Most real estate enterprises face the same issue of having their most valuable assets trapped in systems designed for yesterday’s problems. In these situations, raising capital drags on for months, compliance eats into profit margins, and the structure itself locks out investors who could bring real value. When speed and flexibility matter most, these limitations become expensive bottlenecks.

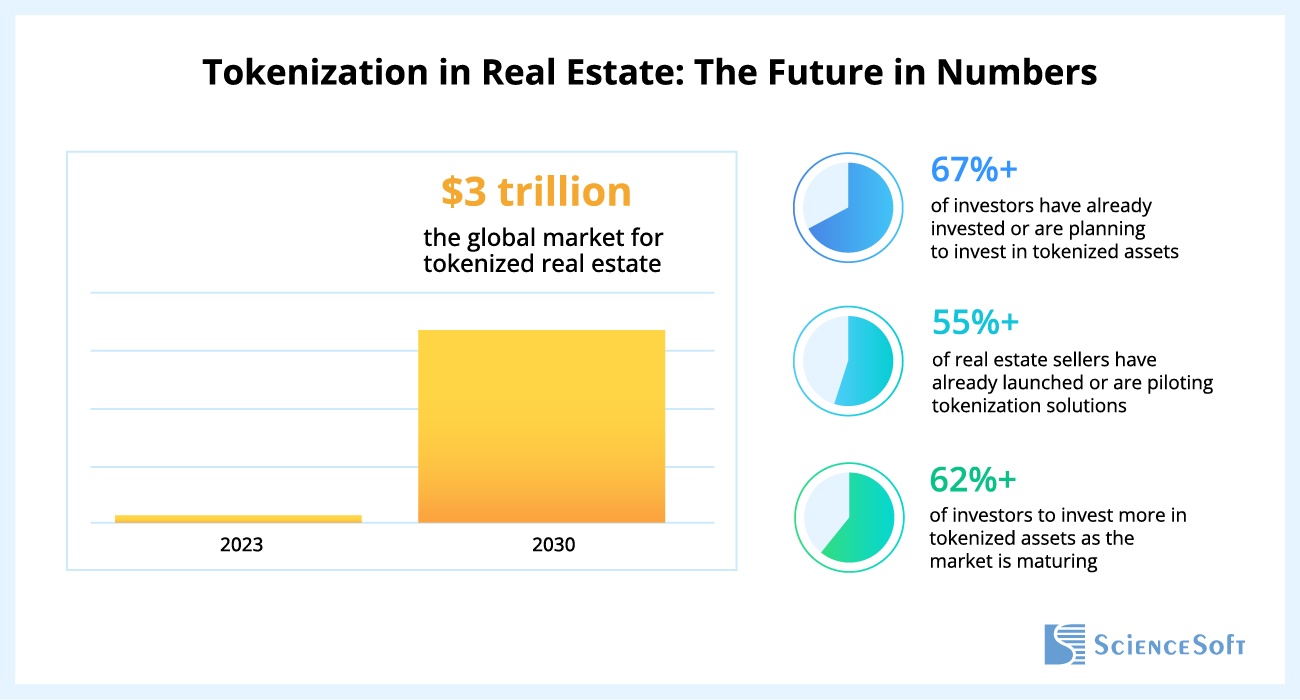

Real estate tokenized investment platforms cut through these roadblocks by turning property rights into digital tokens that investors can buy, sell, and trade. As a result, fractional ownership becomes possible, liquidity improves, and operating costs drop. Suddenly, enterprises can reach investors anywhere in the world, opening lucrative doors that were not possible before. Because of this unprecedented rate of success, tokenized real estate is on track to hit $3 trillion by 2030.

We’ve spent years at Intellivon building these platforms for enterprises that need them actually to work securely, compliantly, and at scale. In this blog, we’re going to show you how we do it, from the first design decisions through launch and beyond.

Real-Estate Tokenization Market Size & Enterprise ROI

The global tokenized real-estate market is accelerating toward mainstream adoption and is set to reshape the $280 trillion real-estate asset class. Analysts project it will reach $3 trillion by 2030, representing over 1% of global real-estate AUM.

Key Market Insights:

- As of 2025, about 12% of firms have launched tokenization initiatives, while another 46% are piloting platforms, showing a clear shift toward digital investment infrastructure.

- This rapid adoption is being driven by an estimated 85% CAGR from 2023 to 2030, powered by improving regulatory clarity and growing institutional demand for alternative, compliant investment vehicles.

- Fractional Ownership Uptake: Over 60% of fractional-property investors are under 40, expanding reach to younger wealth segments.

- Institutional Interest: 56% of institutional investors now rank real estate as the top real-world asset for tokenization.

- Global Reach: Platforms report investors from 45+ countries, reducing geographic barriers by 70%.

- Secondary Market Volume: Liquidity pools exceed $25 million daily, with volumes up 230% year-over-year.

- Time-to-Liquidity: Tokenized assets reach liquidity in 48 hours, versus months in private placements.

- Compliance Cost Reduction: Smart contracts cut compliance expenses by up to 90% (BlocHome case).

