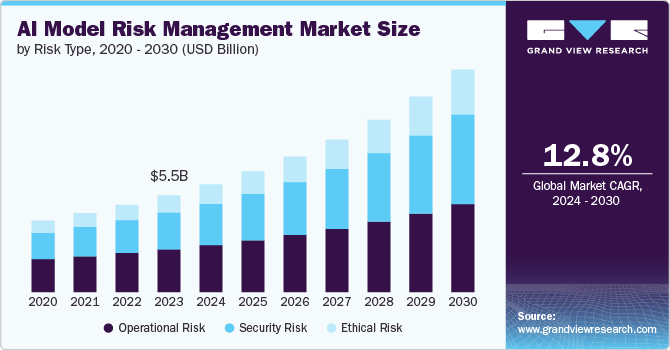

Financial enterprises are entering a period dominated by fast-changing rules, more cyber threats, and a more complex dynamic market. Traditional standardized risk management tools no longer fit the problems. Rather, AI-powered custom risk tools tailored to fit unique enterprise operations are constantly being adopted by leading organizations.

In March 2023, the Silicon Valley Bank announced a $1.8 billion loss on the sale of bond holdings and plans to raise additional capital. The cause? Poor financial risk management. Yet, 60% of financial enterprises are still primarily relying on traditional risk tools for risk management, which were designed for yesterday’s problems.

This is where AI is reshaping the financial risk landscape when integrated with custom risk tools. AI is not just accelerating the detection of risk but redefining how institutions anticipate, quantify, and respond to it. The question is no longer whether to adopt AI in finance, but whether your current systems are agile enough to withstand what’s coming next.

In this blog, we will cover how AI-powered custom risk tools are addressing these anomalies, our approach to building and implementing risk tools for your financial needs, and some emerging trends in this area. Intellivon’s AI experts create custom solutions to meet your enterprise risk management needs.

The Right Time To Use AI Custom Risk Tools For Financial Enterprises

Numbers that suggest that AI-powered custom risk tools are driving the future of financial enterprises:

- More than 60% of financial institutions have already integrated AI into their operations by early 2025, with common uses like fraud detection, credit risk assessment, and risk management support.

- 91% of U.S. banks use AI for fraud detection, demonstrating AI’s effectiveness in real-time threat identification and prevention

As financial enterprises swiftly adopt AI-driven custom risk tools, this might be the right time for your enterprise to invest in the right risk management partner. With over 11 years of expertise, Intellivon pioneers AI-driven risk management solutions, leveraging advanced technologies like ML, anomaly detection, and predictive modeling to build custom tools that help financial enterprises proactively manage evolving risks.

Understanding the Financial Risk Landscape in 2025

The financial world in 2025 is fast, unpredictable, and highly connected. For large enterprises, this creates a serious challenge. Risks can appear suddenly, from many directions, and old systems are struggling to keep up.

Many financial institutions still depend on traditional tools to manage risk. These systems were built for a slower time and often cannot handle the volume, speed, or variety of today’s data. As a result, some of the biggest risks go undetected until it is too late.

The Types of Risks Financial Enterprises Face Today

Enterprise-level risk is not limited to the stock market or interest rates. It now includes several other major areas:

1. Market Risk

Changes in stock prices, interest rates, or currency values can impact financial operations instantly. With the rise of automated trading, markets move faster than ever, and it’s harder to predict those shifts using old methods.

2. Credit Risk

This happens when borrowers or customers fail to pay what they owe. Traditional credit checks often miss warning signs that more advanced tools could catch earlier.

3. Operational Risk

Mistakes, system errors, or process failures inside the company can disrupt services. As more work moves online, problems with technology or third-party vendors can cause serious delays or losses.

4. Cyber Risk

Hacking, fraud, and data breaches have become regular threats. As technology grows more complex, so do the methods used by attackers. Standard IT tools often fall short of stopping these advanced risks.

Speed and Complexity Are the Biggest Challenges

Financial institutions collect a huge amount of information every day. But having data is not the same as understanding it. Most legacy systems cannot process live updates or make quick decisions. They rely on fixed rules and historical patterns, which no longer reflect today’s fast-changing environment.

Lessons from the Failure of Older Risk Models

One example is the Value-at-Risk (VaR) model, which many firms used to estimate how much they could lose on investments. During the 2020 market crash, this model failed to give accurate warnings. It could not handle the unusual and sudden changes brought on by the global crisis. This led to large losses for some institutions that had trusted it too heavily.

Why a New Approach to Risk Is Urgently Needed

The world has changed, but many financial risk tools have not. Companies that continue to rely on outdated systems are putting themselves at risk. What is needed now are smarter, faster, and more flexible solutions that can keep up with the pace of modern finance.

Why Custom Risk Tools Outperform Traditional Solutions

AI-powered custom risk tools offer a more targeted, responsive, and secure foundation for enterprise risk strategy. Built specifically for each organization’s operations and environment, these solutions provide measurable benefits that go far beyond what standardized platforms can offer.

1. Built To Fit Your Enterprise Issues

AI-powered custom risk tools are tailored to match the exact structure and workflow of a business. Whether an institution operates across multiple jurisdictions or serves niche asset classes, a customized platform allows risk models to reflect these specifics. This avoids the need for process adjustments that often come with generic systems.

For example, a global bank can embed its proprietary scoring methods, connect directly with its internal data architecture, and build real-time reporting dashboards without having to reshape operations to fit someone else’s model.

This level of precision ensures the institution gets exactly what it needs from its risk management system.

2. Strengthening Security and Supporting Compliance

Financial institutions operate under strict and evolving regulatory expectations. Custom risk tools can be designed with compliance rules woven directly into their structure. This includes region-specific mandates such as AML, KYC, or GDPR, which often require unique workflows and automated controls.

