Credit risk is now a strategic enterprise risk, not a mere operational challenge. Traditional methods depend on outdated scoring models and siloed data, leaving institutions exposed to defaults, regulatory penalties, and stalled growth. As lending accelerates across retail banking, fintech, and corporate portfolios, the inability to evaluate risk in real time has become a barrier to profitability. The market is shifting fast, with global adoption of AI-powered credit risk platforms now seen as the way forward. These platforms process diverse datasets, generate explainable risk scores, and enable institutions to scale lending without compromising compliance.

At Intellivon, we help enterprises build AI-powered credit risk analytics platforms that are secure, compliant, and future-ready. Each platform is designed to integrate seamlessly with existing systems, reduce portfolio risk, and open access to new lending opportunities. In this blog, we’ll explore what these platforms are, why they matter, and how we build them from the ground up as long-term strategic assets.

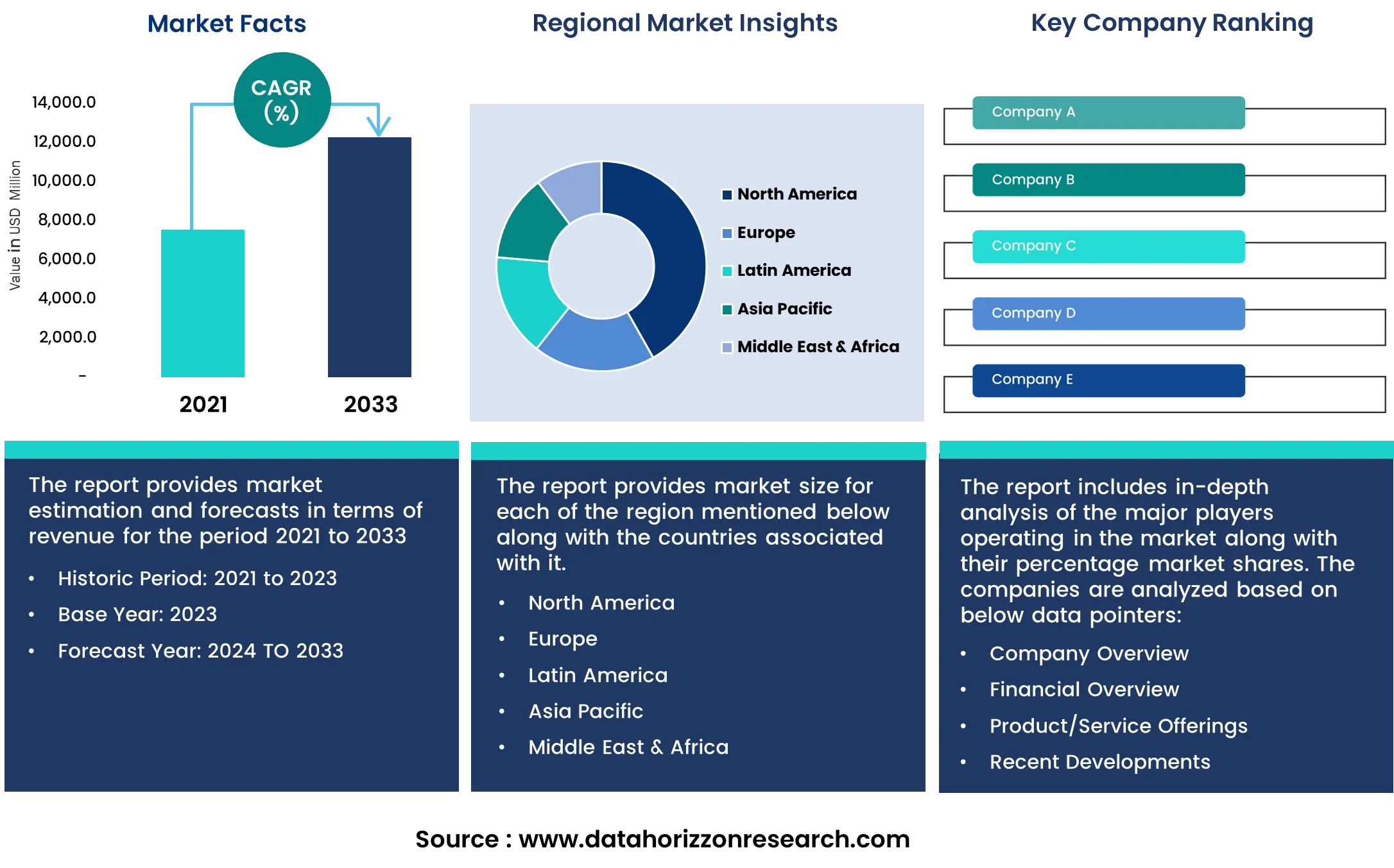

Market Insights of Credit Risk Platforms

This growth is fueled by technology integrations such as AI, ESG factors, and alternative data. Key drivers include rising demand for regulatory compliance, improved risk data aggregation, greater accuracy in default prediction, and automation of credit processes.

