Enterprises continue to struggle with the inefficiencies of traditional asset management. Bonds, real estate, commodities, and receivables often sit locked in systems that are slow, costly, and difficult to transfer. Settlements take days, ownership records are scattered across intermediaries, and opportunities to unlock liquidity are lost. These challenges not only delay capital flows but also prevent enterprises from scaling investment opportunities at the speed the market demands.

A real-world asset tokenization platform changes this by converting assets into digital tokens that are compliant, auditable, and secure. Additionally, it allows enterprises to create liquidity, streamline ownership transfers, and reduce operational costs. The platform makes it possible to manage once-static assets with the same flexibility and efficiency as digital-native ones.

At Intellivon, we design and deliver enterprise-grade asset tokenization platforms that combine regulatory alignment, blockchain infrastructure, and seamless integration with existing systems. In this blog, we’ll show you what these platforms include and how we build them for enterprises.

Why Enterprises Are Exploring Asset Tokenization Platforms Now

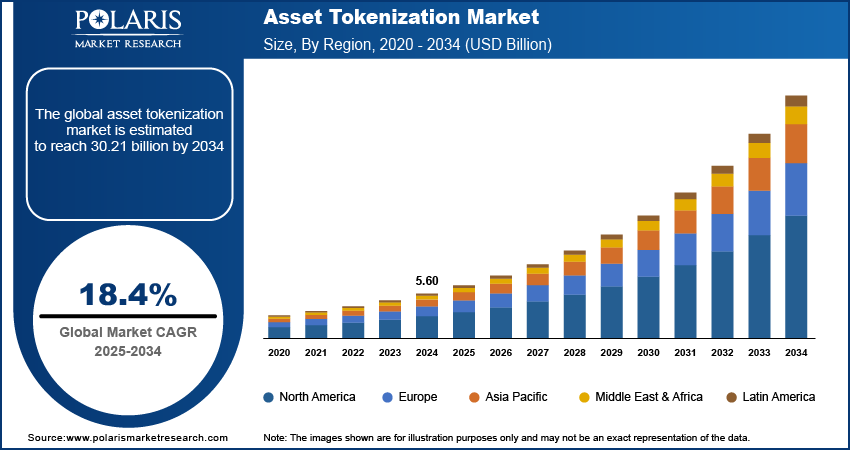

The global asset tokenization market was valued at USD 5.60 billion in 2024 and is projected to grow to USD 30.21 billion by 2034, at a CAGR of 18.4% from 2025 to 2034.

By 2025, over 60% of Fortune 500 companies and global banks had already launched pilots or invested in tokenization infrastructure. This signals that tokenization is entering the mainstream of institutional finance

- Tokenization unlocks liquidity in illiquid assets, reducing settlement times from days to near-instant.

- Enterprises report up to 40% improvements in working capital through fractional ownership and faster transfers.

- Regulators in the US, UK, EU, and APAC are creating sandboxes and frameworks for tokenized finance.

- Platforms automate compliance with KYC/AML and deliver audit trails that reduce operational risks.

- Investors demand new structures, driving a surge in tokenized securities, loans, and receivables.

- 70% of banks and asset managers rank tokenization among their top three digital priorities.

Asset tokenization represents a pivotal shift for enterprises aiming to unlock liquidity, reduce operational costs, and maintain compliance in a digital-first, regulated marketplace.

What are Real-World Asset Tokenization Platforms?

At its core, a real-world asset (RWA) tokenization platform takes something traditionally slow and complex, such as bonds, real estate, or trade receivables, and transforms it into something more efficient and scalable. It transforms it into something more efficient and scalable. It represents it as a digital token on a blockchain.

These tokens aren’t abstract cryptocurrencies. They are legally tied to ownership rights, cash flows, or claims on an underlying asset. That link is what makes tokenization into an operational tool for enterprises.

A well-architected platform builds an end-to-end system that manages issuance, compliance, trading, settlement, and reporting in one environment. Instead of relying on layers of intermediaries, enterprises can create assets that are programmable, instantly transferable, and governed by embedded compliance rules. The result is faster access to liquidity, more efficient capital flows, and greater transparency for both issuers and investors.

For enterprises, the value lies not only in efficiency gains but also in opening new investment structures. Tokenization platforms make it possible to fractionalize high-value assets, extend access to broader investor groups, and build products that were previously too costly or complex to administer.

How Do Real-World Asset Tokenization Platforms Work?

A tokenization platform isn’t a single tool. It is a sequence of steps that takes a traditional asset, attaches enforceable rights, and transforms it into a programmable token. Below is a practical framework that shows how enterprises move from asset selection to scaled adoption.

Step 1: Define the Asset and Legal Wrapper

The process begins with asset selection. Enterprises choose bonds, receivables, or real estate. They then attach a legal wrapper, such as an SPV, note, or fund unit. This wrapper binds the token to ownership rights and ensures the digital version has legal standing.

Step 2: Map Jurisdictions and Compliance Rules

Enterprises decide where issuance occurs and who may hold the token. Teams define jurisdiction, investor category, and geography. Developers then code these rules into contracts. As a result, transfers remain compliant by design.

