Building a clinical intelligence platform is a significant step for any healthcare organization, and planning or budgeting for it can be challenging. Unlike most software purchases, it is difficult to find a straightforward price tag or a one-size-fits-all solution.

Every project is unique because each network has its own specific needs. The costs will vary based on how complex the organization is, how well the current systems work together, the level of integration required, and the number of clinical tasks needed for the platform to manage from the beginning.

The real challenge is that many organizations start planning without a clear understanding of what they actually need. This uncertainty can lead to higher costs. At the same time, projects often take longer than anticipated, expenses continue to rise, and sometimes the platform fails to meet expectations.

Our goal with this blog is to help you avoid these common issues. Drawing from Intellivon’s hands-on experience with large provider networks, we will explain what truly drives costs, which decisions have the biggest financial impact, and what it takes to make a smart, well-planned investment right from the start.

Why the Cost to Build Clinical Intelligence Software Is Rising in 2026

Large healthcare organizations increasingly rely on clinical intelligence systems to extract value from expanding clinical data. These platforms analyze EHR records, flag patient risk earlier, and improve both clinical and operational workflows.

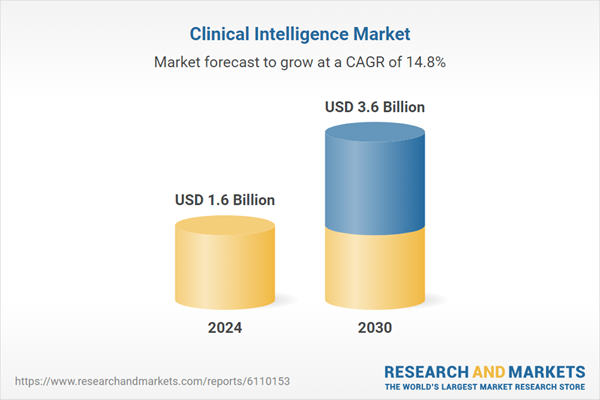

As chronic disease rates climb and value-based care expands, many providers are investing in data-driven decision support. The global clinical intelligence market was valued at approximately $1.6 billion in 2024. It is projected to reach $3.6 billion by 2030, growing at a 14.8 percent compound annual growth rate during the forecast period.

- Rapid growth in healthcare data from EHRs, laboratories, and diagnostic systems is accelerating demand for advanced clinical intelligence capabilities.

- Advances in artificial intelligence and machine learning are making predictive analytics more practical and clinically actionable at enterprise scale.

- Large health systems face mounting pressure to reduce operating costs while improving patient outcomes and care efficiency.

- Rising chronic disease prevalence is increasing demand for proactive, data-driven clinical decision support across provider networks.

- Regulatory requirements, including HIPAA, continue to push organizations to strengthen data governance, security, and oversight practices.

The cost to build clinical intelligence software is rising because enterprise expectations have shifted. Health systems no longer invest in passive reporting layers.

They now demand real-time insight, governed AI, and deep interoperability across complex care environments.

Each added requirement expands engineering scope, compliance effort, and infrastructure spend. Therefore, understanding these cost drivers is essential for realistic budgeting in 2026 and beyond.

1. From Static Reporting to Real-Time Clinical Intelligence

Moving from traditional BI dashboards to real-time clinical intelligence significantly increases development cost. Static reporting environments rely on batch data and simpler pipelines. In contrast, operational intelligence requires continuous data ingestion and event-driven processing that must run reliably at scale.

Why this raises clinical software cost:

- Continuous data ingestion pipelines increase infrastructure and engineering effort

- Event-driven architectures require a low-latency, high-availability design

- Real-time decision support expands testing and validation scope

2. Regulatory and Clinical Governance Pressure

Compliance expectations around clinical intelligence have intensified. Enterprise buyers now require explainable models, full audit trails, and formal clinical safety validation. As a result, governance is no longer a lightweight add-on. It is a core cost component of the platform.

Why this raises clinical software cost:

- Explainability frameworks add model development and review effort

- End-to-end auditability increases data engineering complexity

- Clinical safety validation introduces formal review workflows

- Ongoing model monitoring adds long-term operational expense

3. Interoperability Expectations

Large provider networks operate across multiple EHRs, labs, and partner systems. Supporting FHIR and HL7 standards while maintaining reliable connectivity requires substantial integration work. In addition, cross-system normalization and real-time feeds increase both build time and maintenance costs.

Why this raises clinical software cost:

- FHIR and HL7 interface development requires specialized expertise

- Deep EHR connectivity increases integration effort across facilities

- Terminology normalization adds ongoing data engineering overhead

- Real-time feeds raise infrastructure and support costs

4. AI and Predictive Layer Complexity

The predictive layer often becomes the largest cost multiplier in modern clinical intelligence platforms. Building reliable models requires extensive feature engineering, training pipelines, and clinical validation. Furthermore, running models continuously at enterprise scale demands significant infrastructure investment.

Why this raises clinical software cost:

- Model training pipelines require specialized data science resources

- Feature engineering across clinical data increases preparation effort

- Clinical validation extends timelines and review cycles

- Scalable AI infrastructure raises cloud and compute expenses

Next, we break down the typical cost components involved in building an enterprise clinical intelligence platform.

How Much Does It Cost to Build Clinical Intelligence Software in 2026?

Enterprise clinical intelligence software typically ranges from $90,000 to $650,000 or more. Costs rise with real-time data needs, AI depth, and multi-facility scale.

The clinical software cost for modern intelligence platforms varies more than most buyers expect. In 2026, most enterprise initiatives fall between $90,000 and $650,000+, yet the final investment depends heavily on architectural ambition.