- Enterprises using advanced platforms reduced default rates by up to 35% and improved borrower onboarding speed by 60% with automated scoring and workflows.

- In North America, 78% of banks use dedicated AI-powered credit risk tools, and Asian adoption is growing at a 16% CAGR.

- Real-time credit analytics platforms cut review times from days to minutes, accelerating loan approvals and enhancing customer experience.

- Institutions that modernized risk systems saw 25–30% drops in NPAs and 15% loan book growth within two years.

- Predictive AI and automation save up to 40% in compliance and reporting costs compared to legacy systems.

- Regulatory compliance is streamlined, with 3x fewer manual interventions required during audits.

- The next wave of platforms incorporates alternative data, machine learning, and ESG scoring, now demanded by over 60% of tier-1 lenders.

This data highlights a rapidly expanding opportunity where AI-powered credit risk platforms are strategic necessities. Enterprises that invest early not only reduce exposure to defaults but also gain competitive speed, stronger compliance, and measurable growth.

What Is an AI-Powered Credit Risk Analytics Platform?

An AI-powered credit risk analytics platform is an enterprise-grade system designed to evaluate borrower risk in real time, across millions of data points. Unlike traditional scoring tools that rely heavily on outdated credit bureau data, these platforms combine financial history, behavioral patterns, market signals, and alternative data to generate predictive and explainable risk insights.

A true enterprise-grade platform integrates seamlessly with loan origination systems, CRMs, ERPs, insurance underwriting engines, and payment networks. It serves as a central ecosystem where institutions can manage credit decisions, monitor compliance, detect fraud, and run portfolio stress tests, all from a single, secure environment.

For modern financial institutions, this shift is more than technical. It transforms credit risk from a backward-looking calculation into a forward-looking strategy, enabling faster lending decisions, reduced defaults, and compliance-ready reporting.

