The enterprise blockchain landscape is changing quickly as organizations shift from the hype around cryptocurrency to finding real-world uses that tackle important business problems. Today, enterprises are using blockchain solutions to fix issues like operational inefficiencies, security weaknesses, and trust gaps across various industries. For example, healthcare systems manage patient data, and financial institutions handle billions in transactions. Walmart has cut food safety investigation times from weeks to seconds by using blockchain for supply chain tracking. Meanwhile, JPMorgan processes more than $2 billion every day on its blockchain network.

At Intellivon, we have helped large enterprises successfully implement blockchain, ensuring they can scale, meet regulations, and see a return on investment. Our experience demonstrates that blockchain is crucial for gaining a competitive edge in the digital economy. In this detailed analysis, we will look at key blockchain trends shaping 2026, review successful adoption strategies, and offer a practical guide for implementing solutions that provide real business value.

Why Enterprises Can’t Ignore Blockchain in 2026

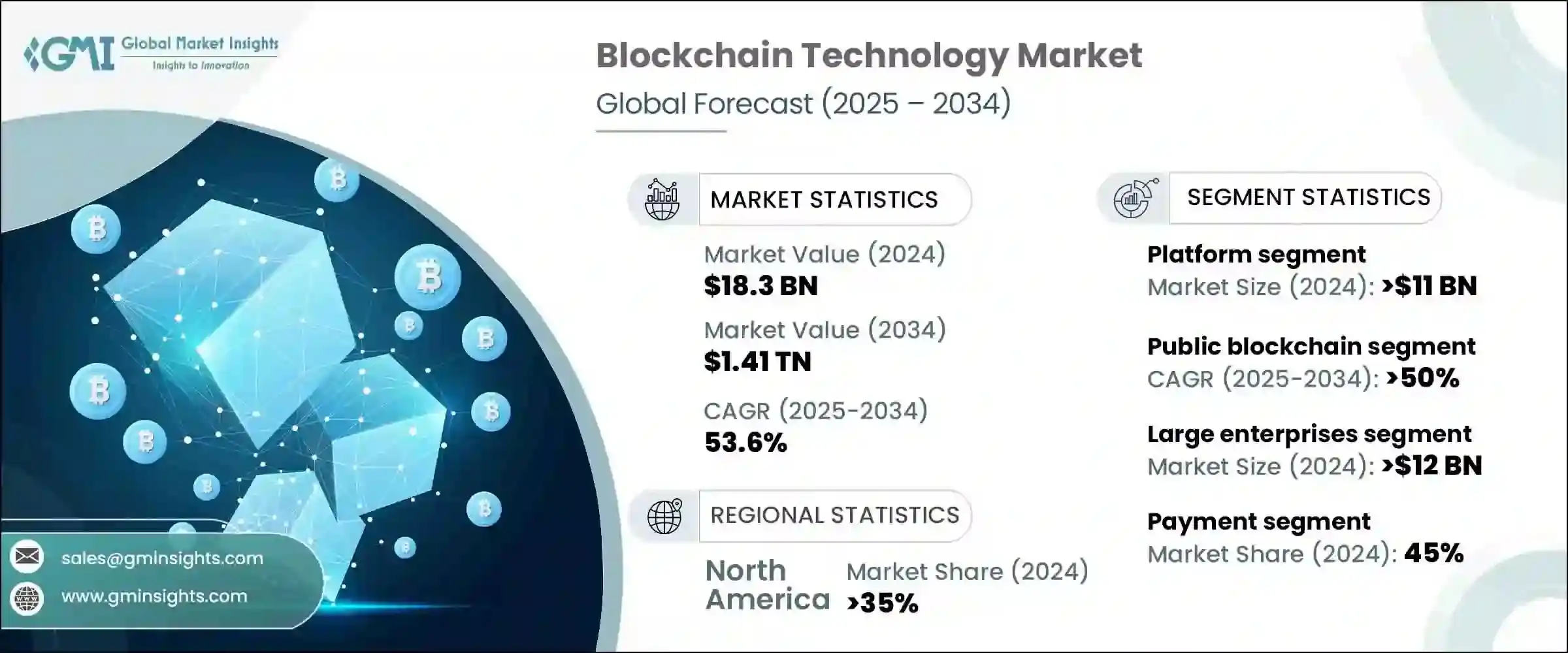

Enterprise blockchain is no longer optional. With rapid growth, strong investment, and proven benefits in compliance-heavy industries, it is becoming a core part of digital transformation strategies. The global enterprise blockchain market was $9.6 billion in 2023 and will reach $287.8 billion by 2032 at a 47.5% CAGR.

- Financial services lead adoption, holding 41% of revenue share in 2025, with payments driving 42% of application revenues.

- The healthcare blockchain market will grow from $5.5 billion in 2025 to $43.37 billion by 2030, at a CAGR of 52.5%.

- 39% of healthcare organizations already have blockchain in production or pilot use, mainly for clinical data exchange and fraud prevention.

- Over 60% of banks are testing distributed ledger technology for faster settlements, fraud reduction, and compliance.

- Asia-Pacific will see the fastest growth, driven by government support in fintech and healthcare digital transformation.

- Data protection needs drive 58% of enterprise demand, with finance and healthcare leading adoption.

- AI integration, cost efficiency, and cross-border innovation accelerate demand for blockchain-as-a-service and consortium networks.

Top Blockchain Trends in 2026 Across Key Industries

Blockchain adoption is not happening at the same speed everywhere. Some industries are ahead of others because of their unique challenges and opportunities. Healthcare, financial services, and AI-focused sectors are taking the lead. Each is using enterprise blockchain to tackle issues that old systems cannot resolve.

Healthcare

1. Patient-Centric Identity

One of the most important trends in healthcare is shifting control of medical data back to the patient. Enterprise blockchain can enable self-sovereign identities where patients own their health data and grant or revoke access through secure, immutable records. Here, every interaction can be logged on-chain, giving both patients and regulators full visibility into how and when data is used.

How Enterprises Grow with This Trend:

- Healthcare enterprises that adopt patient-centric identity models build stronger trust, which directly translates to higher patient retention and loyalty.

