In most cases, by the time a financial institution spots a risky loan, the damage is already done. This is because traditional credit risk systems rely on backward-looking data and static models that cannot keep pace with the rapid changes in borrower circumstances. That is exactly why credit risk AI systems have come up as a practical solution that catches these risks early, adapts to real-world behavior shifts, and helps fintech teams make confident decisions faster. These systems are built to give your team the insights they need when it matters most, and not to replace their expertise.

We’ve spent years building these systems for fintech companies, through which we have learned what actually works beyond the hype. In this blog, we share our process by explaining why these systems have become essential, how we approach development to match real business needs, and what it takes to build something that genuinely scales with your enterprise and delivers measurable gains.

What is a Fintech Credit Risk AI System?

A Fintech credit risk AI system is an enterprise-grade platform built to evaluate, monitor, and manage borrower risk across the entire lending lifecycle. Unlike legacy bureau-based scoring models that lean heavily on static reports, these systems integrate diverse data sources and apply advanced machine learning to provide real-time, adaptive insights.

Core Functions That Define It

- Data Ingestion and Unification: Pulling data from banks, payment platforms, credit bureaus, and non-traditional sources such as mobile usage or e-commerce behavior.

- Risk Scoring and Decisioning: Delivering instant approvals or rejections using predictive models that weigh repayment capacity, historical behavior, and contextual risk factors.

- Portfolio Monitoring: Continuously scanning existing borrower accounts to detect early signs of delinquency, stress scenarios, or fraud-linked anomalies.

- Compliance and Reporting: Automating regulatory submissions, audit trails, and documentation to meet standards such as CFPB, OCC, Basel III, or regional lending frameworks.

How It Differs from Legacy Systems

| Aspect | Legacy Credit Scoring (e.g., FICO) | AI-Driven Credit Risk Systems |

| Data Sources | Primarily bureau-reported credit histories | Structured + alternative data (transactions, mobile, e-commerce, utilities) |

| Update Frequency | Batch updates, often delayed | Real-time ingestion and scoring |

| Evaluation Style | Static, rule-based risk evaluation | Adaptive, predictive modeling with continuous learning |

| Borrower Coverage | Excludes thin-file or unbanked borrowers | Expands access to underserved and new borrower segments |

| Decision Speed | Slow, dependent on bureau cycles | Instant approvals and risk-adjusted pricing |

| Regulatory Alignment | Limited transparency, manual audit processes | Built-in explainability, audit logs, and compliance dashboards |

| Business Impact | Narrow growth, higher defaults, and missed opportunities | Scalable growth, proactive risk management, and compliance readiness |

