Enterprise healthcare is under mounting pressure from every direction. Access remains uneven, follow-ups are inconsistent, chronic care is still largely reactive, and clinical teams are overwhelmed by documentation and coordination work. While point teleconsult tools have expanded reach, they address only a narrow slice of a much larger operational and clinical challenge. The deeper issue lies in disconnected care delivery across digital and physical channels, where patients move between systems without continuity and leaders lack real-time visibility into performance and outcomes.

What large health systems now require is a unified telehealth and virtual care platform that embeds real-time virtual visits into a continuous digital care ecosystem. When architected correctly, this platform strengthens patient engagement, improves longitudinal care coordination, and equips clinicians and administrators with actionable, data-driven insight across the full care lifecycle rather than isolated encounters.

At Intellivon, we build enterprise-grade telehealth and virtual care platforms engineered for scale, regulatory rigor, and long-term operational resilience. Our teams design AI-driven virtual care ecosystems where telehealth becomes a seamless part of everyday clinical operations. In this blog, we will show how these platforms are built from the ground up, from strategic design through enterprise deployment at scale.

Key Market Takeaways of Telehealth and Virtual Care Platforms

Telehealth and virtual care have moved beyond pandemic-era stopgaps. They now function as permanent care delivery channels across large hospital systems, payer networks, and integrated care groups.

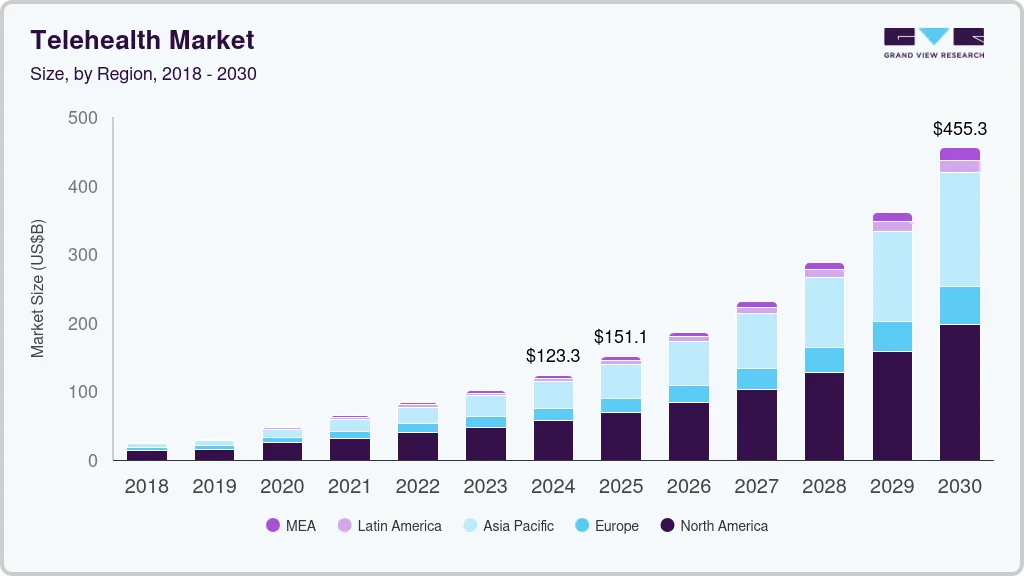

According to Grand View Research, the global telehealth market was valued at approximately USD 123 billion in 2024 and is expected to cross USD 455 billion by 2030, expanding at an annual growth rate of nearly 25% over the forecast period. More importantly, utilization has stabilized at scale rather than declining, which confirms that virtual care is now operationally embedded in mainstream healthcare delivery.

Key Market Insights:

- Global telehealth market size is estimated at USD 120–130 billion in 2024, projected to reach USD 400–455+ billion by 2030, depending on scope definitions and segments included.

- CAGR ranges from 11.5% to nearly 25%, driven by broadband expansion, smartphone adoption, and digital care reimbursement frameworks.

- Virtual care platforms alone represent a smaller but faster-growing segment, valued around USD 13–15 billion in 2024 and expected to exceed USD 110–247 billion by the early 2030s, with 25–30% annual growth.

- Post-pandemic utilization remains high, with large networks reporting over one million virtual visits annually across nationwide footprints.

- Patient loyalty is strong, with close to 9 in 10 patients expressing a preference to continue virtual care for future interactions.

- Provider adoption is now enterprise-wide, with centralized virtual care hubs, RPM programs, and AI-driven population health becoming standard operating models.

- North America leads in revenue share, supported by reimbursement structures and value-based care programs.

- Value-based care programs are accelerating adoption, as telehealth combined with AI and RPM is now used to manage risk, prevent readmissions, and control long-term costs.

- AI-enhanced virtual care is shifting platforms from reactive visits to predictive, continuous care models through early anomaly detection and automated interventions.

- Virtual care is becoming the digital front door for many health systems, replacing fragmented access channels with unified patient engagement layers.

From a business standpoint, these market signals explain why large healthcare enterprises are entering this space aggressively. Unified telehealth and virtual care platforms are now treated as long-term infrastructure investments that directly influence utilization control, workforce efficiency, and revenue protection.

Well-executed enterprise virtual care programs are already delivering 15–30% reductions in avoidable admissions, 20–40% improvements in patient engagement, and measurable operating margin expansion within the first 18–24 months, making the ROI case increasingly difficult to ignore.

What Is a Telehealth and Virtual Care Platform?

A telehealth and virtual care platform is a unified digital care system that combines real-time virtual visits with continuous remote care, powered by AI, clinical workflows, and secure enterprise integrations.

At an enterprise level, this platform becomes part of the core care delivery infrastructure. It links patients, clinicians, care coordinators, and data systems through a single operational fabric. Clinical data flows in from devices, EHR systems, and patient apps. AI analyzes this data to detect risk early and trigger timely interventions. The result is a shift from episodic treatment to ongoing, outcome-focused care that operates at scale across multiple service lines.

Telehealth vs Virtual Care: How They Work Together in Enterprise Care Models

In enterprise care delivery, telehealth enables real-time clinical access, while virtual care orchestrates continuous, data-driven care across the full patient lifecycle.

When unified correctly, the two form a continuous digital care loop rather than disconnected services.

