Legacy systems in enterprises are becoming too slow to manage important assets, contracts, and records, and are heavily dependent on intermediaries, which puts their privacy severely at risk. At the same time, regulators are calling for more transparency, while global markets are shifting toward digital-first models. Enterprise tokenization platforms answer this challenge by allowing organizations to convert real-world assets into blockchain-based tokens. These tokens act as digital representations of value that can be transferred, fractionalized, or traded with the speed of information, while still carrying the compliance and auditability enterprises need.

At Intellivon, we design tokenization platforms that embed compliance rules directly into smart contracts, integrate with ERP and finance applications, and scale across regions and industries. In this blog, we’ll explore what enterprise tokenization really means, why leading organizations are investing in it, and the steps we use to develop a platform that secures today’s value while opening new opportunities for tomorrow.

What Is an Enterprise Tokenization Solution?

An enterprise tokenization solution is a platform that enables organizations to digitize physical, financial, or intangible assets into secure blockchain tokens. These tokens act as verifiable proofs of ownership or rights, allowing assets to be transferred, traded, or fractionalized with the same reliability as traditional systems but far greater speed and efficiency.

The key difference of the platform lies in the enterprise context, where clients, investors, and partners can interact with tokenized assets in a governed, transparent environment. This includes everything from a bank offering tokenized bonds to its customers, to a logistics firm giving clients real-time access to tokenized shipping documents, to an energy company enabling buyers to hold and trade tokenized carbon credits.

For this reason, an enterprise-grade tokenization solution must go beyond technical execution. It requires governance models that meet regulatory standards across multiple regions, interoperability with existing finance and supply chain systems, and scalability to serve thousands or even millions of end users. At its core, it is an architecture for trust, giving enterprises and their clients a common platform to transact securely in the digital economy.

