Direct-to-consumer telehealth apps have drastically transformed how people access healthcare, and Hims & Hers is leading the way in reshaping patient expectations across systems. More than just a telehealth platform, Him & Hers has normalized conversations about hair loss and mental health that people once whispered about in doctors’ offices.

But they hold the top position as a DTC telehealth platform because they make healthcare feel less clinical and more human. However, building a similar platform in the UK market has its own peculiarities. This is because the NHS shapes how people think about healthcare access, their regulations are stringent, and cultural attitudes toward wellness differ from the US model. Building a successful DTC telehealth platform requires threading a needle between clinical accuracy and consumer expectations, all while staying compliant with CQC requirements and MHRA guidelines.

We have years of experience in building enterprise-grade DTC telehealth platforms that work with existing healthcare systems rather than replacing them. Our platforms preserve legacy data and integrate cleanly across EHRs and other existing systems. After reading this blog, you will be clear on how we build such platforms from the ground up to scale responsibly, remain compliant in the UK market, and deliver long-term commercial and clinical impact.

Key Takeaways of the DTC Telehealth Services Market Trends

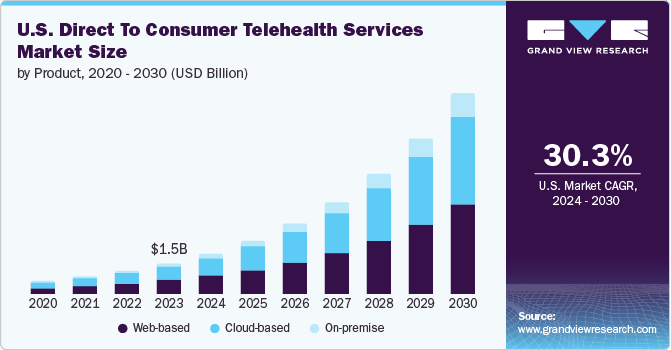

According to the Grand View Research, the U.S. direct-to-consumer telehealth market reached an estimated value of USD 1.47 billion in 2023 and is expected to expand rapidly through 2030, growing at an annual rate of over 30%.

Market Insights:

- Hims & Hers operates on flexible subscription pricing, typically ranging from USD 20 to USD 75 per month, with over 80% of customers remaining active beyond the initial three-month period.

- The platform delivers significantly faster onboarding through AI-driven patient matching, reducing wait times by approximately 40% while maintaining patient satisfaction near 90%.

- Younger populations are leading adoption, with nearly 60% of Gen Z expressing a preference for telehealth-first care experiences.

- Top-performing DTC platforms consistently report subscriber retention exceeding 80%, alongside patient satisfaction scores approaching 90%.

- Subscription-based pricing contributes more than 90% of total platform revenue, underscoring the long-term sustainability of the DTC model.

- Web-based care delivery continues to dominate, accounting for approximately 46% of total DTC telehealth usage.

Despite these growing metrics, DTC telehealth platforms continue to face practical constraints alongside growth. Fragmented reimbursement policies and rising cybersecurity risk create ongoing operational pressure, while adoption among older populations remains slower due to trust and usability barriers.

At the same time, high-growth areas such as weight management are accelerating, with the therapeutic market expected to exceed USD 2 billion by 2025. White-label DTC platforms also present a clear opportunity, allowing health systems to enter the market quickly without building complex infrastructure from scratch.

What Is the DTC Telehealth Platform Him & Hers UK?

Hims & Hers UK is a modern DTC telehealth platform built around the principles of access, privacy, and continuity rather than episodic appointments. It allows individuals to get care for specific conditions through structured digital assessments, followed by clinician review and, where appropriate, prescription treatment delivered directly to the patient.

What sets the model apart is how tightly care delivery and commerce are integrated. Clinical workflows, prescribing safeguards, pharmacy fulfillment, and subscriptions operate as one coordinated system. This structure allows the platform to scale repeat care responsibly while maintaining regulatory oversight.

Globally, Hims & Hers has demonstrated that condition-led, subscription-based care can achieve strong adoption and retention when trust and convenience are aligned. In the UK, the platform reflects a broader shift toward consumer-initiated healthcare that operates alongside traditional services, offering predictable access without compromising governance.

For enterprises, it provides a clear blueprint for how DTC telehealth platforms can function as sustainable operating models rather than standalone digital products.

What Features Make Him & Hers UK Stand Out?

Hims & Hers UK is not a typical telehealth portal. Its distinguishing strength lies in the combination of clinical rigor, consumer convenience, and repeat engagement design. The platform’s features are crafted not just to connect users with clinicians but to sustain long-term health journeys in ways that traditional models rarely achieve.

1. Condition-Centered Care Flows

These are structured, symptom-driven intake sequences tailored to specific health needs. Instead of general questionnaires, users follow optimized paths that guide them through relevant questions, easing decision fatigue while capturing clinical data. This improves triage accuracy and user satisfaction.

2. Integrated Prescribing and Delivery

Once a clinician authorizes treatment, prescriptions are fulfilled through connected pharmacy partners.

Medications are shipped directly to the user’s address. By aligning clinical decision workflows with dispensing operations, the platform delivers care end-to-end.

3. Subscription and Continuity

The platform moves beyond one-off visits. Subscription plans provide recurring access to care and refills. This encourages retention, predictable revenue streams, and ongoing engagement rather than episodic interaction.

4. User-First Digital Experience

Every digital touchpoint, from onboarding to follow-ups, is designed for simplicity and clarity. Clear progress indicators, easily accessible support, and mobile-friendly flows reduce abandonment and build trust.