Why Fintech Enterprises Should Invest in Credit Risk AI Systems in 2025

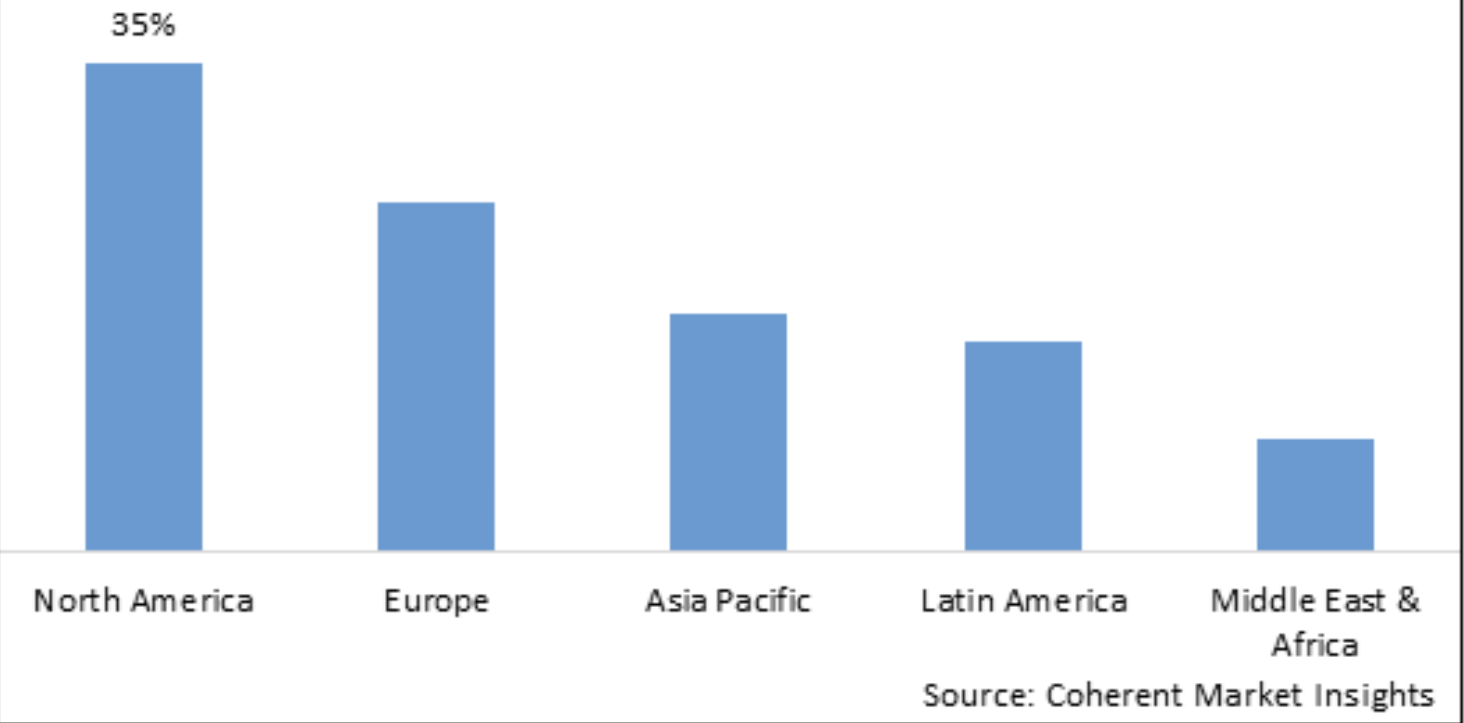

The global credit risk assessment market is projected to hit USD 9.52 billion in 2025, scaling to USD 23.97 billion by 2032 at a 14.1% CAGR.

Within this, AI-driven credit scoring alone will account for $2.25 billion, with North America capturing 40% of the market and the U.S. alone valued at $757.7 million. This signals not just growth, but a structural transformation in how credit risk is assessed and managed.

Why Fintechs Need Credit Risk AI

- Traditional credit models cannot keep up with real-time loan demand, especially with the rise of BNPL and instant lending.

- AI models expand data utilization, improving default prediction accuracy and enabling financial inclusion for underserved borrowers.

- Fraud in digital payments is forecast to surpass $48 billion by 2026, making AI-powered fraud detection non-negotiable.

- Institutions using AI have cut loan approval times from weeks to minutes, with risk assessment time reduced by up to 60%.

- AI adoption has helped some lenders reduce default rates by as much as 25%, reinforcing its role as a profitability driver.

Key Drivers Behind Adoption

- Regulatory pressure: stricter Basel III and GDPR mandates are accelerating next-gen risk adoption.

- Competitive necessity: 75% of large banks are expected to integrate AI by 2025 or risk losing ground.

- Cloud-native solutions: modular AI platforms enable even mid-sized fintechs to deploy advanced tools without heavy infrastructure investment.

AI is now the foundation for profitability, compliance, and resilience in a digital-first financial ecosystem. For fintech leaders, the decision is not whether to invest in AI credit risk systems, but how quickly they can move to avoid being left behind.

How AI is Reshaping Credit Risk in Fintech

The lending ecosystem is changing faster than traditional risk models can keep up. Fintech firms face rising defaults, pressure from regulators, and growing demand from underserved markets. AI has become the lever that helps lenders respond to these challenges while creating opportunities for growth.

