Customer analytics has moved from being a support function to becoming the strategic backbone of modern fintech growth. Legacy data systems and static dashboards can no longer keep pace with how customers transact across digital wallets, lending apps, and neobanks. Without real-time insights, fintechs risk higher churn, poor credit decisions, and compliance gaps that erode profitability.

The market is evolving rapidly, with global fintechs adopting customer analytics software platforms that merge structured and unstructured data, apply predictive AI models, and deliver explainable insights across every customer interaction. These platforms drive personalized experiences, fraud prevention, and long-term customer lifetime value.

At Intellivon, we specialize in helping enterprises develop fintech customer analytics platforms that are secure, compliance-ready, and scalable for the future. In this blog, we’ll explore what customer analytics means for fintechs, the features that matter, and how to build a solution that converts data into a competitive advantage.

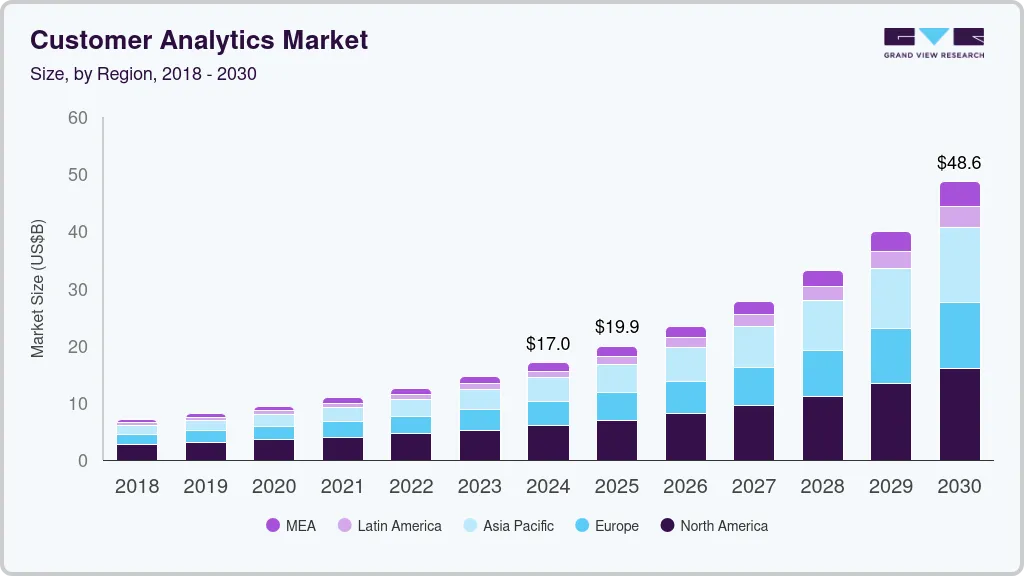

Key Takeaways of the Customer Analytics Market

- This surge is fueled by rapid digital transformation, data proliferation, and enterprises’ need to deliver real-time, hyper-personalized engagement.

- AI-augmented self-service analytics democratize insights, enabling enterprises to operationalize analytics faster and at scale.

- Cloud-native analytics platforms lower total cost of ownership (TCO), making advanced analytics accessible for small- and medium-sized enterprises.

- Retail media networks and e-commerce expansion create fresh opportunities for data-driven personalization and deeper engagement.

- Integration of customer data platforms (CDPs) into marketing stacks drives seamless cross-channel campaign optimization.

- Strategic enterprise impact: analytics identifies churn causes, increases upsell/cross-sell rates, and boosts customer lifetime value.

- Banking, retail, and telecom are among the leading adopters, using real-time analytics and AI to transform engagement and reduce acquisition costs.

- Predictive analytics adoption has improved conversion rates and satisfaction scores, directly impacting revenue and profitability.

- Privacy-compliant analytics tools are now essential, balancing regulatory requirements with effective customer engagement strategies.

In summary, the rapid growth of the customer analytics market underscores its value as a critical growth lever for enterprises. Organizations that harness predictive, AI-driven, and compliant analytics platforms are positioned not only to improve operational efficiency but also to secure stronger customer loyalty and sustainable revenue growth.

What Is Customer Analytics Software in Fintech?

