Fraud is now a business crisis, more than just a tech problem. Today’s fraudsters can build synthetic identities, hijack accounts in real time, and run mule networks that slip past traditional rule-based systems. This results in billions in losses, rising regulatory fines, and legitimate customers getting blocked. That’s why Feedzai became the gold standard by using machine learning, behavioral analytics, and real-time risk scoring. It processes millions of transactions per second and stops fraud before it happens, all with explainable AI that regulators can trust. That’s why tier-one banks, payment processors, and e-commerce platforms rely on it.

At Intellivon, we help enterprises build AI fraud detection platforms tailored to their specific risks, integrated into their existing infrastructure, and designed to scale without breaking. In this blog, we’ll walk you through how Feedzai operates, what sets it apart, and how we develop a fraud detection system for your enterprise that becomes a strategic asset, driving trust, reducing friction, and protecting revenue.

Key Takeaways of the AI-Powered Fraud Detection Market

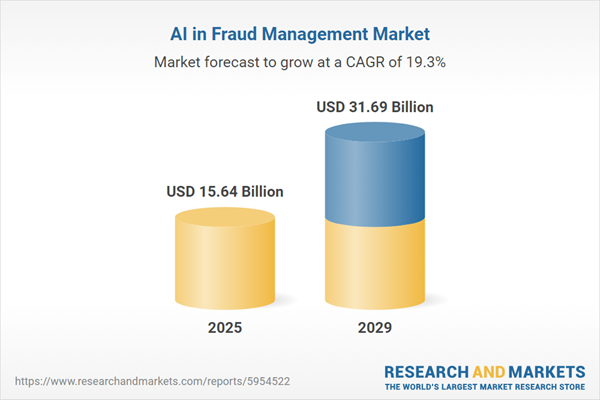

The AI in fraud management market has grown rapidly in recent years. Valued at $13.05 billion in 2024, it is projected to reach $15.64 billion in 2025, reflecting a strong CAGR of 19.8%. This growth shows how enterprises are prioritizing advanced fraud prevention as a core part of their digital strategy.

- 65% of businesses remain unprotected against even basic bot-driven fraud, making AI-based detection no longer optional but a core business requirement.

- Enterprises adopting AI-powered fraud systems report up to 4x higher detection rates while cutting false alerts by nearly 50%, driving measurable reductions in operational costs and direct losses.

- The broader AI fraud management market is projected to surpass $65.3 billion by 2034, growing at an 18% CAGR, which is a clear signal that fraud prevention technology is now a strategic enabler for enterprises.

Investing in a fraud detection platform modeled after Feedzai is a growth strategy. Enterprises gain:

- Higher fraud detection accuracy with fewer false positives.

- Reduced financial losses and compliance exposure.

- Scalable architecture capable of supporting billions of transactions.

- Improved customer trust through seamless, low-friction fraud prevention.

With fraud losses escalating globally and AI-powered scams growing more advanced, adopting a Feedzai-like platform positions enterprises ahead of both regulatory risk and market competition. The ROI is not only in fraud reduction but also in the ability to compete confidently in a trust-driven digital economy.

Why Feedzai Became the Benchmark in AI Fraud Detection

Feedzai is often cited as the industry standard in AI-driven fraud prevention. What sets it apart is not just the depth of technology, but how it translates into enterprise outcomes, including scalability, compliance, and measurable fraud reduction.

1. Trusted by Global Financial Institutions

Tier-one banks, payment providers, and digital commerce platforms use Feedzai to safeguard billions of transactions. Institutions like Citi, Lloyds, and Revolut rely on it because it can handle the complexity of modern fraud without slowing down customer experience. Trust at this scale signals reliability that few platforms can match.

2. Real-Time Decisioning at Scale

Feedzai’s engine delivers risk scoring in under 50 milliseconds, even across millions of daily transactions. That speed matters. Delays can frustrate customers or create transaction drop-offs. Feedzai shows that real-time protection and customer convenience can co-exist when the architecture is designed for low-latency performance.

3. Hybrid AI Approach

Fraud patterns evolve constantly. Feedzai uses a hybrid model of supervised, unsupervised, and reinforcement learning to cover both known and emerging fraud tactics. This adaptability minimizes blind spots and helps enterprises stay ahead of fraudsters without endless manual updates to rules.

4. Explainable and Regulator-Friendly

Fraud detection cannot be a “black box.” Regulators and auditors demand clear explanations for every blocked or flagged transaction. Feedzai integrates explainable AI (XAI), making every decision traceable and auditable. This capability not only satisfies compliance frameworks like GDPR and PSD2 but also builds enterprise trust internally.