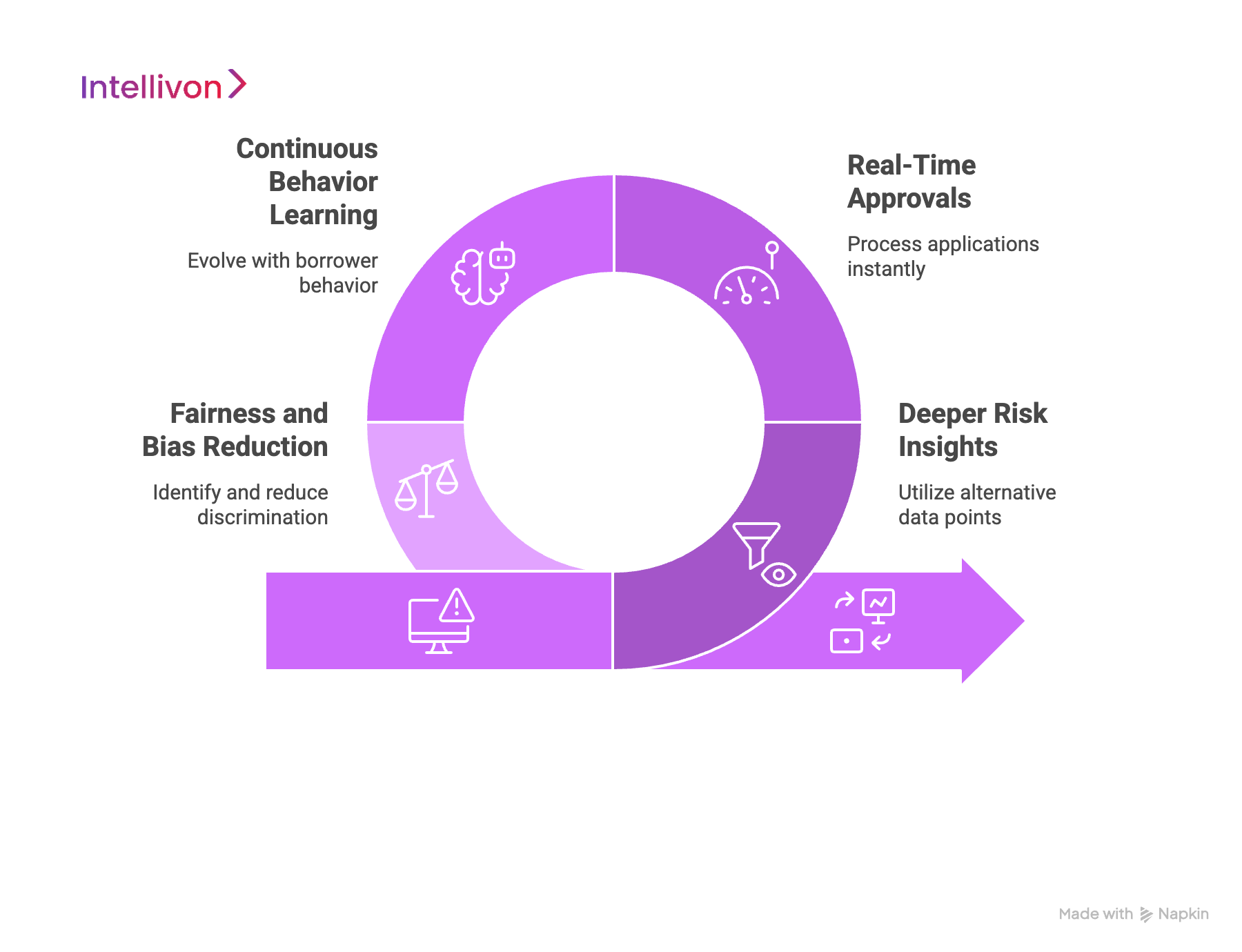

1. Deeper Risk Insights

AI systems pull in alternative data points that legacy models overlook. These include transaction histories, mobile device behavior, digital wallets, utility bill payments, and even e-commerce purchase patterns. For fintech lenders, this means the ability to underwrite borrowers who might otherwise be invisible to traditional credit bureaus.

2. Real-Time Approvals

Conventional credit risk workflows run on batch cycles. That delay is unacceptable in a fintech landscape where customers expect instant approvals. AI-driven scoring engines process applications in real time, weighing multiple variables simultaneously, and returning decisions in seconds without compromising accuracy or compliance.

3. Continuous Behavior Learning

Once a loan is issued, AI doesn’t stop working. Repayment patterns, transaction streams, and customer interactions continuously feed back into the model. This creates a living system that evolves with borrower behavior, catching early signs of delinquency and adjusting strategies dynamically.

4. Fairness and Bias Reduction

Bias in credit decisioning has long been a barrier to inclusive lending. AI introduces fairness constraints and model audits that help identify and reduce discrimination. Enterprises can show regulators and customers that their platforms support equitable access while maintaining profitability and compliance.

Together, these capabilities mark a decisive shift from static, backward-looking models to dynamic, adaptive systems. For fintech leaders, AI has become the foundation for delivering faster approvals, fairer access, and more resilient lending operations.

Types of Fintech Credit Risk AI Systems

Credit risk challenges differ across lending models, industries, and regulatory landscapes, and no single system can address them all. Enterprises now rely on specialized AI systems designed to meet unique workflows, compliance needs, and borrower expectations.

1. Consumer Lending Systems

These platforms power BNPL, personal loans, and micro-lending products. They emphasize instant decision-making, alternative data scoring, and fairness checks to expand access while protecting portfolio health.

2. SME Credit Risk Systems

Used for business underwriting and merchant lending, these systems integrate accounting data, cash-flow analysis, and transaction monitoring. They provide more accurate evaluations of small businesses than bureau-only models.

3. Portfolio Monitoring Platforms

Focused on loan book health, these platforms flag early signs of delinquency, conduct stress testing, and track repayment anomalies. They enable proactive interventions before risks escalate.

4. Fraud-Integrated Risk Platforms

These systems combine fraud detection with credit scoring. They catch synthetic identities, account takeovers, and hidden fraud rings while assessing borrower risk in real time.

5. Embedded Credit Risk Systems

Embedded systems are integrated into e-commerce platforms, gig economy apps, and digital wallets. They provide instant, seamless credit checks at checkout or transaction points.

