Real estate has been an attractive asset class, but investing in it has always been complex. High entry barriers, limited liquidity, and endless paperwork make it difficult for enterprises to quickly attract global investors. By the time many firms realize they are losing opportunities, whether from slow settlement cycles, compliance delays, or restricted access to cross-border capital, the investment window has already closed.

Stake has proven that tokenization can change this story. By fractionalizing property ownership, automating compliance, and opening global participation, Stake has become one of the fastest-growing platforms in real estate tokenization. For enterprises, its success signals how technology can unlock investor confidence and new revenue streams.

At Intellivon, we build enterprise-grade tokenized real estate platforms that cut through legal, financial, and operational complexity. In this blog, we’ll break down what makes Stake successful, explore monetization models, and show how we develop such platforms from the ground up.

Real-Estate Tokenization Market Size & Enterprise ROI

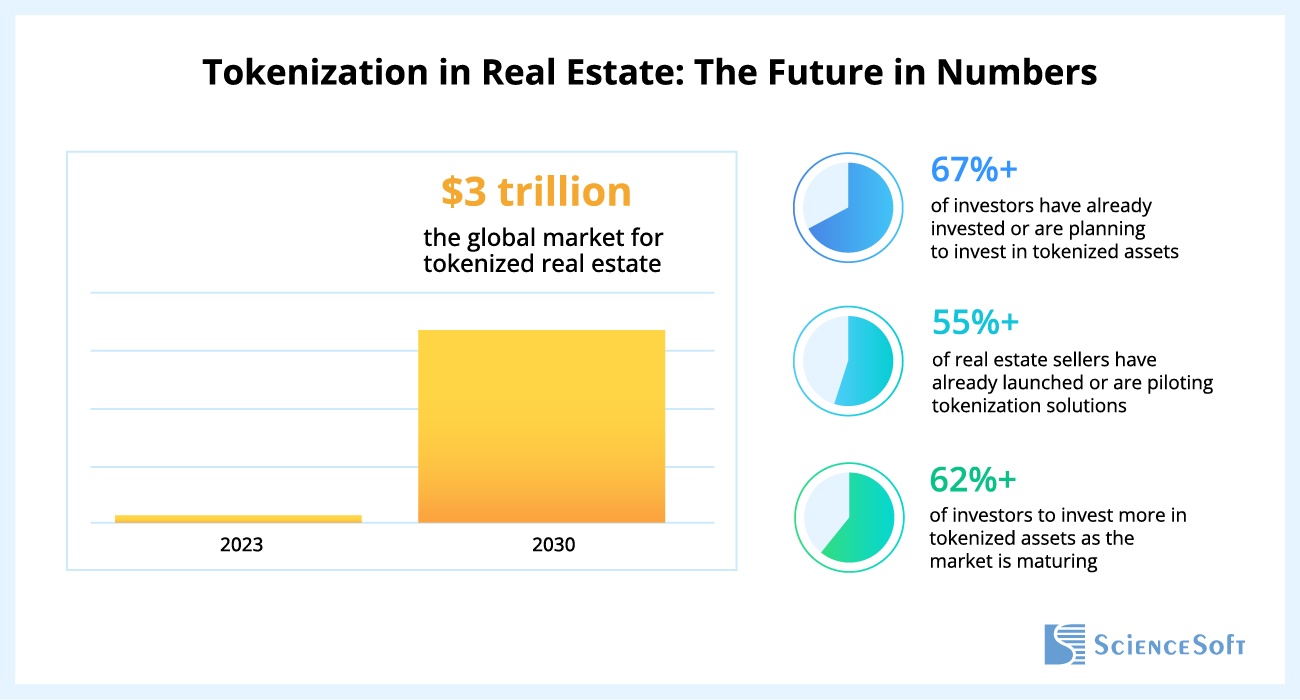

The global tokenized real-estate market is accelerating toward mainstream adoption and is set to reshape the $280 trillion real-estate asset class. Analysts project it will reach $3 trillion by 2030, representing over 1% of global real-estate AUM.

Key Takeaways

- As of 2025, about 12% of firms have launched tokenization initiatives, while another 46% are piloting platforms, showing a clear shift toward digital investment infrastructure.

- This rapid adoption is being driven by an estimated 85% CAGR from 2023 to 2030, powered by improving regulatory clarity and growing institutional demand for alternative, compliant investment vehicles.

- Fractional Ownership Uptake: Over 60% of fractional-property investors are under 40, expanding reach to younger wealth segments.

- Institutional Interest: 56% of institutional investors now rank real estate as the top real-world asset for tokenization.

- Global Reach: Platforms report investors from 45+ countries, reducing geographic barriers by 70%.

- Secondary Market Volume: Liquidity pools exceed $25 million daily, with volumes up 230% year-over-year.

- Time-to-Liquidity: Tokenized assets reach liquidity in 48 hours, versus months in private placements.

- Compliance Cost Reduction: Smart contracts cut compliance expenses by up to 90% (BlocHome case).