A narrowly scoped analytics tool sits at the lower end. In contrast, a system-wide intelligence layer must support real-time ingestion, governed AI, and deep interoperability across the care network.

In addition, buyers should view this as a staged investment rather than a single build event. Many organizations start with a targeted workflow, then expand once adoption and data quality mature. Therefore, early architectural decisions often determine whether future expansion remains cost-efficient or becomes expensive technical debt.

Quick Cost Snapshot by Platform Maturity

| Platform Type | Typical Scope | Integration Depth | AI and Real-Time Capability | Estimated Cost Range |

| Departmental intelligence tool | Single service line or department analytics | Limited EHR feeds, mostly batch | Basic descriptive analytics | $90k–$150k |

| Workflow-connected intelligence | Multi-department clinical workflows | Moderate EHR and care system integration | Early predictive models, partial real-time | $150k–$300k |

| Multi-facility intelligence platform | Cross-hospital operational and clinical visibility | Deep multi-EHR interoperability | Advanced predictive intelligence, near real-time | $300k–$500k |

| Enterprise clinical intelligence layer | System-wide governed decision infrastructure | Enterprise-wide interoperability fabric | Full predictive and prescriptive intelligence at scale | $500k–$650k+ |

What this means in practice

Most provider organizations begin with a focused intelligence use case to validate data readiness and clinical adoption. However, leadership teams that plan for enterprise scale early often avoid costly rework, fragmented pipelines, and governance gaps later.

In 2026, the difference between a scalable platform and a short-lived tool often comes down to early architectural discipline.

Tier-Wise Cost Breakdown for Clinical Intelligence Platforms

Clinical intelligence platform costs increase sharply as the scope expands from departmental analytics to enterprise-wide intelligence. Integration depth and governance needs drive most of the spend.

Clinical software cost varies significantly by deployment tier. As platforms expand across departments, facilities, and research environments, both technical and governance requirements grow.

Therefore, understanding tier-wise investment helps leadership teams budget realistically and avoid under-scoping early decisions.

Cost Comparison by Platform Tier

| Platform Tier | Primary Focus | Integration Complexity | Governance Depth | Typical Buyers | Estimated Cost Range |

| Department-Level Intelligence | Quality dashboards and specialty analytics | Low, limited EHR feeds | Basic reporting controls | Service line leaders, department heads | $90k–$150k |

| Hospital-Wide Intelligence | Cross-department clinical and operational signals | Moderate multi-system integration | Structured clinical governance | Hospital operations and clinical leadership | $150k–$300k |

| Multi-Hospital Intelligence | Cross-site normalization and population visibility | High multi-EHR interoperability | Enterprise data governance | Health system leadership teams | $300k–$500k |

| Academic and IDN Intelligence | Research-grade AI and system-wide intelligence | Very high, multi-source ecosystem | Advanced model and data oversight | Academic medical centers and large IDNs | $500k–$700k+ |

1. Department-Level Intelligence Cost

Department-level platforms represent the lowest entry point for clinical intelligence investment. These solutions typically focus on quality dashboards, specialty analytics, and limited reporting workflows within a single service line. Because integrations remain narrow, engineering effort stays relatively contained.

Most organizations at this stage rely on batch data rather than real-time feeds. As a result, infrastructure and validation requirements remain manageable. Typical buyers include service line leaders and department heads who want better visibility without committing to enterprise transformation.

However, these tools often reach their limits quickly. When organizations later require cross-department insight, significant rework may be necessary. Therefore, even at this level, forward-looking architecture decisions can reduce future clinical software cost.

2. Hospital-Wide Intelligence Cost

Hospital-wide intelligence platforms expand visibility across departments and care workflows. At this stage, the platform must correlate cross-department signals, support care coordination insights, and trigger workflow-based alerts. Consequently, both integration and governance requirements increase.

Identity complexity becomes more visible here. Patient matching, provider normalization, and workflow routing require a stronger data engineering discipline. In addition, near real-time processing often enters the roadmap, which raises infrastructure costs.

Typical buyers include hospital operations leaders and clinical transformation teams. While the investment is higher than departmental tools, the operational impact also becomes more measurable. Many organizations see this tier as the first meaningful step toward enterprise intelligence maturity.

3. Multi-Hospital Intelligence Cost

Multi-hospital platforms introduce a different level of complexity. The focus shifts toward cross-site normalization, population health visibility, and network-wide performance benchmarking. At this scale, interoperability becomes one of the largest cost drivers.

Health systems must reconcile multiple EHR configurations, terminology differences, and inconsistent documentation patterns. Therefore, data engineering and governance frameworks expand significantly. Real-time or near-real-time data flows also become more common, which increases infrastructure overhead.

Typical buyers at this stage are health system executives responsible for network performance. While the investment is substantial, this tier often delivers the strongest operational and financial impact. Organizations that skip foundational work earlier frequently see costs rise faster here.

4. Academic and IDN Intelligence Cost

Academic medical centers and large integrated delivery networks operate at the highest level of clinical intelligence maturity. Their platforms must support research datasets, advanced AI models, and deep governance controls across clinical and academic environments.

Validation requirements are significantly stricter. Models often require formal clinical review, bias monitoring, and continuous performance oversight. In addition, research use cases introduce complex data pipelines and privacy controls that further increase cost.

Because of this expanded scope, these environments typically carry the highest clinical software cost. However, they also unlock advanced capabilities such as precision medicine insights, research acceleration, and system-wide optimization. Organizations operating at this tier usually view clinical intelligence as core strategic infrastructure rather than a reporting tool.

Clinical intelligence software is no longer a discretionary analytics expense. It has become a core investment for organizations aiming to scale insight, efficiency, and clinical performance.

With the right architecture and partner, this cost transforms into long-term growth and operational advantage.

