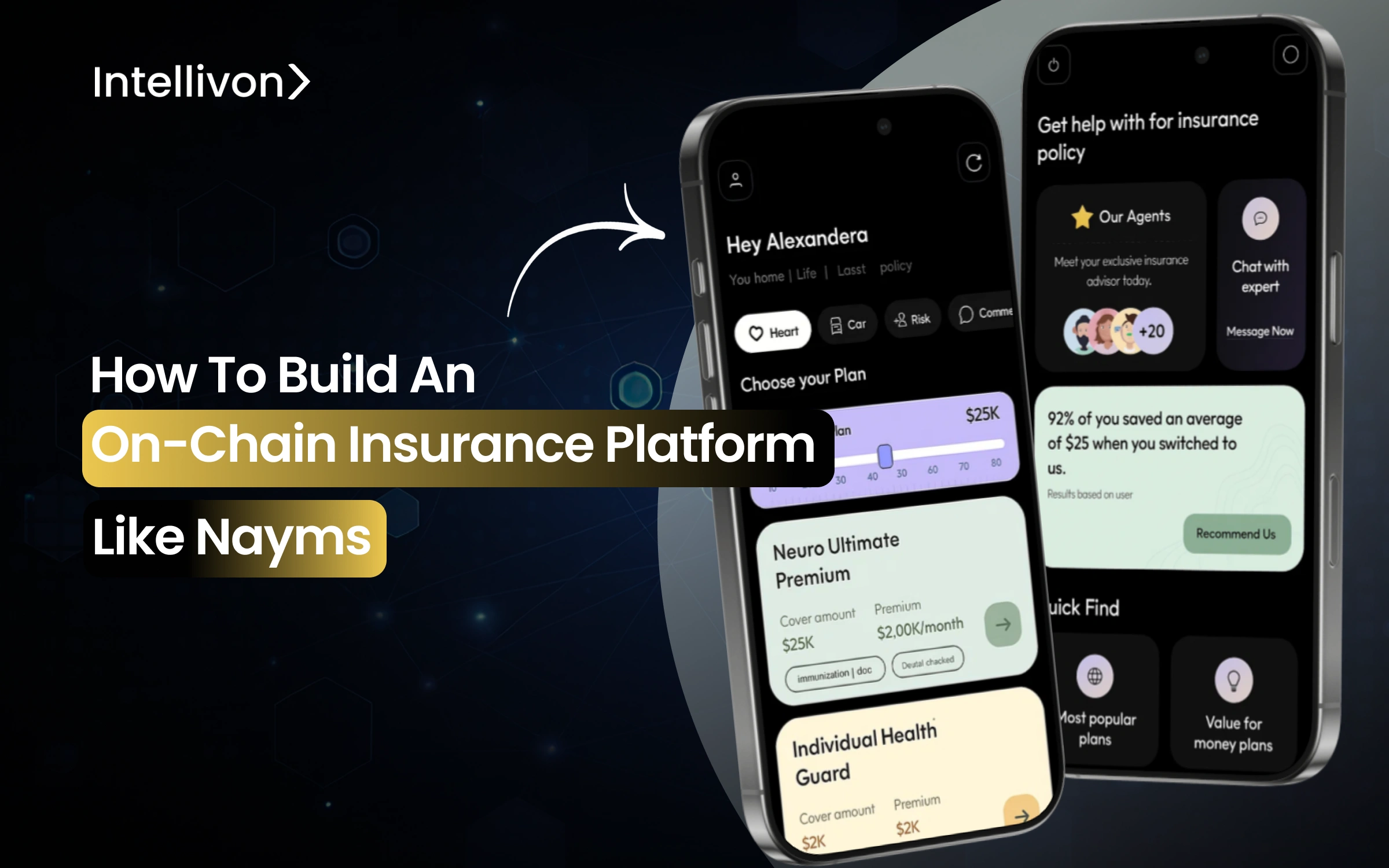

Insurance underpins every industry, yet the systems behind it remain outdated, riddled with slow claims and paper-heavy processes. Enterprises spend millions wrestling with inefficiencies while investors struggle to access transparent, risk-adjusted opportunities. On-chain insurance platforms are rewriting that story. By putting policies, premiums, and claims directly on blockchain rails, they automate what used to take weeks, make every transaction auditable, and open doors for alternative capital providers. Nayms, now rebranded as OnRe, raised $12 million at an $80 million valuation in 2023, proof that the on-chain insurance platforms model is not just possible, but is also gaining serious traction.

Intellivon’s expertise in this space comes from building regulation-ready on-chain insurance platforms that combine smart contracts, decentralized identity, and AI-driven underwriting without disrupting enterprise operations. We’ve helped insurers, brokers, and capital providers bring new products to market faster and more transparently. In this blog, we’ll show you how we build these platforms from the ground up.