- Operational Savings: Custody integration saves 40% annually in IT and security operations.

- Settlement Efficiency: On-chain settlement reduces transaction fees by 75%.

- Payback Period: Typical platform CAPEX (~$500K) pays back in 12–18 months.

- Revenue Growth: Enterprises report 20–30% incremental revenue uplift in Year 1.

- TCO Reduction: Ownership costs drop 30% compared to legacy compliance and trading systems.

- Case Studies: BlocHome cut compliance costs by 90% and onboarded 800 investors in Month 1; Elevated Returns tokenized $1B in Southeast Asia; RealT averaged 231 investors per property.

Key takeaway: By 2030, tokenized real estate will be a multi-trillion-dollar market. Enterprises that invest now can unlock liquidity, cut costs by up to 90%, and access global capital, thereby driving revenue growth of 20–30% and achieving payback within 18 months. This makes the case clear for adopting Intellivon’s enterprise-grade tokenization solutions.

What are Tokenized Real-Estate Investment Platforms?

A tokenized real-estate investment platform takes property ownership and represents it as digital tokens on a blockchain. Each token reflects a share of the underlying asset, whether that’s a single building, a portfolio, or a structured fund. These tokens can then be issued, purchased, and traded, giving enterprises and their investors access to liquidity that traditional structures rarely provide.

Unlike consumer crowdfunding portals, enterprise platforms are built to handle regulatory demands, cross-border participation, and institutional-grade custody. Compliance is coded directly into the smart contracts, so every transaction automatically respects KYC, AML, and securities laws. This gives enterprises the protection they need while assuring investors that the platform operates under strict governance.

A full solution combines several layers: the blockchain foundation for issuing tokens, investor onboarding for identity and compliance checks, custody modules for wallet security, and trading features that enable secondary-market liquidity. For the enterprise, the result is a platform that can fractionalize property assets, distribute them to investors, and manage them efficiently at scale.

In practice, these platforms expand the investor base, reduce administrative costs, and shorten capital formation cycles. What once took months to execute can now happen within days or even hours, opening real estate to a broader and more global pool of investors.

Why Enterprises Should Build a Tokenized Real-Estate Platform

Enterprises hold vast real-estate portfolios that are often slow to monetize and expensive to manage. As global investors demand easier access and faster liquidity, enterprises need a new model.

1. Unlocking Liquidity in Illiquid Assets

Real estate is historically one of the most illiquid asset classes. Tokenization breaks properties into digital tokens that can be traded on regulated platforms. This allows enterprises to release capital tied up in assets, improve balance sheet efficiency, and give investors faster exit options.

2. Expanding the Investor Base

Tokenized platforms open doors to new investor groups. Fractional ownership lowers the entry barrier, enabling participation from both institutional funds and accredited investors across global markets. For enterprises, this creates a far larger pool of capital without the geographic and administrative limitations of traditional structures.

3. Reducing Costs and Improving Efficiency

Automating compliance through smart contracts cuts manual processing. On-chain KYC, AML, and settlement processes reduce administrative overhead and lower transaction costs. Case studies show enterprises achieving up to 90% savings in compliance operations, freeing resources for growth-focused activities.

4. Driving Enterprise Growth

Beyond efficiency gains, tokenization positions enterprises as forward-thinking market leaders. Early movers gain credibility with institutional partners and regulators while building a long-term competitive edge in a market projected to reach $3 trillion by 2030.

Building a tokenized platform is a growth strategy. Enterprises that act now can capture new revenue streams, reduce friction, and expand globally. With the “why” established, the next question is which blockchain model to build on, whether public or permissioned, which we’ll explore in the following section.

Public vs Permissioned Blockchains for Tokenization

Enterprises need clarity when choosing the base network for a tokenized real-estate platform. The decision affects compliance, operating cost, performance, and investor trust. Use the comparison below to evaluate what matters most for regulated, cross-border investment flows.

Public vs Permissioned Blockchain for Tokenization Comparison Table

| Factor | Public Blockchain | Permissioned Blockchain |

| Regulatory posture | Requires controls at the app layer | Controls at the network and app layers |

| KYC/AML enforcement | Off-chain or smart-contract gates | Native identity and access controls |

| Investor whitelisting | Possible, but external lists are common | Built-in, role-based identities |

| Data privacy | Transparent by default | Selective disclosure and private state |

| Transaction finality | Probabilistic to fast, network dependent | Deterministic and predictable |

| Throughput and latency | Variable, tied to network demand | Tuned to enterprise SLAs |

| Fee predictability | Variable gas, subject to spikes | Stable fees set by operators |

| Operational control | No control over validators | Full control of the validator set |

| Change management | Community governance timelines | Enterprise change boards and SLAs |

| Compliance reporting | On-chain proofs plus off-chain tools | Native audit logs and reporting |

| Data residency | Global replication by default | Region-bound nodes if required |

| Governance model | Open community governance | Consortium or single-owner governance |

| Ecosystem and tooling | Broadest tooling and talent pool | Focused tooling, enterprise features |

| Interoperability | Strong public bridges and standards | Interop via gateways to public chains |

| Smart-contract standards | Wide support for token standards | Curated standards, stricter reviews |

| Security surface | Large, tested networks | Smaller surface, stronger per-node controls |

| Downtime risk | Rare, but outside your control | SLA-driven, under your control |

| Upgrades and forks | Community-scheduled | Enterprise-scheduled with rollback paths |

| Vendor lock-in risk | Lower, open ecosystems | Higher if tied to a single vendor |

| TCO over 3–5 years | Lower infra, higher variable fees | Higher setup, lower variable fees |

| Best fit | Broad distribution and retail-adjacent use | Regulated issuance and institutional flows |