Take the case of a fintech firm that builds its own risk engine. It can program the tool to flag suspicious behavior in real time, trigger internal alerts, and generate audit-ready reports automatically. This not only streamlines compliance efforts but also significantly reduces risk exposure

3. Ready to Scale with Your Enterprise

Off-the-shelf solutions often require costly upgrades, custom plug-ins, or third-party integrations when an enterprise grows or shifts direction. Custom tools are designed to scale without these limitations.

For instance, if a payment processor expands operations into multiple new regions, its custom risk system can quickly be updated to include country-specific rules, thresholds, and risk indicators. The same system can support new product lines or services without needing to be rebuilt from scratch.

4. Innovation Becomes a Competitive Advantage

Custom risk tools enable organizations to build intelligence that is not available anywhere else. By designing their own algorithms or combining data in new ways, financial enterprises can surface insights competitors are unable to match.

An investment firm, for example, might develop a proprietary AI-based analytics platform that reacts to non-traditional market signals, such as social sentiment or supply chain disruptions to make risk decisions before public models detect them.

5. Clean Integration with Existing Legacy System

Rather than forcing a business to reconfigure its systems, custom tools can be built to connect directly with existing architecture. This includes ERP systems, customer databases, core banking platforms, or trading interfaces.

A large insurance provider, for example, could link its risk assessment engine with claims data, policyholder profiles, and call center interactions. This allows for real-time risk scoring during customer engagements, reducing friction and improving service accuracy.

A Real-World Example: Stripe’s Bespoke Fraud Engine

Stripe, a global leader in online payments, developed its own fraud detection platform to address the specific challenges of large-scale digital transactions.

Rather than relying on third-party fraud tools, Stripe designed a system that adapts to changes in user behavior and detects threats using real-time intelligence.

This approach gave Stripe the flexibility to support rapid international growth while offering clients a higher level of protection than generic solutions could provide.

How AI Elevates Custom Risk Tools for Financial Enterprises

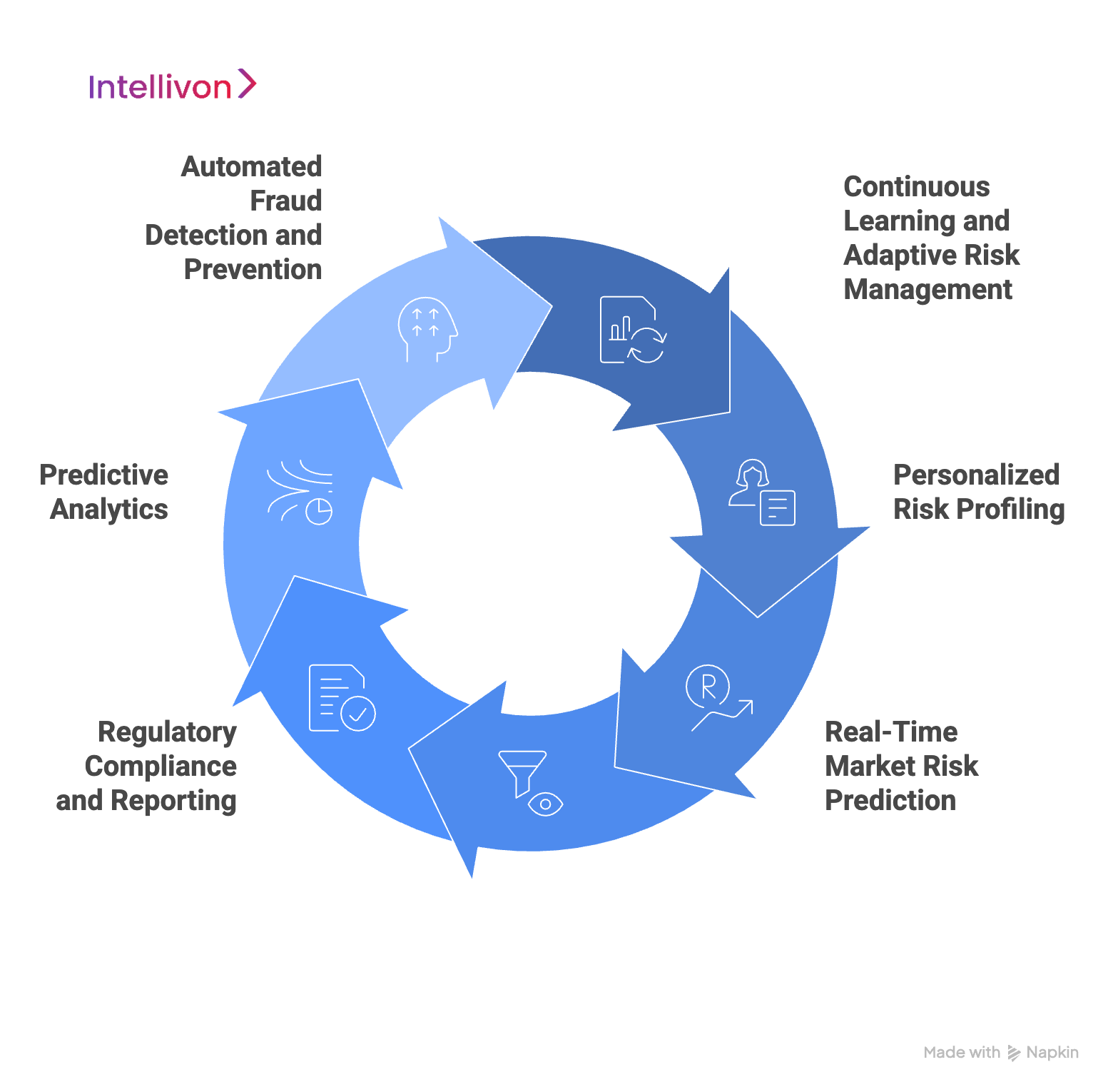

AI is powering a new generation of custom risk tools by enabling financial institutions to process data faster, adapt to change, and detect risk more accurately. These tools bring flexibility, precision, and speed to areas where legacy systems often fall short.