1. Telehealth as the Real-Time Care Access Layer

Telehealth enables synchronous clinical encounters through video, audio, and secure chat. It replaces physical visits when immediacy matters. Scheduling, digital prescriptions, clinical documentation, and short-term follow-ups sit here. Its primary value is access, speed, and provider reach.

2. Virtual Care as the Continuous Care Orchestration Layer

Virtual care operates between and around visits. It includes remote patient monitoring, automated check-ins, chronic care programs, and AI-driven risk tracking. This layer focuses on continuity, adherence, and long-term outcomes rather than one-time consultations.

3. How They Interlock Inside Enterprise Systems

Telehealth captures the clinical moment while virtual care sustains the patient journey. Data from telehealth visits feeds virtual care workflows. In turn, virtual care insights drive who needs the next telehealth interaction and when.

Enterprises do not choose between telehealth and virtual care. They engineer them together. When unified, they transform episodic encounters into continuous, intelligence-driven care delivery.

Core Use Cases of Telehealth and Virtual Care Platforms for Enterprises

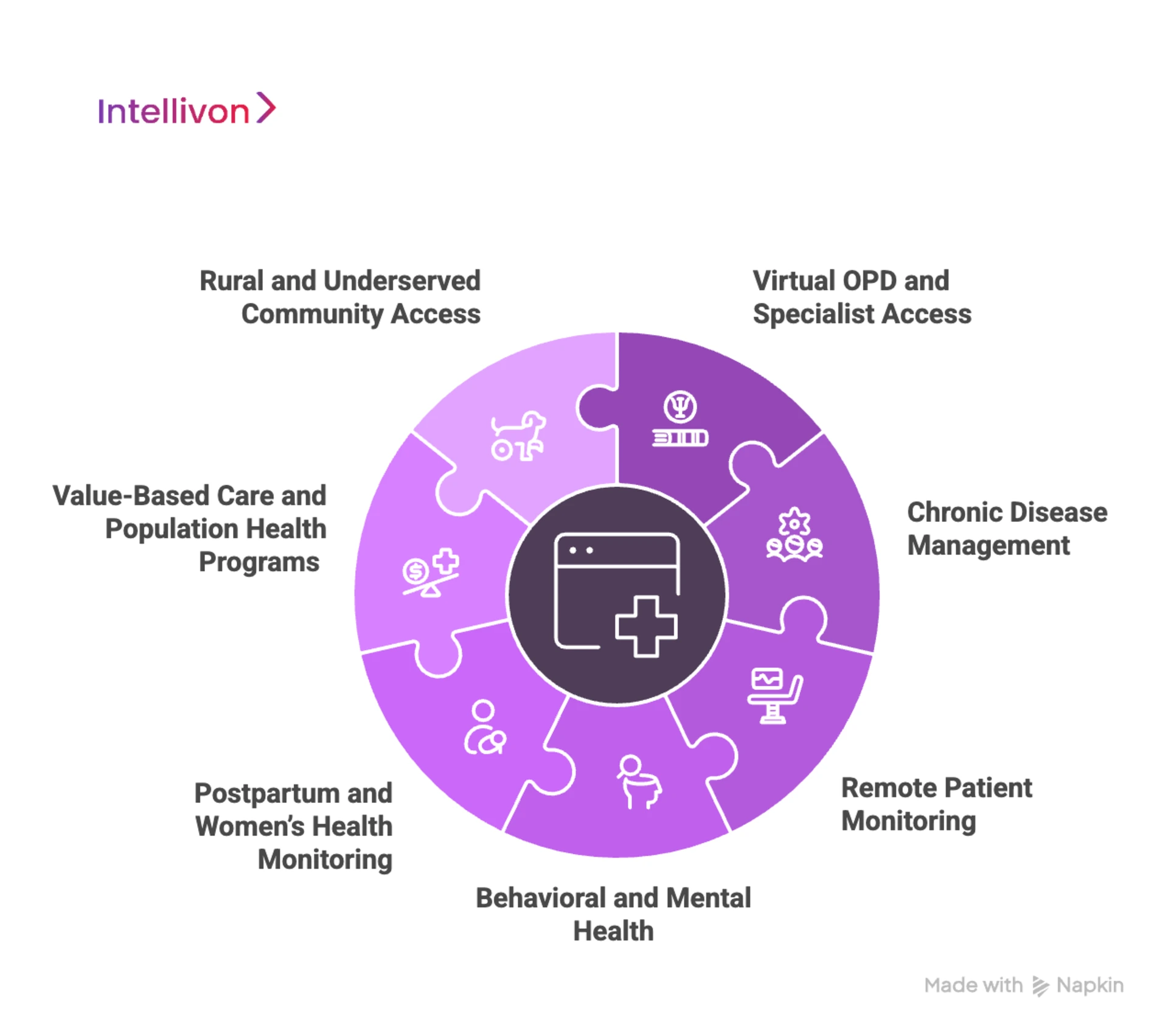

Enterprises deploy telehealth and virtual care platforms to reduce admissions, scale specialist access, manage chronic populations, and support value-based care at the system-wide level.

These platforms now sit at the center of access strategy, chronic care operations, post-acute recovery, and population health programs. Below are the most impactful enterprise use cases shaping adoption today.

1. Virtual OPD and Specialist Access

Multi-hospital systems use telehealth to absorb outpatient demand without expanding physical infrastructure. Virtual OPDs help redistribute specialist access across regions and time zones.

Enterprise example: Apollo Hospitals runs large-scale virtual OPD programs across urban and Tier 2–3 cities to balance specialist load and improve rural access.

2. Chronic Disease Management

Virtual care platforms now power long-term management of diabetes, cardiac disease, COPD, and renal conditions through RPM and structured digital care plans.

Enterprise example: Kaiser Permanente uses continuous virtual monitoring and tele-visits to manage high-risk chronic cohorts and reduce avoidable admissions.

3. Remote Patient Monitoring

Hospitals deploy RPM to safely discharge patients earlier and monitor recovery at home. This protects bed capacity and lowers readmission risk.

Enterprise example: Cleveland Clinic operates home monitoring programs for cardiac and post-surgical patients using integrated telehealth and RPM workflows.