How to decide

- Choose permissioned if you need strict KYC, data residency, and predictable fees.

- Choose public if you prioritize open access, broad liquidity, and ecosystem reach.

- Many enterprises adopt a hybrid pattern: issue and govern on permissioned, then list compliant representations on a public network for market reach.

Your base network sets the rules for compliance, scalability, and cost. With the network choice clear, the next step is the enterprise architecture blueprint that ties identity, custody, contracts, integrations, and audit into a single, resilient platform.

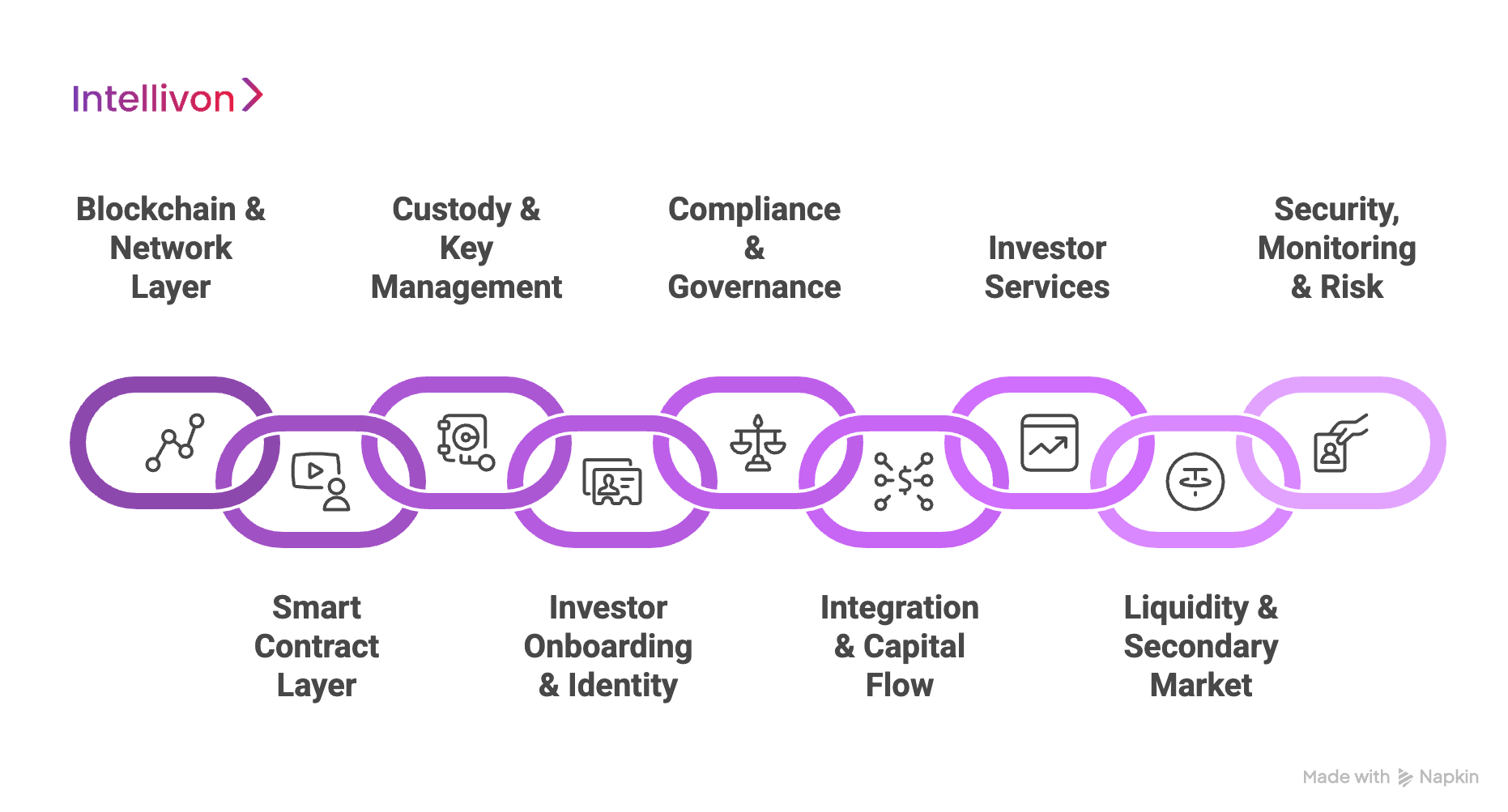

Enterprise Architecture Blueprint: Secure Tokenization Platform Design

A tokenized real-estate investment platform is more than a tokenization engine. It must manage the full lifecycle of investor participation, like onboarding, compliance, trading, custody, settlement, and reporting. Below is the blueprint decision-makers need to evaluate.