- Operational Savings: Custody integration saves 40% annually in IT and security operations.

- Settlement Efficiency: On-chain settlement reduces transaction fees by 75%.

- Payback Period: Typical platform CAPEX (~$500K) pays back in 12–18 months.

- Revenue Growth: Enterprises report 20–30% incremental revenue uplift in Year 1.

- TCO Reduction: Ownership costs drop 30% compared to legacy compliance and trading systems.

- Case Studies: BlocHome cut compliance costs by 90% and onboarded 800 investors in Month 1; Elevated Returns tokenized $1B in Southeast Asia; RealT averaged 231 investors per property.

By 2030, tokenized real estate will be a multi-trillion-dollar market. Enterprises that invest now can unlock liquidity, cut costs by up to 90%, and access global capital, thereby driving revenue growth of 20–30% and achieving payback within 18 months. This makes the case clear for adopting Intellivon’s enterprise-grade tokenization solutions.

What Is Stake?

Stake is a digital real estate investment platform that has shown how tokenization can transform property ownership. By converting real estate into fractionalized, blockchain-backed shares, it creates accessible investment opportunities while reducing the friction of traditional transactions.

For enterprises, Stake is a proof point that real estate tokenization can attract global investors, embed compliance, and create new liquidity streams in a sector long defined by slow settlements and rigid structures.

Key Features of Stake’s Real Estate Platform

- Fractional Ownership Model: Converts properties into digital shares, enabling enterprises to broaden capital inflows without requiring full-asset sales.

- Integrated Compliance: Automated KYC and AML frameworks help organizations meet regulatory requirements across multiple jurisdictions seamlessly.

- Global Investor Accessibility: Digital-first onboarding allows enterprises to open property markets to international participants.

- Automated Dividend Distribution: Smart contracts handle rental income and appreciation payouts, reducing manual overhead and risk of errors.

- Enterprise-Grade Interfaces: Dashboards and mobile platforms offer transparent reporting and governance tools that scale to institutional portfolios.

What Makes Stake Stand Out

Stake’s traction shows how tokenization unlocks real estate liquidity and modernizes investor access. Its hybrid design, which blends blockchain infrastructure with regulated property management, has created a trusted pathway for wider adoption.

For enterprises, this model highlights clear opportunities:

- Modernizing REITs: Transitioning legacy trusts into digital, tokenized structures to expand participation.

- Cross-Border Property Investment: Simplifying global capital inflows without adding layers of intermediaries.

- Institutional Asset Management: Delivering transparent governance, reporting, and liquidity options for large portfolios.

- Sustainable Financing: Tokenizing green projects and ESG-linked properties to attract impact-driven investors.

Stake proves that tokenization is viable. But to serve enterprises, platforms must evolve further, thereby embedding compliance, enabling large-scale integrations, and supporting global scalability. That is where Intellivon builds upon what Stake started, incorporating compliance, interoperability, and governance into the platform from day one. We will look into more details on this topic in the upcoming sections.

