Decentralized Finance (DeFi) is reshaping how lending and borrowing work, steering financial interactions into secure, blockchain-powered platforms. For enterprises, this change is a structural shift that creates new opportunities to unlock liquidity, reduce costs, and expand into global markets without relying on intermediaries. By using smart contracts, collateralized lending, and tokenized assets, enterprises can build financial systems that are transparent, borderless, and highly efficient. The growing demand for secure, scalable lending platforms makes it clear that DeFi is becoming a priority for forward-looking enterprises.

Intellivon’s expertise is rooted in building enterprise-ready DeFi lending and borrowing platforms that merge decentralization with compliance, security, and AI-driven intelligence. Our solutions are designed to help enterprises navigate regulation, manage risk, and scale globally with confidence. In this blog, we will show you how we build these platforms from the ground up, what they cost, and why they’re transforming enterprise finance.

Key Takeaways of The DeFi Platform Market

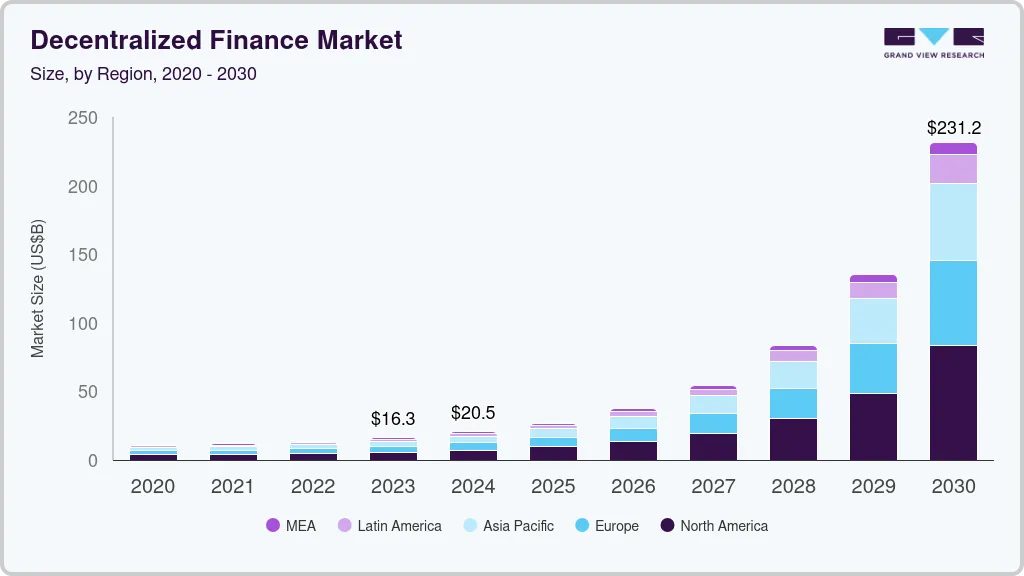

The global decentralized finance market was valued at USD 20.48 billion in 2024. By 2030, it is projected to reach USD 231.19 billion, growing at a rapid CAGR of 53.7% between 2025 and 2030. This explosive growth reflects how widely DeFi is being accepted and highlights its role as a major driver of transformation in the financial sector.

Key Takeaways:

- Institutional involvement in DeFi surged, with JPMorgan, Goldman Sachs, and BlackRock exploring yield farming and lending services.

- Institutional Total Value Locked (TVL) in DeFi reached USD 42 billion in 2024, reflecting growing enterprise trust in decentralized systems.

- Stablecoins now support over 92% of DeFi lending and DEX protocols, with USD 146 billion circulating by mid-2025.

- The DeFi token market capitalization hit USD 98.4 billion, marking a 38% year-on-year increase in liquidity.

- Cross-chain stablecoin bridges transferred USD 12.6 billion in the first half of 2025.

- Enterprises still lose USD 120 billion annually to cross-border payment fees, with one-third of transactions taking more than a day to settle.

- The global banking sector’s price-to-book ratio of 0.9 underscores inefficiency, while DeFi shows compounding ROI potential.

For large enterprises, the signal is undeniable: DeFi is scaling fast, with institutional capital and tokenized infrastructure maturing at pace. Onboarding decentralized financial systems in 2025, it is essential to remain competitive in a digitized global economy.