Step 3: Establish Identity and Onboarding

Investors complete KYC and AML checks to prove eligibility. Approved participants receive digital credentials that allow platform access. Teams can revoke access instantly if requirements change. This creates a flexible compliance layer that adapts as regulations evolve.

Step 4: Design Tokens and Smart Contracts

Developers create tokens using standards like ERC-3643 or ERC-1400. Smart contracts automate transfers, redemptions, lockups, and governance rights. Teams can design partitions or classes for investors with different entitlements. These contracts make assets programmable and auditable.

Step 5: Build the Primary Issuance Portal

Enterprises launch a subscription portal for investors. Once the system receives and verifies funds, it mints and distributes tokens. The platform synchronizes the registrar and blockchain ledger. This keeps all records accurate and traceable.

Step 6: Integrate Settlement and Cash Operations

The platform connects fiat rails and approved stablecoins. It automates payments and reconciliations, reducing manual overhead. The system logs every cash flow in real time. Finance teams and auditors gain a clear line of sight.

Step 7: Secure Custody and Key Management

Enterprises protect keys through MPC or hardware modules. Teams require multiple approvals for sensitive actions like minting or burning. They also define override processes for court orders or regulatory requests. This ensures custody remains resilient and trusted.

Step 8: Enable Secondary Liquidity

Teams connect tokens to permissioned venues or regulated sandboxes. The platform enforces whitelists and compliance rules wherever tokens trade. Enterprises design liquidity programs and redemption windows. These measures keep secondary markets orderly and compliant.

Step 9: Orchestrate Data and Reporting

The system integrates oracles for NAV and pricing data. It updates cap tables automatically and generates scheduled reports for compliance teams. These records provide full transparency. Regulators can verify ownership and transactions at any time.

Step 10: Scale and Extend

Enterprises expand once the platform proves stable. Teams add new asset classes or extend into new geographies. They track KPIs like settlement speed, transaction costs, and liquidity depth. Each iteration builds confidence while audits reinforce long-term trust.

These platforms work by taking enforceable rights, encoding them into tokens, and embedding compliance into every transaction. The outcome is an infrastructure where assets remain liquid, auditable, and ready for institutional scale.

