprises that start small may see monthly bills climb quickly, adding $10K–$20K per year to operating expenses if scaling isn’t planned carefully.

4. Security Audits and Penetration Testing

Passing regulatory checks and keeping data safe requires ongoing security testing. Independent penetration tests, red-team exercises, and vulnerability scans can cost $5K–$15K per round, and most enterprises need these at least twice a year.

5. Continuous Monitoring and Governance

Enterprises must retain logs for audits, monitor fraud in real time, and manage compliance dashboards. Tools like SIEM platforms, observability suites, or fraud-detection engines often carry hidden subscription fees, adding $5K–$10K per month to operating budgets.

6. Staff Training and Change Management

Rolling out new fintech systems means retraining employees and aligning departments. These programs aren’t free, and large organizations can spend $10K–$25K on workshops, documentation, and adoption programs to ensure smooth transitions.

Why these costs matter: If left unplanned, hidden expenses can derail ROI models and delay time-to-market. Enterprises that plan for these items up front avoid budget shocks later.

At Intellivon, we identify hidden costs during the planning stage and build them into the roadmap. This transparency ensures enterprises know exactly what to expect, keeping projects compliant, secure, and financially predictable.

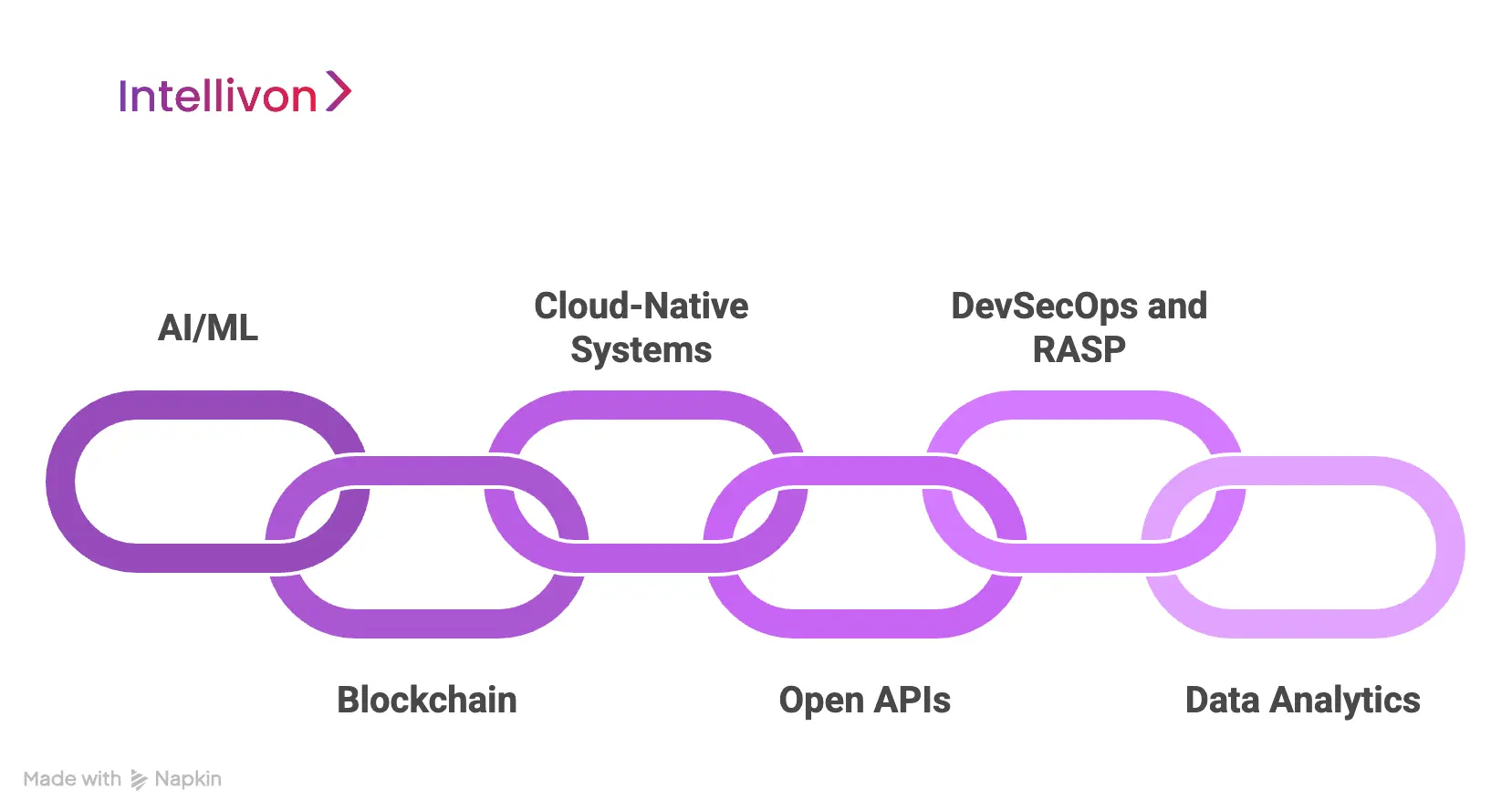

Advanced Tech We Use to Build Enterprise FinTech Software

At Intellivon, we believe advanced technology should solve real business problems, and not overwhelm decision-makers. That’s why we focus on tools and frameworks that make fintech software more secure, scalable, and compliant. Here’s how our technology choices translate into business value.

1. AI/ML

Think of AI/ML as the brain that learns from your data. We use it to spot unusual transactions, predict risks, and even recommend financial products to customers. For enterprises, this means less fraud, faster decisions, and stronger customer trust.

2. Blockchain

Blockchain is like a digital ledger that no one can tamper with. We use it to speed up cross-border payments, track transactions transparently, and reduce paperwork. Smart contracts (self-executing agreements) help automate compliance-heavy tasks, saving time and cutting costs.

3. Cloud-Native Systems

Instead of running everything on bulky in-house servers, we build on the cloud. This makes fintech apps flexible, allowing them to easily handle a surge in users or transactions without slowing down. It also reduces infrastructure costs, since you only pay for what you use.

4. Open APIs

APIs are connectors that let your fintech platform “talk” to other systems, like banks, payment processors, or ID verification services. At Intellivon, we build with an API-first mindset so enterprises can plug in new services without expensive rebuilds.

5. DevSecOps and RASP