How Stake Works As A Tokenized Real Estate Platform

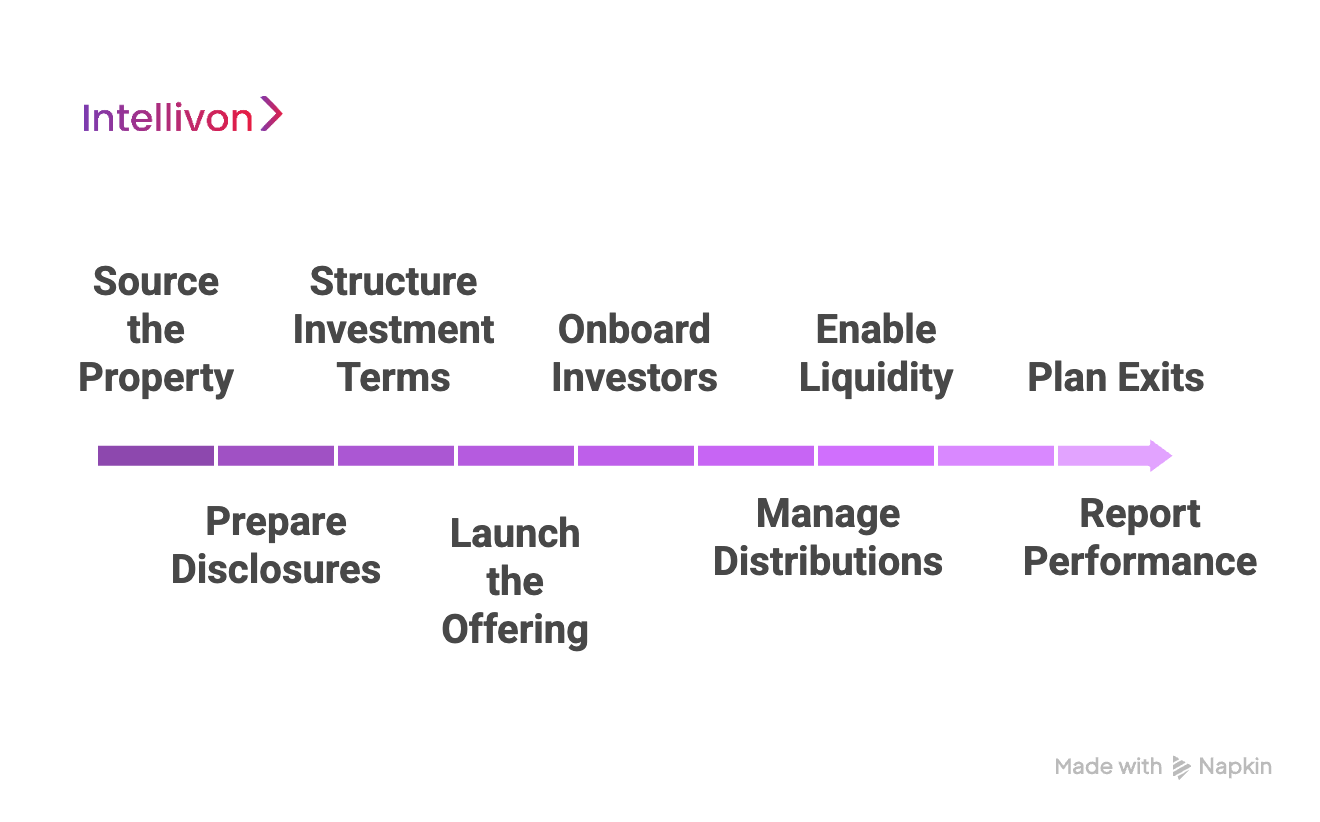

Understanding how Stake operates provides a clear baseline before designing an enterprise version. Its process takes investors from property selection through compliance, income distribution, and eventual exit, all within a secure digital framework. Below is a step-by-step walkthrough of the journey.

1. Source the Property

The process begins with selecting a property that has well-defined yield expectations and risk assumptions. A Special Purpose Vehicle (SPV) is created to legally hold the property title. This wrapper defines investor rights, distribution rules, and exit conditions. All supporting documents, from valuation reports to legal contracts, are stored in a secure data room for review.

2. Prepare Disclosures

Before the property can be offered, full disclosures are prepared. Financial data, lease agreements, and insurance details undergo validation. Compliance checks ensure nothing is overlooked. These verified records then form the property’s “golden record”, which is a structured digital file that powers listings, investor presentations, and ongoing reporting across the platform.

3. Structure Investment Terms

Once the SPV is established, its equity is split into units or shares. Pricing is defined, along with minimum ticket sizes and allocation rules. At this stage, investors can see expected yields, fees, and timelines. Clear visibility allows them to make informed decisions before committing capital.

4. Launch the Offering

With terms in place, the property is listed as an offering. Investors subscribe through a guided process, moving funds into escrow until the raise is complete. Once the funding target is achieved, the SPV updates its ownership register to reflect the confirmed investor base. This creates a legally binding record of ownership that matches the digital ledger.

5. Onboard Investors

Participation requires identity and suitability checks. KYC and AML procedures are run through approved providers, ensuring that only verified investors gain access. Permissions are applied based on jurisdiction, investor category, and risk profile. This approach minimizes regulatory risk while keeping the process efficient.

6. Manage Distributions

The property is then managed through the SPV, which collects income such as rent. Operating expenses are deducted, and net proceeds are distributed to investors on a defined schedule. Each payout is recorded in the system, ensuring both accuracy and transparency. Investors can track income without waiting for manual updates.

7. Enable Liquidity

To address real estate’s biggest drawback, which is illiquidity, Stake provides scheduled liquidity windows. During these events, investors can sell their units to others within the platform. All transfers follow disclosure requirements and compliance rules. The SPV’s cap table and the blockchain ledger update automatically, keeping ownership records synchronized.

8. Report Performance

Performance reporting is continuous rather than periodic. Investors access dashboards showing occupancy, income, and valuations in real time. The platform also generates statements, tax packs, and compliance notices. Governance actions such as voting, buybacks, or refinancing are managed through structured digital workflows.

9. Plan Exits

Finally, when a maturity date or trigger event occurs, the SPV exits the property. Proceeds are used to settle obligations, and net returns are distributed to investors. Capital can then flow into new offerings, with the same structured process repeated for each property cycle.

This flow illustrates how Stake simplifies property selection, investor onboarding, distributions, and exits within a digital-first framework.

Key Features of a Tokenized Real Estate Platform Like Stake

Stake has demonstrated that fractional ownership, automated compliance, and accessible digital interfaces can make real estate more liquid and attractive to investors. For enterprises, however, the task is broader. They need to replicate these proven capabilities while extending them with the security, governance, and scalability that institutional markets demand.

Below are the ten features that define an enterprise-grade tokenized real estate platform inspired by Stake’s success.