- Hospitals and insurers gain a competitive edge by demonstrating transparency in data handling, reducing legal risks, and attracting partnerships with research organizations seeking compliant data-sharing frameworks.

- In addition, enterprises can monetize patient-driven data exchanges, creating new revenue streams while improving compliance and brand reputation.

Example: Mayo Clinic has piloted decentralized health data initiatives that allow patients to manage access permissions for their records. In the near future, such solutions could be fully operational, enabling patients to share specific health records with specialists on demand. This builds trust, reduces friction in referrals, and ensures compliance with strict privacy laws like HIPAA and GDPR.

2. Secure Data Exchange

Healthcare data is often locked in silos. Different hospitals, labs, and insurers use incompatible systems, which creates delays and leads to repeated testing. Enterprise blockchain can serve as a shared trust layer, enabling the secure exchange of electronic health records (EHRs) and other clinical data across institutions. Using global standards like HL7 FHIR, blockchain ensures that every data update is verified, tamper-proof, and accessible to authorized parties in real time.

How Enterprises Grow with This Trend:

- Hospitals and insurers that adopt interoperable blockchain networks reduce redundant diagnostics, saving millions in wasted costs.

- Faster data exchange improves treatment outcomes and patient satisfaction, directly boosting throughput and revenues.

- Enterprises that participate early in blockchain consortia also position themselves as regional or national hubs for health data exchange, unlocking new partnerships with government agencies, research institutions, and private providers.

Example: Kaiser Permanente has already invested heavily in integrated care systems. By next year, it could expand into blockchain-based national health data networks, enabling secure interoperability with external hospitals and labs. This would cut down unnecessary testing, accelerate referrals, and improve both patient outcomes and enterprise efficiency.

3. Blockchain + IoMT Integration

The Internet of Medical Things (IoMT) includes wearable devices, implantables, and remote monitors that generate real-time patient data. While this data is valuable, ensuring its accuracy and preventing tampering is a constant challenge. In the coming years, enterprise blockchain will provide a secure provenance layer for IoMT data. Devices can anchor data proofs on-chain, making every reading traceable and tamper-evident. Combined with edge computing, blockchain ensures that only validated data flows into clinical systems and AI-driven predictive care models.

How Enterprises Grow with This Trend:

- Healthcare enterprises gain the ability to move from episodic treatment to continuous care models, powered by trusted device data.

- This reduces hospital readmissions, lowers operational costs, and improves patient outcomes.

- For device manufacturers and healthcare providers, blockchain-backed IoMT opens subscription-based revenue models for long-term remote monitoring services.

- Enterprises that secure IoMT data also gain regulatory confidence, making it easier to scale digital health programs across regions.

Example: Philips Healthcare is expanding its connected care portfolio with remote monitoring solutions. Anchoring device data to blockchain could guarantee data integrity for millions of patients, allowing clinicians to trust remote vitals for diagnosis and intervention. This would not only enhance care quality but also drive recurring revenue through digital health service subscriptions.

4. Smart Contracts for Automation

Healthcare operations are often slowed down by manual paperwork, claim processing, and compliance checks. These inefficiencies increase costs and delay patient care. Within the next few years, blockchain-powered smart contracts are expected to automate many of these workflows. Insurance claims, patient consent forms, provider credentialing, and even clinical trial agreements can be executed automatically once pre-set conditions are met.

How Enterprises Grow with This Trend:

- Enterprises that adopt smart contracts reduce administrative costs, which can account for more than 20% of healthcare spending.

- Faster claims settlement improves cash flow for hospitals and increases satisfaction for patients and providers.

- Clinical trial sponsors benefit from transparent consent tracking, reducing compliance risks and accelerating study timelines.

- By embedding automation into their processes, enterprises free up staff resources, enabling them to scale operations without proportionally increasing costs.

Example: UnitedHealth Group (Optum) has piloted blockchain for claims processing. It could fully automate claim adjudication through smart contracts, cutting settlement times from weeks to hours. This transformation would reduce fraud, speed up reimbursements, and strengthen Optum’s position as a leader in healthcare efficiency.

5. Pharmaceutical Supply Chain Traceability

Counterfeit drugs remain a $200 billion global problem, putting patients at risk and costing enterprises billions in lost revenue. Traditional supply chains struggle with fragmented tracking systems and limited visibility. Soon, blockchain will enable end-to-end traceability across the entire pharmaceutical lifecycle. Every unit of medication can be serialized and tracked, with cold-chain data (like temperature logs) anchored on-chain. Hospitals and pharmacies can instantly verify the authenticity of drugs before administering them to patients.

How Enterprises Grow with This Trend:

- Pharmaceutical companies and healthcare providers that adopt blockchain supply chain solutions gain a significant edge in compliance, brand reputation, and patient safety.

- Enterprises avoid regulatory penalties by meeting global requirements such as the U.S. Drug Supply Chain Security Act (DSCSA).

- They also reduce losses from counterfeits and spoiled shipments, protecting revenue and ensuring patient trust.

- Over time, verified supply chains can be monetized through premium partnerships, as providers prefer working with pharma firms that guarantee drug authenticity.

Example: Pfizer has been involved in blockchain consortia like MediLedger to pilot drug provenance solutions. In the next phase, Pfizer could deploy full-scale blockchain serialization and cold-chain monitoring across its global network. This would eliminate counterfeit risks, safeguard compliance, and strengthen its market leadership in pharmaceutical supply chain integrity.

2. Fintech

1. Tokenization of Funds and Securities

Instead of relying on traditional paper-based systems, real-world assets such as bonds, private credit, and money-market funds can be represented as digital tokens on a blockchain. Tokenization enables instant settlement, fractional ownership, and transparent lifecycle management of securities. Smart contracts automate events like dividend payments, interest accrual, and compliance checks, creating faster and more efficient markets.

How Enterprises Grow with This Trend:

- Financial institutions adopting tokenization unlock new liquidity opportunities by making previously illiquid assets tradable in smaller, fractional units.