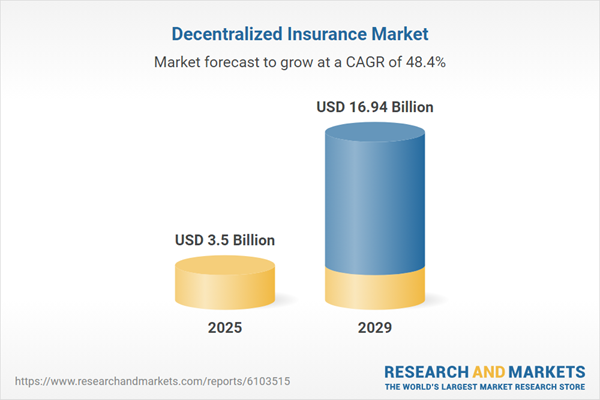

Key Takeaways of the Decentralized Insurance Market

The decentralized insurance market is expanding rapidly. Valued at $2.36 billion in 2024, it is projected to reach $3.5 billion in 2025, growing at a 48% CAGR. This surge is fueled by blockchain adoption, rising use of cryptocurrencies, dissatisfaction with traditional insurance, the rise of DeFi, and early insurtech investments.

Key Takeaways:

- The blockchain in the insurance sector will grow from USD 2.74B in 2025 to USD 82.56B by 2033, at a 53% CAGR.

- Growth is driven by DeFi adoption, parametric insurance, and rising cyber and smart contract risks.

- 58% of global insurers plan to expand blockchain investments in 2025, targeting claims automation and fraud prevention.

- 77% of insurers expect smart contracts to dominate policy issuance and settlement within two years.

- 24% of blockchain insurance investments go to claims management, with fraud detection, underwriting, and identity verification close behind.

- DeFi providers like Nexus Mutual, InsurAce, Ensuro, OpenCover, and Uno Re lead with coverage for hacks, breaches, and parametric risks.

- Parametric insurance powered by IoT and oracles delivers automated payouts based on measurable real-world events.

- Peer-to-peer pools and DAO-governed claim systems reduce intermediaries and lower operational costs.

- Traditional inefficiencies, such as slow claims, manual processes, and high costs, are being replaced by instant, auditable on-chain automation.

- Enterprises in digital sectors, finance, and supply chains can now cover cyber risks and smart contract vulnerabilities absent in legacy offerings.

- Asia-Pacific leads blockchain insurance adoption, while Europe is the fastest-growing region.

- Blockchain insurers promise 40–60% cost reductions in claims and policy administration compared to traditional models.

- With cyberattacks and contract vulnerabilities rising 25% YoY, demand for transparent, on-chain coverage is accelerating.

For enterprises, on-chain insurance is a structural shift in risk management, delivering speed, transparency, and resilience that traditional insurers can’t match.

What is Nayms (Now OnRe)?

Nayms, recently rebranded as OnRe, is a next-generation on-chain insurance marketplace designed to solve one of the most persistent enterprise challenges in insurance, which includes connecting regulated capital with transparent, automated risk management.

Instead of relying on fragmented legacy systems, Nayms brings brokers, insurers, reinsurers, and investors together on a blockchain-based platform where policies, premiums, and claims are executed through smart contracts under a regulated framework. Licensed in Bermuda, Nayms bridges the gap between blockchain innovation and compliance, giving enterprises a trusted way to access decentralized insurance.

Key Features of the Nayms Platform

- Segregated Accounts (SACs): Each insurance program runs in a ring-fenced smart contract “cell,” isolating capital and liabilities for regulatory clarity.

- Tokenized Capital Pools: Investor funds are tokenized, enabling fractional participation in insurance and transparent tracking of capital flow.

- Automated Claims via Oracles: Real-world events are verified through oracles, triggering accurate and timely payouts without manual intervention.

- Secondary Market Liquidity: Insurance positions can be traded, providing liquidity to investors and flexibility to enterprises.

- Regulatory Framework: Licensed under Bermuda’s Digital Asset Business and Innovative (Re)Insurance regime, ensuring compliance from day one.

Why Enterprises Pay Attention to Nayms

Nayms matters because it demonstrates how insurance can scale on-chain while staying aligned with global regulatory standards. Enterprises see it as a model for how blockchain can reduce claims friction, improve auditability, and open new channels of capital.

With $12 million raised in 2023 at an $80 million valuation, it has also proven that institutional appetite for decentralized insurance is very real. The platform sets a precedent for insurers, reinsurers, and even enterprises outside financial services to explore blockchain-driven risk transfer.

