Large insurers face volumes of data, shifting customer demands, and tighter regulations, challenges that traditional underwriting systems struggle to keep up with. It’s time for a new approach that’s faster, smarter, and more adaptable. The adoption of AI in insurance underwriting is still green, but the top 25 industry leaders are already reaping its benefits.

The AI handles the manual grunt work of combing through thousands of pages of actuarial data, identifying patterns of risk, and consolidating them. At the same time, the insurance underwriter uses his expertise to personalize terms and conditions for policyholders. Leading companies, such as Allianz and Hagerty, have reported a 31% reduction in processing times and a 43% improvement in risk assessment accuracy after integrating AI into their insurance underwriting processes. This suggests that the need for integrating AI into underwriting is a solution that every insurance enterprise must adopt at scale.

At Intellivon, we help enterprises achieve this by developing AI insurance underwriting solutions from scratch and seamlessly integrating them into existing legacy systems without compromising proprietary data. In this blog, we will dissect how insuretech enterprises can grow with scalable AI-powered insurance underwriting solutions.

The Right Time To Invest in AI-Powered Underwriting for Insurance Enterprises

Key Market Drivers of this Growth:

- 66% of brokers say carriers must process submissions faster, accelerating the push for AI-assisted underwriting.

- Many insurers are moving from AI experiments to full-scale implementation and staff training for underwriting workflows.

- AI-driven underwriting can reduce policy approval times by up to 80%, allowing insurers to serve more customers quickly.

- AI has cut standard underwriting decision times from days to just 12.4 minutes, while keeping accuracy above 99% for simpler policies.

- AI has reduced the time required for complex policy processing by over 30% and improved predictive risk accuracy by 43%.

- AI adoption has led to a 50%+ increase in underwriter productivity and up to 15% revenue growth through personalized pricing and risk evaluation.

- Integrating IoT and telematics in underwriting can reduce claim losses by around 20%.

Generative AI and Its Impact on Insurance Underwriting

Generative AI is driving a significant shift in how underwriting is conducted across the insurance industry. By enabling faster decisions, better risk models, and enhanced customer experiences, it’s becoming a vital part of modern insurance operations. Here’s how:

1. Faster, Accurate Risk Modeling

One of the biggest advantages of generative AI is its ability to handle complex risk scenarios. In segments like cyber insurance, predictive models powered by generative AI have reduced underwriting errors by 34%. Even better, cyber claim frequencies have dropped by up to 22%, thanks to real-time threat intelligence.

These results show how well generative AI understands evolving risks. Instead of relying on outdated models, it learns from current and historical data to make better decisions quickly.

2. Quick Efficiency Gains

Underwriting decisions that once took days or weeks now take just 12.4 minutes on average. This incredible time reduction is driven by AI-powered underwriting systems enhanced with generative models.

For simpler policies, risk assessment accuracy has reached over 99%. Some insurers have seen up to 80% faster policy issuance, a massive operational gain. This kind of efficiency not only saves time but also lowers costs and improves customer satisfaction.

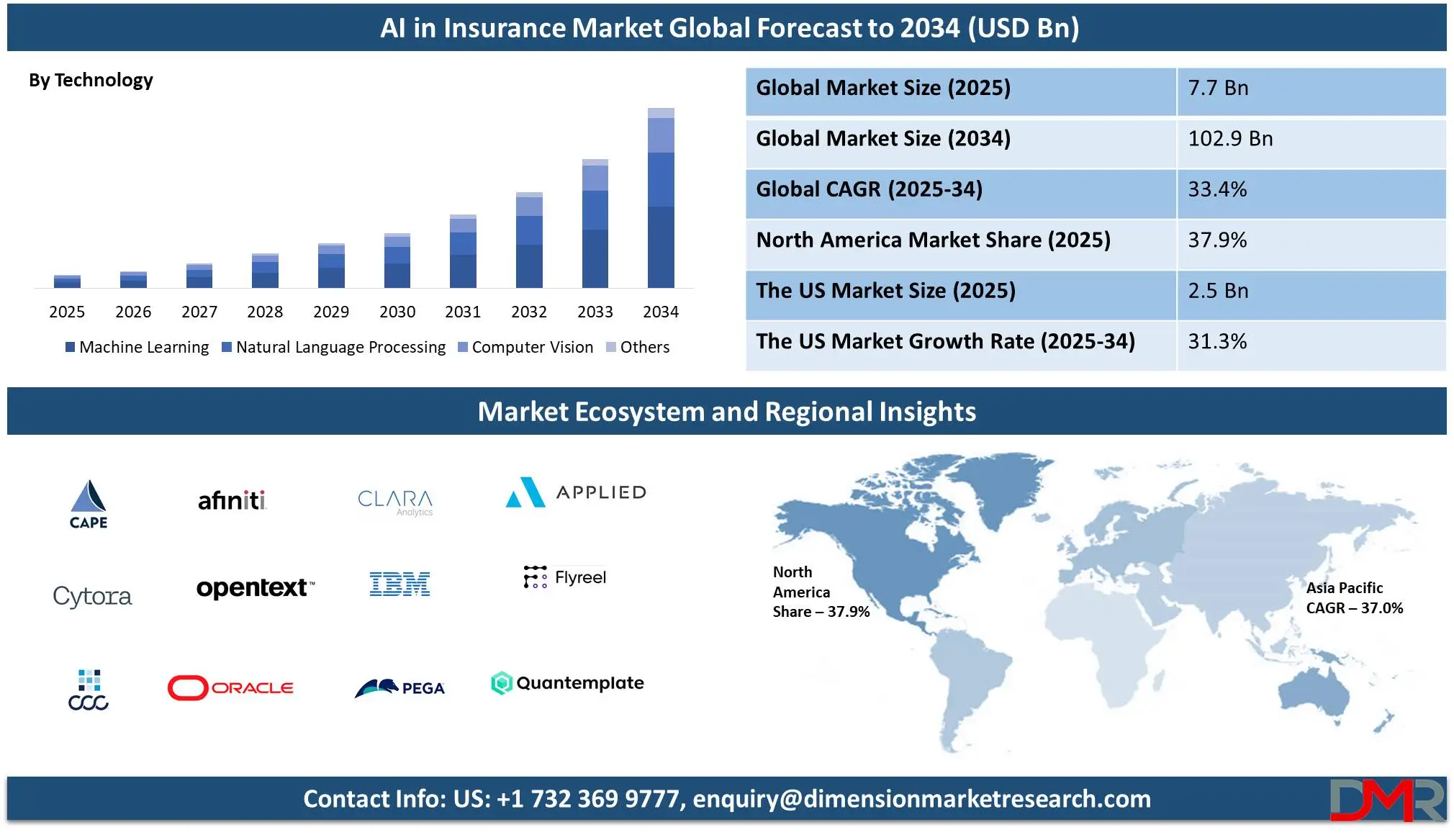

3. Rapid Market Growth and Adoption

The market for generative AI in insurance is growing at an impressive pace. It was valued at around $1.08 billion in 2024 and is projected to reach approximately $1.51 billion in 2025. That’s a compound annual growth rate (CAGR) of nearly 40%.

Notably, North America leads adoption, accounting for about 44% of the global market share. This dominance reflects the region’s mature InsureTech ecosystem and investment in advanced AI capabilities.

4. Real-Time Adjustments to Policies

Another powerful feature of generative AI is its simulation capability. It helps insurers adjust policies on the fly, based on emerging threats or changing risk conditions.

In areas like cyber insurance, these dynamic updates can be up to 84% accurate in predicting financial impacts. This leads to faster responses, better preparedness, and more resilient underwriting models.

5. Stronger Fraud Detection

Fraud is a serious concern in the insurance space. Fortunately, AI in insurance is also advancing fraud detection. Generative AI can identify risk anomalies and highlight suspicious behavior before claims are processed.

