Moving money across borders still feels slow and complicated when legacy systems take days to pass through multiple intermediaries, and pile on heavy compliance checks. Blockchain-powered cross-border payment software changes this by allowing tokenized transfers, real-time settlement, and compliance built directly into each transaction. Instead of waiting for funds to clear, enterprises can complete payments in minutes with full transparency and auditability. This shift is transforming how organizations handle liquidity, global trade, and treasury operations.

At Intellivon, we build blockchain payment platforms that make this shift possible for large enterprises. Our solutions replace outdated banking networks with tokenized, real-time systems that connect directly to ERP and treasury environments. The enterprises we partner with gain the confidence to expand globally with scalable infrastructure. In this blog, we will explain why enterprises are moving toward blockchain payments, what features matter most, and how Intellivon builds this software from the ground up.

Why Enterprises Are Moving Toward Blockchain Payments

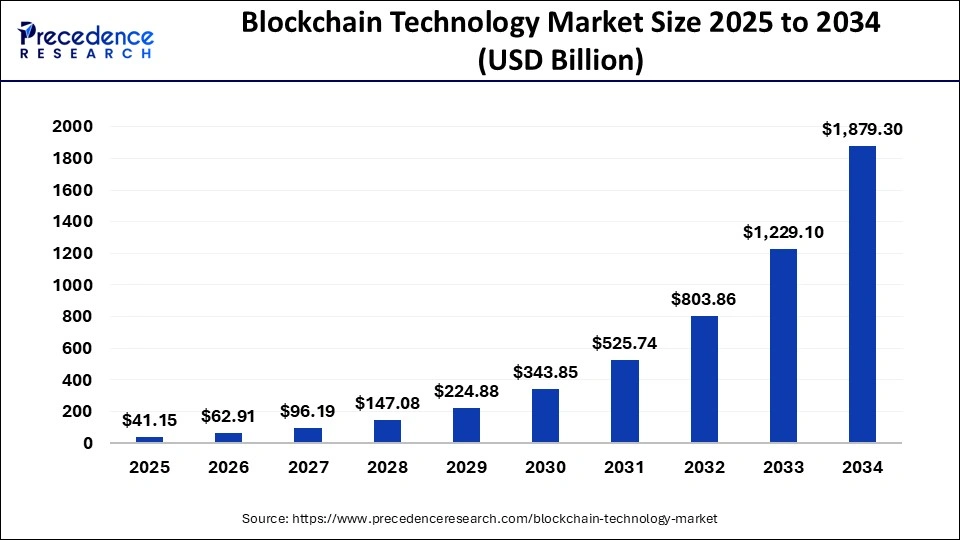

Within this, blockchain-enabled cross-border payments represent one of the fastest-growing segments, moving from niche adoption to mainstream enterprise infrastructure.

Market Size & Growth

- Cross-border payments will reach $238 trillion in transaction value by 2025.

- Blockchain and stablecoin rails will account for over $2 trillion, a sharp rise from less than $600 billion in 2022.

- Blockchain-enabled cross-border payment flows are growing at a 46% CAGR through 2030, outpacing legacy banking volumes.

Adoption & Penetration

- Over 37% of global enterprises are already using or piloting blockchain platforms for payments.

- SWIFT has launched blockchain pilots across 11,000 banks, accelerating institutional adoption.

Speed & Cost Efficiency

- Blockchain payments settle in under 10 seconds, compared to up to 72 hours with SWIFT.

- Enterprises report 50–70% fee savings, with costs dropping from $25 per transfer to under $4.

- Stablecoins enable intraday liquidity management, reducing working capital delays by up to 12%.

Risk Mitigation & Transparency

- On-chain KYC/AML automation cuts compliance overhead by 40%.

- Transparent, immutable records reduce fraud rates by 33% across global flows.

Market Transformation

- Stablecoins account for nearly 32% of all B2B blockchain payments.

- Over 120 central banks are piloting CBDCs with blockchain rails for real-time FX and programmable compliance.

- Asia-Pacific leads adoption through regulatory sandboxes, while Europe advances stablecoin innovation and the US focuses on custody and compliance.

Enterprise ROI

- Blockchain reduces treasury reconciliation time by 35% and speeds up audits by 28%.

- Early adopters report 8–12% uplift in margins from cost savings and new market access.

Key takeaway: Blockchain-powered cross-border payments are unlocking trillions in global transaction value, delivering instant settlement, lower costs, stronger compliance, and measurable enterprise efficiency.

What Is Blockchain-Powered Cross-Border Payment Software?

Blockchain-powered cross-border payment software is an enterprise platform that uses distributed ledger technology to move money across regions faster, cheaper, and with greater transparency.

Unlike traditional systems that rely on correspondent banks and multiple intermediaries, these platforms allow two parties to exchange value directly, with every transaction recorded on an immutable ledger. This means payments can be verified instantly, without the delays and costs that come from passing through multiple financial institutions.

