Building a real-time algorithmic trading system is a high-stakes financial decision. What starts as a conversation about code and architecture quickly shifts to questions about capital allocation, risk tolerance, and competitive advantage. The real costs aren’t always obvious upfront. This is because, beyond the initial development sprint, you are looking at ongoing expenses that include ultra-low-latency infrastructure, live market data subscriptions, regulatory overhead, and 24/7 operational support. For leadership teams, the critical question rests with “Which investments will actually move the needle, and where are we at risk of burning budget on things that don’t?”

At Intellivon, we’ve helped enterprises navigate exactly these kinds of decisions by building trading platforms that scale intelligently, stay compliant without bloat, and keep operating costs predictable over time. In this guide, we will break down the real cost drivers, flag the hidden expenses most people miss, and explain how we build these systems from the ground up.

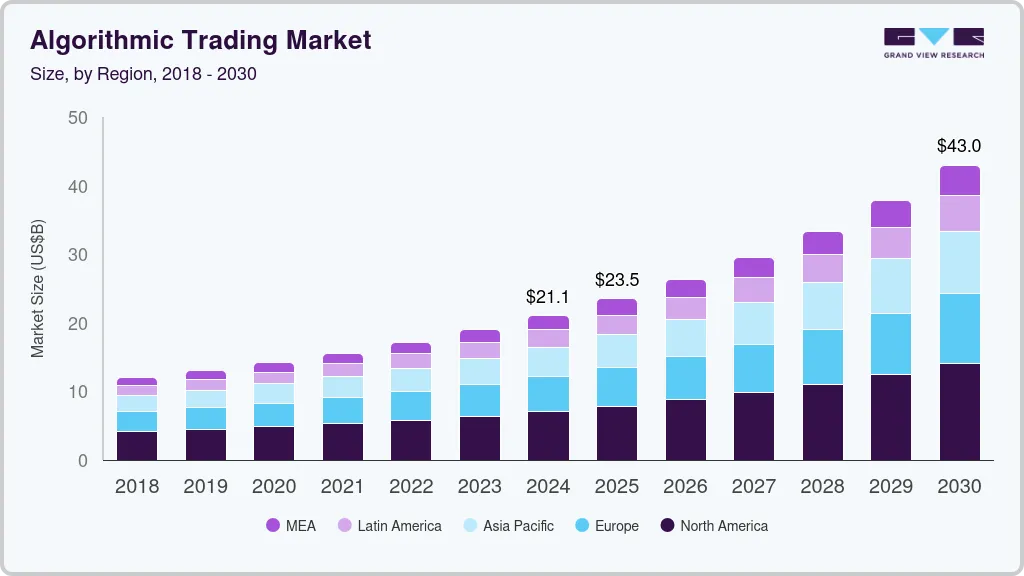

Key Takeaways of the Algorithmic Trading Market

The global algorithmic trading market was valued at USD 21.06 billion in 2024 and is projected to nearly double, reaching USD 42.99 billion by 2030 at a CAGR of 12.9%. This growth reflects how critical algorithmic systems have become for institutions seeking faster execution, deeper liquidity, and more competitive trading strategies.

- Algorithmic trading already accounts for over 60% of trading volume in major markets like the US and Europe.

- India saw 7.2 million trading app downloads in early 2024, up 47% year-over-year, showing retail adoption at scale.

- By 2027, cloud-based deployments are expected to make up 55% of implementations, enabling faster rollouts and lower costs.

- High-frequency algorithms now execute trades in milliseconds, exploiting inefficiencies that manual traders cannot capture.

- 80% of enterprises integrating AI and machine learning into strategies report improved accuracy and reduced risk.

- Compliance remains a rising cost, with audit expenses projected to grow 20% annually, increasing demand for automated, transparent reporting.

Enterprises that invest strategically in real-time trading infrastructure have seen ROI payback periods as short as 18–24 months. Faster execution, fewer errors, and compliance readiness turn these platforms into not just technology upgrades, but long-term profit engines.

What is a Real-Time Algorithmic Trading System?

A real-time algorithmic trading system is a platform that uses advanced algorithms to execute trades in milliseconds. It processes live market data, identifies opportunities, and places orders faster than any human trader could manage.

These systems are designed to make decisions automatically. Instead of relying on manual analysis, they apply pre-defined rules, statistical models, or machine learning to spot trading patterns and act instantly. For enterprises, the benefit lies in consistency, speed, and the ability to capture even the smallest market inefficiencies.