Core Features of Enterprise Clinical Intelligence Software

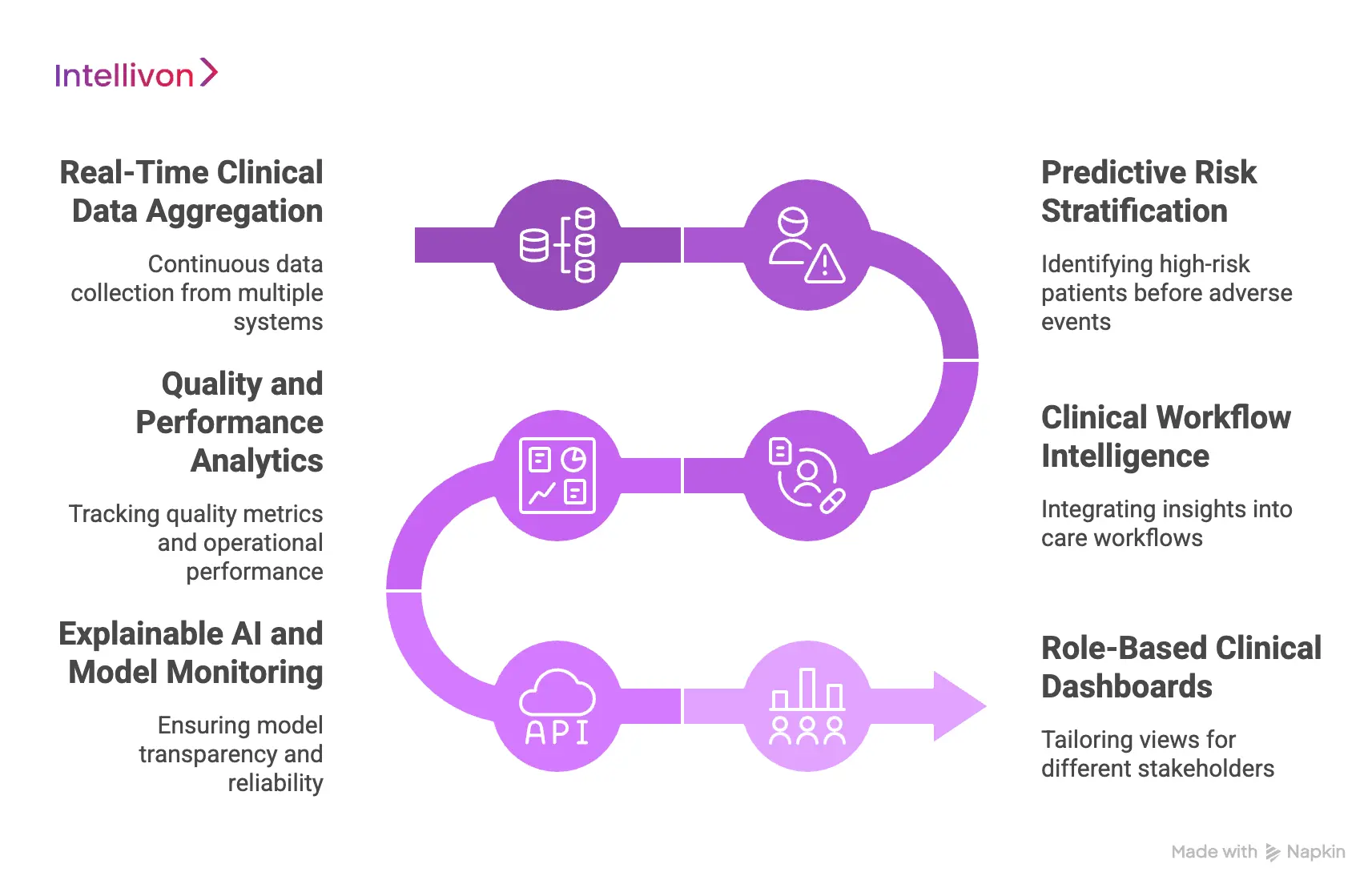

Enterprise clinical intelligence platforms combine real-time data aggregation, predictive analytics, and workflow intelligence to turn clinical data into governed, actionable decisions at scale.

After reviewing clinical software cost, most leaders ask a practical question: What exactly does the investment deliver? At the enterprise level, clinical intelligence platforms go far beyond dashboards.

They unify fragmented data, surface risk early, and deliver insight directly into care workflows. The features below represent the capabilities that typically drive measurable operational and clinical impact.

1. Real-Time Clinical Data Aggregation

Enterprise platforms must continuously collect and normalize data from multiple clinical systems. This includes EHRs, laboratories, imaging platforms, and operational sources. Real-time aggregation ensures that care teams work with current, reliable information rather than delayed reports.

Why it matters

- Enables timely clinical and operational decisions

- Reduces manual data reconciliation across systems

- Supports network-wide visibility

2. Predictive Risk Stratification

Predictive risk stratification helps organizations identify high-risk patients before adverse events occur. Models analyze longitudinal data, utilization patterns, and clinical indicators to surface early warning signals. Therefore, care teams can prioritize outreach and interventions more effectively.

Why it matters

- Supports proactive population health programs

- Improves care management prioritization

- Helps reduce avoidable admissions and readmissions

3. Clinical Workflow Intelligence

Insight only delivers value when it fits naturally into clinical workflows. Workflow intelligence connects risk signals to real operational actions such as care manager tasks, discharge planning, or escalation alerts. As a result, organizations move from passive reporting to active intervention.

Why it matters

- Improves clinician adoption and trust

- Reduces alert fatigue when properly governed

- Accelerates response to high-risk situations

4. Quality and Performance Analytics

Enterprise leaders require consistent visibility into quality metrics and operational performance. Clinical intelligence platforms track measures across departments and facilities, which helps identify variation and improvement opportunities. In addition, benchmarking supports more informed strategic decisions.