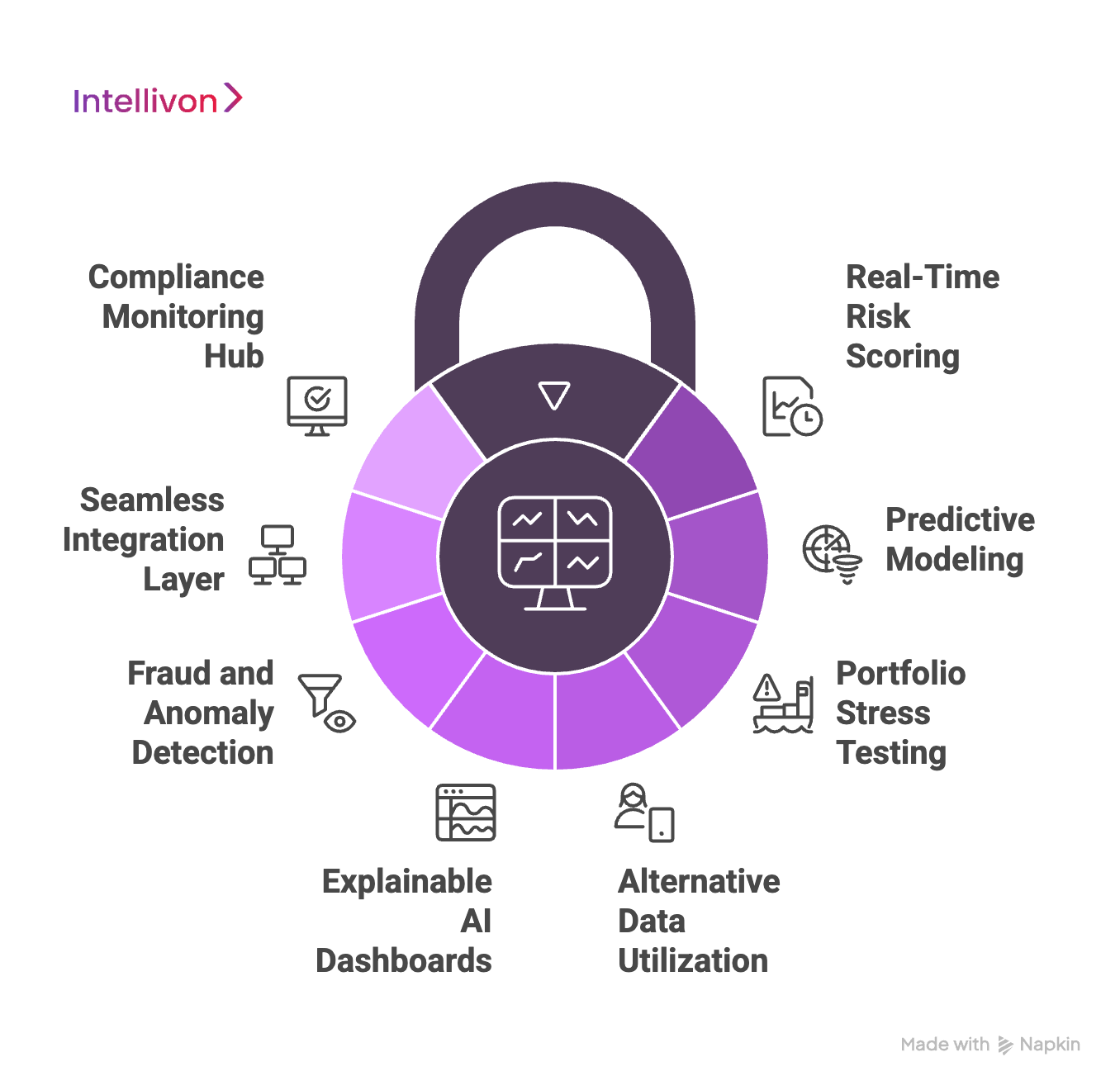

Key Features of an AI-Powered Credit Risk Analysis Platform

An AI-powered credit risk analytics platform is a strategic system that reshapes how enterprises approach lending. Merging predictive intelligence, alternative data, and compliance-ready reporting into a single framework enables institutions to reduce risk exposure while scaling faster. Below are the features that set these platforms apart.

1. Real-Time Risk Scoring

Traditional credit assessment workflows often take days, creating bottlenecks for both lenders and borrowers. A modern platform evaluates borrower risk instantly by analyzing financial history, spending behavior, and contextual data in real time.

This immediate decision-making capability not only accelerates loan approvals but also enhances customer satisfaction. For enterprises, it means faster growth without increasing exposure to defaults.

2. Predictive Modeling

Legacy systems focus on past performance, but predictive modeling looks ahead. By training machine learning models on diverse datasets, platforms can forecast which borrowers are likely to default months in advance.

This gives risk teams the ability to intervene early, restructure terms, or adjust exposure. In practice, it transforms credit risk management from reactive firefighting into a proactive strategy.

3. Portfolio Stress Testing

Economic conditions are rarely stable. Platforms include stress testing modules that simulate downturns, regulatory shifts, or liquidity crunches to see how portfolios will respond.

By modeling scenarios such as interest rate hikes or market crashes, risk managers gain a clear view of vulnerabilities before they materialize. This capability helps enterprises prepare contingency plans and maintain resilience.

4. Alternative Data Utilization

Millions of potential borrowers remain invisible to traditional bureau-based scoring. AI-powered platforms solve this by incorporating alternative data such as telecom records, utility bills, rental histories, and even digital transaction patterns.

This approach not only broadens financial inclusion but also improves risk assessment accuracy for thin-file customers. For lenders, it means expanding into new markets with confidence.

5. Explainable AI Dashboards

Regulators increasingly demand transparency in AI-driven decisions. Explainable AI dashboards show exactly why a borrower was approved or denied, breaking down the factors that influenced the score.

This ensures auditability and builds trust with compliance teams, regulators, and customers. Instead of being a black box, the system becomes a transparent partner in risk management.

6. Fraud and Anomaly Detection

Fraudulent applications and synthetic identities are sophisticated enough to bypass static rules. Platforms use anomaly detection, graph analytics, and behavioral monitoring to identify suspicious activity before it enters loan books.

By reducing fraud at the source, enterprises protect both their portfolios and customer trust. This proactive defense is critical as fraud losses climb globally each year.

7. Seamless Integration Layer

Enterprises can’t afford fragmented systems. With an API-first design, the platform integrates smoothly with core banking software, insurance underwriting systems, ERPs, and payment networks.

This unified environment eliminates silos, enabling consistent risk evaluation across products and geographies. It ensures that every part of the institution operates on the same risk intelligence foundation.

8. Compliance Monitoring Hub

Keeping up with evolving regulations, like Basel III, IFRS 9, GDPR, AML/KYC, is a constant challenge. The compliance hub automates reporting, continuously monitors adherence, and alerts teams when thresholds are at risk.

This reduces manual intervention and lowers the cost of compliance. For global enterprises, it means staying regulator-ready across multiple jurisdictions without duplicating effort.

These features work together to make credit risk analytics platforms a strategic enabler for enterprises. They combine speed, foresight, and accountability, turning credit risk from a necessary function into a driver of sustainable growth and resilience.

Layered Architecture of an AI-Powered Credit Risk Analytics Tool

An enterprise-grade credit risk analytics platform cannot be built on a single algorithm or dashboard. It requires a multi-layered architecture that ensures scalability, compliance, and accuracy across every stage of the credit lifecycle.