Core Capabilities

A real-time system typically includes:

- Market Data Ingestion: Capturing live price quotes, order book updates, and news feeds.

- Signal Generation: Algorithms that detect patterns and decide when to buy or sell.

- Order Execution: Direct connections to exchanges through protocols like FIX or native APIs.

- Risk Controls: Safeguards that enforce limits, stop trades, or flag anomalies.

- Monitoring Tools: Dashboards for P&L tracking, latency checks, and regulatory reporting.

Together, these capabilities create a trading engine that runs continuously, adapting to market shifts with precision. For leadership teams, the value comes from turning speed and automation into measurable financial performance.

How Does a Real-Time Algorithmic Trading System Work?

A real-time algorithmic trading system follows a structured flow. Each layer of the system plays a critical role in transforming raw market data into profitable trades. The process starts with information capture and ends with execution, monitoring, and continuous feedback.

1. Market Data Acquisition

The system begins by collecting live data feeds directly from exchanges. This includes prices, order book movements, and relevant news signals. Enterprises often pay for direct exchange feeds to cut latency, as even a few milliseconds can change profitability.

2. Signal Generation

Algorithms process incoming data to identify opportunities. Strategies may use statistical models, technical indicators, or AI-driven prediction models. Once a signal is detected, the system decides whether to buy, sell, or wait.

3. Order Execution and Management

The platform connects to exchanges through high-speed protocols like FIX or native APIs. Orders are routed instantly, with execution engines ensuring the lowest possible delay. Smart order routing and slicing techniques are used to minimize market impact.

4. Risk Management and Compliance

Built-in safeguards enforce exposure limits and prevent runaway trades. Kill switches, margin checks, and pre-trade controls ensure the system stays within compliance frameworks. This protects enterprises from costly fines and reputational risk.

5. Feedback and Monitoring

Finally, results are tracked in real time. Dashboards highlight profit and loss, latency performance, and exceptions. Continuous feedback loops allow strategies to adapt and improve without manual intervention.

The flow is simple, which involves capturing data, generating signals, executing orders, managing risk, and monitoring results. Each step builds on the last, ensuring trades happen quickly and safely. With this flow in mind, the next step is to look at the key features that make such a system enterprise-ready.