6. RegTech-Integrated Risk Platforms

These platforms merge compliance automation and credit decisioning. They generate audit-ready reports, streamline Basel III validation, and align with GDPR or CCPA mandates, which are critical for fintechs operating across multiple jurisdictions.

7. Alternative Asset Risk Platforms

Designed for crypto lending and digital asset-backed loans, these systems analyze tokenized assets, wallet history, and blockchain transactions to calculate borrower risk in emerging markets.

8. Hybrid Ecosystem Platforms

Larger enterprises often deploy hybrid stacks that blend consumer, SME, fraud, and compliance modules. This creates a single system with a 360° view of borrower and portfolio risk. In practice, many fintechs adopt more than one of these system types, tailoring their architecture to industry focus, compliance requirements, and growth strategy.

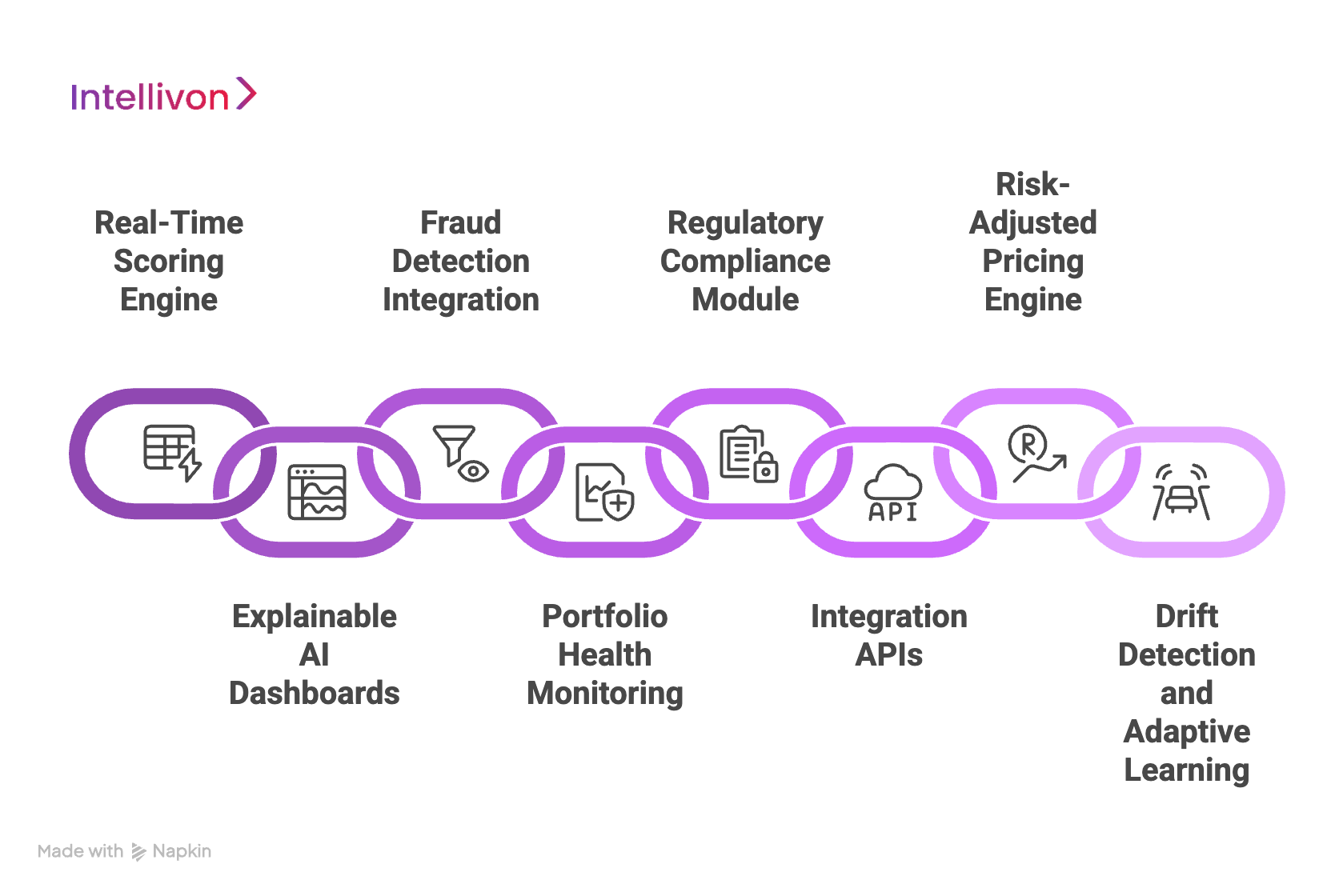

Features to Include in a Credit Risk AI System

For fintech enterprises, the right features can make the difference between scalable lending growth and mounting losses. A credit risk AI system must provide transparency, compliance, and resilience, and the following features are core for such a system to function seamlessly.