Each layer performs a distinct role, working together to deliver real-time insights, predictive risk models, and compliance-ready outputs.

1. Data Ingestion Layer

At the foundation lies the data ingestion layer, responsible for pulling information from diverse sources. This includes structured data such as financial transactions and credit bureau reports, semi-structured feeds from ERP and CRM systems, and unstructured inputs like contracts, loan applications, and emails.

The goal is to unify siloed information into a single ecosystem where every data point can be processed for risk scoring.

2. Data Processing and Cleansing Layer

Raw data is often inconsistent, duplicated, or incomplete. This layer applies AI-powered ETL pipelines to standardize formats, remove errors, and enrich datasets with missing attributes.

By cleansing the data at scale, the platform ensures that downstream models work with high-quality, trustworthy inputs, avoiding the “garbage in, garbage out” problem that plagues legacy systems.

3. AI and Machine Learning Model Layer

Once data is structured, the intelligence layer applies machine learning models to extract insights. These models handle credit scoring, fraud detection, and predictive forecasting across portfolios.

Advanced techniques such as anomaly detection, graph AI, and reinforcement learning enable institutions to not only assess borrowers but also detect emerging risks in real time. Bias detection and fairness controls are embedded to ensure responsible AI.

4. Explainability and Compliance Layer

For enterprises operating under strict regulations, black-box outputs are unacceptable. This layer translates model results into explainable insights through dashboards that highlight key drivers behind each decision.

Whether it’s Basel III, IFRS 9, GDPR, or local lending laws, the platform’s compliance module ensures that every risk decision is transparent, audit-ready, and regulator-approved.

5. API Decisioning Layer

Risk insights are most valuable when embedded directly into operational systems. The API decisioning layer integrates with loan origination platforms, payment processors, insurance underwriting systems, and core banking software.

This real-time connectivity enables instant approvals, automated workflows, and consistent decision-making across departments and geographies.

6. Visualization and Reporting Layer

The final layer presents risk intelligence in a format accessible to decision-makers. Interactive dashboards allow CROs, CFOs, and compliance officers to monitor portfolio performance, run stress test scenarios, and generate regulatory reports.

This top layer converts complex analytics into actionable insights, empowering leadership teams to make informed decisions quickly.

This layered architecture is the framework Intellivon applies when building credit risk analytics platforms for global enterprises. Each layer is designed to ensure scalability, regulatory compliance, and predictive power, enabling institutions to transform credit risk management into a competitive advantage.

AI-powered credit risk analytics platforms are not one-size-fits-all solutions. Their strength lies in adapting to different industries, each with unique risk factors, compliance obligations, and lending models. From banks to fintechs to microfinance institutions, these platforms enable enterprises to reduce defaults, speed up approvals, and remain regulator-ready while expanding lending responsibly.

Enterprise Use Cases of AI-Powered Credit Risk Analytics

AI-powered credit risk analytics platforms are not one-size-fits-all solutions. Their strength lies in adapting to different industries, each with unique risk factors, compliance obligations, and lending models. From banks to fintechs to microfinance institutions, these platforms enable enterprises to reduce defaults, speed up approvals, and remain regulator-ready while responsibly expanding lending.

1. Retail Banking

Retail banks face increasing demand for instant credit decisions while managing stricter compliance and rising default risks. AI-powered platforms enable them to balance speed with resilience.

Use Case 1: Instant Loan Approvals

Instead of days-long approvals, AI-driven platforms evaluate risk instantly across bureau, transaction, and behavioral data. Borrowers receive credit faster, and banks win customer loyalty while minimizing exposure.

Use Case 2: Credit Card Risk Scoring

Traditional credit card models use static thresholds. AI models dynamically assess spending behavior, repayment history, and external signals to set accurate credit limits and reduce delinquency rates.

Use Case 3: BNPL and Micro-Credit Expansion

Banks can safely extend buy-now-pay-later or micro-credit products by analyzing borrower behavior beyond bureau scores. This widens financial access while maintaining portfolio stability.

Example: JPMorgan Chase

JPMorgan deployed AI-powered retail credit analytics to reduce loan losses while approving credit faster. The platform improved decision-making speed without compromising regulatory oversight, allowing growth and compliance to move hand in hand.

2. Corporate and SME Lending

Lending to corporates and SMEs involves higher ticket sizes, greater complexity, and wider exposure. AI platforms bring foresight and precision to these high-stakes portfolios.

Use Case 1: Portfolio Stress Testing

AI models simulate multiple economic conditions—such as market downturns or liquidity crunches—helping banks forecast potential losses and strengthen capital planning.

Use Case 2: SME Loan Approvals

AI evaluates GST filings, POS transactions, and cash flow statements to create accurate risk profiles for SMEs, which are often underserved by traditional scoring.

