Businesses that explore blockchain encounter roadblocks such as platforms that promise scale but falter under real-world demand, solutions that deliver speed but compromise compliance, and architectures that look good in pilots but collapse when asked to support millions of transactions. Leaders already know that blockchain can streamline operations, modernize payments, and open new revenue streams. The challenge is finding a platform that blends scalability with governance, security, and integration into existing enterprise systems.

Venom has emerged as a powerful reference point. With its masterchain and dynamic sharding, it demonstrates how blockchain can scale elastically while supporting public and private ecosystems under one framework. Its testnet recorded over one million wallets and more than 350 million transactions, proving the strength of its masterchain and dynamic sharding model. For enterprises, this is a glimpse into the future of compliant, interoperable infrastructure.

At Intellivon, we’ve built platforms that carry these principles forward into regulated industries, combining compliance-first design, seamless integration, and measurable ROI. This blog provides a blueprint on how to build an enterprise blockchain platform like Venom that goes beyond scalability to true enterprise readiness.

Key Takeaways of the Blockchain Platform Market

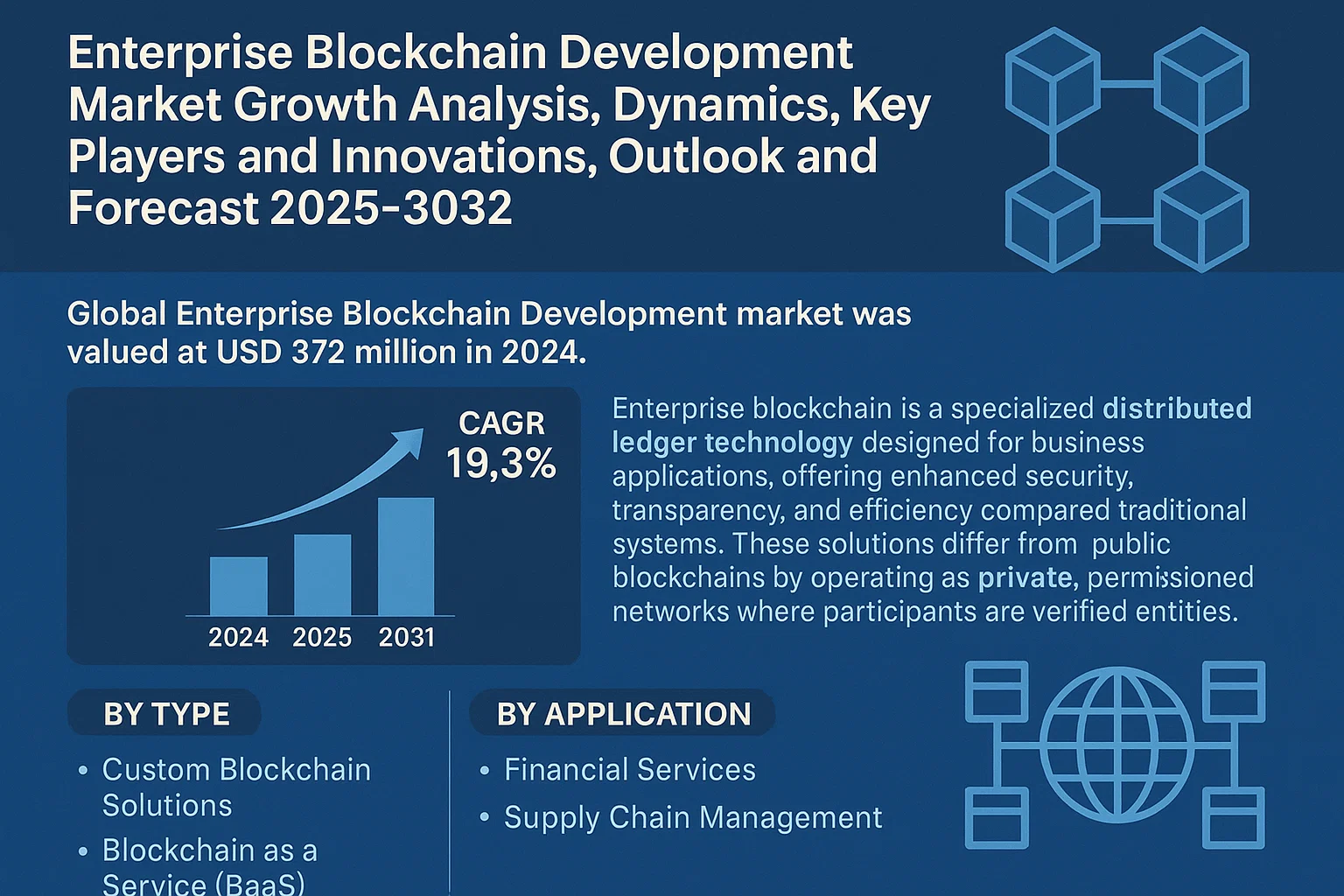

The global enterprise blockchain development market was valued at USD 372 million in 2024 and is projected to reach USD 1.23 billion by 2031, growing at a 19.3% CAGR. This rapid growth is powered by private, permissioned networks that combine security with operational transparency.