These features work together to create a seamless journey where care access, clinical governance, and ongoing engagement reinforce one another. This combination sets Hims & Hers UK apart and illustrates what enterprise telehealth platforms must deliver to remain competitive and relevant.

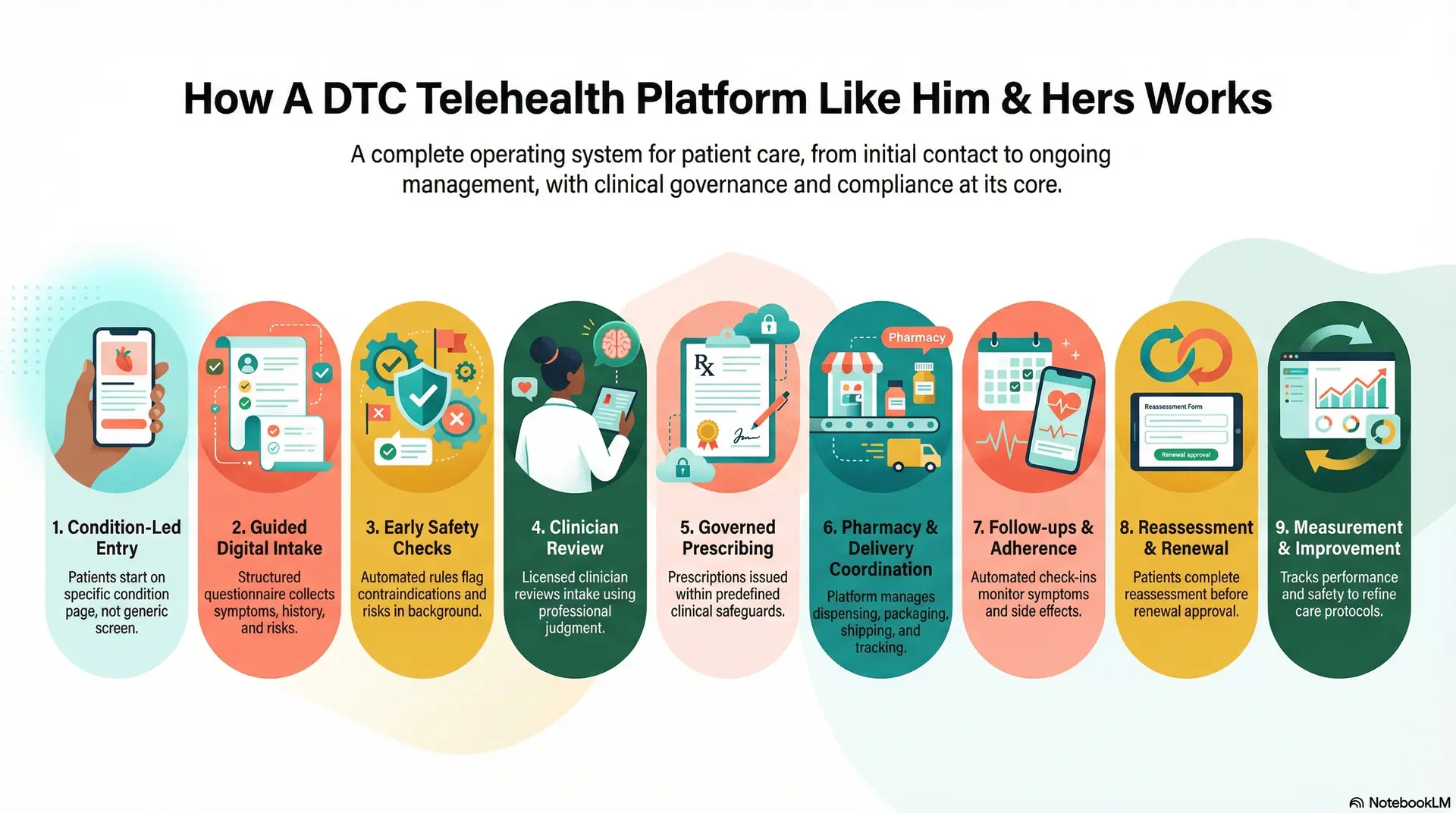

How A DTC Telehealth Platform Like Him & Hers Works

A DTC telehealth platform works best when it behaves like an operating system instead of being a booking tool. It guides the patient through one clear path, then routes the work to the right clinical and operational teams. In the UK, this also means the workflow must carry compliance controls from start to finish.

A DTC telehealth platform succeeds when the workflow feels simple to the patient but remains tightly governed behind the scenes. Each step is designed to move care forward without breaking clinical accountability or regulatory control.

Step 1: Condition-led entry

Patients begin their journey through a specific condition page rather than a generic booking screen. This reduces uncertainty, sets expectations early, and helps users feel confident about what comes next.

Step 2: Guided digital intake

The platform collects symptoms, medical history, medications, allergies, and risk indicators through a structured questionnaire. Although the experience feels lightweight, the output is organized for clinical review.

Step 3: Early safety checks

Automated rules run quietly in the background to flag contraindications, unsafe combinations, or missing information. Higher-risk cases surface early, before the clinician’s time is spent.

Step 4: Clinician review

A licensed clinician reviews the intake, requests clarification when needed, or routes the case to a live consultation. Clinical judgment remains central at this stage.

Step 5: Governed prescribing

When treatment is appropriate, prescriptions are issued within predefined safeguards. Clinical rationale, consent, and prescribing details are captured automatically.