What Is a DeFi Lending and Borrowing Platform?

A DeFi lending and borrowing platform is a digital marketplace that uses blockchain technology to connect lenders and borrowers directly, without intermediaries like banks or financial brokers. At its core, it replaces traditional loan agreements with smart contracts, which are self-executing programs that enforce the terms of lending, borrowing, collateral, and repayment automatically.

For lenders, the platform provides an opportunity to earn returns by depositing their digital assets, such as stablecoins, Ethereum, or tokenized real-world assets, into liquidity pools. Instead of lending to a single borrower, their funds are combined with those of others, creating a pool from which borrowers can draw. In return, lenders earn interest that is calculated and distributed automatically.

Borrowers, on the other side, gain access to capital by locking collateral into the platform. This collateral could be in the form of cryptocurrencies or tokenized assets like real estate or bonds. If the borrower fails to repay, the smart contract automatically liquidates the collateral, ensuring lenders are protected. Unlike traditional loans, credit checks are not required, since collateral and contract rules govern the process.

For enterprises, the appeal lies in the efficiency and transparency of this model. Every transaction is recorded on a blockchain, which eliminates disputes and creates audit-ready records. Costs are lower since there are no intermediaries, and settlements occur instantly rather than over days. Furthermore, enterprises can access global liquidity, meaning capital isn’t limited by geography.

Think of it as a borderless credit marketplace where smart contracts act as the rule book. Instead of relying on a bank to mediate trust, the system itself guarantees fairness, speed, and security.

Why Enterprises Need DeFi Lending and Borrowing Platforms

For enterprises, decentralized lending and borrowing platforms represent a strategic shift in how capital is raised, managed, and deployed. Finance leaders, treasury teams, and operations executives are under constant pressure to reduce costs, unlock liquidity, and accelerate settlements. DeFi platforms meet these demands by combining automation, transparency, and borderless capital flows into a single infrastructure.

1. New Revenue Streams

Enterprises can create additional income by charging transaction fees, interest spreads, or licensing the platform to other businesses. For CFOs, this means unlocking a recurring revenue model that sits alongside the core business and strengthens financial resilience.

2. Global Liquidity Access

Treasury teams no longer need to depend solely on regional banking relationships. With DeFi platforms, enterprises can tap into international liquidity pools instantly, lowering borrowing costs and gaining faster access to working capital in new markets.

3. Operational Efficiency

Smart contracts take over manual back-office processes like loan servicing, settlements, and compliance reporting. This reduces administrative overhead for finance departments, minimizes delays in treasury operations, and provides audit-ready records at a lower cost.

4. Competitive Differentiation

Offering decentralized lending services positions enterprises as innovators. Clients gain faster settlements, higher yield opportunities, and transparent processes. This translates into stronger client retention and brand differentiation in competitive markets.

5. Future-Proofing Finance

By adopting DeFi now, enterprises prepare for the tokenized future, where real estate, bonds, and invoices become digital collateral. Early adoption lets strategy leaders capture market share and set industry benchmarks before peers catch up.

In short, DeFi lending platforms help enterprises cut inefficiencies, access global liquidity, and create long-term growth opportunities. For executives shaping financial strategy, the question has shifted from “why” to “when and how fast can we deploy?” This naturally leads to the next discussion that covers which enterprises stand to gain the most from this shift.

Which Enterprises Benefit Most from DeFi Lending and Borrowing Platforms?

The impact of decentralized lending extends far beyond retail finance. Different types of enterprises are discovering unique advantages depending on their industry, scale, and financial needs. Those most affected by inefficiencies in traditional systems are moving first, while others are beginning to explore DeFi as tokenization and compliance frameworks mature.

1. Banks and Financial Institutions

Traditional institutions are under pressure to modernize. DeFi lending platforms allow them to create hybrid models that combine trust and compliance with the speed and transparency of blockchain. By integrating tokenized assets and automated lending pools, they reduce infrastructure costs and expand lending opportunities across markets.

2. Fintechs and Digital-First Lenders

Fintechs thrive on delivering faster, more innovative services. By embedding decentralized lending directly into their ecosystems, they can attract new customers, retain existing ones, and access global liquidity without the overhead of legacy banking systems.