- This widens the investor base, reduces barriers to entry, and creates new revenue streams through token marketplaces.

- Enterprises also cut costs tied to reconciliation and recordkeeping, improving profitability while ensuring compliance.

- Asset managers and custodians that lead in tokenization will capture market share as investors increasingly demand faster, more flexible investment options.

Example: BlackRock launched its tokenized institutional liquidity fund, BUIDL, which allows investors to hold shares as blockchain tokens. These funds can dominate short-term investment strategies, proving the scalability and profitability of tokenized financial products at the enterprise level.

2. Wholesale DLT Settlement Networks

Traditional interbank settlement systems are slow and often involve multiple intermediaries. Payments can take days to clear, tying up liquidity and increasing counterparty risk. Wholesale distributed ledger technology (DLT) settlement networks will soon provide real-time, 24/7 settlement between banks and financial institutions. These systems use tokenized cash backed by central bank accounts, ensuring finality and security while cutting out delays.

How Enterprises Grow with This Trend:

- Banks and financial institutions adopting wholesale DLT networks reduce costs tied to collateral, reconciliations, and failed settlements.

- They also unlock intraday liquidity, improving capital efficiency and risk management.

- Enterprises offering treasury services can introduce new premium products like on-demand liquidity and programmable cash, generating fresh revenue streams.

- Early adopters will gain a strategic advantage by attracting corporate clients that demand faster, cheaper, and more transparent settlement services.

Example: Fnality International is building a blockchain-based payment system backed by central bank funds. Within the next few years, its networks could support instant interbank settlements across multiple currencies, giving participants an edge in efficiency and trust while reshaping global financial plumbing.

3. CBDCs and Multi-CBDC Platforms

Cross-border payments are slow, costly, and burdened with intermediaries. Central Bank Digital Currencies (CBDCs) aim to change this. CBDCs will soon be integrated into multi-CBDC platforms, allowing countries to connect their digital currencies on a shared blockchain network. This enables instant, atomic settlement across currencies with full regulatory oversight. Enterprises gain faster, cheaper, and more transparent payment rails that traditional correspondent banking cannot match.

How Enterprises Grow with This Trend:

- Financial institutions that integrate CBDCs can offer corporate clients near-instant international payments, cutting transaction costs and reducing reliance on nostro accounts.

- This improves liquidity management while opening new opportunities in global trade finance.

- Banks can also package premium services like programmable escrow payments, event-driven remittances, and just-in-time supplier payouts.

- By being early adopters, enterprises position themselves as leaders in the next generation of cross-border financial infrastructure.

Example: The mBridge project, led by the Bank for International Settlements and central banks in Hong Kong, China, Thailand, and the UAE, has already piloted multi-CBDC transactions. Platforms like mBridge can support full-scale international trade settlements, setting a new global standard for cross-border payments.

4. Deposit Tokens and Interbank Shared Ledgers

Commercial banks are experimenting with deposit tokens, which are blockchain-based representations of traditional bank deposits. Unlike stablecoins issued by private firms, deposit tokens remain within the regulated banking system and are backed 1:1 by deposits. These tokens will be widely used on shared interbank ledgers by next year, enabling real-time payments, programmable cash flows, and seamless integration with corporate systems.

How Enterprises Grow with This Trend:

- Banks adopting deposit tokens will offer corporate clients faster, programmable treasury solutions.

- Enterprises can automate complex financial workflows like milestone-based payments, escrow management, or supplier settlements. This reduces reliance on manual reconciliation and speeds up global operations.

- Banks also gain new service revenues by embedding programmable cash into ERP and supply chain platforms.

Early movers will win trust by keeping these innovations under regulatory oversight, making them safer than unregulated stablecoins.

Example: J.P. Morgan has pioneered deposit token work through its Onyx platform. Deposit tokens could become standard for institutional payments, allowing banks like J.P. Morgan to expand global liquidity services while setting benchmarks for regulated digital money.

5. Compliance-by-Design Systems

Regulatory compliance is one of the costliest challenges for financial institutions. Traditional systems rely on manual audits, fragmented reporting, and after-the-fact reviews. In the coming years, blockchain will enable compliance-by-design, where every transaction is automatically checked against regulatory rules through embedded smart contracts. These systems create real-time audit trails, automate KYC/AML verification, and reduce fraud by design.

How Enterprises Grow with This Trend:

- Enterprises using compliance-by-design blockchains cut regulatory reporting costs and minimize the risk of penalties.

- Banks gain trust from regulators by providing transparent, real-time access to transaction records.

- This improves their ability to expand into new regions and launch innovative services faster.

- For large enterprises, compliance becomes a business enabler instead of a barrier, unlocking growth while maintaining strict oversight.

Example: ING Bank has tested zero-knowledge proof technology to verify KYC/AML compliance without revealing sensitive client data. Such blockchain-enabled compliance systems could become mainstream, reducing operational risks and positioning ING as a leader in digital trust.

3. AI

1. Verifiable AI and Model Transparency

AI models are becoming central to enterprise decision-making, from healthcare diagnostics to financial risk analysis. However, leaders often struggle to trust the outputs of “black box” systems. Soon, blockchain will provide verifiable AI frameworks, where model versions, training datasets, and performance benchmarks are logged immutably on-chain. Zero-knowledge proofs (zk-proofs) will allow enterprises to prove claims about accuracy, fairness, or compliance without exposing sensitive data or proprietary algorithms.

How Enterprises Grow with This Trend:

- Enterprises that deploy verifiable AI win faster regulatory approvals and client trust. They reduce liability by showing transparent, auditable AI performance, making procurement cycles shorter and partnerships easier to secure.

- This creates a direct path to scaling AI-powered services across regulated industries like finance and healthcare, where compliance is critical.

- Companies that lead with verifiable AI also differentiate themselves by offering “trust-first” solutions in a market increasingly focused on accountability.

Example: IBM has worked on explainable AI initiatives, and by 2026, could pair blockchain with zk-proofs to provide verifiable model claims in financial services. This would help banks adopt AI-driven decision engines while staying compliant with strict auditing standards.