4. Behavioral and Mental Health

Virtual care platforms are now core to behavioral health access, where demand far exceeds physical capacity. Enterprises use digital triage, teletherapy, and AI-powered engagement to scale coverage.

Enterprise example: NHS expanded national virtual mental health services to reduce wait times and extend access across regions.

5. Postpartum and Women’s Health Monitoring

High-risk maternal care increasingly relies on telehealth with continuous remote monitoring to prevent complications and early readmissions.

Enterprise example: Mount Sinai Health System runs postpartum remote monitoring programs for hypertension and recovery surveillance.

6. Value-Based Care and Population Health Programs

Payers and provider groups deploy virtual care as an operating layer for managing risk-based contracts and outcome-linked reimbursement.

Enterprise example: UnitedHealth Group integrates virtual care and RPM into population health programs to manage utilization and total cost of care.

7. Rural and Underserved Community Access

Government-backed health systems use telehealth platforms to extend specialty care into underserved geographies without building physical facilities.

Enterprise example: Veterans Health Administration operates one of the world’s largest enterprise telehealth networks to serve rural veterans nationwide.

These use cases show that telehealth and virtual care platforms are no longer niche digital projects. They now function as an enterprise operating infrastructure that directly impacts access equity, clinical outcomes, and cost control across entire health systems.

How Virtual Telehealth Care Platforms Cut Hospital Admissions by 50%

Hospital admissions are one of the most expensive failure points in any care delivery model. They strain bed capacity, inflate payer costs, and expose systems to avoidable clinical risk. Virtual telehealth care platforms attack this problem upstream. By shifting from reactive visits to continuous digital oversight, they change when and how intervention happens. The result is a structural reduction in admissions, readmissions, and length of stay.

1. Integrated Virtual Care for High-Risk Patients

A large-scale integrated virtual care initiative, MeCare, delivered some of the strongest real-world impact seen in chronic care management. After enrollment, emergency presentations fell by 76%, while hospital admissions dropped by 50%. Average length of stay also declined by 12%, easing both clinical load and inpatient congestion.

Even after accounting for operating costs, the program produced a median net saving of nearly A$982 per patient per month. This outcome highlights how continuous virtual oversight, not episodic teleconsults, drives sustained system-level savings.

2. Remote Monitoring for Acute Deterioration Prevention

A US cost-utility study on remote pulse-oximetry monitoring for moderately ill COVID-19 patients showed how fast telemonitoring can intervene before clinical decline escalates.

Home-based monitoring reduced hospitalizations by 87% and mortality by 77% compared with usual care. Financially, it delivered average savings of US$11,472 per patient in just three weeks, while also improving quality-adjusted life years.

This demonstrates the value of real-time physiological surveillance embedded inside virtual care platforms.

3. Postpartum Hypertension and Readmission Control

In a hospital-operated telehealth plus remote patient monitoring program for postpartum hypertension, readmission rates declined sharply from 3.7% to 0.5%, according to outcomes reported in PubMed-indexed clinical studies.

The program paired frequent digital check-ins with automated blood pressure ingestion and rapid care escalation. These results show how targeted virtual care programs in high-risk populations can neutralize one of the most persistent drivers of early readmissions.

These outcomes explain why hospital systems increasingly view virtual telehealth care platforms as core admission-reduction infrastructure rather than optional digital add-ons. These platforms reclaim inpatient capacity and deliver recurring cost savings that compound month after month.

Key Features of an Enterprise-Grade Telehealth and Virtual Care Platform

An enterprise-grade telehealth and virtual care platform must unify clinical workflows, real-time interoperability, regulatory compliance, patient engagement, and operational scalability within a single secure digital care infrastructure.

The features below define what separates consumer-grade tools from true enterprise virtual care infrastructure.

1. Clinical Experience & Workflow Optimization

At the clinical layer, the platform must feel as natural as an in-person visit while removing digital friction. High-definition, low-latency video enables stable consultations across varying network conditions.

Multi-party conferencing allows caregivers, interpreters, or secondary specialists to join seamlessly. Virtual waiting rooms manage intake and patient flow before visits begin.

Clinical collaboration is supported through:

- Secure screen sharing for labs and imaging

- Encrypted document and image exchange

- Digital whiteboards for patient education

Ambient AI documentation transcribes visits and drafts structured clinical notes automatically, reducing manual charting time. Integrated e-prescribing supports medication workflows, including controlled substances where regulations permit.

2. Interoperability & Integration Ecosystem

Enterprise value depends on uninterrupted data flow. The platform must sync bi-directionally with EHR and EMR systems so that appointments, patient demographics, and clinical notes update instantly. Contextual launch enables providers to initiate visits directly from patient charts.

Interoperability is reinforced through:

- Native HL7, FHIR, and imaging standard support

- Real-time integration with wearables and medical devices

- Health information exchange connectivity for longitudinal patient history

This integration layer ensures clinicians always operate with a complete, current patient context.

3. Security, Compliance & Governance

Regulatory exposure is one of the largest enterprise risks in virtual care. The platform must meet healthcare privacy and security mandates across jurisdictions. Strong identity governance ensures only authorized users access sensitive data.

Core controls include:

- Single sign-on with enterprise identity providers

- Mandatory multi-factor authentication for clinical staff

- Granular role-based permissions across departments

- End-to-end data encryption in transit and at rest

- Immutable audit logs for every access and interaction

These safeguards protect patient trust and preserve legal defensibility.

4. Patient Engagement & Access

Adoption depends on simplicity. White-labeled interfaces preserve institutional branding and patient confidence. Browser-based access allows patients to join visits through secure links without app downloads. Smart self-scheduling aligns patient demand with provider availability.

Engagement is reinforced through:

- Automated triage to guide care routing before booking

- SMS, email, and app-based visit reminders

- Integrated eligibility checks and digital payments before each visit

These elements directly reduce no-show rates and revenue leakage.

5. Enterprise Administration & Scalability

Operations teams require visibility and control across the entire deployment. Multi-tenant architecture supports multiple hospitals, departments, and regions within a single platform while maintaining strict data segregation. Provider availability management enforces licensure boundaries and on-call rotations automatically.