1. Personalized Risk Profiling

Modern financial enterprises are moving away from generalized client models. With AI, institutions can build detailed and adaptive risk profiles based on a wide range of data sources. These may include transaction patterns, communication history, online behavior, and even social sentiment.

This deeper understanding allows institutions to group clients by real behavioral patterns and investment preferences, rather than static demographics. Risk tolerance, for example, becomes a measurable, dynamic indicator rather than a guess based on income or age.

Example:

Platforms like ClientRisk Profiler use behavioral finance algorithms to analyze individual actions and preferences. This helps advisors offer investment strategies that match real client needs, not just industry assumptions.

2. Real-Time Market Risk Prediction

AI-driven custom risk tools are capable of scanning markets continuously and analyzing countless variables as they shift. By monitoring financial news, reports, sentiment analysis, and macroeconomic data feeds, these systems provide early warnings about potential downturns.

This enables enterprises to adjust strategies before market shocks impact portfolios. What once required days of manual analysis can now be done in minutes with high accuracy.

3. Automated Fraud Detection and Prevention

One of the most widely adopted applications of AI in finance is fraud detection. Machine learning models are especially skilled at finding subtle patterns and unusual behaviors across high-volume transactions. These tools establish behavioral baselines and then flag any actions that deviate from them.

Unlike rule-based systems, AI tools improve over time, adjusting to new fraud tactics without needing manual rule updates.

Example

Solutions such as Zest AI analyze how users typically interact with a platform, from login times to payment habits. When unexpected behavior occurs, the system can take immediate action, reducing risk exposure and reinforcing trust.

4. Regulatory Compliance and Reporting

Keeping up with evolving compliance standards is one of the biggest operational challenges in finance. AI reduces this burden by automating rule checks, document processing, and reporting workflows. This helps institutions stay compliant while reducing manual effort and the chance of errors.

Custom risk tools powered by AI can be programmed to reflect the specific regulatory frameworks an institution must follow, whether local or international.

Example

Arya.ai offers automated compliance solutions that handle large volumes of regulatory documents and identify gaps before they become problems. These systems help teams generate audit-ready reports faster and with fewer resources.

5. Predictive Analytics

AI models are capable of analyzing not only financial data but also behavioral and contextual information to evaluate credit and operational risks more precisely. This goes beyond traditional scoring and allows lenders and institutions to make better-informed decisions.

In operations, predictive models can help detect where breakdowns, inefficiencies, or delays may occur, well before they escalate.

6. Continuous Learning and Adaptive Risk Management

The financial environment is always evolving. New threats, market conditions, and consumer behaviors appear regularly. AI-powered custom risk tools that use adaptive algorithms and reinforcement learning can adjust as these changes occur, without manual reconfiguration. This ensures that risk assessments remain accurate over time and that institutions stay ahead of emerging threats rather than reacting to them after damage is done.

Example

The SuperAGI Risk Assessment Suite applies real-time feedback to fine-tune its predictions continuously. As more data becomes available, the system updates its models automatically, ensuring institutions are working with the most current information.