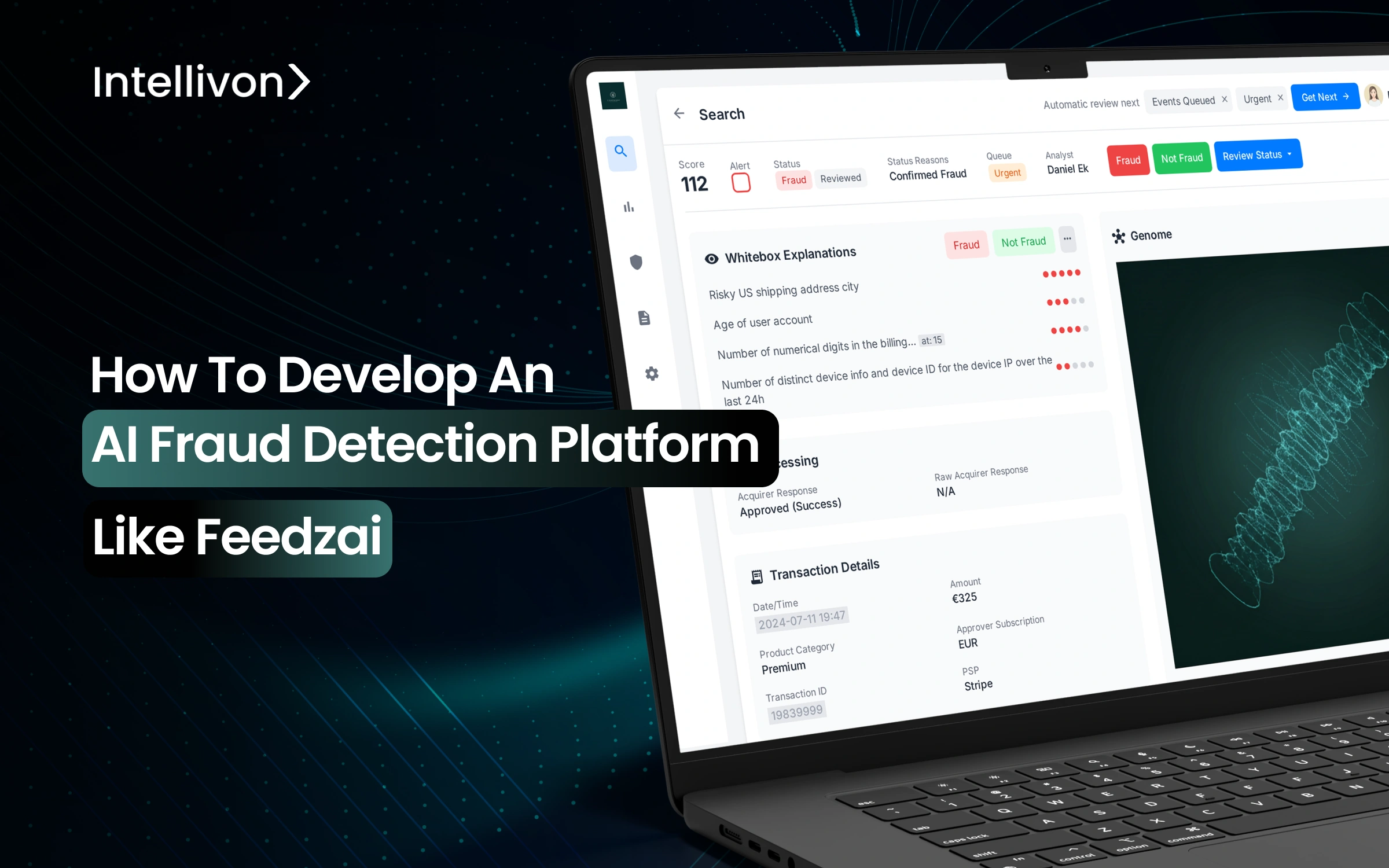

5. Analyst-Driven Case Management

Technology alone cannot close every fraud case. Feedzai equips fraud teams with dashboards, alerts, and investigation tools. Analysts can review, escalate, or override decisions quickly. More importantly, their feedback loops back into the system, continuously improving model performance.

Feedzai became the benchmark because it solved the two hardest challenges in fraud detection: scaling intelligence across billions of transactions while keeping regulators and customers satisfied. That combination is rare, which is why enterprises look to replicate its model when building their own platforms.

Decoding Feedzai: How the Platform Works

Feedzai is more than a fraud detection tool. It is an enterprise platform designed to handle scale, compliance, and continuous learning. Understanding how it works provides a clear blueprint for enterprises that want to build something similar.