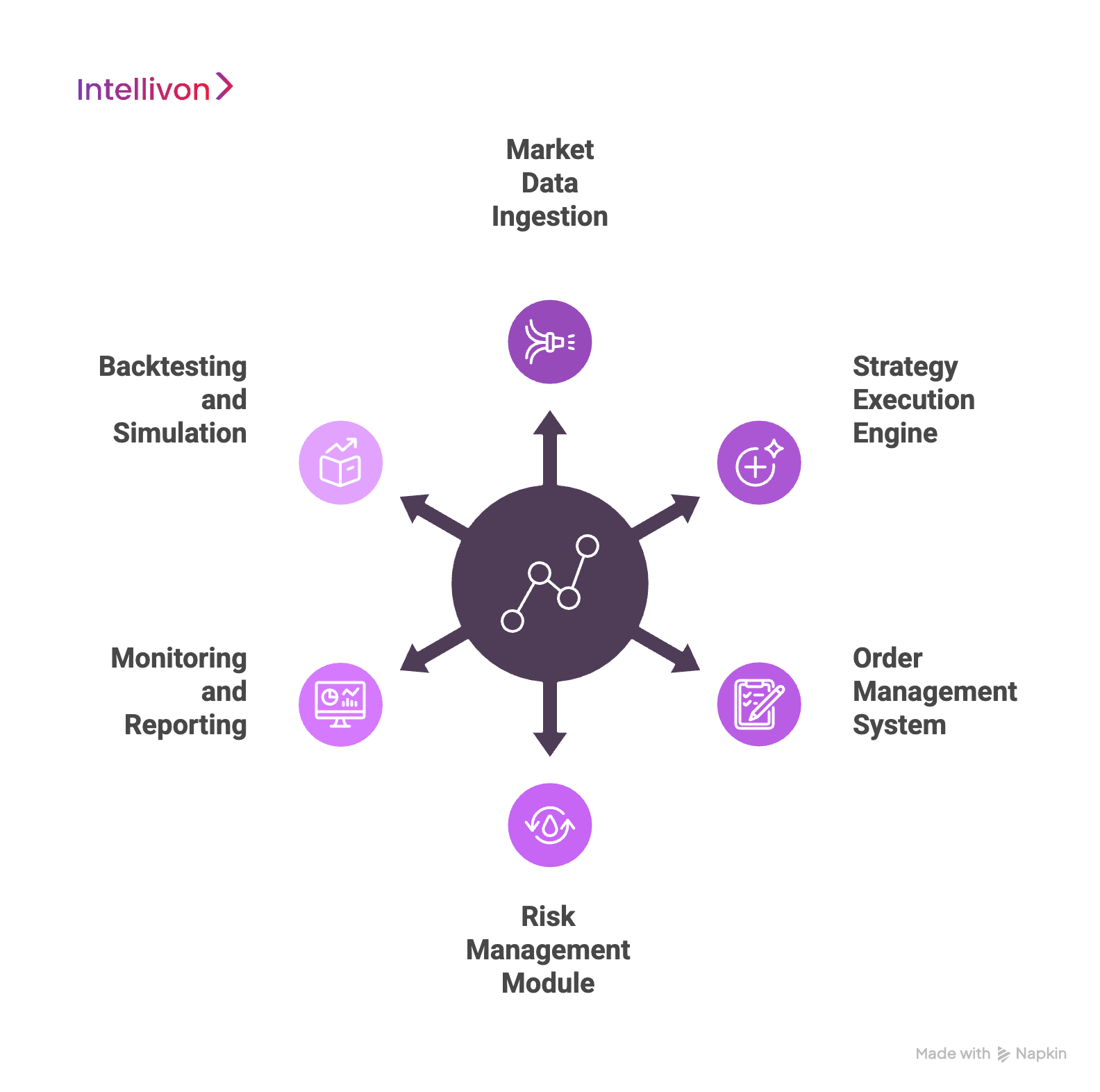

Key Features of a Real-Time Algorithmic Trading System

in sync to deliver precision, scale, and compliance. Each feature addresses a different enterprise need, from rapid execution to transparent reporting. Together, they determine both the cost to build and the ROI potential.

1. Market Data Ingestion

Every trading decision starts with data. The ingestion layer collects live price quotes, order book updates, and tick-by-tick movements from exchanges. Many enterprises pay for direct exchange feeds, which are faster but significantly more expensive than vendor data streams.

The system must also handle alternative sources, such as news sentiment or macroeconomic feeds, that influence trading signals. Robust ingestion prevents delays because even milliseconds of lag can erode profits.

2. Strategy Execution Engine

This is the decision-making brain of the platform, since it applies algorithms built on statistics, technical models, or machine learning. A well-architected engine ensures trades execute instantly when signals appear.

Enterprises often require the flexibility to run multiple strategies at once, like equities, FX, derivatives, or crypto, without slowing performance. Scalability here drives costs upward, but it also allows firms to spread fixed costs across larger trading volumes.

3. Order Management System (OMS)

The OMS organizes, routes, and tracks every order sent to exchanges. It manages order lifecycles, including submissions, cancellations, and modifications.

For enterprises, this system must integrate with FIX gateways or native APIs to guarantee compliance and low latency. A weak OMS increases slippage, missed fills, and operational errors. A robust OMS adds upfront development costs but protects against far more expensive losses over time.

4. Risk Management Module

Risk controls are non-negotiable, and for this reason, real-time checks enforce position limits, margin rules, and regulatory obligations. Kill switches must be in place to stop abnormal trading instantly.

Compliance teams often require detailed logs that can be presented to regulators. Enterprises spend heavily here, but the alternative is worse, which is multi-million-dollar losses, fines, or reputational damage. Strong risk engines transform costs into long-term insurance.

5. Monitoring and Reporting

Visibility matters for both executives and regulators. Dashboards show trades in progress, system health, and profit-and-loss updates in real time. Automated reports streamline compliance audits, which continue to rise in frequency and cost.

Transparent monitoring not only reduces operational risk but also builds trust with stakeholders who demand evidence of control.

6. Backtesting and Simulation Tools

Before deploying a strategy live, enterprises must test it against historical data. Backtesting tools simulate trades in past market conditions, helping teams measure profitability, slippage, and risk exposure.

Advanced simulation platforms can also stress-test strategies during rare but extreme events, such as flash crashes. While these tools add development expense, they save far more by preventing costly failures in live markets.

These features transform trading systems from experimental projects into institutional-grade platforms. Each carries its own cost implications, from data feeds to compliance modules.

Technical Architecture of Real-Time Algorithmic Trading Systems

The architecture of a real-time algorithmic trading system defines both performance and cost. A system that looks complete on paper often fails in practice because critical layers were underfunded or poorly integrated. Enterprises must view the platform as a stack of interdependent layers, each with its own cost drivers and ROI impact.