2. Federated Marketplaces

AI thrives on quality data, but enterprises often hesitate to share datasets due to privacy risks and compliance barriers. Blockchain will soon power federated AI marketplaces, where organizations can contribute datasets or model updates without exposing raw information. Secure multiparty computation (MPC) and federated learning ensure collaboration while blockchain records contributions, usage, and payments through transparent smart contracts.

How Enterprises Grow with This Trend:

- Enterprises participating in federated marketplaces reduce data acquisition costs and accelerate AI development.

- Contributors are rewarded fairly based on the value their data or model improvements bring, creating new revenue streams.

- Buyers gain access to richer, more diverse datasets that improve model performance without regulatory headaches.

- By joining these ecosystems early, enterprises position themselves as key players in industry-wide AI networks that drive innovation and growth.

Example: Owkin has built federated learning platforms for medical research. By 2026, such platforms could evolve into blockchain-powered marketplaces where hospitals, research institutes, and pharma companies securely collaborate, sharing insights while monetizing contributions at scale.

3. Privacy-Preserving AI

Blockchain, combined with privacy-preserving technologies like secure multiparty computation (MPC), confidential computing, and zero-knowledge proofs, can enable AI to analyze data without ever exposing the raw information. Blockchain ensures that every computation is logged immutably, providing a trusted record of consent, purpose, and usage.

How Enterprises Grow with This Trend:

- Organizations that adopt privacy-preserving AI can finally collaborate across borders and industries without risking data leaks or compliance violations.

- This unlocks high-value use cases such as cross-institution healthcare research, fraud detection across multiple banks, or customer personalization in regulated industries.

- Enterprises also gain a strong reputation for safeguarding user data, which improves customer trust and attracts partnerships.

- The result is faster innovation, reduced compliance risk, and access to new revenue streams.

Example: Microsoft Azure has already tested confidential computing for secure AI. Combining it with blockchain could allow hospitals in different countries to share encrypted cancer research data, accelerating discoveries while ensuring GDPR and HIPAA compliance.

4. Model Governance

AI models evolve constantly, with new training data, parameters, and updates introduced over time. Without strong governance, enterprises risk deploying biased, outdated, or tampered models. With continuous developments down the line, blockchain will act as the governance backbone for AI, logging every model version, dataset lineage, parameter change, and deployment approval on an immutable ledger. Smart contracts will enforce multi-party approvals, rollback rights, and compliance checks before models are pushed live.

How Enterprises Grow with This Trend:

- Enterprises that implement blockchain-based model governance drastically cut audit times, reduce compliance risks, and build regulator confidence.

- This makes it easier to scale AI solutions in sensitive industries like healthcare and finance.

- Businesses also reduce downtime and costs linked to AI drift or errors, as automated monitoring and on-chain triggers ensure models are quickly flagged and rolled back when issues arise.

- Ultimately, enterprises gain resilience, compliance assurance, and stronger competitive positioning as trusted AI providers.

Example: HSBC has explored blockchain in operational audits. In the coming years, it could use blockchain-backed AI governance to manage credit scoring models. This would provide regulators with a transparent view of every model update, ensuring accountability and improving trust in automated lending systems.

5. AI-Assisted Smart Contracts

Smart contracts are already transforming industries, but they require human developers to set rules and conditions. AI will soon enhance these systems, enabling autonomous agents to propose, test, and optimize smart contracts. Blockchain provides the trust and governance layer, ensuring all AI-generated changes are transparent, auditable, and reversible if needed. Enterprises can deploy agents that adjust supply chain contracts, financial agreements, or healthcare service terms in real time, based on live data.

How Enterprises Grow with This Trend:

- Enterprises adopting AI-assisted smart contracts reduce manual intervention and speed up operations.

- Automated contract optimization lowers costs, minimizes disputes, and improves responsiveness to market changes.

- Businesses also unlock new service models, such as dynamic pricing, real-time insurance policies, and adaptive logistics contracts.

- By using blockchain as a safeguard, organizations enjoy both agility and accountability, positioning themselves as digital-first leaders in their industries.

Example: Siemens has tested blockchain-based energy trading. By 2026, Siemens could deploy AI-driven agents that autonomously adjust energy trading contracts in response to real-time supply and demand shifts, maximizing efficiency and profitability while maintaining full regulatory compliance.