Step 6: Pharmacy and delivery coordination

Approved prescriptions move into a fulfillment workflow that manages dispensing, packaging, shipping, and tracking. Patients see updates inside the same platform.

Step 7: Follow-ups and adherence

The platform schedules check-ins, symptom updates, and side-effect monitoring. Care becomes continuous rather than transactional.

Step 8: Reassessment and renewal

Before refills, patients complete a short reassessment. Clinicians review changes and adjust treatment or renew care accordingly.

Step 9: Measurement and improvement

The platform tracks conversion, drop-offs, turnaround time, fulfillment performance, and safety events. Clinical teams also review outcomes to refine protocols.

This step-by-step flow turns digital demand into structured, repeatable care delivery. When designed correctly, it improves access while preserving oversight, compliance, and sustainable unit economics at scale.

Key Business Models Behind Platforms Like Hims & Hers

DTC telehealth platforms succeed when their business model mirrors how patients actually engage with care over time. Platforms like Hims & Hers are not built around single transactions. They are structured to support continuity, controlled growth, and operational visibility as demand increases.

1. Subscription-Led Care as the Core Revenue Engine

Subscriptions anchor the commercial model. Instead of charging per visit, patients enroll in recurring plans that cover assessments, clinician oversight, and medication refills over time.

This approach stabilizes cash flow and improves lifetime value. More importantly, it allows enterprises to plan staffing, pharmacy operations, and infrastructure capacity with far greater accuracy. Care delivery becomes proactive and predictable rather than reactive.

2. Condition-Specific Care Productization

Each condition operates as a defined service line with its own intake logic, treatment protocols, pricing, and review cadence. This removes ambiguity from both the patient and clinician experience.

For enterprises, this structure simplifies governance. Protocols are easier to audit, outcomes are easier to track, and expansion into new conditions follows a repeatable pattern instead of bespoke builds.

3. Bundled Pricing Across Care and Fulfillment

Consultation, prescribing, medication dispensing, and delivery are presented as a single bundled experience. Patients see clarity and transparency rather than fragmented charges.

Operationally, bundling reduces billing friction, lowers support overhead, and minimizes revenue leakage. It also aligns incentives across clinical and pharmacy workflows.

4. Longitudinal Data–Driven Expansion

Revenue growth does not rely on aggressive acquisition alone. Platforms use longitudinal data to introduce dosage adjustments, complementary therapies, or adjacent care programs when clinically appropriate.

This creates expansion revenue that feels like care progression, not upselling, while strengthening retention and outcomes.

These business models turn DTC telehealth into a controlled growth platform rather than a volatile service line. When commercial structure and care delivery evolve together, enterprises gain resilience, scalability, and long-term trust.