Large organizations already contribute more than 60% market revenue, using their influence to accelerate ecosystem maturity and real-world adoption.

Strategic Benefits for Enterprises

- Enhanced security: Tamper-proof data ensures trust and prevents fraud.

- Cost reduction: Smart contracts cut reconciliation and compliance costs by up to 30%.

- Operational efficiency: Real-time auditability and automation boost performance.

- Regulatory compliance: Permissioned models simplify audits and meet cybersecurity mandates.

- New business models: Consortium networks enable tokenization and cross-industry collaboration.

High-Potential Use Cases

- Financial services: Fraud prevention, payments, and trade finance.

- Supply chain: Provenance tracking and logistics visibility.

- Healthcare: Secure data exchange with compliance built in.

- Real estate: Transparent asset management and efficient processes.

- Government: Secure digital processes and citizen trust.

Trends Accelerating Investment

- Hybrid infrastructure and public-private collaboration speed integration.

- Asia Pacific leads adoption through favorable regulation and innovation.

- Blockchain-as-a-Service (BaaS) lowers barriers and enables rapid scaling.

Enterprise decision makers now see blockchain as foundational to resilient, transparent, and agile operations. With regulations tightening and digital risks escalating, investment in blockchain is mission-critical for long-term business success and competitive leadership.

What is the Venom Blockchain Platform?

Venom is a next-generation blockchain platform designed to address one of the biggest enterprise challenges, which is scaling without losing control. Instead of relying on a single chain to handle every transaction, Venom introduces a masterchain that coordinates multiple workchains.

Each workchain can be tailored for different needs, such as public applications, private enterprise solutions, or sector-specific networks, while still being connected under the same secure framework. This layered model creates a foundation where enterprises can innovate with confidence, knowing performance and governance are baked in.

Key Features of the Venom Blockchain Platform

- Masterchain and Workchains: A Layer-0 masterchain ensures governance and security, while customizable Layer-1 workchains handle execution.

- Dynamic Sharding: Workloads are distributed automatically, with shardchains splitting or merging as demand changes to maintain efficiency.

- Threaded Virtual Machine (TVM): Smart contracts run asynchronously, enabling parallel execution and higher throughput across industries.

- Public–Private Interoperability: Native cross-chain messaging allows private enterprise networks to interact securely with public ecosystems.

- Configurable Virtual Machines: Beyond the TVM, enterprises can run EVM-compatible workchains, making it easier to migrate existing applications.

- Regulatory Positioning: Developed within the Abu Dhabi Global Market framework, Venom emphasizes compliance and governance from the ground up.

Why Enterprises Pay Attention to Venom

Venom resonates with enterprises because it goes beyond speed. Its architecture demonstrates how blockchain can handle millions of transactions while supporting the regulatory and governance needs of governments, banks, and large corporations.

Enterprises see Venom as a model for hybrid adoption, where public networks provide global reach and liquidity, while private chains offer compliance and confidentiality.

The use cases are wide-ranging, from central banks exploring CBDCs, insurers and banks improving settlement and fraud prevention, logistics players tracking global supply chains, to DeFi innovators bridging into traditional finance. Venom proves that blockchain can evolve from a niche technology into a mission-critical layer of enterprise infrastructure.

How Venom Works: A Step-by-Step Flow

Understanding Venom’s architecture is easier when you follow the path of a single transaction. Here’s how it moves through the system:

1. Transaction Initiation

A user or enterprise application signs a transaction using a Venom-compatible wallet. This could be anything from transferring tokens to executing a smart contract.

2. Routing to the Right Workchain

The masterchain checks where the transaction belongs and routes it to the appropriate workchain and shardchain. This ensures it reaches the right part of the network without unnecessary delays.

3. Dynamic Sharding Kicks In

If the shard handling this transaction is overloaded, it automatically splits into smaller shards to balance the traffic. When activity decreases, shards merge back to save resources.

4. Smart Contract Execution

The transaction triggers a smart contract running on the Threaded Virtual Machine (TVM). Unlike traditional blockchains, Venom processes contracts asynchronously, allowing multiple workflows to run in parallel.

5. Message Passing Across Chains

If the contract needs to interact with another contract on a different workchain, the platform sends an internal message. This cross-workchain communication happens natively, and no external bridge is required.

6. Consensus and Finality

Validators confirm the block using Proof-of-Stake with Byzantine Fault Tolerance. Once two-thirds of validators approve, the transaction is final. Enterprises value this deterministic finality because it eliminates the uncertainty of waiting for multiple confirmations.

7. Settlement and Storage

Execution fees are deducted, storage is updated, and the results are recorded immutably across the network. This ensures both accountability and transparency for audit purposes.

8. Global Synchronization

The masterchain updates its global state to reflect the completed transaction, keeping all workchains and shards in sync.

9. Continuous Scaling

As transaction volumes rise or fall, the network continues to adapt through dynamic sharding, ensuring consistent performance without bottlenecks.

This step-by-step process shows why Venom is more than just another blockchain. Its design ensures transactions are processed quickly, securely, and at scale, all while supporting both public and private enterprise use cases.