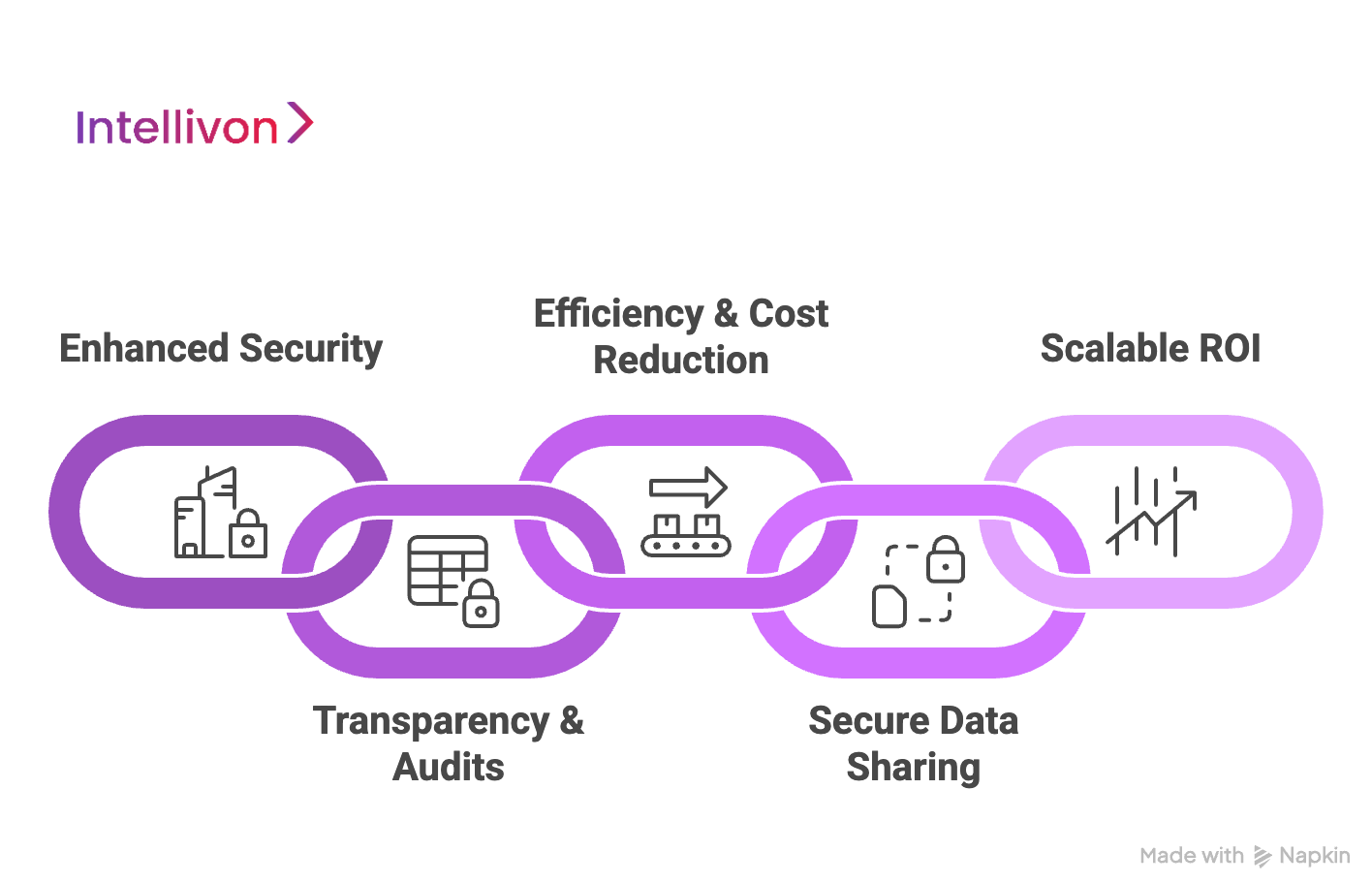

Benefits of Blockchain for Enterprises

Blockchain is a key tool that improves security, ensures compliance, lowers costs, and provides measurable returns on investment. Enterprises that constantly face pressure to cut risks, improve audit readiness, and streamline operations can see blockchain as a clear solution to their most urgent priorities.

1. Stronger Security and Data Integrity

Blockchain lessens serious cybersecurity risks by using cryptographic safeguards and decentralized storage. In financial services, for instance, blockchain has been employed to secure high-value cross-border payments. This reduces the risk of fraud and builds client trust in sensitive transactions.

2. Greater Transparency and Faster Audits

Enterprises with massive financial transactions face regulatory pressure to show accountability. Blockchain offers a shared, tamper-proof ledger where every transaction is visible to authorized users. In healthcare, providers are starting to use blockchain to track medical records and consent logs. This creates transparent audit trails that meet HIPAA requirements while protecting patient data. Walmart’s use of blockchain for food supply chains is another example; product traceability was cut from days to seconds, making compliance checks quicker and boosting customer confidence.

3. Higher Efficiency and Lower Costs

Blockchain streamlines workflows with smart contracts, removing paperwork, human errors, and third-party costs. In insurance, for example, blockchain speeds up claims processing by cutting intermediaries, lowering administrative costs, and improving customer satisfaction. Similarly, logistics companies report faster clearance and fewer disputes by relying on blockchain-based shipment records.

4. Secure, Controlled Data Sharing

Businesses find it hard to share data with partners without exposing sensitive information. Blockchain solves this by allowing permissioned access, which means only approved parties can view or update data. This is changing global trade networks, where ports, shippers, and customs authorities can collaborate securely in real time while keeping data confidential. For enterprises, this leads to fewer delays and more trust across multi-stakeholder environments.

5. Scalable ROI

The financial benefits are clear. Enterprises that adopt blockchain report up to a 41% improvement in ROI due to fraud reduction, quicker settlement times, and the removal of unnecessary intermediaries. In supply chain operations, companies notice less spoilage and fraud, while in financial services, blockchain cuts back-office reconciliation costs. Beyond immediate savings, blockchain adds strategic value: it builds stakeholder trust, lowers regulatory risk, and accelerates time-to-value in essential operations.

The enterprise landscape is moving toward the convergence of AI, IoT, digital finance, and decentralized technologies. Blockchain provides the trust and verification layer that ties them together, ensuring every data stream, decision, and transaction is secure and verifiable. Enterprises that adopt blockchain early position themselves to scale with emerging technologies rather than play catch-up later