Customer analytics software in fintech is the intelligence layer that transforms raw financial data into actionable insights. Unlike traditional BI systems, these platforms are built to handle real-time transaction streams, behavioral data, and compliance-bound information at scale. For fintechs, this shift is critical: customer analytics is no longer about understanding “what happened” last quarter but predicting “what happens next” in every customer journey.

At its core, a fintech customer analytics platform integrates multiple data sources, such as digital wallets, banking APIs, KYC/AML systems, and even customer support interactions, into a unified data model. This enables enterprises to move beyond siloed views of customers and create a 360-degree profile that supports personalization, fraud detection, credit risk assessment, and regulatory reporting.

The difference lies in speed and intelligence. Today’s fintech analytics software embeds AI and machine learning models that can segment users in real time, identify fraud patterns within milliseconds, and generate predictive scores for churn or default risk.

Combined with visualization layers, compliance modules, and API-first design, these platforms give fintechs the ability to act on insights immediately, whether that means approving a loan, flagging a suspicious payment, or tailoring a financial product to a customer’s unique behavior.

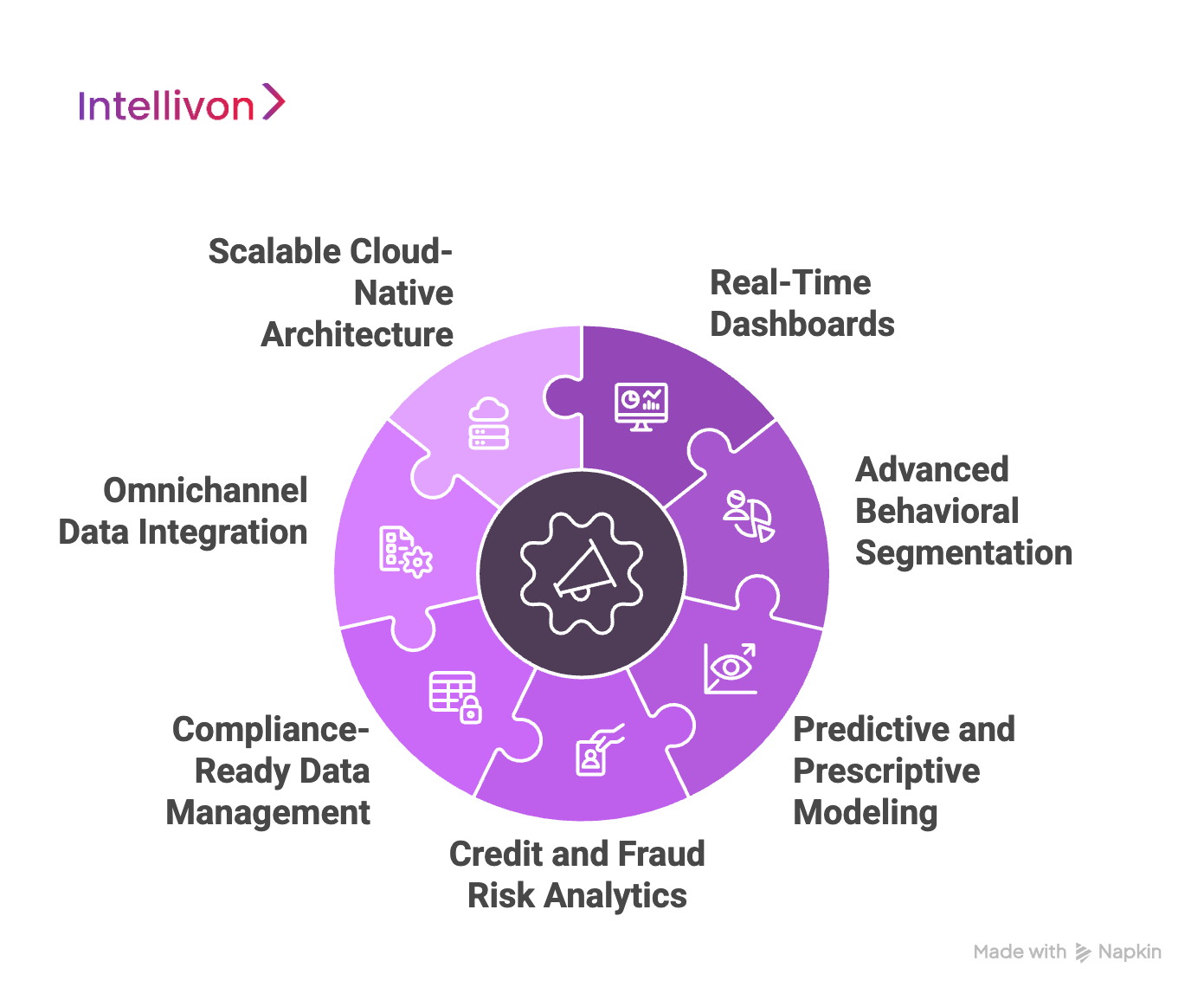

Key Features of Customer Analytics Software for Fintechs

Fintechs operate in an environment where customer expectations, risk factors, and compliance requirements are constantly changing. To compete, customer analytics platforms must go beyond basic reporting and deliver real-time, AI-powered, compliance-ready insights. Below are the features that enterprises should prioritize when building or investing in customer analytics software for fintechs.

1. Real-Time Dashboards and Reporting

Modern fintechs can’t afford to analyze yesterday’s data. Real-time dashboards allow decision-makers to monitor transactions, customer behaviors, and operational KPIs as they happen. This ensures immediate detection of fraud, personalized offers at the right moment, and rapid adaptation to market conditions.

2. Advanced Behavioral Segmentation

Not all customers behave the same. Behavioral segmentation tools use transaction history, spending patterns, and engagement data to group users into micro-segments. Fintechs can then design targeted campaigns, personalize financial products, and improve retention strategies that speak directly to each group’s needs.

3. Predictive and Prescriptive Modeling

Predictive analytics allows fintechs to forecast churn, default risk, or product adoption rates with accuracy. Prescriptive models go one step further by suggesting the best course of action, whether it’s adjusting loan terms, offering retention discounts, or flagging high-risk accounts for review.