3. Asset Managers and Investment Firms

Firms managing large portfolios benefit from new liquidity channels. By lending idle digital assets or borrowing against tokenized holdings, they can enhance yields and diversify risk management strategies in ways that traditional custodianship cannot match.

4. Real Estate, Supply Chain, and Manufacturing Enterprises

Industries with illiquid assets or receivables face ongoing liquidity challenges. Tokenizing real estate, invoices, or trade contracts allows these enterprises to unlock working capital quickly, supporting growth without waiting on slow credit approvals.

5. Multinational Corporations

Enterprises operating across borders often absorb high transaction costs and settlement delays. DeFi lending platforms provide instant access to capital in multiple markets and reduce reliance on intermediaries, improving both efficiency and profitability.

6. Emerging Enterprises and SMEs

Smaller businesses, especially in developing economies, often struggle with limited access to credit. DeFi creates a pathway to global financing by allowing them to use tokenized collateral and connect directly with international liquidity providers.

In essence, the enterprises that gain the most are those constrained by legacy inefficiencies, whether in cross-border payments, asset liquidity, or capital access. For them, decentralized lending becomes a strategic enabler of growth, resilience, and long-term competitiveness.

Key Features of an Enterprise DeFi Lending and Borrowing Platform

When enterprises explore decentralized lending, they quickly realize it takes more than just putting loans on a blockchain. To work at scale, the platform must combine transparency and automation with safeguards for compliance, security, and liquidity.

Some features are absolutely essential from day one, while others help enterprises stay ahead of the curve as the market matures.

1. Smart Contract Infrastructure

At the heart of the system are smart contracts, which are self-executing programs that remove the need for manual intervention. They handle everything from loan creation and repayments to interest distribution. This guarantees accuracy, transparency, and speed, which enterprises cannot achieve with paper-based or legacy processes.

2. Collateral Management

No enterprise will risk funds without strong safeguards. Collateral management ensures every loan is backed securely. The platform constantly tracks asset values, enforces over-collateralization, and liquidates collateral automatically if it falls below safety thresholds. This assures lenders that their capital is protected even in volatile markets.

3. Liquidity Pools

Instead of matching individual lenders with borrowers, liquidity pools gather funds from many participants and make them available on demand. This structure supports scale, keeps capital working efficiently, and adjusts interest rates dynamically to balance supply and demand.

4. Multi-Asset and Tokenization Support

Enterprises deal with more than cryptocurrencies alone. A robust platform must support tokenized real-world assets, such as real estate, receivables, or bonds, so businesses can unlock liquidity without selling valuable holdings. Tokenization broadens the scope of collateral and connects DeFi with real enterprise assets.

5. Identity and Compliance Integration

Compliance is not optional. Enterprises need KYC, AML, and increasingly Decentralized Identity (DID) to verify participants without exposing sensitive data. This creates a trust layer that satisfies regulators and reassures stakeholders, while still preserving the decentralized foundation.

6. Risk Management and Security

Trust in the system depends on resilience. Independent audits of smart contracts, multi-signature wallets, insurance funds, and continuous on-chain monitoring protect against both technical flaws and malicious activity. These safeguards ensure institutional-grade confidence.

7. Analytics and Dashboards

For enterprises, visibility is as important as automation. Real-time dashboards show the health of liquidity pools, loan performance, and compliance readiness. Instead of raw data, leaders see actionable insights that guide financial strategy and risk management.

8. Advanced Differentiators

Beyond the essentials, some features help enterprises push ahead:

- AI-driven credit scoring and predictive monitoring reduce risk.

- Cross-chain interoperability broadens liquidity options across ecosystems.

- Governance structures, whether decentralized or consortium-led, add flexibility in how rules are set and enforced.

These differentiators don’t make or break a platform, but they shape whether it becomes a leader in its category.

Ultimately, the essentials create a foundation enterprises can trust, while advanced capabilities position the platform as a future-proof solution. The combination is what transforms DeFi lending from a technical experiment into a reliable enterprise infrastructure.

Architecture of a DeFi Lending and Borrowing Platform for Enterprises

The architecture of a DeFi lending platform is more than code and smart contracts. For enterprises, it requires an ecosystem that scales globally, satisfies regulators, and safeguards capital. The design must integrate automation with compliance and governance, while remaining flexible enough to evolve with market needs.