Administrative oversight is supported by:

- Real-time operational analytics for volume, wait times, and throughput

- Clinical outcome tracking for virtual versus in-person care

- Live technical support consoles for active session troubleshooting

This foundation allows the system to scale without service degradation.

6. Advanced & Future-Ready Capabilities

Future-facing features extend the platform beyond basic teleconsultation. At the same time, asynchronous workflows enable store-and-forward care for imaging and structured digital submissions.

Real-time translation enhances accessibility for multilingual populations. Other than that, geographic compliance routing enforces jurisdiction rules automatically. Virtual nursing and inpatient sitter workflows extend digital care into clinical interiors.

These capabilities prepare enterprises for next-generation digital care delivery models.

When engineered correctly, these features form a unified enterprise virtual care infrastructure that supports clinical efficiency, regulatory resilience, patient engagement, and long-term digital health scalability.

Architecture of a Scalable Telehealth and Virtual Care Platform

A scalable telehealth and virtual care platform is built on a layered architecture that separates access, care delivery, intelligence, data, and governance to ensure performance, security, and long-term extensibility.

Each architectural layer should be responsible for a specific set of capabilities, with clear interfaces to the others. This approach keeps the platform stable under load, easier to evolve, and safer to audit.

1. Experience and Access Layer

This layer handles every user-facing interaction. It includes patient portals, provider consoles, contact-center views, and mobile apps. Single sign-on, multi-factor authentication, consent capture, and session management live here.

The goal is to provide a consistent experience across channels while enforcing strong identity controls. This layer must support white-labelling, localization, and accessibility for different regions and brands.

2. Telehealth and Virtual Care Services Layer

Here sits the core care delivery capabilities. Synchronous telehealth visits, secure messaging, virtual waiting rooms, and multi-party consults run alongside asynchronous care flows, remote monitoring dashboards, and digital care plans.

This layer manages visit states, care tasks, and clinical documentation hooks. It is designed to support multiple programs such as urgent care, specialty clinics, chronic care, and post-acute recovery within the same platform.

3. Workflow and Orchestration Layer

This layer coordinates how work moves across teams and systems. It powers intake flows, triage steps, escalation rules, routing logic, and task assignment.

Care coordinators, nurses, and physicians all rely on this orchestration engine to see what needs attention next. It often runs on a rules engine and event-driven architecture, so changes to pathways can roll out without redeploying core services.

4. AI, Analytics, and Decision Support Layer

This is where intelligence is applied. AI models score risk, predict deterioration, flag non-adherence, and recommend next-best actions. Analytics pipelines generate operational and clinical dashboards.

This layer feeds insights back into workflows, such as notifying a nurse when RPM readings drift, or scheduling a telehealth visit when a patient falls into a higher risk band. It should support model lifecycle management, monitoring, and clear explainability controls.

5. Data Platform and Storage Layer

All clinical, operational, and engagement data flows into this layer. It typically combines transactional stores for live workloads and analytical stores for longitudinal analysis. Structured and unstructured data, including notes, transcripts, and device streams, are managed under consistent governance.

This is also where retention policies, data residency, and backup strategies are enforced. The data platform must integrate cleanly with existing enterprise data lakes and reporting tools.

6. Integration and API Layer

This layer connects the platform to the outside world. It exposes APIs for EHR systems, claims platforms, CRM suites, HIEs, device vendors, and third-party digital health partners. It handles FHIR, HL7, DICOM, and payer-specific formats.

An API gateway manages traffic, authentication, throttling, and versioning. This provides a controlled way to plug the platform into complex hospital and payer ecosystems without brittle point integrations.

7. Security, Compliance, and Governance Layer

Security and compliance form a horizontal layer that spans the entire stack. Encryption standards, role-based access policies, audit logging, incident response workflows, and regulator-ready reports are defined here and enforced everywhere.

This layer aligns the platform with HIPAA, GDPR, regional health data laws, SOC 2, and internal risk frameworks. It also supports regular access reviews and compliance attestations.

8. Platform, DevSecOps, and Reliability Layer

This bottom layer keeps everything running. It covers cloud infrastructure, container orchestration, auto-scaling, observability, disaster recovery, and performance tuning.

DevSecOps pipelines ensure that code, infrastructure, and models move through testing and security checks before deployment. Site reliability practices keep latency low and uptime high, even during traffic spikes such as flu season or public health emergencies.

When telehealth and virtual care platforms are architected in these layers, enterprises gain a clean foundation that can handle new programs, regions, and regulations without constant rework.

How AI Is Transforming Telehealth and Virtual Care Delivery

AI is shifting virtual care from reactive video visits to predictive, continuous, and automated care delivery by embedding intelligence across triage, monitoring, documentation, and clinical decision support.

Enterprises now use AI to absorb complexity, surface risk earlier, and automate large portions of clinical and administrative work without compromising safety or compliance.

1. AI-Driven Triage and Demand Routing

AI now acts as the first line of clinical sorting. Symptom analysis, historical data, and risk scoring determine the right level of care before a visit is ever scheduled.

This prevents emergency departments from being overloaded with low-acuity cases and ensures high-risk patients move faster through the system. For large enterprises, this directly improves throughput and access equity.

2. Early Anomaly Detection

RPM (Remote Patient Monitoring) generates thousands of data points per patient every month. AI models filter this stream in real time to detect early physiological deviations that indicate deterioration. Instead of waiting for patient-reported symptoms, care teams receive proactive alerts.

This shift alone has redefined how enterprises manage chronic and post-acute populations at scale.

4. Ambient Clinical Documentation

AI-powered listening tools capture conversations during virtual visits and convert them into structured clinical documentation. Providers spend less time typing and more time with patients.

Orders, prescriptions, and follow-ups can also be triggered automatically based on visit context. This directly reduces documentation fatigue and accelerates care cycles.

5. Predictive Risk Stratification

At the population level, AI identifies patients likely to deteriorate, disengage, or require hospitalization in the near term.

These insights guide proactive outreach programs and value-based care interventions. Enterprises shift from managing visits to managing risk across entire cohorts.

6. AI-Powered Care Pathway Orchestration

Clinical pathways are no longer static rule sets. AI continuously adjusts them using incoming data, outcomes, and engagement patterns.