How Nayms Works as an On-Chain Insurance Platform

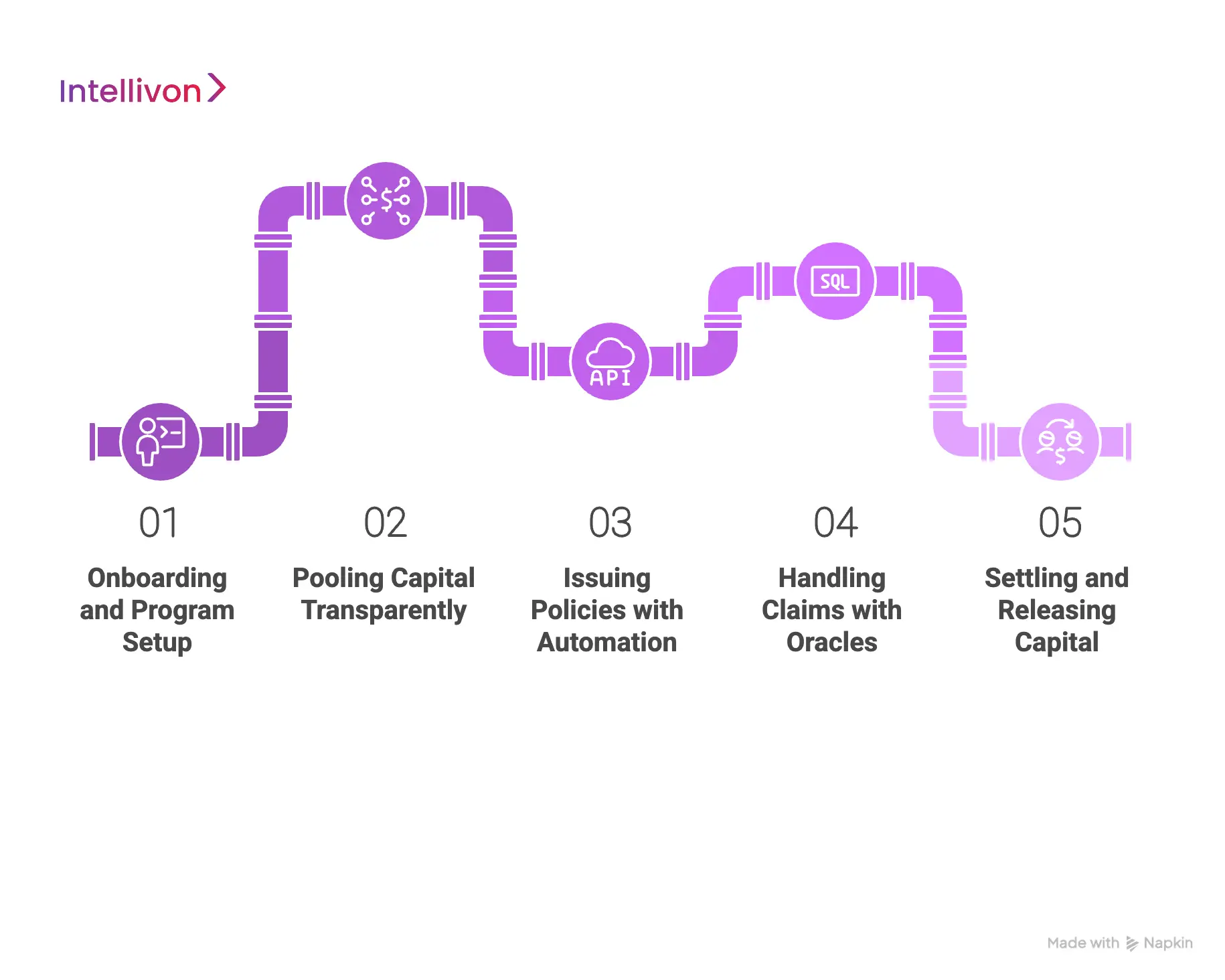

The simplest way to think about Nayms is that it shifts the entire insurance process into a secure, regulated blockchain marketplace. Instead of disconnected systems and paperwork, everything runs on a coordinated, transparent foundation. Here’s how that looks step by step.

1. Onboarding and Program Setup

Brokers, insurers, and investors first join the platform through a verified onboarding process. Once inside, a new insurance program is created within a segregated smart-contract cell. This cell locks in coverage terms, limits, fees, and timelines, ensuring clarity and immutability from day one.

2. Pooling Capital Transparently

Investors contribute funds to the program’s pool and receive digital tokens representing their share of the risk. The pool’s capacity and performance are visible in real time, creating confidence for both underwriters and participants.

3. Issuing Policies with Automation

Policies are generated through smart contracts, with premiums collected automatically in approved digital assets such as stablecoins. This makes policy issuance immediate and cash flow tracking effortless.

4. Handling Claims with Oracles

Trusted data feeds, like oracles, connect the contract to real-world events. If a covered incident occurs, payouts can be triggered instantly. Complex claims can still be escalated for review, but always with a transparent, auditable trail.

5. Settling and Releasing Capital

At the close of a program, returns, fees, and premiums are distributed according to the contract. Investors can exit or roll their capital into new programs, while the cell closes with a permanent, tamper-proof record.

For enterprises, this means insurance starts acting like a real-time financial platform, is fast, transparent, and governed by rules rather than delays.

What is an On-Chain Insurance Platform?

At its core, an on-chain insurance platform moves the entire insurance lifecycle, like policy creation, capital pooling, claims, and reporting, onto blockchain rails. Instead of relying on siloed systems and manual reconciliation, it creates a unified environment where every step is automated, verifiable, and accessible in real time.

