The telehealth app market is growing quickly, with many new apps entering the field. However, most of these apps struggle to generate sufficient revenue. The problem is that businesses often think about making money only after they have set up their clinical workflows and technology. Currently, the platform can handle the workload, but the business model isn’t strong enough.

Successful companies that make telehealth financially viable include monetization from the beginning. They design their platforms to verify eligibility, organize meetings, gather necessary documents, and ensure compliance right away. This approach allows revenue to increase alongside the platform instead of trying to fix issues once they arise.

Monetizing telehealth apps is already profitable, but starting in 2026, the focus will shift from visit-based income to ongoing reimbursable care models. Companies now need platforms that check eligibility, support continuous documentation, and produce revenue that is ready for audits throughout the entire care process. At Intellivon, we have already adapted to this change. This blog shares our experience and describes how we create and monetize these platforms from the ground up.

Why You Should Invest In Telehealth Apps Right Now

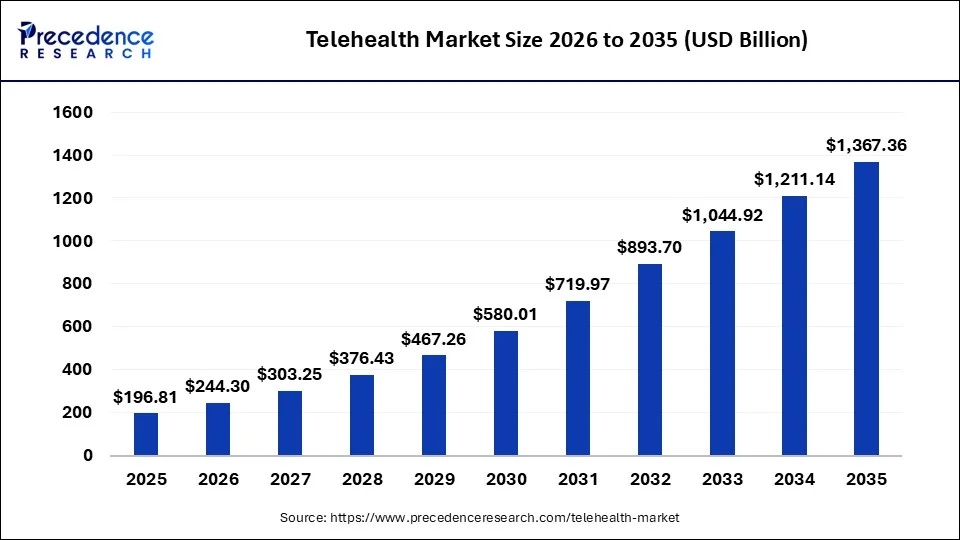

The global telehealth market was valued at USD 196.81 billion in 2025 and is expected to grow to USD 244.30 billion in 2026, reaching nearly USD 1,367.36 billion by 2035 at a CAGR of 23.19%. As a result, telehealth is no longer an experimental delivery channel. It is becoming a core operating layer for healthcare systems, payers, and employers.

Key Growth Drivers:

- Chronic diseases and aging populations now require continuous remote oversight rather than episodic, in-person care.

- Widespread smartphone use, affordable broadband, and wearables enable always-on data capture and mobile-first care delivery.

- Patients increasingly demand convenient, flexible care that reduces time and cost burdens, especially among digital-native groups.

- Proven improvements in access, continuity, and outcomes have made telehealth a mainstream healthcare delivery model.

- Beyond market expansion, the strongest case for telehealth investment comes from measurable operational and clinical returns.

Operational and Clinical ROI

-

Telehealth significantly reduces no-show rates. This directly improves revenue capture and clinician utilisation. A 2025 study in publicly insured type 2 diabetes patients reported a 71.4% drop in no-shows with comparable clinical outcomes.

- Virtual transition-of-care programs reduce readmissions and follow-up gaps. One large health system reported 30-day readmissions of 14.9% versus 20.1% for benchmarks, with telehealth follow-up no-shows below 5%.

- Post-discharge telemedicine programs consistently show readmission reductions of 1–5 percentage points, depending on care design and patient population.