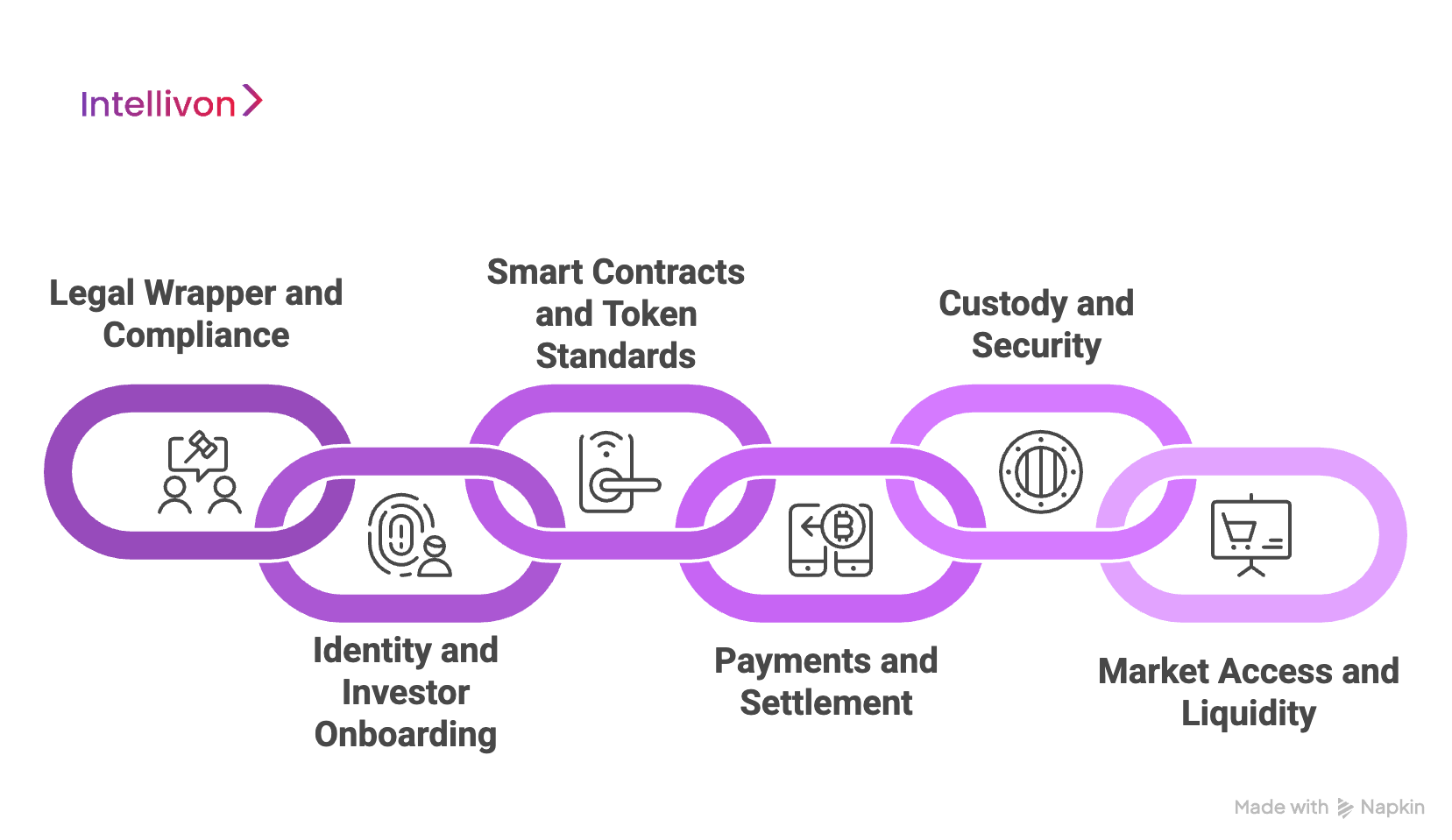

Core Components of a Tokenization Platform

A tokenization platform is more than a blockchain with tokens on top. It is a layered system where each component plays a role in making assets liquid, compliant, and tradable at scale. Think of it as an operating stack, where if one layer is missing or weak, the entire structure loses trust and usability.

1. Legal Wrapper and Compliance

Every token must have a legal foundation. That means assets are issued through structures such as SPVs, fund units, or debt notes. These wrappers connect the digital token to enforceable rights.

Compliance rules like investor eligibility and transfer restrictions are defined alongside. Together, they ensure tokens can stand up to regulatory scrutiny.

2. Identity and Investor Onboarding

No enterprise platform works without knowing who the investors are. Identity checks through KYC and AML form the gatekeeping layer. Once verified, investors receive digital credentials that allow them to transact.

If conditions change, access can be revoked instantly. This keeps the market safe and compliant.

3. Smart Contracts and Token Standards

The actual behavior of the token lives in smart contracts. Standards such as ERC-3643 or ERC-1400 encode the rules of ownership, transfers, lockups, and corporate actions.

This automation reduces reliance on intermediaries and ensures every action can be audited in real time.

4. Payments and Settlement

Tokens are only useful if money moves just as efficiently. That is why settlement is integrated with both fiat rails and regulated stablecoins.

Automating reconciliations, treasury operations, and reporting reduces friction, allowing capital to flow quickly while staying transparent.

5. Custody and Security

Enterprises demand institutional security. Keys are stored using MPC or hardware modules, and sensitive actions such as minting or burning require multiple approvals.

This layer prevents fraud, reduces operational errors, and builds trust among regulators and investors alike.

6. Market Access and Liquidity

Finally, assets need a marketplace. Platforms connect issuance portals to secondary venues or regulatory sandboxes. Whitelists and compliance rules travel with the token, ensuring lawful transfers. With this, liquidity becomes practical instead of theoretical.

When all of these components work together, the platform does more than tokenize assets. It creates an ecosystem where compliance, efficiency, and liquidity are built into every transaction.

What Types of Real-World Assets Can Be Tokenized?

The power of tokenization lies in its flexibility. Almost any asset that carries ownership rights, cash flows, or claims can be represented digitally. For enterprises, this means turning previously illiquid or hard-to-trade assets into programmable units that can move across markets with speed and transparency.

1. Financial Instruments

The earliest adoption has come from financial assets. Government bonds, treasuries, and money market funds are already being issued in tokenized form. Institutions such as BlackRock and Franklin Templeton have launched large-scale pilots, proving that tokenization can work within regulated markets. Corporate debt and equities are also moving in this direction, creating faster fundraising and new secondary liquidity options.

2. Real Estate

Property has long been considered an illiquid asset class. Tokenization changes this by fractionalizing ownership of commercial buildings, residential units, or development projects.

Enterprises can package real estate into SPVs or REIT structures and then issue tokens tied to enforceable rights. This lowers entry barriers for investors and unlocks liquidity for issuers.

3. Commodities and Physical Assets

From gold and silver to oil, grain, and industrial metals, commodity-linked tokens are gaining traction. These assets often sit idle in warehouses or trading systems.

Tokenization creates a way to transfer, trade, or finance them more efficiently, while also enabling transparent audit trails along the supply chain.

4. Intangible and Emerging Assets

The opportunity goes beyond traditional categories. Carbon credits and renewable energy certificates are already being digitized to improve traceability and reporting. Intellectual property, royalties, and music or film rights are also being structured into tokens.

Even luxury assets such as art, wine, and collectible cars are entering tokenized marketplaces, offering fractional ownership of items once reserved for a select few.

Taken together, these examples show that tokenization is not limited to one sector. It is a framework enterprises can apply across financial, physical, and intangible assets to unlock liquidity and create entirely new markets.

Compliance and Governance System in RWA Platforms

Tokenization only works if investors and regulators can trust it. Without a compliance and governance system built into the platform, the risks outweigh the benefits. Enterprises must prove that every token is tied to enforceable rights, that transfers follow the law, and that oversight is constant. This is where most pilots fail, and where enterprise-ready platforms succeed.