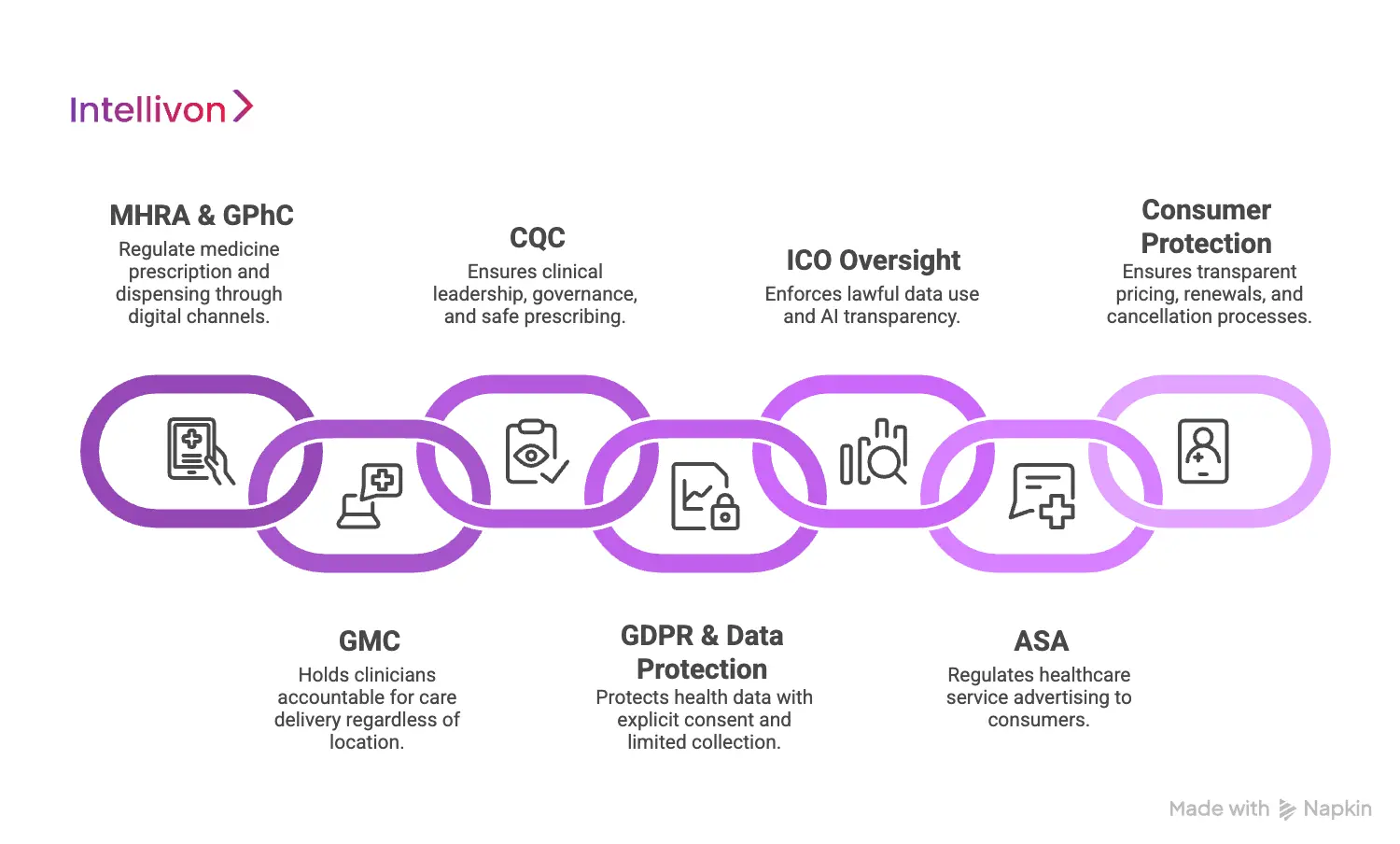

UK Regulatory & Compliance Requirements For DTC Telehealth Platforms

UK DTC telehealth platforms must comply with healthcare, prescribing, data protection, advertising, and consumer regulations, all enforced through system-level controls rather than manual policy enforcement.

What follows is the full regulatory landscape enterprises must design for when building at scale.

1. MHRA & GPhC

The Medicines and Healthcare products Regulatory Agency and the General Pharmaceutical Council regulate how medicines are prescribed, dispensed, and supplied through digital channels.

As a result, platforms must ensure prescribing decisions follow appropriate clinical assessment, remain evidence-based, and are fully documented, while online pharmacies meet supervision, storage, and dispensing standards. In practice, this means that safeguards must be enforced by workflow logic rather than relying on manual checks or post-hoc review.

2. GMC

The General Medical Council holds clinicians accountable regardless of where care is delivered. Digital platforms do not change professional responsibility.

Therefore, DTC telehealth systems must support verified prescriber identity, clearly defined supervision and escalation paths, and complete audit trails for every clinical decision. When volumes grow, traceability becomes the difference between controlled scale and regulatory exposure.

3. CQC

When a platform delivers diagnosis, treatment, or prescribing through UK clinicians, Care Quality Commission registration applies.

CQC expects evidence of clinical leadership, governance structures, safeguarding processes, and safe prescribing with appropriate follow-up. Digital-only delivery does not reduce scrutiny. In many cases, it increases expectations around consistency and control.

4. GDPR and UK Data Protection Obligations

Health data is treated as special category data under UK law, which raises the compliance bar significantly. Platforms must capture explicit consent tied to specific purposes, limit data collection to what is necessary, and disclose clearly when AI supports clinical or operational decisions.

Consent must remain actionable, revocable, and logged automatically, particularly as platforms introduce personalization, analytics, and automation across the care journey.

5. ICO Oversight and AI Transparency

The Information Commissioner’s Office enforces lawful data use beyond surface-level GDPR compliance.

This includes scrutiny of automated triage logic, secondary data usage for personalization, and the explainability of AI-assisted recommendations. In many DTC platforms, AI governance gaps surface faster than clinical issues, especially as algorithms influence access and treatment pathways.

6. ASA

The Advertising Standards Authority regulates how healthcare services are presented to consumers.

Accordingly, platforms must tightly control health claims, testimonials, endorsements, and before-and-after imagery. Marketing content must align with clinical evidence and prescribing limitations, with approval workflows designed to prevent non-compliant claims from reaching the public.

7. Consumer Protection and Subscription Law

DTC telehealth platforms also fall under UK consumer protection frameworks, which makes subscription governance a compliance issue rather than a commercial detail.

Clear pricing, transparent renewals, simple cancellation flows, and defined refund processes are all required. When these controls are weak, enterprises face legal exposure that sits outside traditional healthcare regulation.

Compliance must live inside clinical workflows, prescribing logic, data access controls, and marketing systems, where it is enforced consistently rather than explained repeatedly.

94% of Users Are Willing To Regularly Use Telehealth Platforms

A vast majority of users who try telehealth once are willing to use it again, signaling a permanent shift toward virtual-first healthcare experiences.

According to Deloitte, 94% of consumers who have used a virtual care service say they are willing to use it again, a sharp increase from 80% in 2020. This change reflects habit formation, not novelty. Virtual care has become familiar, trusted, and normalized across everyday health needs.

1. Virtual Care Builds Confidence After First Use

The most important adoption barrier has already been crossed. Trust is no longer hypothetical.

Once patients complete a virtual visit successfully, uncertainty drops sharply. They understand how care is delivered, how prescriptions are handled, and how follow-ups work. As a result, telehealth becomes part of their default care behavior rather than an exception.

For enterprises, this means demand compounds over time. Each successful interaction increases the likelihood of repeat usage, subscription enrollment, and long-term retention.

2. Younger Populations Redefining Provider Loyalty

The same research highlights a deeper strategic signal. 33% of Gen Z and 43% of millennials say they would switch doctors if virtual visits are not available. This is not a marginal preference. It is a redefinition of what access means.

These demographics are entering their highest lifetime healthcare spending years. Their expectations are shaped by digital-first services in every other industry. When healthcare lags behind, loyalty erodes quickly.

For organizations, virtual access is no longer an enhancement. It directly influences patient retention, brand perception, and long-term revenue stability.