This creates personalized care journeys that adapt as patient conditions change. For health systems, this brings consistency to care delivery without sacrificing individual responsiveness.

AI transforms telehealth and virtual care from a digital access layer into an intelligent care operating model. As virtual programs expand, AI becomes the only practical way to sustain both care quality and operational control.

Data Security and Compliance for Telehealth and Virtual Care Platforms

Enterprise virtual care platforms must embed security and regulatory compliance into every architectural layer to protect patient data, preserve trust, and withstand continuous audit scrutiny.

Without a built-in security and compliance framework, scale itself becomes a liability.

1. Regulatory Alignment Across Jurisdictions

Enterprise platforms must comply with multiple healthcare privacy and AI regulations depending on the region and patient geography.

This typically includes HIPAA for protected health information, GDPR for personal data processing across Europe, and regional health data localization rules. The platform must enforce compliance through automated controls rather than manual policy enforcement.

2. Identity, Access, and Zero-Trust Controls

Every virtual care interaction depends on identity integrity. Strong single sign-on, multi-factor authentication, and role-based access ensure that only authorized personnel reach clinical data.

Zero-trust models assume no implicit access, even within internal networks. This dramatically reduces lateral breach risk across distributed care environments.

3. End-to-End Data Encryption

All clinical data must remain encrypted both in transit and at rest. Secure transport protocols protect real-time video, device streams, messaging, and document exchange.

Encryption at rest safeguards databases, backups, and long-term data stores against internal and external compromise.

4. Auditability, Traceability, and Forensic Readiness

Enterprise compliance depends on complete visibility into system behavior. Immutable audit logs capture every login, data access event, file transfer, and clinical interaction. These records support regulatory reporting, incident investigation, and legal defensibility during audits or breach reviews.

5. Data Residency and Governance Policies

Different regions mandate where patient data may be stored and how long it can be retained. Enterprise platforms must enforce data residency controls, automated retention schedules, and secure deletion workflows. Governance policies ensure that data usage remains aligned with both legal obligations and organizational risk frameworks.

In telehealth and virtual care, security and compliance function as continuous enforcement systems woven into every workflow, data exchange, and user interaction.

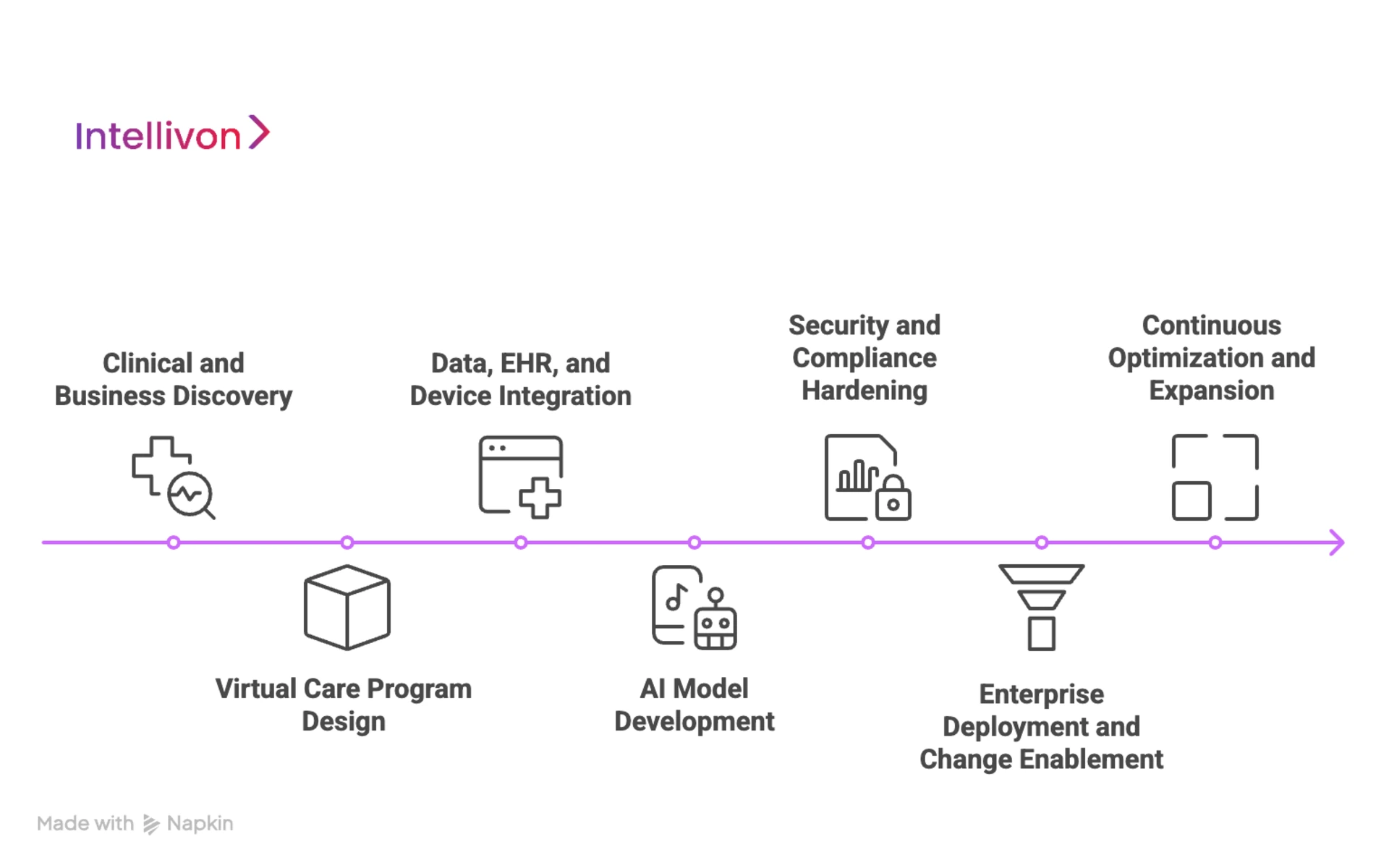

How We Build AI-Driven Telehealth and Virtual Care Platforms

Enterprise virtual care platforms require a structured build approach that aligns clinical strategy, enterprise architecture, AI intelligence, regulatory controls, and long-term scalability from the very first phase.