Business Model of The Venom Blockchain Platform

When you look at the platform Venom, it’s clear it was not designed only for developers or crypto enthusiasts. Its economic design speaks directly to enterprises that need both sustainability and predictable value capture.

The business model can be understood across three main layers, which include protocol economics, enterprise monetization, and ecosystem growth, before arriving at the larger strategic takeaway.

1. Protocol-Level Economics

At the foundation of Venom’s model is its native token. This token powers transactions, secures the network through staking, and manages storage fees. What makes the approach notable is the granularity of its fee system.

Instead of a flat gas model like Ethereum, Venom separates compute costs, storage fees, and message-passing fees. This ensures enterprises pay only for the exact resources they consume, a structure CFOs and compliance teams find easier to account for.

Incentives for validators and delegators are funded through a mix of fees and token issuance. Over time, Venom aims to balance inflationary rewards with deflationary mechanisms like fee burning. This shift is important because it aligns long-term token value with network growth, something enterprises consider when committing to a platform.

2. Enterprise Monetization

Enterprises don’t adopt blockchain only to experiment. They look for business models that support real ROI. Venom addresses this through multiple levers:

- Custom Workchain Licensing: Organizations can launch private or industry-specific workchains, complete with their own governance and compliance settings.

- CBDC and Government Partnerships: Regulators and central banks can use Venom’s architecture to build digital currency systems without leaving the safety of a regulated framework.

- Compliance Modules as SaaS: Enterprises can plug in pre-built compliance features, such as GDPR-ready storage or HIPAA-compatible audit logs, without custom development.

This creates a dual revenue model: transaction-driven income at the protocol level and service-driven income from enterprise clients.

3. Ecosystem Incentives

No platform thrives without developers and innovators. Venom invests in ecosystem growth by funding developer grants, supporting early-stage projects, and creating partnerships with large institutions.

The design even allows for revenue sharing with dApps, ensuring the protocol captures value when applications scale. For decision makers, this means Venom is not just a platform, but an ecosystem play, one where the network’s growth drives collective benefit rather than siloed success.

4. Strategic Takeaway

Venom’s business model is a blend of technical foresight and enterprise pragmatism. At one level, it ensures that validators, developers, and token holders have aligned incentives. At another, it creates clear monetization pathways for enterprises through custom networks and compliance services.

The long-term vision balances short-term service revenue with long-term token value accrual, creating a model that feels less speculative and more like the enterprise-grade infrastructure leaders expect when adopting a new technology.

Features of an Enterprise Blockchain Platform Like Venom

A blockchain platform becomes truly enterprise-ready when it goes beyond speed and scale to deliver compliance, governance, and adaptability. Venom’s design points us in that direction, but building a platform for large organizations requires a well-rounded feature set. Here are twelve capabilities that define a Venom-like enterprise blockchain.

1. Dynamic Sharding for Elastic Scalability

The network adjusts itself based on demand. Shards split when workloads grow and merge when they shrink, ensuring performance remains consistent without overusing resources. For enterprises handling seasonal peaks, this elasticity prevents downtime and cost inefficiencies.

2. Masterchain Coordination

The masterchain acts as the command center, keeping validators, shard maps, and network configurations in sync. This layer of control provides enterprises with the confidence that governance and security stay centralized, even when operations scale globally.

3. Multi-Workchain Architecture

Different industries have different needs. These platforms allow the creation of multiple workchains, each tailored for finance, supply chain, healthcare, or government services. Enterprises can run private, public, or consortium-based chains, all under a shared security framework.

4. Native Public–Private Interoperability

Enterprises often need private ledgers for sensitive data and public chains for liquidity and collaboration. The blockchain platform supports secure communication between both environments without relying on external bridges, reducing risk and complexity.

5. Threaded Virtual Machine (TVM)

The TVM processes smart contracts asynchronously. This means multiple workflows can run in parallel, unlike traditional blockchains that queue contracts one by one. Enterprises gain higher throughput and the ability to manage complex workflows at scale.

6. Configurable Virtual Machines

Not every use case fits one execution environment. It supports alternative VMs, such as EVM-compatible ones, enabling enterprises to migrate existing Ethereum applications seamlessly while experimenting with more advanced execution models.

7. Advanced Identity & Access Management

Modern enterprises demand fine-grained control over user access. Features like Decentralized Identifiers (DIDs), role-based permissions, and Zero Trust models allow secure onboarding of employees, partners, and even AI agents, fully aligned with global standards.

8. Regulatory & Compliance Modules

From GDPR in Europe to HIPAA in healthcare, compliance isn’t optional. Venom-like platforms integrate privacy-preserving storage, auditable logs, and configurable retention policies, making it easier to meet evolving mandates without heavy custom builds.

9. Privacy-Preserving Smart Contracts

Enterprises often deal with sensitive IP and customer data. By embedding zero-knowledge proofs, private smart contracts, and selective disclosure features, the platform lets businesses control who sees what, without breaking the integrity of the ledger.