1. Infrastructure Layer

At the base is the physical and virtual infrastructure. Enterprises must choose between cloud-based deployments, which are cost-efficient and scalable, and co-location hosting, which offers the lowest possible latency.

High-frequency strategies often demand specialized servers, FPGA cards, and network interface cards optimized for microsecond execution. Infrastructure spend is one of the largest upfront investments, but it sets the ceiling for system performance.

2. Data Layer

Trading systems are only as strong as their data pipelines. The data layer ingests direct market feeds, vendor-supplied consolidated feeds, and alternative data such as sentiment or macroeconomic indicators.

Time-series databases like kdb+ or in-memory stores like Redis allow massive tick data processing without delay. Enterprises must budget not only for acquisition but also for long-term storage and redundancy.

3. Strategy Layer

The strategy engine translates data into trading signals. Quants and engineers build models using rule-based logic, statistical frameworks, or machine learning.

Core execution logic is often developed in C++ or Java for speed, while Python and R remain common for research. Backtesting and simulation environments sit in this layer, giving teams the ability to validate and stress-test strategies before going live.

4. Execution and Order Management Layer

The execution stack ensures trades reach the market quickly and efficiently. A Smart Order Router directs orders to the best venue, while the Order Management System (OMS) manages order lifecycles, like placement, modification, and cancellation.

Connectivity relies on FIX gateways or native APIs. Poorly designed execution introduces slippage and increases transaction costs, making this layer one of the most sensitive to both latency and compliance requirements.

5. Risk and Compliance Layer

Real-time risk management prevents catastrophic losses. Systems enforce position limits, margin rules, and stop-loss thresholds at the microsecond level. Pre-trade risk filters stop non-compliant orders before they reach the exchange.

Audit trails and logging functions ensure transparency for regulators, satisfying MiFID II, SEC, ESMA, or SEBI frameworks. This layer adds recurring costs but protects against fines and reputational damage.

6. Monitoring and Analytics Layer

Enterprises need visibility across every component. Dashboards display live P&L, latency metrics, and risk exposures. Log aggregation tools such as Splunk or the ELK stack consolidate system events for fast diagnosis.

Post-trade analytics help compliance and strategy teams evaluate execution quality. A strong monitoring layer not only lowers downtime but also accelerates decision-making during fast market moves.

This layered architecture turns trading code into a resilient enterprise platform. Each layer, from infrastructure to monitoring, adds both value and cost. With the architecture mapped, the next step is to analyze the specific cost factors that determine how much enterprises will spend to build and maintain these systems.