In addition, these models improve compliance. With explainable AI, insurers can meet regulatory requirements more transparently. This builds trust with both regulators and customers while reducing legal risk.

As the market continues to grow, AI in insurance will only become more essential in underwriting innovation and enterprise success.

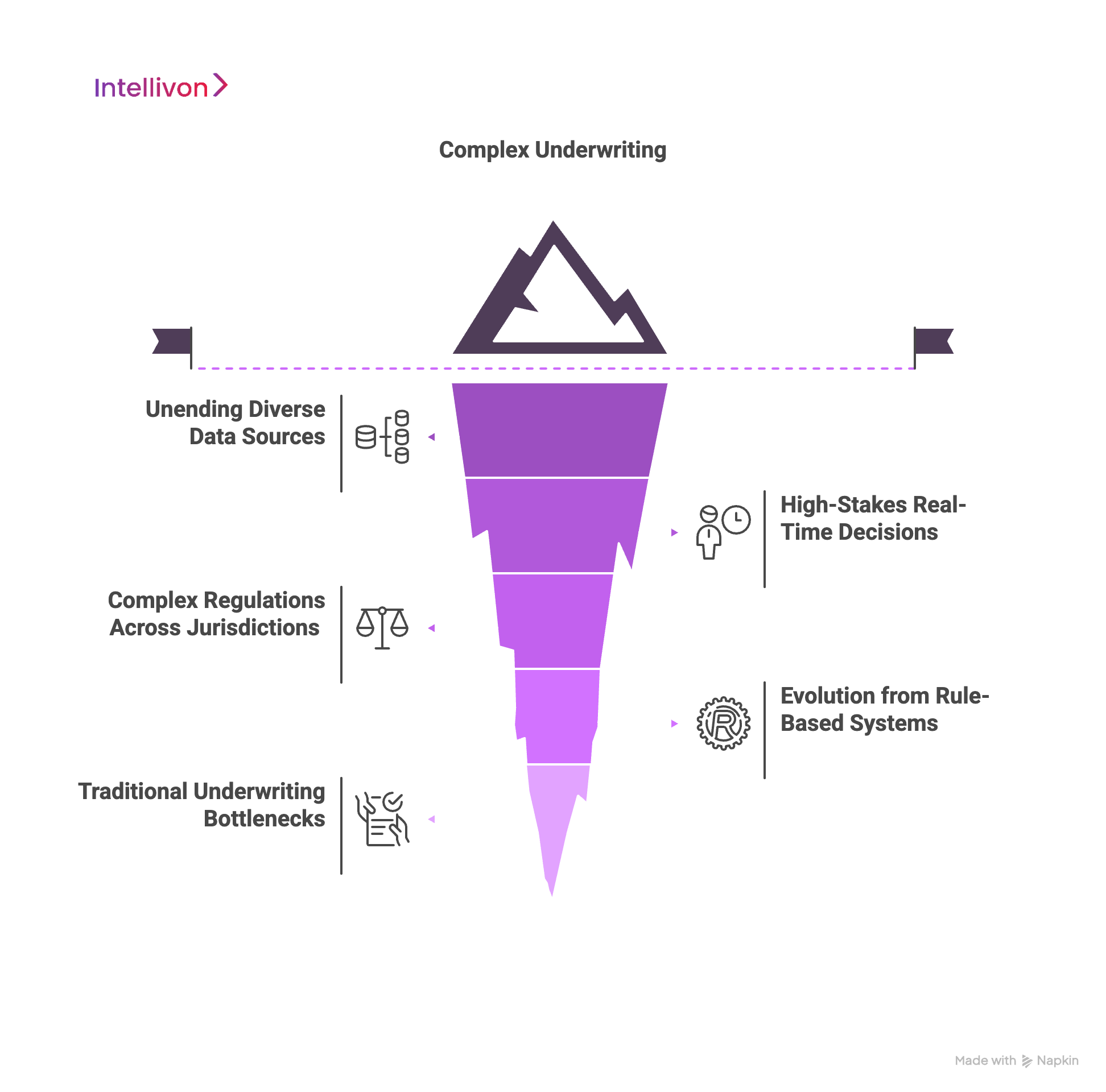

Why Underwriting Is Complex for Insuretech Enterprises

Modern insurance underwriting is more complicated than ever. For InsureTech enterprises, scaling fast while managing high-risk portfolios means dealing with complex data, instant decisions, and strict regulations. While AI in insurance offers solutions, the road to adoption is far from simple.

1. Unending Diverse Data Sources

Underwriting today relies on more than just application forms and credit scores. Insuretechs must pull in and process:

- Structured data like financials, claims history, and demographic info

- Unstructured data such as doctors’ notes, social media signals, or IoT sensor logs

- External data from third-party risk databases, weather APIs, or credit agencies

This volume and variety of data demand robust systems that can handle scale and complexity. For example, a Fortune 500 insurer managing commercial property policies must analyze building blueprints (PDFs), real-time satellite imagery, and local climate risk reports, all at once.

2. High-Stakes Real-Time Decisions

Speed is no longer optional. Clients expect quotes instantly, especially for auto, health, and cyber insurance. But fast decision-making in high-risk segments means underwriting engines must be both quick and precise.

Imagine a large global insurer offering cyber liability coverage to enterprise clients. Underwriters need to assess current threat exposure, past incident history, and security hygiene, all in real time. Delays could cost deals, while poor risk assessment could mean multi-million-dollar payouts.

3. Complex Regulations Across Jurisdictions

Insurance is one of the most heavily regulated industries. Laws vary by state, country, and product line. Insuretechs serving multiple regions must comply with:

- NAIC (U.S.) guidelines

- GDPR (EU) data privacy laws

- Anti-money laundering (AML) and Know Your Customer (KYC) regulations

A giant insurer expanding into APAC markets must tailor underwriting logic to meet both global compliance frameworks and local nuances. This adds layers of complexity when deploying any AI system, especially at scale.

4. Evolution from Rule-Based Systems

Legacy insurance systems were built on rule-based logic. These systems apply static decision trees, such as “if X, then Y” rules. But for today’s fast-moving risk environment, that’s no longer enough.

5. Traditional Underwriting Bottlenecks

Large insurers often suffer from:

- Siloed data and manual handoffs

- Weeks-long quote cycles

- Inconsistent decisions across regions or underwriters

- High operational overhead and error rates

For example, a leading health insurance provider might face policy approval times averaging 11 days due to fragmented data and rigid rule systems.

This is where AI in insurance steps in, with models that learn from real-time data, update constantly, and provide nuanced decisions that rule-based systems can’t.

How AI Works in Underwriting for Insuretech Enterprises

AI is revolutionizing how insurance companies assess risk. It transforms traditional, manual underwriting into a faster, smarter, and more accurate process. By automating complex steps and delivering real-time insights, AI in insurance helps underwriters make data-driven decisions with confidence. Let’s explore how this works in detail.

1. Data Collection and Integration

The first step in AI-driven underwriting is gathering a substantial amount of data. This includes:

- Structured data like financial statements, application forms, and claims history

- Unstructured data, such as doctors’ notes, images, or PDFs

- External data feeds, including credit reports, weather forecasts, or IoT sensor readings

AI systems bring all of this into data lakes or cloud warehouses. Then, technologies like natural language processing (NLP) and image recognition extract key information automatically. This removes the need for underwriters to read through lengthy documents or scan endless spreadsheets. For example, instead of manually analyzing a 50-page medical file, an AI system can extract relevant diagnoses and treatment timelines in seconds.

2. Risk Analysis and Scoring

Once the data is clean and ready, AI moves on to analyzing risk. This is where machine learning (ML) models shine. They evaluate thousands of variables at once to find patterns and predict outcomes that traditional systems miss.

AI considers economic data, behavioral history, environmental risks, and past claims. It generates a risk score that predicts how likely a claim is and what it might cost. Generative AI adds a new layer by simulating “what-if” scenarios. For example, in property insurance, it might simulate fire or flood risk under different weather conditions. This makes the underwriting process more dynamic and forward-looking.