Use Case 3: Dynamic Credit Monitoring

Continuous AI-driven monitoring highlights when an SME’s repayment ability changes, allowing proactive restructuring rather than costly defaults.

Example: Standard Chartered Bank

Standard Chartered implemented AI models to improve SME loan approvals by 35% while keeping defaults stable. This strengthened both profitability and financial inclusion goals.

3. Insurance

Insurance companies depend on accurate risk assessment and fraud prevention. AI-powered platforms bring transparency and speed to underwriting and claims.

Use Case 1: Underwriting Risk Analytics

By combining health, lifestyle, and financial data, AI provides granular risk scores for applicants, leading to fairer premiums and reduced exposure.

Use Case 2: Claims Fraud Detection

Anomaly detection uncovers fraudulent patterns, like duplicate claims, inflated reports, or staged events—before payouts are made, saving millions in losses.

Use Case 3: ESG-Linked Risk Scoring

As ESG compliance grows, insurers integrate environmental and social data into underwriting, ensuring risk models align with sustainability mandates.

Example: Allianz

Allianz leverages AI-based risk analytics to refine underwriting and cut fraudulent claims, saving millions annually in operational costs while meeting ESG-linked compliance expectations.

4. Fintechs and Digital Lenders

Fintechs thrive on speed, often approving customers in minutes. AI platforms let them expand lending responsibly while managing compliance at scale.

Use Case 1: Alternative Data Scoring

AI uses telco records, e-commerce data, and utility payments to score customers with thin or no bureau history, opening up new markets.

Use Case 2: Embedded Lending

At checkout, platforms provide instant risk scoring for BNPL or ecosystem loans, allowing frictionless lending inside digital commerce flows.

Use Case 3: Automated Compliance Checks

AI-driven KYC and AML checks streamline onboarding, helping fintechs scale without falling foul of regulators.

Example: Zest AI

Zest AI empowered credit unions to approve 25% more borrowers while ensuring fairer outcomes and reducing bias in credit decisioning, proving AI’s role in inclusive growth.

5. Microfinance and Financial Inclusion

Microfinance institutions and rural banks often work with borrowers outside traditional credit systems. AI platforms unlock scalable, responsible inclusion.

Use Case 1: Mobile Data Credit Scoring

Borrowers’ mobile money transactions and telco usage patterns are used to estimate repayment capacity, providing visibility where bureaus have none.

Use Case 2: Utility and Rent Data

AI incorporates bill payment histories and rental data to measure financial discipline, creating a credible profile for unbanked borrowers.

Use Case 3: Scalable Lending in Emerging Markets

Platforms enable MFIs to safely expand portfolios across rural regions while keeping defaults in check.

Example: Tala

Tala uses AI-powered scoring from mobile and utility data to provide microloans in Kenya and India. This has driven high repayment rates while promoting financial inclusion in underserved markets.

These industry-specific use cases demonstrate how credit risk analytics platforms are reshaping financial services. From retail banks approving loans in seconds to microfinance institutions scaling into rural regions, AI transforms credit risk into a driver of growth, compliance, and customer trust. Enterprises adopting these platforms now are building stronger, more resilient lending ecosystems for the future.