1. Defining the Concept

“On-chain” means the key functions of insurance live on a blockchain. Smart contracts, rather than manual workflows, handle policies, premiums, claims, and settlements. These contracts execute automatically when predefined conditions are met, leaving no room for delay or dispute.

2. How It Differs from Traditional Models

Traditional digital insurance platforms still depend on centralized databases, brokers, and reconciliations. On-chain platforms replace this with transparent ledgers and immutable logic, giving enterprises full visibility into how risk is priced, shared, and settled.

3. The Role of Capital Pools

Instead of relying only on large reinsurers, capital is raised transparently through tokenized pools. Investors, from institutions to specialized funds, can participate in underwriting, with their contributions tracked and ring-fenced for specific programs.

Why Oracles Matter

For the system to work, policies need reliable triggers. Oracles bridge the gap by feeding in trusted data such as weather events, cyber incidents, or shipment delays. This allows payouts to happen automatically, based on verifiable facts.

Enterprise Advantage

For enterprises, this model cuts friction dramatically. Claims can be resolved faster, compliance is easier to demonstrate, and access to alternative capital is broadened. In short, insurance becomes a platform for growth and resilience rather than a cost center weighed down by inefficiencies.

Features of an On-Chain Insurance Platform Like Nayms

On-chain insurance platforms come with a set of core features that are directly designed to fix the inefficiencies enterprises face with traditional insurance. Each feature solves a long-standing pain point, and together they create a much more reliable and scalable system.

1. Smart Contracts for Automation

Smart contracts replace long paper trails with logic coded directly on the blockchain. They define coverage, premium schedules, and payout rules in advance. When an event occurs, payouts are triggered automatically, without delays or disputes. For enterprises, this means less time lost in claim reviews and more certainty in how risk is managed.

2. Tokenized Capital Pools

Instead of waiting on a handful of reinsurers, capital is raised through tokenized pools. Investors commit funds, and tokens represent their share of the risk. Enterprises benefit from faster access to diversified capital, and every contribution is transparent, so funding capacity is never in doubt.

3. On-Chain Policy Issuance

Every policy is issued directly on the blockchain, making it tamper-proof and auditable. Premiums are collected automatically in approved assets like stablecoins, creating smoother financial operations. Enterprises gain predictable cash flow and a permanent, verifiable record of each policy.

4. Oracles for Real-World Data

Claims need reliable proof, and oracles provide it. They feed data such as weather events, shipping delays, or cyberattacks straight into the contract. This makes settlement a process of verification, not negotiation, reducing fraud and speeding up resolution.

5. Secondary Market Liquidity

Insurance programs often lock up capital for long periods. By tokenizing investor positions, platforms create optional secondary market trading. This flexibility attracts more capital providers and gives enterprises confidence that their programs will remain funded and stable over time.

6. Regulatory and Compliance Layer

Without regulatory approval, innovation doesn’t scale. Licensed platforms like Nayms (OnRe) build compliance into the framework, such as KYC, AML, and solvency checks, which are embedded in workflows. Enterprises can innovate with blockchain while staying within legal boundaries, reducing regulatory risk.

Together, these features make insurance faster to issue, cheaper to run, and more transparent to manage, thereby aligning it with the pace and expectations of modern enterprise operations.

Enterprise Architecture of an On-Chain Insurance Platform Like Nayms

To bring an on-chain insurance platform to life, enterprises need to understand its architecture. It is a layered design where each component plays a role in keeping capital secure, policies enforceable, and claims auditable.

1. Smart Contract Layer

At the foundation are smart contracts. These contracts define the terms of every program: coverage, premium schedules, triggers, and payout rules. Once deployed, they run independently, ensuring no participant can alter agreements mid-way. For enterprises, this guarantees predictability and removes the risks of manual tampering.

2. Capital Pool Layer

Above the contracts sit tokenized capital pools. Each program has its own pool, funded by investors who receive tokens representing their share. These pools are ring-fenced, so liabilities from one program can’t spill into another. This separation gives enterprises confidence in solvency and risk isolation.

3. Oracle and Data Layer

Insurance depends on trusted information. Oracles connect blockchain contracts with external data sources such as weather feeds, logistics trackers, or cybersecurity alerts. When a policy trigger is met, the oracle provides proof, enabling automated, transparent payouts. This reduces fraud risk and accelerates claims.

4. Compliance and Identity Layer

Regulation is non-negotiable in insurance. On-chain platforms embed compliance workflows directly, like KYC, AML, and solvency checks run as part of the process.

Decentralized identity (DID) solutions ensure participants are verified while keeping data secure and private. Enterprises benefit from baked-in governance without additional manual overhead.

5. User and Reporting Layer

On top sits the enterprise interface. Dashboards show real-time metrics on premium flows, claims, reserves, and pool performance. Regulators and auditors can access the same immutable data, reducing reporting burdens. This layer makes the system usable by business teams, not just technical specialists.

When combined, these layers form a resilient architecture, with contracts automating, pools securing capital, oracles bringing truth, compliance enforcing governance, and dashboards keeping decision-makers in control. It’s a design that aligns innovation with enterprise stability.