1. Legal Wrappers and Asset Structuring

Every tokenized property must begin with a solid legal foundation. Stake achieves this through SPVs, which translate tokens into enforceable rights backed by corporate structures.

Enterprises adopting this approach can extend it with REITs or fund-level wrappers, ensuring compliance across jurisdictions while reducing disputes and providing a strong governance backbone.

2. Fractional Ownership Engine

Fractionalization makes high-value assets accessible to a wider pool of investors. Stake showed how breaking properties into affordable units drives adoption.

Enterprises must take this further by aligning tokenization with standards like ERC-3643 or ERC-1400, embedding rules for transfer restrictions, voting rights, and whitelisting. This ensures tokens remain auditable, transferable, and legally defensible in every market.

3. Compliance-First Onboarding

Trust in tokenized real estate begins with compliance. Stake simplifies KYC and AML checks without burdening the investor. Enterprises, however, must support multi-jurisdictional verification and investor categorization while plugging into digital identity frameworks.

This not only accelerates onboarding but also ensures regulatory adherence in regions as diverse as the U.S., EU, and the Middle East.

4. Institutional-Grade Custody

Investor confidence requires secure custody of both digital tokens and fiat funds. Stake separates investor assets via SPVs, but enterprises need stronger controls.

Custody solutions should include institutional-grade providers, multi-sig wallets, and recovery protocols that align with enterprise risk frameworks. This ensures investor assets remain safe even in complex multi-party operations.

5. Secondary Market Liquidity

Illiquidity is the biggest barrier to traditional real estate. Stake addresses this with structured exit windows for investors. Enterprises can build on this by introducing regulated secondary marketplaces where tokens can trade within compliance guardrails.

Such liquidity mechanisms not only attract investors but also increase valuations, since assets become more dynamic and tradable.

6. Automated Income and Corporate Actions

Investors expect real returns, not paperwork. Stake distributes rental income through its platform, ensuring timely payouts. Enterprises should expand this automation to cover the entire lifecycle, such as dividends, tax withholding, governance votes, refinancing, or asset disposal.

Smart contracts and rule-based engines reduce administrative overhead and minimize errors, while creating trust through consistency.

7. ERP, CRM, and Banking Integration

Real estate tokenization must coexist with enterprise operations. Stake demonstrates simple investor interfaces, but enterprises require seamless API integration with ERP systems for finance, CRM platforms for investor relations, and banking/payment gateways for fund flows.

These integrations prevent tokenization from becoming a siloed initiative and instead weave it into enterprise workflows.

8. Transparent Dashboards and Reporting

Transparency is a cornerstone of Stake’s appeal, with dashboards that track yields and distributions. Enterprises need dashboards that extend beyond investor views to include audit trails, compliance monitoring, and tax-ready reports.

Exportable statements, regulator portals, and trustee access create an environment where transparency is the foundation of trust.

9. Scalable Security Architecture

Tokenized real estate platforms hold sensitive data and high-value assets, making them prime targets. Stake ensures investor protection through regulatory oversight, but enterprises must enforce layered security. This includes encryption, fraud monitoring, penetration testing, and incident response protocols.

A security-first architecture reassures investors and regulators that tokenized assets are protected at scale.

10. Multi-Jurisdictional Compliance Modules

Global investors mean global rules. Stake focuses on markets like the UAE and Saudi Arabia under the DFSA and CMA frameworks. Enterprises must design compliance engines that cover multiple regions simultaneously, from SEC exemptions in the U.S. to MiFID II in Europe.

Built-in rule sets and automated restrictions ensure every transfer stays within legal boundaries, reducing risk and enabling international growth.

Stake has already proven that fractional ownership and automated compliance resonate with investors. By extending these features with deeper compliance, stronger custody, and system-wide integrations, enterprises can transform tokenization into a cornerstone of their real estate strategy.

Architecture of a Tokenized Real Estate Platform Like Stake

To replicate a platform like Stake at enterprise scale, technology and governance must be tightly interwoven. Below is a layered view of how a tokenized real estate platform should be designed when modeled on Stake but adapted for institutional demands.

1. Presentation Layer

This is the interface investors and administrators interact with. Stake’s mobile-first dashboards show the power of clarity and ease of use. For enterprises, this layer must extend to include investor portals, admin consoles, and regulator dashboards. Features like customizable views, multilingual support, and secure authentication ensure accessibility without compromising control.

2. Application Layer

Here sits the core business logic. It includes token issuance engines, smart contract workflows, compliance modules, and automated distribution systems. Inspired by Stake’s proven model, this layer must also manage subscription workflows, investor communication, and corporate actions such as voting or refinancing. The goal is to align the digital representation of property with its real-world legal and financial operations.

3. Integration Layer

A true enterprise platform cannot exist in isolation. The integration layer connects tokenized assets with ERP systems for finance, CRM systems for investor relations, custodians for fund management, and banks for fiat settlement. APIs also allow linkage with payment rails, audit platforms, and reporting tools, ensuring tokenization fits smoothly into the enterprise’s broader ecosystem.