The key differentiator lies in tokenization. Assets such as fiat currency, stablecoins, or even future CBDCs can be represented as digital tokens. These tokens are transferred on the blockchain, enabling near real-time settlement while embedding compliance rules directly into the transaction through smart contracts. Enterprises benefit from automated checks for KYC, AML, and regulatory reporting, reducing compliance overhead.

Another critical feature is programmable payments. Smart contracts allow organizations to set conditional rules for execution, for example, releasing funds only when a shipment reaches customs or when trade documentation is validated.

This transforms payments from passive transfers into active, auditable workflows. For enterprises, this software creates a secure, transparent, and scalable payment infrastructure aligned with modern global operations.

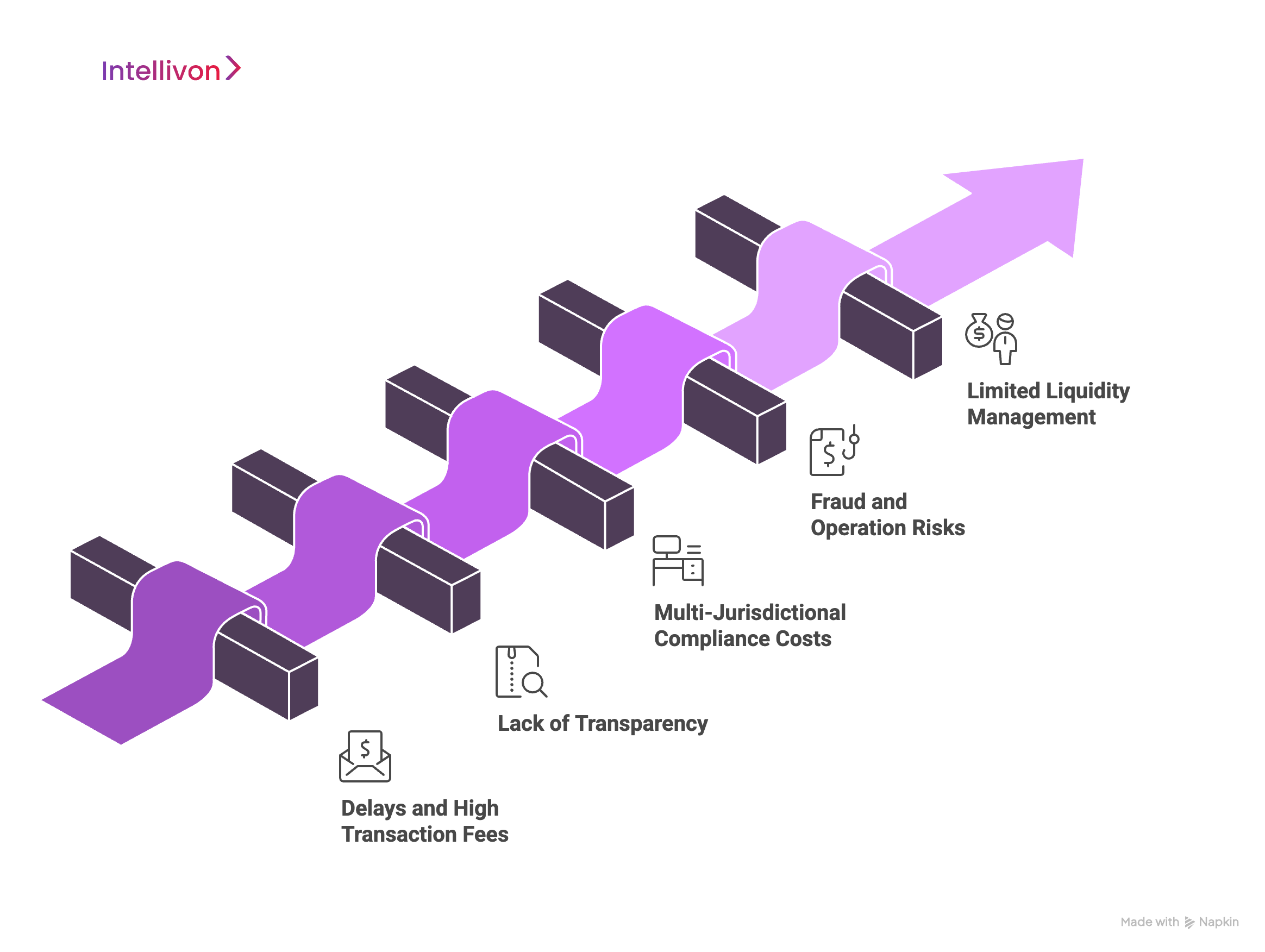

Enterprise Pain Points With Legacy Cross-Border Payments

Global enterprises depend on efficient cross-border payments to keep trade, treasury, and supplier networks moving. Yet legacy systems create friction at every step. Understanding these pain points is critical to recognizing why blockchain-powered payment platforms are no longer optional but essential.

1. Delays and High Transaction Fees

Legacy payments can take two to five business days to settle. Each intermediary bank adds time, fees, and risk. For enterprises moving large volumes across regions, this creates unnecessary working capital pressure and increased operating costs.