1. User Interaction Layer

This is the enterprise-facing interface, which is an intuitive dashboard for lenders, borrowers, and administrators. Secure wallet integrations and responsive mobile access ensure seamless participation. Embedded reporting tools provide executives with visibility into loans, liquidity pools, and compliance metrics in real time.

2. Identity and Compliance Layer

Trust is established here. KYC and AML checks, combined with Decentralized Identity (DID) frameworks, allow verified participation without exposing sensitive data. Permissioned pools can be created for institutions or accredited participants, ensuring adherence to regulatory requirements while maintaining efficiency.

3. Core Smart Contract Layer

Smart contracts handle execution, such as loan creation, interest accrual, repayments, and collateral liquidation. Automated enforcement eliminates manual intervention, reduces disputes, and guarantees consistent rule application. Enterprises benefit from transparent, tamper-proof workflows that strengthen reliability.

4. Asset and Tokenization Layer

This layer bridges traditional and digital finance. Real estate, trade receivables, and bonds can be tokenized to serve as collateral. By unlocking value from illiquid assets, enterprises gain access to faster, cheaper capital while tapping into global liquidity markets.

5. Scalability and Shardchains Layer

Performance matters at enterprise scale. Shardchains distribute workloads, preventing congestion and keeping costs predictable. Specialized shards can be dedicated to asset classes like stablecoins or real estate, while private shards serve consortium-led institutional pools.

6. Security and Risk Management Layer

Institutional adoption depends on resilience. Independent audits, multi-signature controls, insurance mechanisms, and AI-driven anomaly detection form a comprehensive defense. Continuous monitoring ensures platform stability and investor confidence.

7. Governance Layer

Decision-making cannot be left vague. Governance may be community-driven or consortium-based, depending on the operating model. Enterprises gain flexibility to adapt rules, manage risk thresholds, and incorporate jurisdictional mandates as regulations evolve.

8. Strategic Delivery Partner

The complexity of aligning these layers into one seamless system requires experience across AI, blockchain, and enterprise infrastructure. A trusted development partner like the team behind Intellivon’s enterprise solutions brings that expertise, designing architectures where compliance, scalability, and automation are not afterthoughts but part of the foundation.

In essence, the architecture functions as a living ecosystem. DID ensures identity and compliance, shardchains deliver scale, and governance maintains adaptability. With the right strategic partner, enterprises can launch lending platforms that are secure, regulator-ready, and future-proof.

The Role of AI in Enterprise DeFi Lending and Borrowing Platforms

Artificial intelligence brings the intelligence layer that transforms DeFi lending from a rules-based system into an adaptive enterprise solution. Where smart contracts provide automation, AI adds foresight, risk awareness, and efficiency. This combination is what allows decentralized platforms to meet institutional standards for trust and reliability.

1. Smarter Risk Profiling

Static collateral ratios don’t always reflect borrower behavior. AI models analyze wallet history, repayment patterns, and even off-chain financial data to generate more accurate credit assessments. This enables platforms to lower collateral requirements for trusted participants while keeping capital secure.

2. Predictive Collateral Monitoring

Market volatility can erode collateral values in minutes. AI-driven engines continuously monitor asset performance and issue early alerts when positions are at risk. Automated triggers then initiate margin calls or liquidation before lenders face losses.

3. Fraud and Anomaly Detection

Decentralized platforms are prime targets for exploits. Machine learning models flag unusual activity such as wallet clustering, flash-loan abuse, or suspicious fund movements. These safeguards reduce exposure to fraud and improve institutional confidence in decentralized lending.

4. Dynamic Interest Optimization

Traditional DeFi relies on fixed formulas to set rates. AI introduces predictive analytics that forecast supply and demand trends in liquidity pools. This ensures more balanced borrowing costs while keeping returns competitive for lenders.

5. Automated Compliance and Reporting

Regulatory obligations require constant vigilance. AI systems screen transactions in real time for AML and KYC anomalies, while generating audit-ready compliance reports across jurisdictions. This reduces administrative overhead and keeps platforms regulator-ready.

6. Enterprise Intelligence Layer

The integration of AI into DeFi platforms is not a practical necessity for scaling securely. The enterprise solutions group at Intellivon’s innovation practice embeds AI across risk management, fraud detection, and compliance modules, ensuring platforms are resilient and regulator-aligned from the start.