1. Regulatory Compliance Framework

Every issuance must align with the rules of its jurisdiction. In practice, this means designing the platform around regimes such as MiCA in the EU, the SEC in the US, or MAS in Singapore. Eligibility, disclosures, and transfer restrictions are set upfront, then coded directly into contracts. At Intellivon, we embed these compliance frameworks into the design, reducing risk and preventing costly retrofits later.

2. Identity and Investor Onboarding

Investor access begins with strict KYC and AML checks, sanctions screening, and risk assessments. Once verified, investors receive credentials that allow them to interact with the platform.

If their status changes, access can be revoked immediately. Intellivon integrates decentralized identity tools and automated monitoring to keep compliance continuous rather than reactive.

3. Governance and Corporate Actions

Enterprises need a system to manage redemptions, coupon payouts, voting rights, and dividend distributions. Smart contracts automate these actions but remain under enterprise control through multi-signature approvals.

Intellivon ensures the registrar of record and blockchain state always match, so regulators and investors see a single, trusted version of truth.

4. Risk and Control Mechanisms

Operational controls are as important as legal ones. Keys are managed with MPC or hardware modules, and sensitive actions require multiple approvals. Oracles feeding NAV and price data are quorum-based, with safeguards against anomalies.

Our experts build platforms with break-glass procedures and audit logs, so enterprises can respond quickly to regulatory or operational events.

5. Enterprise Oversight and Reporting

Finally, compliance must be visible. Dashboards for compliance officers and legal teams provide real-time oversight of subscriptions, transfers, and redemptions.

Automated reports flow to regulators on schedule. Intellivon integrates these systems with existing ERP and fund accounting platforms, creating seamless reconciliation and reducing manual work.

In short, compliance is not a layer added after launch. It is the foundation of every enterprise-grade tokenization platform we build at Intellivon, ensuring that liquidity and efficiency never come at the cost of trust.

The Role of AI in RWA Tokenization Platforms

Blockchain provides the foundation for trust and compliance, but on its own, it cannot handle the dynamic complexity of enterprise operations. This is where AI extends the value of tokenization platforms. By adding intelligence to compliance, risk, and operations, AI transforms tokenization from a static infrastructure into a living system that adapts in real time.

1. Compliance and Risk Monitoring

Traditional compliance checks are reactive. With AI, monitoring becomes continuous. Machine learning models scan transactions for anomalies, detect sanction risks, and predict fraud patterns before they occur.

At Intellivon, platforms are designed with AI-driven KYC and AML modules that give compliance teams the ability to stay proactive.

2. Smart Contract and Security Assurance

Smart contracts govern how assets move, but even small errors can create financial or legal exposure. AI-powered auditing tools help detect vulnerabilities before contracts are deployed.

Once live, anomaly detection monitors unusual activity and alerts administrators. These safeguards are embedded into Intellivon’s delivery approach, giving enterprises confidence in both security and auditability.

3. Valuation and Transparency

Accurate pricing is the backbone of investor trust. AI models ingest market data and generate near-real-time valuations or NAV updates for tokenized assets.

This creates transparency for investors and simplifies regulatory reporting. Valuation engines implemented by Intellivon ensure tokenization platforms stay aligned with enterprise finance teams and external auditors.

4. Investor Behavior and Liquidity Planning

Tokenized assets introduce new liquidity patterns, such as fractional redemptions or micro-subscriptions. AI helps enterprises forecast redemption cycles, segment investor profiles, and plan liquidity buffers. With these insights, platforms can maintain trading activity while protecting issuers from unnecessary risk.

5. Operational Efficiency

Beyond compliance and risk, AI drives efficiency in day-to-day operations. Automated reconciliation, report generation, and conversational AI agents for investor support reduce manual workload.

By integrating these AI modules with enterprise systems, Intellivon ensures tokenization platforms are not only compliant but also lean and responsive.

In short, AI makes tokenization platforms smarter. Enterprises that partner with Intellivon gain systems that are secure, transparent, and intelligent from day one.