Investing in telehealth apps right now makes commercial sense because adoption is accelerating while monetisation models are maturing. These improvements protect margins under value-based contracts, reduce penalties, and create repeatable, enterprise-scale profitability.

What Enterprises Really Monetise in Telehealth Platforms

Telehealth monetisation often gets reduced to visits, users, or app activity. At enterprise scale, that framing breaks down quickly. Healthcare organisations do not monetise software usage. Instead, they monetise governed care delivery, enforce workflows, and measurable outcomes. These outcomes can be contracted, audited, and scaled.

This distinction matters early because it changes how leaders think about revenue. When monetisation is anchored to value creation rather than features, decisions around models, architecture, and partnerships become far clearer.

1. Access Governance Over App Usage

Enterprises do not generate predictable revenue from raw usage alone. Here, the app engagement fluctuates, but governed access creates stability. At the end, the real monetisable asset is control over who enters care, when they are eligible, and under what conditions services are delivered.

Telehealth platforms enable enterprises to monetise:

- Eligibility-based access for specific populations or plans

- Employer or payer-backed enrollment pathways

- Service-line and region-specific care availability

- Policy-driven access tied to compliance and risk controls

In this model, the application is only the interface. The value sits in access governance that can be priced, bundled, and enforced consistently across large populations.

2. Clinical Workflows as Revenue-Enabling Infrastructure

Revenue in telehealth is not triggered by scheduling a visit. Instead, it is triggered by completing regulated clinical workflows correctly and consistently. Intake, triage, documentation, follow-ups, and escalations are not administrative steps. They are the infrastructure that enables billing, reimbursement, and audit readiness.

When platforms enforce these workflows by design, enterprises gain:

- Higher visit completion and documentation accuracy

- Reduced billing errors and denied claims

- Faster audit cycles with lower compliance risk

- Greater confidence in scaling new care programs

Without workflow enforcement, monetisation becomes manual and fragile. With it, revenue becomes repeatable.

3. Operational Outcomes Tied to Enterprise Contracts

Enterprises rarely monetise care in isolation. This is because they monetise outcomes tied to contracts with payers, employers, and health systems. Telehealth platforms create value when they improve metrics that directly influence revenue and margin performance.

These outcomes include:

- Lower no-show rates and better clinician utilisation

- Reduced readmissions and avoidable acute care

- Improved continuity across chronic and post-discharge care

- More predictable performance under value-based models

When telehealth consistently delivers these results, it becomes a monetisable operating layer rather than a cost centre. Additionally, once the value is clearly defined, enterprises can evaluate monetisation strategies that are compatible with regulation and scale.