At Intellivon, we approach telehealth and virtual care as mission-critical digital infrastructure rather than a standalone software product. Our process is designed for large health systems that must balance clinical safety, operational scale, regulatory scrutiny, and long-term ROI. Every platform is engineered through a phased enterprise delivery model.

1. Clinical and Business Discovery

We begin by anchoring the platform in real operational and clinical priorities. This phase focuses on understanding care delivery gaps, access constraints, readmission drivers, workforce pressure points, and financial goals.

We map current workflows across service lines and identify where virtual care can directly alter cost, capacity, and outcomes. This ensures the platform solves measurable enterprise problems rather than adding surface-level digital features.

2. Virtual Care Program Design

Once objectives are clear, we design the overall virtual care operating model. This includes defining care programs, integration boundaries, deployment phasing, and scalability paths across hospitals, clinics, and regions.

The platform architecture is structured to support synchronous telehealth, asynchronous care, and continuous monitoring without creating future integration debt.

3. Data, EHR, and Device Integration Engineering

We then build the integration backbone that connects the platform to EHR systems, device ecosystems, and enterprise data environments. Bi-directional data flow is engineered to preserve clinical continuity across virtual and physical care.

Device pipelines are standardized, so real-time vitals and patient-reported data enrich the clinical record without fragmentation.

4. AI Model Development

AI capabilities are introduced only after data reliability is established. We develop and fine-tune models for triage, risk stratification, documentation automation, and RPM anomaly detection using real operational data.

Each model is validated for safety, transparency, and clinical governance before moving into production workflows.

5. Security, Compliance, and Regulatory Hardening

Security frameworks are embedded alongside application engineering. Identity governance, encryption controls, audit logging, data residency enforcement, and compliance reporting are built directly into platform workflows.

This phase ensures the platform can withstand regulatory audits and enterprise risk reviews without operational rework.

6. Enterprise Deployment and Change Enablement

Platform rollout follows a controlled enterprise deployment model. We plan staged go-lives across facilities, specialties, and care programs.

Clinical training, operational onboarding, and adoption monitoring are tightly coordinated so teams can shift from physical to virtual workflows without productivity loss or patient disruption.

7. Continuous Optimization and Program Expansion

After launch, the platform enters a continuous optimization cycle. We monitor clinical utilization, operational performance, patient engagement, and financial impact.

AI models are refined, workflows are adjusted, and new care programs are added incrementally. This allows the platform to evolve with enterprise strategy rather than being frozen at launch.

This structured build approach ensures that telehealth and virtual care platforms become durable enterprise systems that scale safely, remain compliant under regulatory pressure, and continue delivering measurable clinical and financial value year after year.

Cost to Build a Telehealth and Virtual Care Platform for Large Enterprises

Building an enterprise telehealth and virtual care platform is not a software expense. It is a regulated digital care infrastructure investment. Costs extend well beyond video visits into clinical workflows, AI intelligence, EHR integration, cybersecurity, compliance validation, and large-scale system reliability.

At Intellivon, we design phased cost models that align with board-level capital planning, regulatory obligations, and near-term ROI realization. Early phases focus on launching a production-ready virtual care core without overcommitting capital upfront.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost (USD) |

| Clinical & Business Discovery | Enterprise workflow analysis, care program design, regulatory scoping, and ROI modeling | 12,000 – 20,000 |

| Platform Architecture & Program Design | Multi-layer platform blueprint, scalability planning, deployment mapping | 18,000 – 30,000 |

| Core Telehealth & Virtual Care Build | Video consults, messaging, scheduling, dashboards, care task orchestration | 40,000 – 75,000 |

| EHR & Device Integration | Single EHR integration, FHIR/HL7 mapping, RPM device ingestion | 22,000 – 40,000 |

| AI & Clinical Intelligence Layer | Triage models, documentation automation, RPM anomaly detection | 25,000 – 45,000 |

| Security, IAM & Compliance Controls | HIPAA/GDPR alignment, IAM, encryption, audit logging | 15,000 – 28,000 |

| Testing, QA & Security Validation | Load testing, clinical workflow validation, penetration testing | 10,000 – 18,000 |

| Pilot Deployment & Enterprise Training | Live rollout, clinician onboarding, stabilization | 12,000 – 22,000 |

Total Initial Enterprise Pilot Range: USD 154,000 – 278,000. This supports a fully functional, secure, enterprise-ready pilot platform covering:

- One major EHR system

- One to two high-impact care programs

- Live operation in a real hospital environment

Annual Maintenance and Optimization Costs: Ongoing support, cloud usage, AI model tuning, monitoring, and compliance updates typically require:

- 14–20% of the initial build cost per year

- Approx. USD 22,000 – 55,000 annually

This includes uptime management, security patching, performance tuning, and changing regulatory requirements.

Hidden Costs Enterprises Should Plan For

Even with a controlled pilot budget, several recurring expenses should be anticipated early:

- Additional EHR, payer, and partner system integrations

- Expansion of RPM device fleets and data ingestion volumes

- Regulatory document updates as AI and privacy laws evolve

- Cloud compute and storage growth as usage scales

- Clinical change management and staff retraining

- Ongoing identity and patient matching optimization at scale

Planning for these early prevents uncontrolled budget escalation during program expansion.

Best Practices to Stay Within the Budget

Large health systems that control platform costs successfully follow a disciplined approach:

- They start with one high-friction, high-ROI care program only

- They avoid multi-region and multi-EHR rollouts in phase one

- They enforce security and compliance from day one, not post-pilot

- They use a modular platform design to add programs without rework

- They track utilization, admissions impact, and ROI weekly during the first 90 days

This model allows leadership teams to validate real clinical and financial impact before approving broader capital deployment.

Contact us for a free cost estimate and architecture consultation. At Intellivon, we specialize in building enterprise-grade telehealth and virtual care platforms with controlled budgets, compliance-first architecture, and measurable operational ROI, ensuring scale without fiscal or regulatory risk.

Real-World Examples of These Platforms

Leading enterprise telehealth platforms demonstrate how unified virtual care infrastructure can scale access, reduce utilization pressure, and support continuous care across millions of patients.