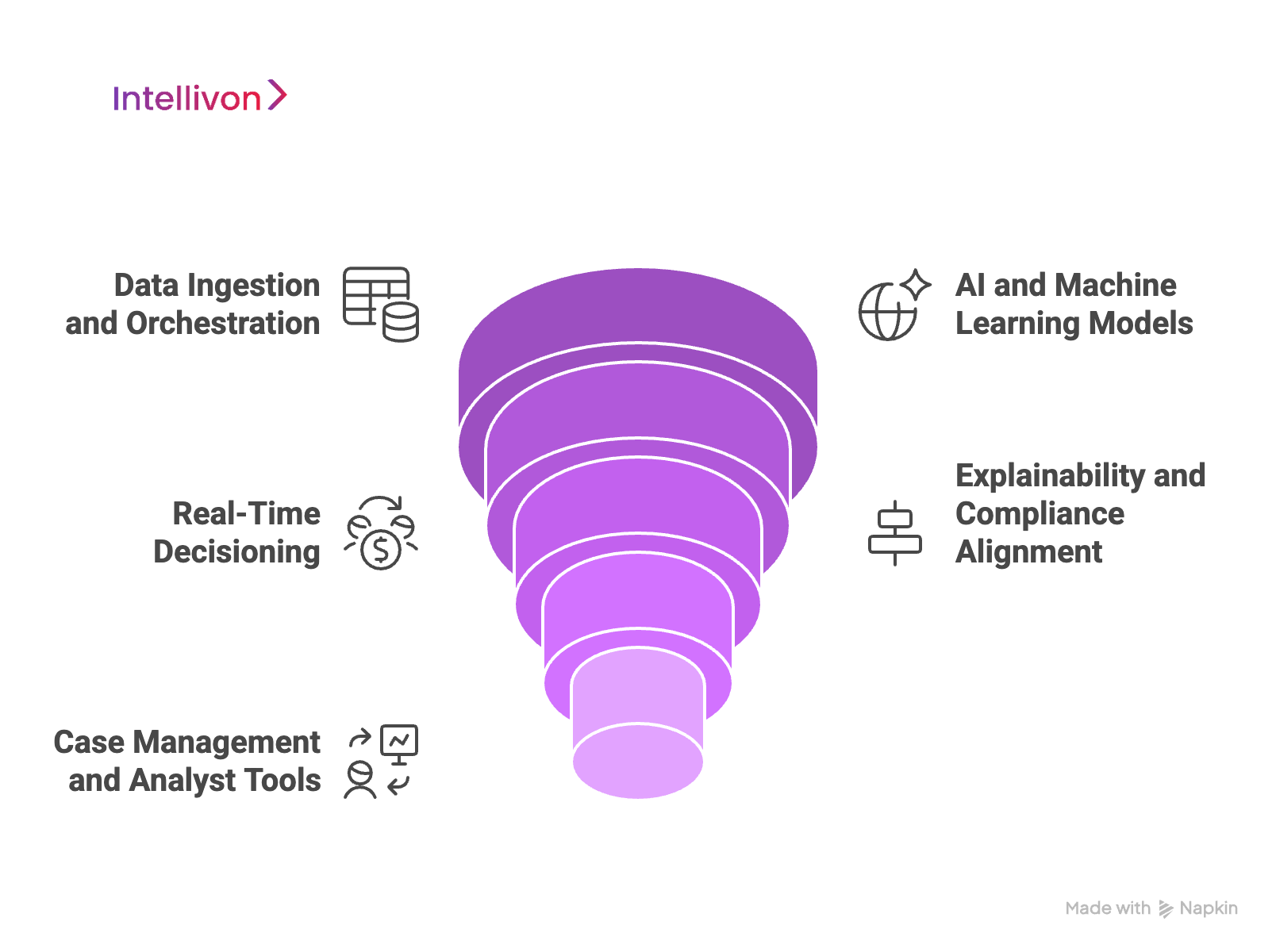

1. Data Ingestion and Orchestration

The platform starts by unifying data streams. It pulls information from payment gateways, customer accounts, devices, biometrics, and even geolocation. By orchestrating these diverse inputs into a single data fabric, Feedzai eliminates blind spots that fraudsters exploit.

For an enterprise, this means designing ingestion pipelines that capture both structured and unstructured data in real time. Tools like Apache Kafka or Flink often support these architectures.

2. AI and Machine Learning Models

Feedzai applies multiple layers of AI. Supervised machine learning models that handle known fraud scenarios. Unsupervised models identify anomalies that don’t match past behavior. Reinforcement learning continuously adapts based on new threats.

This multi-pronged approach allows the system to detect both established fraud patterns and emerging tactics that traditional systems miss. Enterprises seeking to replicate this must invest in diverse model stacks rather than relying on a single algorithm.

3. Real-Time Decisioning

Speed is the difference between catching fraud and letting it through. Feedzai’s decisioning layer evaluates transactions in less than 50 milliseconds. Each event receives a risk score, which determines whether it is approved, flagged, or blocked.

To achieve this, enterprises need low-latency infrastructure and microservices that can handle spikes in transaction volume without downtime.

4. Explainability and Compliance Alignment

Every fraud decision must stand up to regulatory scrutiny. Feedzai integrates explainable AI, giving clear reasons why a transaction was flagged. This is critical for compliance frameworks like PSD2, GDPR, and AML regulations.

By making AI decisions transparent, enterprises can demonstrate accountability to regulators, auditors, and customers, which is non-negotiable in today’s environment.

5. Case Management and Analyst Tools

Fraud analysts remain central to the process. Feedzai provides them with dashboards, alerts, and case management workflows. Analysts can escalate cases, override AI decisions, and feed insights back into the system.

This human-in-the-loop design ensures the platform doesn’t operate in isolation. Instead, it continuously improves based on both machine learning and human expertise.

Feedzai’s architecture works because it combines data breadth, model diversity, real-time decisioning, regulatory transparency, and analyst empowerment. Enterprises aiming to build similar platforms must replicate this balance rather than focusing on AI models alone.

Features Of An AI Fraud Detection Platform Like Feedcai

Enterprises considering a fraud detection system must focus on the essentials. Features that are “nice to have” will not hold up against evolving threats or regulatory scrutiny. Below are nine non-negotiable features every enterprise-grade fraud detection platform should include, modeled after the strengths that made Feedzai the benchmark.