What This Changes Inside the Enterprise

High willingness to reuse telehealth shifts internal priorities. Platforms must be built for repeat engagement, not occasional demand spikes.

That affects:

- Care pathways, which must support ongoing relationships

- Infrastructure, which must handle predictable volume growth

- Compliance models, which must scale with usage rather than rely on manual oversight

When virtual care becomes habitual, weak foundations surface fast.

Why This Matters Now

The 94% figure is not just a satisfaction metric. It is a signal of behavioral lock-in. Enterprises that treat DTC telehealth as a side channel risk losing relevance with digitally fluent populations. Those who design it as a core operating layer gain a durable growth advantage.

In the next phase of healthcare delivery, availability will define trust. Platforms that make access simple, consistent, and repeatable will set the standard for patient relationships in the years ahead.

Core Platform Architecture for a DTC Telehealth System

A DTC telehealth platform only becomes viable at enterprise scale when its architecture mirrors how care, regulation, and commerce intersect in the real world. Demand may start with a consumer click, but delivery depends on controlled workflows that coordinate clinicians, pharmacies, data, and recurring revenue. In the UK, this coordination must also withstand regulatory scrutiny across every step.

Below are the eight essential architectural layers required to build a DTC telehealth system that can grow without losing control.

1. Experience & Engagement Layer

The experience and engagement layer shapes how patients discover, enter, and remain engaged with the platform. It supports condition-specific journeys, guided intake, subscription onboarding, account management, and follow-up interactions.

The goal is to reduce friction while still capturing structured, clinically meaningful data. At scale, this layer directly influences conversion, retention, and support load.

Tech used:

- React or Next.js for web applications

- Flutter or React Native for mobile apps

- Backend-for-Frontend (Node.js)

- CDN and edge delivery (CloudFront, Akamai)

- Feature flagging and experimentation tools

2. Identity, Access & Consent Layer

Consent governs who can access what, under which conditions, and with what permissions. It separates patient, clinician, pharmacy, and admin roles while enforcing consent for care delivery, data usage, communications, and AI-assisted steps.

Strong identity and consent controls are foundational for both trust and regulatory compliance.

Tech used:

- OAuth2 / OpenID Connect

- Auth0, Keycloak, or AWS Cognito

- Multi-factor authentication

- Role-based and attribute-based access control

- Consent records stored in relational databases

- Encryption key management systems

3. Clinical Intake, Triage & Decision Support Layer

This layer transforms patient-reported information into clinician-ready insight. It runs structured questionnaires, flags contraindications, identifies red risks, and routes cases to the appropriate clinical queue. While automation improves speed, final clinical judgment remains human-led.

Tech used:

- Rules engines for clinical logic

- FastAPI or Spring Boot services

- Structured data models (FHIR, where appropriate)

- Redis for session and state management

- Controlled NLP components with safety constraints

4. Care Orchestration & Workflow Layer

This is the operational backbone of the platform. It coordinates tasks, approvals, escalations, SLAs, follow-ups, renewals, and second reviews. Every action is timestamped and auditable. As volumes increase, this layer prevents operational chaos and protects clinical accountability.

Tech used:

- Workflow engines (Temporal, Camunda, Zeebe)

- Event-driven messaging (Kafka, RabbitMQ)

- Job scheduling and orchestration tools

- Event sourcing patterns for traceability

5. Prescribing, Pharmacy & Fulfillment Layer

This layer connects clinical decisions to real-world medication delivery. It enforces prescribing rules, captures clinical rationale, routes prescriptions to approved pharmacies, and manages inventory, packaging, shipping, and delivery tracking. It also supports discreet fulfillment and exception handling, which are critical in DTC care.

Tech used:

- Medication knowledge base integrations

- Pharmacy partner APIs

- Order and inventory management services

- Shipping carrier integrations

- Webhooks and event streams for status updates

- Immutable audit logs for prescribing actions

6. Payments, Subscriptions & Revenue Layer

Revenue-based layer manages how money flows through the platform. It supports subscription plans, renewals, proration, retries, refunds, and entitlements. Access to care workflows is tied directly to payment state, ensuring commercial logic and clinical delivery remain aligned.

Tech used:

- Payment gateways (Stripe, Adyen)

- Subscription billing engines

- Entitlement and access services

- Dunning and retry logic

- PCI-compliant tokenization via providers

7. Data, Analytics & Intelligence Layer

This layer turns platform activity into insight. It tracks funnel performance, clinical SLAs, fulfillment times, adherence, retention, and outcomes. It also supports privacy-safe analytics and reporting for both operational teams and leadership.

Tech used:

- PostgreSQL for transactional data

- Data warehouses (Snowflake, BigQuery, Redshift)

- ELT pipelines (Fivetran, dbt)

- Event tracking platforms

- BI and reporting tools

8. Security, Compliance & Observability Layer

This layer enforces encryption, access monitoring, auditability, and resilience. It supports GDPR principles, UK regulatory requirements, and incident response readiness. As scale increases, this layer ensures the platform remains defensible under scrutiny.

Tech used:

- Encryption at rest and in transit

- Secrets management (Vault, AWS Secrets Manager)

- Web application firewalls

- SIEM and logging platforms

- Observability tools (OpenTelemetry, Datadog)

- Policy-as-code and compliance automation

When these eight layers work together, a DTC telehealth platform becomes more than a digital product. It becomes a governed operating system for care delivery, revenue, and compliance. This architectural discipline is what allows platforms like Hims & Hers to scale responsibly while maintaining trust and control.