In effect, AI transforms DeFi lending from a passive system into a proactive ecosystem. Enterprises gain faster insight, reduced risk, and improved profitability, thereby building confidence that decentralized lending can operate at an institutional scale.

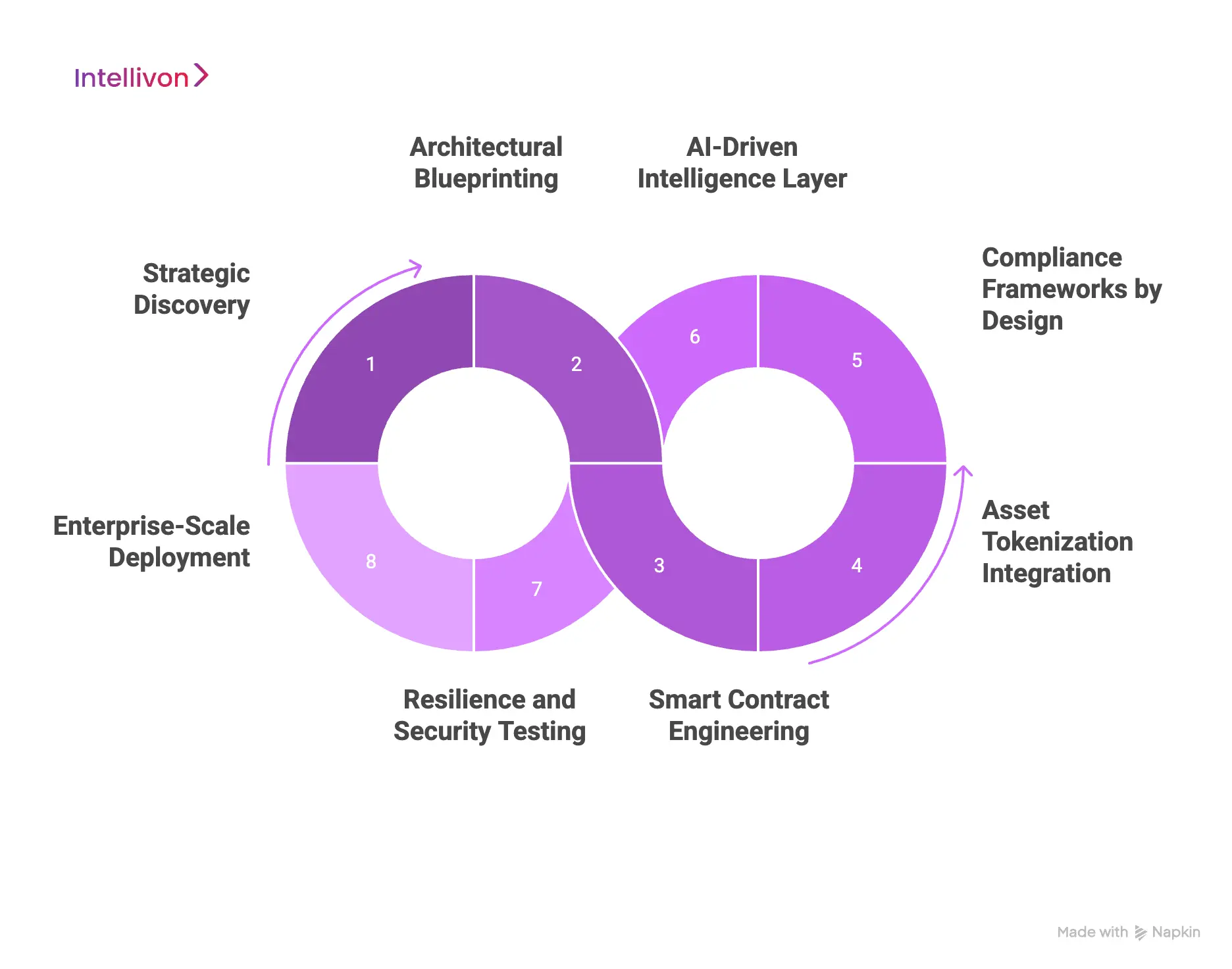

How We Create DeFi Lending and Borrowing Platforms for Enterprises

Delivering a secure, scalable, and compliant DeFi lending demands an approach rooted in enterprise experience. Intellivon has refined a proven process that brings together blockchain expertise, AI-driven intelligence, and regulatory alignment to help organizations adopt decentralized finance without disruption.