4. Credit and Fraud Risk Analytics

Fraudulent activity and credit risk are two of the largest threats in fintech. With AI-driven fraud detection and dynamic credit scoring models, platforms can instantly detect suspicious patterns and evaluate borrower risk in real time. This protects revenues while building trust with customers.

5. Compliance-Ready Data Management

Every data point in fintech is tied to regulation. Compliance-ready data management systems ensure that analytics platforms adhere to PCI-DSS, GDPR, PSD2, SOC 2, and AML/KYC frameworks. Automated reporting and audit logs minimize the cost of compliance while keeping enterprises audit-ready.

6. Omnichannel Data Integration

Customers interact across multiple touchpoints, such as mobile apps, websites, chatbots, and call centers. Omnichannel integration unifies this data to provide a single customer view. For fintechs, this means better product recommendations, seamless experiences, and consistent insights across departments.

7. Scalable Cloud-Native Architecture

Fintechs grow fast, and analytics must scale with them. Cloud-native platforms not only reduce infrastructure costs but also ensure that data pipelines, AI models, and compliance modules can expand seamlessly as transaction volumes increase.

The must-have features of customer analytics software for fintechs are about ensuring growth, compliance, and customer trust at enterprise scale. Real-time dashboards enable faster reactions, predictive models drive proactive decisions, and compliance-ready design keeps regulators satisfied. For fintech leaders, the right feature set transforms analytics from a reporting tool into a profitability and risk-management engine.

How AI Powers Customer Analytics in Fintech

Artificial Intelligence has become the engine behind modern customer analytics in fintech. AI-driven platforms predict what will happen next and prescribe the best action. From scoring creditworthiness to predicting churn, AI gives fintechs the ability to make faster, smarter, and more compliant decisions at scale. Here is how:

1. AI-Driven Credit Scoring

Conventional credit scoring relies on static historical data and often excludes customers with thin files. AI-driven credit scoring models expand this view by analyzing alternative data sources such as mobile usage, transaction behaviors, and even social signals.

These models generate dynamic, explainable credit scores that enable fintechs to responsibly lend to underserved markets while reducing defaults.

2. Behavioral Biometrics for Fraud Detection

Fraudsters evolve faster than static rule-based systems. AI-driven analytics leverage behavioral biometrics, like typing speed, device orientation, geolocation, and transaction patterns, to identify anomalies invisible to traditional fraud tools.