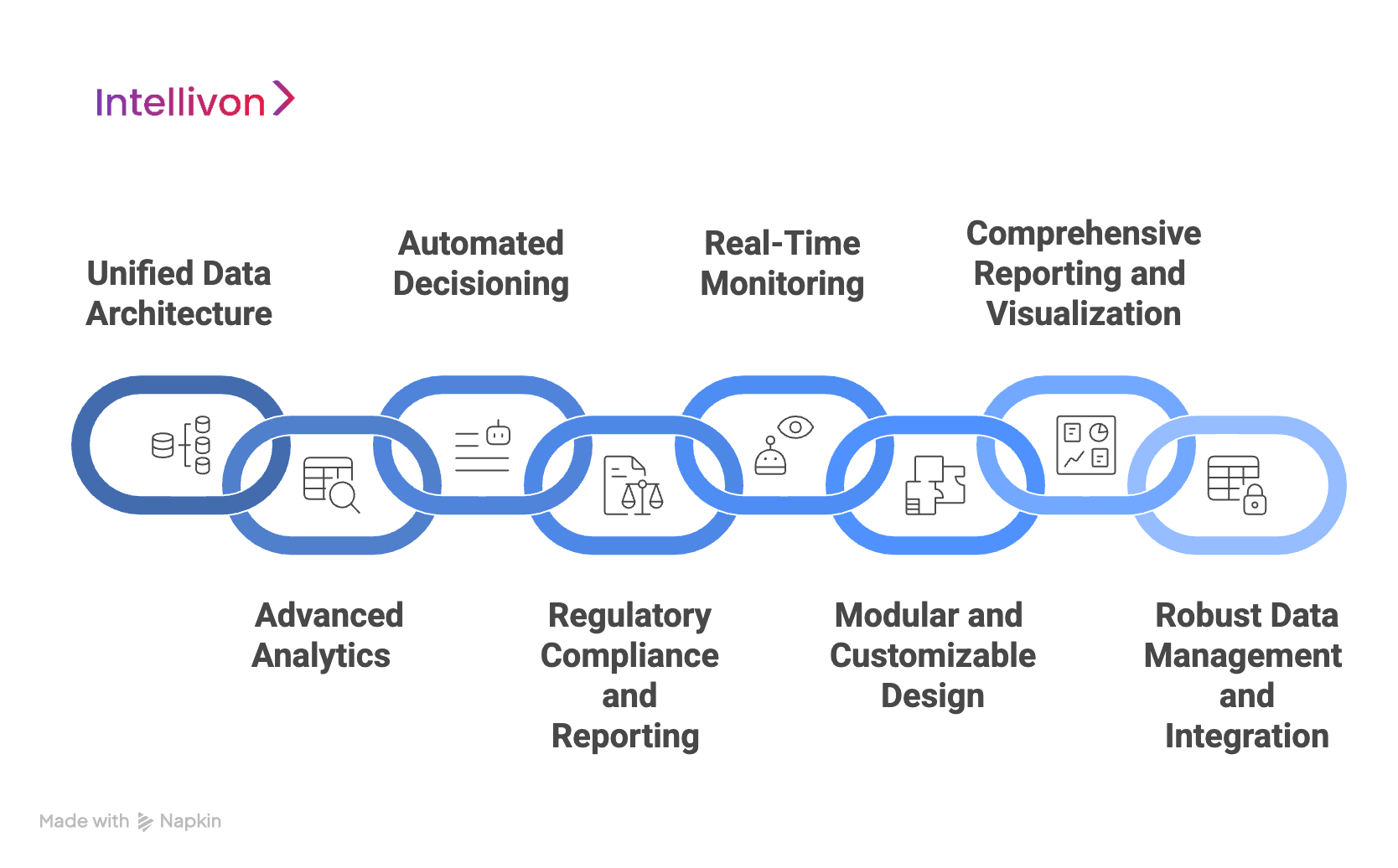

Core Features of Custom Risk Tools That Drive Enterprise Success

AI-powered custom risk tools go beyond reactive reporting and generic analysis. They offer a set of core capabilities that directly improve business outcomes, enhancing compliance, strengthening oversight, and preparing enterprises for uncertainty. From automating regulatory updates to real-time stress scenario modeling, these solutions help financial institutions reduce complexity while increasing agility.

1. Unified Data Architecture

AI-powered custom risk tools create a single, consistent view of risk across the organization, eliminating data silos and ensuring all teams have access to the same reliable information for decision-making.

Example: Platforms like FICO Enterprise Risk Suite integrate data from various departments, making risk assessments more accurate and operations more efficient.

2. Advanced Analytics

These tools use powerful analytics and data-driven models to assess risks like credit, market, and operations, enabling more precise, future-focused risk management.

Example: RiskMetrics by MSCI helps manage multi-asset risks and perform scenario analysis, providing reliable risk calculations such as Value at Risk (VaR) and Expected Shortfall.

3. Automated Decisioning

AI-driven custom risk tools automate processes like credit application handling, approvals, and risk scoring, reducing manual work, speeding up operations, and ensuring more consistency.

Example: Fiserv Risk Office automates credit decisions and flags potential risks early, helping to mitigate problems before they arise.

4. Regulatory Compliance and Reporting

Integrated compliance features streamline regulatory reporting and ensure adherence to changing standards across various jurisdictions.

Example: Platforms like FICO and Predict360 automate the monitoring and reporting for regulations such as Basel, IFRS 9, and CECL, reducing compliance challenges and costs.

5. Real-Time Monitoring

Custom risk tools continuously monitor portfolios and send real-time alerts about emerging risks, helping organizations react swiftly and prevent potential losses.

Example: Fiserv Risk Office’s early warning systems and predictive tools identify risks early, enabling timely intervention.

6. Modular and Customizable Design

These custom enterprise risk tools are flexible and can be tailored to meet the specific needs of each organization, allowing them to grow and adapt as the business evolves.

Example: Predict360’s modular design lets banks select only the features they need, with the option to add more as their requirements change.

7. Comprehensive Reporting and Visualization

These tools offer customizable dashboards and detailed reports, helping stakeholders easily understand risk exposures, trends, and performance at a glance.

Example: RiskMetrics provides customizable dashboards that allow organizations to communicate risk insights clearly to management and regulators.

8. Robust Data Management and Integration

AI-driven custom risk tools ensure data quality and easy integration with existing systems, supporting reliable analysis and seamless implementation.

Example: FICO Enterprise Risk Suite integrates well with core systems like Oracle, making data management more efficient and reliable.

Modular AI Suite Built To Handle Financial Enterprise Risks

The best AI-powered custom risk suite should represent a strategic shift from reactive reporting to forward-looking enterprise risk intelligence. Designed to meet the growing complexity of financial systems, it should combine AI, real-time analytics, and seamless system integration into one unified architecture.

As financial institutions face interconnected global markets, evolving regulations, and heightened risk volatility, traditional siloed systems no longer suffice. Intellivon’s custom AI risk modular suite responds to this shift, preparing institutions for dynamic risk profiles, continuous regulatory updates, and unpredictable market conditions.

Modular Intelligence Built for Financial Scale

At the heart of our platform is a modular design that provides flexibility, speed, and control across all areas of enterprise risk management. Each module functions independently, but all are built to work together through a shared data model and unified analytics layer.

1. RiskSignal AI: Intelligent Risk Detection

This module acts as the platform’s central intelligence system. It processes more than ten billion data points daily, using advanced machine learning to identify patterns across credit, market, operational, liquidity, and concentration risks.

Features include:

- Real-time risk detection with sub-second latency

- Behavioral analysis across client transactions and trading activity

- Correlation mapping across asset classes

- Predictive scoring powered by internal and external data, including geopolitical and cyber risk feeds

RiskSignal AI helps institutions move beyond static dashboards by providing ongoing insights that evolve with market dynamics.

2. ComplianceBot: Automation for Global Regulatory Excellence

ComplianceBot turns regulatory adherence into a proactive, automated process. Using natural language processing, the system reads and interprets updates from regulators across more than fifty jurisdictions.

Features include:

- Automatic conversion of new regulations into business rules

- Adaptive controls based on evolving risk environments

- Auto-generation of compliance documentation and audit reports

- Support for variance tracking and submission accuracy

This enables compliance teams to stay ahead of regulations without manually rewriting policy workflows or rebuilding systems.

3. StressTest Pro: Advanced Scenario Modeling Engine

This module brings AI into one of the most critical aspects of risk planning: stress testing. Institutions can simulate future scenarios that reflect real-world volatility, not outdated assumptions.