Role of AI in Hims-Style Telehealth Platforms

In DTC telehealth platforms, AI strengthens intake, triage, personalization, and operations by improving speed and consistency, while clinicians retain full decision-making authority.

1. AI-Assisted Intake and Clinical Data Structuring

The first point of pressure in DTC telehealth is intake. High volumes of patient-reported data arrive in inconsistent formats, often with missing or unclear context. AI helps normalize this information by structuring free-text inputs, validating responses, and guiding users through adaptive questionnaires.

This improves data completeness before a clinician ever reviews the case. As a result, clinicians spend less time interpreting raw inputs and more time making informed decisions. Intake becomes faster, cleaner, and more reliable at scale.

2. Risk Identification and Triage Support

AI plays a critical role in early risk detection. Models assist in flagging contraindications, potential medication conflicts, and symptom patterns that require escalation. They also identify cases that lack sufficient information, preventing premature review.

Importantly, AI does not approve or deny care. It prioritizes attention. Clinicians remain responsible for final judgment, while AI ensures that higher-risk cases surface earlier and low-risk cases follow established pathways safely.

3. Longitudinal Personalization and Engagement

Hims-style platforms depend on continuity rather than one-off visits. AI supports this by analyzing longitudinal engagement data to personalize follow-up timing, reassessment prompts, and adherence reminders.

This personalization is operational, not diagnostic. It helps patients stay on track without influencing clinical decisions directly. Over time, this improves retention, outcomes, and patient satisfaction while reducing manual follow-up burden.

4. Operational Automation and Scale Efficiency

Beyond clinical workflows, AI drives efficiency across operations. It assists with customer support routing, refill timing, inventory forecasting, and exception handling across pharmacy fulfillment.

As demand grows, these efficiencies protect margins and service quality. AI allows teams to scale without proportionally increasing headcount, which is critical in clinician- and pharmacist-constrained environments.

5. AI Governance, Transparency, and Control

In the UK, AI use must be explainable, auditable, and disclosed. Platforms must log where AI influences workflows, define clear boundaries, and ensure humans retain authority over all clinical outcomes.

Strong governance turns AI into a compliance asset rather than a risk. Weak governance does the opposite.

AI enables Hims-style telehealth platforms to scale responsibly by improving speed, consistency, and engagement across the care lifecycle. Its power lies in disciplined augmentation. When governed correctly, AI strengthens trust, efficiency, and long-term platform resilience rather than undermining them.