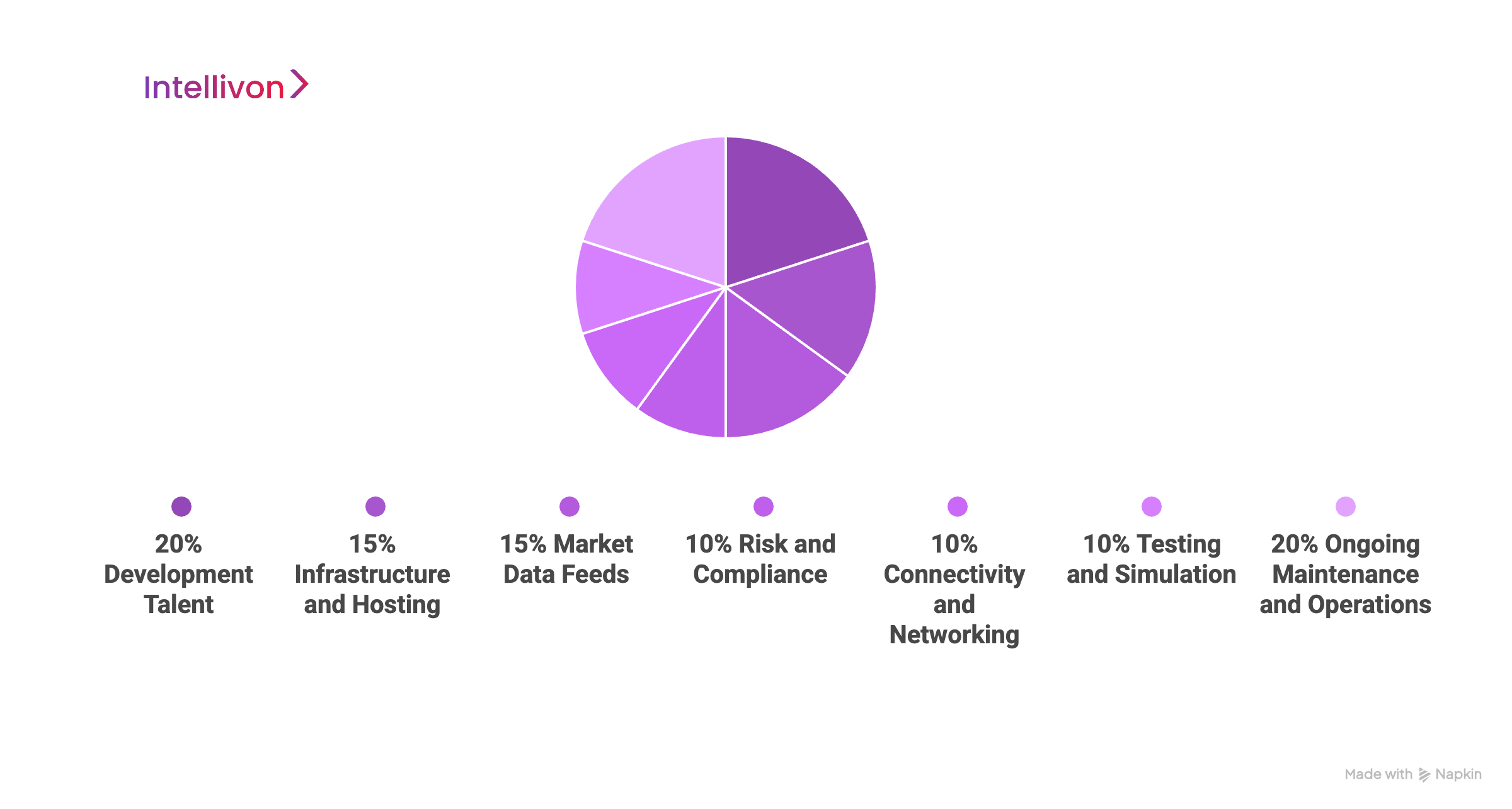

Factors Affecting the Cost of Building a Real-Time Trading System

The cost of building a trading system is never a single number. It depends on architecture choices, trading goals, and the scale of operations. Each cost driver contributes differently to the overall budget. Some are upfront investments, while others recur monthly or annually.

1. Infrastructure and Hosting

Servers, storage, and networking hardware form the backbone of the platform. Enterprises running high-frequency strategies must invest in co-location facilities near exchanges.

Co-lo racks, cross-connects, and ultra-low-latency NICs can add hundreds of thousands per year. Cloud-based infrastructure reduces upfront costs but creates recurring operating expenses. The trade-off is between performance and flexibility.

2. Market Data Feeds

Real-time data is one of the most expensive recurring costs. Direct exchange feeds ensure speed but can cost thousands per month per market. Vendor-consolidated feeds are cheaper but introduce latency.

Alternative data sources, like news sentiment, social feeds, or macroeconomic data, add extra subscription costs. Enterprises must balance the need for breadth with the need for speed.

3. Development Talent

Specialized talent drives a significant portion of the budget. Enterprises need quants, C++ or Java developers, Python engineers for research, and DevOps staff.

Salaries for experienced professionals often exceed $150k annually in global hubs. Offshore development teams reduce cost but may slow delivery. Retaining talent adds long-term expenses but protects against turnover risks.

4. Risk and Compliance

Compliance costs rise steadily each year. Pre-trade risk modules, audit trails, and regulatory reporting systems must be developed and maintained.

External audits, legal consultation, and certifications add further expenses. Skipping this layer can expose enterprises to fines or losses far greater than the cost of proper controls.

5. Connectivity and Networking

Exchanges charge for connectivity, including cross-connects and access fees. Some firms invest in microwave or laser networks to shave microseconds off latency.

These upgrades cost millions annually but matter in high-frequency environments. For mid-frequency traders, standard fiber connectivity is usually sufficient, keeping costs moderate.

6. Testing and Simulation Environments

Backtesting frameworks and simulation tools require robust data storage and computing resources.

Building environments that replicate live markets accurately is expensive, but it reduces costly errors in production. Many enterprises budget six figures annually for this layer alone.

7. Ongoing Maintenance and Operations

Even after launch, systems demand constant upkeep. Hardware upgrades, patching, bug fixes, and performance tuning create a recurring cost stream.