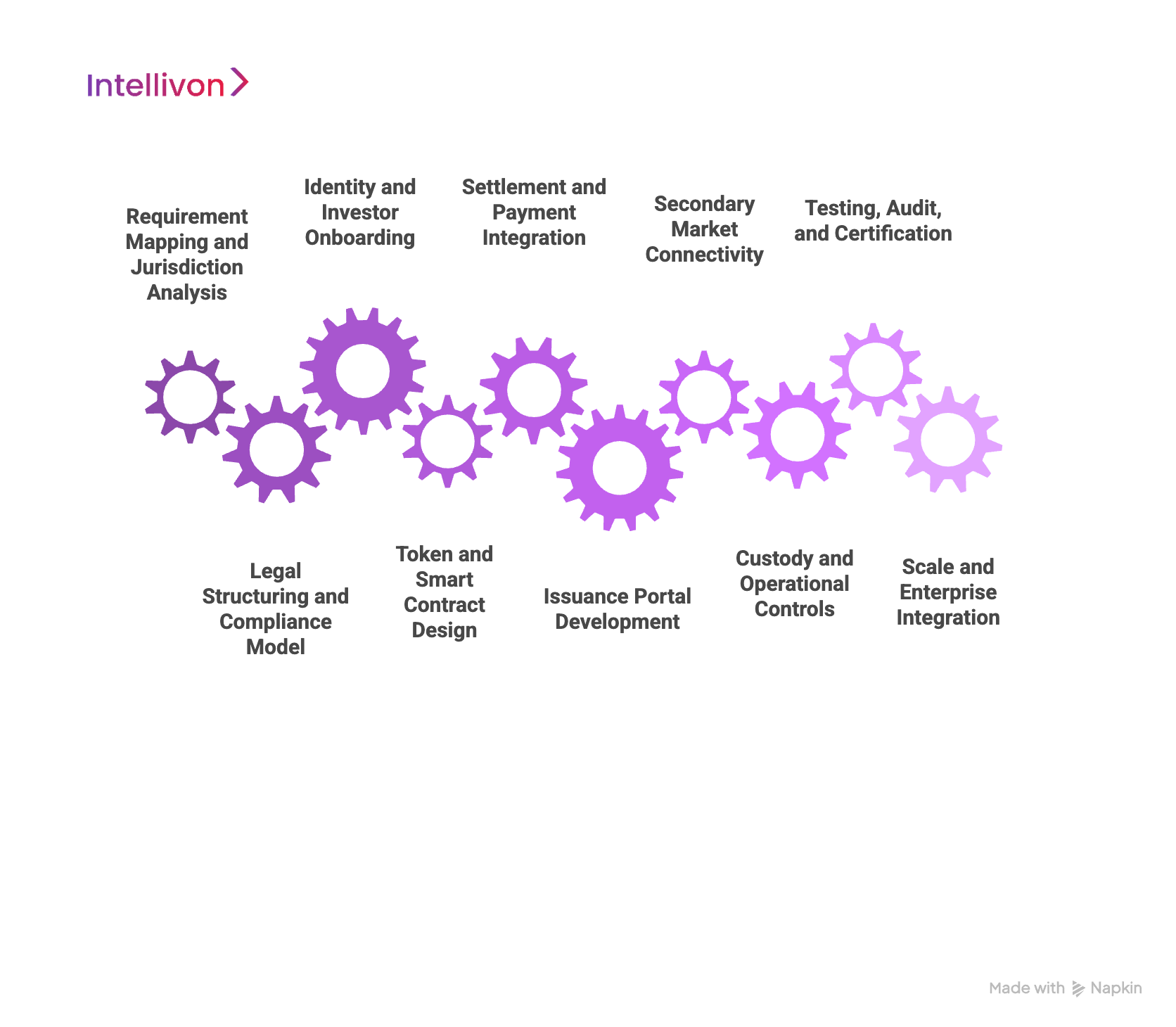

How We Build a Real-World Asset Tokenization Platform (Step-by-Step)

Tokenization is not a quick add-on. It requires a structured build process that balances legal certainty, compliance, and technical scalability. At Intellivon, this framework has been shaped by real enterprise deployments, ensuring every layer, all the way from onboarding to secondary markets, works seamlessly together.

Step 1: Requirement Mapping and Jurisdiction Analysis

The journey begins with clarity. Enterprises must define which assets are being tokenized, which legal wrapper is suitable, and where issuance will take place. By working with compliance teams from the outset, Intellivon ensures that the strategy aligns with regulations before any code is written.

Step 2: Legal Structuring and Compliance Model

Once the jurisdiction is set, legal rules are captured. Investor categories, transfer restrictions, and disclosure obligations are mapped here. Instead of leaving these as manual processes, Intellivon builds them directly into smart contracts, making compliance part of the platform’s DNA.

Step 3: Identity and Investor Onboarding

No platform functions without trust in its investors. KYC, AML, and sanctions checks are performed to verify eligibility. Approved participants are issued credentials or decentralized IDs, which can be revoked if needed. This creates a living compliance layer that evolves with regulation.

Step 4: Token and Smart Contract Design

The asset’s digital life is defined in smart contracts. Using standards like ERC-3643 or ERC-1400, Intellivon encodes ownership transfers, lockups, redemptions, and governance rights. Every action is automated, reducing reliance on intermediaries while keeping the process auditable.

Step 5: Settlement and Payment Integration

For tokenization to succeed, money must move as efficiently as tokens. Settlement rails for fiat and regulated stablecoins are integrated, while treasury operations and reconciliations are automated. This provides finance teams with faster liquidity and a clear audit trail.

Step 6: Issuance Portal Development

Enterprises need a smooth way to launch offerings. The issuance portal allows investors to subscribe, complete compliance steps, and transfer funds. Once cleared, tokens are minted and distributed. Intellivon ensures registrars and blockchain ledgers remain in sync, so records are always accurate.