The lack of speed prevents treasury teams from responding quickly to liquidity needs, leaving them exposed when markets shift.

2. Lack of Transparency

Traditional correspondent banking chains make it difficult to trace a transaction from origin to settlement. Enterprises often lack visibility into where payments are delayed or why they are flagged.

This uncertainty complicates reconciliation and forces finance teams to rely on manual processes that slow reporting cycles. The lack of real-time insight undermines confidence in cash positions.

3. Multi-Jurisdictional Compliance Costs

Every payment that crosses borders carries overlapping obligations, from AML checks to FATF standards. Enterprises operating in multiple jurisdictions face complex, manual processes that increase compliance costs significantly.

Finance and legal teams spend more time coordinating reviews than focusing on higher-value activities. This administrative burden not only adds expense but also slows execution at scale.

4. Fraud and Operational Risks

Legacy systems leave room for duplicate payments, settlement mismatches, and outright fraud. Fraudsters exploit the time lag and opaque routing between institutions.

Since transactions often cannot be verified in real time, detection and correction are slow, leading to greater financial risk. For enterprises, this situation poses a strategic vulnerability.

5. Limited Liquidity Management

Treasury operations depend on knowing where funds are and when they can be used. With slow settlement cycles, working capital gets tied up unnecessarily.

This limits liquidity flexibility and increases the cost of financing operations. Enterprises cannot redeploy capital efficiently, creating missed opportunities in fast-moving markets.

These persistent pain points explain why enterprises are reassessing the foundations of their payment infrastructure. The search is not simply for cost savings, but for speed, transparency, and reliability. Blockchain-powered platforms are emerging as the natural answer, designed to overcome these legacy challenges while preparing enterprises for the future of global finance.

Why Blockchain Is the Future of Enterprise Cross-Border Payments

The challenges of legacy payment infrastructure have pushed enterprises to search for something faster, more transparent, and built for scale. Blockchain technology delivers on these needs by combining immutability, automation, and tokenization into a single payment rail.

1. Immutable Ledger for Transparency

Every transaction recorded on a blockchain is permanent and verifiable. Enterprises gain real-time visibility into the status of payments and can track funds from initiation to settlement without relying on multiple intermediaries.

This audit trail improves trust with regulators, partners, and auditors while reducing disputes and reconciliation time.

2. Smart Contracts for Automated Compliance

Traditional compliance processes are manual, slow, and costly. With blockchain, smart contracts embed KYC and AML checks directly into the transaction flow.

Payments are executed only when compliance requirements are met, reducing overhead and lowering the risk of regulatory breaches across multiple jurisdictions.

3. Tokenization for Liquidity

Representing fiat currencies, stablecoins, or CBDCs as digital tokens allows enterprises to move value instantly.

Settlement that once took days can now be completed within seconds, freeing up liquidity and giving treasury teams flexibility to redeploy working capital in real time.

4. Interoperability with Emerging Rails

As central banks pilot digital currencies and regulators advance stablecoin frameworks, interoperability becomes crucial.

Blockchain platforms can connect with both traditional systems and future digital rails, ensuring enterprises are prepared for the next evolution of payments.

5. Scalability for High-Volume Corridors

Unlike legacy systems that struggle with scale, blockchain infrastructure is designed to handle high-volume transactions across multiple regions.

For enterprises managing global supply chains, this means payment capacity grows with business expansion instead of becoming a bottleneck.

These capabilities show why blockchain is not just an upgrade but a foundation for the next generation of enterprise payments. The question now is not whether enterprises should adopt blockchain-powered platforms, but how to ensure they include the right features to deliver long-term value.

Must-Have Features of an Enterprise-Grade Blockchain Cross-Border Payment Platform

Enterprises cannot adopt payment technology that feels experimental. The platform must be strong enough to handle global transaction volumes, secure enough to withstand cyber risks, and flexible enough to integrate with existing systems. These features transform blockchain platforms from pilot projects into mission-critical infrastructure.

1. Strong Encryption

Every transaction must be protected from start to finish. End-to-end encryption shields sensitive payment data, user details, and compliance records. This ensures trust between counterparties and prevents breaches in high-volume corridors.

2. Built-In Compliance

A compliance-first design ensures payments meet global standards like FATF, GDPR, and ISO 20022. Embedding rules directly into the system makes it audit-ready, reduces regulatory friction, and builds trust with both regulators and partners.

3. Multi-Currency Support

Enterprises must work across fiat currencies, stablecoins, and CBDCs. Native support for these assets allows treasury teams to move liquidity efficiently without relying on fragmented networks or additional conversion layers.

4. Automated Checks

KYC and AML reviews often slow transactions. Automating these checks within the platform ensures compliance without delays, reducing costs and improving speed across multiple jurisdictions.

5. Tokenized Assets

Tokenization represents money or assets as digital tokens. This enables fractional payments, instant settlement, and programmable treasury functions, giving enterprises greater control over liquidity and capital flows.