Features include:

- AI-powered scenario generation based on current market indicators

- Reverse stress testing to expose critical vulnerabilities

- Monte Carlo simulations and dynamic tail-risk modeling

- Automated support for Basel III, CCAR, IFRS 9, and resolution planning

The result is faster preparation for unexpected downturns and stronger institutional resilience.

Flexible, Scalable, and Built for Enterprise Architecture

Our modular architecture allows institutions to deploy modules individually or as a complete system. Each implementation can be customized by region, business unit, or regulatory scope. Organizations can scale gradually, starting with a single module, such as RiskSignal AI, and adding others as needs evolve.

1. Real-Time Adaptability and Continuous Learning

The platform is designed to learn and adapt automatically. With built-in data ingestion, feature engineering, model training, and deployment, it updates in real time.

Features include:

- Drift detection and automatic model recalibration

- Reinforcement and ensemble learning for better prediction accuracy

- Transfer learning across similar risk environments

- Regulatory intelligence feeds from global authorities and peer institutions

This continuous learning framework ensures that risk models stay relevant, even as external conditions change.

2. Seamless Integration with Modern and Legacy Systems

The platform offers a full range of integration options using RESTful APIs and GraphQL. It supports both legacy infrastructure, such as COBOL mainframes and DB2 databases, and modern environments running Kubernetes, microservices, and cloud-native systems.

Features include:

- Real-time streaming for millions of transactions per second

- Batch processing for legacy workflows

- Specialized connectors for core banking, data lakes, and ERP systems

Security and Performance That Meet Enterprise Expectations

Security and performance are built into every layer of the platform. From network architecture to audit logging, the system is designed to meet the most rigorous institutional standards.

1. Zero-Trust Security Model

Features include:

- Role-based access controls

- End-to-end encryption

- Micro-segmented networks

- Live threat detection and alerting

Audit trails are automatically maintained, capturing every model decision, update, and user action.

2. Cloud-Native Scalability and Analytics Speed

Built for high-demand environments, the platform uses horizontal scaling and multi-cloud deployment to ensure continuous performance. In-memory computing provides sub-second analytics for high-frequency use cases, while optimized database design supports deep risk modeling.

Features include:

- Auto-scaling based on compute demand

- Load balancing for global access

- Columnar storage, data compression, and intelligent indexing for faster processing

Intellivon’s AI custom risk platform gives financial enterprises the ability to act, adapt, and lead with confidence. It replaces fragmented systems and reactive reporting with real-time intelligence, regulatory foresight, and true operational agility.

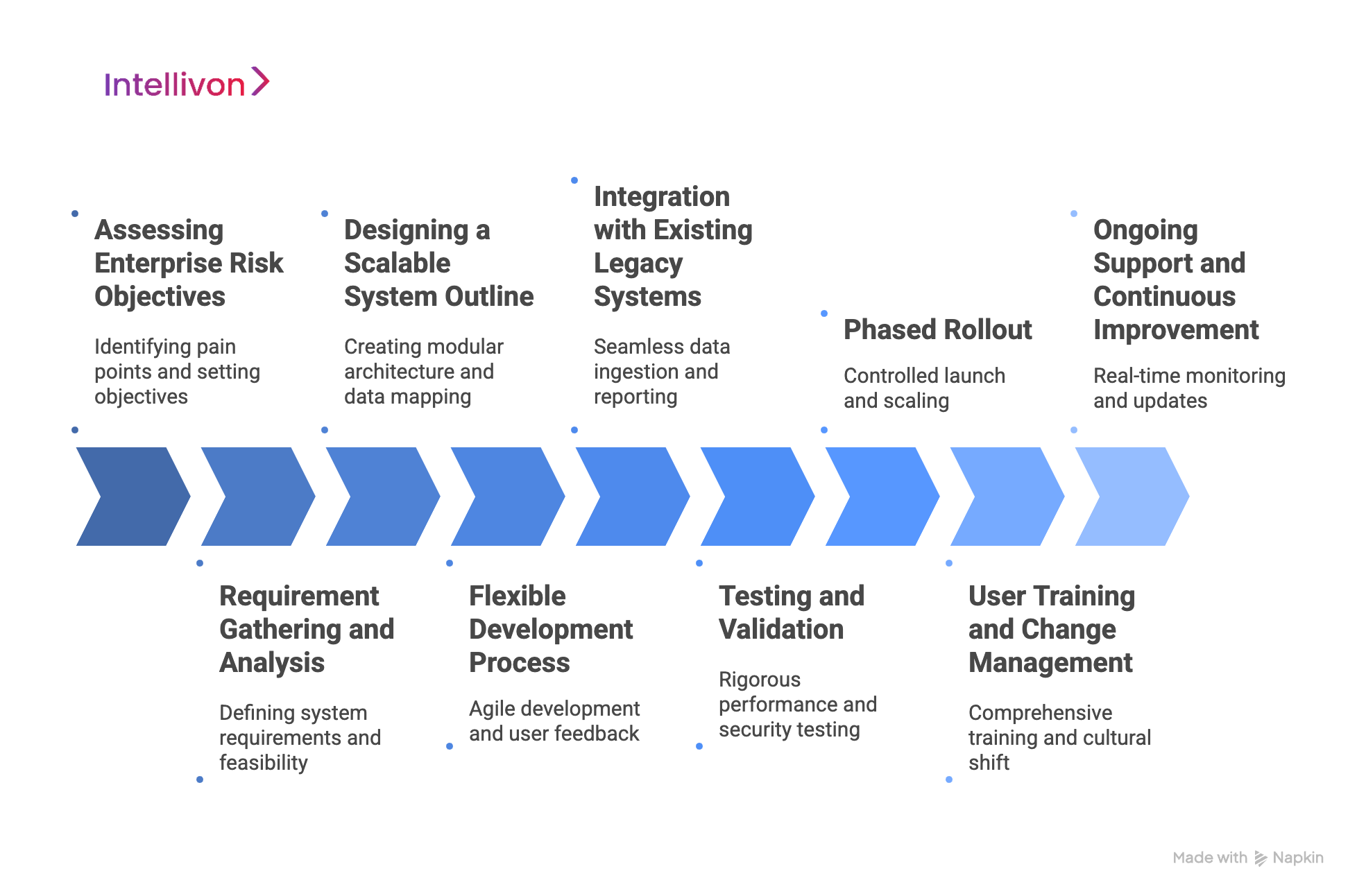

Step-by-Step Implementation Process of Our Custom Risk Engine

Deploying a custom risk engine in a large financial enterprise is a critical transformation. It requires thoughtful planning, strong cross-functional coordination, and a clear focus on long-term value. Intellivon’s implementation approach is designed to be structured yet adaptable, ensuring alignment with institutional goals, existing systems, and regulatory expectations from start to finish.