3. Automated Decision Support

Once risk scores are calculated, AI provides recommendations. These can include:

- Approve or decline the policy

- Adjust coverage limits

- Suggest pricing based on risk and company guidelines

- Flag the application for human review

In most cases, this process happens in under 15 minutes, which is a huge improvement over the multi-day turnaround of traditional underwriting.

Just as importantly, AI offers explainable decisions. This means the system shows why a recommendation was made, which is critical for transparency and regulatory compliance.

4. Dynamic Pricing and Policy Customization

No two customers are the same, and AI understands that. It enables dynamic pricing that reflects real-time risk changes. Let’s say a customer installs a new home security system or begins exercising regularly. AI can adjust its premium based on this new information.

By using behavioral models and market data, insurers can:

- Offer more competitive prices

- Tailor coverage to customer needs

- Improve customer satisfaction and retention

This creates policies that are both profitable and fair.

5. Continuous Learning and Fraud Detection

AI doesn’t stop after making a decision. It keeps learning.

Each time a claim is filed, or a market condition shifts, the AI system updates its models. This ensures that risk assessments remain accurate over time.

AI also helps fight fraud. With advanced behavioral analytics, it spots unusual activity, like a sudden spike in claims or mismatched documents. By catching these early, insurers can reduce financial losses and protect genuine policyholders.

6. Seamless Integration and Communication

To be effective, underwriting AI must connect to all the right systems. This includes:

- CRM (Customer Relationship Management) tools

- Claims processing platforms

- Policy administration software

- Customer support interfaces

When integrated well, AI automates entire workflows. For example, it pulls in applicant data from the CRM, processes it, pushes decisions to the policy admin system, and sends updates to the customer, all without human input.

Generative AI chatbots also support underwriters by handling customer communication. These virtual assistants can answer FAQs, send reminders, or request missing documents, freeing up valuable human time for complex tasks.

As the industry becomes more complex, AI ensures that InsureTech enterprises stay ahead, offering smarter, faster, and fairer underwriting at scale.

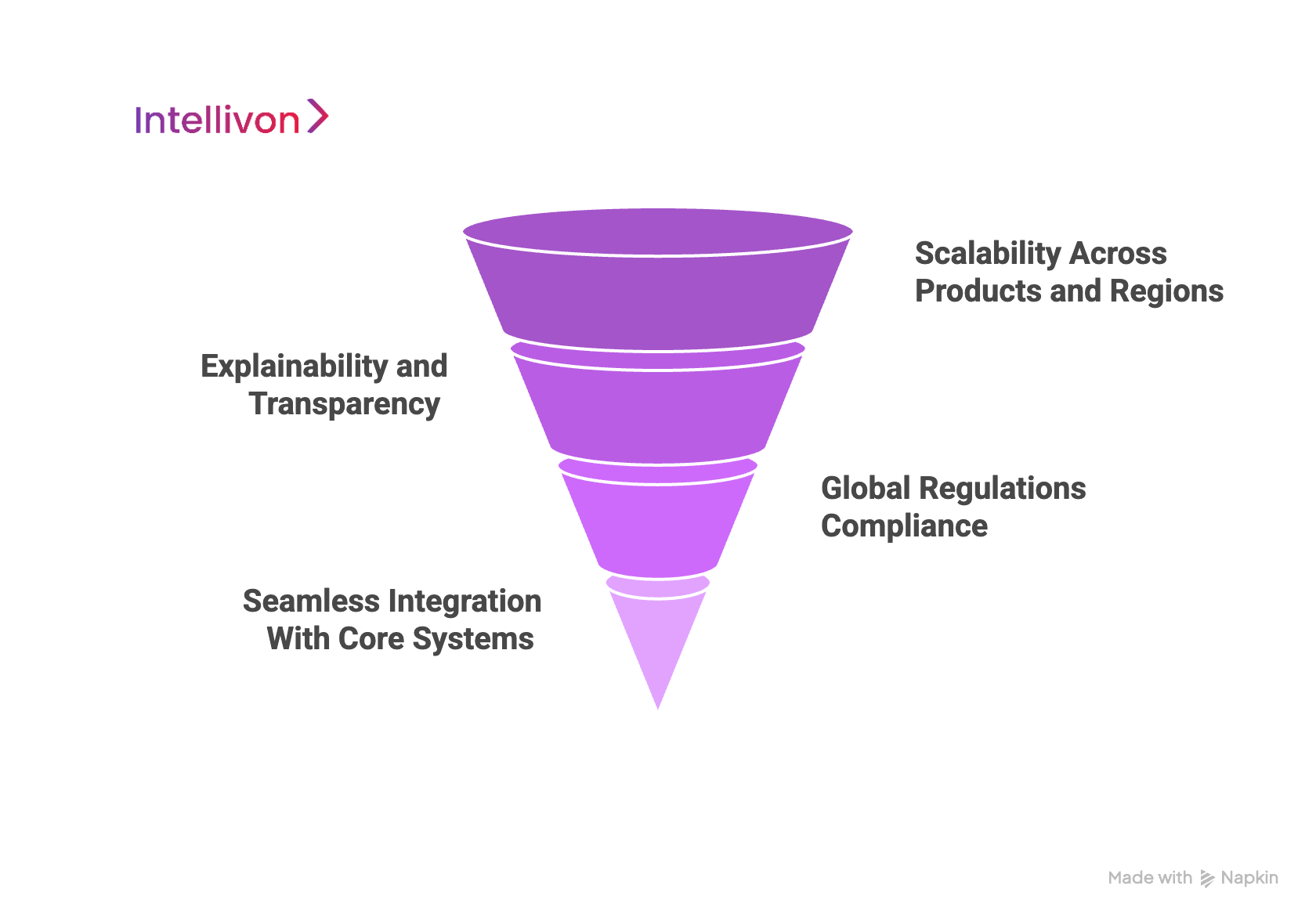

What Makes an AI Model Enterprise-Ready for Underwriting

As insurers face growing complexity in risk modeling, compliance, and customer expectations, off-the-shelf AI solutions often fail to meet these needs. Enterprise-ready models must be built to scale, integrate securely, and adapt across regions and regulatory environments.

At Intellivon, we specialize in building such AI systems, tailored to the needs of large insurers. Our underwriting AI solutions are designed to be transparent, compliant, and operationally efficient from day one.

1. Scalability Across Products and Regions

Large insurers underwrite a wide variety of policies, ranging from health and life to commercial property and cyber risk. Each line of business involves unique data inputs, rules, and risk frameworks. On top of that, underwriting models must work across multiple geographic markets with varying regulations and environmental factors.

We build scalable AI models using modular architectures that can be quickly adapted to different product lines and geographies, without retraining from scratch.

2. Explainability and Transparency

Enterprise insurers cannot afford to use black-box AI models that no one can explain. Regulatory frameworks and internal risk teams demand full visibility into how AI makes its decisions. From a customer standpoint, transparency builds trust, especially when policy pricing or approvals are involved.

To support this, Intellivon’s underwriting AI solutions include built-in explainability using tools like SHAP and LIME, ensuring every output can be traced back to its data drivers.

3. Global Regulations Compliance

AI used in underwriting must adhere to strict legal and data protection standards. Whether it’s GDPR in Europe or HIPAA in the U.S., models must be compliant from the ground up. This requires secure data handling, audit trails, and model fairness assessments.

We ensure compliance by embedding regulatory rules into model design and deployment pipelines, with documentation and audit-readiness built into every stage.

4. Seamless Integration with Core Insurance Systems

AI that can’t connect to existing systems creates silos instead of value. For enterprise deployment, models must integrate with CRM platforms, policy administration software, and claims systems, without disrupting ongoing operations.