1. Real-Time Scoring Engine

Modern borrowers expect instant decisions. Real-time scoring engines process multiple data sources in milliseconds, allowing lenders to approve or reject applications without delay. This engine significantly boosts customer satisfaction while protecting against high-risk approvals.

2. Explainable AI Dashboards

Transparency is essential when regulators or internal auditors demand justification. Dashboards that clearly explain “why” a decision was made give risk teams confidence and ensure compliance standards are consistently met.

3. Fraud Detection Integration

Fraud is one of the biggest threats to digital lending. By integrating fraud signals with credit scoring, enterprises can stop synthetic identities and account takeovers while still offering seamless onboarding for legitimate borrowers.

4. Portfolio Health Monitoring

A loan decision doesn’t end at approval. Portfolio monitoring tools track borrower performance, delinquency trends, and stress scenarios. This provides lenders with early-warning alerts to intervene before small risks turn into larger losses.

5. Regulatory Compliance Module

Automated compliance features generate audit-ready reports aligned with frameworks like Basel III, GDPR, or CFPB. They simplify reporting obligations and lower the cost of meeting evolving regulatory demands.

6. Integration APIs

Risk systems must work in harmony with existing infrastructure. APIs allow seamless integration with KYC, payments, accounting platforms, and core banking systems, making the credit risk system a connected part of enterprise workflows.

7. Risk-Adjusted Pricing Engine

Not all borrowers should pay the same rate. A pricing engine ties loan terms directly to risk profiles, balancing access to credit with profitability and risk control.

8. Drift Detection and Adaptive Learning

Borrower behavior shifts with markets, and models degrade over time. Drift detection ensures continuous monitoring, while adaptive learning pipelines retrain models so they remain accurate in changing conditions.

These features form the foundation of an enterprise-ready risk system. They balance speed with compliance, expand access while protecting against fraud, and deliver transparency to regulators and boards. Together, they ensure lending operations remain profitable, scalable, and resilient in a rapidly evolving financial landscape.

AI Techniques We Use in Credit Risk Scoring

At Intellivon, we design capable credit risk AI systems that combine precision with adaptability. Our approach is built on proven machine learning methods, applied in ways that directly align with enterprise lending priorities, like compliance, speed, and resilience.

1. Supervised Machine Learning

We deploy supervised models trained on historical repayment and default data. Using methods like gradient boosting and logistic regression, we deliver accurate default predictions with built-in explainability, giving risk officers confidence in every decision.

2. Unsupervised Machine Learning

Our systems identify hidden borrower clusters and anomalies that traditional scoring overlooks. For example, sudden changes in transaction behavior or repayment cycles are flagged early, enabling lenders to act before risk escalates.

3. Natural Language Processing (NLP)

Intellivon applies NLP to extract insights from unstructured data such as bank statements, invoices, and tax filings. This enriches borrower profiles without manual intervention, creating a deeper, more reliable foundation for underwriting.

4. Graph AI

We use graph-based AI to detect fraud rings, shared devices, and hidden borrower connections. This capability strengthens fraud detection and ensures lending platforms are protected against coordinated attacks.

5. Reinforcement Learning

Our reinforcement learning models adapt credit lines dynamically. Borrowers who demonstrate strong repayment behavior may earn higher limits, while riskier patterns trigger reductions. This ensures credit exposure is always aligned with real-time borrower performance.

By combining these techniques, we transform credit scoring into a living system. Our models evolve continuously, improve risk prediction accuracy, and reduce both defaults and regulatory challenges. For enterprises, this means faster approvals, stronger compliance, and a risk management system that grows securely with the business.

Our Technology Stack for Building Credit Risk AI Systems

At Intellivon, we build credit risk platforms that are cloud-native, secure, and designed for enterprise scale. Every layer of our credit risk tool stack is chosen to meet compliance requirements, integrate seamlessly with banking systems, and deliver reliable performance under high transaction volumes.

1. Cloud Infrastructure

We deploy on AWS, GCP, or Azure, with PCI-DSS-ready environments. This ensures scalability, high availability, and adherence to financial data security standards.

2. Data Layer

Our systems handle both structured and alternative data through Kafka, Spark, and Snowflake. This architecture supports real-time ingestion, large-scale analytics, and resilient data pipelines.

3. Machine Learning Frameworks

For model development, we rely on XGBoost, PyTorch, and TensorFlow. This combination supports explainable traditional models alongside deep learning architectures, allowing enterprises to balance transparency with predictive power.

4. Model Governance

We integrate MLflow and Kubeflow to manage experiments, track lineage, and enforce approval workflows. These tools ensure models remain audit-ready and compliant with Basel III, CFPB, and OCC standards.