Why it matters

- Strengthens quality reporting accuracy

- Highlights performance variation across sites

- Supports value-based care initiatives

5. Explainable AI and Model Monitoring

As predictive models expand, explainability becomes essential. Enterprise platforms must show why a risk score was generated and how models perform over time. Continuous monitoring helps detect model drift, bias, or performance degradation before it affects care decisions.

Why it matters

- Builds clinical and regulatory trust

- Supports audit readiness and compliance

- Maintains long-term model reliability

6. Role-Based Clinical Dashboards

Different stakeholders require different views of the same intelligence layer. Role-based dashboards tailor visibility for clinicians, care managers, and operational leaders. This targeted design improves usability while maintaining governance controls.

Why it matters

- Delivers relevant insight to each user group

- Reduces information overload

- Improves enterprise adoption rates

Understanding these core capabilities makes it easier to evaluate where implementation costs originate and how platforms scale across large provider networks.

Clinical Intelligence Software Use Cases Across Healthcare

Clinical intelligence software supports early risk detection, throughput optimization, and value-based care. These use cases turn clinical data into measurable operational and financial outcomes.

Clinical intelligence platforms deliver the most value when tied to clear operational goals. Across large provider environments, the same patterns appear repeatedly.

Organizations want earlier risk visibility, smoother patient flow, stronger revenue protection, and better population outcomes. The use cases below show where enterprise teams typically see the fastest return.

1. Early Risk Detection and Deterioration Monitoring

Health systems increasingly use clinical intelligence to identify patient decline before it becomes critical. These platforms continuously monitor vitals, lab trends, and clinical documentation to surface early warning signals. As a result, care teams can intervene sooner and reduce adverse events.

Common focus areas

- Sepsis and clinical deterioration alerts

- Rapid response team activation support

- ICU transfer risk identification

- Nursing surveillance dashboards

Enterprise impact

- Faster clinical intervention

- Improved patient safety metrics

- Reduced emergency escalations

2. Length of Stay and Throughput Optimization

Length of stay remains one of the most sensitive cost levers in hospital operations. Clinical intelligence software helps teams predict discharge readiness and remove bottlenecks that slow patient flow. Therefore, organizations gain better control over bed utilization and capacity planning.

Common focus areas

- Discharge readiness prediction

- Bed and unit flow visibility

- Case management prioritization

- Transfer coordination signals

Enterprise impact

- Lower average length of stay

- Improved bed turnover

- Better capacity management during surges

3. Readmission Risk Prediction

Reducing avoidable readmissions continues to be a major priority for health systems. Clinical intelligence platforms analyze longitudinal patient data to identify individuals at higher risk after discharge. Care managers can then focus outreach where it matters most.

Common focus areas

- 30-day readmission risk scoring

- Post-discharge follow-up prioritization

- Medication and care gap signals

- Social risk overlays

Enterprise impact

- Lower readmission penalties

- More efficient care management programs

- Stronger performance in value-based contracts

4. Revenue Integrity and Coding Intelligence

Clinical intelligence is increasingly used to protect revenue and improve documentation accuracy. By analyzing clinical notes and coding patterns, the platform flags gaps that may affect reimbursement or quality reporting. In addition, it helps organizations reduce denial exposure.

Common focus areas

- Clinical documentation improvement signals

- Coding completeness checks

- Medical necessity risk alerts

- Denial risk prediction

Enterprise impact

- Improved revenue capture

- Reduced claims rework

- Better alignment between clinical and financial data

5. Population Health and Value-Based Care

As value-based models expand, organizations need stronger visibility into attributed populations. Clinical intelligence platforms aggregate longitudinal data and highlight care gaps across large cohorts. This allows teams to prioritize outreach and manage chronic conditions more proactively.

Common focus areas

- Risk stratification across populations

- Care gap identification

- Chronic disease cohort management

- Quality measure tracking

Enterprise impact

- Better performance in risk contracts

- More targeted care interventions

- Improved population outcomes

6. Clinical Operations Command Centers

Large health systems are investing in command center models to manage operations in real time. Clinical intelligence software feeds these centers with live data across facilities, departments, and patient flows. Consequently, leaders gain a system-wide view of capacity and risk.

Common focus areas

- Real-time census monitoring

- Transfer and bed coordination

- ED boarding visibility

- Network throughput dashboards

Enterprise impact

- Faster operational decisions

- Reduced bottlenecks across facilities

- Stronger system-wide situational awareness

With these use cases in mind, the next step is understanding the key cost components that shape enterprise clinical intelligence investments.