4. Blockchain Layer

At the foundation, blockchain ensures transparency, security, and immutability. Stake’s approach demonstrates how digital ownership can build trust. For enterprises, this layer must support token standards like ERC-3643 or ERC-1400, and allow for permissioned or hybrid networks depending on regulatory requirements. It anchors the authenticity of ownership records and trading activity.

5. Compliance and Governance Layer

This is the architecture’s “guardrail.” It embeds regulatory frameworks, jurisdictional restrictions, investor whitelists, and transfer policies directly into the system. Automated compliance reduces the risk of manual oversight while providing regulators with real-time visibility into transactions and investor profiles.

6. Security Layer

Enterprises must anticipate threats that go beyond basic encryption. A dedicated security layer enforces multi-factor authentication, key management, fraud detection, penetration testing, and continuous monitoring. Policy-based access ensures that sensitive actions, like corporate votes or large transfers, are safeguarded by governance protocols.

This architecture illustrates how a Stake-like real estate tokenization platform becomes enterprise-ready when compliance, security, and integrations are built in. Intellivon develops these systems to help organizations expand investor access, meet regulatory standards, and scale portfolios with confidence. In the next section, we’ll outline the step-by-step process for developing such a platform.

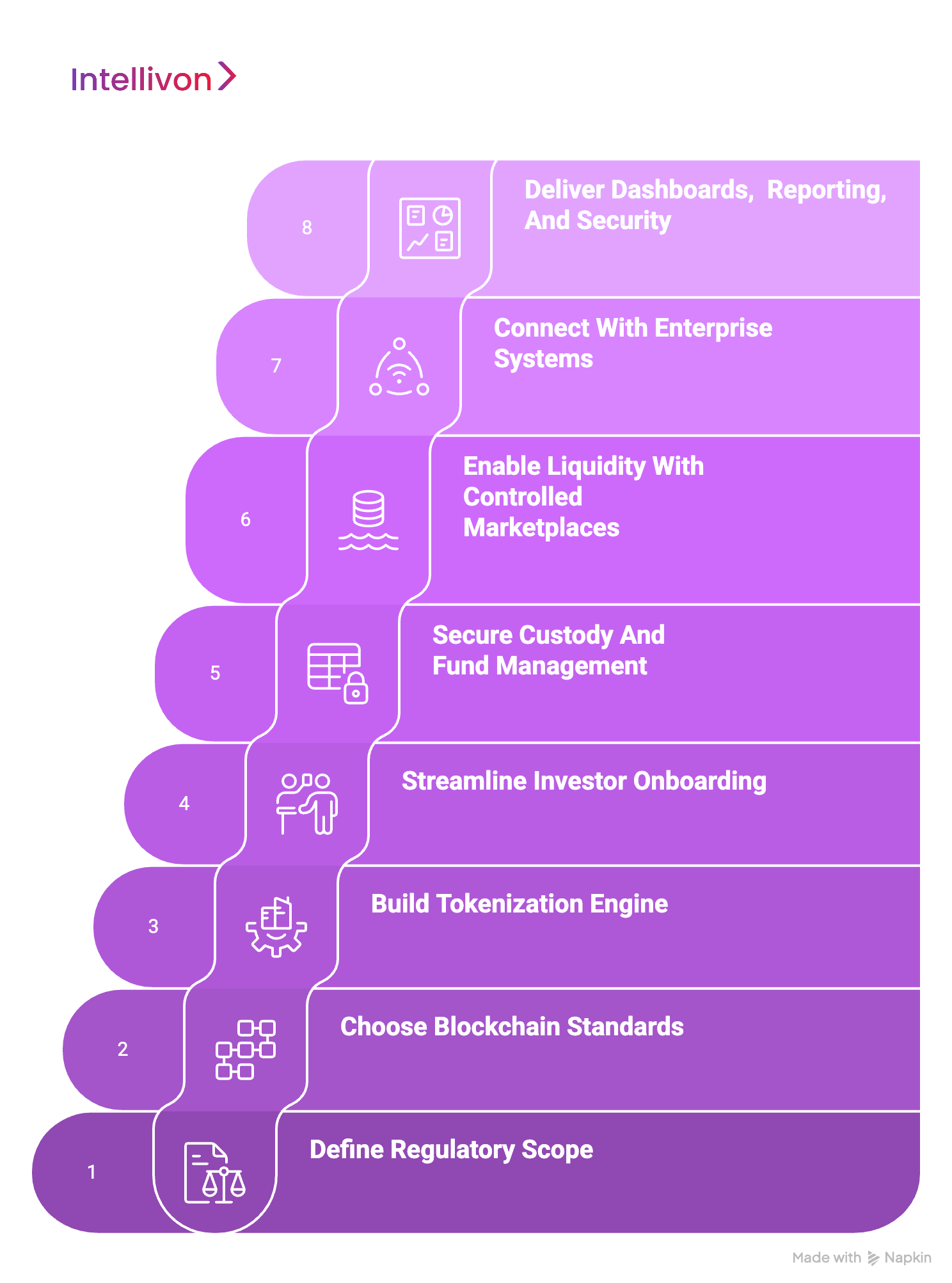

How We Develop Tokenized Real Estate Platforms Like Stake

Building a Stake-like platform for enterprises is not just about writing smart contracts or launching a marketplace. It requires a structured journey where regulation, technology, and business goals move in lockstep. At Intellivon, we guide enterprises through a clear process that ensures every layer, like legal, financial, and technical, is designed for trust and long-term scale.