Support staff, monitoring tools, and scaling requirements push annual operations into the high six-figure range for institutional platforms.

Each of these cost drivers adds weight to the budget, but not all deliver equal returns. The challenge for enterprises is knowing which costs accelerate performance and which can be optimized. To make sense of the numbers, the next section explores detailed cost breakdowns and realistic ranges for different system types.

Cost of Building a Real-Time Algorithmic Trading System

At Intellivon, the goal is to help enterprises build trading platforms that are scalable, compliant, and cost-effective. Our pricing framework is flexible, aligned with growth goals and risk appetite, instead of forcing a rigid package. If early projections stretch beyond budget, scope is refined collaboratively, ensuring what matters most, which is enterprise-grade reliability, regulatory compliance, and uncompromising security, remains intact.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement mapping, trading goals, latency needs, risk appetite, and compliance readiness (SEC, MiFID II, SEBI) | $8,000 – $15,000 |

| Architecture & System Design | Blueprinting multi-layer architecture (data ingestion, strategy engine, OMS, risk, monitoring) | $12,000 – $20,000 |

| Market Data Integration | Direct exchange feeds, vendor feeds, order book data pipelines, and time-series databases | $15,000 – $30,000 |

| Strategy Engine Development | Signal generation logic, multi-asset strategy modules, backtesting environments, and simulation frameworks | $20,000 – $40,000 |

| Order Management & Execution Module | OMS with FIX/API integration, smart order routing, and latency-optimized execution logic | $18,000 – $35,000 |

| Risk & Compliance Framework | Real-time margin checks, kill switches, audit logs, and regulatory reporting workflows | $10,000 – $25,000 |

| Monitoring & Analytics Tools | Dashboards for P&L, latency, risk exposure, log aggregation, and post-trade analytics | $8,000 – $18,000 |

| Testing & Quality Assurance | Backtesting validation, live-simulation testing, compliance audits, and performance tuning | $10,000 – $20,000 |

| Deployment & Scaling | Cloud rollout or co-location setup, connectivity to exchanges, and monitoring dashboards | $8,000 – $15,000 |

Total Initial Investment Range: $120,000 – $250,000 (institutional-grade system)

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Data Subscriptions: Direct feeds can cost $5,000–$50,000 annually per exchange.

- Exchange Connectivity: Cross-connect fees, FIX gateway licenses, and co-location racks add recurring costs.

- Latency Upgrades: FPGA cards, specialized NICs, or microwave networks can exceed six figures yearly.

- Talent Churn: Losing a senior quant or C++ engineer can delay projects and increase costs.

- Compliance Audits: External audits and legal reviews are rising by ~20% annually.

- Infrastructure Growth: Storage for tick data grows rapidly, creating ongoing cloud or hardware costs.

Best Practices to Avoid Budget Overruns

From Intellivon’s experience delivering enterprise-grade trading systems, several practices keep projects on track:

- Start with Core Strategies: Launch with one or two validated strategies, then scale.

- Embed Compliance Early: Build audit trails, risk filters, and reporting frameworks from day one.

- Use Modular Components: Develop OMS and strategy modules that can be reused across asset classes.

- Balance Infra Spend: Match co-location or FPGA use to strategy needs to control costs.

- Automate Monitoring: Deploy observability tools early to prevent downtime and spot inefficiencies.

- Plan Continuous Optimization: Update models, engines, and compliance workflows to stay market-ready.

Request a tailored proposal from Intellivon’s enterprise fintech team, and you’ll receive a roadmap that fits your budget, enforces compliance, and accelerates ROI in real-time trading.