6. Seamless Integration

Enterprises cannot afford systems that operate in silos. API-driven integration allows payments to flow directly into ERP, CRM, and treasury environments, creating a unified financial picture across global operations.

7. Real-Time Dashboards

Finance leaders need clear visibility. Real-time dashboards track settlement status, compliance results, and liquidity flows, helping teams reconcile faster and forecast more accurately.

With these features in place, blockchain payment platforms evolve from being experimental pilots into enterprise-grade systems. The next step is seeing how these capabilities translate into real-world use cases across industries.

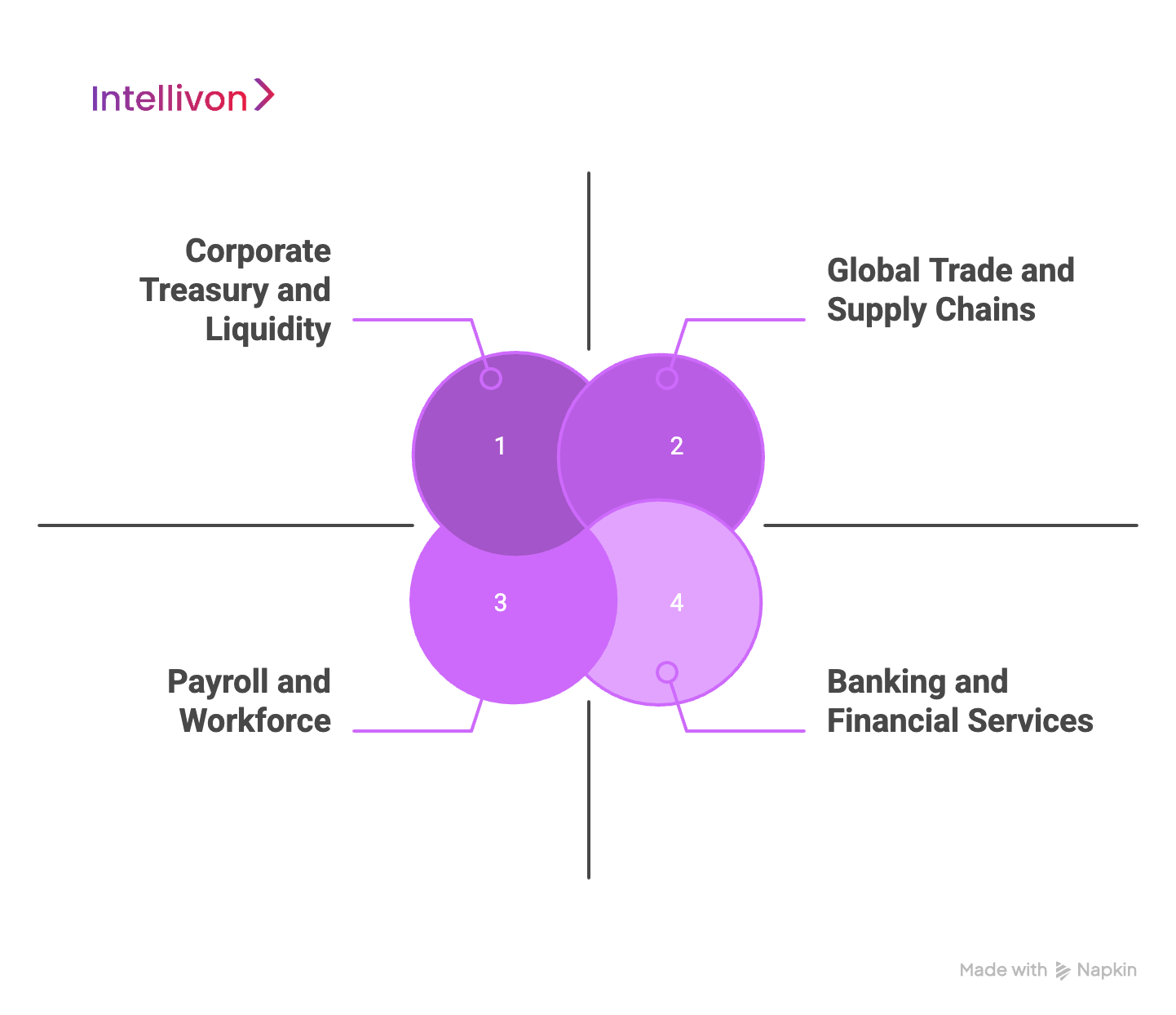

Enterprise Use Cases of Blockchain Cross-Border Payments

Blockchain cross-border payment platforms are being embedded into enterprise operations across industries. The value lies not only in faster transactions but also in how payments integrate into supply chains, treasury management, payroll, and financial services. These use cases show where enterprises are gaining the strongest returns.

1. Global Trade and Supply Chains

In global trade, payment delays can stall shipments, weaken supplier trust, and inflate financing costs. Blockchain platforms streamline this process by connecting buyers, suppliers, and regulators in a transparent, shared ledger. By automating settlements and embedding compliance checks, enterprises reduce disputes and accelerate the movement of goods.