How AI Enhances On-Chain Insurance Platforms

While blockchain provides the foundation of transparency and automation, AI adds intelligence to the system. It turns raw data and rules into smarter decisions that improve underwriting, pricing, and claims. For enterprises, this combination means insurance programs that are not only automated but also adaptive and resilient.

1. AI-Driven Risk Modeling

AI can process years of historical claims data, market trends, and even unstructured sources like news feeds to assess risk. For enterprises, this means more accurate underwriting models that adapt to emerging threats such as cyberattacks or supply chain disruptions.

2. Fraud Detection and Anomaly Spotting

Insurance fraud drains billions annually. AI algorithms scan transactions and claims patterns in real time to detect anomalies, thereby flagging suspicious activity before payouts occur. This reduces losses and strengthens trust across the platform.

3. Predictive Pricing and Premium Optimization

Traditional pricing often lags behind reality. AI analyzes behavioral, operational, and external risk signals to adjust premiums dynamically. Enterprises benefit from pricing that is fairer, more competitive, and aligned with actual exposure.

4. Claims Automation with NLP and Imaging

For complex claims, such as damage assessments, AI tools like natural language processing (NLP) and image recognition can automate review. They extract relevant details from documents, photos, or reports, streamlining processes that previously took weeks.

Together, AI and blockchain create a system that doesn’t just execute rules, but learns and improves with every cycle, thereby helping enterprises reduce costs, minimize risk, and build more reliable coverage.

Role of DID (Decentralized Identity) in On-Chain Insurance Platforms

While blockchain provides the foundation of transparency and automation, AI adds intelligence to the system. It turns raw data and rules into smarter decisions that improve underwriting, pricing, and claims.

1. AI-Driven Risk Modeling

AI can process years of historical claims data, market trends, and unstructured signals to assess risk more accurately. This helps enterprises design coverage that adapts to emerging threats such as cyberattacks or supply chain disruptions.

2. Fraud Detection and Anomaly Spotting

AI models scan transactions and claims in real time, detecting unusual activity before payouts are made. This minimizes fraud losses and increases platform reliability.

3. Predictive Pricing and Premium Optimization

AI enables dynamic pricing that reflects real-world exposure, not outdated actuarial tables. Enterprises can offer fairer, more competitive premiums while protecting profitability.

4. Claims Automation with NLP and Imaging

From reading reports to analyzing photos, AI reduces the manual load in claims review. This shortens settlement times and creates a better experience for policyholders.

At Intellivon, we design on-chain insurance platforms with AI woven into the architecture. Our systems learn and adapt with every cycle, helping enterprises reduce cost, mitigate risk, and build resilient coverage models.

Advanced Scalability Options: Shardchains & Beyond

For enterprises, scaling is essential. To this effect, an on-chain insurance platform must handle thousands of policies, capital pools, and claims without slowing down. Scalability models such as shardchains and Layer-2 solutions make this possible.

1. Shardchains for Parallel Processing

Shardchains distribute workloads across multiple chains that run in parallel. One shard may handle cyber policies in Europe, while another manages parametric agriculture insurance in Asia. Enterprises can expand globally without fear of bottlenecks.

2. Layer-2 Enhancements

Routine tasks like premium collections or micro-claims can move off the main chain to Layer-2 networks. This reduces fees, increases throughput, and keeps performance smooth even during spikes in activity.

3. Enterprise-Grade Performance

When shardchains and Layer-2 are combined, the system scales dynamically with demand. Enterprises can launch new products or expand into new markets without compromising compliance or governance.

This is where Intellivon steps in. We design insurance platforms that balance scalability with enterprise control, ensuring your programs can grow from pilot to global deployment without disruption. By combining shardchains, Layer-2, and advanced orchestration, we build systems ready for millions of transactions and the regulatory scrutiny that comes with them.