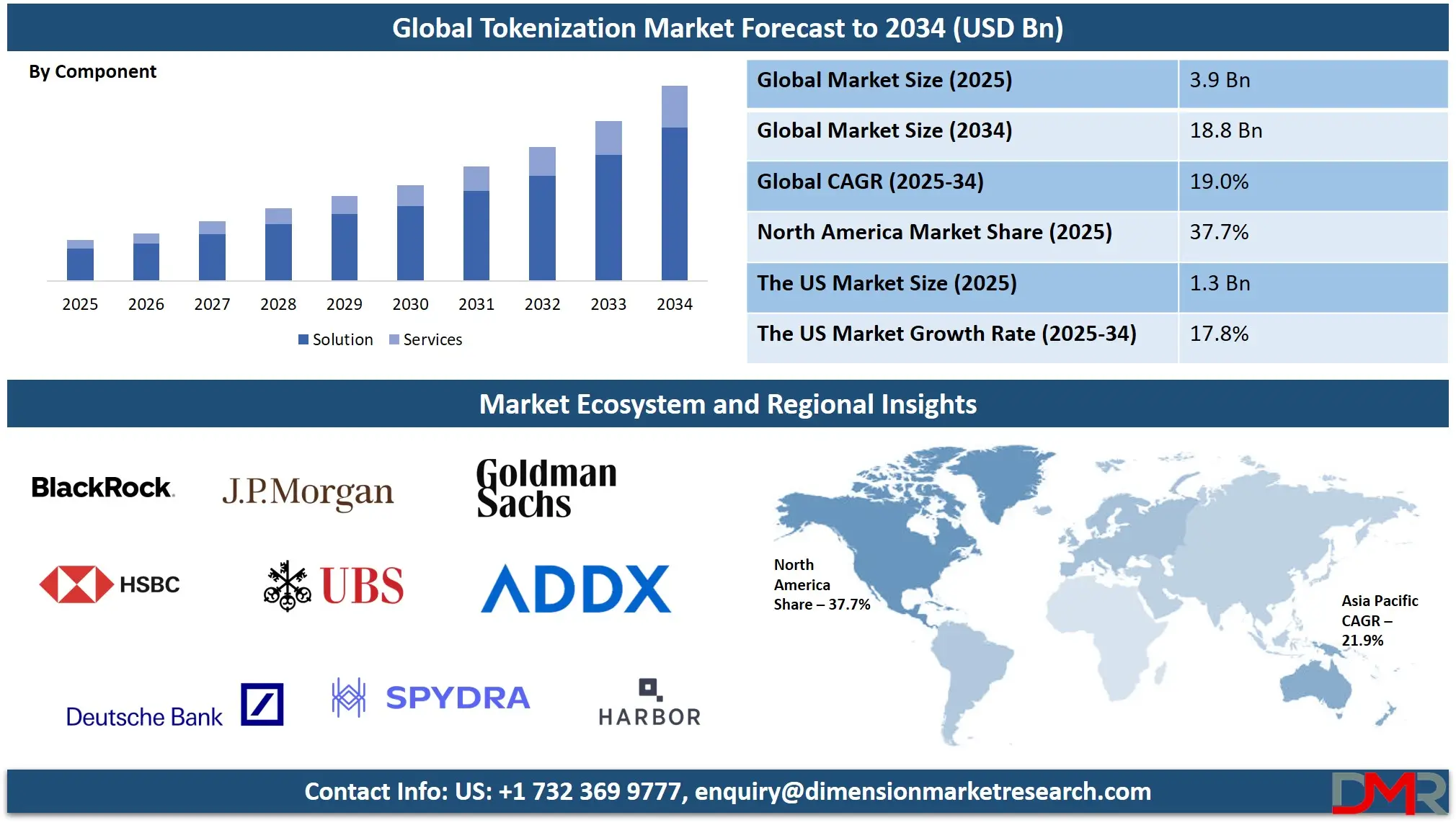

Key Takeaways of the Global Tokenization Market

The tokenization market is growing fast. It’s projected to rise from $3.3 billion in 2024 to $18.8 billion by 2034, expanding at an annual growth rate of more than 17%. By 2030, tokenized assets could represent over $16 trillion worldwide, with financial services, real estate, and retail driving most of the adoption.

- By 2025, 60%+ of major enterprises in finance, healthcare, and retail are piloting or deploying tokenization solutions.

- Enterprises using tokenization see a 30–50% reduction in compliance audit scope and costs versus legacy data protection.

- Organizations report a 75% faster time-to-audit-readiness, freeing resources and reducing regulatory risk.

- Tokenization makes 97% of breached data useless to attackers, elevating it as a board-level cybersecurity priority.

- The average ROI exceeds 200% within two years for regulated industries, driven by breach reduction, efficiency gains, and compliance savings.

The market signals are clear. Tokenized assets are set to reach over billions in value within this decade, while enterprises already using tokenization are reporting faster compliance cycles, reduced audit costs, and stronger returns on investment.

Those who act now can create new client services, open fresh revenue streams, and establish a leadership position in the digital economy that is rapidly emerging. Waiting means playing catch-up in a market that is moving at unprecedented speed.

How Enterprise Tokenization Solutions Work

At its core, an enterprise tokenization solution takes a real-world asset and turns it into a secure digital token on a blockchain. The process sounds technical, but the principles are straightforward once broken down.

1. Asset Identification and Valuation

The first step is selecting the asset, which can be anything from real estate, securities, supply chain goods, or even carbon credits, and establishing its value. This ensures the token accurately reflects something tangible that clients can trust.

2. Token Creation and Smart Contracts

A token is generated on the blockchain using accepted standards like ERC-20 for fungible assets or ERC-721 for unique items. Smart contracts attach rules to the token, such as who owns it, how it can be transferred, whether it can be split into fractions, and what compliance checks must be met before transactions occur.

3. Custody and Identity Management

Tokens require secure storage and clear identity verification. Enterprises integrate custody solutions and client onboarding with KYC and AML checks to ensure only verified parties can hold or trade assets.

4. Client-Facing Interactions

Once created, tokens become accessible through enterprise platforms. Clients may buy fractional shares of real estate, track tokenized invoices in supply chains, or trade renewable energy certificates. The token behaves like the asset itself, but with the added benefits of instant settlement and global reach.

5. Integration with Enterprise Systems

Finally, the platform connects with ERP, CRM, and financial systems, so tokens are not isolated on a blockchain. Instead, they fit directly into reporting, compliance, and operational workflows enterprises already use.