Step 7: Secondary Market Connectivity

Liquidity becomes real when tokens can move beyond primary issuance. Platforms are linked to regulated exchanges or sandbox environments where compliance rules continue to travel with the token. This gives enterprises confidence that every trade remains lawful.

Step 8: Custody and Operational Controls

Security is central to trust. Keys are managed with MPC or hardware modules, and sensitive actions require multiple approvals. Intellivon also defines contingency procedures for overrides and regulatory requests, reducing risk while maintaining operational continuity.

Step 9: Testing, Audit, and Certification

Before launch, platforms undergo rigorous validation. Smart contracts are audited, penetration tests are run, and compliance reports are prepared. This stage provides assurance for boards, regulators, and investors that the platform is ready for scale.

Step 10: Scale and Enterprise Integration

Once proven, the platform extends into new asset classes or markets. Integration with ERP, CRM, and fund accounting systems embeds tokenization into enterprise operations. Continuous monitoring and audits maintain trust while enabling growth.

Intellivon builds tokenization platforms as enterprise infrastructure, not experiments. Each step ensures assets are liquid, compliant, and seamlessly integrated into existing workflows, giving enterprises both immediate value and long-term scalability.

Cost of Creating a Real-World Asset Tokenization Platform

At Intellivon, the focus is on helping enterprises build tokenization platforms that are scalable, compliant, and future-ready. That’s why our pricing framework is flexible. It adapts to growth goals, regulatory obligations, and risk appetite, rather than forcing rigid, one-size-fits-all packages.

If initial projections stretch beyond the budget, the scope is refined collaboratively. The priority always remains the same, which is preserving enterprise-grade reliability, uncompromising security, and full regulatory alignment.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement mapping, risk modeling, KPI definition, compliance readiness (GDPR, SOC 2, AML/KYC, FATF) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting layered architecture (DLT, APIs, compliance, digital identity, reporting dashboards) | $8,000 – $15,000 |

| Core Ledger & Token Layer | Settlement engine, token issuance/redemption, payment flows, modular upgrade paths | $12,000 – $25,000 |

| Interoperability & Connectivity | Integration with SWIFT, RTGS, UPI, ACH, and APIs for multi-asset corridors | $10,000 – $20,000 |

| Compliance & Digital Identity | Automated AML/KYC, fraud detection, digital ID frameworks, real-time regulatory reporting | $10,000 – $22,000 |

| Platform Development & UX | Enterprise dashboards, wallet APIs, issuance portals, integration with ERP/CRM | $12,000 – $25,000 |

| Security & Audit Controls | Smart contract audits, encryption, anomaly detection, compliance monitoring | $8,000 – $15,000 |

| Testing & Quality Assurance | End-to-end validation, compliance checks, scalability and resilience testing | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, sandbox onboarding, governance frameworks, monitoring dashboards | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Integration Complexity: Middleware for ERP, treasury, and settlement systems.

- Liquidity Management: Initial liquidity pools or settlement reserves.

- Compliance Overhead: Ongoing audits, legal reviews, and global regulation updates.

- Infrastructure Costs: Cloud compute and database performance at scale.

- Change Management: Training teams and partners on new workflows.

- Monitoring & Maintenance: Regular security patches and compliance updates.

Best Practices to Avoid Budget Overruns

- Start with Focused Scope: Pilot one asset class before scaling across markets.

- Design for Compliance Early: Embed AML/KYC frameworks from day one.

- Use Modular Architecture: Reusable wallet, API, and settlement components accelerate growth.

- Optimize Infrastructure Spend: Balance blockchain layers with efficient cloud scaling.

- Embed Observability: Monitor flows, liquidity, and compliance in real time.

- Plan for Iteration: Update modules regularly as regulations evolve.

Request a tailored proposal from Intellivon’s enterprise blockchain team. You’ll receive a roadmap designed to fit your budget, enforce compliance, and scale with your long-term growth.