The examples below reflect how virtual care operates as core infrastructure rather than a side-channel.

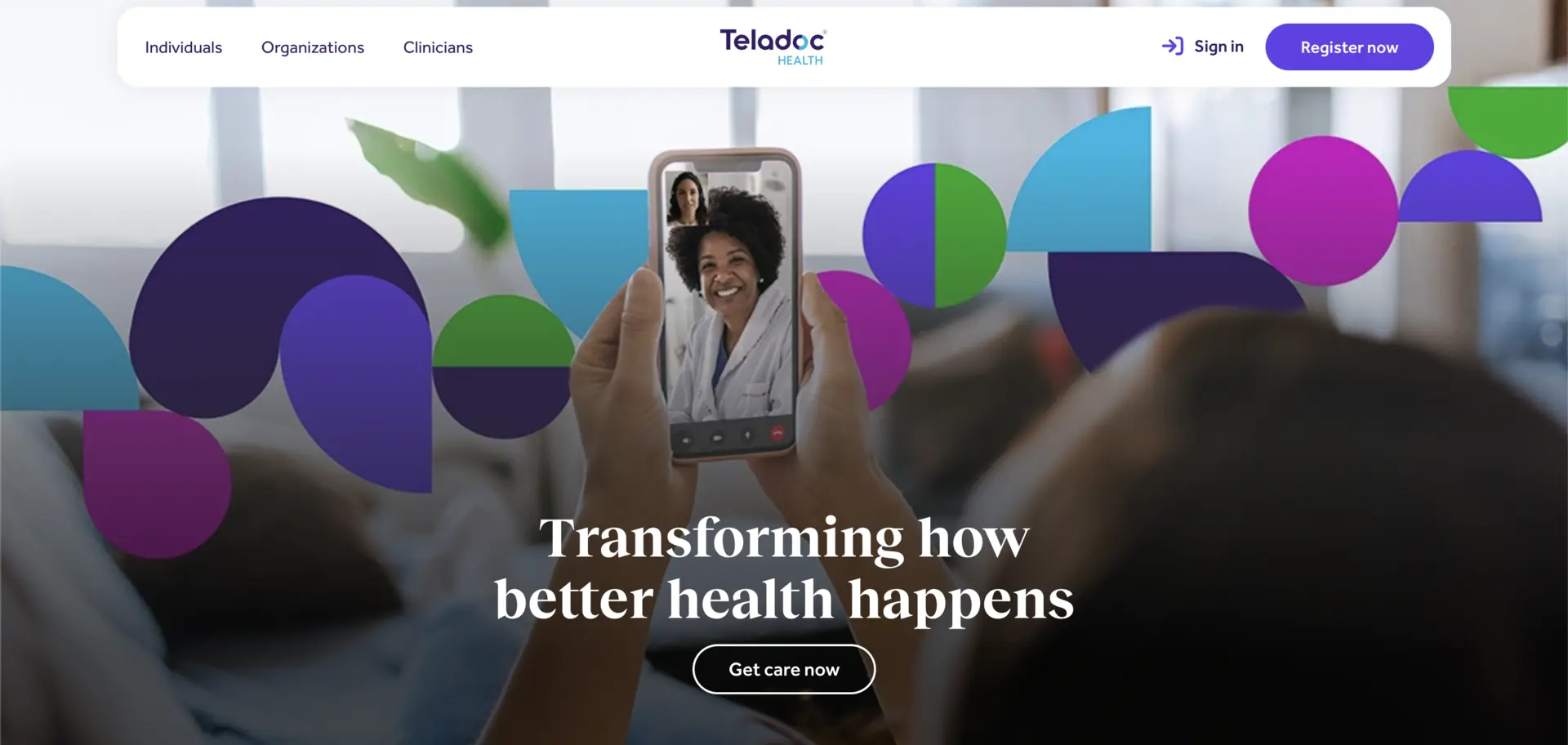

1. Teladoc Health

Teladoc Health operates one of the largest global virtual care networks, spanning primary care, specialty care, chronic condition management, mental health, and remote monitoring. Its platform integrates synchronous visits with longitudinal care programs and AI-enabled engagement tools.

For enterprises and payers, Teladoc supports population-scale access while helping to reduce avoidable ER utilization, manage chronic cohorts continuously, and stabilize care delivery across geographies.