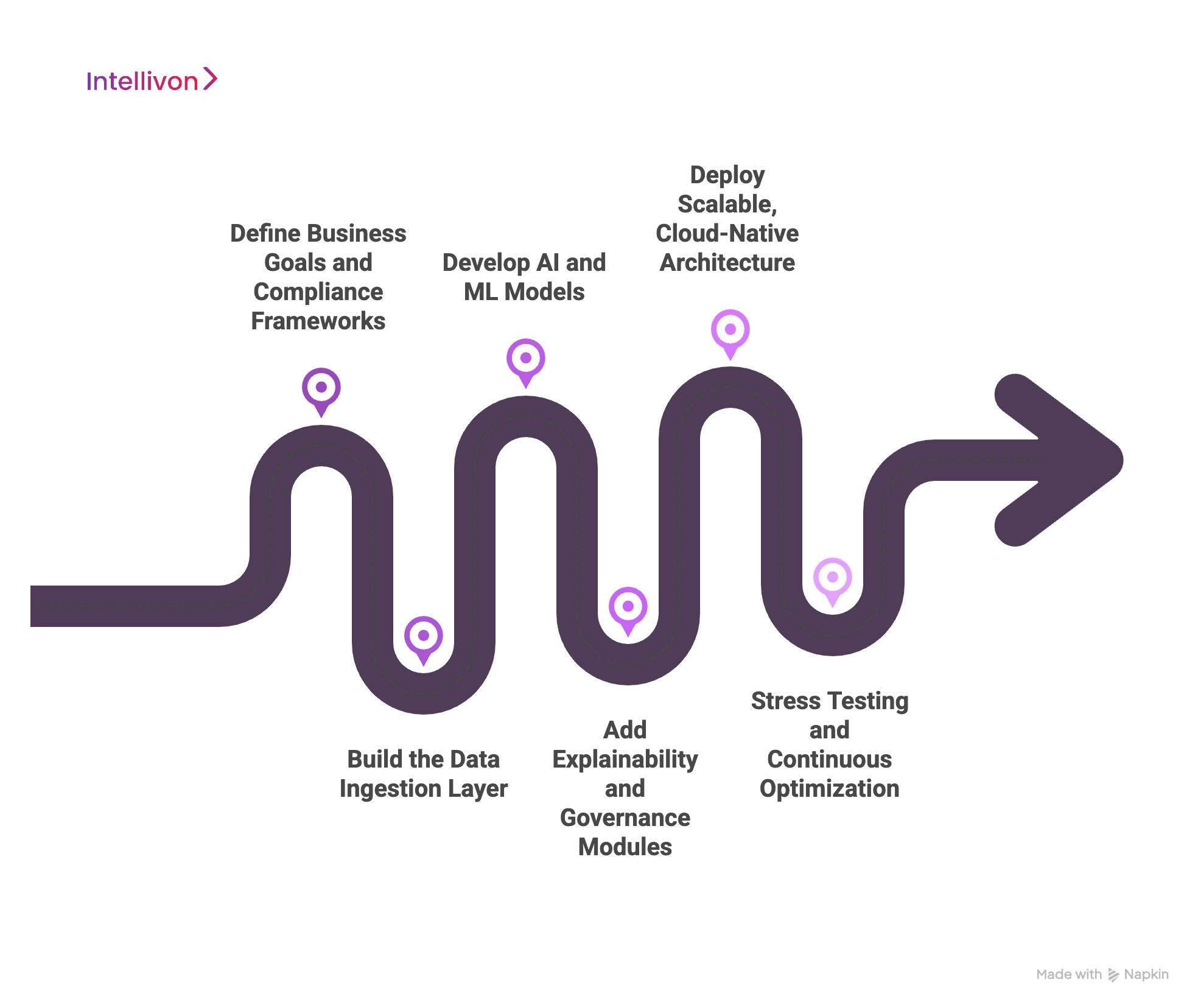

How We Build Enterprise-Grade Credit Risk Analytics Platforms

Building a credit risk analytics platform for an enterprise is about designing a system that aligns with business goals, integrates seamlessly with legacy systems, and meets global compliance standards. At Intellivon, we follow a structured, proven framework that ensures every platform we deliver is scalable, secure, and tailored to enterprise needs.

Step 1: Define Business Goals and Compliance Frameworks

Every engagement begins with a deep dive into an organization’s objectives, risk appetite, and regulatory environment. By mapping against Basel III, IFRS 9, AML/KYC, and GDPR from the outset, we ensure the platform is future-ready and regulator-approved, avoiding costly retrofits later.

Step 2: Build the Data Ingestion Layer

We set up robust pipelines to collect structured (transactions, credit bureau data), semi-structured (CRM, ERP), and unstructured data (contracts, applications, communications). By unifying silos into a central data ecosystem, enterprises get a complete view of borrower and portfolio risk.

Step 3: Develop AI and ML Models

Our machine learning models are trained to handle credit scoring, predictive default detection, fraud analytics, and portfolio forecasting. To ensure fairness and compliance, we embed bias-detection modules and explainability frameworks at this stage.

Step 4: Add Explainability and Governance Modules

Enterprises cannot afford black-box models. We build dashboards that show exactly why decisions were made, enabling compliance teams to track risk, satisfy regulators, and maintain transparency with stakeholders.

Step 5: Deploy Scalable, Cloud-Native Architecture

The platform is built API-first and microservices-driven, making it flexible enough to plug into core banking, ERP, underwriting, and payments systems. This ensures smooth deployment and scalability across geographies and business units.

Step 6: Stress Testing and Continuous Optimization

We don’t just deliver and walk away. Platforms are validated under economic stress scenarios and fine-tuned with real-world repayment data. Continuous optimization ensures risk models improve accuracy and adapt to evolving borrower behavior

By combining robust data pipelines, advanced AI models, and compliance-first design, we ensure institutions reduce defaults, accelerate lending, and scale confidently in complex financial environments.

Cost to Build an AI-Powered Credit Risk Analytics Platform

At Intellivon, the goal is to help enterprises build credit risk analytics platforms that are both scalable and future-ready. That’s why our pricing framework is flexible, aligned with business growth targets, compliance obligations, and risk appetite, rather than forcing a rigid one-size-fits-all package.