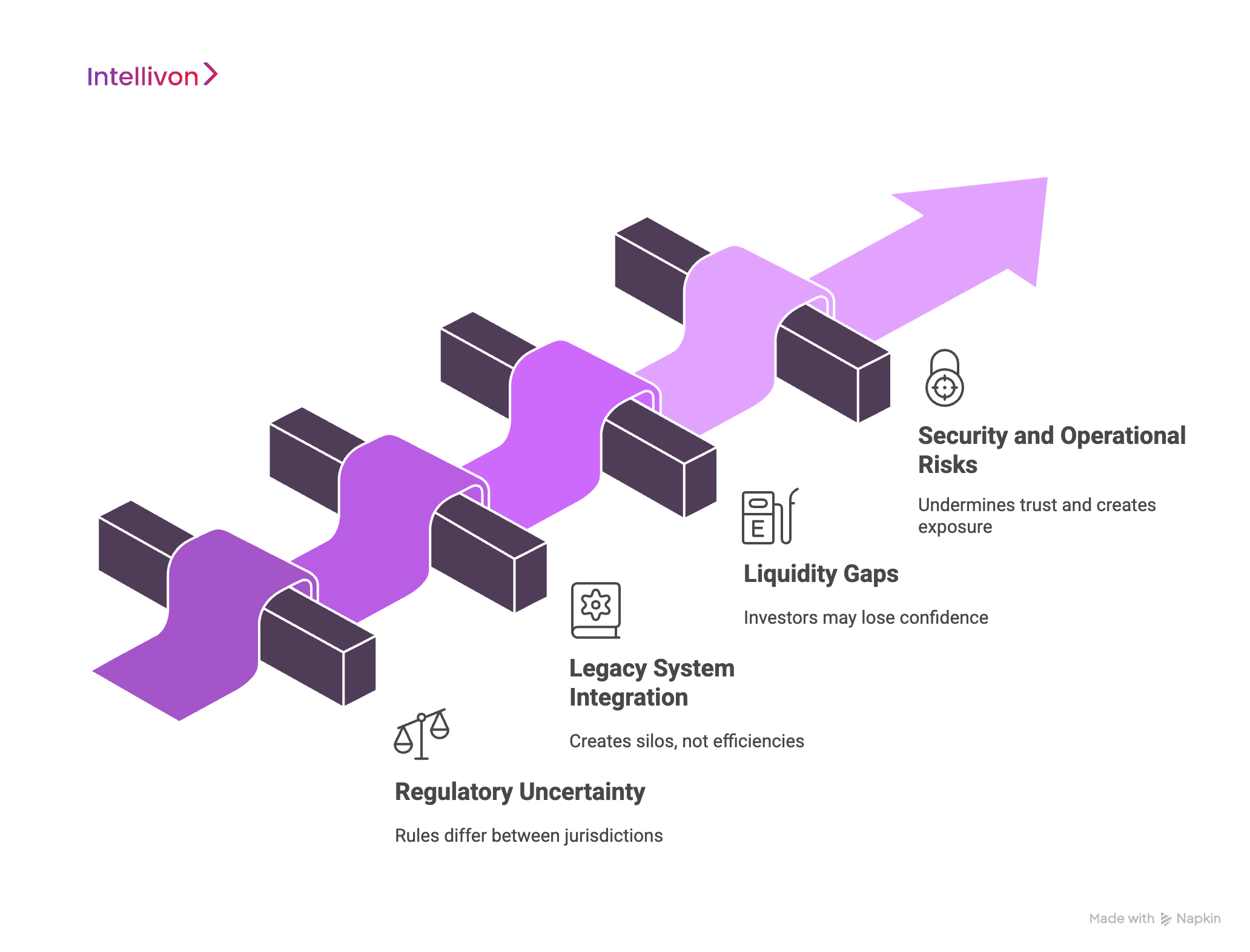

Overcoming Challenges To Creating Real-World Asset Tokenization Platforms

Tokenization platforms hold enormous promise, but adoption is rarely smooth. Enterprises often run into barriers that are less about technology and more about compliance, integration, and execution. Addressing these challenges early makes the difference between a successful platform and a stalled pilot.

1. Regulatory Uncertainty

Rules for tokenized assets differ widely between jurisdictions, and in some regions, regulations are still evolving. This creates hesitation around launches and limits access for certain investors.

The most effective way forward is to build compliance into the platform itself. Intellivon’s framework encodes regulatory requirements directly into smart contracts, keeping subscriptions, transfers, and redemptions aligned with the latest standards.

2. Legacy System Integration

Enterprises already depend on ERP, CRM, and fund accounting systems. If tokenization platforms cannot connect to these systems, they create silos instead of efficiencies. APIs and middleware are the bridge.

By integrating tokenization into the existing enterprise stack, Intellivon ensures reconciliations, reporting, and data flows remain seamless across departments.

3. Liquidity Gaps

Issuing a token is only the first step, while liquidity is what sustains adoption. Without it, investors may lose confidence, and enterprises cannot raise capital effectively.

Phased market rollouts, structured redemption programs, and venue connectivity are key to solving this. At this stage, Intellivon helps enterprises design liquidity strategies that make secondary trading both compliant and sustainable.

4. Security and Operational Risks

Even the strongest platforms can be undermined by fraud, mismanaged keys, or flawed smart contracts. These risks not only create financial exposure but also damage trust.

Enterprises need institutional-grade custody, independent audits, and contingency protocols. Intellivon deploys multi-party controls, security playbooks, and ongoing monitoring to protect against both technical failures and operational threats.

In short, tokenization comes with real challenges, but they are not insurmountable. With compliance-first design, seamless integration, sustainable liquidity, and enterprise-grade security, Intellivon builds platforms that scale with confidence.

Real-World Enterprise Examples using RWA Tokenization Platforms

The best way to understand tokenization’s potential is to examine enterprises already using these platforms. These cases show that adoption has moved beyond pilots and into production-level use.

1. Siemens

In 2023, Siemens issued a €300 million digital bond under Germany’s Electronic Securities Act. The bond was recorded on a blockchain, reducing settlement times from several days to just two. Tokenization lowered administrative costs, streamlined subscriptions, and proved that corporates outside finance can raise capital more efficiently through blockchain infrastructure.