In practice, this means a bank could offer investors tokenized bonds directly through its client platform, or a logistics company could allow customers to track tokenized shipping documents in real time. The technology works in the background, but the outcome is a faster, more transparent, and more client-centric way to manage assets.

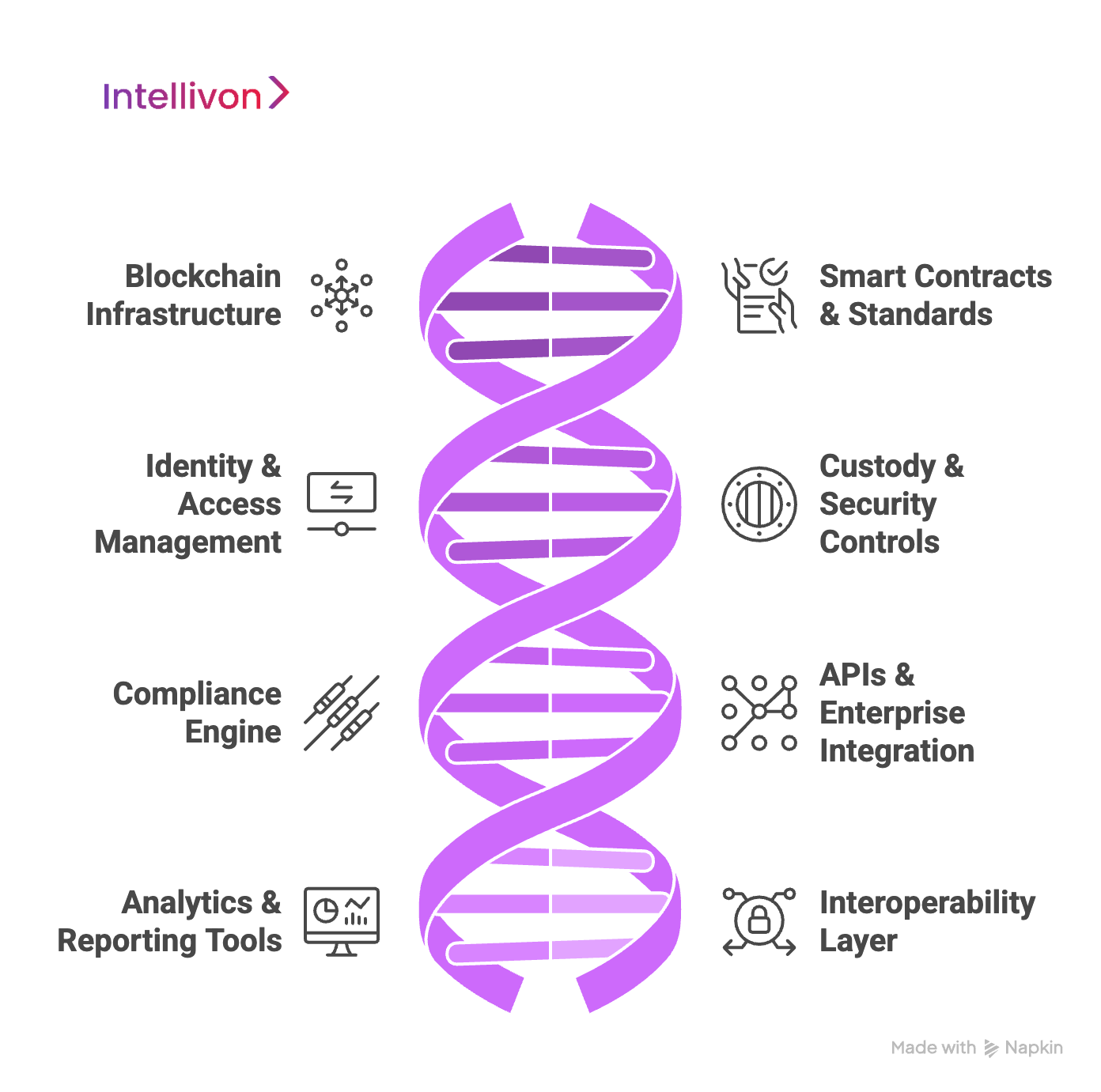

Key Features of an Enterprise Tokenization Solution

This enterprise tokenization solution secures assets, ensures compliance, and integrates with enterprise operations at scale. The following components form its foundation:

1. Blockchain Infrastructure

The core ledger guarantees immutability, auditability, and global availability. Enterprises can choose private, public, or hybrid models depending on control, performance, and market integration requirements.