5. Security and Compliance

From encryption in transit and at rest to SOC 2, GDPR, and CCPA alignment, our systems embed a compliance-first architecture. Continuous monitoring and automated audits safeguard sensitive financial data.

6. Integration APIs

Intellivon develops REST and gRPC APIs for seamless connectivity with KYC, AML, core banking, and payment platforms. This ensures credit risk systems become part of existing enterprise workflows, not siloed add-ons.

Why Our Stack Matters

By combining proven cloud platforms, resilient data pipelines, and enterprise-grade security, Intellivon ensures credit risk AI systems are scalable, compliant, and future-ready. The result is faster approvals, stronger risk detection, and the operational reliability enterprises need to compete in modern lending.

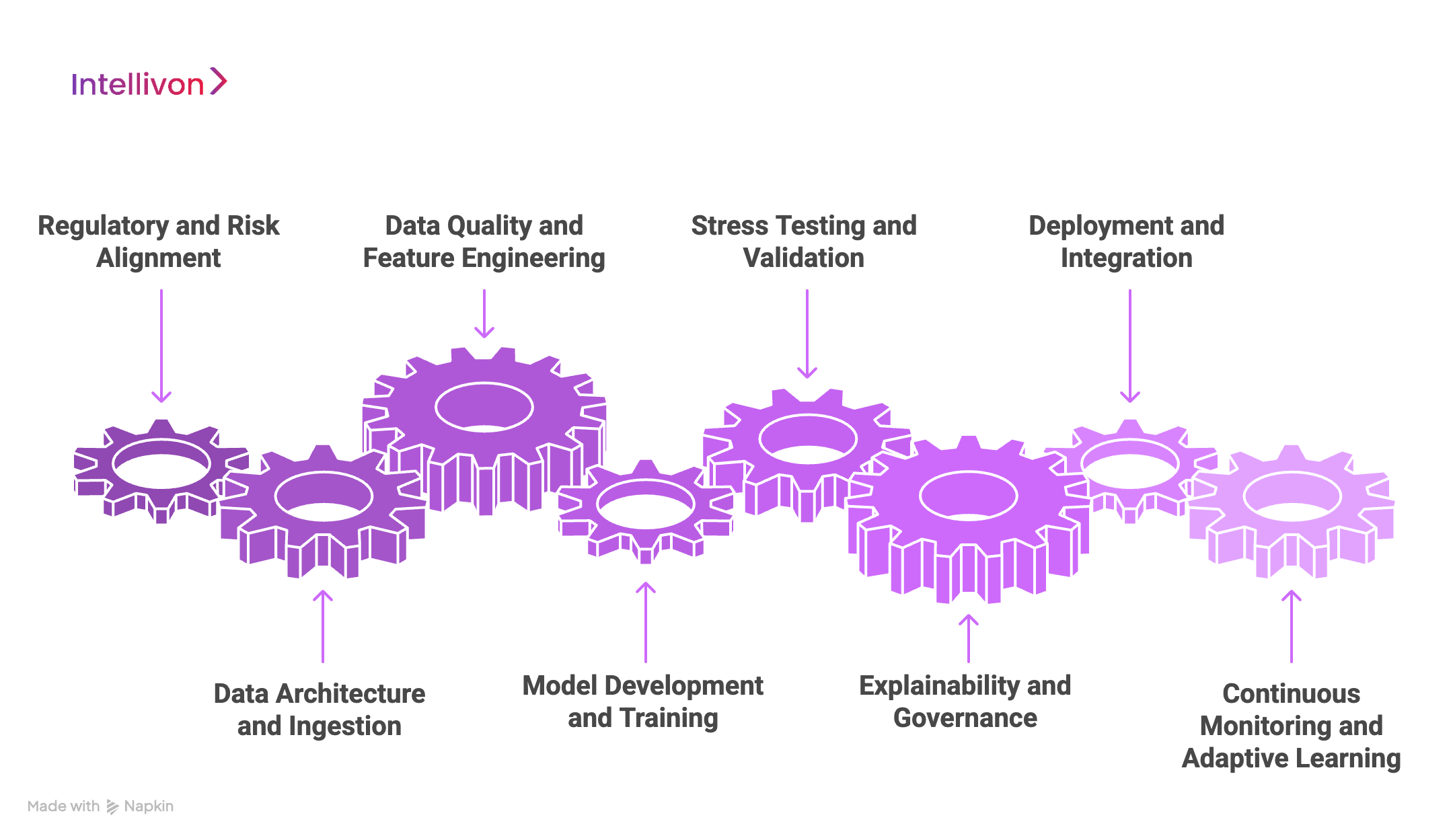

How We Develop Fintech Credit Risk AI Systems

At Intellivon, building a credit risk AI system is a structured journey rather than a simple deployment. Each stage is carefully designed to align with regulatory requirements, enterprise goals, and long-term scalability. Below is our step-by-step approach:

Step 1: Regulatory and Risk Alignment

We start by mapping the regulatory landscape that applies to your markets. Every model is framed with compliance-first architecture. At the same time, we align risk models with enterprise KPIs such as reducing default ratios, increasing approval speed, and improving portfolio profitability.