1. Strategic Discovery

Every project begins with a comprehensive assessment of enterprise objectives, existing workflows, and regulatory environments. Intellivon’s team identifies the exact use cases, be it global liquidity, tokenized receivables, or hybrid lending models, that align with measurable outcomes.

2. Architectural Blueprinting

The next stage focuses on designing a modular architecture. Intellivon structures each platform with clear layers that include user interface, compliance, and DID, smart contract backbone, asset tokenization, shardchain scalability, and governance. This ensures seamless interoperability with existing enterprise systems.

3. Smart Contract Engineering

Security-first development guides the creation of the smart contract ecosystem. Intellivon engineers write, test, and audit contracts for lending, collateral management, repayments, and liquidation logic, ensuring both performance and resilience.

4. Asset Tokenization Integration

Intellivon specializes in converting real-world assets into secure digital tokens. From real estate to trade receivables, enterprises gain the ability to unlock liquidity from illiquid holdings, bridging traditional finance with decentralized capital markets.

5. Compliance Frameworks by Design

Regulatory alignment is embedded from day one. Intellivon integrates KYC, AML, and DID modules, providing enterprises with verifiable compliance, audit-ready reporting, and privacy-preserving identity systems that satisfy global standards.

6. AI-Driven Intelligence Layer

Artificial intelligence powers dynamic decision-making across the platform. Intellivon’s solutions include predictive risk modeling, fraud detection, collateral monitoring, and adaptive interest rate optimization, thereby transforming lending into a proactive, data-driven ecosystem.

7. Resilience and Security Testing

Before deployment, Intellivon subjects each platform to exhaustive audits, penetration testing, and stress simulations. Insurance reserves, monitoring engines, and governance safeguards are embedded to ensure institutional-grade protection.

8. Enterprise-Scale Deployment

Finally, Intellivon manages the rollout, onboarding, and scaling strategy. Whether expanding into new asset classes, enabling private shards for consortium use, or integrating with cross-chain networks, the platform is engineered for growth without compromising compliance.

This eight-step process reflects Intellivon’s commitment to building enterprise DeFi systems that combine innovation with trust. By integrating technology, governance, and intelligence from the ground up, the result is a lending and borrowing platform that delivers measurable impact and positions enterprises for the next era of finance.

Cost of Developing a DeFi Lending and Borrowing Platform for Enterprises

At Intellivon, the goal is to help enterprises build DeFi platforms that are both powerful and sustainable. That’s why the pricing framework is designed to be flexible and aligned with growth goals and compliance requirements rather than forcing a rigid, one-size-fits-all package.

If early projections stretch beyond your budget, the scope is refined collaboratively. The focus always remains on preserving the core value: productivity, enterprise-grade reliability, and uncompromising security.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, workflow mapping, KPI definition, and compliance readiness (GDPR, SOC 2, regional banking laws) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting layered architecture (user, compliance/DID, smart contracts, tokenization, governance) and integration planning | $8,000 – $15,000 |

| Core Smart Contract Development | Building lending, collateral, liquidity pool, and repayment logic with modular upgrade capability | $12,000 – $25,000 |

| Asset Tokenization & Multi-Asset Integration | Frameworks for tokenizing real-world assets (real estate, receivables, bonds) and enabling multi-asset collateral | $10,000 – $20,000 |

| AI Intelligence Layer | Risk scoring, predictive collateral monitoring, fraud detection, and interest rate optimization | $10,000 – $22,000 |

| Platform Development & Customization | Dashboards, enterprise portals, mobile/web apps, and integration with ERP/CRM/Treasury systems | $12,000 – $25,000 |

| Security & Compliance Alignment | Smart contract audits, encryption, KYC/AML/DID modules, and continuous compliance monitoring | $8,000 – $15,000 |

| Testing & Quality Assurance | Stress testing, compliance checks, end-to-end workflow validation, and performance tuning | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, shardchain setup, data residency controls, monitoring dashboards, and consortium onboarding | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

Even with clear planning, additional costs may emerge over the lifecycle of the platform:

- Integration Complexity: Connecting with legacy ERP, treasury, and compliance systems often requires custom middleware.

- Liquidity Bootstrapping: Enterprises must plan how initial pools will be funded or incentivized.