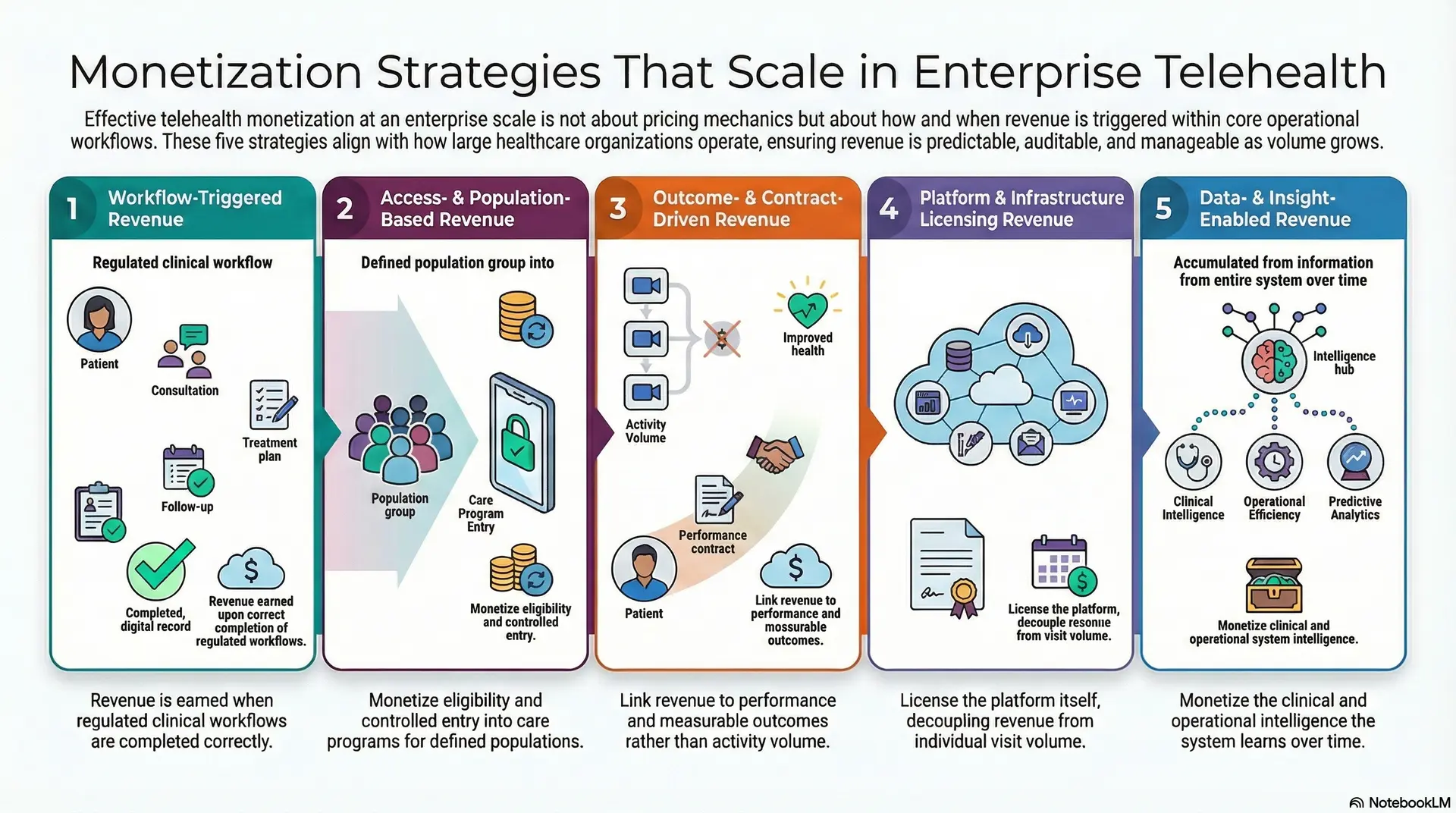

Monetization Strategies That Scale in Enterprise Telehealth

Monetization strategies that work in pilots often fail once telehealth becomes part of core care delivery. This is because, as volumes grow and regulatory oversight increases, revenue must remain predictable, auditable, and operationally manageable.

At the same time, the strategies that scale are not defined by pricing mechanics. Instead, they are defined by how and when revenue is triggered inside enterprise workflows.

The following approaches endure because they align with how healthcare organizations actually operate at scale.

1. Workflow-Triggered Revenue

In enterprise telehealth, revenue is earned when regulated clinical workflows are completed correctly. For instance, scheduling a visit does not guarantee value, but completion does. Additionally, intake, triage, documentation, follow-ups, and escalation paths are the moments where care becomes monetizable.

Platforms that enforce these workflows by design consistently convert scheduled encounters into completed, billable care. This improves revenue capture without increasing demand or staffing. As volume grows, workflows remain repeatable and auditable, which stabilizes margins.

This strategy fails when workflows depend on manual steps or fragmented systems. In those environments, billing delays increase, audits become harder, and revenue growth slows.

2. Access- and Population-Based Revenue

Many enterprise telehealth programs generate stable revenue by governing who can access care and under what conditions. Instead of monetizing each interaction, organizations monetize eligibility and controlled entry into care programs.

This approach supports employer-sponsored access, payer-funded populations, and region-specific service lines. As a result, revenue becomes tied to defined populations rather than unpredictable usage patterns. That predictability makes forecasting easier and contracts more defensible.

Access-based monetization breaks when eligibility rules sit outside the platform. Without system-level enforcement, leakage appears through unauthorized access, inconsistent utilization, and compliance risk.

3. Outcome- and Contract-Driven Revenue

At enterprise scale, telehealth revenue is often linked to performance rather than activity. Contracts reward reduced readmissions, better continuity, improved adherence, or lower acute utilization. Telehealth platforms support these goals by maintaining longitudinal engagement and consistent follow-through.