Step 1: Define Regulatory Scope

Every successful platform begins with structure. Real estate assets are placed inside SPVs, REITs, or fund vehicles, giving tokens a legal backbone that courts and regulators recognize.

This step protects investors by making sure their digital shares are tied to enforceable ownership. It also gives enterprises flexibility to operate in multiple jurisdictions while reducing regulatory risks early in the process.

Step 2: Choose Blockchain Standards

Once the legal wrapper is clear, the next decision is technological. We help enterprises select blockchain frameworks and token standards such as ERC-3643 or ERC-1400.

These standards encode compliance rules, such as investor eligibility, jurisdictional limits, and transfer restrictions, directly into the tokens. By embedding compliance into the design, the platform avoids costly retrofits and builds regulator confidence from the start.

Step 3: Build Tokenization Engine

With standards set, we design the system that converts property shares into digital tokens. This engine automates everything from pricing and allocation to ownership tracking.

Investors can see how much of a property they own in real time, while enterprises gain a clear, auditable ledger of every transaction. It transforms what used to be slow, paper-heavy work into a transparent and efficient process.

Step 4: Streamline Investor Onboarding

Investor participation only grows when the onboarding process is simple and secure. We integrate KYC, AML, and digital identity verification into a guided workflow that makes entry smooth for qualified investors.

Enterprises benefit because approvals happen faster, while regulators can trust that every participant has been screened. This balance of usability and compliance is what makes platforms sustainable at scale.

Step 5: Secure custody and fund management

Custody is where trust is won or lost. We configure workflows that safeguard both fiat funds and digital tokens through institutional-grade custodians or policy-driven wallets.

Features like multi-signature access, recovery protocols, and segregated accounts reassure investors that their assets are protected. For enterprises, this reduces liability and strengthens governance across every deal.

Step 6: Enable liquidity with controlled marketplaces

Liquidity is what makes tokenized real estate attractive compared to traditional structures. We design mechanisms that allow investors to trade their holdings through scheduled exit windows or regulated secondary marketplaces.

Every transfer respects compliance rules, ensuring transparency without opening the system to misuse. For enterprises, these liquidity features unlock new investor bases and improve the perceived value of their portfolios.

Step 7: Connect with enterprise systems

A tokenized platform must integrate into existing operations. That’s why we connect it with ERP systems for accounting, CRM platforms for investor relations, and banking rails for payments.

These integrations reduce duplicate work, make reporting easier, and allow tokenization to become part of an enterprise’s daily workflow rather than a separate experiment.

Step 8: Deliver dashboards, reporting, and security

The final layer is visibility and protection. We build dashboards that show investors their income, valuations, and holdings, while administrators can monitor compliance and regulators can access audit trails.

Automated reports, tax packs, and voting modules ensure every stakeholder has what they need. Surrounding it all is a security framework with encryption, real-time monitoring, and fraud detection, giving enterprises confidence that the system can withstand operational and cyber risks.

By following this roadmap, enterprises can see exactly how a Stake-like platform is built from the ground up. With Intellivon leading development, tokenized real estate shifts from being an emerging concept into a proven growth strategy.

Cost to Build a Tokenized Real-Estate Platform

At Intellivon, we know enterprises need tokenization platforms that are powerful yet sustainable to build and operate. That’s why our pricing framework is flexible, aligning with your compliance obligations, investor needs, and scaling ambitions, rather than forcing you into a one-size-fits-all model.

If early estimates stretch your budget, we collaborate with your teams to refine the scope while keeping the core value intact. Investor trust, compliance enforcement, and operational resilience remain non-negotiable, even when adjustments are made to timelines or features.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, legal structuring (SPVs/REITs), compliance mapping (SEC, DFSA, MiFID II), and ROI modeling. | $6,000 – $10,000 |

| Architecture & Design | Layered blueprinting across presentation, blockchain, custody, compliance, and security modules with integration mapping. | $7,000 – $12,000 |

| Core Tokenization Engine | Development of token issuance, share fractionalization, ownership ledger, and transfer restriction rules. | $10,000 – $18,000 |

| Investor Onboarding & Compliance | KYC/AML integrations, digital identity workflows, investor categorization, and jurisdictional rule enforcement. | $8,000 – $15,000 |

| Marketplace & Liquidity Layer | Building controlled exit windows, secondary trading modules, and whitelisted transfer workflows. | $8,000 – $14,000 |