This provides a frictionless experience for genuine users while reducing false positives and fraud losses.

3. Predictive Churn Prevention

Customer churn is one of the biggest cost drivers in fintech, often eroding profitability faster than acquisition can compensate. AI models can analyze engagement frequency, spending shifts, and digital behavior patterns to identify customers at risk of leaving.

Platforms then trigger retention campaigns, like personalized offers, proactive outreach, or loyalty rewards, before churn occurs.

4. Personalized Financial Planning

AI elevates customer engagement by powering hyper-personalized financial planning tools. These platforms analyze income, spending, and savings patterns to deliver real-time recommendations, whether it’s optimizing budgets, suggesting investments, or highlighting risk exposure.

Personalized financial guidance not only improves customer satisfaction but also increases adoption of additional financial products.

AI is the driver of customer analytics in fintech. From smarter credit scoring to real-time fraud detection and personalized financial planning, AI delivers measurable ROI across the customer lifecycle. Fintechs that integrate AI into analytics gain the ability to predict, personalize, and protect at scale, creating lasting competitive advantage.

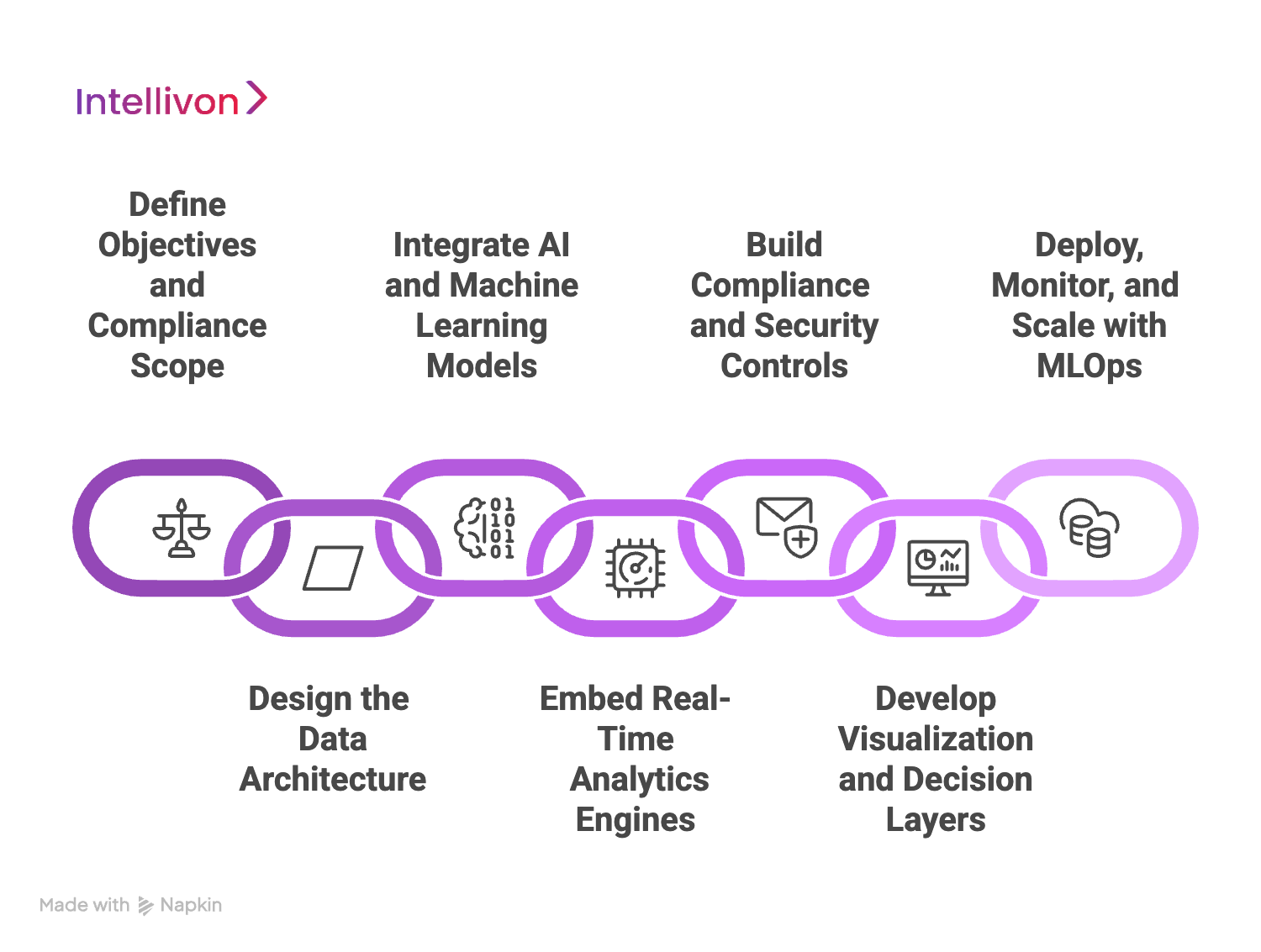

How We Build Customer Analytics Software for Fintechs

Developing customer analytics platforms for fintechs is not a one-size-fits-all exercise. Every enterprise operates within its own regulatory boundaries, product mix, and growth strategy. At Intellivon, we follow a structured yet flexible framework that ensures each platform is secure, compliant, and built for scale.

1. Define Objectives and Compliance Scope

We begin by working with your leadership to map business objectives, regulatory requirements, and risk appetite. This ensures the analytics platform is aligned with enterprise goals, whether it’s reducing churn, improving cross-sell rates, or enhancing fraud prevention.

By embedding compliance frameworks like PCI-DSS, GDPR, and AML/KYC from day one, costly retrofits are avoided later.

2. Design the Data Architecture

Our architects design a cloud-native, API-first architecture that consolidates customer data across banking APIs, payment gateways, CRMs, and support channels.

The goal is to eliminate silos and enable a 360-degree customer view. We incorporate scalable pipelines so your platform grows seamlessly with increasing transaction volumes.