In simple terms, we build security into the software from day one. Every update, feature, or release passes automated checks for compliance and security. This avoids last-minute audit issues and keeps enterprises ahead of regulators.

6. Data Analytics

Enterprises generate huge amounts of data, but data is only useful if it tells a story. We create easy-to-use dashboards that show patterns in customer behavior, cash flow, and credit risk. These insights help leaders make faster, smarter business decisions.

Why this matters for enterprises: Advanced tech is valuable only when it aligns with business goals. At Intellivon, we ensure every technology choice, whether AI, blockchain, or cloud, is used to make fintech platforms safer, smarter, and more cost-efficient.

Features We Integrate into Enterprise FinTech Software

At Intellivon, we build fintech platforms that go beyond basic payments. Every feature we integrate is designed to strengthen security, simplify compliance, and enhance user experience. This is what makes enterprise fintech software not just functional, but future-ready.

1. Secure & Adaptive Authentication

Security is the first line of trust. We integrate multi-factor authentication, biometrics, and adaptive risk-based login systems that adjust to user behavior.

For example, a low-risk login may allow quick access, while unusual patterns trigger additional verification. This balance keeps security strong without frustrating genuine users, something global fintech leaders have mastered.

2. Real-Time & Local Payment Options

Customers expect money to move instantly, no matter the location. We integrate real-time payment processing, support for local banking rails, and fallback routing when one channel fails.

This ensures payments are processed without delays, improving customer satisfaction and keeping cash flow steady. For enterprises, it reduces failed transactions and opens doors to new markets.

3. Subscription & Usage Billing

Revenue models are evolving. Modern enterprises need flexible billing options that support subscriptions, pay-per-use services, and tiered pricing. We integrate billing systems that manage recurring charges, handle upgrades or downgrades, and automate invoicing.

This creates consistent revenue streams and eliminates manual errors in payment collection.

4. Fraud Detection & Dispute Management

Fraud is one of the biggest risks in finance, but it can be managed with smart technology. Our systems combine machine learning, behavioral analytics, and custom fraud rules to detect suspicious activity instantly.

We also integrate dispute and chargeback management, making it easier for enterprises to handle fraudulent claims quickly while protecting legitimate customers.

5. Compliance Automation & Audit Trails

Regulations like AML, KYC, GDPR, and PCI-DSS are constantly evolving. We build platforms that automate compliance checks, generate ready-to-submit reports, and keep detailed audit trails.