1. Assessing Enterprise Risk Objectives

Every implementation begins with a thorough understanding of the organization’s current risk posture and strategic priorities. This includes identifying pain points in existing processes, uncovering regulatory gaps, and setting measurable objectives for the custom risk engine.

Cross-functional input is essential at this stage. Stakeholders from compliance, risk, IT, legal, and business units work together to define the desired outcomes. This ensures the solution aligns with the institution’s growth plans, operational model, and regulatory environment.

2. Requirement Gathering and Analysis

Once strategic alignment is established, detailed functional and technical requirements are documented. This includes defining how the system should handle risk detection, assessment, mitigation, and reporting.

A feasibility analysis follows, examining whether the organization has the necessary infrastructure, resources, and data capabilities to support the implementation. This step also identifies any early constraints or risks that may affect delivery.

3. Designing a Scalable System Outline

The technical design phase focuses on creating a modular, scalable architecture tailored to the institution’s environment. The outline must support seamless integration with existing platforms, flexible user interfaces, and robust data security.

Planning also includes data flow mapping, role-based access structures, and mechanisms for compliance automation. The goal is to build a future-ready system that can adapt as both business needs and regulatory requirements evolve.

4. Flexible Development Process

Using agile development principles, Intellivon’s team develops and tests core modules in short cycles. This approach enables quick feedback from internal teams, faster identification of usability issues, and ongoing refinement throughout the development process.

Each feature is built, reviewed, and optimized with direct user input, ensuring practical value at every stage.

5. Integration with Existing Legacy Systems

Seamless integration with core banking, CRM, ERP, and compliance platforms is a key milestone. This phase ensures the new risk engine can ingest real-time data, support consistent reporting, and operate alongside existing workflows without disruption.

Integration also maximizes the value of prior technology investments, eliminating the need for duplicate systems or manual workarounds.

6. Testing and Validation

Before the system goes live, it undergoes rigorous validation. This includes performance benchmarking, load testing, security assessments, and end-user acceptance testing.

Institution-specific testing scenarios ensure the platform can handle realistic risk conditions, compliance tasks, and data volumes. Key users are invited to test the system in live conditions and provide feedback for final adjustments.

7. Phased Rollout

Intellivon recommends a phased rollout, starting with a limited pilot in select departments or regions. This controlled launch allows for targeted monitoring, real-time adjustments, and measured scaling.

Once performance benchmarks are met, the rollout expands across the enterprise in defined phases, minimizing risk while building confidence in the platform.

8. User Training and Change Management

Effective adoption depends on user readiness. Comprehensive training sessions are provided for risk managers, compliance officers, analysts, and other stakeholders. Ongoing support resources, user guides, and helpdesk channels are made available to reinforce adoption.

Change management efforts also focus on cultivating a data-informed, risk-aware culture across the organization.

9. Ongoing Support and Continuous Improvement

Following deployment, Intellivon provides structured support for ongoing system optimization. This includes real-time monitoring, automated updates, and regulatory rule refreshes. Institutions receive performance dashboards, risk alerts, and periodic reports that guide further refinements.

The platform evolves continuously through machine learning and client-driven configuration, ensuring it remains aligned with both business strategy and regulatory expectations over time.

Use Cases On Financial Enterprises Using AI Custom Risk Tools

Custom AI-driven risk tools are mission-critical for modern financial enterprises. From loan risk mitigation to regulatory compliance, enterprises are using these platforms to anticipate threats, respond with agility, and deliver measurable results across departments.

Below are real examples of how forward-looking institutions are leveraging custom risk engines to solve complex challenges and unlock business value.

1. RAZE Banking: Fighting Fraud with Predictive Intelligence

RAZE Banking faced mounting pressure from a rise in cyber threats and fraudulent activities, which were undermining both their financial integrity and customer trust. To address this, they implemented an AI-powered analytics engine that actively monitored transactions and customer behavior to detect anomalies.

Results:

- 45 percent reduction in fraudulent transactions within the first year

- 20 percent improvement in compliance efficiency

- 30 percent boost in operational effectiveness across key departments

The system’s continuous monitoring allowed the institution to take swift, data-driven action, reducing losses and reinforcing its reputation for security.

2. TowneBank: Automating Compliance for the CECL Era

Faced with the complexity of the CECL accounting standard, TowneBank’s compliance platform analyzed more than fifteen years of historical and forward-looking data, enabling the bank to automate modeling, enhance reporting, and support broader enterprise queries through natural language interactions.

Results:

- Accelerated digital transformation across risk and finance teams

- Improved ability to respond to organizational and compliance queries

- Increased readiness for audits and regulatory examinations

TowneBank now manages compliance with greater speed and accuracy, while freeing up staff to focus on strategic initiatives.

3. BNY Mellon: Early Risk Detection at Scale

To stay ahead of emerging threats, BNY Mellon adopted machine learning tools capable of processing vast volumes of data and identifying risk signals in real time. These tools helped the bank detect signs of financial distress, fraud, and systemic risk early, well before traditional systems would have flagged them.