How We Build On-Chain Insurance Platforms Like Nayms for Enterprises

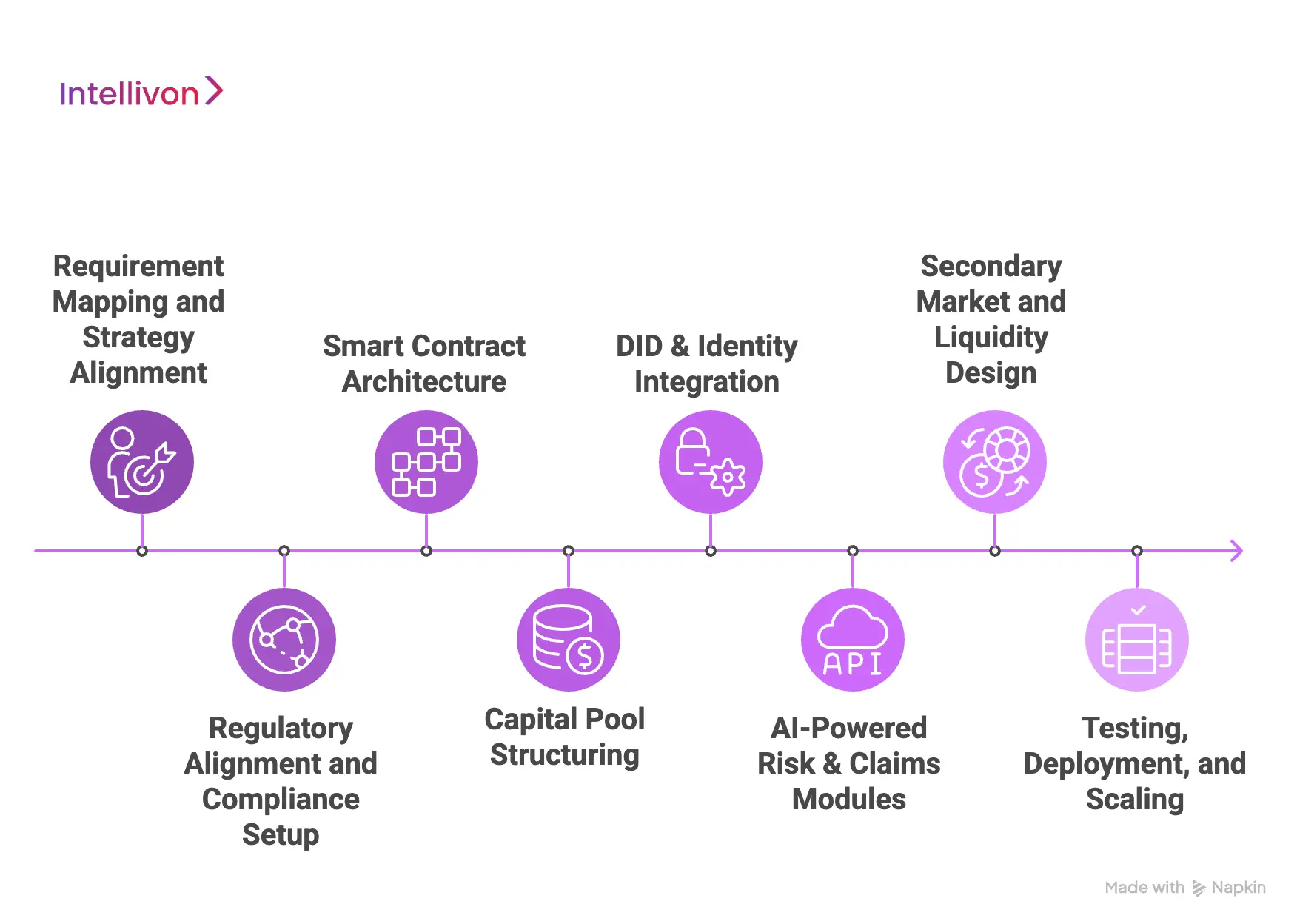

Building an on-chain insurance platform isn’t just about deploying smart contracts. It’s about creating a secure, compliant, and scalable system that works for global enterprises from day one. At Intellivon, we follow a structured, step-by-step process that ensures every platform is aligned with business goals, regulatory expectations, and long-term scalability.

Step 1: Requirement Mapping and Strategy Alignment

We begin by working closely with your leadership and compliance teams to define objectives, risk appetite, and KPIs. In addition, we identify where insurance inefficiencies currently exist and map them against blockchain opportunities. As a result, the platform blueprint is designed to support enterprise goals while preparing for regulatory readiness directly.

Step 2: Regulatory Alignment and Compliance Setup

Every jurisdiction has its own rules, and insurance cannot operate without meeting them. Therefore, our team aligns your operating regions with frameworks such as Bermuda’s IIGB, GDPR, HIPAA, or local insurance laws. Consequently, compliance is embedded into the platform from the outset, avoiding costly retrofits and delays later in the lifecycle.

Step 3: Smart Contract Architecture

The next stage is designing modular smart contracts that handle core functions, like policy issuance, premium collection, capital pooling, and claims settlement. Moreover, these contracts are built with transparency and auditability in mind, ensuring every transaction can be verified. This approach ensures long-term adaptability so new products can be added without rewriting the entire system.

Step 4: Capital Pool Structuring

On-chain insurance requires secure, transparent capital to back programs. For this reason, we design tokenized capital pools with segregated account structures that ring-fence liabilities. In doing so, enterprises protect investor confidence while ensuring solvency across multiple product lines.

Step 5: DID & Identity Integration

Trust and compliance depend on verified participants. Accordingly, decentralized identity modules are integrated to perform KYC, AML, and participant verification at scale. This means enterprises balance compliance with privacy, giving stakeholders confidence in secure onboarding and ongoing governance.

Step 6: AI-Powered Risk & Claims Modules

Automation is powerful, but intelligence makes it stronger. Therefore, we embed AI models for underwriting, fraud detection, and claims automation that learn continuously from new data. As a result, risk scoring improves over time, and operational burden on human reviewers is significantly reduced.