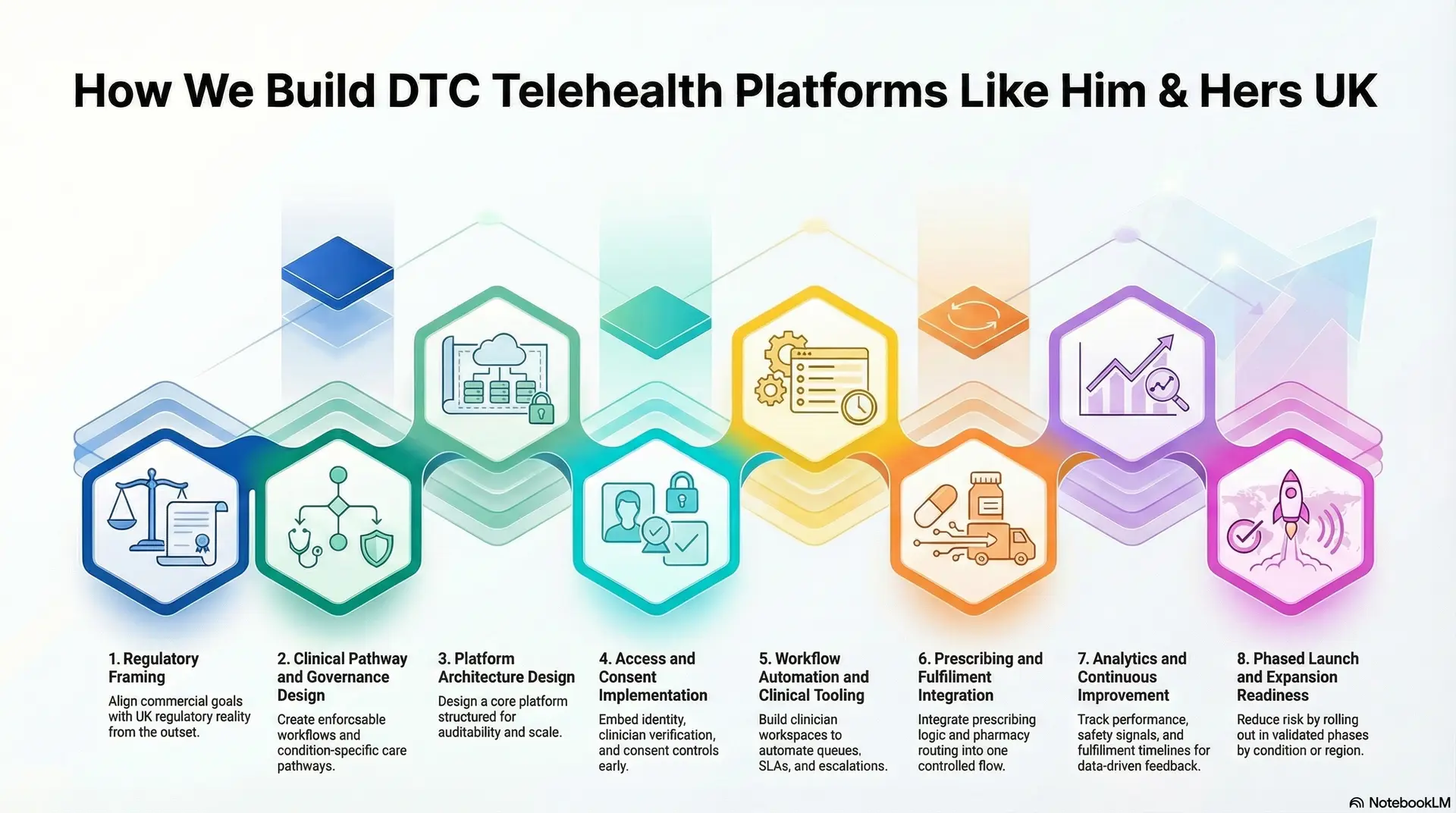

How We Build DTC Telehealth Platforms Like Him & Hers UK

We treat building DTC telehealth platforms like the design of a regulated operating platform that must balance growth, safety, and long-term control. Our experience working with enterprise healthcare systems shapes a delivery model that prioritizes durability over speed alone.

Below is the eight-step approach we follow to build platforms comparable to Hims & Hers in the UK market.

Step 1: Regulatory Framing

Every platform begins with clarity. We work with stakeholders to define target conditions, user segments, pricing logic, and growth goals, while mapping UK regulatory exposure from the outset.

This step aligns commercial ambition with compliance reality. It ensures that expansion plans, marketing strategy, and care scope remain feasible under MHRA, GPhC, GMC, and CQC expectations.

Step 2: Clinical Pathway and Governance Design

Next, we design condition-specific care pathways that define intake logic, review steps, escalation rules, and follow-up cadence. Clinical governance is documented and translated into enforceable workflows.

This creates a shared blueprint for clinicians, product teams, and compliance leaders. As volume grows, these pathways protect consistency and accountability.

Step 3: Platform Architecture Design

We design the core platform architecture across experience, workflow orchestration, prescribing, fulfillment, payments, and data layers. Data models are structured for auditability, not convenience.

This step prevents rework later. It ensures the platform can scale without breaking under regulatory or operational pressure.

Step 4: Access and Consent Implementation

Identity and consent are embedded early, not added later. We implement role-based access, clinician verification, and granular consent controls tied to specific data uses.

This allows enterprises to expand AI, analytics, and personalization safely while remaining compliant with UK data protection requirements.

Step 5: Workflow Automation and Clinical Tooling

We build clinician workspaces and workflow engines that manage queues, SLAs, renewals, and escalations. Automation reduces manual coordination without removing human oversight.

Clinicians retain authority, while operations gain predictability and visibility across growing demand.

Step 6: Prescribing and Fulfillment Integration

Prescribing logic, medication safety checks, and pharmacy routing are integrated into one controlled flow. Fulfillment operations are treated as part of care delivery, not a downstream add-on.

This alignment reduces errors, improves delivery reliability, and supports discreet, subscription-based medication supply.

Step 7: Analytics and Continuous Improvement

We instrument the platform to track conversion, retention, clinical SLAs, fulfillment timelines, and safety signals. Insights are shared across leadership, operations, and clinical teams.

This data-driven feedback loop allows platforms to improve outcomes while maintaining cost and quality discipline.

Step 8: Phased Launch and Expansion Readiness

We support phased rollouts by condition or region, followed by controlled expansion. Each phase is validated against compliance, performance, and financial benchmarks.

This approach reduces risk while accelerating time to sustainable scale.

Building a DTC telehealth platform like Hims & Hers UK demands disciplined alignment between care delivery, regulation, and commercial strategy. Intellivon brings this alignment into every build, helping enterprises launch faster while staying compliant, scalable, and positioned for long-term growth.

Cost To Build A DTC Telehealth Platform Like Him & Hers UK

Building a DTC telehealth platform like Hims & Hers UK does not require a single, heavy upfront investment. Most enterprises start with a focused foundation that supports condition-led care, secure online prescribing, subscription billing, and pharmacy fulfillment. The platform then evolves as user volumes grow, new conditions are added, and regulatory scope expands.

At Intellivon, we structure cost around platform readiness and regulatory durability, not feature overload. This approach allows organizations to launch faster, validate demand early, and scale responsibly without locking capital into unnecessary complexity before it delivers value.

Estimated Cost Breakdown (USD 80,000–220,000)

| Cost Component | What It Covers | Estimated Range |

| Discovery & DTC Care Model Design | Condition selection, subscription logic, UK regulatory mapping, prescribing boundaries, and platform architecture | $8,000 – $18,000 |

| Condition-Led UX & Intake Design | Patient journeys, structured assessments, accessibility logic, and conversion-optimized flows | $8,000 – $16,000 |

| Clinical Intake, Triage & Workflow Engine | Symptom logic, contraindication checks, routing rules, SLAs, and escalation paths | $10,000 – $22,000 |

| Clinician Workspace & Review Tools | Secure review dashboards, messaging, documentation, and approval workflows | $8,000 – $18,000 |

| Prescribing & Pharmacy Integration Layer | Medication rules, audit trails, pharmacy APIs, inventory and delivery coordination | $12,000 – $30,000 |

| Subscription Billing & Revenue Controls | Plans, renewals, retries, refunds, entitlements, and access gating | $6,000 – $15,000 |

| Identity, Consent & Access Governance | User verification, clinician identity, consent capture, RBAC, and audit logs | $6,000 – $14,000 |

| Security & UK Compliance Controls | GDPR safeguards, prescribing governance, logging, and policy enforcement | $6,000 – $15,000 |

| Analytics, Monitoring & Reporting | Funnel metrics, retention tracking, clinical SLAs, and executive dashboards | $5,000 – $12,000 |

| Testing, Pilot & Stabilization | QA, clinical validation, pharmacy testing, and early optimization | $5,000 – $10,000 |

Typical Investment Ranges

- Lean MVP DTC Telehealth Platform: $80,000 – $130,000: Suitable for one or two conditions, limited subscriptions, and early market validation within the UK.