1. Blockchain & Network Layer

The blockchain and network layer is the foundation of the platform. Enterprises typically use permissioned networks for regulatory control, sometimes bridging to public chains for secondary-market liquidity.

Validator governance, predictable transaction costs, and interoperability with other ecosystems are key factors in the choice.

2. Smart Contract Layer

Smart contracts define token issuance and investor rights. Standards like ERC-3643 and ERC-1400 are designed for securities, embedding KYC and AML checks directly into the transfer logic.

They automate compliance, manage restrictions on transfers, and enforce corporate actions such as dividend distribution.

3. Custody & Key Management

Investor confidence depends on secure custody. Institutional wallets, hardware security modules (HSMs), and multi-party computation (MPC) protect private keys.

Recovery policies, multi-signature approvals, and insurance coverage add layers of protection for both issuers and investors.

4. Investor Onboarding & Identity Layer

This layer manages digital KYC, AML, investor accreditation, and FATF Travel Rule compliance.

Once verified, investors are whitelisted and assigned roles. This ensures only eligible participants can invest, and every transaction is tied to a verified identity.

5. Compliance & Governance Layer

Enterprises need automated compliance across multiple jurisdictions. This layer provides real-time audit logs, automated reporting for regulators, and configurable rules to adapt to changes in SEC, ESMA, SEBI, or MAS requirements.

GDPR and CCPA compliance ensure data handling meets global standards.

6. Integration & Capital Flow Layer

Beyond ERP and CRM integration, an investment platform must connect with banking rails and payment gateways.

This allows investors to fund purchases in fiat or stablecoins and enables readiness for future CBDC settlement. Integration with treasury systems and accounting platforms ensures smooth capital flow management.

7. Investor Services Layer

This layer is what investors see and interact with. It includes dashboards to view holdings, performance reports, and transaction history.

It also supports dividend or rental income distribution, tax documentation, and real-time portfolio valuations, all delivered in a secure, user-friendly interface.

8. Liquidity & Secondary Market Layer

Liquidity turns tokenized property into a true investment product. Secondary trading modules, partnerships with market-makers, and integration with regulated ATS/MTFs allow investors to buy and sell tokens under compliant conditions.

Liquidity pools further accelerate time-to-exit for investors.

9. Security, Monitoring & Risk Management

Enterprises must maintain resilience. Real-time monitoring detects suspicious activity, while continuous smart contract auditing reduces technology risks.

Disaster recovery systems, SLA-driven uptime, and controlled upgrade paths protect against disruption. Risk dashboards provide enterprises with oversight across compliance, liquidity, and operations.

When these layers are combined, enterprises gain a secure, compliant, and investor-ready platform that can attract global capital. With the architecture defined, the next step is to look at the features that make these platforms effective in practice for both enterprises and investors.

Real-Estate Investment Platform Features

An enterprise-grade tokenized real-estate investment platform must do more than issue digital tokens. It has to deliver the full set of features that give investors confidence, meet regulatory requirements, and create a seamless operating model for the enterprise. Below are the essential features every decision-maker should expect.

1. Investor Onboarding & Compliance

The platform should offer digital onboarding with automated KYC, AML, and accreditation checks. This ensures only verified investors gain access, while compliance is enforced from the first interaction.

2. Fractional Ownership

Properties are divided into fractional tokens, each backed by legal ownership rights. This lowers entry barriers, attracts new investor groups, and makes large assets accessible to a wider pool of participants.

3. Secure Custody & Wallet Management

Integrated wallets, multi-signature approvals, and MPC key management protect investor holdings. Custody infrastructure must also support recovery and insurance, giving institutions confidence in long-term security.

4. Secondary Market Liquidity

Investors expect flexibility to exit. Secondary trading modules and partnerships with regulated exchanges make tokenized shares tradable within hours instead of months, improving overall market liquidity.

5. Dividend & Income Distribution

Real estate generates rental income or dividends. The platform should automate payouts, allocate earnings proportionally to token holders, and provide tax-ready reporting.

6. Investor Dashboards & Reporting

Transparent dashboards display holdings, performance, and transaction history. Enterprises can use these features to keep investors informed, while regulators benefit from clear audit trails.

These features transform tokenization from a technology experiment into a trusted investment platform.