1. Real-Time Risk Scoring

Fraud happens in milliseconds, and so should prevention. A must-have feature is the ability to score transactions in real time with extremely low latency. This ensures suspicious activity is intercepted before funds move, while genuine customers continue seamlessly. Without this capability, fraud detection lags behind the attack itself.

2. Multi-Channel Fraud Coverage

Fraudsters target every touchpoint, like online, mobile, card payments, and in-store systems. Platforms must unify detection across these channels so that behavior flagged in one area informs risk assessment in another. A disconnected system leaves exploitable blind spots that attackers can move through undetected.

3. Advanced AI and Model Diversity

No single model can cover the complexity of modern fraud. Effective systems combine supervised learning for known scenarios, unsupervised learning for new anomalies, and reinforcement learning for adaptive protection. This mix ensures continuous defense even as fraud tactics shift daily.

4. Behavioral Analytics

Static transaction data isn’t enough. Platforms must analyze user behavior, such as typing patterns, device usage, navigation flows, and even geolocation trails. These subtle signals uncover fraud that looks legitimate at first glance, such as synthetic identities or sophisticated account takeovers.

5. Device and Session Fingerprinting

Every device leaves a unique trace. Capturing browser fingerprints, device IDs, and session histories allows enterprises to block fraudulent logins, automated scripts, or repeated bot attempts. This capability is critical to stopping scalable, automated fraud attacks.

6. Continuous Learning and Retraining

Fraud never stands still, so neither can detection. A non-negotiable requirement is continuous learning, where models retrain on live data, analyst feedback, and simulated attack scenarios. This cycle prevents model drift and keeps accuracy high over time.

7. Explainable AI and Compliance Alignment

Executives and regulators need clarity, not black boxes. Platforms must explain why each transaction was flagged and provide audit-ready logs. This transparency is essential for frameworks like PSD2, GDPR, and AML directives, and it builds trust internally across risk and compliance teams.

8. Case Management and Analyst Dashboards

Fraud detection is not fully automated. Analysts need tools to investigate, escalate, and resolve cases quickly. Dashboards must provide context-rich alerts, flexible reporting, and workflows that let teams feed insights back into the AI models, strengthening the system continuously.

9. Scalable, Resilient Architecture

Fraud detection only works if it performs under pressure. Platforms must handle billions of events across geographies without downtime. Cloud-native microservices, elastic scaling, and disaster recovery protocols ensure enterprises stay protected even during transaction spikes or unexpected outages.

These nine features define the baseline for an AI fraud detection platform that operates at Feedzai’s standard. Each one directly contributes to better detection rates, stronger compliance, and a smoother customer experience. Omitting any of them compromises the effectiveness of the entire system.

How We Develop An AI Fraud Detection Platform Like Feedzai

Building an enterprise-grade fraud detection platform is not a quick project. It requires structured execution across multiple dimensions, like business alignment, technical depth, and regulatory assurance. Here’s the 8-step process Intellivon follows to deliver a platform that matches the benchmark set by Feedzai.