This strategy works because outcomes can be measured, priced, and shared across stakeholders. Payers, employers, and health systems align incentives around results rather than volume. As programs expand, revenue grows with performance, not with administrative overhead.

Outcome-driven monetization fails when data continuity breaks. Without reliable tracking across the care journey, enterprises struggle to prove impact or defend contract performance.

4. Platform and Infrastructure Licensing Revenue

Some enterprises monetize telehealth by licensing the platform itself rather than individual care events. Health systems, governments, and large organizations pay for operating capability across regions, service lines, or departments.

This model scales because revenue is decoupled from visit volume. Once the platform is deployed, incremental expansion requires minimal additional cost. Governance, security, and isolation become the primary value drivers.

Licensing models break when platforms lack enterprise-grade controls. Without tenant isolation, role-based access, and compliance enforcement, expansion increases risk instead of revenue.

5. Data- and Insight-Enabled Revenue

As telehealth platforms mature, they generate continuous operational and clinical intelligence. Enterprises increasingly monetize what the system learns over time, not just the care it delivers.

This includes predictive risk signals, utilization trends, adherence patterns, and performance benchmarks. These insights support payer decision-making, employer program optimization, and health system capacity planning. Revenue is generated through analytics-enabled contracts rather than raw data exchange.

This strategy scales because insight generation improves with volume and duration. It fails when data remains fragmented or analytics lack clinical and operational context.

While these strategies scale in enterprise environments, no single approach fits every organization. The right monetization model depends on regulatory exposure, operating maturity, and risk tolerance. That decision requires a clear understanding of constraints, which is where enterprises often struggle next.

Telehealth Monetization Models Used at Enterprise Scale

Monetization models answer a different question than strategies. Strategies define where value is created. Models define how that value is converted into revenue. At enterprise scale, only a small set of models remains viable because they can withstand regulation, audits, and operational complexity.

The models below are used by large health systems, payers, employers, and public-sector programs because they scale predictably and remain defensible over time.

1. Per-Member-Per-Month (PMPM)

This model monetizes governed access to care across a defined population. Revenue is tied to eligibility rather than visit volume, which stabilizes cash flow and simplifies forecasting.

PMPM models work well for employer programs, payer networks, and chronic care initiatives. They require strong access controls, enrollment governance, and clear service boundaries. Without those controls, utilization spikes and margins erode.

2. Fee-for-Service With Workflow Enforcement

Fee-for-service remains viable when workflows are enforced end-to-end. Revenue is triggered only when intake, consultation, and documentation are completed correctly.

At enterprise scale, this model depends on automation. Eligibility checks, standardized documentation, and audit-ready records must be built into the platform. When manual steps dominate, billing delays and denials increase quickly.

3. Outcome-Based and Shared-Savings Models

Outcome-based models tie revenue to performance metrics such as reduced readmissions, improved adherence, or lower acute utilization. These models align incentives across providers, payers, and employers.

They require longitudinal data, continuity of care, and reliable analytics. Enterprises that lack data integration or follow-through struggle to prove outcomes, which weakens revenue realization.

4. Platform and Infrastructure Licensing

In this model, enterprises pay for the capability to operate telehealth across service lines, regions, or departments. Revenue is decoupled from visit volume and tied to platform availability and governance.

Licensing models scale well for large health systems and government programs. They demand enterprise-grade security, role-based access, and tenant isolation. Without these, expansion increases risk instead of value.

5. Analytics and Insight-Based Contracts

Some enterprises monetize telehealth by packaging operational and clinical intelligence. Revenue comes from analytics that support population health management, capacity planning, and performance optimization.

This model scales as data accumulates over time. It requires clean data pipelines, de-identification controls, and strong governance when analytics lack context or trust, and monetization stalls.

What matters most is alignment. When monetization models match how the platform governs access, workflows, and outcomes, revenue becomes predictable and scalable.

How Enterprises Choose the Right Telehealth Monetization Model

There is no universal monetization model that works for every enterprise. What succeeds in one organization can fail quickly in another, even within the same market. The difference is rarely vision or demand. It comes down to constraints. Enterprises choose monetization models by understanding what their operating environment can realistically support.