A. Supplier Payments

Instead of routing funds through multiple correspondent banks, enterprises can pay suppliers directly on-chain. Payments settle within minutes once delivery milestones are confirmed, helping reduce working capital tied up in accounts payable. This improves supplier relationships and strengthens supply chain resilience.

Example: Maersk and IBM’s TradeLens platform demonstrated how blockchain can reduce paperwork and speed up settlements in global logistics.

B. Escrow Services

Smart contracts function as automated escrow accounts that hold funds securely until contractual conditions are met. Once trade documentation or customs clearance is verified, the payment is released instantly. This reduces risk for both buyer and seller while creating a clear, auditable record of the transaction.

2. Corporate Treasury and Liquidity

Treasury teams face constant pressure to optimize liquidity and manage currency risk. Traditional banking systems trap capital in slow settlement cycles, limiting how quickly funds can be redeployed. Blockchain enables faster currency conversion, pooled liquidity, and better visibility across regions, helping treasury teams act with greater precision.

A. FX Conversion

Tokenized money allows enterprises to convert currencies instantly at competitive rates. By removing intermediary banks, foreign exchange transactions become faster and less expensive. For organizations handling high-volume international payments, this means millions saved annually and improved liquidity control.

Example: JPMorgan’s Onyx has enabled real-time blockchain-based FX settlement for multinational corporates.

B. Liquidity Pools

Enterprises can use blockchain to create tokenized liquidity pools that hold funds across multiple currencies. These pools can be tapped instantly, allowing treasury teams to support subsidiaries or fund projects without delays. This reduces idle capital and makes liquidity management far more efficient.

3. Payroll and Workforce

Enterprises with distributed teams or contractors face long delays and high costs when paying salaries across borders. Blockchain software simplifies payroll by making transfers instant, low-cost, and compliant. For employees, this means timely paychecks, and for employers, it reduces administrative complexity.

A. Global Salaries

Blockchain platforms allow companies to pay employees in different countries within minutes rather than days. This eliminates banking fees and reduces errors caused by intermediaries. The result is improved employee satisfaction and stronger workforce retention.

Example: Bitwage has piloted blockchain-based payroll systems to provide instant international salary payments.

B. Compliance Reporting

Payroll often creates heavy compliance burdens, especially when operating across multiple tax jurisdictions. Smart contracts can automate reporting by generating auditable records for regulators. This reduces the workload on HR and finance teams while minimizing the risk of errors in multi-country reporting.

4. Banking and Financial Services

Banks are adopting blockchain not just for their own operations, but also to provide faster, modernized services to enterprise clients. By launching blockchain corridors, they can offer real-time settlement, reduce dependence on SWIFT, and prepare for future digital currencies.

A. Cross-Border Corridors

Banks are deploying private blockchain networks to move money directly between institutions. This bypasses correspondent chains, reduces costs, and improves settlement speed for enterprise clients. Large banks use these corridors to expand services while maintaining compliance oversight.

Example: HSBC and Wells Fargo use blockchain to settle FX trades directly, without traditional intermediaries.

B. CBDC Integration

As central banks pilot digital currencies, financial institutions are testing blockchain corridors that can handle both fiat and CBDC transactions. This prepares enterprises for a future where CBDCs play a central role in international payments. It also allows banks to maintain relevance as new forms of settlement emerge.

These use cases show that blockchain is reshaping enterprise workflows across industries. To understand how these results are achieved, we need to examine the underlying technology stack that powers blockchain cross-border payment platforms.

Technology Stack for Blockchain-Powered Cross-Border Payment Software

Building an enterprise-grade cross-border payment system requires more than a blockchain ledger. It needs a complete technology stack that balances security, compliance, and integration with existing enterprise systems. At Intellivon, we design and deploy platforms with these layers in mind, ensuring that every component works seamlessly together and scales with enterprise needs.

1. Blockchain Layer

The blockchain network is the foundation. It secures transactions, validates settlements, and provides an immutable record for audits.

A. Network Choice

Intellivon helps enterprises select the right framework, like Ethereum, Hyperledger, Corda, or Quorum, based on performance, governance, and compliance requirements. Most clients choose permissioned networks for privacy and regulatory control, while maintaining interoperability with public chains when needed.

B. Consensus Mechanisms

We implement enterprise-grade consensus models like Proof of Authority or Practical Byzantine Fault Tolerance. These ensure fast settlement while meeting the reliability standards required for high-volume transactions.

2. Tokenization Engine

Tokenization converts money and assets into digital tokens that can move across borders instantly.

A. Stablecoins

Intellivon integrates regulated stablecoins into enterprise platforms to enable predictable, low-cost settlement across global corridors.

B. CBDCs

As central banks roll out digital currencies, we will future-proof platforms to ensure seamless CBDC adoption without disrupting existing operations.

C. Asset Tokens

Beyond currencies, we design systems that tokenize trade receivables, invoices, or commodities, enabling enterprises to access new financing options.

3. Compliance and Security

Cross-border payments cannot succeed without compliance and strong defenses against fraud. Intellivon embeds both into the core architecture.