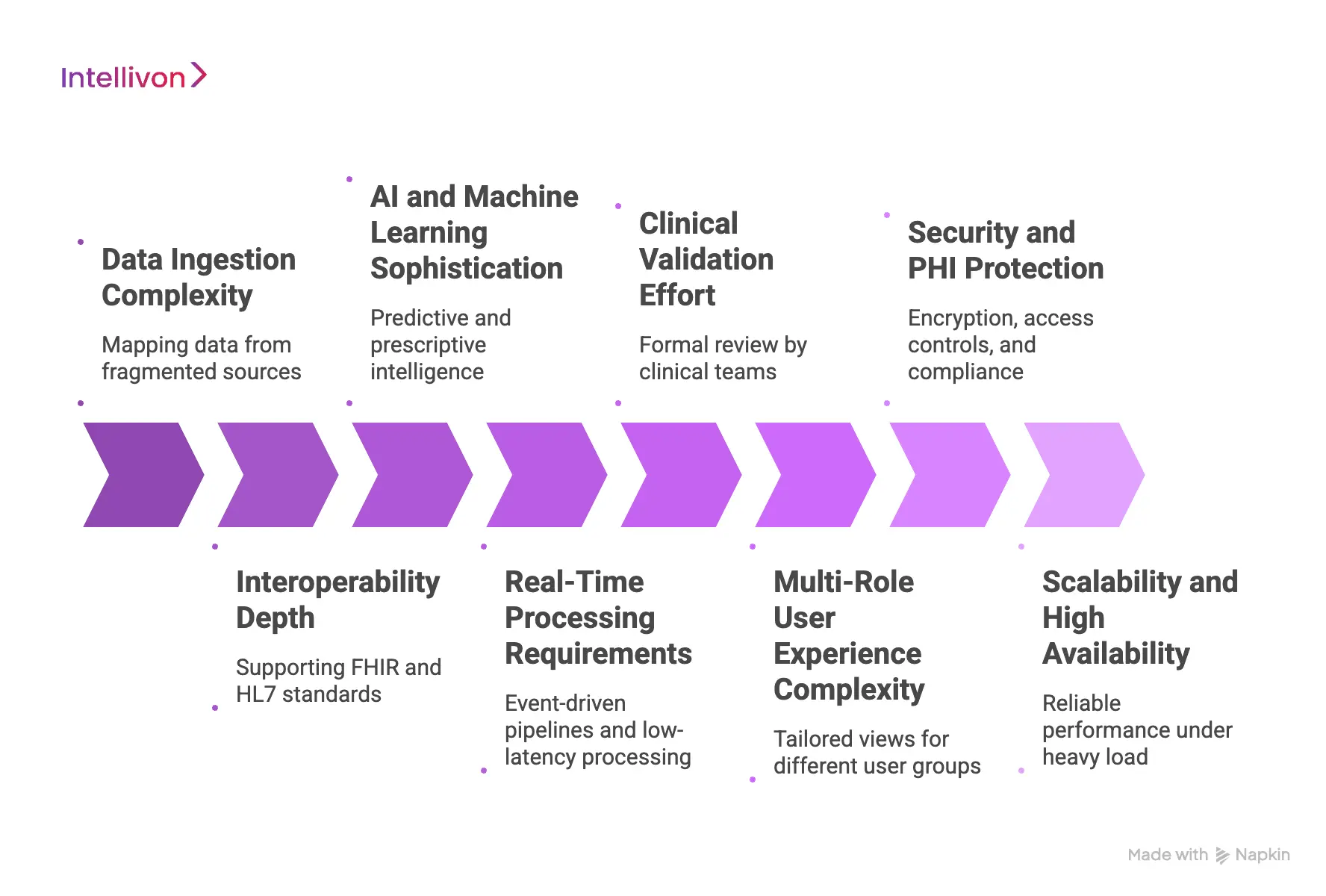

What Impacts Clinical Intelligence Software Development Cost the Most?

Clinical software cost rises fastest when platforms require deep interoperability, real-time processing, and governed AI. Scope and validation demands drive most enterprise spending.

The clinical software cost for enterprise intelligence platforms depends less on basic development and more on architectural depth. As organizations move from simple analytics to real-time, governed intelligence, both build effort and long-term operating costs increase.

Therefore, leaders should evaluate the drivers below before finalizing budgets. These factors consistently shape the true investment required for enterprise-grade deployments.

1. Data Ingestion Complexity

Clinical intelligence platforms must pull data from many fragmented sources. These often include EHRs, labs, imaging systems, and operational tools. Each new source introduces mapping work, data quality checks, and pipeline maintenance. Consequently, ingestion complexity can expand faster than expected.

Organizations with cleaner data environments usually control costs more effectively. However, highly fragmented ecosystems require more engineering effort and ongoing monitoring.

2. Interoperability Depth

Interoperability remains one of the largest cost drivers in healthcare software projects. Supporting FHIR and HL7 standards is only the starting point. True enterprise integration requires deep EHR connectivity, cross-system normalization, and reliable data exchange across facilities.

As integration depth increases, testing, interface management, and maintenance overhead also grow. Therefore, multi-EHR environments typically see higher clinical software costs than single-system deployments.

3. AI and Machine Learning Sophistication

Predictive and prescriptive intelligence adds another layer of complexity. Basic risk scoring models are relatively manageable. However, advanced AI programs require feature engineering, model training pipelines, and continuous performance monitoring.

In addition, explainability and bias review are now expected in many environments. These requirements increase both development time and governance effort.

4. Real-Time Processing Requirements

Real-time clinical intelligence demands a very different architecture from batch reporting systems. Event-driven pipelines, low-latency processing, and high-availability infrastructure all increase engineering scope. As a result, platforms that must support live clinical workflows carry higher build and cloud costs.

Not every use case requires full real-time capability. However, when organizations demand it, the cost curve rises quickly.

5. Clinical Validation Effort

Healthcare platforms operate under stricter validation expectations than typical enterprise software. Predictive models and clinical signals often require formal review by clinical teams. In many cases, organizations must document safety checks, testing protocols, and ongoing performance monitoring.

This validation work extends timelines and introduces additional governance overhead. Therefore, it is a major contributor to overall clinical software cost.

6. Multi-Role User Experience Complexity

Enterprise clinical intelligence platforms serve many user groups. Clinicians, care managers, analysts, and executives all require tailored views. Designing role-based dashboards and workflow integrations increases both product and design effort.

In addition, usability testing becomes more involved because workflows must align with real clinical practice. Poor UX design often leads to rework, which further increases costs.

7. Security and PHI Protection

Security requirements in healthcare are non-negotiable. Platforms must protect sensitive patient data while maintaining usability and performance. This includes encryption, access controls, audit logging, and compliance with HIPAA and related standards.