This not only reduces the burden on compliance teams but also ensures enterprises remain regulator-ready at all times, saving both time and potential penalties.

6. Analytics & Insights Dashboards

Data should drive business decisions, not sit unused. We design dashboards that give enterprises real-time visibility into revenue streams, transaction patterns, and customer behavior.

Predictive analytics highlight risks and opportunities before they happen. Leaders can act faster with clear insights instead of sifting through raw spreadsheets.

7. Tokenization & Saved Payments

Customers prefer smooth experiences when making payments. We integrate tokenization, which replaces sensitive data with secure tokens, allowing one-click payments without compromising safety.

This reduces checkout friction, boosts conversion rates, and builds long-term loyalty. It’s the kind of feature global leaders like Stripe and PayPal rely on to keep customers coming back.

8. Event Notifications & Webhooks

Enterprises often need instant visibility into key events, whether it’s a high-value transfer, a suspicious login, or a failed payment. We integrate notification systems and webhooks that trigger automated actions.

For example, a flagged transaction can instantly alert fraud teams or lock accounts, helping enterprises respond in real time.

9. Multi-Currency & Cross-Border Support

Global business requires global payment capabilities. We integrate multi-currency support, automated foreign exchange, and settlement across different regions.

Customers can pay in their local currency while enterprises receive seamless settlements. This feature helps businesses expand internationally without facing constant friction around payments.

Successful global fintech platforms deliver trust, flexibility, and scalability through the features above. At Intellivon, we integrate these capabilities thoughtfully, ensuring every enterprise platform is built to compete with the best in the world.

Monetization Strategies for Enterprise FinTech Software

Building enterprise fintech software is a major investment, but the right revenue model ensures long-term growth. At Intellivon, we help enterprises design monetization strategies tailored to their market, customers, and compliance requirements. Here are the most effective approaches, with real-world examples.

1. Subscription-Based Models

Enterprises charge users a fixed monthly or yearly fee for platform access. For example, QuickBooks Online offers subscription plans for accounting and expense tracking, while Xero uses a similar model for enterprise bookkeeping and financial management.

Subscriptions create reliable, recurring revenue and allow enterprises to forecast growth with confidence.

2. Transaction Fees & Commissions

This model generates revenue on every payment processed. Stripe and PayPal lead the way by charging a percentage fee per transaction.

Similarly, Adyen powers global payments for companies like Spotify and Uber, earning revenue from transaction volume. At enterprise scale, small percentages quickly translate into significant revenue streams.

3. White-Label Licensing

Here, fintech platforms are licensed to other organizations to rebrand and deploy. FIS Global and Temenos provide white-label core banking and digital finance solutions to banks worldwide.

Smaller financial institutions use these platforms under their own branding, while the enterprise earns licensing fees without managing end customers directly.

4. API Monetization

APIs can themselves be products. Plaid charges enterprises for access to its financial data APIs, enabling services like account verification and transaction insights.

TrueLayer uses a similar model, monetizing APIs that connect fintech apps to banks. This strategy turns infrastructure into a scalable revenue engine.

5. Data-Driven Insights

With proper anonymization and compliance, enterprises can sell insights back to customers or partners. Experian and Equifax, for example, monetize credit and risk data by packaging it into enterprise-grade reports.

Similarly, Moody’s Analytics offers risk scoring and financial trend insights as a paid service.

6. Hybrid Approaches

Many of the biggest fintech players blend models for resilience. Robinhood earns through a mix of commission-free trading (supported by payment for order flow), premium subscriptions via Robinhood Gold, and interest on uninvested cash.

Revolut combines subscriptions, transaction fees, and currency exchange spreads to create multiple income streams.

Monetization strategies work best when aligned with business goals. At Intellivon, we study how leading platforms generate revenue and design models that match our clients’ long-term vision, ensuring fintech apps become both valuable products and profitable businesses.

Famous FinTech Software and Their Estimated Costs

Looking at successful fintech platforms shows us how enterprises can design profitable models and what it might cost to build comparable solutions today.

1. Stripe (Transactions, APIs & Billing)

Stripe has become one of the most trusted names in global payments by combining transaction fees with API monetization. Every payment processed through the platform generates a small revenue stream, while its APIs for billing, fraud detection, and reporting add extra value for enterprises.

The strength of Stripe lies in its simplicity, as it enables companies to accept payments globally with built-in compliance and developer-friendly tools.