This decision determines how quickly telehealth reaches breakeven, how exposed the organization is to audits, and how confidently the platform can scale.

1. Regulatory Exposure and Audit Tolerance

Regulatory posture is the first filter. Enterprises operating across multiple regions, payer frameworks, or public programs must prioritize models that hold up under scrutiny. Monetization strategies tied to governed workflows, eligibility rules, and outcomes tend to perform better in high-exposure environments.

When this constraint is ignored, revenue may appear strong early on. Over time, audits, documentation gaps, and reimbursement challenges begin to erode margins.

2. Operating Model Maturity

Some organizations have standardized workflows, clean documentation, and strong clinical governance. Others operate across fragmented systems and service lines. This difference matters.

Complex monetization models require mature operations. Outcome-driven or insight-enabled revenue depends on continuity, reliable data capture, and consistent execution. Enterprises with lower maturity often perform better with simpler, access-based, or workflow-triggered approaches until foundations improve.

3. Revenue Predictability Versus Growth Appetite

Every enterprise balances stability against upside. Some prioritize predictable, contract-backed revenue that finance teams can forecast with confidence. Others accept variability in exchange for long-term growth potential.

Telehealth monetization models reflect this tradeoff. Population-based and platform licensing models favor predictability. Outcome-driven and insight-enabled approaches reward performance over time but require patience and operational discipline.

4. Time to Breakeven Expectations

Breakeven timelines shape everything. Programs expected to pay for themselves quickly often rely on models that activate revenue early, such as workflow-triggered or access-based monetization. Models tied to long-term outcomes or intelligence generation typically deliver higher lifetime value, but over a longer horizon.

Enterprises that mismatch breakeven expectations with monetization design often experience internal friction, even when clinical performance is strong.

Bringing the Decision Together

When these constraints are evaluated together, the right monetization model becomes clearer. The table below summarizes how common enterprise constraints align with scalable telehealth monetization strategies.

Telehealth Monetization Model Selection by Enterprise Constraint

| Enterprise Constraint | Workflow-Triggered | Access-Based | Outcome-Driven | Platform Licensing | Insight-Enabled |

| Regulatory exposure tolerance | Medium | Low | High | Low | Medium |

| Operational maturity required | High | Medium | High | High | Very high |

| Revenue predictability | Medium | High | Medium | Very high | Medium |

| Time to breakeven | Short to medium | Short | Medium | Short | Medium to long |

| Audit resilience | High | High | High | Very high | High |

| Best suited for | Providers | Employers, payers | Value-based orgs | Large systems | Data-mature enterprises |

Once the right model is defined, the challenge shifts from choice to execution. That is where platform design, governance, and delivery capability determine whether monetization remains theoretical or becomes repeatable at scale.

Telemedicine Visits Have 64% Higher Completion Rates Than In-Person

Telemedicine fundamentally improves visit completion, which directly impacts revenue predictability and clinician utilization. When fewer appointments fall through, enterprises recover capacity that would otherwise remain unused. This shift has meaningful monetization implications at scale.

1. Higher Completion Is a Revenue Multiplier

Large-scale observational data show telemedicine visits achieve a 73.4% completion rate, compared to 64.2% for in-person care, a difference of 9.2 percentage points.

After adjusting for patient and visit characteristics, telemedicine demonstrated approximately 64% higher odds of visit completion. For enterprise operators, this difference compounds quickly. Each completed visit represents recovered revenue, stabilized schedules, and more efficient use of clinical staff.

2. Fewer Dead Slots, Higher Clinician Utilization

Missed appointments create invisible losses. Clinicians remain idle, support staff stay allocated, and operating costs continue regardless of patient attendance. Telemedicine reduces this friction by removing travel, time-off, and logistical barriers that often cause no-shows.

As a result, organizations see:

- More predictable daily schedules

- Higher visit throughput per clinician

- Reduced operational waste tied to idle capacity

These gains translate into stronger margins without increasing headcount.

3. Monetization Impact at Enterprise Scale

At scale, higher completion rates unlock measurable financial upside. Enterprises can support higher patient volumes using the same clinical workforce while improving billing consistency.