10. Enterprise Governance & Orchestration

Large-scale networks require clear governance. Tools such as multisignature approvals, on-chain voting, and policy-based contract upgrades ensure stakeholders retain oversight while maintaining operational agility.

11. DevOps & Lifecycle Observability

Enterprises need reliability more than raw performance. Built-in CI/CD pipelines, monitoring dashboards, and telemetry services provide the transparency operations teams require to keep mission-critical systems running.

12. Interoperability & Integration Ecosystem

No enterprise runs blockchain in isolation. By supporting standards like ISO 20022 and SWIFT gpi, and offering connectors for ERP and CRM systems, the platform ensures blockchain integrates seamlessly into existing IT landscapes.

These features create a blueprint for a platform that becomes an enterprise operating layer, capable of supporting finance, supply chain, healthcare, and government systems with equal strength.

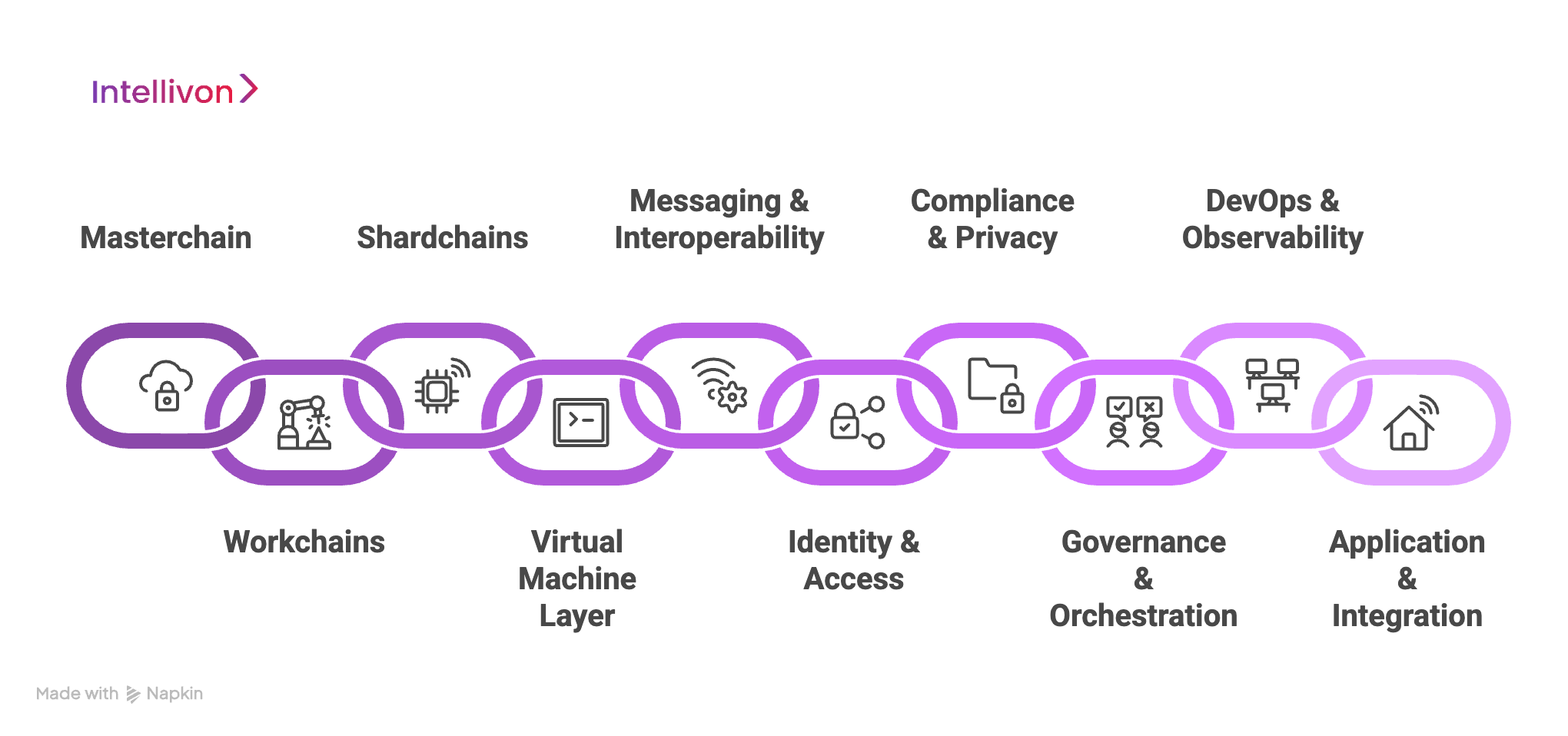

Architecture of an Enterprise Blockchain Platform Like Venom

To understand how a Venom-like platform delivers both scale and enterprise adaptability, it helps to break it down into architectural layers. Each layer plays a distinct role, and together they form a blueprint that enterprises can rely on for mission-critical applications. At Intellivon, we structure enterprise blockchain programs around these layers to ensure both technical strength and business relevance.

1. Masterchain (Layer-0 Backbone)

The masterchain is the coordination layer. It manages validators, shard maps, and global governance. For enterprises, it acts as the root of trust, anchoring security and providing a single source of truth for the entire network. Intellivon designs masterchain configurations to align with compliance obligations and governance frameworks.