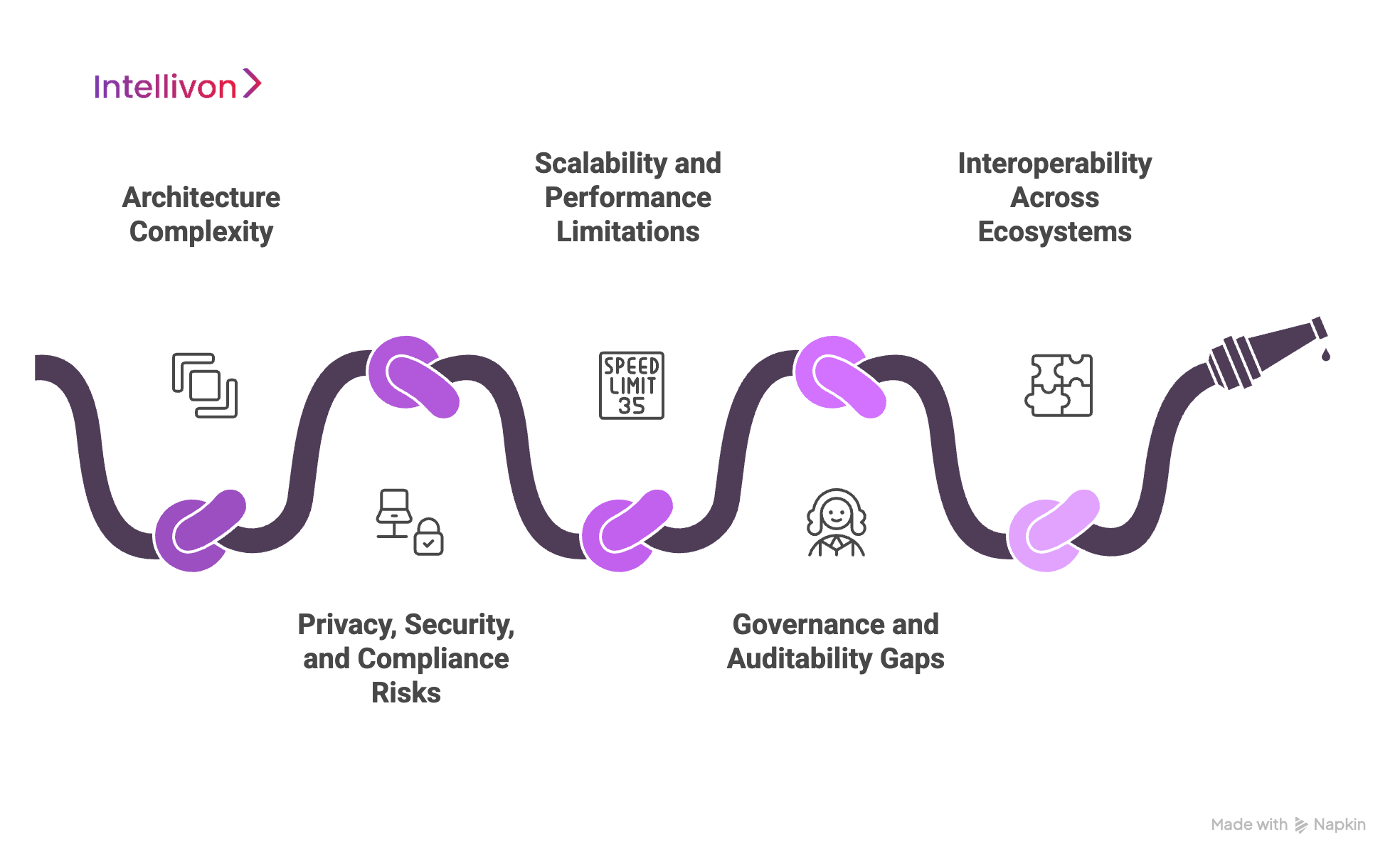

Overcoming Challenges in Building & Implementing Blockchain Solutions

Enterprise blockchain holds huge promise, but successful adoption is not without hurdles. Many organizations stall at the pilot stage because of technical, operational, or regulatory challenges. At Intellivon, we understand these barriers well and have designed our solutions to address them directly. Here are the most common challenges and how we help enterprises overcome them.

1. Architecture Complexity

Blockchain solutions require a blend of distributed ledgers, smart contracts, data privacy layers, and integration points with existing systems. This complexity can overwhelm enterprises and delay implementation.

Intellivon solves this by delivering a unified architectural framework where blockchain, AI, and compliance modules are pre-integrated. Our modular design ensures seamless connections with ERP, CRM, EHR, and other core enterprise systems, allowing clients to deploy blockchain without disrupting day-to-day operations.

2. Privacy, Security, and Compliance Risks

Sensitive data must remain protected at all times. Enterprises in healthcare, fintech, and AI face strict compliance obligations under frameworks like HIPAA, GDPR, and PCI DSS. Mishandling data exposes businesses to fines and reputational damage.

We address this with a privacy-first design, leveraging confidential computing, secure multiparty computation, and zero-knowledge proofs. These technologies ensure that raw data never leaves enterprise control, while blockchain stores only encrypted commitments and proofs. The result is compliance by design, not by afterthought.

3. Scalability and Performance Limitations

Traditional blockchain networks are not built for the high transaction volumes enterprises demand. Latency and cost issues can stall adoption, particularly in data-heavy industries.

Our experts overcome this through scalable design patterns such as off-chain storage, sharded ledgers, and proof aggregation. By processing heavy workloads off-chain and anchoring only the essential data on-chain, our solutions achieve enterprise-grade performance. Clients benefit from near real-time settlement, predictive analytics, and IoT-scale data handling at sustainable costs.

4. Governance and Auditability Gaps

AI models, supply chains, and financial systems require clear governance. Without it, enterprises risk unauthorized changes, model drift, or audit failures.

We build governance directly into the blockchain fabric. Every model update, transaction, or consent action is recorded immutably. Smart contracts enforce multi-party approvals, rollback rights, and separation of duties. Regulators and auditors can instantly review tamper-proof logs, reducing audit cycles from months to days while increasing trust in enterprise operations.

5. Interoperability Across Ecosystems

Enterprises rarely operate in isolation. They depend on suppliers, regulators, and partners who may use different platforms and blockchains. Lack of interoperability often prevents blockchain initiatives from scaling.

Intellivon resolves this with consortium-ready solutions that use decentralized identity, verifiable credentials, and oracle frameworks to connect different stakeholders securely. We also support hybrid deployment models where enterprises can anchor private transactions to public chains, enabling interoperability without losing control.

By solving these challenges, Intellivon helps enterprises move beyond pilot projects into enterprise-grade blockchain adoption that is scalable, compliant, and profitable.

Our Enterprise Blockchain Solution Architecture

To move from pilot projects to enterprise-grade adoption, organizations need a unified framework that combines blockchain, AI, and compliance by design.

We have developed a modular architecture that addresses the complexity of large-scale deployments while ensuring scalability, security, and interoperability. This framework is built for real-world enterprise demands and can be tailored to healthcare, fintech, and AI-intensive industries.

1. Core Blockchain and Trust Layer

At the foundation sits a permissioned distributed ledger that acts as the single source of truth. It supports smart contracts for automation, consortium governance for multi-party ecosystems, and optional anchoring to public chains for verifiability. This ensures transparency without compromising enterprise control.