Estimated cost to build today: $400,000–$700,000

Stripe proves that transaction fees combined with flexible APIs create a scalable fintech model with recurring revenue.

2. FIS Digital One (White-Label Banking Platform)

FIS Digital One delivers digital banking infrastructure that banks can license and rebrand as their own. This white-label approach is successful because it allows institutions to modernize quickly without building from scratch.

For FIS, the model ensures steady enterprise revenue while clients get a proven, compliant platform tailored to their branding needs.

Estimated cost to build today: $500,000–$800,000

White-label licensing requires modular and secure design, but it creates adoption at scale across financial institutions.

3. FIS IBS (Integrated Banking Solution)

FIS IBS powers essential banking functions such as deposits, lending, and accounting. Its SaaS and licensing model make it a mission-critical solution for financial institutions worldwide.

Enterprises invest in platforms like IBS because core banking must be reliable, compliant, and scalable, and failure here is not an option. The platform’s strength lies in its ability to lock in clients long-term due to the cost and complexity of switching providers.

Estimated cost to build today: $600,000–$1,000,000

Building a core banking system is expensive but results in high-value, long-term enterprise relationships.

FIS ADaaS (Accounting Data as a Service)

FIS ADaaS is a strong example of turning backend infrastructure into revenue. The platform monetizes through API usage, charging clients each time they access real-time financial and accounting data.

This works because enterprises need reliable, compliant access to data without the burden of maintaining their own infrastructure. It is efficient for both the provider and the customer, with scalability baked into the model.

Estimated cost to build today: $300,000–$500,000

API-driven platforms show how even backend services can become profitable when built with compliance and scalability in mind.

Conclusion

Building enterprise fintech software requires a substantial investment. However, with the right strategy, it can provide long-term value. From initial planning and MVP development to adding features and ongoing maintenance, each stage has clear costs and hidden costs that can quickly rise if ignored.

Successful platforms like Stripe and FIS show that careful budgeting, being ready for compliance, and focusing on customer needs are crucial. Selecting the right solution provider helps bring these elements together smoothly, minimizing risks and maximizing ROI.

How Intellivon Helps You Build Enterprise FinTech Software

At Intellivon, we specialize in guiding enterprises through this journey. Our focus on compliance, security, and scalability ensures that your fintech platform grows with your business. By aligning technology choices with your business goals, we help you avoid wasted spend, accelerate time-to-market, and build systems that generate measurable ROI. Your enterprise fintech software is an investment in future growth, customer trust, and competitive advantage.

Why Choose Intellivon?

- Compliance-First Design: We integrate global regulations like AML, KYC, PCI-DSS, and GDPR from the ground up.

- Scalable Infrastructure: Cloud-native, API-first systems that grow with your transaction volumes and global reach.

- Faster Time-to-Market: Prebuilt fintech modules for onboarding, payments, and KYC speed up delivery.

- Enterprise Reliability: DevSecOps, automated audits, and advanced monitoring keep platforms secure and always regulator-ready.

- Proven Business Impact: We align costs with ROI, ensuring your platform is a growth engine.

Ready to Build the Future of FinTech?

Your enterprise needs a partner who understands the cost, compliance, and scalability challenges of fintech software. Book a consultancy call with our fintech experts and let’s design a roadmap that makes your investment predictable, your platform secure, and your growth unstoppable.

FAQ’s

Q1. What is the average enterprise fintech software cost?

A1. The average cost to build enterprise fintech software ranges from $300,000 to $500,000, depending on scope, features, and compliance requirements. Ongoing maintenance adds another 15–20% annually.

Q2. What factors affect the cost of building fintech software?

A2. Key factors include the scope of features, compliance with regulations like AML/KYC, integration with legacy systems, advanced technology use (AI, blockchain, cloud), and the expertise of the development team.

Q3. How long does it take to build enterprise fintech software?

A3. On average, it takes 9 to 18 months. Smaller MVP projects can launch within a year, while full-scale platforms with global features often require longer timelines.

Q4. Are there hidden costs in fintech software development?

A4. Yes. Hidden costs include compliance certifications, vendor licensing fees, cloud hosting, security audits, monitoring tools, and employee training. These can add 10–20% to the total budget.

Q5. What monetization strategies work best for fintech platforms?

A5. Popular models include subscription plans, transaction fees, white-label licensing, API monetization, and data-driven insights. Many enterprises use a hybrid approach to diversify revenue streams.