| Custody & Fund Management | Wallet management, multi-sig access, institutional custody connections, and secure fiat/token reconciliation. | $6,000 – $12,000 |

| ERP/CRM & Banking Integration | APIs to connect with enterprise ERP, CRM, payments, and financial systems for seamless operations. | $5,000 – $10,000 |

| Security & Compliance Framework | Encryption, continuous monitoring, fraud detection, penetration testing, and regulator dashboards. | $6,000 – $10,000 |

| Testing & Quality Assurance | Scenario-based testing, stress/load simulation, compliance checks, and audit validation. | $4,000 – $8,000 |

| Deployment & Scaling | Cloud rollout, regional hosting, monitoring dashboards, and operational embedding across geographies. | $4,000 – $8,000 |

Total Initial Investment Range: $50,000 – $100,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

Even with a defined roadmap, certain costs surface later in the lifecycle:

- Integration Complexity: Legacy ERP and CRM systems often require custom middleware to sync with tokenization workflows.

- Regulatory Overhead: Continuous monitoring and reporting for SEC, GDPR, or regional regulators add recurring costs.

- Investor Education: Platforms require onboarding and training programs so investors understand digital ownership models.

- Data Normalization: Preparing property, valuation, and compliance data for digital workflows takes effort.

- Cloud & Custody Fees: Hosting, custody arrangements, and blockchain API usage can increase recurring expenses

- Change Management: Structured adoption programs for internal teams and compliance officers are vital.

Best Practices to Avoid Budget Overruns

From our enterprise deployments, these practices consistently reduce costs and increase ROI:

- Start Narrow, Scale Fast: Pilot with one high-value property, then expand portfolios once results are proven.

- Design Compliance Upfront: Embed policy enforcement in tokens and workflows to avoid retrofits later.

- Build Modular Features: Reuse the same engine for multiple properties and jurisdictions.

- Invest in Observability: Track costs per transaction, liquidity flows, and compliance triggers from day one.

- Human Oversight as Value: Treat human-in-the-loop checks as investor trust enhancers, not inefficiencies.

- Continuous Improvement: Regularly refine reporting, compliance modules, and security updates to prevent drift.

Request a tailored quote from Intellivon today, and we’ll design a tokenized real estate platform that aligns with your budget, enforces compliance, and scales smoothly with your enterprise’s growth strategy.

How We Monetize A Tokenized Real Estate Platform Like Stake

A platform like Stake creates new revenue channels for the enterprise. Tokenization unlocks monetization opportunities that traditional real estate structures cannot deliver. By embedding compliance, liquidity, and automation into the core, enterprises can design platforms that generate steady income while scaling investor participation globally.

1. Transaction and Marketplace Fees

Every time an investor buys, sells, or transfers a tokenized share, the platform can charge a small percentage. These transaction fees mirror how traditional exchanges operate, but at lower costs, creating a consistent revenue stream tied to trading activity.

2. Listing and Structuring Fees

Enterprises can charge property owners or developers a fee to tokenize and list their assets on the platform. This monetization model works like a digital exchange listing, where sponsors pay for access to investors and liquidity.

3. Compliance-as-a-Service

KYC, AML, and ongoing compliance checks represent value beyond the platform. By offering these services as part of investor onboarding or fund management, enterprises can charge recurring fees while giving stakeholders confidence in regulatory oversight.

4. Custody and Asset Management Fees

Safekeeping digital tokens and managing distributions is another monetization lever. Enterprises can apply management fees for administering custody, dividends, or reinvestment workflows, similar to how traditional asset managers charge for overseeing funds.

5. Liquidity Premiums

Liquidity has intrinsic value in real estate. By enabling secondary transfers or exit windows, enterprises can charge small premiums or commissions on liquidity events, capturing revenue each time investors seek flexibility.

6. Subscription or SaaS Licensing

Enterprises deploying white-labeled versions of the platform can monetize through SaaS-style licensing. This model allows banks, REITs, or asset managers to run tokenized marketplaces under their own brand while paying for infrastructure access.

Monetization in tokenized real estate is multi-layered, combining transactional revenues with ongoing service fees and liquidity premiums. Stake proved that investors value accessibility, and enterprises can build on that foundation to design platforms where compliance, trust, and liquidity themselves become profitable services.

Compliance & Regulation for a Real-Estate Tokenization Platform Like Stake

No matter how seamless the technology, tokenized real estate platforms live or die by compliance. Investors will not commit capital if ownership rights are unclear, regulators will intervene if transfers violate securities laws, and enterprises risk reputational damage if audits fail. For enterprises, this means designing platforms where regulation is not an obstacle, but a built-in trust mechanism.

1. Legal Wrappers and Enforceable Ownership

Every property must sit inside a legal wrapper, most often a Special Purpose Vehicle (SPV) or, at times, a REIT structure. This ensures tokens represent real, enforceable ownership rather than speculative claims.