3. Integrate AI and Machine Learning Models

We build and train predictive models for churn analysis, customer segmentation, fraud detection, and credit risk scoring.

Using frameworks like TensorFlow, PyTorch, and Scikit-learn, we ensure models are accurate, explainable, and enterprise-ready. For fintechs, this means faster decisions with transparent outputs that stand up to regulatory audits.

4. Embed Real-Time Analytics Engines

Intellivon leverages streaming technologies such as Apache Kafka and Spark to deliver real-time insights.

This enables instant fraud flagging, personalized product recommendations, and faster response to customer actions. Enterprises gain the ability to act on insights in milliseconds rather than waiting for batch reports.

5. Build Compliance and Security Controls

We incorporate multi-layered security with AES-256 encryption, role-based access, anomaly detection, and automated audit logs.

Compliance is operationalized through continuous monitoring dashboards that align with SOC 2, PSD2, and local regulatory mandates. This design ensures fintechs are always audit-ready while maintaining customer trust.

6. Develop Visualization and Decision Layers

Data is only valuable when it drives action. Intellivon develops custom dashboards and decision-support interfaces that present insights to teams across marketing, risk, operations, and compliance.

With real-time visualization, leaders can act on churn risks, fraud alerts, or upsell opportunities immediately.

7. Deploy, Monitor, and Scale with MLOps

Finally, we implement MLOps pipelines to continuously monitor model performance, retrain when needed, and deploy new features without disruption. This ensures the analytics platform evolves with changing customer behaviors, regulatory updates, and fintech product expansions.

Our end-to-end framework ensures your solution is future-ready, compliant by design, and tailored to your enterprise goals. By combining advanced AI, scalable architecture, and security-first principles, we empower fintechs to unlock customer insights that drive profitability, trust, and long-term competitive advantage.

Cost to Build Fintech Customer Analytics Software

At Intellivon, the goal is to help enterprises build scalable, sustainable customer analytics platforms for fintechs. That’s why our pricing framework is flexible, aligned with growth goals, compliance obligations, and data complexity, rather than forcing a rigid, one-size-fits-all package.