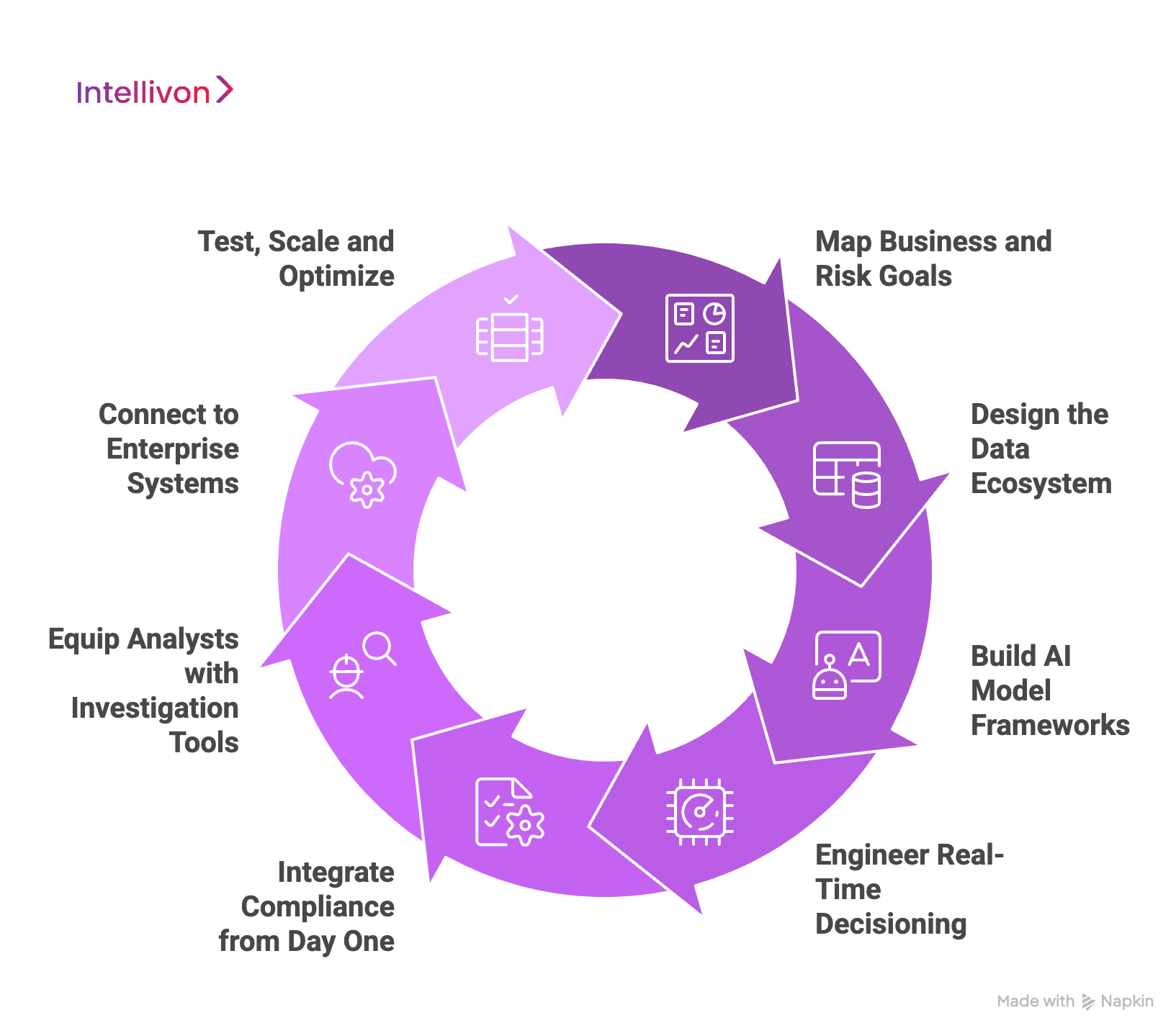

Step 1: Map Business and Risk Goals

We start by working with leadership to define fraud-related KPIs, compliance obligations, and tolerance levels. This ensures the platform connects directly to measurable business objectives such as lowering false positives, reducing fraud losses, and satisfying AML requirements.

Step 2: Design the Data Ecosystem

Our team identifies every relevant data source, such as transactions, accounts, devices, and external intelligence feeds. We design ingestion pipelines that bring this data together in real time while enforcing strong governance and privacy standards.

Step 3: Build AI Model Frameworks

We create a multi-layered AI model stack, where supervised models catch known fraud patterns, and unsupervised techniques flag anomalies. Reinforcement learning adapts the system to evolving tactics. Domain-specific feature engineering sharpens accuracy for each industry.

Step 4: Engineer Real-Time Decisioning

We architect a low-latency engine that evaluates transactions in less than 50 milliseconds. Microservices handle transaction spikes without downtime. Every decision balances fraud prevention with customer experience.

Step 5: Integrate Compliance from Day One

We embed audit-ready logs, explainable AI outputs, and regulatory workflows into the platform. This design ensures the system is PSD2, GDPR, and AML-ready at launch, eliminating expensive compliance retrofits later.

Step 6: Equip Analysts with Investigation Tools

Fraud teams gain more than alerts. We provide dashboards that link cases, highlight suspicious relationships, and generate instant reports. Analysts can act quickly and feed insights back into the system, closing the loop between human and machine intelligence.

Step 7: Connect to Enterprise Systems

We integrate the fraud platform with existing core banking systems, payment gateways, CRMs, and ERPs. Seamless integration ensures fraud detection runs within business workflows rather than in isolated silos.

Step 8: Test, Scale, and Optimize

We run pilots with historical and synthetic fraud data to validate accuracy. Once live, we scale elastically across geographies and transaction volumes. Continuous retraining pipelines keep the system sharp against new threats.

This process creates more than a fraud detection tool. It delivers a compliance-ready, AI-driven platform that adapts as threats evolve and strengthens customer trust. By following a structured build, enterprises can achieve Feedzai-level performance while tailoring the system to their own operations.

Cost of Building an AI Fraud Detection Platform Like Feedzai

At Intellivon, the goal is to help enterprises build fraud detection platforms that are both scalable and future-ready. That’s why the pricing framework is flexible, aligned with business growth targets, compliance demands, and risk appetite, rather than forcing a one-size-fits-all package.

When early projections exceed the available budget, the scope is refined collaboratively. The focus always stays on what matters most: enterprise-grade reliability, uncompromising security, and regulatory assurance that stands up to audits.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, fraud risk modeling, KPI definition, compliance readiness (AML, PSD2, GDPR, SOC 2) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting layered architecture (data ingestion, AI model pipelines, decisioning engine, dashboards, compliance modules) | $8,000 – $15,000 |

| Core AI/ML Model Development | Training supervised, unsupervised, and reinforcement models with custom fraud features | $12,000 – $25,000 |

| Data Integration & Feature Engineering | Ingesting transaction data, device fingerprints, behavioral analytics, and third-party threat intelligence | $10,000 – $20,000 |

| Real-Time Decisioning Layer | Building a low-latency scoring engine with API-first design and microservices | $10,000 – $22,000 |

| Platform Development & Customization | Enterprise dashboards, fraud analyst portals, mobile/web consoles, and integration with ERP/CRM systems | $12,000 – $25,000 |

| Security & Compliance Alignment | Encryption, access control, explainable AI modules, audit-ready logs, KYC/AML integration | $8,000 – $15,000 |

| Testing & Quality Assurance | End-to-end fraud simulation, compliance validation, performance stress testing, and scalability tuning | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, real-time monitoring dashboards, elastic scaling, and regulatory sandbox onboarding | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Integration Complexity: Connecting with legacy banking cores, treasury systems, and payment gateways often requires middleware.