2. Workchains (Customizable Layer-1s)

Workchains handle execution and can be customized for industry-specific needs. A financial institution might run a regulated payments workchain, while a government agency could run one for digital identity. Each inherits masterchain security but defines its own logic. We build industry-tuned workchains that adapt to vertical requirements without compromising security.

3. Shardchains

Shardchains bring elasticity. They split under heavy demand and merge during low traffic, ensuring consistent performance and cost efficiency. For enterprises, this means a network that scales automatically with workload spikes. Our experts implement shard strategies designed for sectors like banking, logistics, or healthcare, where traffic is unpredictable.

4. Virtual Machine Layer

Smart contracts run on the Threaded Virtual Machine (TVM), which uses asynchronous message passing for parallel execution. Enterprises that require compatibility with existing Ethereum apps can also deploy EVM-compatible workchains, blending innovation with familiarity. Intellivon guides on selecting the right execution environment for both performance and integration efficiency.

5. Messaging & Interoperability Layer

Native messaging allows workchains to communicate securely without bridges. Beyond internal communication, this layer can support external standards such as ISO 20022, SWIFT gpi, or Hyperledger. We equip this layer with integration middleware, ensuring enterprises can connect blockchain to their broader IT and compliance ecosystems.

6. Identity & Access Layer

This layer governs authentication and permissions. Decentralized Identifiers (DIDs), role-based access controls, and Zero Trust principles enable enterprises to onboard employees, partners, or AI agents with compliance-ready security. Our experts embed enterprise-grade identity frameworks that match regulatory mandates.

7. Compliance & Privacy Layer

Enterprises operate in highly regulated sectors. This layer integrates encrypted storage, configurable data retention, and privacy-preserving techniques such as zero-knowledge proofs. The result is a blockchain that supports auditability without sacrificing confidentiality. Intellivon engineers compliance modules that satisfy global standards from GDPR to HIPAA.

8. Governance & Orchestration Layer

Enterprises need structured control. Multisignature approvals, voting mechanisms, and upgrade orchestration ensure policies are enforced transparently. This layer makes it possible to manage consortium-led networks without governance bottlenecks. We deploy orchestration frameworks that streamline multi-stakeholder governance while ensuring accountability.

9. DevOps & Observability Layer

Running blockchain at scale requires operational maturity. Built-in CI/CD workflows, monitoring dashboards, logging, and telemetry tools keep systems stable. Service-level commitments at this layer give enterprises the confidence to run critical workloads. Intellivon enables these capabilities with enterprise DevOps integration and 24/7 observability.

10. Application & Integration Layer

At the top sits the application layer. APIs, SDKs, and connectors integrate blockchain with ERP, CRM, and legacy platforms. This makes adoption seamless, reducing friction for enterprises that already run complex IT landscapes. Our experts deliver pre-built integration templates that accelerate rollout without disrupting core systems.

Each layer builds on the next, creating a platform that is scalable, secure, and adaptable to industry-specific demands. With Intellivon as the development and integration partner, enterprises gain an enterprise-grade operating layer that is built for compliance, designed for interoperability, and engineered for measurable ROI.