In value-based or hybrid reimbursement models, consistent follow-through also protects quality metrics that influence downstream payments.

In short, telemedicine improves revenue by making care more likely to happen. When enterprises design platforms around completion, utilization, and accountability, monetization becomes repeatable rather than reactive.

Core Architecture Used To Monetize Telehealth Apps

Telehealth monetization does not sit in billing systems or pricing plans. It sits in how the platform is architected. At enterprise scale, revenue becomes reliable only when the system enforces who can access care, how care is delivered, and how outcomes are recorded and audited.

The architecture below reflects how monetization is designed into enterprise telehealth platforms, layer by layer.

1. Identity and Access Control Layer

This layer governs who enters the system and under what conditions. It enforces eligibility rules tied to employers, payers, regions, and service lines. Without this control, monetization becomes unpredictable and exposed to compliance risk.

For enterprises, access control ensures that only authorized populations receive billable care. It also supports contract-based access models where revenue is tied to defined groups rather than individual visits.

2. Care Intake and Eligibility Layer

This layer structures how patients enter care. It captures consent, validates eligibility, and routes patients into the correct care pathways. These steps are revenue-enabling checkpoints.

When intake is enforced by the platform, enterprises reduce downstream billing errors and prevent care from being delivered outside reimbursable or contracted boundaries.

3. Workflow Orchestration Layer

Workflow orchestration is where monetization becomes operational. This layer governs triage, consultations, documentation, follow-ups, and escalations. It ensures that every billable action is completed in the correct order.

Platforms that lack orchestration rely on manual coordination, which breaks under scale. Orchestration allows enterprises to convert scheduled care into completed, compliant encounters consistently.

4. Clinical Documentation and Data Integrity Layer

Revenue depends on defensible records. This layer ensures documentation is complete, time-stamped, and aligned with regulatory requirements. It supports audits, reimbursements, and performance-based contracts.

When documentation quality is inconsistent, monetization slows. When it is enforced systematically, revenue cycles accelerate and audit risk drops.

5. Integration and Interoperability Layer

Enterprise monetization requires clean integration with EHRs, billing systems, payer platforms, and analytics tools. This layer allows monetization models to evolve without rebuilding the platform.

As enterprises add new partners or service lines, interoperability prevents fragmentation. It also enables hybrid monetization models that combine reimbursements, contracts, and outcomes.

6. Analytics and Insight Layer

This layer transforms operational data into monetizable intelligence. It supports performance tracking, utilization analysis, and outcome measurement across populations.

For enterprises, analytics enable outcome-based contracts, shared savings models, and insight-driven revenue streams. Value increases as data accumulates over time.

7. Governance and Compliance Enforcement Layer

This final layer ensures policies are enforced consistently across the platform. It governs role-based actions, audit trails, and regulatory controls.

Without governance, monetization erodes quietly through leakage and risk exposure. With it, enterprises scale telehealth programs confidently while protecting revenue and compliance.

Together, these layers form an operating architecture for monetization. When designed as a system, telehealth platforms move beyond episodic revenue and support predictable, enterprise-scale profitability.

How Intellivon Monetizes Telehealth Apps For Enterprise Clients

Intellivon enables enterprise telehealth monetization by designing revenue logic into platform architecture, workflows, governance, and scale planning from the start.

The focus is always on making revenue predictable, defensible, and scalable.

1. Monetization Is Defined During Platform Discovery

Monetization decisions begin with how care will be accessed and governed. Intellivon works with enterprises to define eligibility, service boundaries, and breakeven expectations before workflows are designed.

This prevents revenue models from conflicting with regulatory or operational constraints later. By clarifying monetization intent early, platforms avoid costly rework and delayed ROI.

2. Revenue Engineered Into Care Workflows

Our experts design workflows that convert intent into completed, compliant actions. Intake, triage, documentation, and follow-ups are structured to support billing accuracy and audit readiness. These workflows are enforced by the system, not left to manual coordination.

As a result, enterprises recover capacity, reduce leakage, and stabilize revenue as volumes increase.

3. Compliance and Governance Are Built In

Monetization depends on trust. Intellivon embeds governance controls that enforce role-based actions, consent handling, and documentation standards across the platform.