- Compliance Overhead: AML, PSD2, GDPR, and regional financial regulations demand continuous legal and audit support.

- Data Labeling & Governance: High-quality fraud datasets require labeling and governance to keep models accurate and unbiased.

- Cloud & Infrastructure Spend: Running AI models and real-time scoring engines consumes compute if not optimized.

- Change Management: Training fraud teams, risk officers, and compliance teams on new workflows adds operational overhead.

- Maintenance & Monitoring: Regular audits, model retraining, and updates are essential to prevent drift and maintain regulatory readiness.

Best Practices to Avoid Budget Overruns

Drawing from experience building enterprise-scale AI fraud detection platforms, a few practices consistently keep costs predictable:

- Start with Focused Scope: Launch with one fraud scenario, validate ROI, then expand coverage.

- Design for Compliance Early: Embed AML, PSD2, and GDPR frameworks from day one to avoid rework.

- Adopt Modular Model Design: Use reusable fraud detection models that scale across new product lines and geographies.

- Optimize Infrastructure Spend: Leverage cloud-native scaling and batch scoring for low-priority checks to cut compute costs.

- Embed Observability from Launch: Monitor fraud catch rates, false positive ratios, and analyst productivity in real time.

- Plan for Continuous Improvement: Update AI models, compliance modules, and dashboards to stay aligned with evolving threats.

Request a tailored proposal from Intellivon’s enterprise AI team, and you’ll receive a roadmap that aligns with your budget, enforces compliance, and scales with your long-term growth strategy.

Industry Use Cases of an AI Fraud Detection Platform

AI fraud detection systems are reshaping industries by combining real-time intelligence with a compliance-ready design. Below are high-impact use cases, with examples that show how enterprises already benefit from platforms like Feedzai.

1. Banking and Financial Services

Banks sit at the epicenter of fraud, from card-not-present attacks to complex money laundering networks. Traditional rule-based systems often miss new fraud tactics or generate overwhelming false positives. AI changes this by analyzing millions of transactions per second and linking anomalies across accounts, geographies, and behaviors.

- Lloyds Banking Group implemented AI-driven fraud monitoring to protect digital banking customers. The system flagged anomalies in customer spending patterns, reducing card fraud losses while maintaining customer trust.

The outcome for banks included lower fraud losses, faster regulatory reporting, and improved customer experience.

2. Payments and Fintech

Payment providers process billions of high-speed transactions. Latency of even a fraction of a second can mean blocked payments and unhappy customers. AI-driven fraud systems protect this flow by spotting patterns in merchant activity, device signals, and bot-driven transactions.

- Stripe integrates AI-based fraud detection to identify suspicious merchants and stolen card use. Its Radar tool, built on AI, reduces chargeback rates while keeping checkout friction minimal.

For fintechs, this translates into scalable fraud defense that grows alongside transaction volume without compromising user experience.

3. E-Commerce and Retail

Retailers face fraud on multiple fronts: fake returns, promo code abuse, stolen card transactions, and account takeovers. AI helps by linking behavioral signals, such as device fingerprints, IP geolocation, and purchase history, to flag transactions that appear legitimate but deviate from normal customer behavior.

- Walmart uses AI to detect suspicious returns and refund abuse, protecting margins while reducing operational strain on customer service teams.

For retailers, the outcome is fraud protection that scales during seasonal peaks without alienating genuine buyers.

4. Insurance

Fraudulent claims remain one of the largest drains on insurance profitability. False medical claims, staged accidents, and inflated billing all create heavy financial leakage. AI enables insurers to cross-check claims against historical data, social behavior, and external intelligence sources, making fraud detection proactive rather than reactive.

- Zurich Insurance uses AI to fast-track legitimate claims while routing suspicious ones for further review, improving efficiency and reducing payout fraud.

For insurers, this delivers faster settlements for honest customers and significant savings by blocking fraudulent payouts.

5. Telecommunications

Telecom companies battle fraud such as SIM cloning, international revenue share fraud, and fake subscriber activations. AI-driven systems detect abnormal call routing, excessive data usage, and suspicious activation patterns that human teams could never track at scale.

- AT&T leverages AI-driven anomaly detection to reduce revenue leakage from subscription fraud and protect against network misuse.

The benefit for telecoms is lower revenue loss, greater customer trust, and proactive defense against subscription abuse.

6. Cross-Border Transactions

Global transfers carry higher fraud risks due to jurisdictional differences, regulatory gaps, and the anonymity of international fund flows. AI systems identify unusual routing patterns, large fund movements inconsistent with customer history, and connections to high-risk geographies.

- HSBC adopted AI-driven AML systems to monitor international wire transfers. The platform highlighted suspicious transaction chains across multiple jurisdictions, enabling faster regulatory compliance.

For enterprises managing global operations, the advantage lies in faster detection of laundering attempts and compliance-ready reporting across multiple jurisdictions.