How We Build Enterprise Blockchain Platforms Like Venom

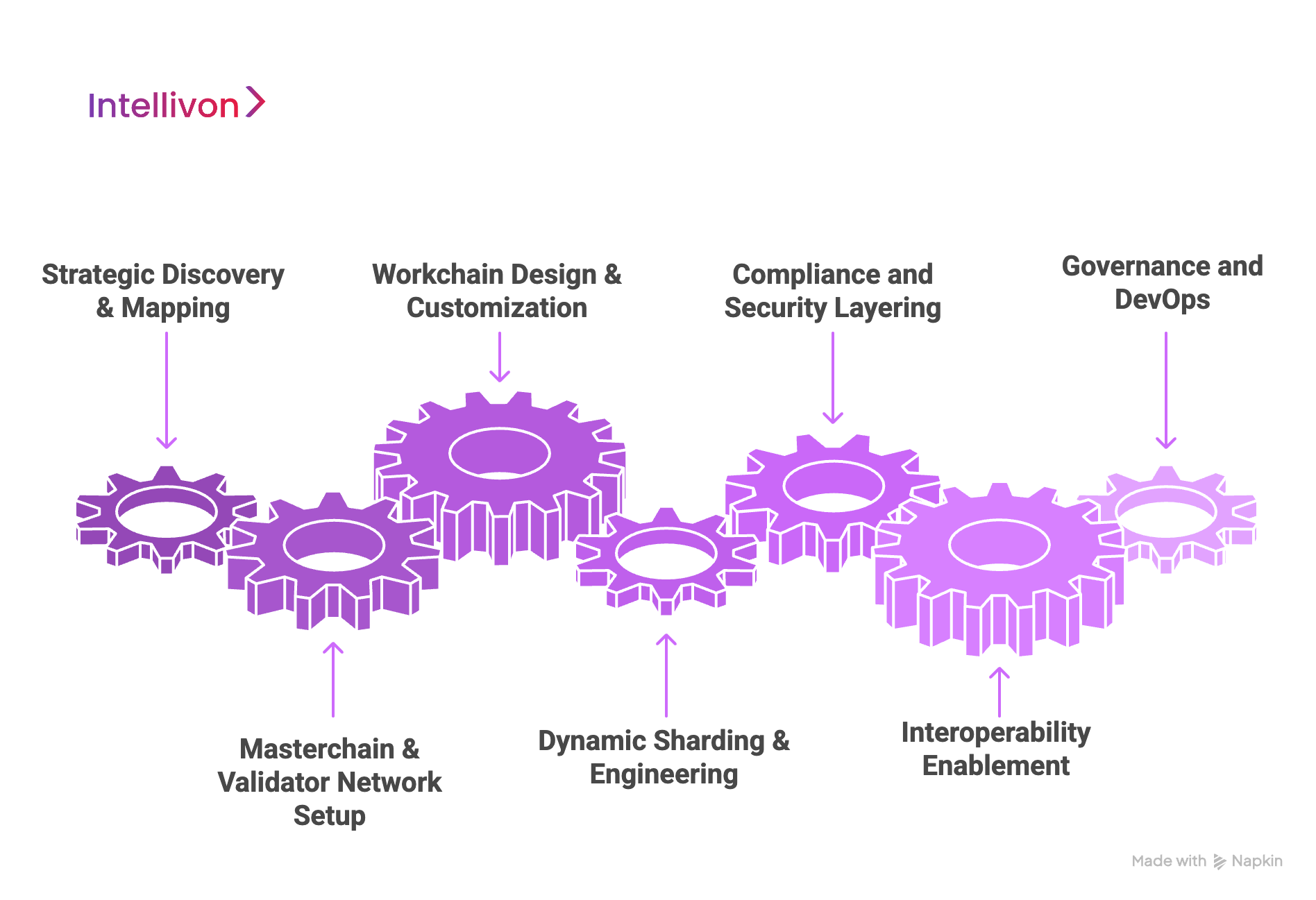

At Intellivon, we approach the development of Venom-like enterprise blockchain platforms through a structured, seven-phase journey. Each phase ensures enterprises move from concept to production with confidence, compliance, and measurable business outcomes.

Phase 1: Strategic Discovery & Mapping

Every program begins with clarity. We engage stakeholders to understand strategic goals, regulatory obligations, and existing IT landscapes. This ensures the blockchain design is not a technology experiment, but a business-driven initiative aligned with enterprise objectives.

Phase 2: Masterchain & Validator Network Setup

We establish the Layer-0 backbone, which is the masterchain, along with validator pools and staking mechanics. This phase anchors trust and governance, ensuring that enterprises have a secure, compliant foundation for expansion.

Phase 3: Workchain Design & Customization

Different industries demand different rules. Intellivon designs custom workchains tailored for finance, supply chain, healthcare, or government use cases. Each inherits masterchain security but integrates unique compliance policies and tokenomics where required.

Phase 4: Dynamic Sharding & Engineering

Scalability must be elastic. We implement dynamic sharding strategies so workloads split under heavy demand and merge during low traffic. This guarantees enterprises can handle peak transaction volumes without disruption or resource waste.

Phase 5: Compliance and Security Layering

Once scalability is in place, we embed enterprise layers. This includes decentralized identity management (DIDs), regulatory compliance modules (GDPR, HIPAA, PCI-DSS), and privacy-preserving techniques such as zero-knowledge proofs. These ensure the platform is ready for regulated, high-stakes environments.

Phase 6: Interoperability Enablement

No blockchain exists in isolation. Intellivon deploys APIs, SDKs, and connectors for ERP (SAP, Oracle), CRM (Salesforce), and banking standards (ISO 20022, SWIFT gpi). This ensures blockchain adoption doesn’t disrupt existing systems but strengthens them.

Phase 7: Governance and DevOps

The final phase embeds governance frameworks (multisig approvals, voting systems, upgrade orchestration) alongside DevOps observability (CI/CD pipelines, telemetry, SLAs). With these in place, the platform transitions from pilot to production, ready to support millions of users, cross-industry workflows, and regulatory audits.

This seven-phase process ensures enterprises deploy an enterprise-grade operating layer designed for compliance, scalability, and measurable ROI. With Intellivon’s experience across regulated industries, every phase is engineered to bridge innovation with business reality.

Real-World Use Cases & Enterprise Applications of The Platform

Venom-like platforms show their real strength when applied to industry-specific challenges. By combining scalability, compliance, and interoperability, they unlock value across sectors where trust, transparency, and efficiency are critical.

1. Finance

The financial services sector has been at the forefront of blockchain experimentation. What institutions need today is not just speed, but systems that meet regulatory demands while reducing operational inefficiencies. A Venom-like blockchain platform can modernize financial infrastructure and create new business models.

A. CBDCs and Digital Currency Infrastructure

Central banks and governments can launch Central Bank Digital Currencies (CBDCs) on private workchains, ensuring regulatory oversight while enabling fast, secure payments for citizens and businesses. The native public–private interoperability allows CBDCs to interact safely with commercial banking systems.