Results:

- Stronger early detection of insolvency and fraud risks

- More agile decision-making and faster response to emerging threats

- Improved ability to manage complex enterprise-wide risk portfolios

The platform continues to play a central role in strengthening operational and reputational resilience.

4. Wells Fargo: Smarter Customer Risk Profiling

Wells Fargo integrated deep learning algorithms to improve customer risk assessments and operational risk management. By continuously analyzing transaction histories, behavioral patterns, and credit data, the system generated dynamic risk scores that updated in real time as new information became available.

Results:

- Improved accuracy in identifying high-risk customer segments

- Reduced losses through timely anomaly detection

- Enhanced customer experience by limiting false alarms and unnecessary disruptions

This adaptive profiling has helped the bank deliver more precise service while reinforcing internal control systems.

| Institution | Challenge | Before AI Implementation | After AI Implementation |

| RAZE Banking | Rising fraud, cyber threats, regulatory inefficiencies | High fraud volumes, reactive compliance, operational silos | 45% drop in fraud, 20% improvement in compliance, 30% higher efficiency |

| TowneBank | CECL compliance and reporting complexity | Manual data processing, slow modeling, audit pressure | Automated 15-year data analysis, accelerated reporting, audit readiness |

| BNY Mellon | Slow risk signal detection across vast datasets | Delayed identification of fraud and insolvency risks | Proactive risk flagging, faster response times, improved risk mitigation |

| Wells Fargo | Inaccurate customer risk profiling, high false positives | Static risk models, frequent false alerts, operational losses | Real-time dynamic risk scoring, reduced losses, better customer service |

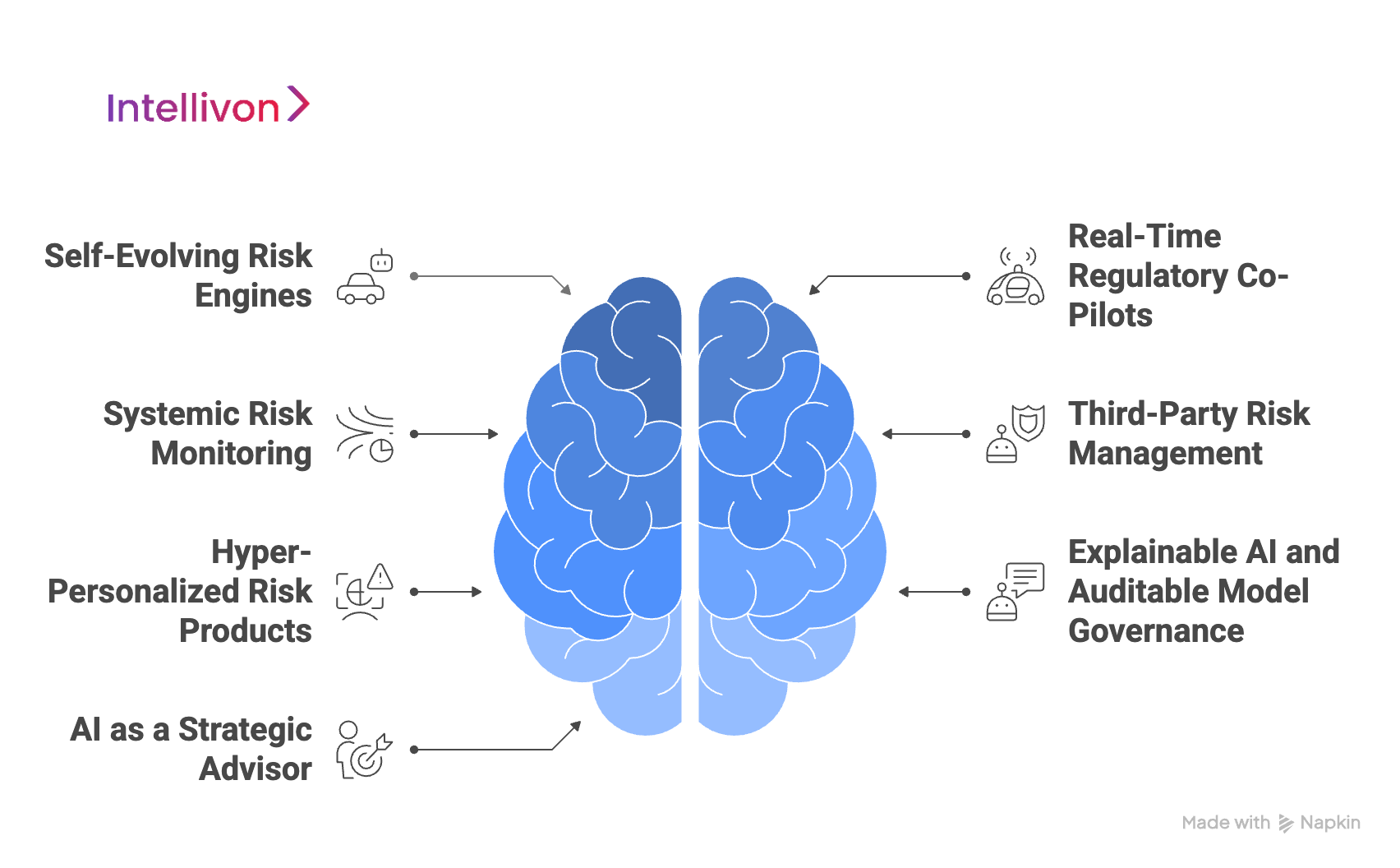

The Future of AI in Enterprise Financial Risk Management

The shift is getting clearer: from delayed reactions based on historical data to real-time, forward-looking insights that actively guide decision-making. As the financial ecosystem grows more interconnected and regulatory expectations rise, AI is becoming a strategic imperative. With the right tools in place, risk management creates opportunity, maintains resilience, and helps enterprises gain a competitive advantage.