Building security into the architecture from the beginning is essential. However, these controls add both development and ongoing operational expense.

8. Scalability and High Availability

Enterprise buyers expect platforms to perform reliably under heavy load. Supporting multi-facility environments requires scalable infrastructure, failover planning, and continuous monitoring. High availability design also increases testing and DevOps complexity.

Organizations that underestimate scalability requirements often face expensive retrofits later. Therefore, planning for growth early usually reduces long-term clinical software cost.

Clinical intelligence software development cost is shaped primarily by integration depth, real-time expectations, and governance requirements. Organizations that evaluate these drivers early can scope more accurately and avoid costly surprises as the platform scales.

Phase-Wise Cost to Build Clinical Intelligence Software

Clinical intelligence budgets are split across discovery, data pipelines, intelligence logic, integration, and validation. The largest spend usually sits in interoperability and clinical testing.

Clinical intelligence software rarely succeeds as a single “build and launch” project. Instead, costs stack across phases that reduce risk and protect adoption. Therefore, it helps to view the budget as a phased investment tied to clear deliverables.

The table below shows a practical enterprise allocation pattern. These ranges assume a total clinical software cost of $90,000 to $650,000+, so you can scale them up or down.

Estimated Phase-Wise Budget Allocation

| Phase | % Budget | Cost Range | What It Covers |

| Discovery & clinical alignment | 8% | $7k–$52k | Use case selection, workflow mapping, stakeholder alignment, success metrics, governance approach, implementation plan |

| Data engineering & pipelines | 16% | $14k–$104k | Source assessment, ingestion pipelines, data quality rules, terminology mapping, identity basics, batch or streaming setup |

| Core intelligence engine | 14% | $13k–$91k | Cohort logic, rule engine, scoring framework, event definitions, alert routing foundations, configuration tooling |

| AI/model development | 14% | $13k–$91k | Feature engineering, model training, calibration, explainability approach, monitoring hooks, drift, and performance baselines |

| Integration layer | 18% | $16k–$117k | FHIR and HL7 interfaces, EHR integration, cross-system normalization, workflow triggers, API gateway patterns |

| Testing & clinical validation | 16% | $14k–$104k | Test planning, safety checks, model validation, audit trails, performance testing, and clinician review cycles |

| Deployment | 14% | $13k–$91k | Cloud or hybrid setup, security hardening, CI/CD, observability, rollout support, training readiness |

Integration and validation usually consume the largest share because they require specialized work and careful clinical oversight. In addition, data engineering remains a major cost center because it determines accuracy and trust.

A realistic budget plan spreads cost across discovery, data engineering, integration, and clinical validation. When you fund these phases intentionally, you reduce risk and protect outcomes. Therefore, the investment becomes predictable, scalable, and easier to defend internally.

Clinical Intelligence Software ROI: When Do Hospitals See Returns?

Most hospitals begin to see measurable ROI from clinical intelligence software within 6 to 18 months. Impact depends on workflow adoption, data readiness, and targeted use cases.

After reviewing the clinical software cost, the next question is timing. Enterprise leaders want to know when the investment starts paying back.

In most large provider environments, meaningful returns appear within 6 to 18 months of a well-scoped deployment. However, the timeline varies based on data maturity, clinical adoption, and the initial use case selected. Therefore, organizations that align the platform with high-impact workflows tend to see faster financial and operational gains.

Early Wins: First 3 to 6 Months

The first phase of ROI usually comes from operational visibility and workflow improvements. Even before advanced AI matures, hospitals often identify inefficiencies that were previously hidden.

Typical early gains

- Improved care manager prioritization

- Better discharge visibility

- Reduction in manual reporting effort

- Faster identification of high-risk patients

These improvements may not immediately transform the balance sheet. However, they build internal confidence and support broader rollout decisions.

Measurable Impact: 6 to 12 Months

By the six-month mark, organizations that achieve strong clinical adoption begin to see quantifiable performance improvements. At this stage, predictive models and workflow intelligence start influencing real outcomes.

Common ROI signals

- Reduction in avoidable readmissions

- Shorter average length of stay

- Improved bed utilization

- Fewer documentation gaps affecting reimbursement

Because these metrics tie directly to cost and revenue, executive teams usually view this window as the first meaningful return period.

Strategic Returns: 12 to 18 Months

The most significant value typically appears once the platform scales across departments or facilities. At this point, the organization moves from isolated improvements to system-level optimization.

Enterprise-level impact

- Network-wide throughput gains

- Stronger performance in value-based contracts

- Reduced variation across facilities

- More predictable operational planning

In addition, mature deployments often unlock secondary benefits such as better clinician satisfaction and stronger governance visibility.

What Accelerates ROI

Hospitals that see faster returns usually share several characteristics. They start with focused use cases and align the platform tightly to real workflows. In addition, they invest early in data quality and clinical governance.

Key accelerators

- Clear executive sponsorship

- High-quality, accessible data sources

- Workflow-embedded intelligence delivery

- Strong clinical validation and trust

- Phased rollout with measurable milestones

Clinical intelligence software delivers the fastest returns when tied to operational workflows rather than standalone analytics. With disciplined execution, most hospitals begin seeing measurable impact within the first year, and enterprise-scale value follows soon after.

Hidden Costs in Clinical Intelligence Platforms

Hidden expenses in clinical intelligence platforms often emerge after launch. Data quality work, ongoing integrations, and governance overhead can significantly increase total clinical software cost.

Many organizations budget carefully for initial development, yet overlook the secondary expenses that appear during scale and operations. These hidden costs rarely show up in early proposals. However, they often determine the true long-term clinical software cost.