B. Tokenized Securities and Asset Issuance

Banks and asset managers can issue tokenized bonds, equities, and funds on customizable workchains. This reduces settlement time from days to minutes, while giving regulators real-time auditability over trading and investor flows.

C. Cross-Border Payments and Remittances

Global transactions remain costly and slow. With dynamic sharding and ISO 20022-ready integration, enterprises can process high-volume international payments at lower cost while meeting anti-money laundering and compliance checks.

2. Supply Chain

Modern supply chains stretch across continents, making transparency and trust difficult to maintain. Blockchain provides a single ledger of truth that improves visibility, prevents fraud, and strengthens collaboration between manufacturers, distributors, and retailers.

A. Provenance Tracking

Producers can attach digital tokens to physical goods, recording their journey from origin to shelf. Shoppers can verify authenticity, while enterprises gain insights that reduce counterfeiting and improve quality assurance.

B. Logistics Optimization

Carriers and logistics firms can coordinate shipments more efficiently by recording every checkpoint on the blockchain. Smart contracts automate customs clearance, reducing delays and lowering operating costs for global supply networks.

C. Supplier Compliance Management

Venom-like platforms support selective disclosure of documents. Suppliers can share certifications or audit reports with buyers and regulators without exposing sensitive business data, ensuring trust while protecting confidentiality.

3. Healthcare

Healthcare organizations handle highly sensitive data. Blockchain can provide a secure, auditable foundation for information exchange, improving collaboration between providers, payers, and regulators without risking patient privacy.

A. Secure Patient Data Exchange

Hospitals, clinics, and insurers can share patient data across private workchains with encrypted fields and access controls. This ensures continuity of care while maintaining HIPAA and GDPR compliance.

B. Clinical Trial Management

Pharmaceutical companies can record trial results immutably, ensuring transparency and reducing the risk of data manipulation. Regulators and research institutions gain confidence in data integrity, accelerating approvals.

C. Healthcare Supply Chain

From vaccines to medical devices, blockchain ensures authenticity and traceability. Enterprises can monitor conditions like temperature during transport, reducing spoilage and ensuring patient safety.

4. Government

Governments worldwide are exploring blockchain as a way to increase transparency, reduce bureaucracy, and strengthen citizen trust. A Venom-like platform enables secure, scalable public services.

A. Digital Identity Systems

Decentralized identifiers allow citizens to hold verifiable, self-sovereign digital identities. Governments can streamline services such as tax filing, voting, or benefits distribution without relying on fragmented legacy systems.

B. Land and Asset Registries

Property transfers can be recorded on blockchain ledgers, eliminating fraud, reducing disputes, and ensuring long-term trust in national record systems. This brings transparency to one of the most corruption-prone areas of governance.

C. Regulatory Compliance Automation

Agencies can use blockchain to automate reporting, auditing, and compliance for financial institutions or corporates. This reduces manual workloads while improving oversight.

5. Web3 and DeFi

Web3 adoption has accelerated, but enterprises hesitate due to concerns around compliance, security, and integration. Venom-like platforms bridge this gap by combining decentralized ecosystems with enterprise-grade governance.

A. Hybrid Finance (DeFi + TradFi)

Banks can safely interact with DeFi protocols through interoperable workchains, unlocking liquidity while maintaining regulatory controls. This creates a path for regulated institutions to join decentralized ecosystems.

B. NFTs for Enterprise Applications

Beyond art, NFTs can represent intellectual property, patents, or digital licenses. Enterprises can tokenize these assets, trading or licensing them securely across private and public networks.

C. DAO-Driven Consortia

Enterprises in industries like energy or telecom can form decentralized autonomous organizations (DAOs) to manage shared infrastructure. Governance mechanisms ensure fair decision-making while reducing administrative overhead.

These use cases illustrate why a Venom-like architecture resonates with enterprises. It makes it practical, compliant, and valuable across industries where trust and performance are non-negotiable.

Overcoming Challenges for an Enterprise Blockchain Platform

Enterprises pursuing Venom-like blockchain platforms face real obstacles. Success depends not just on identifying the challenges, but on having the right partner to solve them.

1. Regulatory Uncertainty

Blockchain regulation differs across regions and industries. What passes compliance in one market may be restricted in another. Enterprises risk stalled projects or non-compliance if they lack a clear regulatory alignment strategy.

At Intellivon, we embed compliance-by-design into every platform. From GDPR and HIPAA to PCI-DSS and emerging CBDC frameworks, our modules include encrypted data fields, configurable retention, and audit-ready logs. We work directly with enterprise compliance teams to ensure every deployment satisfies current regulations while staying adaptable to future mandates.

2. Complex Integrations

Legacy systems, like ERP, CRM, and core banking, were not designed for blockchain. Connecting them without creating silos or disruptions is one of the biggest enterprise hurdles.

Intellivon builds plug-and-play connectors and integration middleware tailored for SAP, Oracle, Salesforce, and financial messaging standards like ISO 20022 and SWIFT gpi. This ensures blockchain adoption fits seamlessly into existing operations, strengthening workflows rather than complicating them.