Intellivon delivers underwriting AI through API-first, cloud-native architectures that integrate seamlessly with both legacy and modern systems, making deployment efficient and risk-free.

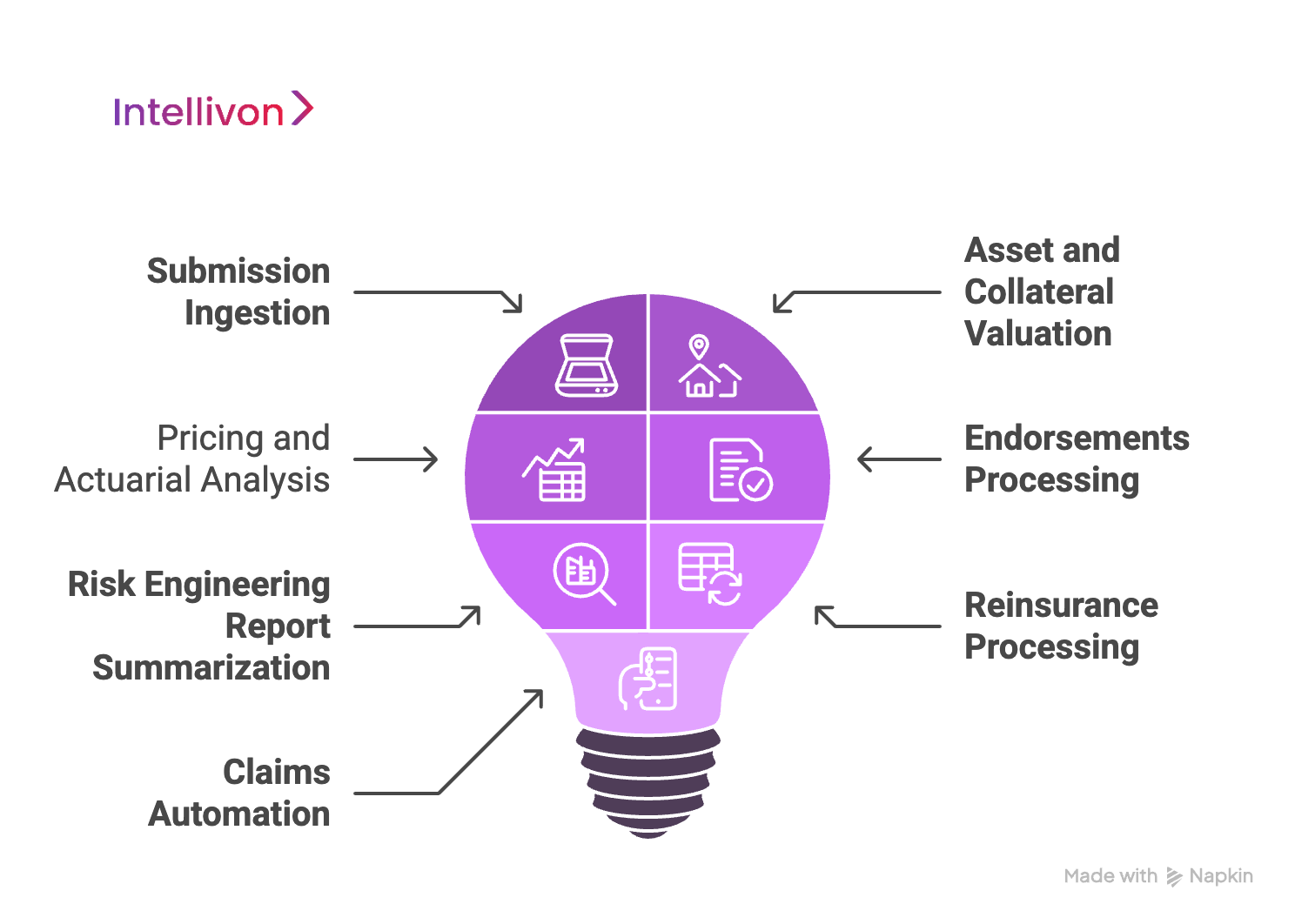

AI Enterprise Insurance Underwriting Key Use Cases

While the potential of AI in insurance is widely discussed, the true value is seen in practical, enterprise-scale deployments. From processing complex submissions to accelerating claim resolution, here are seven critical areas where AI is redefining how large insurers underwrite risks, price policies, and serve customers. Each use case shows how automation and intelligence deliver tangible gains in speed, accuracy, and scalability.

1. Submission Ingestion

Large insurers often receive thousands of broker submissions daily in varying formats, like Market Reform Contracts (MRCs), loss runs, or unstructured PDFs. Manually reviewing and entering this information slows down quote generation and increases error rates. AI transforms this by using NLP, LLMs, and OCR to extract and normalize critical data fields. These systems automatically route submissions that match risk appetite, helping underwriters focus on high-value opportunities.

Example

Liberty Mutual uses AI to route submissions that match their risk appetite, letting underwriters focus on more complex cases. This speeds up quote turnaround times, reduces manual errors, and ensures consistent, audit-ready data across the company.

2. Asset and Collateral Valuation

Insuring large properties, infrastructure, or high-value equipment requires timely and accurate valuation. Traditional assessments rely heavily on manual site visits and inconsistent market data. AI integrates satellite imagery, geospatial analytics, and IoT sensor data to produce real-time asset evaluations. These insights help underwriters quantify exposure, assess environmental risks, and adjust coverage limits accordingly, faster and with fewer blind spots.

Example

ZestyAI helps insurers assess property and climate risks by analyzing data like satellite images and weather patterns. Their platform gives detailed risk assessments at the property level, improving asset valuations. By factoring in risks like wildfires and floods, insurers can make better underwriting decisions. This approach speeds up the process and helps optimize pricing for commercial properties.

3. Pricing and Actuarial Analysis

Actuarial teams face the challenge of pricing policies based on increasingly dynamic variables, from climate trends to behavioral data. AI enhances traditional models by analyzing vast historical datasets alongside real-time market and risk indicators. It allows for hyper-personalized pricing that adapts to changes, improving both profitability and customer satisfaction.

Example

Allianz uses AI to enhance its pricing and actuarial analysis. By integrating AI with traditional actuarial models, Allianz analyzes large sets of historical data along with real-time market indicators to adjust pricing dynamically. This enables them to offer more personalized, accurate premiums based on factors like climate trends and customer behavior, improving profitability while ensuring customers receive fair pricing tailored to their specific risk profiles.

4. Endorsements Processing

Endorsements, which are policy amendments requested by clients, are frequent in large commercial accounts. Processing them manually causes delays in billing, coverage updates, and premium adjustments. AI systems automate the detection and classification of endorsement requests, updating policy records instantly and ensuring downstream systems are aligned.

Example

AXA XL simplifies the endorsement process for large commercial accounts by automating how policy changes are handled with the use of AI . When clients request updates, their system quickly processes the changes, adjusting coverage and premiums without delays. This ensures that clients’ policies are always up to date and reduces the time it takes to reflect changes in billing and coverage.

5. Risk Engineering Report Summarization

Large underwriters rely on detailed risk engineering reports to assess technical hazards in properties or operations. These reports are often lengthy, inconsistent in format, and time-consuming to review. AI systems extract key risks, normalize grading systems, and present actionable summaries for underwriters, ensuring no critical insights are missed.

Example

Zurich Insurance simplifies the review of risk engineering reports by automatically highlighting the key risks and standardizing assessments using AI. This allows underwriters to quickly get to the important details without having to go through lengthy, inconsistent reports. It speeds up the risk evaluation process and ensures nothing important is overlooked.

6. Reinsurance Processing

For enterprise insurers and reinsurers, treaty and facultative reinsurance processes are data-heavy and format-diverse. Bordereaux files must be reconciled manually, causing delays and reporting inaccuracies. AI automates data ingestion, validation, and reconciliation, improving compliance and reducing operational costs.