- Compliance Overhead: Jurisdictional regulations (GDPR, AML, local banking standards) require ongoing legal and audit support.

- Cloud & Infrastructure Costs: Running AI-driven monitoring and scaling shard chains may increase compute usage if not optimized.

- Change Management: Training teams, educating clients, and managing governance transitions add operational costs.

- Maintenance & Monitoring: Ongoing updates, regulatory adaptations, and observability tools are vital to avoid downtime.

Best Practices to Avoid Budget Overruns

From Intellivon’s experience delivering enterprise-scale DeFi solutions, several practices consistently keep costs predictable:

- Start with Focused Scope: Launch one priority lending use case, then expand after ROI validation.

- Design for Compliance Early: Build GDPR, SOC 2, and AML rules into architecture to prevent costly retrofits.

- Use Modular Smart Contracts: Reusable modules accelerate the development of new features and asset classes.

- Optimize Infrastructure Spend: Balance shardchain use with layer-2 scalability to control gas and compute costs.

- Embed Observability from Launch: Monitor liquidity health, risk exposure, and transaction throughput continuously.

- Build Governance Flexibility: Configure permissioned pools or consortium-led governance upfront to avoid redesign.

- Plan for Continuous Improvement: Regular updates to AI models, compliance modules, and tokenization frameworks maintain relevance.

Request a tailored proposal from Intellivon’s enterprise blockchain team, and you’ll receive a roadmap that fits your budget, enforces compliance, and scales with your long-term growth.

How We Maintain Security and Compliance in DeFi Platforms

For decentralized lending to be enterprise-ready, it must be as secure as it is innovative. No organization will commit capital or reputation to a platform unless it proves resilient against technical flaws, market volatility, and regulatory pressure. A strong security and compliance framework transforms DeFi from an experimental idea into a trusted enterprise infrastructure.

1. Multi-Layered Security

Protection starts with independently audited smart contracts that rule out exploitable vulnerabilities before launch. Multi-signature wallets add governance control, while hardware security modules safeguard critical assets.

Real-time monitoring systems then track every transaction, flagging anomalies before they escalate into larger risks.

2. Regulatory Alignment

Enterprises need assurance that decentralized platforms won’t put them at odds with regulators. Integrated KYC and AML modules, combined with Decentralized Identity (DID) frameworks, create verifiable compliance without compromising user privacy.

Audit trails built into the blockchain allow enterprises to generate regulator-ready reports instantly, saving time and reducing complexity.

3. Risk and Collateral Protection

Automated liquidation ensures lenders remain protected when collateral values fall. Insurance reserves or recovery pools cover unexpected events, strengthening institutional trust. Together, these mechanisms provide a buffer against both predictable and unforeseen risks.

4. Trust Through Governance

Enterprises often require permissioned pools or consortium-led participation. Governance frameworks ensure only authorized participants can join, and that compliance policies remain enforceable across different jurisdictions. This balances decentralization with the accountability enterprises need.

Your Strategic Implementation Partner

Delivering all of these safeguards requires deep experience in enterprise-grade blockchain deployments. The solutions portfolio developed by Intellivon’s blockchain practice integrates security, compliance, and governance into the platform architecture from day one, giving organizations the confidence to scale without disruption.

Real-World Examples of Enterprise DeFi Lending Platforms

Enterprises often ask whether decentralized lending is still a niche experiment or a proven model. The reality is that several platforms already demonstrate how lending and borrowing can work in a decentralized context, while some institutions are piloting enterprise versions inspired by DeFi principles.

1. Aave Arc

Aave Arc is one of the most direct examples of institutional DeFi lending. It allows whitelisted participants who have cleared KYC/AML checks to lend and borrow assets through liquidity pools. By merging Aave’s core lending mechanics with compliance controls, it demonstrates how enterprises can safely operate in decentralized environments.

2. Compound and Compound Treasury

Compound remains a foundational DeFi lending protocol, enabling users to supply assets to earn interest and borrow against collateral. Its enterprise-focused extension, Compound Treasury, simplifies access for businesses by offering fixed-yield stablecoin deposits. While Treasury leans more toward yield generation than borrowing, it still represents a bridge between enterprises and decentralized lending markets.