A. AML/KYC

We automate AML and KYC checks directly within the payment flow. This reduces compliance costs and ensures every transaction meets jurisdictional requirements before execution.

B. DevSecOps

Our development process integrates security from the start. By following DevSecOps principles, we deliver resilient platforms that adapt to evolving regulatory and cybersecurity challenges.

C. RASP and Monitoring

We deploy runtime protection and monitoring tools to detect anomalies in real time. This reduces fraud exposure and ensures operational continuity.

4. Integration Layer

A blockchain platform cannot work in isolation. It must connect to existing systems across the enterprise.

A. ERP/CRM Links

Intellivon integrates blockchain platforms with ERP and CRM environments so payments flow directly into financial workflows without manual reconciliation.

B. Treasury Dashboards

We build real-time dashboards for treasury teams to monitor liquidity, FX exposure, and settlement status, enabling faster and more accurate financial decisions.

C. Banking APIs

Our platforms link with banking APIs, allowing enterprises to use blockchain corridors where available and traditional rails where adoption is still emerging.

By combining these layers into a unified stack, Intellivon delivers platforms that are not just technically advanced but also enterprise-ready.

How We Develop Blockchain-Powered Cross-Border Payment Software

At Intellivon, we follow a structured development process that ensures the final product is secure, compliant, and capable of scaling with enterprise needs. Each stage is designed to balance innovation with operational practicality.

Step 1: Requirement Analysis

We start by working closely with finance, compliance, and IT teams to understand payment corridors, volumes, and regulatory environments. This stage helps us capture specific enterprise challenges, such as liquidity bottlenecks or reconciliation delays, that the platform must solve. The outcome is a requirements blueprint that aligns technology with business goals.

Step 2: Use Case Mapping

Enterprises often face multiple cross-border pain points, but not all deliver equal ROI. We map potential use cases, from supplier settlements to treasury FX, and prioritize those with the highest immediate value. This creates a clear development roadmap that produces quick wins without losing sight of long-term strategy.

Step 3: Architecture Design

Our architects design a compliance-first framework that can handle multiple currencies, jurisdictions, and integrations. Security is embedded from day one, while tokenization and interoperability layers are planned to ensure future compatibility with stablecoins and CBDCs. This ensures the platform isn’t just functional—it’s enterprise-ready.

Step 4: Tokenization Development

Tokenization is where value transfer becomes real. We develop modules that represent fiat, stablecoins, and assets as digital tokens, enabling near-instant movement of value. Enterprises gain the flexibility to manage multi-currency flows, fractional settlements, and programmable liquidity strategies without adding complexity.

Step 5: Smart Contract Automation

We design smart contracts to handle compliance checks and trigger-based payments. Whether it’s AML verification, customs clearance, or invoice validation, contracts execute only when conditions are met. This reduces manual work, minimizes risk, and ensures every transaction aligns with regulatory obligations.

Step 6: Integration Layering

No enterprise can afford a siloed system. We integrate blockchain payment workflows directly into ERP, CRM, and treasury platforms through APIs. This ensures payments are automatically reflected in financial systems, eliminating manual reconciliation and creating a unified view of liquidity across regions.

Step 7: Security Hardening

Security is continuous in our software, not an afterthought. Our DevSecOps approach embeds protection at every stage, supported by runtime monitoring and RASP tools.

We simulate high-volume corridors, test for vulnerabilities, and ensure resilience against fraud, cyberattacks, and operational disruptions. This gives enterprises confidence in deploying at scale.

Step 8: Pilot and Rollout

We begin with controlled pilots in selected corridors to validate compliance, speed, and performance under real-world conditions. Once proven, the platform is scaled across subsidiaries, regions, and currencies. Our team supports change management with training, workshops, and operational handholding to ensure adoption is smooth and sustained.

By following these steps, Intellivon delivers platforms that go beyond proof-of-concept. The result is enterprise-grade infrastructure that streamlines payments, strengthens compliance, and prepares organizations for the future of tokenized finance. The next challenge lies in addressing the barriers enterprises face when developing such systems and ensuring they can be deployed at scale.