Therefore, leadership teams should evaluate the areas below before finalizing investment assumptions.

Common Hidden Cost Areas

| Hidden Cost Area | Why It Appears | Approx Annual Cost Impact |

| Data quality remediation | Inconsistent or incomplete source data requires ongoing cleanup | $15k–$60k |

| Interface maintenance | EHR and partner interfaces require continuous updates and monitoring | $20k–$80k |

| Model monitoring and retraining | Predictive models drift and require periodic tuning | $25k–$90k |

| Clinical validation cycles | New use cases require clinician review and safety checks | $15k–$50k |

| User training and adoption support | New staff and workflows require ongoing enablement | $10k–$40k |

| Cloud and infrastructure overages | Real-time workloads often exceed initial estimates | $20k–$100k |

| Security and compliance updates | Evolving regulations require periodic controls review | $10k–$35k |

| Reporting and measuring changes | Quality programs and metrics evolve frequently | $8k–$30k |

What This Means

Most of these costs do not appear during the initial build phase. Instead, they accumulate gradually as the platform expands across departments and facilities. Therefore, organizations that plan for them early usually avoid budget surprises later.

Hidden costs in clinical intelligence platforms rarely come from a single source. Instead, they build gradually through data work, integrations, governance, and scale. Organizations that plan for these realities early are far more likely to protect long-term ROI.

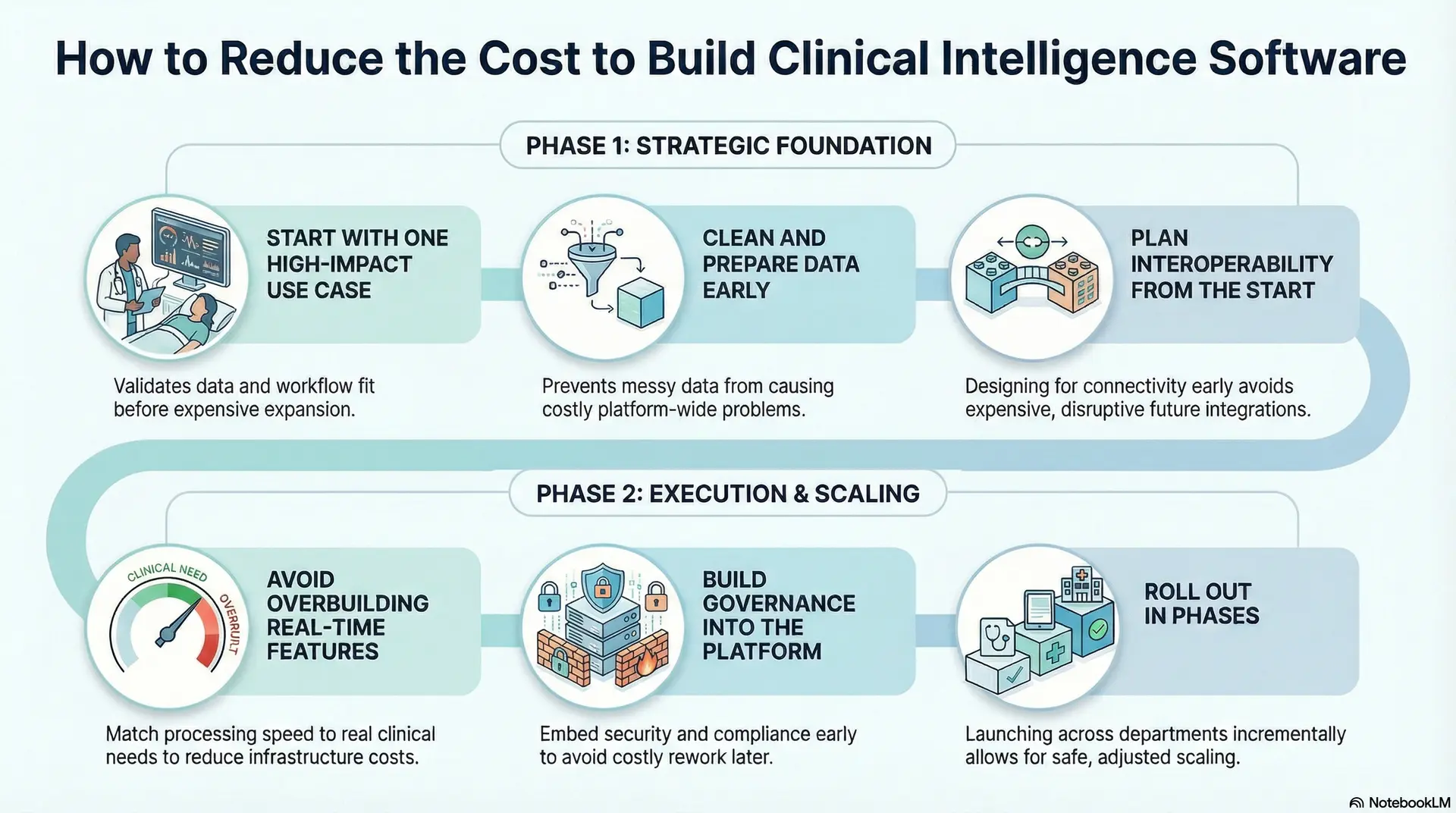

How to Reduce the Cost to Build Clinical Intelligence Software

You can lower clinical software cost by starting small, cleaning your data early, and planning for scale from the beginning. Smart choices prevent expensive rework later.

The cost to build clinical intelligence software can rise quickly if the scope grows too fast. However, many organizations control spending by taking a structured and practical approach. The goal is not to remove important capabilities. Instead, it is to invest carefully and avoid waste. When teams plan well, they often see faster results with lower long-term cost.