Example

Munich Re streamlines reinsurance processing by using AI to automate the reconciliation of treaty and facultative reinsurance data. Instead of manually handling diverse and data-heavy bordereaux files, their system quickly ingests, validates, and reconciles the data. This reduces errors, ensures compliance, and cuts down on operational costs, making the process faster and more accurate.

7. Claims Automation

Enterprise claims handling is complex, especially when involving health records, police reports, and multi-party documentation. AI systems extract critical information, assess severity, detect fraud patterns, and route claims for approval or further investigation. This significantly cuts processing time and enhances transparency.

Example

Progressive Insurance uses AI to automate the claims process by quickly extracting key details from health records, police reports, and other documents. The system assesses the severity of claims, detects potential fraud, and routes them for approval or further investigation. This speeds up the process, reduces errors, and increases transparency for both the insurer and the claimant.

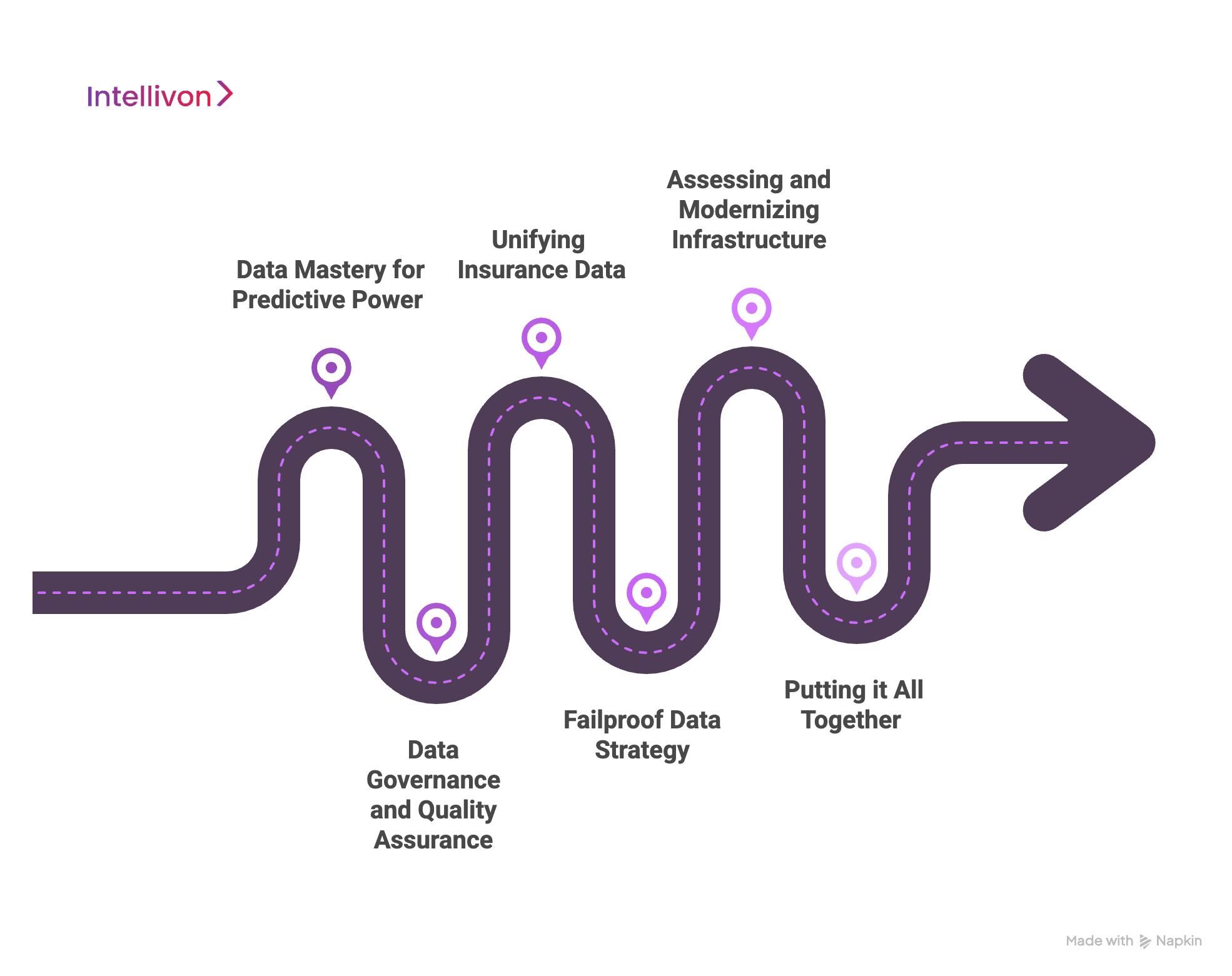

How We Ensure Strategic Data Readiness for AI Insurance Underwriting

The success of AI in insurance underwriting depends on strategic, high-quality data foundations. Without robust data pipelines, even the most advanced models can yield biased or inaccurate outcomes. As insurers adopt AI to improve risk decisions, streamline operations, and personalize pricing, data readiness becomes the key differentiator between experimentation and enterprise-scale transformation.

1. Data Mastery for Predictive Power

Modern insurance underwriting involves analyzing a wide variety of data types, like structured policy and claims data, unstructured documents like MRCs and loss runs, and alternative data sources such as telematics, IoT sensor feeds, aerial imagery, and even public records. These data types arrive in different formats, often fragmented across legacy systems, slowing model development and impeding accuracy.

Unlocking predictive power begins with centralizing and organizing this diversity. AI systems rely on real-time ingestion pipelines that can extract, normalize, and enrich data from all these sources. For example, telematics inputs improve commercial auto underwriting, while property insurers increasingly depend on geospatial and climate data to quantify wildfire and flood risks.

2. Data Governance and Quality Assurance

High-quality data fuels high-performing models, but poor data can amplify risk. In an AI-driven underwriting environment, governance and traceability are essential. Insurers must ensure data integrity through strict validation processes, clear metadata management, and continuous audits of the inputs used to train and update models.

Ethical considerations are equally important. With regulations like GDPR, HIPAA, and data localization laws tightening globally, it’s critical to protect personal information and provide transparency. This includes anonymizing sensitive fields, implementing access controls, and maintaining a clear lineage from source to model output. Insurers that embed governance into their pipelines can defend their decisions, remain compliant, and build customer trust.

3. Unifying Insurance Data

Siloed data is one of the biggest obstacles to underwriting AI. Often, policy records live in one system, claims in another, and broker submissions in yet another. Without harmonized datasets, it’s impossible to deliver the real-time insights that modern underwriting demands.

A unified data architecture connects these silos using schema alignment, entity resolution, and centralized data lakes or warehouses. This unified layer enables risk scoring models to draw on full applicant histories, market context, and emerging exposures without manual intervention. In one case, an enterprise insurer increased claim prediction accuracy by over 20% after consolidating disparate underwriting, claims, and asset valuation data into a unified framework.

4. Failproof Data Strategy

While having access to data is essential, strategy determines whether that data becomes usable intelligence. Intellivon’s effective insurance AI data strategy focuses on three critical pillars: dataset design, feature engineering, and continuous learning.

1. Comprehensive Training Datasets

Training AI models requires historical claims, policy behavior, and third-party data, all optimized for completeness and balance. Where gaps exist, such as rare risk scenarios, synthetic data generation fills in, helping the model generalize without overfitting. External signals like socioeconomic trends, satellite maps, or industry indexes add further granularity for better risk segmentation.

2. Feature Engineering

Underwriters have always relied on structured variables like age, asset value, and coverage type. But AI allows for richer, alternative features: driver behavior from telematics, humidity levels for mold risk, or even property usage inferred from IoT sensors. Real-time enrichment adds depth, while privacy-preserving techniques like federated learning keep data secure across environments.