3. MakerDAO

MakerDAO pioneered collateral-backed lending through the creation of DAI. Users lock up assets such as ETH or tokenized holdings to generate the stablecoin, effectively borrowing against collateral. For enterprises, MakerDAO highlights how stablecoins can serve as reliable liquidity anchors within decentralized lending ecosystems.

4. JPMorgan and DBS Pilots

Large banks, including JPMorgan and DBS, are running blockchain pilots that tokenize collateral and streamline interbank lending. These initiatives are not “pure DeFi” because they operate in permissioned, regulated environments, but they showcase how DeFi principles, like automation, transparency, and smart contract enforcement, are being adapted for institutional use cases.

Taken together, these examples highlight a spectrum of adoption. For enterprise, it is clear: decentralized lending is evolving into a practical, enterprise-ready model.

Conclusion

Decentralized lending and borrowing platforms are reshaping how enterprises access liquidity, manage collateral, and reduce financial inefficiencies. By combining smart contracts, tokenization, and AI-driven intelligence, these systems deliver transparency, speed, and scalability that legacy finance cannot match.

To capture these benefits, enterprises need experienced solution providers who understand both blockchain technology and regulatory environments. Building in-house without specialized expertise increases risk, cost, and compliance challenges. Partnering with the right provider ensures platforms are designed securely, aligned with business goals, and ready to scale with evolving global markets.

Build Your DeFi Lending and Borrowing Platform With Intellivon

At Intellivon, we design enterprise-grade DeFi platforms that are secure, compliant, and scalable, tailored to the way global organizations operate. Our frameworks combine blockchain, AI-driven intelligence, and compliance-first design to help enterprises unlock liquidity, streamline lending operations, and prepare for a tokenized future without disruption.

Why Partner With Intellivon?

- Tailored Financial Infrastructure: Every platform is designed around your business model, asset mix, and compliance obligations, ensuring a solution that matches your growth goals.

- Compliance and Regulatory Alignment: Built to satisfy GDPR, SOC 2, AML/KYC, and regional financial regulations from the ground up, with audit-ready reporting embedded into the system.

- Proven Enterprise Delivery: Over a decade of experience delivering blockchain and AI solutions that reduce operational costs, improve capital efficiency, and enable global expansion.

- Resilient Security Architecture: Independent audits, insurance mechanisms, anomaly detection, and multi-signature controls protect both institutional capital and customer trust.

- Future-Ready Tokenization Frameworks: Support for real-world assets such as real estate, invoices, or bonds, helping enterprises unlock new liquidity streams and adapt to emerging financial ecosystems.

- Scalable Architecture Design: Cloud-native, shardchain-enabled, and API-driven platforms that integrate seamlessly with ERP, CRM, and treasury systems, ensuring smooth enterprise adoption.

Book a discovery call with Intellivon today to explore how we can help you build a DeFi lending and borrowing platform that not only strengthens financial operations but also positions your enterprise as a leader in the decentralized economy.

FAQs

Q1. How much does it cost to build a DeFi lending and borrowing platform?

A1. The cost to develop an enterprise-grade DeFi lending platform typically ranges from $50,000 to $150,000, depending on scope, features, compliance requirements, and integrations with existing systems. Ongoing maintenance usually adds 15–20% annually.

Q2. Can DeFi platforms integrate with traditional banking systems?

A2. Yes. Through APIs and middleware, DeFi platforms can connect with ERP, CRM, and even core banking systems. Enterprises often adopt hybrid (CeDeFi) models that balance decentralized mechanics with existing infrastructure.

Q3. What makes DeFi lending secure for enterprises?

A3. Security depends on audited smart contracts, multi-signature wallets, collateral management, insurance reserves, and continuous monitoring. Enterprises also rely on built-in compliance features such as KYC/AML and DID frameworks to ensure trust and resilience.

Q4. Which industries benefit most from DeFi lending platforms?

A4. Industries with high liquidity needs or large illiquid assets benefit most, including banks, fintechs, asset managers, real estate firms, supply chain companies, and global corporates managing cross-border capital flows.

Q5. How do enterprises stay compliant when using DeFi lending platforms?

A5. Compliance is maintained by embedding KYC, AML, GDPR, and SOC 2 protocols directly into the platform. Enterprises also use permissioned pools and audit-ready reporting to satisfy regulatory bodies across jurisdictions.