If early projections stretch beyond your budget, the scope is refined collaboratively. The focus always remains on preserving what matters most: enterprise-grade reliability, regulatory compliance, and uncompromising security.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Phase 1: Discovery & Compliance Mapping | Requirements gathering, defining KPIs, and mapping to regulatory frameworks (GDPR, PCI-DSS, AML/KYC). | $20,000 – $40,000 |

| Phase 2: Data Architecture & Integration | Designing cloud-native architecture, integrating APIs (banking, payments, CRMs), and creating a unified customer data model. | $40,000 – $80,000 |

| Phase 3: AI/ML Model Development | Building predictive models for churn, fraud detection, credit scoring, and segmentation with explainability modules. | $60,000 – $120,000 |

| Phase 4: Real-Time Analytics Engine | Implementing streaming pipelines (Kafka, Spark), dashboards, and real-time monitoring tools for fraud and engagement. | $50,000 – $100,000 |

| Phase 5: Compliance & Security Layer | Encryption, anomaly detection, automated audit logs, and compliance-first workflows for regulatory reporting. | $30,000 – $70,000 |

| Phase 6: Visualization & Decision Layer | Building executive dashboards, role-based views, and customer insights portals for business teams. | $25,000 – $60,000 |

| Phase 7: Deployment, MLOps & Scaling | Continuous monitoring, retraining pipelines, version control, and platform scaling for growing transaction volumes. | $40,000 – $80,000 |

Total Investment Ranges

- MVP Build (Lean, compliance-ready prototype): $80,000 – $150,000

- Mid-Scale Analytics Platform: $200,000 – $350,000

Why Enterprises Trust Intellivon with Cost Optimization

- Flexible Scope Alignment: Budgets adapted without compromising compliance or core AI capabilities.

- Regulatory-First Design: Compliance baked in from the start, avoiding expensive reworks.

- Scalable Architecture: Designed to grow with transaction volumes and customer adoption.

- Measurable ROI: Platforms deliver quantifiable gains, which include reduced churn, fraud prevention, and higher customer lifetime value.

At Intellivon, we ensure your investment results in a future-ready analytics platform built around your enterprise goals, not just industry standards.

Enterprise Use Cases of Customer Analytics in Fintech

Customer analytics platforms are transforming how financial enterprises understand and serve customers. By combining real-time data with AI-driven insights, fintechs are creating experiences that are personalized, compliant, and revenue-generating. Below are the most impactful enterprise use cases, with examples of how global leaders apply them.

1. Retail Banking

In retail banking, the ability to cross-sell or upsell depends on predicting what customers need before they ask for it. Customer analytics platforms ingest transaction data, savings habits, and life events to build highly specific customer profiles. Banks then use these insights to recommend credit cards, personal loans, or wealth products tailored to each individual. This not only increases the share of wallet but also deepens long-term relationships.

Example: HSBC applies predictive analytics to track financial milestones and spending behaviors, enabling it to push personalized offers that improve conversion rates and boost lifetime value.

2. Digital Payments

Payment platforms must secure billions of transactions every day, often in less than a second. Traditional fraud detection systems rely on static rules, which generate false positives and slow down customer experience. By contrast, analytics platforms analyze behavioral signals, geolocation data, and device usage in real time, instantly flagging suspicious activity while approving genuine transactions. This balance reduces fraud costs while preserving customer trust.

Example: Mastercard’s Decision Intelligence uses AI-driven analytics to evaluate each transaction against global patterns, preventing billions of dollars in fraud annually without disrupting user experience.

3. Insurance (InsurTech)

Fraudulent claims cost insurers billions, but customer analytics platforms now offer a proactive defense. InsurTech firms use pattern recognition and predictive modeling to detect anomalies in claims submissions, flagging potential fraud for investigation. At the same time, underwriting processes are optimized by analyzing historical claims data, lifestyle factors, and digital footprints, enabling faster, more accurate risk scoring.

Example: Lemonade leverages AI analytics to instantly process claims, auto-approve legitimate ones, and identify fraud risks early, resulting in faster payouts and reduced operational losses.

4. Wealth Management

In wealth management, customer loyalty is built on relevance. Analytics platforms evaluate investment patterns, risk appetite, and behavioral triggers to craft personalized advisory recommendations. They also monitor early signals of churn, such as reduced logins or smaller deposits, allowing advisors to intervene proactively. This approach strengthens relationships while increasing assets under management.