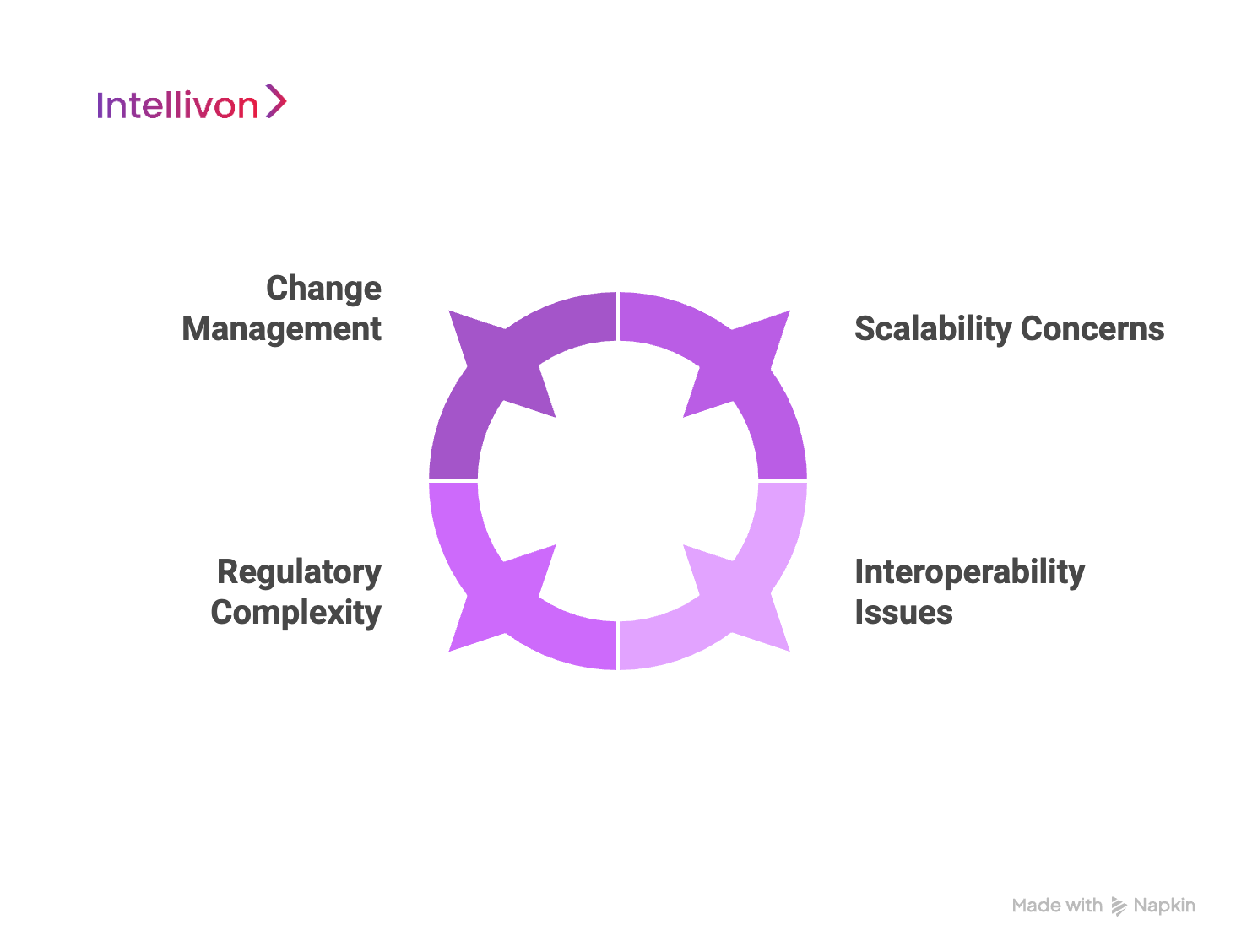

Overcoming Challenges in Developing Blockchain Cross-Border Payment Software

Adopting blockchain for cross-border payments offers clear benefits, but enterprises face significant challenges in execution. These obstacles involve compliance, interoperability, scalability, and organizational readiness. Below are the major barriers and how Intellivon helps enterprises overcome them.

1. Regulatory Complexity

Every cross-border transaction must meet overlapping AML, KYC, FATF, and GDPR requirements. The complexity multiplies when payments span multiple jurisdictions with conflicting standards. For large enterprises, managing these rules manually slows operations, drives up costs, and increases the risk of penalties.

Intellivon addresses this by embedding compliance into the payment flow itself. Our smart contract frameworks automate AML/KYC checks, while audit-ready reporting aligns with FATF and ISO 20022 standards. Instead of adding compliance overhead, the system ensures transactions are executed only when requirements are satisfied, thereby reducing both risk and administrative cost.

2. Interoperability Issues

Blockchain networks are fragmented, with different protocols, standards, and governance models. Enterprises often hesitate to adopt because they worry about being locked into one network or being unable to connect with existing systems like SWIFT or SEPA.

We design platforms with interoperability as a core principle. Intellivon’s architecture connects permissioned networks to public chains when required, and integrates directly with traditional banking rails through APIs. This ensures enterprises can expand corridors gradually, without losing compatibility with legacy systems or future CBDC networks.

3. Scalability Concerns

Enterprises handle millions of transactions across corridors. Legacy blockchain platforms often struggle to scale beyond pilot projects, leading to bottlenecks that undermine adoption. For CFOs and treasury teams, a system that cannot scale with business growth is a non-starter.

Intellivon builds platforms on high-throughput frameworks optimized for enterprise volumes. Our solutions use advanced consensus models and sharding techniques to handle thousands of transactions per second. This ensures enterprises can grow without being limited by the technology underpinning their payment systems.

4. Change Management

Introducing blockchain platforms into global organizations requires cultural and process change. Finance teams are often reluctant to abandon trusted systems, and IT departments face the challenge of integrating new infrastructure without disrupting existing workflows.