1. Self-Evolving, Autonomous Risk Engines

In the near future, risk platforms will become more autonomous. Using reinforcement learning and generative AI, these systems will continuously improve their performance by learning from fresh data and adapting to emerging threats. This will eliminate the need for frequent manual intervention, allowing enterprises to detect and neutralize novel risks, even those without historical precedent.

2. Real-Time Regulatory Co-Pilots

The role of AI in compliance is set to expand dramatically. Generative models will begin interpreting new regulations, generating policy recommendations, and advising compliance officers in real time.

These “regulatory co-pilots” will help organizations close the gap between legislative change and operational readiness. As regulations grow more interconnected globally, dynamic compliance solutions will become a baseline expectation for regulatory alignment.

3. Systemic Risk Monitoring

Financial ecosystems are increasingly interconnected. As algorithmic trading and AI lending models grow in influence, the potential for systemic shocks rises. Future AI systems will focus on detecting risky market behaviors such as synchronized trades or dependency on singular data sources.

Regulators and enterprises alike will use these tools to monitor cross-institutional correlations that could threaten broader financial stability. Detecting systemic vulnerabilities before they escalate will become a regulatory priority.

4. Managing Third-Party and Supply Chain Risk

AI will also play a critical role in overseeing the security and stability of third-party vendors, especially as financial institutions grow more reliant on external technology providers, cloud platforms, and data vendors.

Next-generation risk engines will continuously evaluate vendor health, flagging potential vulnerabilities or non-compliance before they disrupt core operations. This shift will ensure resilience across increasingly complex digital supply chains.

5. Hyper-Personalized Risk Products

AI will enable financial institutions to create risk solutions tailored to each individual client in real time. Products such as adaptive insurance plans, dynamic credit lines, or situational lending models will be informed by behavioral patterns and market signals.

These tools will be embedded directly into customer-facing platforms, making risk management seamless and proactive. Institutions that adopt this approach will unlock new revenue streams while delivering highly personalized financial services.

6. Explainable AI and Auditable Model Governance

As AI models become more intricate, transparency will become essential. Post-2026, we will see widespread adoption of explainable AI frameworks that offer clear documentation for how decisions are made within risk engines.

Enterprises will need to demonstrate accountability, especially to regulators and audit teams. Built-in explainability will ensure that models are not only effective but also governable, helping institutions maintain trust and reduce model risk.

7. AI as a Strategic Advisor, Not a Replacement

Despite rising autonomy, AI will not replace human judgment in enterprise risk management. Instead, it will enhance it. Risk professionals will rely on AI to simulate scenarios, identify weak signals, and bring overlooked patterns to the surface.

Strategic decisions will remain in the hands of human experts, supported by AI as a trusted advisor.

Conclusion

In today’s high-stakes financial landscape AI-driven custom risk tools are changing this dynamic. By combining predictive analytics, real-time monitoring, and tailored compliance frameworks, they empower financial institutions to act before risks escalate. This shift from reactive defense to proactive intelligence is a strategic transformation.

Early adopters of AI-powered risk engines are already seeing faster fraud detection, sharper risk insights, simplified compliance, and greater agility in a rapidly evolving market. These capabilities are no longer optional for enterprises aiming to lead.

Why Choose Intellivon for AI-Powered Custom Risk Tools?

At Intellivon, we build AI-powered custom risk engines that empower financial enterprises to move beyond reactive compliance into predictive, real-time risk intelligence. Our modular solutions integrate seamlessly with legacy systems, support evolving regulatory demands, and deliver enterprise-grade accuracy, scalability, and performance.

Why Choose Us?

- Proven Success in Financial AI Solutions

We’ve helped top-tier financial institutions transform their risk operations through AI, reducing fraud, improving regulatory alignment, and enhancing decision-making. - 11+ Years of Experience in AI for Regulated Industries

Our deep industry knowledge ensures your custom risk engine meets the highest standards of compliance, security, and governance from day one. - Mastery of 40+ AI, ML, and Risk Analytics Frameworks

From predictive modeling to regulatory NLP engines, we tailor your solution using the best-fit technologies for your institution’s unique needs. - 200+ Certified AI Experts, Risk Specialists, and Data Scientists

Our cross-functional team brings the domain expertise required to design, deploy, and maintain scalable, high-performing risk platforms across global markets.

Ready to transform your risk function into a competitive advantage? Book a strategy call with our AI Risk Experts.

FAQ’s

Q1. What are AI-powered custom risk tools in finance?

A1. AI-powered custom risk tools are tailored software solutions that use artificial intelligence and machine learning to identify, assess, and manage financial risks. Unlike off-the-shelf systems, these tools are built around an enterprise’s specific operations, data, and regulatory requirements, enabling real-time insights and predictive analytics.

Q2. How do AI-driven risk engines improve financial risk management?

A2. AI-driven risk engines enhance risk management by analyzing vast datasets in real time to detect anomalies, forecast market volatility, and automate compliance. They help financial institutions respond faster to emerging risks, reduce human error, and make proactive decisions based on data-driven insights.

Q3. Why are traditional risk management systems no longer enough for enterprises?

A3. Traditional systems often rely on static models and delayed reporting cycles, which can miss fast-moving threats. They also struggle with complex regulatory changes and lack the flexibility to adapt to unique business models. AI tools offer the speed, accuracy, and adaptability required in today’s dynamic financial landscape.

Q4. Can AI help with regulatory compliance in finance?

A4. Yes. AI tools can automate regulatory monitoring, detect policy changes, and generate audit-ready reports. They support compliance with frameworks like Basel III, CECL, and GDPR by adapting to new rules instantly and reducing the manual burden on compliance teams.

Q5. What are the benefits of using custom AI risk solutions over off-the-shelf tools?

A5. Custom AI risk solutions provide a precise fit for an organization’s structure, workflows, and regulatory needs. They offer better integration, enhanced security, personalized risk profiling, and the flexibility to scale or adapt as the business evolves—advantages that generic platforms often lack.