3. Privacy vs. Transparency

Blockchains are transparent by design, but enterprises often need confidentiality. Industries such as healthcare, finance, and supply chain require selective disclosure, not an “all-or-nothing” approach.

We implement privacy-preserving smart contracts powered by zero-knowledge proofs, selective disclosure frameworks, and private workchains. This enables enterprises to share what’s necessary with regulators or partners, without exposing sensitive IP, personal data, or financial information.

4. Governance & Scalability

Without structured governance, enterprise blockchain projects risk misaligned stakeholders, stalled upgrades, or operational bottlenecks. At scale, this can derail entire networks.

Intellivon provides enterprise governance frameworks with multisig approvals, on-chain voting systems, and policy-based orchestration tools. Combined with dynamic sharding strategies, this ensures scalability happens with accountability. Enterprises gain both elastic performance and structured control over decision-making.

Every enterprise blockchain journey brings challenges, but with the right partner, each becomes a catalyst for growth. Intellivon combines technical depth with regulatory expertise, ensuring that scalability, compliance, and interoperability are not trade-offs but guaranteed outcomes.

Conclusion

Venom demonstrates how blockchain can scale elastically, but scalability alone is not enough for enterprises. True adoption requires a platform that integrates compliance, governance, privacy, and interoperability into its core design. A Venom-like blockchain platform is an operating layer that transforms how industries manage data, transactions, and trust.

To achieve this, enterprises must work with a solution provider capable of aligning blockchain architecture with regulatory frameworks, legacy systems, and measurable ROI. Those who act early will not only modernize their operations but also shape the standards of tomorrow’s digital economy.

Build Your Next Enterprise Blockchain Platform With Intellivon

At Intellivon, we design enterprise-grade blockchain platforms that are scalable, compliant, and engineered for the demands of global industries. Our solutions are built for measurable ROI, helping enterprises modernize operations, reduce costs, and unlock new revenue models through secure, interoperable blockchain infrastructure.

Why Partner With Intellivon?

Compliance-Embedded Architecture: Every platform is built with GDPR, HIPAA, PCI-DSS, and financial frameworks in mind, ensuring operations remain regulator-ready from day one.

Hybrid Public–Private Workchains: We enable enterprises to run private, consortium, and public workchains under one umbrella, scalable, interoperable, and tailored to industry-specific needs.

Enterprise System Integrations: Seamless connectors integrate blockchain with ERP, CRM, core banking, and supply chain systems, ensuring adoption strengthens existing workflows.

Privacy & Security at Scale: Zero-knowledge proofs, selective disclosure, and advanced fraud detection keep data confidential while maintaining trust across networks.

Proven Enterprise Expertise: With deep experience in regulated industries, we deliver tested frameworks and reusable modules that accelerate time-to-market and reduce risk.

Book a discovery call with Intellivon today and see how we can design a Venom-like blockchain platform that delivers compliance, scalability, and enterprise transformation at a global scale.

FAQs

Q1. What makes Venom different from other blockchains?

A1. Venom separates itself with dynamic sharding, a masterchain that coordinates multiple customizable workchains, and built-in public–private interoperability. This architecture allows the platform to scale elastically while supporting compliance and governance capabilities that most generic blockchains lack. For enterprises, it means faster transactions, predictable costs, and infrastructure that can be tailored to industry-specific needs without sacrificing performance.

Q2. How does dynamic sharding work in an enterprise blockchain?

A2. Dynamic sharding allows the network to split into smaller shards when demand increases and merge back when demand decreases. For enterprises, this means resources are allocated efficiently, performance remains stable, and high-volume workloads such as payments or supply chain transactions can run without bottlenecks. It provides the elasticity large organizations need to handle both predictable and seasonal spikes.

Q3. Why do enterprises need both private and public blockchains?

A3. Private blockchains give enterprises the control and confidentiality required for regulated industries, while public blockchains provide global reach, liquidity, and ecosystem collaboration. A Venom-like platform supports both under one architecture, enabling hybrid adoption. Enterprises can keep sensitive workflows private while still participating in open ecosystems where collaboration, tokenization, or cross-industry partnerships create additional value.

Q4. How much does it cost to build a Venom-like blockchain platform?

A4. Costs vary depending on scale, customization, and industry requirements. On average, enterprises can expect development costs to range from $50,000 – $150,000, covering architecture design, compliance modules, integrations, and deployment. Ongoing costs for governance, DevOps, and scaling are additional. Working with an experienced solution provider ensures investment translates into measurable ROI and long-term sustainability.

Q5. How do Venom-like platforms handle compliance and privacy?

A5. Venom-inspired platforms embed compliance and privacy at the protocol level. Features like encrypted storage, configurable data retention, and audit-ready logs satisfy regulations such as GDPR, HIPAA, and PCI-DSS. Privacy-preserving smart contracts and zero-knowledge proofs allow enterprises to selectively disclose information, ensuring sensitive data stays confidential while regulators and partners still get the transparency they need.