This step ensures that the system protects the business from both financial and regulatory penalties.

Step 2: Data Architecture and Ingestion

The strength of an AI system depends on the quality of data it consumes. We build pipelines that integrate both structured data, such as bureau records, bank statements, and historical repayment files, and alternative data like mobile activity, utility bill history, and e-commerce transactions.

By combining these sources, the system generates more complete borrower profiles and identifies risks earlier than traditional models can.

Step 3: Data Quality and Feature Engineering

Financial data is often inconsistent, incomplete, or noisy. We apply advanced cleaning, normalization, and feature extraction methods to create reliable predictors.

Features such as income volatility, repayment discipline, cash burn rates, and spending clusters are engineered to reveal deeper borrower behavior. This stage turns raw data into actionable intelligence that drives stronger risk predictions.

Step 4: Model Development and Training

We use a multi-model development strategy to balance accuracy, fairness, and transparency. Logistic regression and gradient boosting are used for regulator-friendly transparency, deep learning models capture complex borrower behaviors, and hybrid ensembles combine them for higher accuracy.

During this phase, we also embed fairness and bias detection frameworks to ensure inclusive lending practices that meet both ethical and regulatory expectations.

Step 5: Stress Testing and Validation

Before deployment, we rigorously test models against adverse scenarios. We simulate conditions such as recessions, sudden unemployment spikes, or regulatory shifts to confirm that the models remain stable under pressure.

Backtesting against historical data validates reliability, ensuring that systems perform consistently in both stable and volatile environments.

Step 6: Explainability and Governance

AI-driven credit scoring cannot be a black box. We integrate explainability dashboards powered by SHAP and LIME so risk officers, auditors, and regulators can see the reasoning behind each decision.

Governance pipelines, which include audit trails, lineage tracking, and approval workflows, are embedded to ensure the system remains fully audit-ready and compliant with evolving standards.

Step 7: Deployment and Integration

We deploy on a cloud-native, microservices-based architecture that ensures scalability and resilience. APIs integrate seamlessly into existing enterprise systems like loan origination, KYC/AML platforms, payment gateways, and core banking systems.

This architecture ensures that AI-driven scoring delivers instant, reliable decisions without disrupting existing workflows.

Step 8: Continuous Monitoring and Adaptive Learning

Credit risk is never static. Once live, the system monitors portfolio health, model drift, delinquency trends, and fraud signals in real time.

Automated retraining pipelines ensure the models evolve with changing borrower behavior and macroeconomic conditions. This continuous feedback loop keeps enterprises ahead of emerging risks and protects long-term portfolio stability.

This methodology ensures enterprises receive a system that is compliance-first, data-rich, transparent, and continuously adaptive. For business leaders, it means scaling lending confidently, avoiding regulatory setbacks, and building long-term resilience into credit operations.

Cost of Developing a Fintech Credit Risk AI System

At Intellivon, we recognize that fintech enterprises need credit risk platforms that are both secure and cost-effective. That’s why our pricing model is designed to be flexible and aligned with your requirements, and not a one-size-fits-all package.

If costs risk exceeding your planned budget, we collaborate with you to streamline the scope while safeguarding the core value of risk management, compliance, and decisioning speed.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Compliance Strategy | Requirement gathering, KPI alignment, regulatory mapping (CFPB, OCC, Basel III, GDPR) | $6,000 – $10,000 |

| Architecture & Data Design | System blueprint, data pipelines, integration planning (bureau, banking, alternative data) | $8,000 – $14,000 |

| Model Development & Integration | Machine learning models, fraud detection integration, NLP for financial docs, API connections | $12,000 – $20,000 |

| Platform Development & Customization | Dashboards, risk-adjusted pricing engine, workflow customization, compliance module setup | $14,000 – $22,000 |

| Security & Regulatory Alignment | Encryption, access controls, audit trails, Basel III and GDPR validation | $6,000 – $12,000 |

| Testing & Validation | Stress testing, bias/fairness audits, backtesting against defaults, performance optimization | $6,000 – $12,000 |

| Deployment & Scaling | Cloud rollout, monitoring dashboards, API scaling, multi-region data residency setup | $5,000 – $10,000 |

Total Initial Investment Range: $50,000 – $100,000

Ongoing Optimization (Annual): $5,000 – $10,000

Factors That Influence Cost

The final investment depends on several variables:

- Data Sources: Number and complexity of integrations (bureaus, banking, e-commerce, mobile).

- Model Complexity: Advanced AI techniques (deep learning, graph AI, reinforcement learning) vs. simpler supervised models.