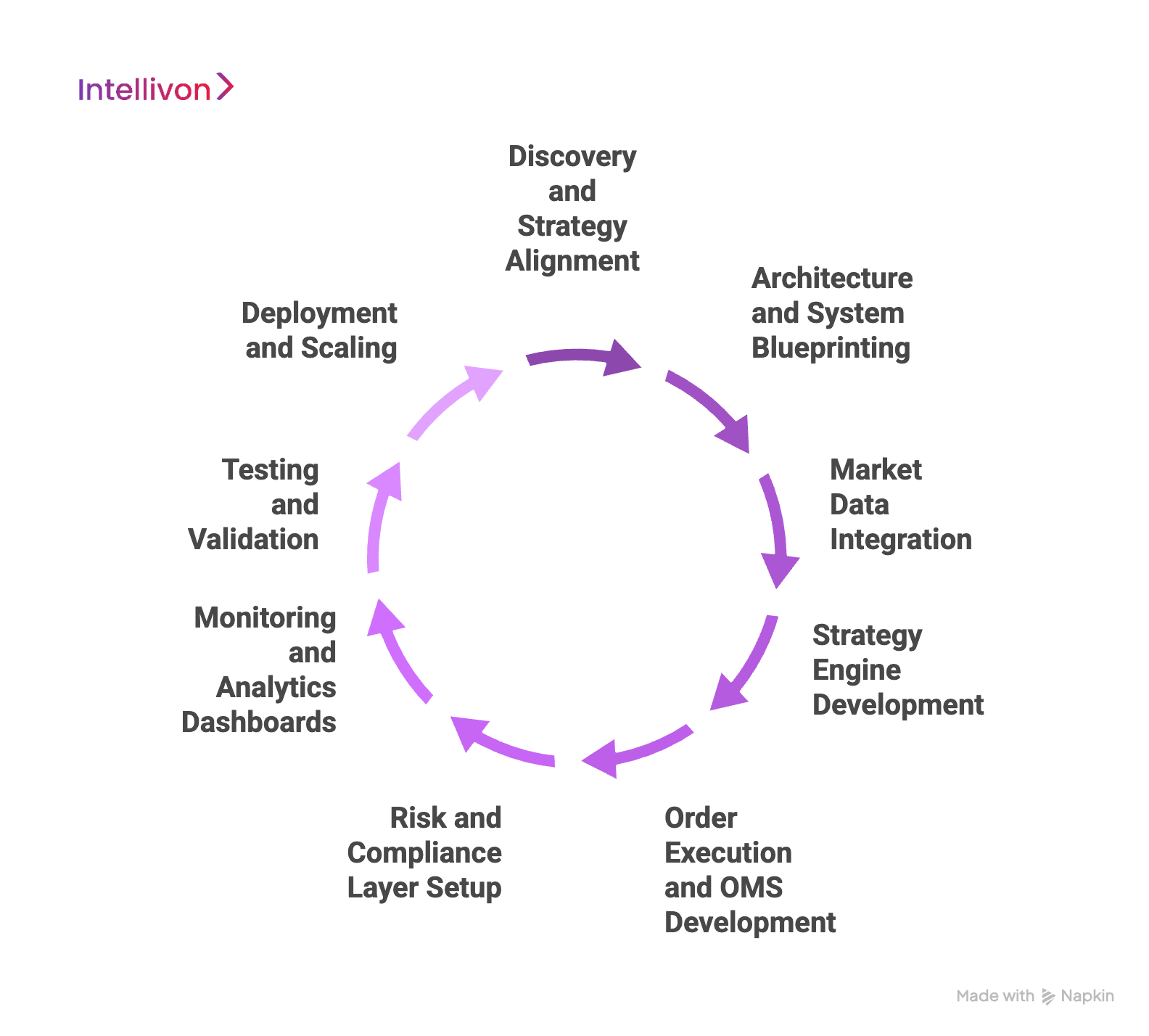

Step-by-Step Process to Build a Real-Time Algorithmic Trading System

Building a real-time algorithmic trading system is a structured journey. Each step requires alignment between business goals, technical capabilities, and compliance requirements. Enterprises that treat this as a piecemeal project often face delays, rework, or runaway costs. A phased approach ensures every layer is built with purpose.

1. Discovery and Strategy Alignment

The process begins with understanding the enterprise’s objectives. Teams define trading strategies, target markets, latency needs, and compliance obligations. At Intellivon, workshops with leadership and compliance officers help map KPIs and risk appetite before development starts.

2. Architecture and System Blueprinting

Once requirements are clear, a system blueprint is created. This covers infrastructure, data pipelines, execution modules, and monitoring frameworks. Intellivon’s architects design modular systems that scale across assets and support future upgrades without disruption.

3. Market Data Integration

Live data feeds are integrated into the platform. This includes direct exchange connections, vendor feeds, and alternative data sources. Our engineers ensure ingestion pipelines are resilient, latency-optimized, and compliant with exchange requirements.

4. Strategy Engine Development

Trading logic is built into the system. This may include rule-based strategies, statistical models, or AI-driven prediction engines. Intellivon helps enterprises validate strategies through backtesting and simulation environments before they are deployed live.

5. Order Execution and OMS Development

A robust Order Management System (OMS) routes trades with precision. Smart order routing, order slicing, and latency-sensitive execution are implemented. We build OMS modules that integrate seamlessly with FIX gateways or native APIs for direct exchange access.