2. Smart Contracts and Token Standards

Smart contracts encode business logic into tokens, such as transfer rules, ownership rights, and settlement conditions. Adopting standards like ERC-20, ERC-721, or ERC-1400 ensures interoperability while keeping governance aligned with enterprise policies.

3. Identity and Access Management

Built-in KYC, AML, and integration with enterprise IAM systems strengthen trust and security. This ensures only authorized parties can create, hold, or exchange assets, satisfying both operational security and regulatory obligations.

4. Custody and Security Controls

Enterprises need to safeguard tokenized assets with hardened custody solutions: hardware security modules (HSMs), multi-signature wallets, and encrypted vaults. These minimize the risk of theft, fraud, or system failure.

5. Compliance Engine

Regulatory rules are embedded into the platform, enabling automated adherence to standards like GDPR, SEC requirements, MiCA, or local securities laws. This reduces manual oversight, lowers audit costs, and accelerates readiness for regulators.

6. APIs and Enterprise Integration

APIs link the platform with ERP, finance, CRM, and supply chain systems. This creates a seamless flow where tokenized assets are reflected instantly across business processes, removing silos and streamlining reporting.

7. Analytics and Reporting Tools

Comprehensive dashboards and reporting modules provide visibility into tokenized transactions, regulatory status, and performance metrics. This enables leadership teams to make informed decisions backed by real-time data.

8. Interoperability Layer

Cross-chain compatibility ensures enterprises can operate across multiple ecosystems without being locked into a single technology. This flexibility supports expansion into new markets and future-proofs investments.

Together, these components make tokenization platforms enterprise-ready, ensuring that they are secure, compliant, and designed to integrate seamlessly with existing operations while unlocking efficiency and growth.