When initial projections exceed the available budget, the scope is refined collaboratively. The focus always remains on what matters most: enterprise-grade reliability, uncompromising security, and regulatory assurance that can withstand global audits.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, risk modeling, KPI definition, regulatory alignment (Basel III, IFRS 9, GDPR, AML/KYC) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting layered architecture (data ingestion, ML pipelines, explainability modules, compliance dashboard) | $8,000 – $15,000 |

| Core AI/ML Model Development | Training supervised, unsupervised, and reinforcement models for credit scoring, portfolio risk, and fraud detection | $12,000 – $25,000 |

| Data Integration & Feature Engineering | Ingesting transactions, bureau data, ERP/CRM records, alternative data (utility, telco, digital) | $10,000 – $20,000 |

| Real-Time Decisioning Layer | Low-latency scoring engine with API-first, microservices-based architecture | $10,000 – $22,000 |

| Platform Development & Customization | Enterprise dashboards, CRO/analyst portals, compliance consoles, and integration with banking/insurance cores | $12,000 – $25,000 |

| Security & Compliance Alignment | Encryption, access control, explainable AI modules, audit-ready reporting, AML/KYC integration | $8,000 – $15,000 |

| Testing & Quality Assurance | End-to-end validation, stress testing, bias checks, scalability optimization | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, regulatory sandbox onboarding, elastic scaling, and real-time monitoring | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Integration Complexity: Connecting to legacy banking cores, ERPs, and loan origination systems often requires additional middleware.

- Compliance Overhead: Continuous updates for Basel III, IFRS 9, GDPR, and AML regulations demand legal and audit support.

- Data Labeling & Governance: Clean, unbiased credit datasets require ongoing curation and governance.

- Cloud & Infrastructure Spend: Running AI pipelines and real-time scoring engines consumes compute if not optimized.

- Change Management: Training credit officers, analysts, and compliance teams on new workflows adds operational effort.

- Maintenance & Monitoring: Regular audits, model retraining, and continuous optimization prevent model drift and compliance gaps.

Best Practices to Avoid Budget Overruns

Drawing from Intellivon’s experience building enterprise-grade risk platforms, several practices consistently keep costs predictable:

- Start with Focused Scope: Launch with one portfolio or product line, validate ROI, then scale.

- Design for Compliance Early: Embed Basel III, IFRS 9, GDPR, and AML frameworks from day one to avoid expensive retrofits.

- Adopt Modular Model Design: Use reusable scoring and fraud models that scale across new geographies and verticals.

- Optimize Infrastructure Spend: Deploy cloud-native scaling, batch scoring for low-priority checks, and elastic compute to lower costs.

- Embed Observability from Launch: Monitor default rates, scoring accuracy, and compliance metrics in real time.

- Plan for Continuous Improvement: Update ML models, compliance modules, and dashboards as market conditions and regulations evolve.

Request a tailored proposal from Intellivon’s enterprise AI team, and you’ll receive a roadmap aligned with your budget, risk appetite, and growth strategy, thereby delivering a platform that is scalable, compliant, and resilient.

Overcoming Challenges While Deploying AI-Powered Credit Risk Analytics Tools

Building a credit risk analytics platform for an enterprise is a complex journey. It requires handling fragmented data, legacy systems, and strict compliance demands. Many organizations struggle with these challenges, which can derail projects if not addressed strategically. At Intellivon, we approach each challenge with a solution-first mindset, ensuring the platform is both practical and future-ready.

1. Data Quality and Siloed Information

Financial data often sits across multiple systems, like core banking, ERP, CRM, or third-party feeds. Inconsistent formats, duplicate entries, and missing fields compromise model accuracy.

Intellivon builds intelligent data ingestion and cleansing pipelines that unify silos, validate data quality, and enrich records with missing attributes. This ensures models work on reliable, enterprise-grade inputs.

2. Bias and Fairness in Models

Without safeguards, AI models may unintentionally reinforce bias, leading to unfair scoring and regulatory risks. Enterprises cannot afford discrimination in lending.

We embed fairness controls and bias-detection modules in our models. Explainable AI frameworks provide full visibility into how decisions are made, ensuring ethical outcomes that satisfy regulators.

3. Legacy System Integration

Many enterprises rely on legacy core banking or underwriting systems that were not built for AI integration. Forcing compatibility often leads to costly delays.

We use API-first, microservices-based middleware to bridge old and new systems. This allows seamless integration without disrupting existing operations, making modernization smoother and less risky.

4. Regulatory Complexity

Global institutions must navigate Basel III, IFRS 9, GDPR, AML/KYC, and regional compliance rules simultaneously. Legacy approaches often miss red flags and fail audits.

Intellivon builds compliance-first design into the platform itself. Automated monitoring, audit-ready dashboards, and regulator-friendly reporting reduce manual interventions and keep enterprises aligned with evolving frameworks.