Step 7: Secondary Market and Liquidity Design

Insurance platforms benefit when investors have flexibility. For this reason, where regulation permits, we design modules that allow tokenized positions to be traded on secondary markets. Consequently, enterprises gain access to a healthier capital ecosystem, while investors enjoy optional liquidity without destabilizing programs.

Step 8: Testing, Deployment, and Scaling

Finally, platforms are tested under real-world stress conditions and validated by independent audits. In addition, deployment includes cloud rollout, shardchain setup, and Layer-2 scalability features to handle growth. This ensures enterprises can expand from pilot projects to global adoption without disruptions in performance or compliance.

With this structured process, Intellivon delivers a foundation for enterprise-grade insurance innovation that balances speed, security, and regulatory confidence.

Cost of Developing an On-Chain Insurance Platform for Enterprises

At Intellivon, the goal is to help enterprises build insurance platforms that are both scalable and sustainable. That’s why our pricing framework is flexible, aligned with growth goals, compliance obligations, and risk appetite rather than forcing a rigid, one-size-fits-all package.

If early projections stretch beyond your budget, the scope is refined collaboratively. The focus always remains on preserving what matters most: enterprise-grade reliability, regulatory compliance, and uncompromising security.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, risk modeling workshops, KPI definition, compliance readiness (GDPR, HIPAA, SOC 2, Bermuda frameworks) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting layered architecture (smart contracts, capital pools, oracles, DID/compliance, reporting dashboards) | $8,000 – $15,000 |

| Core Smart Contract Development | Policy issuance, capital pooling, premium logic, and claims settlement contracts with modular upgrade paths | $12,000 – $25,000 |

| Asset Tokenization & Pooling Framework | Tokenizing capital contributions, structuring segregated accounts (SACs), and liquidity management modules | $10,000 – $20,000 |

| AI Intelligence Layer | Underwriting risk models, fraud detection, predictive claims automation, and dynamic premium optimization | $10,000 – $22,000 |

| Platform Development & Customization | Enterprise dashboards, broker portals, mobile/web apps, and integrations with ERP/CRM/compliance systems | $12,000 – $25,000 |

| Security & Compliance Alignment | Smart contract audits, KYC/AML/DID modules, encryption, and real-time compliance monitoring | $8,000 – $15,000 |

| Testing & Quality Assurance | End-to-end workflow validation, compliance checks, stress testing, and scalability tuning | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, shardchain setup, data residency controls, monitoring dashboards, and regulatory sandbox onboarding | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Integration Complexity: Connecting with legacy ERP, treasury, and claims systems often requires middleware.

- Liquidity Bootstrapping: Enterprises must plan how initial pools of underwriting capital will be funded or incentivized.

- Compliance Overhead: Regional regulations (GDPR, AML, HIPAA, local insurance laws) demand ongoing legal and audit support.

- Cloud & Infrastructure Costs: Running AI risk engines, shardchains, and monitoring dashboards adds compute costs if not optimized.

- Change Management: Training internal teams, brokers, and partners on new workflows creates additional operational overhead.

- Maintenance & Monitoring: Regular audits, regulatory updates, and platform monitoring are essential to prevent downtime or compliance breaches.

Best Practices to Avoid Budget Overruns

From Intellivon’s experience delivering enterprise-scale blockchain insurance solutions, several practices keep costs predictable:

- Start with Focused Scope: Launch one insurance line, validate ROI, then expand to others.

- Design for Compliance Early: Embed regulatory frameworks (GDPR, AML, HIPAA, Bermuda) from day one to avoid costly rework.

- Use Modular Smart Contracts: Reusable policy and claims modules accelerate development across new product lines.

- Optimize Infrastructure Spend: Balance shardchain use with Layer-2 scaling to control transaction costs.

- Embed Observability from Launch: Monitor claims ratios, pool health, and premium flows in real time.

- Plan for Continuous Improvement: Update AI models, compliance modules, and reporting frameworks to keep the platform market-ready.

Request a tailored proposal from Intellivon’s enterprise blockchain team, and you’ll receive a roadmap that fits your budget, enforces compliance, and scales with your long-term growth.

Real-World Enterprise Use Cases of On-Chain Insurance Platforms

On-chain insurance platforms like Nayms are already finding their place across industries where traditional insurance struggles with speed, transparency, or scalability. Therefore, enterprises across multiple sectors are beginning to adopt them.

1. Cybersecurity Coverage

As cyberattacks rise each year, traditional policies struggle with delayed claims and unclear coverage terms. Consequently, on-chain platforms improve reliability by tying claims to verified incident data feeds. For enterprises, this ensures payouts arrive faster in environments where downtime is costly.

2. Supply Chain and Logistics

Disruptions in shipping, customs, or inventory flow often halt global operations. In response, parametric blockchain policies trigger payouts based on IoT or logistics data. Enterprises gain near-instant compensation to recover losses and maintain continuity.

3. Aviation and Travel Insurance

Flight delays, cancellations, and operational risks can leave customers frustrated. As a result, on-chain contracts linked to flight data reduce settlement times from weeks to minutes. Airlines and travel firms benefit from improved trust and fewer disputes.