AI Fraud Detection Use Cases at a Glance

| Industry | Fraud Challenges | AI Use Case | Real-World Example | Enterprise Outcome |

| Banking & Financial Services | Card fraud, account takeovers, mule accounts, AML gaps | Real-time transaction monitoring, anomaly detection across accounts and geographies | Citi partnered with Feedzai for AML; Lloyds used AI to cut card fraud | Reduced fraud losses, faster compliance reporting, stronger customer trust |

| Payments & Fintech | Bot-driven purchases, stolen card usage, and merchant fraud | Sub-second risk scoring, network-wide fraud intelligence | Revolut deployed Feedzai; Stripe Radar detects fraudulent merchants | Scalable fraud defense, low chargeback rates, seamless customer experience |

| E-Commerce & Retail | Return abuse, promo code fraud, and stolen cards | Behavioral analytics, device fingerprinting, and geolocation analysis | Alibaba blocked bot attacks during sales; Walmart detects suspicious returns | Fraud protection during seasonal spikes, reduced losses, and happy legitimate buyers |

| Insurance | False claims, inflated billing, staged accidents | AI-driven claims validation, anomaly detection, predictive analysis | AXA piloted AI for health claims; Zurich fast-tracks legitimate claims | Faster payouts for genuine customers, significant savings from blocked fraud |

| Telecommunications | SIM swaps, subscription fraud, revenue share fraud | Real-time usage anomaly detection, fraud pattern recognition | Vodafone deployed AI against SIM-swap fraud; AT&T reduces revenue leakage | Lower revenue loss, proactive fraud blocking, improved network trust |

| Cross-Border Transactions | Laundering attempts, suspicious fund flows, and high-risk jurisdictions | AI-driven AML monitoring, transaction chain analysis | HSBC uses AI for wire transfers; PayPal secures cross-border eCommerce | Faster laundering detection, compliance-ready audits, and lower fraud exposure |

This table highlights that fraud detection is not confined to banking. Every industry, like payments, eCommerce, insurance, telecom, and cross-border finance, faces fraud at scale. Platforms built to Feedzai’s standard prove that AI can cut losses, ensure compliance, and build customer trust across the board.

Overcoming Challenges To Develop AI Fraud Detection Platforms

Building a fraud detection platform that matches the standard set by Feedzai is not without obstacles. Enterprises often encounter barriers that slow adoption, drain budgets, or reduce effectiveness. Below are the most common challenges and how Intellivon helps solve them:

Challenge 1: Data Quality and Availability

Fraud detection systems are only as strong as the data they process. Many enterprises struggle with fragmented sources, inconsistent formats, or incomplete transaction histories. Poor-quality data reduces model accuracy and increases false positives.

The development process begins with a data ecosystem audit. Ingestion pipelines are designed to unify structured and unstructured data, from payment logs to behavioral signals. Automated cleansing, normalization, and enrichment routines create a “golden dataset” that powers high-accuracy AI models.

Challenge 2: Evolving Fraud Tactics and Model Drift

Fraudsters adapt faster than static systems. Without continuous learning, models degrade over time, leading to missed fraud cases or outdated risk scoring. Enterprises often underestimate how quickly drift undermines their investment.

Adaptive model pipelines are built into the platform. Reinforcement learning and analyst feedback loops ensure that every flagged transaction improves the model. Automated retraining cycles keep the platform ahead of emerging fraud tactics, not reacting to them after losses occur.

Challenge 3: Balancing Fraud Prevention with Customer Experience

Overly strict systems block legitimate users, creating churn and damaging trust. Yet under-sensitive systems allow fraud to slip through. Striking this balance is one of the hardest parts of building a fraud detection platform.

Risk-based scoring frameworks are applied instead of rigid rules. Transactions receive contextual scores, allowing low-risk payments to proceed seamlessly while high-risk ones trigger step-up verification. This approach reduces false positives by up to 40% while protecting customer relationships.

Challenge 4: Compliance and Regulatory Pressure

Financial crime regulations, like PSD2, GDPR, AML, and others, require auditability, transparency, and strict governance. Platforms that fail compliance can expose enterprises to fines, investigations, and reputational loss.

Compliance frameworks are embedded at the architecture level. Every decision is logged with explainable AI outputs. Audit dashboards make it easy to demonstrate compliance to regulators. This proactive approach eliminates the need for costly retrofits.

Challenge 5: Legacy Integration and Scalability

Enterprises often rely on legacy banking cores, ERP systems, or siloed payment infrastructure. Integrating a modern fraud detection engine into these systems, while ensuring scalability, is a major technical hurdle.

Cloud-native microservices are designed for API-first integration. This ensures the fraud platform connects seamlessly with existing systems without disrupting operations. Elastic scaling allows the platform to handle billions of transactions without downtime, even during seasonal spikes.

The path to developing an AI fraud detection platform is complex, but the challenges are solvable. Intellivon’s experience in building enterprise-grade AI systems ensures that data quality, model resilience, compliance, and integration are addressed from day one. The result is a fraud detection engine that reduces losses, satisfies regulators, and enhances customer trust at scale.