Example: Betterment uses predictive analytics to deliver tailored portfolio strategies, align investment advice with customer goals, and reduce churn, helping to expand its base of long-term investors.

5. Digital Lending

Millions of potential borrowers are excluded from traditional credit scoring systems due to limited credit history. Customer analytics platforms unlock these markets by analyzing alternative data sources such as mobile usage, utility payments, and e-wallet activity. This produces a more accurate credit picture and allows fintechs to lend responsibly while expanding reach.

Example: Tala employs customer analytics to evaluate non-traditional data across emerging economies, extending microloans to millions of users who lack formal credit histories.

Customer analytics platforms in fintech deliver measurable value: higher retention, reduced fraud, smarter risk management, and more personalized engagement. By embedding these use cases, enterprises not only optimize operations but also unlock new revenue opportunities at scale.

How We Ensure Compliance When Building Customer Analytics Platforms

Compliance is the foundation of customer trust, market credibility, and operational scalability.. At Intellivon, we embed compliance into every layer of the platform to ensure that enterprises remain secure, audit-ready, and future-proof.

1. Regulatory Mapping from Day One

We start every build by aligning platform workflows to core regulations such as GDPR, PCI-DSS, PSD2, and AML/KYC. By mapping compliance requirements during the discovery phase, enterprises avoid expensive retrofits and ensure that regulatory obligations are hardwired into the system.

2. Data Governance and Security Controls

Intellivon enforces robust data governance frameworks that combine encryption, tokenization, and role-based access control. This ensures that sensitive financial and identity data is protected at every touchpoint, meeting global standards for security and confidentiality.

3. Automated Audit and Reporting Frameworks

Manual reporting slows audits and increases risk. We design compliance dashboards and automated audit logs that provide regulators and internal teams with on-demand transparency. This reduces the operational burden while keeping the enterprise always audit-ready.

4. Explainable and Fair AI Models

Regulators increasingly demand that AI-driven outputs are explainable and unbiased. At Intellivon, we build explainable AI models that clearly document decision logic in fraud detection, credit scoring, or churn prediction. This ensures fintechs meet evolving fairness and accountability standards.

5. Continuous Monitoring

Compliance isn’t static. As regulations evolve, so must the platform. Through continuous monitoring pipelines and MLOps integration, Intellivon ensures platforms adapt seamlessly to new rules without disrupting ongoing operations.

Key Compliance Standards in Fintech Analytics

Customer analytics platforms must comply with overlapping global standards. These include:

- PCI-DSS: Securing payment data at rest and in motion.

- GDPR: Protecting customer privacy and consent in the EU.

- PSD2/Open Banking: Enforcing secure data sharing and authentication.

- AML/KYC: Preventing money laundering and ensuring customer identity verification.

- SOC 2: Ensuring enterprise-grade security, availability, and confidentiality controls.

By embedding compliance at every stage of development, Intellivon delivers customer analytics platforms that enable enterprises to innovate confidently while staying aligned with the strictest regulatory frameworks.

Future of Customer Analytics in Fintech

The customer analytics landscape in fintech is evolving beyond descriptive dashboards and basic segmentation. Over the next five years, analytics platforms will combine AI, blockchain, and open data ecosystems to drive deeper personalization, stronger compliance, and faster decision-making.

For enterprises, this means that customer analytics will shift from being a reporting tool to becoming a predictive, prescriptive, and autonomous growth engine.

1. Predictive and Prescriptive Analytics

While predictive analytics identifies future outcomes, prescriptive analytics recommends the optimal actions. In fintech, this means not just forecasting loan defaults but also suggesting alternative repayment terms, or identifying churn risks and prescribing targeted retention campaigns.

Enterprises that adopt prescriptive models reduce decision latency and increase ROI through faster, evidence-backed interventions.

2. Embedded AI Agents

The future of fintech analytics is autonomous. AI agents will run continuously in the background, making micro-decisions in real time, approving micro-loans, blocking fraudulent payments, or triggering personalized financial offers without human intervention.

These AI-driven agents reduce operational costs and enable fintechs to serve millions of customers simultaneously without degrading accuracy or compliance.