2. Goldman Sachs and BNY Mellon

In 2025, two of the world’s largest financial institutions launched tokenized money market funds. Goldman Sachs used its DAP platform, while BNY Mellon applied its blockchain infrastructure. Investors benefited from faster settlement and transparent record-keeping. These offerings showed how tokenization platforms can modernize traditional funds while ensuring compliance and institutional trust.

3. J.P. Morgan

J.P. Morgan advanced tokenization with its Onyx Digital Assets platform. The bank issued tokenized money market funds and piloted repo transactions, cutting settlement from days to hours. These initiatives reduced counterparty risk and improved liquidity management. The platform demonstrated how tokenization can transform treasury operations at a global scale.

4. Inter-American Development Bank (IDB)

In January 2025, the IDB issued a sterling-denominated digital bond on HSBC’s Orion platform. The blockchain-based system integrated clearing and life-cycle management into one environment. This marked a milestone for supranational institutions. It proved that tokenization can streamline both sovereign and development financing effectively.

5. Elevated Returns – St. Regis Aspen Resort

Elevated Returns used tokenization to fractionalize ownership of the St. Regis Aspen Resort. Investors gained access to a property that was traditionally illiquid. Tokenized shares allowed broader participation in high-value real estate. The project showed how tokenization makes large assets more accessible and tradable.

6. HM Land Registry (UK)

The UK’s HM Land Registry piloted tokenization for property titles. Ownership records were placed on blockchain to improve transparency and reduce paperwork. This project highlighted how tokenization platforms can modernize institutional property systems. It demonstrated efficiency gains for both issuers and investors in real estate transactions.

Together, these cases prove that okenization is not theoretical. Enterprises are already using platforms for bonds, funds, real estate, and sovereign financing. Intellivon helps organizations adopt proven models while tailoring tokenization systems to their compliance needs, asset classes, and growth strategies.

Conclusion

Real-world asset tokenization is no longer a future concept. Enterprises are issuing digital bonds, tokenized funds, and fractional real estate on regulated platforms. The benefits include faster settlement, stronger compliance, broader investor access, and improved capital efficiency. For decision-makers, the real question is when to integrate tokenization into enterprise strategy.

Building these platforms requires careful planning. Legal wrappers, compliance frameworks, interoperability, and security must align in a sustainable way. In addition, hidden costs and operational complexity need early attention. Enterprises that follow best practices can move from pilot to production with confidence. As a result, tokenization becomes both a driver of growth and a lasting competitive advantage.

Build Your Real-World Asset Tokenization Platform with Intellivon

At Intellivon, we design compliant, production-grade RWA platforms that fit how large organizations actually operate. Our teams align legal wrappers, investor identity, smart contracts, and market infrastructure to deliver measurable outcomes: faster subscriptions, cleaner audits, and lower operational risk.

Why Partner With Us

- Compliance-first tokenization: We embed transfer restrictions, registrar controls, and disclosure workflows into contracts so compliance never lags behind issuance.

- Enterprise-grade architecture: Platforms balance private control for internal flows with regulated public access for capital markets.

- Liquidity with strategy: Rollouts begin with primary issuance, followed by carefully structured venue integrations and phased liquidity programs.

- Seamless enterprise fit: ERP, CRM, and treasury systems connect directly with wallets, KYC, and custody for one unified model.

Book a discovery call to scope your first issuance and design a 12-month scale plan tailored to your enterprise.

FAQs

Q1. What is a real-world asset tokenization platform?

A1. A tokenization platform turns physical or financial assets into digital tokens recorded on a blockchain. This allows assets like bonds, funds, or real estate to be issued, transferred, and managed securely. For enterprises, these platforms create efficiency by reducing intermediaries, enabling fractional ownership, and ensuring transparent audit trails for regulators and investors alike.

Q2. How much does it cost to build an RWA tokenization platform?

A2. The cost usually ranges between $50,000 and $150,000 for a production-grade enterprise build. Pricing depends on the number of features, asset classes supported, and integrations required with existing systems. Beyond initial development, enterprises should also plan for annual maintenance costs of 15–20% to cover audits, updates, and compliance changes.

Q3. Which assets can be tokenized?

A3. Enterprises are actively tokenizing government bonds, equities, real estate, commodities like gold, and even carbon credits. Each category requires a different legal wrapper and compliance model, so platforms must be flexible in design. The ability to handle multiple asset types under one system is what makes tokenization platforms a powerful enterprise tool.

Q4. How do enterprises ensure compliance in tokenization?

A4. Compliance is enforced directly through smart contracts and identity frameworks. Rules for transfers, disclosures, and investor eligibility are coded into the platform, leaving little room for error. In addition, enterprises rely on continuous monitoring, regulatory reporting dashboards, and independent audits to ensure alignment with global standards like GDPR, FATF, and AML/KYC requirements.

Q5. How long does it take to build and deploy?

A5. Timelines vary based on complexity, but most enterprise deployments take four to six months. Discovery and compliance mapping usually consume the first phase, while technical build and testing follow. Enterprises in regulated sectors often extend the process slightly to accommodate legal approvals and audit requirements before full production launch.