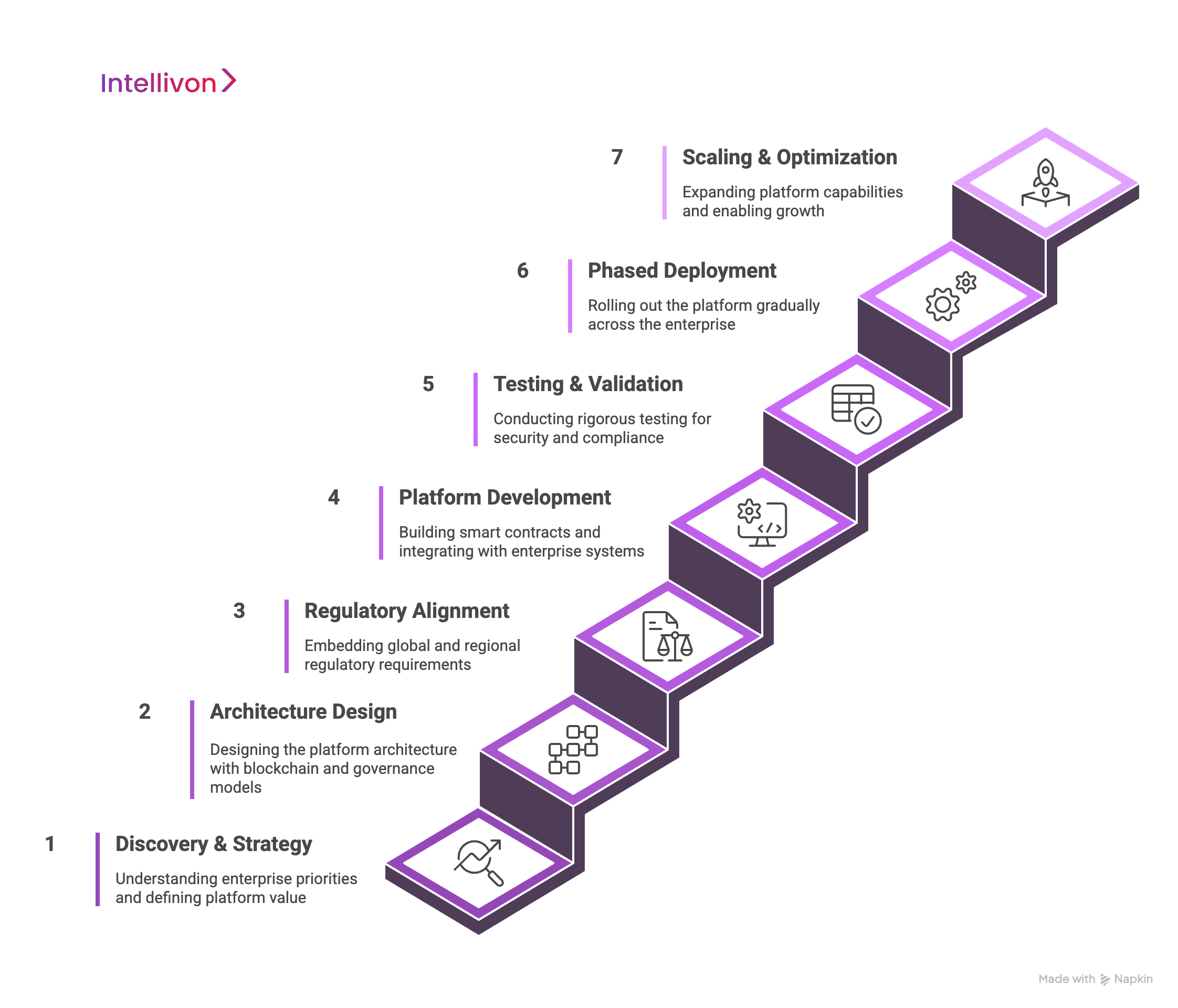

Steps We Follow To Develop an Enterprise Tokenization Solution

Building a tokenization platform for a large enterprise is not a one-off deployment. It is a structured journey that balances strategy, compliance, technology, and scalability. At Intellivon, we follow a phased approach to ensure the platform meets both immediate needs and long-term enterprise goals.

1. Discovery and Strategy

The process begins with a clear understanding of which assets should be tokenized and why. We map enterprise priorities, whether it’s liquidity creation, compliance efficiency, or operational transparency, and define the value the platform will deliver. This ensures tokenization aligns with measurable business objectives.

2. Architecture Design

Next, we design the platform architecture. Decisions at this stage include blockchain type (public, private, or hybrid), governance models, and token standards (ERC-20, ERC-721, ERC-1400). The design phase balances performance, compliance, and integration requirements to create an enterprise-ready foundation.

3. Regulatory Alignment

Tokenization success depends on regulatory acceptance. We work to embed global and regional requirements such as SEC, GDPR, or MiCA into the platform from day one. This reduces audit scope and accelerates readiness, positioning the enterprise ahead of compliance risks.

4. Platform Development

The development phase brings the architecture to life. Smart contracts are built to encode business rules, custody systems are implemented for secure asset storage, and APIs are created to connect with ERP, finance, and supply chain applications. Each feature is designed with scalability in mind.

5. Testing and Validation

Before launch, the platform undergoes rigorous testing, from security audits and penetration tests to compliance simulations and user acceptance trials. This stage ensures resilience, reduces risk, and demonstrates audit readiness.

6. Phased Deployment

Enterprises rarely roll out tokenization in a single step. We recommend a phased deployment, starting with one asset class or business unit and expanding gradually. This approach reduces risk while delivering early wins that build organizational momentum.

7. Scaling and Optimization

Finally, we prepare the platform for scale. This includes adding new asset classes, enabling interoperability with other blockchains, and building analytics dashboards for enterprise-wide insights. At this stage, tokenization evolves from a compliance and efficiency tool into a growth enabler.

This step-by-step framework ensures that tokenization platforms are not just technically sound but strategically aligned with enterprise transformation goals.