3. Continuous Learning Systems

Markets shift. So should models. Effective AI underwriting requires retraining frameworks that detect data drift, reweight model parameters, and monitor decision performance. Some insurers now deploy A/B testing to compare AI-driven underwriting decisions with human or traditional rule-based benchmarks. This loop ensures accuracy keeps pace with evolving risk dynamics.

5. Assessing and Modernizing Infrastructure

Before any underwriting AI model goes live, insurers must assess the readiness of their infrastructure. This includes auditing internal data quality, evaluating partner feeds, and measuring integration maturity across policy admin systems, CRMs, and data lakes. Poorly integrated systems can delay ingestion, distort data formats, or create blind spots in underwriting logic.

In response, many insurers are now prioritizing insurance-specific data lakes, designed to handle ingestion from PDFs, IoT devices, cloud APIs, and structured tables, all while enforcing privacy, consent, and data sovereignty. These lakes serve as the foundation for scalable, trustworthy AI deployments.

6. Putting It All Together

Data readiness is not a single initiative. It’s a continuous process that underpins every successful AI underwriting deployment. From unifying fragmented systems to validating third-party inputs and building future-proof training sets, insurers who invest in their data will ultimately lead in underwriting intelligence, speed, and risk accuracy.

At Intellivon, we’ve helped insurers across the globe move from data silos to AI-ready infrastructure, enabling them to underwrite with more agility, transparency, and confidence.

The Technical Architecture Blueprint for Underwriting AI

For insureTech enterprises, building AI is about designing a scalable, compliant, and interoperable system that integrates smoothly with complex insurance ecosystems. Below is a breakdown of the key technical architectural layers that support effective AI underwriting at scale.

1. Data Pipeline Engineering

Insurers collect vast amounts of data, from application forms and claims histories to real-time telematics and third-party APIs. However, turning that data into structured, AI-ready intelligence requires robust pipelines designed specifically for insurance workflows.

A strong architecture supports multi-source ingestion, including:

- Structured data from policy admin and claims systems

- Unstructured documents like SOVs, broker submissions, and MRCs

- External APIs providing credit, location, weather, or medical risk data

- IoT and sensor feeds for asset valuation or behavior tracking

Enterprise-grade pipelines must balance real-time and batch processing needs. For example, dynamic pricing systems rely on real-time updates from telematics or weather data, while claims pattern analysis might benefit more from scheduled batch ingestion.

In addition, underwriting pipelines must be built around data quality frameworks, such as validating completeness, deduplicating entries, flagging anomalies, and enforcing schema integrity. Without clean, traceable data, AI models risk drift, misclassification, or regulatory noncompliance.

2. AI Model Architecture Selection

Once data flows are established, choosing the right AI model is critical. The choice depends on the complexity of the product line, data volume, and regulatory environment.

For example:

- Ensemble models (e.g., Random Forest, Gradient Boosting) work well for structured historical data where interpretability is required, which are ideal for home, auto, or SMB policies.

- Deep learning (e.g., neural networks, transformers) becomes useful in high-dimensional datasets like cyber insurance, image-based valuation, or NLP use cases such as submission ingestion or endorsement classification.

In regulated markets, Explainable AI (XAI) is essential. Models must not only make the right decisions but also provide human-understandable reasons, especially when a policy is declined or flagged for high risk. This means using techniques like SHAP, LIME, or decision trees as wrappers to ensure regulatory compliance and trust.

Performance must also be measured using enterprise-appropriate benchmarks, such as:

- Loss ratio improvements

- AUC-ROC and precision-recall metrics

- Claim prediction accuracy

- Turnaround time reduction

These indicators ensure models move from promising prototypes to deployable underwriting engines.

3. Integration Layer Design

AI tools can’t operate in isolation. They must plug into a highly fragmented insurance tech landscape. Whether it’s a legacy PAS, CRM, or reinsurance platform, seamless integration is key to adoption.

Modern underwriting systems are designed around API-first architecture, allowing AI models to be consumed via RESTful services. This flexibility supports real-time calls for scoring submissions, recommending premiums, or updating endorsements.

Microservices offer another layer of modularity. Instead of one giant monolithic engine, underwriting functionality is broken into reusable services, like submission parsing, risk scoring, pricing logic, etc., that scale independently and can be updated without breaking the system.

To ensure reliability, especially during high-volume periods, systems are built with fallback mechanisms:

- Model scoring defaults

- Caching of previous decisions

- Graceful degradation policies

This ensures underwriting operations remain stable, even if a component temporarily fails or slows down.

Each of these layers forms the architecture needed to operationalize underwriting AI at enterprise scale. At Intellivon, we’ve helped large insurers deploy this blueprint successfully, ensuring each layer aligns with business objectives, regulatory mandates, and long-term scalability.

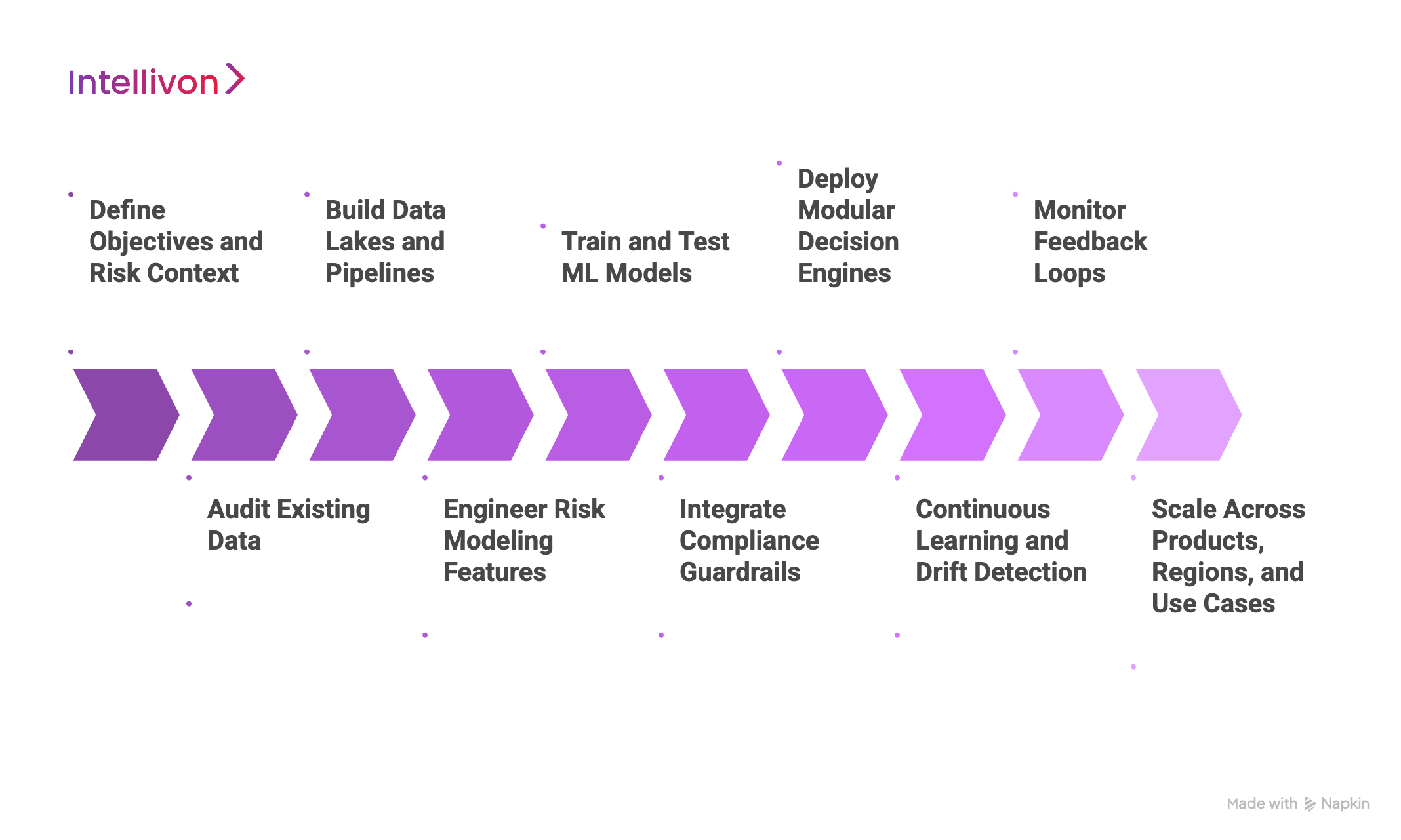

How We Develop Underwriting AI for InsureTech Enterprises Step-by-Step

At the enterprise level, success means operationalizing AI systems that scale across products, geographies, and compliance frameworks, while remaining explainable, accurate, and responsive to changing risks. Here’s a breakdown of how Intellivon approaches the development of underwriting AI in ten strategic steps:

Step 1: Define Objectives and Risk Context

The process begins with aligning the AI’s purpose with real business goals. Whether the aim is to reduce quote turnaround times, improve pricing precision, or automate low-risk cases, every model must map to a clearly defined underwriting objective. We collaborate with both business and actuarial teams to understand line-of-business-specific complexities, risk thresholds, and regulatory boundaries.

Step 2: Audit Existing Data

Before training begins, we perform a full-scale audit of the insurer’s data environment. This includes evaluating structured data from policy admin systems, unstructured broker documents, third-party APIs (e.g., credit, weather), and IoT/telematics streams. We assess for completeness, accuracy, privacy compliance, and relevance to underwriting logic. Any fragmented or siloed data is flagged for unification.

Step 3: Build Data Lakes and Pipelines

Once the audit is complete, we create robust pipelines to ingest and normalize multi-format data. This includes PDFs, loss runs, images, spreadsheets, and telemetry. The goal is to centralize everything into a queryable, schema-aligned data lake tailored for underwriting use cases. Metadata tagging, consent enforcement, and privacy-by-design architecture are implemented from day one.

Step 4: Engineer Risk Modeling Features

With data unified, we begin feature engineering. This involves crafting predictive variables from policy history, claims behavior, external risk indicators, and behavioral data. We enrich features using real-time feeds, for example, using wildfire zone risk overlays for property, or driving behavior scores for commercial auto. Privacy-preserving techniques like differential privacy and federated learning are also applied where needed.

Step 5: Train and Test ML Models

Now, the core risk scoring ML models are trained. We use historical data to train multiple candidate algorithms, typically gradient boosting, ensemble learning, and neural networks, to assess the risk of claim, the likelihood of loss, or the fraud potential. We simulate edge cases using synthetic data (for rare scenarios like pandemics or cyberattacks), and validate results using holdout datasets and performance metrics like AUC, loss ratios, and explainability confidence.

Step 6: Integrate Compliance Guardrails

AI in insurance must coexist with regulatory requirements and underwriting guidelines. We integrate rulesets to enforce compliance thresholds, such as automatically rejecting risks outside appetite or flagging high-risk assets for manual review. Explainable AI (XAI) techniques ensure that model decisions can be interpreted and justified, making audits smoother and reducing exposure to regulatory penalties.

Step 7: Deploy Modular Decision Engines

Once trained and validated, models are packaged into decision engines that slot seamlessly into underwriting workflows. These modules handle submission ingestion, risk scoring, pricing recommendations, and policy approvals, either fully automated or via human-in-the-loop interfaces. Integration with enterprise systems like CRM, PAS, or reinsurance platforms ensures continuity and interoperability.

Step 8: Continuous Learning and Drift Detection

Market conditions shift, and so must the AI. We embed model retraining triggers based on data drift, loss trends, or new regulations. Automated retraining pipelines pull in new claims and policy data, refresh the models, and redeploy them after validation. A/B testing environments allow side-by-side performance tracking of new vs. legacy logic before full rollout.

Step 9: Monitor Feedback Loops

Post-deployment, we track KPIs like quote-to-bind ratios, claim loss ratios, underwriting cycle times, and model confidence scores. Human underwriter feedback is also looped into the system to identify corner cases or false positives. This feedback directly informs periodic recalibration or fine-tuning of both features and thresholds.

Step 10: Scale Across Products, Regions, and Use Cases

Finally, a single underwriting AI engine can be expanded across business lines, like property, auto, specialty, and cyber, each with contextual adjustments. We also help clients localize models across regulatory environments and product variations. This step involves modularizing core models for reuse while layering on line-of-business logic, ensuring speed-to-market with governance intact.

This entire process, from data unification and feature engineering to continuous learning and global scalability, is how we’ve helped large insurers operationalize underwriting AI. Intellivon builds systems that learn, scale, and deliver measurable underwriting performance across time, geography, and complexity. Book a strategy call with Intellivon to get a robust and scalable AI underwriting solution developed for your enterprise.

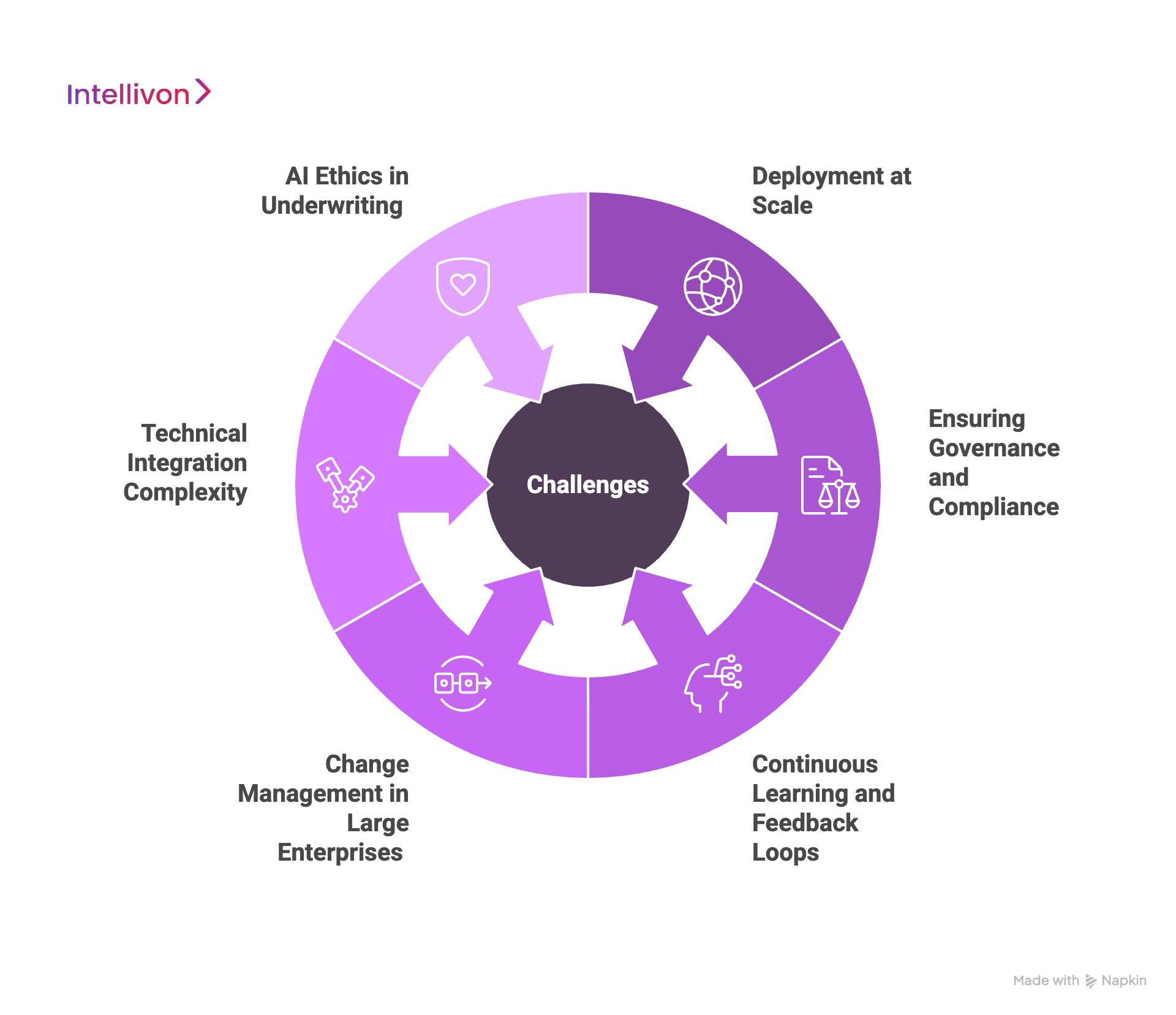

Overcoming Enterprise-scale Underwriting AI Challenges

Enterprise AI in insurance underwriting offers huge benefits, but scaling it comes with unique challenges. These include global system integration, compliance, culture shifts, and technical constraints. However, with a thoughtful, step-by-step strategy, insurers can move from pilot to full-scale deployment.