4. Agricultural Insurance

Farmers and agribusinesses rely on weather-sensitive yields. Therefore, parametric insurance tied to rainfall, temperature, or soil data enables fast payouts when thresholds are breached. Enterprises in food and commodities gain predictable coverage without lengthy manual assessments.

5. DeFi and Digital Asset Risk

In decentralized finance, protocols face risks from smart contract exploits, exchange hacks, and market volatility. On-chain insurance platforms can cover these events with capital raised transparently from investors. For enterprises entering digital finance, this provides a structured safety net.

6. Healthcare and Life Sciences

Medical service disruptions, delayed treatments, or compliance failures impact patient outcomes and enterprise costs. Accordingly, on-chain policies connected to EHR systems or IoT medical devices trigger automated, auditable payouts. Healthcare organizations gain transparent coverage aligned with regulatory needs.

Together, these examples show that on-chain insurance is a cross-industry solution addressing modern risks with speed, transparency, and capital efficiency. For enterprises, it offers real-time protection while supporting future-ready governance.

Conclusion

On-chain insurance is quickly emerging as the future of enterprise risk management. By combining blockchain’s transparency with automated execution, it eliminates inefficiencies that have long slowed down claims, policy issuance, and reporting. Moreover, capital is raised and tracked in real time, policies remain tamper-proof, and claims are verified against trusted data sources without endless back-and-forth. As a result, enterprises finally gain insurance that moves at the speed of modern business.

In addition, on-chain insurance enables enterprises to access new capital markets, launch products faster, and comply with regulations while maintaining governance. Therefore, working with a solution provider experienced in both blockchain and enterprise operations makes this transformation far less daunting. Ultimately, with the right partner, enterprises can progress from experimentation to fully operational platforms that scale globally, reduce costs, and deliver coverage models built for a digital-first economy.

Build Your On-Chain Insurance Platform Like Nayms

At Intellivon, we design enterprise-grade on-chain insurance platforms that are secure, compliant, and scalable, tailored to the way global organizations manage risk. Our solutions combine blockchain transparency, AI-powered intelligence, and compliance-first design to help enterprises launch new insurance programs, streamline claims, and access diversified capital without disruption.

Why Partner With Intellivon?

- Tailored Insurance Infrastructure: Every platform is built around your business model, product lines, and compliance requirements, ensuring solutions that align with growth goals.

- Compliance and Regulatory Alignment: Designed to meet GDPR, HIPAA, AML/KYC, and international insurance frameworks, with audit-ready reporting built into the platform.

- Proven Enterprise Delivery: Over a decade of experience delivering blockchain and AI platforms that reduce friction, improve claims efficiency, and accelerate product launches.

- Resilient Security Architecture: Independent audits, fraud detection, oracle validation, and multi-layer controls protect both capital pools and customer trust.

- Future-Ready Insurance Models: Support for parametric, cyber, supply chain, and DeFi-related coverage, enabling enterprises to innovate with confidence across multiple sectors.

- Scalable Architecture Design: Cloud-native, shardchain-enabled, and API-driven platforms that integrate seamlessly with ERP, CRM, and compliance systems for smooth adoption.

Book a discovery call with Intellivon today to explore how we can help you build an on-chain insurance platform that strengthens risk management and positions your enterprise as a leader in the decentralized economy.

FAQs

Q1. What is an on-chain insurance platform?

A1. An on-chain insurance platform moves the full insurance lifecycle to blockchain; therefore, policies, premiums, capital pools, and claims run by code. Smart contracts automate rules and payouts; as a result, manual effort drops. Moreover, every action is immutably recorded, creating a trustworthy audit trail.

Q2. How does Nayms (OnRe) work as an on-chain insurance platform?

A2. Nayms, rebranded as OnRe, operates as a regulated insurance marketplace. Notably, each program lives in a segregated smart-contract cell. Capital is pooled and tracked transparently, and meanwhile, policies are issued on-chain. Consequently, oracle-verified events can trigger automatic payouts with clear auditability.

Q3. What are the benefits of on-chain insurance for enterprises?

A3. Enterprises gain faster claims and lower admin effort, and compliance reporting becomes simpler. Moreover, tokenized pools broaden investor access and reduce concentration risk. Thus, insurance becomes more reliable, transparent, and aligned with modern operations.

Q4. How much does it cost to build an on-chain insurance platform?

A4. Most enterprise builds land between $50,000 and $150,000; however, scope and integrations can shift totals. That range covers architecture, smart contracts, compliance modules, and dashboards. Additionally, annual maintenance typically adds 15–20% for updates and monitoring.

Q5. How do on-chain insurance platforms ensure compliance and security?

A5. They integrate KYC/AML processes, decentralized identity, and regional regulatory frameworks directly into workflows. Smart contracts are independently audited to prevent vulnerabilities, and all data is encrypted and recorded immutably. This gives enterprises confidence that both governance and security are enforced.