Challenges We Overcome While Developing Enterprise Tokenization Solutions

Enterprises exploring tokenization quickly discover that the barriers are not only technical. Governance, regulation, integration, and adoption all pose hurdles that can slow down or derail initiatives if not addressed head-on. At Intellivon, we design our approach to anticipate these challenges and build solutions that work in real-world enterprise conditions.

1. Regulatory Uncertainty

The rules governing digital assets vary widely across regions and continue to evolve. Without a flexible compliance model, enterprises risk building platforms that fail under scrutiny.

We embed compliance engines into the platform that adapt to frameworks such as SEC guidelines, GDPR, and MiCA. This ensures tokenized assets meet current obligations and can evolve with new regulations.

2. Integration with Legacy Systems

Core systems like ERP, finance, and supply chain applications are not natively designed for tokenization. Creating interoperability is often complex and resource-intensive.

At Intellivon, we provide robust APIs and middleware that connect the tokenization platform directly with existing enterprise systems. This reduces disruption and ensures tokens reflect real-world events in real time.

3. Security and Custody Risks

Tokenized assets are valuable targets. Weak custody mechanisms or key management practices can undermine the entire initiative.

Our experts implement enterprise-grade custody solutions using hardware security modules (HSMs), multi-signature authorization, and encrypted vaults. This provides resilience against both external threats and insider risks.

4. Scalability Across Markets

Enterprises often start with one asset class but quickly need to expand into new markets or geographies. A rigid platform design cannot accommodate this growth.

We build for interoperability and multi-chain support from the start, allowing seamless cross-border operations and expansion into secondary markets without re-architecture.

5. Change Management and Adoption

Introducing tokenization alters workflows and requires new trust models inside and outside the enterprise. Resistance or confusion can stall adoption.

Our experts phase deployments to demonstrate early wins, while providing clear governance frameworks and reporting tools. This builds confidence at every level of the enterprise.

With the right architecture, governance, and security practices, tokenization platforms become not only feasible but transformative for large enterprises.

Real-World Enterprise Tokenization Use Cases

Tokenization platforms are being deployed across industries, each solving long-standing problems around liquidity, compliance, and trust. Here’s how enterprises are putting them to work.

1. Financial Services

A. Tokenized Bonds and Equities

Banks issue digital tokens representing traditional securities. Settlement times drop from days to minutes, and audit trails are available in real time.

B. Tokenized Loans and Syndications

Syndicated loans are broken into tokens, making them easier to distribute among institutional investors with clear, programmable ownership rights.

C. Asset-Backed Securities

Illiquid products like mortgage-backed securities are tokenized, enabling fractional ownership and opening access to broader investor bases.

Example: JPMorgan has already launched a blockchain-based platform (Onyx) that tokenizes intraday repo transactions, reducing settlement risk and proving tokenization’s potential at scale.

2. Real Estate

A. Fractional Property Ownership

Commercial and residential properties are tokenized, allowing enterprises to offer smaller, more affordable investment stakes while improving liquidity.

B. Simplified Ownership Transfers

Property deeds and title records are represented as tokens, enabling faster and more transparent ownership changes without lengthy paperwork.

C. Real Estate Investment Funds

REITs and large portfolios are tokenized, streamlining investor onboarding and secondary market trading.

Example: BlackRock has begun exploring tokenization for parts of its investment fund operations, signaling the shift of real estate and asset management into blockchain-based markets.

3. Supply Chain and Trade Finance

A. Tokenized Invoices

Invoices issued in ERP systems are instantly tokenized, allowing faster trade finance approvals and reducing fraud risk.

B. Tokenized Bills of Lading

Shipping documents become digital tokens that can be verified instantly, preventing duplicate or falsified records in global trade.

C. Tokenized Raw Materials

Commodities like metals or agricultural goods are represented as tokens for better provenance tracking and reduced counterfeiting.

Example: Maersk and IBM’s blockchain trade platform demonstrated how tokenized documents could speed up cross-border trade, cutting processing times and increasing transparency.

4. Healthcare and Life Sciences

A. Tokenized Patient Consents

Patients’ authorizations for data use are represented as tokens, creating clear, auditable permissions across systems.

B. Tokenized Clinical Trial Data

Trial records are tokenized to ensure integrity and traceability while enabling collaboration among research institutions.