This keeps revenue defensible as programs expand across regions and payer environments. Strong governance reduces audit friction and protects margins over time.

4. Platforms Designed to Monetize Beyond Launch

Enterprise telehealth programs evolve as new populations, partners, and care models emerge. Intellivon designs platforms to support this evolution without breaking monetization logic.

We build integrations, analytics, and data structures to enable new revenue streams without rebuilding core systems. This approach shortens the time to breakeven and supports long-term growth.

Intellivon’s role is not to promise monetization. It is to make it operationally inevitable. By treating monetization as a platform outcome rather than a downstream task, enterprises gain the confidence to scale telehealth as a sustainable growth engine.

How Leading Telehealth Platforms Monetise, and What You Can Learn

Enterprise telehealth monetisation becomes credible when it is observable in how leading platforms operate at scale. The organisations below did not succeed because of their features or marketing reach. They monetise by aligning access, workflows, and contracts with how healthcare systems actually function.

Each example shows a different path, shaped by regulation, payer dynamics, and operating maturity.

1. Teladoc Health

Teladoc became a market leader by embedding itself into employer benefits, payer networks, and large health systems. Its scale is built on longitudinal engagement rather than transactional visits. Chronic care, behavioural health, and primary care operate as ongoing programs, not isolated encounters.

How it monetises

Revenue is primarily population-based and contract-driven. Employers and payers pay for governed access to care across defined member groups.

Within those contracts, Teladoc monetises continuity through structured workflows that improve completion, follow-through, and adherence over time. This shifts revenue away from visit volume and toward sustained utilization.

What you can apply

Enterprises can apply this by designing telehealth as a recurring operating layer. Monetisation improves when access is contractually defined, and workflows support ongoing care rather than episodic demand.

2. Amwell

Amwell positioned itself as an enterprise infrastructure rather than a consumer brand. It integrates directly into hospital systems, payer platforms, and regional networks, allowing organisations to extend virtual care without replacing existing systems.

How it monetises

Amwell monetises through platform and infrastructure licensing combined with workflow-triggered revenue. Health systems pay for the capability to deliver virtual care across multiple service lines. Revenue scales as clinicians complete governed workflows within their existing clinical and billing environments.

What you can apply

This approach works when telehealth is treated as shared infrastructure. Enterprises should focus on integration and workflow enforcement so monetisation grows with adoption, not with operational complexity.

3. MDLIVE

MDLIVE scaled by aligning tightly with payer requirements and insured populations. Its growth reflects operational consistency rather than product differentiation. Standardisation is a core strength.

How it monetises

Revenue is driven by access-based and workflow-triggered models. Eligibility is verified upfront, intake is structured, and visit flows are controlled. These controls reduce no-shows and ensure visits convert into reimbursable care at scale.

What you can apply

Enterprises can learn the value of simplifying access and enforcing consistency. Monetisation strengthens when intake and eligibility are automated, reducing variability across large populations.

4. Babylon Health

Babylon operates within public and hybrid healthcare systems where cost control and continuity matter more than volume. Its model integrates digital triage with GP-led care, supporting long-term patient relationships.

How it monetises

Babylon relies on outcome- and contract-driven revenue tied to registered populations. Revenue depends on managing demand, routing care appropriately, and maintaining continuity within fixed budgets. Success is measured by system efficiency, not visit counts.

What you can apply

Enterprises operating in value-based or publicly funded environments should focus on orchestration. Monetisation works when platforms reduce unnecessary utilization and improve continuity across the care journey.

5. Tia Health

Tia Health operates within Canada’s provincial healthcare systems, where compliance and physician governance are tightly regulated. Growth depends on trust and adherence to local requirements.

How it monetises

Revenue is tied to compliant workflow execution. Consultations must meet documentation, licensing, and billing standards to be reimbursed. Monetisation is protected by enforcing these rules at the platform level.

What you can apply

This model highlights the importance of compliance-first design. Enterprises should embed monetisation logic into workflows so revenue remains defensible under strict regulatory oversight.

6. Updoc

Updoc gained traction by addressing high-friction use cases such as prescription renewals and medical certificates. It focused on speed and clarity within regulatory boundaries.