2. Identity and Access Control

Enterprises require strict control over who can access data, models, or transactions. Our architecture uses decentralized identities (DIDs) and verifiable credentials (VCs) to authenticate users, organizations, and devices. Consent rules and policy-as-code frameworks are embedded, so compliance is enforced automatically across all interactions.

3. Privacy-Preserving Compute Layer

Sensitive data often cannot leave its original environment. Our solutions incorporate confidential computing, secure multiparty computation, and zero-knowledge proofs to allow data sharing and model training without exposing raw information. This privacy-first approach enables cross-institution collaboration while keeping enterprises compliant with HIPAA, GDPR, and PCI DSS.

4. AI and Data Provenance Fabric

AI thrives only when data and models are trusted. Our architecture includes a model registry anchored on blockchain, which records every model version, dataset lineage, and approval. This creates a transparent lifecycle for AI, ensuring that regulators and auditors can verify fairness, accuracy, and compliance at any stage.

5. Incentives and Settlement System

Enterprises need clear economics to sustain blockchain adoption. Our framework includes programmable settlement mechanisms where contributors, whether they provide data, model updates, or compute power, are automatically rewarded. Tokenized incentives and fiat settlement options ensure participants see measurable returns, making consortium ecosystems sustainable.

6. Integration and Interoperability

We know enterprises cannot afford siloed systems. Our architecture includes API gateways, data oracles, and enterprise connectors that integrate seamlessly with ERP, CRM, EHR, and financial systems. This allows blockchain to act as a trust layer that enhances, rather than replaces, existing infrastructure.

7. Security and Observability

Enterprises demand operational resilience. Our architecture includes end-to-end encryption, hardware security modules (HSMs), automated monitoring, and tamper-evident logging. These features ensure that every transaction, model update, or data exchange is secure, auditable, and recoverable in the event of disruption.

8. Modular and Adaptable Design

Every enterprise has unique requirements. Our architecture is modular by design, enabling us to adapt the framework to different industries. Whether it’s compliance-heavy healthcare, high-volume fintech, or AI-driven innovation, Intellivon tailors deployments without sacrificing scalability or trust.

With this architecture, Intellivon provides enterprises a ready-to-deploy blueprint that reduces risk, accelerates time-to-value, and ensures that blockchain initiatives deliver measurable outcomes.

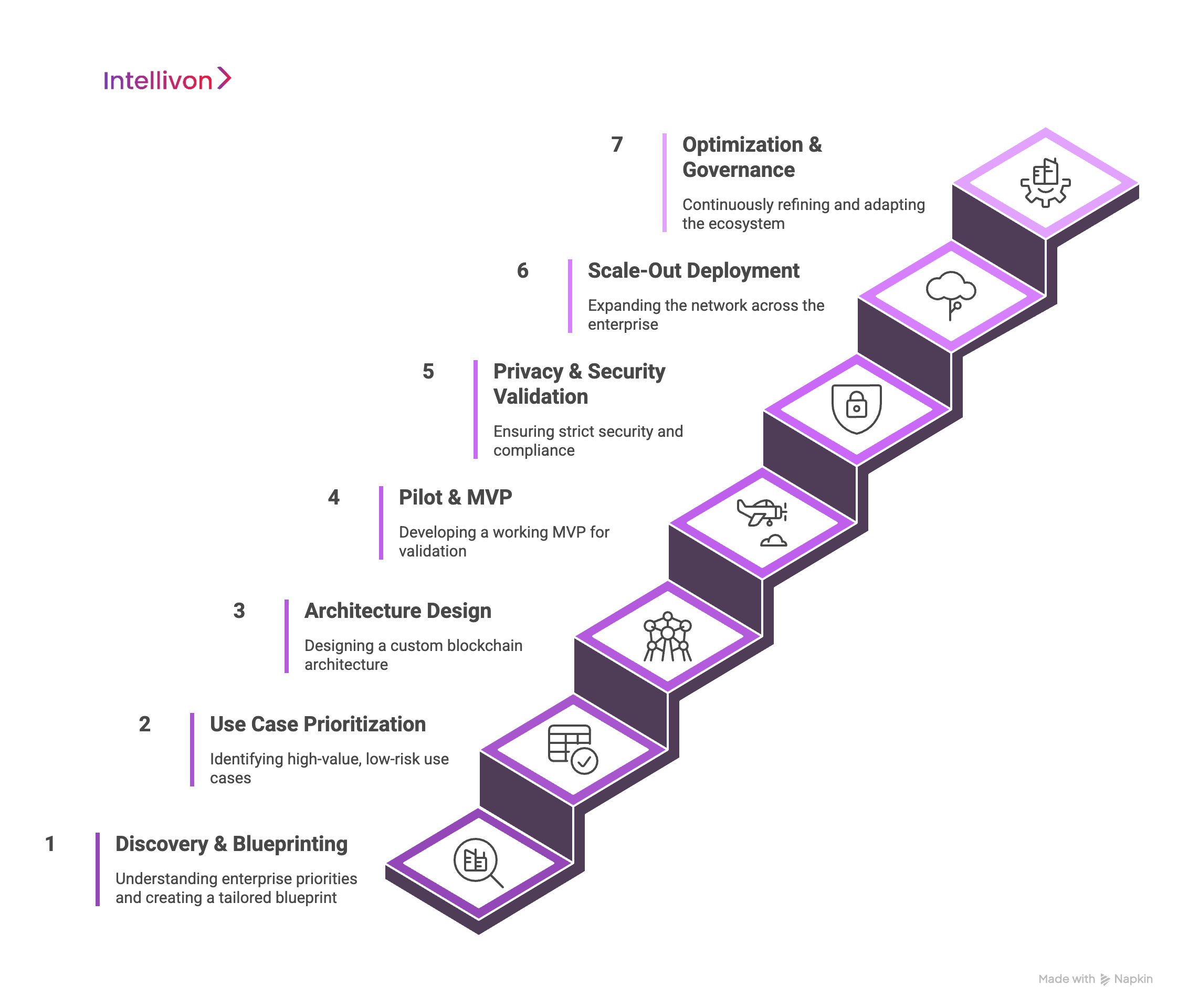

Step-by-Step: How We Develop Enterprise Blockchain Solutions

At Intellivon, we follow a structured approach to ensure enterprises move from strategy to large-scale adoption with measurable results. Our framework balances speed, compliance, and long-term scalability.