C. Tokenized Medical Records

Patient histories are represented as tokens, allowing secure, permissioned access for hospitals and insurers.

Example: Roche has explored blockchain-based tokenization for clinical trial data to enhance transparency and ensure compliance in cross-border research.

5. Sustainability and ESG

A. Tokenized Carbon Credits

Carbon offsets are digitized as tokens, ensuring transparent, verifiable claims that meet regulatory and investor standards.

B. Tokenized Renewable Energy Certificates

Energy production certificates are tokenized, simplifying tracking and reducing fraudulent claims in renewable markets.

C. Tokenized ESG Performance Data

Sustainability metrics are tokenized for easier auditing, making ESG reporting more reliable and efficient.

Example: The World Bank piloted a blockchain-based tokenization project for carbon credits, showing how tokenization can support global sustainability goals.

These use cases and real-world examples illustrate that tokenization is already reshaping how enterprises manage assets, not in isolated pilots but in mainstream operations.

Conclusion

Enterprise tokenization platforms are becoming a strategic foundation for the digital economy. From finance to real estate, supply chain, healthcare, and sustainability, organizations are using tokenization to unlock liquidity, accelerate compliance, and improve transparency. The market trajectory is staggering, with trillions of dollars in assets expected to be tokenized in the coming years.

For enterprises, investing in a robust tokenization platform today positions enterprises not only to protect value but to lead in how it is created, managed, and exchanged tomorrow.

Build Your Enterprise Tokenization Solution with Intellivon

At Intellivon, we design enterprise-grade tokenization platforms that help organizations digitize assets securely, comply with global regulations, and scale across markets. Our platforms combine blockchain infrastructure, integrated compliance engines, and seamless integration with ERP, finance, and supply chain systems to deliver lasting value.

Why Partner with Intellivon?

- Tailored Architecture: Built around your asset classes, workflows, and regulatory needs.

- Compliance-First: Platforms aligned with SEC, GDPR, MiCA, and other global standards.

- Enterprise Expertise: Proven success in finance, real estate, healthcare, and supply chains.

- Scalable Design: Multi-chain, API-driven, and future-ready for global expansion.

- End-to-End Delivery: From strategy and architecture to deployment and scaling, we manage the full journey.

- Security at Core: Enterprise-grade custody, HSMs, and encryption built in from day one.

- Measurable ROI: Designed to reduce audit scope, accelerate readiness, and cut operational costs.

- Innovation Enablement: Platforms that not only secure assets but open doors to new digital revenue models.

- Global Reach: Multi-region deployment models with built-in data residency and interoperability support.

- Trusted Advisory: A partner that brings not only technology but guidance, governance frameworks, and ongoing optimization.

Book a discovery call with Intellivon today and start building a tokenization platform that secures your assets, streamlines compliance, and positions your enterprise for digital leadership.

FAQs

Q1. What is an enterprise tokenization platform?

A1. An enterprise tokenization platform is a system that converts real-world assets, such as securities, real estate, or supply chain documents, into secure digital tokens on a blockchain. It allows organizations to improve liquidity, compliance, and transparency while integrating seamlessly with existing enterprise systems.

Q2. How does tokenization benefit large enterprises?

A2. Tokenization helps enterprises reduce settlement times, cut audit costs, and create new revenue streams. It also strengthens compliance by embedding regulatory rules into digital assets and provides transparency with immutable audit trails.

Q3. Which industries are adopting enterprise tokenization?

A3. Financial services, real estate, supply chain, healthcare, and sustainability sectors are leading adoption. Each uses tokenization to solve industry-specific challenges such as slow settlements, illiquidity, or complex regulatory reporting.

4. Is tokenization secure and compliant?

A4. Yes. Enterprise tokenization platforms use advanced security controls like HSMs, multi-signature custody, and encrypted vaults. Compliance is built into the platform to align with frameworks such as SEC, GDPR, HIPAA, and MiCA.

Q5. What ROI can enterprises expect from tokenization?

A5. Enterprises report significant ROI within two years of deployment. Tokenization can cut compliance scope by up to 50%, reduce breach impact by making data tamper-proof, and unlock new revenue from fractional asset ownership and digital marketplaces.