6. Risk and Compliance Layer Setup

Risk controls and compliance checks are embedded from the start. This includes margin checks, kill switches, position limits, and audit trails. Intellivon ensures every platform is aligned with global frameworks such as MiFID II, SEC, ESMA, or SEBI.

7. Monitoring and Analytics Dashboards

Real-time dashboards and reporting tools provide visibility into performance, risk exposure, and latency metrics. Our experts deploy observability frameworks that alert teams to anomalies and enable faster decisions.

8. Testing and Validation

Before going live, the system undergoes rigorous testing. Backtesting, live simulations, and stress tests confirm reliability. Intellivon’s QA teams validate workflows end-to-end to prevent costly failures in production.

9. Deployment and Scaling

Finally, the system is deployed into production. This may involve cloud rollout or co-location setup, depending on strategy needs. We provide continuous optimization, ensuring the system scales with market demands and adapts to regulatory updates.

This step-by-step process transforms strategy ideas into enterprise-grade trading platforms. By embedding compliance, scalability, and monitoring at each stage, Intellivon helps enterprises launch systems that perform reliably in volatile markets.

Conclusion

Real-time algorithmic trading systems are strategic assets that define competitiveness in modern markets. Building one demands significant investment across infrastructure, data, risk management, and compliance. While costs vary, the real differentiator is how efficiently those resources are aligned to performance and ROI. Enterprises that approach development with clarity can achieve payback in under two years, turning cost into long-term advantage.

Yet, the complexity of integrating strategy, architecture, and regulation makes it risky to go alone. Partnering with a trusted solution provider ensures systems are not only fast and scalable, but also secure, compliant, and sustainable. That combination is what turns a trading platform into a lasting growth engine.

Build Your Real-Time Trading System with Intellivon

At Intellivon, we design enterprise-grade trading platforms that are secure, compliant, and built for scale. Our solutions unite low-latency architecture, AI-driven signal pipelines, and compliance-first controls to help enterprises launch, optimize, and govern real-time trading with confidence.

Why Partner With Intellivon?

- Tailored Trading Infrastructure: Architected around your strategies, asset classes, and risk limits for measurable performance.

- Regulatory Alignment: Designed to meet SEC, MiFID II, ESMA, and SEBI requirements with audit-ready reporting.

- Proven Enterprise Delivery: Years of building high-throughput, low-latency platforms that reduce slippage and improve fill quality.

- Resilient Security and Controls: Independent audits, pre-trade risk, kill switches, and full event-level observability.

- Performance Engineering: Co-location options, optimized OMS, FIX and native APIs, and latency tuning across the stack.

- Scalable Data and Connectivity: Direct feeds, vendor integrations, time-series storage, and API-driven workflows.

- ROI-Focused Roadmaps: Phased rollouts that tie investment to execution quality and payback targets.

Book a discovery call with Intellivon to explore a platform that strengthens execution, reduces risk, and delivers faster time to value.

FAQs

Q1. How much does it cost to build a real-time algorithmic trading system?

A1. The cost ranges from $50,000 for a basic system to $1 million+ for high-frequency platforms. The final budget depends on infrastructure, market data, compliance, and strategy complexity. Enterprises should also plan for 15–20% annual maintenance and optimization costs.

Q2. What are the biggest cost drivers in algorithmic trading system development?

A2. Key cost drivers include infrastructure (servers, co-location), market data feeds, specialized talent, compliance frameworks, and ongoing maintenance. These factors scale with the level of latency and asset coverage required. Regulatory audits and talent retention are often overlooked but add significant recurring expenses.

3. How long does it take to build an enterprise-grade algorithmic trading platform?

A3. Development typically takes 4–9 months, depending on scope. Basic builds are faster, while institutional or HFT systems require longer due to testing, compliance, and infrastructure setup. Enterprises often extend timelines to validate strategies through backtesting before going live.

4. What is the ROI of investing in an algorithmic trading system?

A4. Enterprises often see ROI within 18–24 months. Gains come from improved execution speed, reduced slippage, and scaling strategies without additional human traders. Firms operating in high-frequency environments can shorten this payback window if infrastructure and strategy edge are strong.

5. Should enterprises build algorithmic trading systems in-house or partner with a provider?

A5. Building in-house offers control but requires heavy investment in talent and infrastructure. Partnering with a provider accelerates delivery, embeds compliance, and reduces long-term risk. Many enterprises adopt a hybrid approach, building strategy logic internally while outsourcing infrastructure and compliance layers.