- Regulatory Scope: Coverage for single or multiple frameworks (Basel III, GDPR/CCPA, OCC, CFPB).

- Deployment Model: Cloud-native, hybrid, or on-premises, depending on enterprise preference.

- Customization Depth: Fully tailored dashboards and workflows vs. modular, pre-built components.

- Advanced Features: Bias testing, adaptive learning, portfolio stress simulators, and multi-region scaling.

Request a tailored quote from Intellivon’s AI engineers today. We’ll design a credit risk AI system that aligns with your budget, strengthens compliance, and scales with your lending operations.

Real-World Enterprises Using AI Credit Risk Systems

Global financial institutions and fintech leaders are already proving the value of AI-driven risk systems. These examples highlight how enterprises are applying credit risk AI to scale lending while maintaining compliance and profitability.

1. Goldman Sachs (Marcus)

Goldman’s consumer platform, Marcus, uses AI models to automate underwriting and repayment tracking. By integrating alternative data and portfolio monitoring, Marcus reduced default exposure while still growing loan volumes in a competitive consumer market.

2. SoFi

SoFi relies on AI-powered scoring that goes beyond bureau data. By analyzing employment history, education, and cash flow, SoFi approves borrowers who might otherwise be excluded. This approach not only drives customer growth but also improves repayment predictability.

3. Square (Block)

Square’s lending arm uses AI to assess small businesses based on transaction data from its own payment ecosystem. This allows it to underwrite merchants in real time, offering working capital loans that traditional banks might hesitate to approve.

4. American Express

Amex blends fraud detection with credit risk analytics. Its AI models flag suspicious transaction networks while adjusting credit exposure dynamically. This dual-layered system strengthens both customer trust and regulatory compliance.

5. Upstart

Upstart is an AI-native lending platform that pioneered the use of machine learning in consumer lending. Its models consider hundreds of alternative variables to expand credit access, while maintaining lower-than-average default rates compared to traditional lenders.

These examples show that AI is already shaping lending strategies at scale. From consumer credit to SME underwriting, enterprises that invest in adaptive, transparent, and fraud-aware systems gain faster growth, stronger compliance, and lower risk.

Conclusion

Credit risk defines growth, compliance, and resilience in fintech lending. Traditional models, built on static bureau scores and batch updates, cannot keep pace with the speed and complexity of today’s markets. AI-driven systems, by contrast, adapt continuously, integrate richer data, and deliver transparent, real-time decisions that protect portfolios and satisfy regulators.

For enterprises, investing in a credit risk AI system helps them enable scale, expand access, and stay competitive in a high-stakes digital economy.

Build Your Next Fintech Credit Risk AI System With Intellivon

At Intellivon, we design enterprise-grade credit risk AI platforms that are compliance-first, data-rich, and tailored to your lending strategy. Our approach combines proven machine learning techniques, robust governance frameworks, and scalable architecture to help you move faster without compromising on trust or security.

Why partner with Intellivon?

- Tailored Solutions: We align risk systems with your business goals, compliance needs, and customer segments.

- Compliance-First Design: Every build is mapped to CFPB, OCC, Basel III, and GDPR/CCPA standards.

- Proven Fintech Expertise: Our platforms support consumer, SME, and hybrid lending models with measurable ROI.

- Scalable Architecture: Cloud-native, API-driven design ensures seamless integration and long-term resilience.

Book a discovery call with Intellivon today. Let’s build a credit risk AI system that protects your enterprise, accelerates approvals, and creates the foundation for sustainable fintech growth.

FAQs

Q1. What data is required for AI credit risk scoring?

A1. AI systems combine structured data (credit bureau records, banking transactions, repayment history) with alternative data such as mobile usage, e-commerce activity, and utility payments. This creates richer borrower profiles and more accurate risk predictions.

Q2. How does this differ from bureau scores like FICO?

A2. Bureau scores rely on static, backward-looking data and batch updates. AI-driven systems continuously ingest new data, learn from repayment behavior, and adapt to borrower trends, enabling real-time and fairer decision-making.

Q3. Can it integrate with legacy banking systems?

A3. Yes. With REST and gRPC APIs, AI credit risk systems integrate seamlessly into core banking, KYC/AML platforms, and payment systems. This avoids silos and ensures smooth adoption across existing workflows.

Q4. What regulations apply to credit risk AI platforms?

A4. Compliance requirements vary by region, but common mandates include Basel III, CFPB, OCC, GDPR, and CCPA. A well-architected system automates reporting, ensures transparency, and meets audit-readiness standards.

Q5. What ROI do fintechs typically see?

A5. Enterprises adopting AI credit risk systems have reported up to 60% faster risk assessments, 25% lower default rates, and stronger regulatory alignment. The ROI comes from higher loan volumes, reduced losses, and operational efficiency.