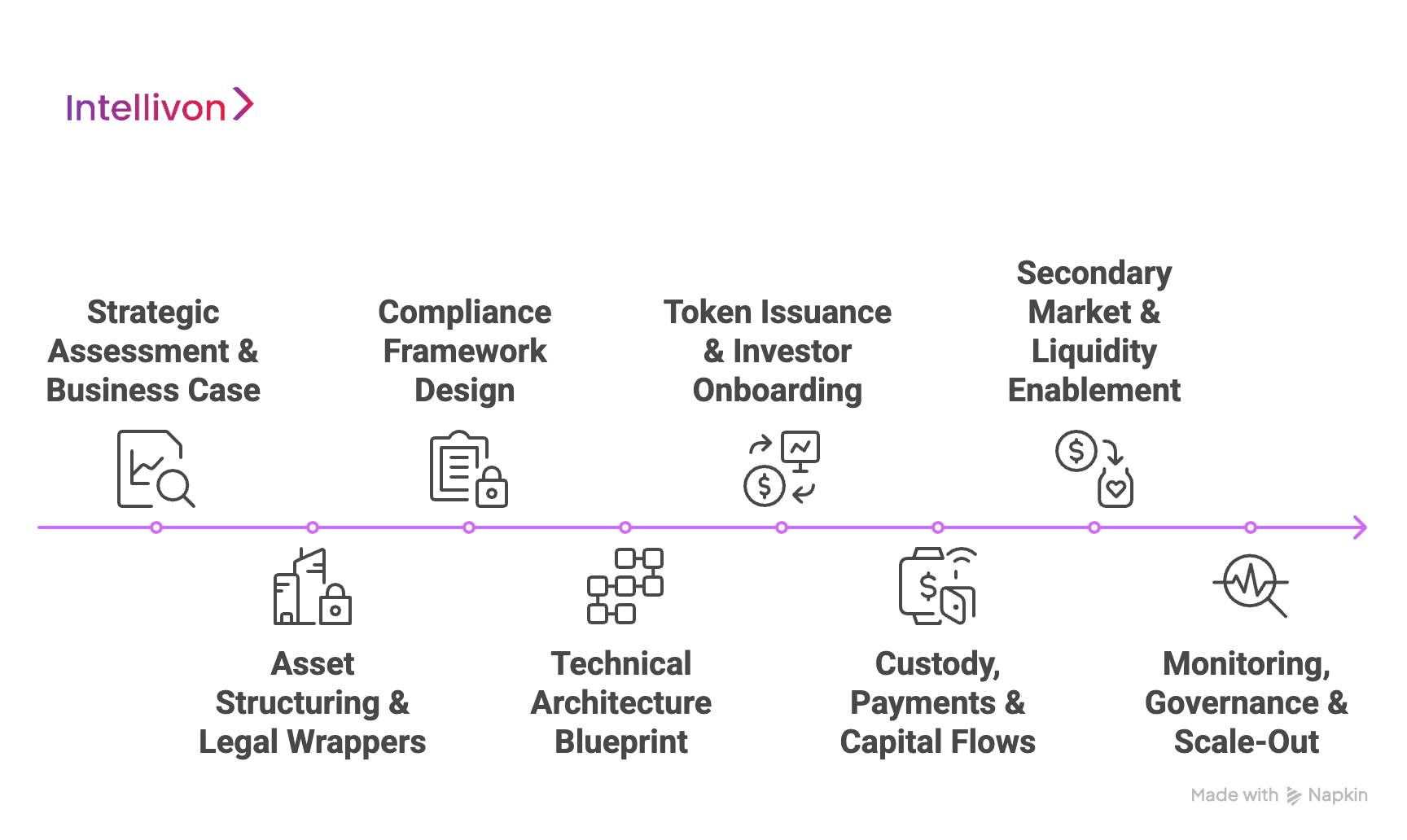

How We Build Tokenized Real-Estate Investment Platforms

At Intellivon, building a tokenized real-estate investment platform is not about deploying off-the-shelf code. Over time, we’ve developed an eight-step framework that consistently delivers secure, compliant, and scalable platforms tailored for large organizations.

1. Strategic Assessment & Business Case

Every build starts with a discovery phase that assesses regulatory readiness, operational fit, and business outcomes. We map out target jurisdictions, evaluate applicable securities laws, and identify potential compliance bottlenecks early.

At the same time, financial modeling helps enterprises understand where ROI will come from new fee revenues, reduced compliance costs, or expanded investor pools. This ensures the platform is not just technically sound, but commercially viable.

2. Asset Structuring & Legal Wrappers

When tokenizing real estate, Special Purpose Vehicles (SPVs) are the most common wrapper. SPVs isolate risk, provide clarity on investor rights, and ensure tokens represent enforceable ownership.

While some enterprises tokenize shares of REITs, it is important to distinguish them from SPVs. REITs are corporate structures with tax advantages, not wrappers. Tokenizing REIT units is possible, but the governance and tax rules differ significantly from SPVs. For most tokenization projects, SPVs remain the primary legal structure.

3. Compliance Framework Design

Regulatory compliance cannot be an afterthought. We embed requirements such as KYC, AML, FATF Travel Rule adherence, and investor accreditation directly into the platform’s workflows.

By hardcoding these checks into smart contracts, compliance becomes automatic rather than manual. This reduces the cost and time of operations while eliminating the risk of accidental violations. Enterprises benefit from a system where every transaction is compliant by design.