3. Blockchain

As regulators demand more accountability, blockchain will play a crucial role in ensuring audit-ready analytics platforms. Immutable records of data processing and decision-making increase transparency, reduce disputes, and strengthen trust with both customers and regulators.

For enterprises, blockchain-integrated analytics will deliver compliance confidence while unlocking new models of financial trust.

4. Open Banking

Open banking regulations are forcing fintechs to integrate with third-party providers, creating opportunities for broader analytics insights. Customer analytics platforms of the future will aggregate data across multiple banks, fintech apps, and even non-financial platforms. This holistic perspective allows enterprises to deliver richer personalization while unlocking new revenue streams from cross-industry collaborations.

The future of customer analytics in fintech will be defined by autonomy, transparency, and ecosystem-wide integration. Platforms that embed AI agents, prescriptive intelligence, blockchain-based auditing, and open banking data will lead the next wave of financial innovation.

Conclusion

Customer analytics has become the strategic core of fintech growth. Platforms that once served as reporting dashboards are now AI-powered engines driving personalization, fraud prevention, churn reduction, and compliance. The market is moving fast, with enterprises that adopt customer analytics software for fintechs already reporting measurable ROI, from improved retention to higher cross-sell rates and reduced fraud losses.

For fintech leaders, the challenge isn’t deciding whether to invest, but how to build platforms that are secure, compliant, and scalable. The future of fintech belongs to organizations that can predict customer needs, personalize engagement, and protect transactions in real time. With customer analytics as the foundation, enterprises can move confidently into that future.

Build Your Fintech Analytics Platform With Intellivon

At Intellivon, we design enterprise-grade customer analytics platforms that are secure, compliant, and built to scale with your fintech’s growth. Our solutions combine AI-powered insights, cloud-native architecture, and compliance-first design to help enterprises understand customers better, reduce risk, and unlock new revenue opportunities.

Why Partner With Intellivon?

- Tailored Analytics Infrastructure: Every platform is built around your business model, regulatory environment, and growth objectives, ensuring solutions that align with long-term strategy.

- Compliance and Security by Design: From GDPR and PCI-DSS to AML/KYC and SOC 2, we embed regulatory requirements into the architecture, making your platform audit-ready from day one.

- Proven Enterprise Delivery: With 11+ years of experience, 200+ experts, and 500+ AI projects delivered, Intellivon is trusted by enterprises to deliver solutions that balance innovation with compliance.

- Future-Ready Architecture: Our platforms are API-first, cloud-native, and designed for scalability, enabling fintechs to innovate confidently in a fast-changing financial ecosystem.

Book your discovery call with Intellivon today to explore how we can help you design a customer analytics platform that not only processes data but transforms it into profitable, predictive, and compliant enterprise intelligence.

FAQs

Q1. What is customer analytics in fintech?

A1. Customer analytics in fintech refers to platforms that collect and analyze transaction, behavioral, and identity data to generate actionable insights. These insights help enterprises personalize services, prevent fraud, improve credit scoring, and optimize customer lifetime value while staying compliant with global regulations.

Q2. How does customer analytics improve customer experience in fintech?

A2. Analytics platforms improve experience by turning raw data into personalized offers, real-time engagement, and frictionless security. Fintechs can anticipate customer needs, recommend tailored products, and detect fraud without adding unnecessary checks, creating smoother and more relevant financial interactions.

Q3. Which AI models are most effective for fintech customer analytics?

A3. The most effective AI models include predictive modeling for churn and credit risk, machine learning classifiers for fraud detection, and recommendation engines for personalization. These models adapt over time, improving accuracy and helping enterprises deliver trusted, data-driven financial services.

Q4. What is the average cost to build fintech customer analytics software?

A4. The cost varies based on scope, features, and compliance requirements. An MVP build typically ranges from $80,000 to $150,000, and mid-scale platforms cost $200,000 to $350,000. The investment is justified by measurable ROI in retention, fraud reduction, and customer lifetime value.

Q5. How do fintechs ensure compliance when using customer analytics platforms?

A5. Fintechs ensure compliance by embedding frameworks such as PCI-DSS, GDPR, AML/KYC, PSD2, and SOC 2 into platform design. At Intellivon, compliance is engineered from the start, with features like data encryption, role-based access, automated audit logs, and explainable AI models keeping platforms secure and audit-ready.