1. Discovery and Blueprinting

We start by understanding your enterprise priorities, compliance requirements, and digital transformation goals. This phase includes stakeholder mapping, workflow analysis, and identifying pain points where blockchain can deliver the highest impact. The outcome is a tailored blueprint with defined ROI targets and regulatory guardrails.

2. Use Case Prioritization

Not every blockchain idea is worth pursuing. We help enterprises identify high-value, low-risk use cases that can deliver early wins. This often includes areas like claims automation, payment settlement, supply chain traceability, or AI model governance. Prioritizing the right use cases ensures quick adoption and visible success.

3. Architecture Design

Once priorities are clear, we design a custom enterprise blockchain architecture based on our modular framework. This includes choosing the right ledger (permissioned or hybrid), setting up identity and access layers, embedding compliance policies, and planning interoperability with existing systems.

4. Pilot and MVP

We develop a working MVP that focuses on one or two critical use cases. This phase validates assumptions, tests integration with enterprise systems, and generates measurable outcomes. By delivering a tangible product in weeks, not years, we build confidence and secure stakeholder buy-in.

5. Privacy and Security Validation

Before scaling, we ensure solutions meet strict enterprise requirements for security and compliance. This involves deploying confidential computing, zero-knowledge proofs, and policy-as-code enforcement to guarantee data privacy and regulatory alignment. Independent security audits are conducted to certify robustness.

6. Scale-Out Deployment

After validation, we expand to additional use cases and scale the network across departments, regions, or partners. Features like sharded networks, settlement systems, and interoperability layers are enabled for high-volume operations. This step ensures blockchain becomes a core enterprise utility rather than a standalone pilot.

7. Continuous Optimization and Governance

Adoption is not the end; instead, it’s the beginning of sustained value. Intellivon provides ongoing optimization, monitoring performance, updating compliance policies, and refining governance structures. We ensure your blockchain ecosystem adapts to new regulations, technologies, and business models without disruption.

With this seven-step process, Intellivon transforms blockchain from an experimental initiative into a scalable enterprise solution that drives measurable growth, efficiency, and resilience.

Conclusion

Blockchain is no longer a technology of the future. By 2026, enterprise blockchain will be a key part of digital transformation strategies in healthcare, fintech, and AI-driven industries. Its ability to provide trust, transparency, security, and automation makes it vital for companies that want to grow in a data-driven world with strict regulations.

For decision-makers, the message is clear: adopting blockchain in 2026 is not just about keeping up with new trends. It is about laying the groundwork for long-term growth, resilience, and leadership in your field.

Why Choose Intellivon For Robust Blockchain Solutions?

Building enterprise blockchain solutions requires deep expertise in distributed systems, privacy-first design, and regulatory alignment. Intellivon delivers all three, helping enterprises unlock trust, scalability, and measurable ROI at every stage of adoption.

Why Choose Intellivon for Enterprise Blockchain?

- Industry-Leading Expertise: Tailored blockchain strategies across healthcare, fintech, and AI ensure alignment with business goals and compliance requirements.

- Unified Architecture: A modular framework combining blockchain, AI, and privacy compute delivers scalable, future-ready enterprise solutions.

- End-to-End Support: From blueprint design to MVP pilots, scale-out deployment, and governance, Intellivon manages the complete blockchain journey.

- Compliance by Design: Embedded policy frameworks and zero-knowledge proofs ensure HIPAA, GDPR, PCI DSS, and financial regulations are met automatically.

- Measurable Business Impact: We define ROI-driven KPIs and deliver tangible improvements in cost reduction, audit readiness, and revenue growth.

- Customer-Centric Approach: Transparent, ethical collaboration builds long-term partnerships focused on growth, compliance, and innovation.

How We Help You Achieve Enterprise Blockchain Excellence

- Map enterprise needs, compliance requirements, and ROI goals.

- Create a tailored blockchain architecture and integration roadmap.

- Deploy pilots, smart contracts, and privacy-first data exchanges.

- Expand into multi-use case, multi-region ecosystems with measurable results.

- Provide continuous governance, performance tuning, and compliance updates.

Schedule your enterprise blockchain consultation with Intellivon today and unlock secure, scalable, and future-ready digital transformation.

FAQs

Q1. How long does it take to implement an enterprise blockchain solution?

A1. Implementation timelines vary, but most enterprises can see results in phases. At Intellivon, we deliver a blueprint in 2–4 weeks, an MVP pilot in 8–12 weeks, and a scale-out deployment over subsequent quarters. This phased approach ensures quick wins while laying the foundation for long-term adoption.

Q2. Is blockchain secure enough for sensitive enterprise data?

A2. Yes. Enterprise blockchain combines cryptography, decentralized identities, and privacy-preserving technologies like confidential computing and zero-knowledge proofs. These safeguards ensure sensitive data stays private and tamper-proof, meeting strict compliance requirements for finance, healthcare, and AI-driven industries.

Q3. How do enterprises measure ROI from blockchain adoption?

A3. ROI can be tracked through cost savings, compliance improvements, and new revenue streams. For example, enterprises cut reconciliation costs, shorten audit cycles by 70%, and unlock monetization opportunities through tokenization and marketplaces. Intellivon defines KPIs upfront to make ROI measurable.

Q4. Can blockchain integrate with our existing enterprise systems?

A4. Yes. Intellivon designs solutions with API gateways, data oracles, and enterprise connectors that integrate with ERP, CRM, EHR, and financial systems. Blockchain acts as a trust layer, enhancing existing infrastructure rather than replacing it.

Q5. What industries benefit most from enterprise blockchain?

A5. While every industry can benefit, healthcare, fintech, and AI-intensive enterprises lead adoption due to compliance needs, fraud prevention, and the demand for trusted data. Other sectors, like supply chain, retail, and government, are rapidly catching up as they seek transparency and efficiency.