4. Technical Architecture Blueprint

This stage defines the backbone of the platform. We help enterprises choose the right blockchain (public, permissioned, or hybrid) and map out smart contract standards such as ERC-3643 or ERC-1400.

Custody, MPC key management, data residency requirements, and system integrations are all defined at this point. The outcome is an enterprise-grade blueprint that balances security, scalability, and interoperability with existing ERP, CRM, and banking systems.

5. Token Issuance & Investor Onboarding

Here, the real estate assets are fractionalized into security tokens that comply with chosen standards. Simultaneously, investors go through automated onboarding that verifies identity, accreditation, and eligibility before granting access.

Whitelisting ensures only approved participants can trade tokens, reducing regulatory exposure. By combining issuance and onboarding, we help enterprises launch with an investor-ready platform that is both efficient and compliant from day one.

6. Custody, Payments & Capital Flows

Custody is a critical layer for investor trust. Our builds integrate institutional-grade wallets, hardware security modules, and MPC for secure key management.

We ensure payment rails connect to traditional banking systems, stablecoins, and prepare for future CBDC settlements. Automated modules handle tax withholding and distribution of rental income or dividends. This creates smooth capital flows while reducing manual intervention.

7. Secondary Market & Liquidity Enablement

A platform without liquidity will struggle to attract investors. We build secondary trading engines and integrate with regulated ATS/MTFs so tokens can be traded legally.

Partnerships with market-makers ensure there is depth in the market, reducing investor exit risk. This transforms real-estate holdings from static, illiquid assets into actively tradable investments with global reach.

8. Monitoring, Governance & Scale-Out

Post-launch, governance is as important as technology. Enterprises get compliance dashboards, risk monitoring tools, and continuous smart contract audits. SLAs ensure uptime, while disaster recovery and controlled upgrade paths protect against disruption.

With this governance model, enterprises can expand into new jurisdictions, launch new asset classes, and grow without losing regulatory alignment or investor trust.

Enterprises can launch faster, scale globally, and build confidence with regulators and investors alike. With the build process established, the next area of focus becomes the compliance of such platforms and how enterprises can budget effectively.

Compliance & Regulation for Real-Estate Tokenization Platforms

No enterprise can launch a tokenized real-estate investment platform without addressing compliance. Since tokens represent securities, every transaction must follow financial regulations. This is where many projects fail, but it is also where Intellivon has helped enterprises succeed by embedding compliance directly into the platform’s architecture.

1. Securities Laws

Tokenized investments fall under securities law. In the U.S., this means SEC oversight, and in Europe, ESMA governs. Intellivon’s frameworks adapt to each jurisdiction, enabling enterprises to operate legally across multiple markets.

2. Travel Rule & Investor Eligibility

Investor verification is mandatory. Our platforms enforce digital KYC and AML from the first interaction. FATF Travel Rule compliance ensures identity data travels with transactions. Investor accreditation checks keep participation secure and within regulatory boundaries.

3. Tax, Cross-Border Capital Flow & Withholding

Income and capital gains create tax obligations. Intellivon’s platforms include tax modules that calculate and withhold where required, while managing cross-border transfers with banking and stablecoin integrations. This reduces the compliance burden for both enterprises and investors.

4. Data Privacy & Residency

Investor data must be protected under global privacy standards. Intellivon designs platforms with GDPR and CCPA compliance as defaults, and supports data residency controls so enterprises can localize storage where required.

With Intellivon, compliance is the foundation of the platform. Once these guardrails are built in, enterprises can focus on the next question every decision-maker asks: what does it cost to build and operate a tokenized real-estate investment platform?

Cost to Build a Tokenized Real-Estate Investment Platform

Building an enterprise-grade tokenized real-estate investment platform is a long-term investment in compliance, investor trust, and operational resilience. Unlike conventional real-estate systems, these platforms require added design for immutability, cryptographic validation, and integration with enterprise financial and compliance workflows.

The cost depends on scope, regulatory complexity, and the level of integration with existing infrastructure. The payoff comes through reduced compliance overhead, stronger fraud prevention, and smoother regulatory audits.

Estimated Development Costs by Phase

| Phase | Description | Cost Range (USD) |

| Discovery & Compliance Mapping | Define enterprise use cases, map regulatory obligations, assess compliance risks. | 8,000 – 15,000 |

| Architecture & Data Design | Design token standards, hybrid on/off-chain data flows, blockchain framework selection. | 15,000 – 25,000 |

| Blockchain Layer Development | Configure blockchain environment, consensus setup, cryptographic foundations. | 20,000 – 40,000 |

| Application & Workflow Integration | Connect platform with ERP, CRM, treasury, and investor management systems. | 25,000 – 50,000 |

| Security & Key Management | Deploy MPC custody, multi-sig approvals, access control, and recovery mechanisms. | 10,000 – 25,000 |

| Testing & Compliance Validation | Conduct smart contract audits, penetration testing, and regulatory certification. | 5,000 – 15,000 |

Total Range: USD 80,000 – 180,000

Hidden Costs to Consider

- Smart contract updates: As business rules evolve, contracts require upgrades and re-audits.