5. Balancing Performance and Explainability

Deep learning models may deliver high accuracy but lack transparency, while interpretable models can fall short on precision. Enterprises need both.

We combine advanced ML with interpretable algorithms, striking the right balance between accuracy and transparency. This hybrid approach ensures compliance teams, regulators, and risk officers can trust the system’s outcomes.

These challenges stop many organizations from scaling credit risk systems successfully. Intellivon’s architecture and delivery model directly address them, ensuring enterprises receive platforms that are accurate, compliant, and seamlessly integrated. By tackling these issues head-on, we turn obstacles into enablers, helping institutions strengthen resilience and accelerate growth.

Conclusion

Credit risk has become a defining factor in enterprise resilience and growth. Institutions that continue to rely on static scoring systems expose themselves to rising defaults, slower approvals, and regulatory penalties. By contrast, AI-powered credit risk analytics platforms transform risk management into a proactive, data-driven discipline that drives confidence in every decision.

The organizations adopting these platforms are not simply reducing non-performing assets; they are gaining speed, accuracy, and scalability in highly competitive markets. With real-time insights, predictive foresight, and built-in compliance, credit risk evolves from a back-office function into a strategic advantage. Enterprises that modernize now will position themselves as leaders, while those that delay risk being left behind in a rapidly digitizing financial ecosystem.

Build Your Enterprise-Grade Credit Risk Analytics Platform with Intellivon

At Intellivon, we design AI-powered credit risk analytics platforms that are secure, compliant, and scalable, tailored to the way global financial institutions operate. Our solutions combine predictive modeling, explainable AI, and compliance-first architecture to help enterprises reduce defaults, accelerate credit decisions, and expand access to new markets without disruption.

Why Partner With Intellivon?

- Tailored Enterprise Platforms: Every platform is custom-built to match your business model, risk appetite, and compliance frameworks, ensuring relevance and measurable ROI.

- Proven Global Expertise: With 11+ years of experience, 500+ AI solutions delivered, and 200+ domain experts, we bring a track record of success across banking, fintech, and insurance.

- Compliance-First Design: Our platforms are aligned with Basel III, IFRS 9, GDPR, SOC 2, and AML/KYC from day one, making regulatory approval and audits seamless.

- Future-Ready Architecture: Built cloud-native and API-first, our platforms integrate with existing banking cores, ERPs, underwriting, and payment systems, ensuring longevity and scalability.

- Security and Reliability: Multi-layered security frameworks, independent audits, and fraud-detection modules protect sensitive data and maintain trust with regulators and customers.

- Continuous Optimization and Support: Post-deployment, we ensure continuous model retraining, compliance updates, and performance monitoring, helping enterprises adapt as markets and regulations evolve.

Book a free strategy call today to explore how Intellivon can help you transform credit risk into a competitive advantage.

FAQs

Q1. What is an AI-powered credit risk analytics platform?

A1. An AI-powered credit risk analytics platform is an enterprise-grade system that evaluates borrower risk in real time using machine learning, predictive modeling, and alternative data. Unlike legacy scoring tools that rely only on credit bureau history, these platforms provide explainable, compliance-ready insights that help institutions reduce defaults, accelerate loan approvals, and strengthen regulatory alignment.

Q2. How do AI-powered credit risk platforms reduce defaults?

A2. These platforms detect early warning signs of potential default by analyzing thousands of behavioral and financial variables. Predictive models flag risks before they become visible in traditional reports, enabling lenders to restructure terms, rebalance exposure, or take corrective actions. As a result, enterprises can reduce non-performing assets (NPAs) by 25–35% while keeping lending portfolios healthy.

Q3. Which industries benefit most from AI-powered credit risk analytics?

A3. Banks, insurers, fintechs, and microfinance institutions all benefit from these platforms. In retail banking, they enable instant personal loan approvals. In insurance, they strengthen underwriting and claims fraud detection. Fintechs use them for thin-file scoring and BNPL decisions, while microfinance firms leverage mobile and utility data to safely serve underserved borrowers.

Q4. What is the cost to build an AI-powered credit risk analytics platform?

A4. The cost to build such a platform typically ranges from $50,000 to $150,000, depending on scope, integrations, and compliance requirements. Enterprises must also plan for hidden costs such as data governance, regulatory audits, and infrastructure optimization. Ongoing maintenance and model retraining usually add 15–20% of the initial build cost annually.

Q5. How do AI-powered credit risk platforms ensure compliance?

A5. These platforms include built-in compliance modules aligned with Basel III, IFRS 9, GDPR, and AML/KYC. Explainable AI dashboards make decisions transparent for regulators and auditors, while automated monitoring reduces manual intervention during audits. By embedding compliance from day one, enterprises avoid costly retrofits and maintain regulatory readiness at all times.