Here’s how insurers can address key AI underwriting challenges and how we’ve built proven solutions that work across large organizations.

1. Deployment at Scale

Insurance enterprises often operate across different geographies, business lines, and legacy platforms. Managing AI across this complexity can slow down rollout and cause inconsistencies in risk decisions.

Our Solution

We use a multi-tenant system architecture so that one core AI engine supports many teams. Local underwriting teams can still apply their own rules while sharing the same model foundation. Using an API-first design, our solutions integrate with core platforms like CRMs and policy systems, without disrupting existing workflows. This ensures quick and stable deployment across subsidiaries.

2. Ensuring Governance and Compliance

In insurance, every decision must stand up to regulatory review. If an AI model denies coverage or adjusts a price, supervisors need to understand why and verify that the decision followed all rules.

Our Solution

We build explainable AI into every system, using tools like SHAP values and rule-based overlays to make outputs traceable and clear. Audit logs track decisions and inputs for every transaction. When regulations change, insurers can update risk rules without retraining models from scratch. This keeps AI compliant, transparent, and regulator-friendly.

3. Continuous Learning and Feedback Loops

The insurance market changes fast. AI systems must learn from new data, detect shifts in risk, and adapt. Without this, models become outdated and can start making bad calls.

Our Solution

We use automated retraining pipelines that feed updated data into AI models. These include new claims, policy updates, and emerging risk patterns. A/B testing lets insurers compare updated models before going live. We also build in human feedback loops, so underwriters can flag decisions and improve model logic in real time.

4. Change Management in Large Enterprises

Even if the tech is solid, many insurers struggle with internal adoption. Some underwriters distrust AI, while some leaders hesitate to invest without clear ROI.

Our Solution

We provide custom training to show underwriters how AI supports, not replaces their expertise. Visual explainability tools build confidence in machine recommendations. For leadership, we show early wins, link metrics to revenue and efficiency, and run co-creation workshops to ensure AI aligns with company goals. Cultural adoption is key, and Intellivon helps drive it.

5. Technical Integration Complexity

Insurance systems are often old, complex, and not built for AI. Bringing in AI without breaking things or slowing systems down is a huge hurdle.

Our Solution

We create modular services that plug into existing systems through secure APIs. That means AI can run on top of legacy tools without major rebuilds. Data migration tools check for consistency and flag errors before launch. We also monitor performance with real-time dashboards to ensure speed and stability, even during high demand.

6. AI Ethics in Underwriting

Bias in AI is risky. If pricing or risk decisions unfairly target certain groups, insurers can lose trust, face lawsuits, or trigger audits.

Our Solution

We build models with bias detection from day one. That includes pre-screening training data, running fairness checks during testing, and reviewing outcomes after deployment. Our models follow ethical standards like fairness, transparency, and appealability. Customers and regulators can understand decisions and challenge them if needed.

Bringing AI to underwriting at the enterprise level requires scalable systems, compliance-ready designs, human trust, and continuous improvement. By addressing these six key challenges head-on, insurers can unlock the full power of AI in insurance and lead the industry into the future.

Conclusion

AI is transforming insurance underwriting from a manual, error-prone process into a fast, intelligent, and data-driven operation. From risk scoring and dynamic pricing to document automation and fraud detection, AI in insurance enables carriers to make smarter decisions at scale.

However, realizing these benefits requires more than just plugging in a model. It calls for robust data strategies, ethical design, explainable systems, and seamless integration with legacy platforms.

Challenges like compliance, organizational adoption, and technical complexity must be tackled with thoughtful planning and future-ready architecture. As underwriting becomes more dynamic and customer-focused, insurers who invest in scalable, responsible AI will lead the industry forward.

Those who delay risk falling behind in both efficiency and market competitiveness. The path to modern underwriting is clear, and AI is the engine that will drive the next era of intelligent insurance.

Ready to Modernize Insurance Underwriting with AI?

With over 11 years of enterprise AI expertise and more than 500 successful deployments globally, Intellivon is your trusted partner in building intelligent, scalable underwriting systems tailored for the insurance industry. From automating risk assessments to enabling real-time decision support, we help insurers move from fragmented workflows to precision-driven underwriting at scale.

What Sets Intellivon Apart

- Tailored AI Architecture: We design, build, and deploy underwriting AI systems that seamlessly integrate with your PAS, CRM, and data lakes.

- Insurance-Specific Intelligence: Our models are trained on millions of real-world insurance data points, incorporating IoT, claims, geospatial, and behavioral risk indicators for unmatched predictive power.

- Explainable and Compliant AI: Every decision is auditable, explainable, and regulator-ready, built with fairness, transparency, and dynamic policy governance.

- Enterprise Integration at Scale: Whether you operate in one region or twenty, our API-first systems support multi-product, multi-jurisdiction deployment with zero disruption.

- Human-Centric Adoption: We deliver full onboarding, underwriter training, and intuitive dashboards, ensuring trust, usability, and long-term ROI.

- Continuous Optimization: Post-deployment, we provide real-time feedback loops, retraining pipelines, and performance tuning so your underwriting AI evolves with your business and risk landscape.

Contact Intellivon for a comprehensive AI underwriting assessment. Our insurance AI consultants will deliver:

- Detailed audit of your underwriting workflows and data ecosystem

- AI readiness, model governance, and integration roadmap

- Use-case roadmap with ROI and compliance alignment

- Competitive benchmarking and future-state scalability plan

Book a strategy call with Intellivon today. Let’s build underwriting systems that are faster, smarter, and enterprise-ready, powered by AI, backed by trust.

FAQ’s

Q1. How is AI used in insurance underwriting?

A1. AI is used to automate risk assessments, extract data from applications, predict claim probabilities, and recommend personalized pricing. It speeds up decisions, improves accuracy, and reduces underwriting costs by processing vast data faster than human underwriters.

Q2. What are the benefits of AI for enterprise insurers?

A2. Enterprise insurers benefit from faster quote turnaround, reduced loss ratios, dynamic pricing, better fraud detection, and scalable underwriting across regions, all while staying compliant with regulatory standards.

Q3. Can AI underwriting systems explain their decisions?

A3. Yes. Modern underwriting AI uses explainable AI (XAI) techniques like SHAP or rule overlays, allowing underwriters and regulators to see why a decision was made, ensuring transparency and accountability.

Q4. How does AI handle unstructured insurance data?

A4. AI uses NLP, OCR, and large language models to extract, standardize, and process data from PDFs, broker emails, medical notes, and claims forms, making previously unusable data actionable.

Q5. Is AI underwriting compliant with insurance regulations?

A5. When built correctly, yes. AI underwriting systems can be designed to meet regulatory requirements by maintaining audit trails, enabling model interpretability, and updating dynamically to align with changing laws.