Intellivon designs tokenization flows that align the digital ledger with corporate registries, making sure every investor’s rights are recognized under law.

2. Multi-Jurisdictional Compliance Modules

Enterprises rarely operate in a single geography. That is why platforms must enforce different regulatory rules simultaneously, from SEC exemptions in the U.S. to DFSA standards in the Middle East, or MiFID II in Europe.

We build compliance engines that automatically enforce these rules at the transaction level, preventing non-eligible investors from entering restricted markets.

3. KYC, AML, and Digital Identity Integration

Investor onboarding is often the first friction point. Platforms like Stake streamline this with simple flows, but at enterprise scale, the complexity multiplies. Our experts integrate advanced KYC and AML services, along with digital identity (DID) frameworks, so every investor is screened, categorized, and continuously monitored.

This reduces fraud, speeds up onboarding, and creates a transparent audit trail that regulators can trust.

4. Smart Contracts for Compliance Enforcement

Compliance cannot rely on manual checks alone. By embedding transfer restrictions, lock-up periods, and whitelist rules into smart contracts, the platform ensures that every trade is compliant before it settles.

This automation eliminates human error, accelerates approvals, and provides regulators with an immutable record of enforcement.

5. Reporting, Auditing, and Regulator Access

Beyond investor dashboards, enterprises must prove compliance at every stage. Intellivon builds reporting frameworks that generate tax-ready statements, audit trails, and regulator-friendly reports.

In high-trust environments, we also enable read-only regulator dashboards, giving authorities visibility into transactions without interfering with operations.

By aligning legal structures, automated KYC/AML, and jurisdiction-aware smart contracts, platforms built with Intellivon are designed to withstand regulatory scrutiny while instilling investor confidence. With compliance in place, enterprises can focus on growth, liquidity, and innovation, knowing the platform itself enforces trust.

Conclusion

Tokenized real estate has proven its value through platforms like Stake, showing how fractional ownership and compliance-driven design attract investors and unlock liquidity. For enterprises, the opportunity lies in scaling this model into secure, global platforms that expand market reach while meeting regulatory obligations.

However, success demands careful legal structuring, embedded compliance, and integration with enterprise systems. Building such a platform in-house can expose organizations to risks and inefficiencies. Partnering with a specialized solution provider ensures the platform is not only technologically sound but also resilient, compliant, and investor-ready. With the right expertise, tokenization shifts from a concept into a reliable strategy for growth in institutional real estate.

Build Your Tokenized Real Estate Platform With Intellivon

At Intellivon, we design enterprise-grade tokenized real estate platforms that are secure, compliant, and engineered for the demands of global property markets. Our solutions are built for measurable ROI, helping enterprises unlock liquidity, expand investor access, and deliver transparent real estate investment experiences at scale.

Why Partner With Intellivon?

- Compliance-Embedded Architecture: Every platform is designed with SPVs, REIT frameworks, and jurisdictional enforcement, ensuring tokens represent enforceable ownership across regions.

- Regulator-Ready Workflows: Automated KYC, AML, and continuous monitoring keep your platform aligned with securities laws, reducing compliance overhead while building trust with regulators.

- Enterprise System Integrations: We connect seamlessly with ERP, CRM, banking, and custody providers, making tokenization a natural extension of existing operations.

- Liquidity That Attracts Investors: Secondary trading modules and controlled exit windows provide investors with the flexibility traditional real estate often lacks.

- Security That Protects Value: From multi-sig custody to fraud detection and continuous monitoring, our frameworks protect both investor capital and enterprise reputation.

- Proven Domain Expertise: With deep experience in enterprise blockchain and tokenization, we bring tested frameworks and reusable compliance modules that accelerate delivery and scale.

Book a discovery call with Intellivon today and see how we can design a tokenized real estate platform that strengthens compliance, safeguards investors, and transforms property portfolios into a growth engine for your enterprise.

FAQs

Q1. What is a tokenized real estate platform, and how does it work?

A1. A tokenized real estate platform converts property shares into blockchain tokens, enabling fractional ownership, automated compliance, and global investor participation with built-in governance.

Q2. How much does it cost to build a tokenized real estate platform?

A2. Developing an enterprise-grade platform typically costs between $80,000 – $250,000, depending on features like compliance automation, marketplace integration, and cross-border regulatory support.

Q3. Is tokenized real estate legal and compliant with regulations?

A3. Yes. Platforms use SPVs, ERC-3643/1400 tokens, and KYC/AML modules to align with securities laws, ensuring legal enforceability and compliance across multiple jurisdictions.

Q4. What are the benefits of tokenized real estate for enterprises?

A4. Enterprises gain new liquidity channels, expand investor bases globally, reduce onboarding costs, and embed compliance directly into smart contracts—unlocking faster, more secure transactions.

Q5. Can tokenized real estate platforms integrate with existing enterprise systems?

A5. Yes. Enterprise platforms integrate with ERP, CRM, and financial systems via APIs, ensuring smooth adoption without disrupting existing operations or compliance workflows.