How it monetises

Revenue is driven by workflow efficiency. Clear eligibility rules and fast completion paths convert intent into completed actions. At the same time, Monetisation depends on removing friction without compromising governance.

What you can apply

Enterprises can learn to monetise narrow, well-defined workflows. When platforms streamline completion while enforcing rules, revenue becomes predictable even in consumer-facing models.

Across regions and systems, the pattern holds. Leading telehealth platforms monetise by governing access, enforcing workflows, and aligning revenue with outcomes. Enterprises that apply these principles build monetisation that survives scale, audits, and market shifts.

Conclusion

Telehealth monetization isn’t something you figure out after launching the platform. You need to design it from the start. The platforms that succeed are those where access controls, clinical workflows, and outcome tracking serve as the foundation for generating revenue. Companies that view monetization as a key part of their operations, rather than just a pricing strategy, develop telehealth programs that grow steadily without collapsing under stress.

When your setup, compliance systems, and execution are in sync from the beginning, telehealth becomes a reliable growth driver instead of a risky gamble. This difference appears in shorter breakeven timelines, clearer audits, and stable profit margins that don’t shrink with each new market or patient group.

Build Monetisation-Ready Telehealth Platforms With Intellivon

At Intellivon, we build monetisation-ready telehealth platforms as enterprise operating systems, not virtual care tools layered onto fragile workflows. Our platforms are designed to govern how access is granted, how care workflows execute, and how revenue is protected across compliance-heavy environments.

Each solution is engineered for healthcare organisations operating at scale. Additionally, platforms are architecture-first and monetisation-aware, with revenue logic embedded across identity, workflows, data, and governance layers. As programs expand across populations, regions, and payer models, predictability, auditability, and margin control remain intact.

Why Partner With Intellivon?

- Enterprise-grade platform architecture aligned with governed access, workflow-triggered revenue, and scalable monetisation models

- Deep interoperability expertise across EHRs, billing systems, identity frameworks, analytics platforms, and payer ecosystems

- Compliance-by-design delivery supporting audit readiness, role-based controls, and regulated monetisation at scale

- AI-assisted orchestration that improves completion, continuity, and operational efficiency without removing clinical accountability

- Proven enterprise delivery model with phased rollout, breakeven planning, KPI validation, and controlled expansion

Talk to Intellivon’s healthcare platform architects to explore how a monetisation-ready telehealth platform can integrate into your existing ecosystem, unlock sustainable revenue, protect regulatory integrity, and scale digital care with confidence.

FAQs

Q1. How do telehealth platforms actually make money at enterprise scale?

A1. Enterprise telehealth platforms monetize by governing access, enforcing compliant workflows, and delivering measurable outcomes. This is because revenue is generated through population-based contracts, workflow-triggered reimbursement, outcome-linked agreements, platform licensing, and analytics-driven enterprise contracts rather than one-off virtual visits.

Q2. What is the most scalable monetization model for telehealth apps?

A2. There is no single best model. This is because the most scalable telehealth monetization models align with enterprise constraints such as regulatory exposure, operating maturity, and breakeven timelines. Successful enterprises often combine population-based pricing with workflow-triggered or outcome-driven revenue models.

Q3. Why do many telehealth apps fail to monetize effectively?

A3. Telehealth apps fail to monetize when monetization is treated as a pricing decision instead of a platform design problem, without an architecture that enforces eligibility, workflows, documentation, and governance. Additionally, revenue leakage, audit risk, and operational friction increase as scale grows.

Q4. How long does it take for an enterprise telehealth platform to break even?

A4. Breakeven timelines vary by monetization model and operating maturity. Workflow-triggered and access-based models often reach breakeven faster. In contrast, outcome-driven, analytics-based models deliver higher long-term value but require a longer ramp-up and stronger data continuity.

Q5. How can enterprises build a monetization-ready telehealth platform?

A5. Enterprises build monetization-ready telehealth platforms by embedding revenue logic into platform architecture from day one. This includes governed access, enforced workflows, audit-ready data layers, and scalable integrations. Partners like Intellivon specialize in designing platforms where monetization remains predictable and defensible as programs expand.