- Regulatory shifts: Changing frameworks (MiCA, SEC, SEBI) may require policy and system adjustments.

- Network operations: Running nodes or a consortium adds infrastructure and maintenance expenses.

- Adoption and training: Staff and investors may need onboarding to adapt to blockchain-enabled workflows.

Strategic ROI for Enterprises

While upfront costs can appear high compared to traditional platforms, the long-term ROI is significant. Automated compliance reduces manual overhead, audit costs fall sharply, and investor trust strengthens as every transaction is verifiable on-chain. Beyond cost savings, tokenization opens new revenue streams from trading fees and expanded investor participation.

The intangible return comes from resilience. Once blockchain-based controls are embedded, compliance and security become architectural guarantees, not recurring vulnerabilities.

Book a strategy session with Intellivon to explore how we design tokenized real-estate platforms that not only cut costs but unlock global growth opportunities.

Overcoming Challenges in Deploying Real-Estate Tokenization Platforms

Enterprises see clear advantages in tokenized real-estate platforms, but the path to deployment is rarely straightforward. At Intellivon, we’ve worked through these challenges alongside enterprises and built solutions that hold up under real-world conditions.

1. Regulatory Complexity & Fragmentation

The biggest challenge is that rules differ across jurisdictions. A framework that works in Singapore may not align with SEC requirements in the U.S. or SEBI oversight in India. Enterprises risk non-compliance if they overlook regional nuances.

Intellivon designs platforms with configurable compliance modules, allowing enterprises to operate across multiple jurisdictions without rebuilding the core system.

2. Platform Security & Investor Trust

Security failures destroy credibility. Investors demand guarantees that their assets and data are safe. Weak custody, untested smart contracts, or insufficient key management can all erode trust.

Our platforms integrate MPC-based custody, institutional-grade wallets, and continuous smart contract audits, ensuring investors and regulators see the system as reliable from day one.

3. Liquidity Risk & Market Depth

Without liquidity, investors hesitate to enter. Enterprises often underestimate how hard it is to design functioning secondary markets.

Intellivon integrates platforms with regulated ATS/MTFs, partners with market-makers, and builds internal liquidity pools. This gives investors faster exits and improves confidence in the asset class.

4. Integration with Legacy Systems

Enterprises rarely start with a blank slate. Their ERP, CRM, and compliance systems must link seamlessly to the tokenization platform. Without integration, operations become fragmented and costly.

Intellivon delivers API-driven architecture, ensuring tokenized workflows become part of the broader enterprise system rather than a silo.

5. Currency, Tax, and Cross-Border Risks

Cross-border flows trigger tax complications, FX risks, and settlement issues. Enterprises cannot risk non-compliance or double taxation.

Our platforms automate withholding, integrate multi-currency payments, and prepare for CBDC-based settlements. This reduces complexity and ensures capital flows remain compliant and efficient.

Challenges are real, but they are solvable with the right design and execution. With obstacles addressed, the next step is to look at case studies and examples of successful tokenized real-estate platforms to see how measurable outcomes are achieved.

Case Studies & Examples of Tokenized Real-Estate Platforms

The best way to understand the impact of tokenized real-estate investment platforms is by looking at real deployments. Enterprises that moved early show how compliance, liquidity, and investor access translate into measurable outcomes.

1. BlocHome: Compliance at Scale

BlocHome built a white-label platform designed to reduce compliance costs for property investments. By embedding automated KYC/AML and on-chain reporting, they cut compliance overheads by nearly 90%.

Within the first month, over 800 investors were onboarded, proof that tokenization can dramatically lower entry barriers while satisfying regulators.

2. Elevated Returns: Institutional Tokenization

Elevated Returns launched one of the largest tokenized real-estate projects in Southeast Asia. The firm tokenized over $1 billion in assets within six months, attracting capital from global family offices and institutional funds. Their case demonstrates how enterprises can use tokenization to open new channels of cross-border capital formation.

3. RealT: Expanding Investor Access

RealT focuses on fractional property ownership in the U.S. Through its platform, it attracted an average of 231 investors per property. Secondary trading turnover averaged 15% per quarter, proving that tokenization not only unlocks liquidity but also sustains active markets for investors.

At Intellivon, we have designed tokenized investment platforms for enterprises that need compliance-first infrastructure. The outcome is not only secure issuance but also a measurable ROI, including lower audit costs, faster investor onboarding, and scalable expansion across jurisdictions.

Monetization Models for Tokenized Real-Estate Investment Platforms

For enterprises, the question is how to monetize investor activity once it’s live. A tokenized real-estate investment platform creates new revenue streams by charging for issuance, trading, custody, and ongoing investor services. Below are the primary models enterprises can adopt.

1. Issuance & Listing Fees

Enterprises can charge asset owners for tokenizing properties and listing them on the platform. This fee covers legal structuring, compliance checks, and initial onboarding of investors.

For large property portfolios or recurring issuances, issuance fees create a predictable revenue line. It also ensures the platform captures value each time new assets are introduced.