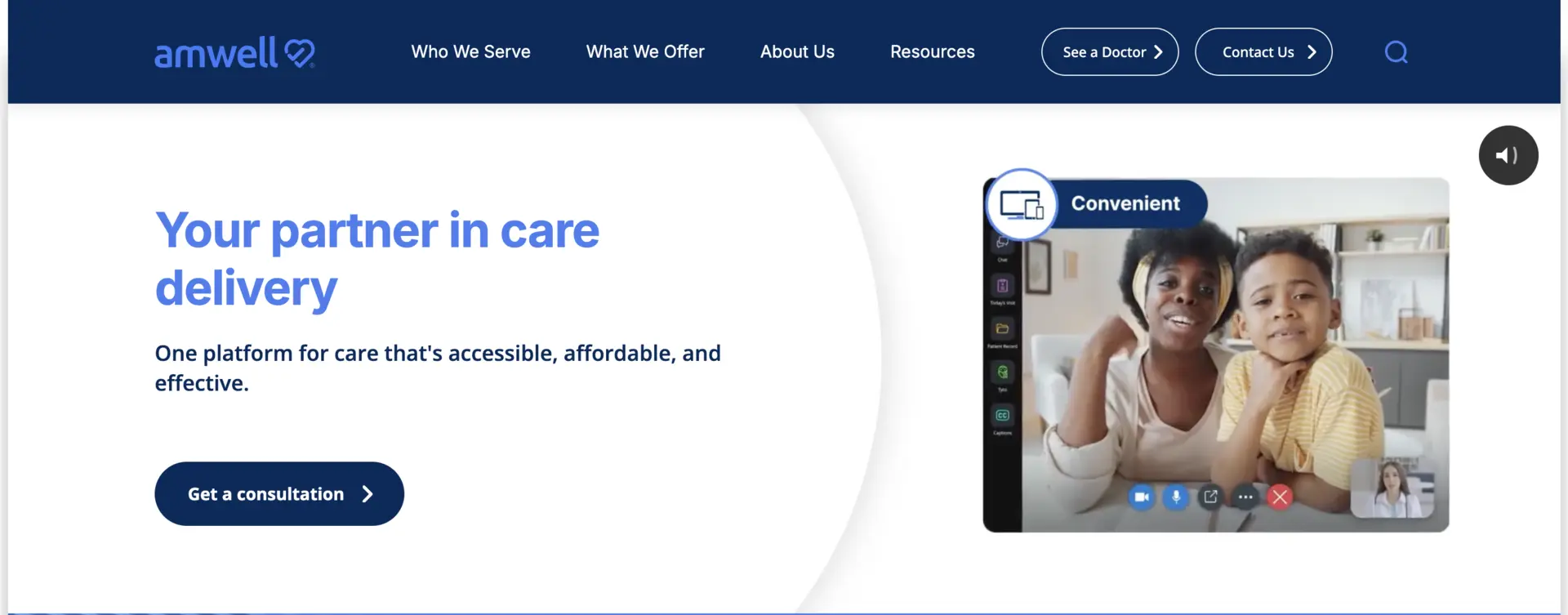

Amwell delivers enterprise virtual care infrastructure to large hospital systems, payers, and government health programs. Its platform supports virtual urgent care, scheduled specialty visits, and hybrid care models tightly integrated with hospital operations. Enterprises use Amwell to extend physician reach, reduce outpatient congestion, and preserve in-network care utilization while maintaining full clinical governance.

3. Epic Virtual Care

Epic Virtual Care is built directly into the Epic EHR ecosystem, allowing health systems to embed virtual visits into everyday clinical workflows.

Providers launch visits from patient charts, and documentation flows automatically into the medical record. This tight integration helps enterprises scale virtual care without disrupting clinician routines, improving adoption while protecting data integrity and compliance.

4. Apollo TeleHealth

Apollo TeleHealth powers large-scale telemedicine and virtual care delivery across India, including rural and government-backed programs. The platform connects remote patients to tertiary care specialists through centralized command centers.

For enterprise healthcare groups, it expands national reach, supports public health initiatives, and addresses access gaps without physical infrastructure expansion.

These platforms illustrate how enterprise telehealth and virtual care succeed when they operate as an integrated care infrastructure rather than isolated digital tools.

Conclusion

Telehealth and virtual care have crossed the threshold from digital convenience to enterprise infrastructure. Unified platforms now shape access, continuity, capacity management, and value-based outcomes across regions and populations. The question is no longer whether virtual care fits strategy, but how quickly it can be industrialized safely at scale.

Enterprises that act early gain compounding advantages in utilization control, workforce efficiency, patient loyalty, and data-driven intelligence. Those who delay face rising costs and fragmented experiences. The next decade will reward systems that treat virtual care as a core operating model rather than a side channel, and long-term.

Build a Telehealth and Virtual Care Platform With Intellivon

At Intellivon, we build enterprise-grade telehealth and virtual care platforms that unify real-time clinical access, continuous monitoring, AI-driven intelligence, and regulatory governance into one secure digital care fabric. Our platforms connect patients, providers, devices, EHRs, and analytics systems without disrupting live hospital operations or clinical productivity.

Each solution is engineered for modern healthcare enterprises. It is compliant by design, resilient under peak clinical loads, interoperable across vendors, and built to deliver measurable clinical and financial ROI from the first deployment phase.

Why Partner With Intellivon?

- Compliance-First Architecture: Every deployment aligns with HIPAA, GDPR, FDA SaMD considerations, and regional digital health regulations with audit-ready governance embedded at every layer.

- Interoperability-Driven Platform Engineering: Native support for FHIR, HL7, DICOM, and enterprise APIs enables secure, real-time integration across EHRs, RPM devices, and payer systems.

- Enterprise-Scale Virtual Care Design: Our platforms support multi-hospital networks, multi-specialty programs, and high-volume virtual visit and RPM workloads without performance degradation.

- AI-Embedded Clinical Intelligence: Built-in AI powers triage, documentation automation, continuous risk detection, and predictive care orchestration across the virtual care lifecycle.

- Zero-Trust Security Framework: Identity-first access controls, end-to-end encryption, and continuous threat monitoring protect PHI without slowing clinical workflows.

- Hybrid Cloud and On-Prem Flexibility: Architectures support regulated hybrid deployments for enterprises with data residency, latency, or sovereign cloud requirements.

- Proven Enterprise Delivery: Our teams bring validated architectures, regulatory maturity, and outcomes-driven execution across large hospital networks and digital health enterprises.

Book a strategy call with Intellivon to explore how a custom-built telehealth and virtual care platform can expand access, reduce admissions, protect revenue, and scale safely across your healthcare enterprise.

FAQs

Q1. What is the difference between a telehealth platform and a virtual care platform?

A1. A telehealth platform focuses on real-time virtual consultations, such as video visits and secure messaging. A virtual care platform goes further by supporting continuous care through remote monitoring, AI-driven follow-ups, care coordination, and population health programs across the full patient lifecycle.

Q2. How long does it take to build an enterprise telehealth and virtual care platform?

A2. For large healthcare enterprises, a production-ready pilot typically takes 4 to 6 months, depending on EHR integration depth, AI scope, compliance requirements, and the number of care programs included in phase one.

Q3. What regulations must a telehealth and virtual care platform comply with?

A3. Enterprise platforms must comply with HIPAA for patient data security in the US, GDPR for international data protection, regional health data localization laws, and evolving AI and medical device software regulations, depending on deployment geography and clinical use.

Q4. What is the expected ROI of an enterprise virtual care platform?

A4. Hospitals typically see ROI through reduced readmissions, higher care team productivity, lower no-show rates, and improved utilization control. Well-run programs often achieve 15–30% reductions in avoidable admissions within the first 12–24 months.

Q5. Can existing EHR systems be integrated with telehealth and virtual care platforms?

A5. Yes. Enterprise platforms integrate bi-directionally with leading EHR systems using FHIR and HL7 standards, allowing real-time sync of appointments, clinical notes, device data, and patient history without disrupting existing hospital workflows.