Future of AI Fraud Detection Platforms

Fraud tactics evolve daily, and so must the technology that defends against them. The future of AI fraud detection platforms will be defined by intelligence that is not only faster but also more adaptive, collaborative, and trusted. Enterprises that anticipate these shifts will be positioned ahead of both fraudsters and competitors.

1. Generative AI for Fraud Simulation

Enterprises are beginning to use generative AI to simulate fraud scenarios before they occur in the real world. By creating synthetic fraud attacks, systems can stress-test detection models and identify vulnerabilities proactively. This reduces the lag between new fraud methods emerging and platforms being able to detect them.

2. Federated Learning and Privacy-First Collaboration

Data privacy laws continue to tighten, yet fraud detection benefits from shared intelligence across institutions. Federated learning will allow multiple banks, payment providers, and eCommerce platforms to collaborate on fraud models without exposing sensitive customer data. This shift turns fraud defense into a networked advantage while maintaining compliance.

3. Explainability as a Business Requirement

As regulators demand accountability, explainable AI (XAI) will move from an add-on to a default. Enterprises will require fraud platforms that can explain every transaction decision in human-readable terms. This will not only satisfy regulators but also build internal confidence in the system’s recommendations.

4. Blockchain and Tokenized Identities

The rise of blockchain-based digital identity frameworks will change onboarding and verification processes. Fraud platforms will integrate with decentralized IDs, tokenized credentials, and immutable transaction records, making identity fraud far harder to execute. Enterprises that align with this early will gain a significant edge in compliance and security.

5. AI-Augmented Fraud Analysts

The role of human fraud analysts will evolve. Instead of manually combing through transactions, they will act as supervisors of AI engines. Augmented dashboards will highlight root causes, recommend next actions, and even auto-resolve low-risk alerts. This reduces analyst fatigue while sharpening decision quality.

6. Cloud-Native, Hyper-Scalable Architectures

With transaction volumes continuing to rise, fraud platforms must operate as cloud-native ecosystems. Future platforms will rely on auto-scaling, containerized microservices, and multi-cloud resilience to ensure uninterrupted fraud monitoring across global markets.

The future of fraud detection will reward enterprises that build platforms ready to adapt, explain, and scale. Those who delay risk relying on outdated systems that not only miss fraud but also alienate customers and regulators. Partnering with experienced providers ensures these future-ready features are built in from the start.

Conclusion

Fraud is a defining challenge for enterprises operating in digital-first economies. Platforms like Feedzai have proven that real-time, AI-driven systems can reduce fraud losses, improve compliance, and protect customer trust on a global scale.

Building a modern fraud detection platform is not just about stopping crime; it is about enabling growth with confidence. Enterprises that invest in scalable, explainable, and compliance-ready AI systems position themselves to handle evolving fraud tactics while maintaining seamless customer experiences. In an environment where fraudsters innovate daily, proactive defense is the only sustainable strategy.

Build Your AI Fraud Detection Platform Like Feedzai With Intellivon

At Intellivon, the mission is to design fraud detection platforms that combine scale, security, and compliance. Each build is tailored to the enterprise’s unique risk landscape, regulatory environment, and growth strategy.

Why Partner with Intellivon?

- Tailored Fraud Solutions: Platforms are aligned with industry-specific fraud patterns, from banking and fintech to eCommerce, insurance, and telecom.

- Compliance-First Design: Every build integrates AML, PSD2, GDPR, and regional regulations from the ground up, reducing audit risk and compliance overhead.

- Proven Enterprise Delivery: With 500+ AI projects deployed globally, the team has delivered measurable ROI across complex, high-volume ecosystems.

- Future-Ready Architecture: Cloud-native, API-first, and built for continuous learning, ensuring the system scales with transaction volumes and evolving fraud tactics.

- Analyst Empowerment: Case management dashboards, explainable AI, and automated workflows give fraud teams the tools to act quickly and decisively.

Enterprises ready to replicate the standard set by Feedzai don’t need to start from scratch. Book a strategy call today to explore how Intellivon can help you build a fraud detection platform that not only reduces risk but also strengthens customer trust and unlocks long-term business resilience.

FAQs

Q1. How does an AI fraud detection platform like Feedzai work?

A1. It analyzes transactions, device data, and user behavior in real time. Machine learning models detect anomalies, assign risk scores, and trigger actions such as approvals, blocks, or additional verification.

Q2. What makes Feedzai different from traditional fraud detection systems?

A2. Feedzai combines supervised, unsupervised, and reinforcement learning with explainable AI. This allows it to adapt continuously, reduce false positives, and satisfy regulators with transparent decision-making.

Q3. How much does it cost to build an AI fraud detection platform?

A3. Development costs range from $50,000 to $150,000 for an enterprise-grade system, depending on scope. Ongoing maintenance typically adds 15–20% annually.

Q4. Which industries benefit most from AI fraud detection?

A4. Banking, payments, and fintech lead adoption, but insurers, retailers, telecom operators, and enterprises handling cross-border transactions also rely on AI-driven fraud detection for compliance and loss prevention.

Q5. What challenges do enterprises face when building fraud detection systems?

A5. Key challenges include poor data quality, evolving fraud tactics, balancing fraud prevention with customer experience, regulatory pressure, and integrating with legacy systems. Each requires a compliance-ready, scalable AI design.