2. Trading & Secondary Market Fees

Secondary-market activity is a major revenue driver. Platforms can collect a percentage on every investor trade, similar to traditional exchanges.

The higher the trading volume, the greater the revenue potential. By creating active markets, enterprises not only generate fees but also reinforce liquidity, which in turn attracts more investors.

3. Custody Service Fees

Secure custody is essential to investor trust. Enterprises can monetize this by charging fees for institutional-grade wallet services, recovery mechanisms, and insurance-backed custody.

Premium tiers can include higher coverage limits, priority support, or multi-currency custody. These services build long-term, recurring revenue while addressing one of the most critical investor concerns, which is asset security.

4. Asset Management Fees

Beyond custody, enterprises can charge for income distribution and portfolio reporting. Tokenized assets often generate rental income or dividends, and platforms can take a percentage for managing payouts and producing transparent investor statements.

For enterprises, this aligns with traditional asset-management practices while adding automation and scale.

5. Compliance & Reporting Services

Enterprises can charge subscription fees for automated KYC/AML checks, investor accreditation, and tax reporting.

By handling compliance as a managed service, platforms reduce friction for investors while creating steady, recurring income streams.

6. Cross-Border & Settlement Services

International investors require settlement in multiple currencies and payment rails. Platforms can earn margins on FX conversions, stablecoin transfers, and eventually CBDC settlements.

By simplifying cross-border capital flows, enterprises reduce friction for investors while capturing value from every transaction that moves through the system.

By charging for issuance, trading, custody, compliance, and cross-border services, enterprises can generate sustainable income while attracting new investor groups. With monetization clarified, the next step is understanding why enterprises should partner with a specialized vendor rather than attempt to build these systems alone.

Conclusion

Tokenized real-estate investment platforms are reshaping how enterprises raise capital, manage compliance, and engage global investors. By combining liquidity, transparency, and automation, they turn one of the most illiquid asset classes into a flexible, revenue-generating market.

For enterprises, the opportunity is clear: those who act early can lower costs, expand investor access, and create long-term growth advantages in a market projected to reach trillions by the end of the decade.

Build Your Enterprise Real Estate Tokenization Platform With Us

At Intellivon, we design enterprise-grade tokenized investment platforms that transform real estate into compliant, liquid, and globally accessible digital assets. Our approach combines advanced blockchain frameworks, compliance-first architecture, and seamless integration with ERP, CRM, and financial systems to deliver platforms that are investor-ready, scalable, and built for long-term trust.

Why Partner With Intellivon?

- Tailored Enterprise Solutions: Every platform is designed around your real-estate portfolio, investor onboarding rules, and jurisdictional compliance—not adapted from generic templates.

- Embedded Regulatory Intelligence: We hardcode SEC, ESMA, SEBI, and MiCA compliance logic into smart contracts, ensuring transactions remain compliant across multiple jurisdictions.

- Proven Results in Capital Markets: From enabling billion-dollar tokenizations to reducing compliance costs by 90%, our deployments deliver measurable ROI for enterprise clients.

- Integration Without Disruption: Our API-driven design links with ERP, CRM, and treasury systems, ensuring tokenization enhances existing workflows instead of creating silos.

- Future-Ready Liquidity Architecture: We embed secondary-market access, stablecoin settlement, and CBDC readiness into every build, giving enterprises a head start in evolving markets.

Book a strategy session with Intellivon today and start building a tokenized real-estate investment platform that unlocks liquidity, scales globally, and delivers regulatory confidence.

FAQs

Q1. What is real-estate tokenization, and how does it work?

A1. Real-estate tokenization converts property ownership into digital tokens recorded on a blockchain. Each token represents a legal share of the asset and can be traded. This gives investors faster access while enabling enterprises to unlock liquidity under full compliance with securities regulations.

Q2. How much does it cost to build a tokenized real-estate investment platform?

A2. Costs depend on scope, regulations, and system integrations. On average, enterprises spend between USD 80,000 and 180,000. This includes compliance mapping, blockchain development, custody, workflow integration, and audits. ROI comes from reduced compliance costs, lower audit risks, and new revenue from issuance and trading fees.

Q3. Is tokenization legal in my jurisdiction?

A3. Yes, if structured correctly. Tokenized investments must follow securities laws in each jurisdiction, for example, SEC in the U.S., ESMA in Europe, or SEBI in India. Regulatory sandboxes in hubs like Singapore and Dubai allow enterprises to launch pilot programs before scaling globally.

Q4. How can I ensure liquidity for tokenized assets?

A4. Liquidity is built through regulated secondary-market trading, partnerships with market-makers, and internal liquidity pools. These features allow investors to exit within days rather than the months required in traditional private placements, making participation more attractive.

Q5. Can this platform integrate with our existing systems?

A5. Yes. Enterprise-grade tokenization platforms integrate seamlessly with ERP, CRM, treasury, and compliance systems using APIs. This ensures tokenized workflows become part of enterprise operations instead of operating as silos, reducing duplication and streamlining adoption.