Below are proven ways to keep enterprise spending under control.

1. Start With One High-Impact Use Case

Projects become expensive when teams try to solve everything at once. A focused starting point helps validate the data, workflow fit, and user adoption. In addition, early success builds confidence for future expansion.

Good places to start

- Readmission risk programs

- Discharge readiness signals

- Care management prioritization

- Command center visibility

Organizations that phase their rollout usually manage clinical software costs more effectively.

2. Clean and Prepare Data Early

Messy data creates problems across the entire platform. Therefore, it is smart to invest early in data cleanup and standardization. Clean pipelines also improve model accuracy and user trust.

Practical steps

- Review data quality before building models

- Standardize clinical terminology

- Fix major patient identity gaps

- Set up ongoing data quality checks

Teams that skip this step often pay more later.

3. Plan Interoperability From the Start

Adding integrations later is expensive and disruptive. Instead, design the platform to support standards-based connectivity from the beginning. This makes future expansion easier and cheaper.

Cost-saving practices

- Use FHIR where it fits the use case

- Build reusable integration components

- Normalize data in a central layer

- Expect multi-EHR environments

Good integration planning protects long-term clinical software costs.

4. Avoid Overbuilding Real-Time Features

Not every feature needs instant processing. Some workflows work well with near-real-time or scheduled updates. Therefore, match speed requirements to real clinical needs before investing in expensive infrastructure.

Evaluate carefully

- Batch versus streaming pipelines

- Alert urgency requirements

- Dashboard refresh needs

- Cloud sizing assumptions

This step alone can reduce infrastructure costs significantly.

5. Build Governance Into the Platform

Adding security and compliance later often leads to rework. Instead, embed access controls, audit logs, and model oversight from the start. This approach keeps the platform safer and easier to manage.

Key moves

- Role-based access controls

- Built-in audit logging

- Explainable AI outputs

- Continuous model monitoring

Strong governance early helps avoid costly fixes later.

6. Roll Out in Phases

Launching across the entire enterprise at once increases risk and cost. A phased rollout allows teams to learn, adjust, and scale safely. In addition, it spreads investment over time.

Recommended path

- Start with one department

- Expand across departments

- Scale to multiple facilities

- Move to full enterprise intelligence

This approach keeps clinical software costs aligned with real value.

Reducing clinical intelligence software cost is about smart planning, not cutting corners. Organizations that start focused, prepare their data, and design for growth usually achieve better results with fewer surprises.

Conclusion

Clinical intelligence is no longer just about static dashboards. Enterprise platforms need to provide real-time insights, reliable automation, and guided decision support across the care network. As a result, the actual cost of clinical software depends on how well it integrates with other systems, how ready the data is, the effort needed for validation, and its ability to scale, and not just the number of features.

Organizations that view clinical intelligence as essential infrastructure typically see stronger and more reliable returns. On the other hand, short-term solutions can lead to costly rework later. A focus on architecture maintains platform stability as data volume and workflow demands increase.

With the right foundation, clinical intelligence can drive measurable growth. Intellivon assists healthcare organizations in creating and expanding enterprise-level AI platforms that provide lasting operational and clinical benefits.

Build Clinical Intelligence Software With Intellivon

At Intellivon, clinical intelligence software is built as a governed decision infrastructure, not as analytics layered onto disconnected systems. Every architectural and delivery decision focuses on data integrity, workflow alignment, and real-time reliability across complex care environments.

As enterprise healthcare ecosystems grow, consistency becomes critical. Governance, performance, and audit visibility remain stable even as data volume, predictive models, and system integrations expand. Therefore, organizations retain control over clinical decisions while improving operational and financial performance at scale.

Why Partner With Intellivon?

- Enterprise-grade clinical intelligence architecture designed for regulated healthcare ecosystems

- Proven delivery across hospitals, multi-site health systems, and digital health platforms

- Compliance-by-design approach with embedded governance and audit readiness

- Secure modular infrastructure supporting cloud, hybrid, and on-prem deployments

- AI-enabled risk detection, workflow intelligence, and performance monitoring with strong oversight controls

Book a strategy call to explore how Intellivon can help you design and scale clinical intelligence software with confidence, control, and long-term enterprise value.

FAQs

Q1. What is clinical intelligence software in healthcare?

A1. Clinical intelligence software helps healthcare organizations turn clinical and operational data into actionable insight. It connects EHR data, risk models, and workflow signals so care teams can make faster and more informed decisions. Unlike basic analytics tools, it supports real-time monitoring, risk detection, and performance tracking across the care network.

Q2. How much does clinical intelligence software cost to build?

A2. The clinical software cost typically ranges from $90,000 to $650,000 or more in enterprise environments. The final investment depends on integration depth, real-time requirements, AI complexity, and the number of facilities involved. Organizations with multi-EHR environments and advanced predictive needs usually fall toward the higher end of the range.

Q3. How long does it take to implement clinical intelligence software?

A3. Most focused deployments take about 4 to 8 months to reach initial production. However, full enterprise rollouts across multiple hospitals can take 9 to 18 months. Timelines depend on data readiness, integration complexity, and how quickly clinical teams adopt the new workflows.

Q4. What data sources are required for a clinical intelligence platform?

A4. A typical platform pulls data from EHR systems, laboratories, imaging platforms, and care management tools. Many organizations also include claims data and social risk indicators. The more complete the data foundation, the more accurate and useful the intelligence signals become.

Q5. How do large health systems ensure clinician adoption?

A5. Successful organizations focus on workflow alignment rather than standalone dashboards. They embed intelligence directly into care manager queues, EHR workflows, and operational views. In addition, they validate signals with clinical teams early and monitor alert performance continuously. This approach builds trust and improves long-term adoption.