- Enterprise-Ready Phase 1 Platform: $150,000 – $220,000: Designed for multi-condition rollout, deeper pharmacy and analytics integration, and full regulatory readiness.

Final cost depends on integration depth, prescribing scope, compliance rigor, and how much automation is required at launch.

Factors That Influence the Cost of DTC Telehealth Platforms

Cost is driven by care complexity and governance, not visual design alone.

- Scope of Clinical Conditions: Single-condition platforms cost less. Multi-condition care with varying prescribing rules increases complexity and effort.

- Depth of Pharmacy and Fulfillment Integration: Basic fulfillment is cheaper. Real-time inventory, exception handling, and subscription logistics add cost but reduce churn.

- Regulatory and Audit Requirements: Strong prescribing controls, clinician oversight, and CQC readiness increase upfront investment while protecting long-term viability.

- AI and Workflow Automation: Basic intake assistance is affordable. Advanced triage, personalization, and operational automation increase cost but improve margins at scale.

- Analytics and Executive Visibility: Minimal reporting shows activity. Enterprise dashboards explain outcomes, utilization, and ROI, which matter once the platform grows.

When built correctly, a DTC telehealth platform becomes a growth engine rather than a cost center. The key is investing early in the layers that protect scale, trust, and regulatory confidence, instead of paying for shortcuts later.

Conclusion

DTC telehealth platforms like Hims & Hers UK demonstrate how healthcare can scale when access, governance, and commercial strategy move in sync. The real transformation is not digital visits. It is the ability to deliver repeat care, predictable revenue, and compliant operations through one governed system. For enterprises, this shift creates a new growth channel that complements existing care models rather than competing with them.

At Intellivon, we build these platforms with durability in mind. Our focus stays on regulatory safety, operational control, and long-term scalability. If your organization is exploring DTC telehealth as a strategic growth lever, the next step is not experimentation. It is building the right foundation to scale with confidence.

Build Your DTC Telehealth Platform With Intellivon

At Intellivon, we build DTC telehealth platforms as enterprise operating layers, not consumer apps or marketing-led front ends. Our platforms are designed to govern how patients enter care, how clinicians deliver treatment remotely, and how control is maintained across prescribing, fulfillment, subscriptions, and regulated infrastructure.

Each solution is engineered for healthcare organizations operating at scale. Platforms are infrastructure-first and compliance-led, with DTC care models integrated into existing EHRs, identity frameworks, pharmacy networks, and analytics systems. As platforms expand across conditions, geographies, and user volumes, clinical oversight, data integrity, and operational predictability remain intact.

Why Partner With Intellivon?

- Enterprise-grade DTC architecture aligned with clinical governance, subscription care models, and scalable growth

- Deep interoperability expertise across EHRs, pharmacy ecosystems, identity platforms, payments, and analytics stacks

- Compliance-by-design delivery supporting UK regulatory requirements, audit readiness, and role-based access control

- AI-assisted orchestration that strengthens intake, triage, fulfillment, and operations without replacing clinical judgment

- Proven enterprise delivery model with phased rollout, KPI-driven validation, and controlled expansion

Talk to Intellivon’s healthcare platform architects to explore how a DTC telehealth platform can integrate into your existing ecosystem, unlock new revenue channels, protect regulatory integrity, and scale digital care with confidence.

FAQs

Q1. What is a DTC telehealth platform, and how does it work?

A1. A DTC telehealth platform allows patients to access care directly through digital channels without traditional referrals. It combines online intake, clinician review, prescribing, and fulfillment into a single, governed workflow. For enterprises, this model supports subscription-based care, predictable demand, and controlled scaling while maintaining regulatory oversight.

Q2. Is it legal to build a DTC telehealth platform like Hims & Hers in the UK?

A2. Yes, DTC telehealth platforms are legal in the UK when they comply with MHRA, GPhC, GMC, CQC, GDPR, and ASA requirements. Compliance must be embedded into platform workflows, including prescribing safeguards, clinician accountability, consent management, and advertising controls, rather than handled through policies alone.

Q3. How much does it cost to build a DTC telehealth platform like Hims & Hers UK?

A3. The cost typically ranges from USD 80,000 to USD 220,000, depending on condition scope, prescribing complexity, pharmacy integration, compliance depth, and automation level. Most enterprises start with a focused MVP and scale the platform as demand, retention, and revenue stabilize.

Q4. What makes DTC telehealth platforms different from traditional telemedicine systems?

A4. Traditional telemedicine focuses on appointments. DTC telehealth platforms focus on repeat care. They are built around condition-specific journeys, subscriptions, integrated fulfillment, and longitudinal engagement. This shift enables predictable revenue, higher retention, and stronger patient relationships over time.

Q5. Can AI be used safely in DTC telehealth platforms?

A5. Yes, when implemented correctly. AI is commonly used to support intake, triage, personalization, and operations, but not to replace clinical decision-making. In the UK, AI use must be transparent, auditable, and governed, with clinicians retaining final authority over all care decisions.