We guide enterprises through a phased adoption model. Intellivon starts with pilot corridors to demonstrate value, then scales to full rollout across subsidiaries and regions. We provide training, compliance workshops, and integration support so teams adopt the system with confidence. This reduces resistance and ensures a smooth transition.

Overcoming these challenges requires both technical expertise and enterprise experience. By addressing compliance, interoperability, scalability, and change management in balance, Intellivon ensures blockchain payment platforms become mission-critical infrastructure.

Real-World Enterprise Examples of Blockchain Cross-Border Payment Software

Enterprises often hesitate to adopt new technology until they see proof of success from their peers. Blockchain-powered cross-border payments are already live in some of the world’s largest institutions. These examples show how global leaders are transforming payments, treasury, and compliance by moving beyond legacy infrastructure.

1. JPMorgan Onyx

JPMorgan created Onyx, a blockchain-based network that enables wholesale payment settlement across borders. The platform reduces reliance on correspondent banking, provides intraday liquidity management, and clears transactions in real time. For corporate clients, this means stronger liquidity visibility and reduced counterparty risk when moving large-value payments.

2. HSBC and Wells Fargo

HSBC and Wells Fargo partnered on a blockchain-based foreign exchange settlement system. Instead of routing transactions through multiple intermediaries, the two banks now settle FX trades directly. This has shortened settlement time from days to minutes and increased transparency in multi-currency corridors.

3. Santander OnePay FX

Santander launched OnePay FX, a blockchain-powered international transfer service for both retail and enterprise customers. It allows payments to be sent instantly, with upfront clarity on exchange rates and fees. The system has improved customer trust and reduced friction in corporate payments.

4. Visa B2B Connect

Visa developed B2B Connect, a blockchain-inspired platform for secure, direct cross-border business payments. It eliminates intermediaries and provides enterprises with predictable settlement times and compliance-ready audit trails. By simplifying B2B transfers, Visa helps enterprises reduce transaction costs and streamline reconciliation.

These enterprise examples confirm that blockchain payments are no longer experimental. They are proven, regulated, and already driving measurable benefits for global leaders. The next step for decision makers is understanding how to conclude the business case and take action.

Conclusion

Blockchain is no longer a future possibility for cross-border payments. It is already transforming how global enterprises handle liquidity, compliance, and transaction efficiency.

By eliminating delays, reducing fees, and embedding transparency into every transfer, blockchain-powered platforms are solving problems legacy systems have struggled with for decades. For enterprises, the choice is no longer about whether to modernize, but how quickly they can act to stay competitive.

Build Your Blockchain Payment Platform With Intellivon

At Intellivon, we design enterprise-grade blockchain cross-border payment platforms that are secure, compliant, and tailored to the way global organizations operate. Our platforms are built to simplify liquidity management, automate compliance, and deliver measurable ROI while scaling seamlessly with enterprise growth.

Why Partner With Intellivon?

- Tailored Solutions: Every platform is designed around your enterprise’s payment corridors, regulatory obligations, and treasury workflows, ensuring relevance from day one.

- Compliance-First Design: We embed FATF, GDPR, AML/KYC, and ISO 20022 standards directly into the architecture so your system remains audit-ready across jurisdictions.

- Proven Enterprise Expertise: With over a decade of large-scale deployments, we understand how to build systems that balance innovation with governance and long-term resilience.

- Future-Ready Architecture: Our platforms are tokenization-enabled, CBDC-ready, and interoperable with both existing rails and emerging financial ecosystems.

Book a discovery call with Intellivon today and see how we can build blockchain payment platforms that strengthen your enterprise for global expansion.

FAQs

Q1. What is blockchain-powered cross-border payment software?

It is an enterprise platform that uses blockchain and tokenization to move money across borders instantly and securely. Unlike traditional correspondent banking, it provides real-time settlement, transparent audit trails, and automated compliance checks.

Q2. How much does it cost to build an enterprise blockchain payment platform?

The cost depends on scope, integrations, and regulatory requirements, but enterprise-grade platforms typically range from $50,000 to $150,000 for phased development. This includes architecture, tokenization, compliance automation, and ERP/treasury integration.

Q3. How do tokenized payments reduce compliance costs?

Tokenization allows compliance rules to be embedded directly into the payment process using smart contracts. This reduces the need for manual KYC/AML checks, lowers administrative overhead, and ensures every transfer meets jurisdictional requirements before it executes.

Q4. Can blockchain platforms integrate with ERP and treasury systems?

Yes. Modern enterprise solutions are built with API-driven integration that connects directly into ERP, CRM, and treasury platforms. This ensures payments are not isolated but form part of the enterprise’s financial ecosystem.

Q5. What are examples of enterprises already using blockchain payments?

Global leaders, including JPMorgan (Onyx), HSBC, Wells Fargo, Santander (OnePay FX), and Visa (B2B Connect), have deployed blockchain platforms. These systems are already processing billions in cross-border flows with faster settlement and stronger compliance.