Global businesses never sleep, but traditional cross-border payments do. This is a nightmare for large enterprises because legacy rails shut down on weekends, causing transactions to queue across multiple intermediaries, leaving them facing costly delays and compliance bottlenecks. This results in a faulty payment ecosystem that cannot keep pace with the fast-moving nature of modern commerce. Blockchain cross-border payment apps solve this by enabling nonstop 24/7/365 operations, near-instant settlements, and tamper-proof compliance records anchored on distributed ledgers.

We have helped several businesses cut settlement cycles from days to hours and significantly reduce intermediary costs through our enterprise-grade apps. In this blog, we will cover how we develop custom blockchain cross-border payment apps from scratch and integrate them with ERP and treasury systems.

What Is a Blockchain Cross-Border Payments App?

A blockchain cross-border payment app is an enterprise-grade application that allows businesses to send and receive money across countries faster, cheaper, and with greater transparency than traditional banking systems. Instead of routing payments through multiple intermediaries, these apps use blockchain rails to move value directly and securely.

It’s important to clarify what these apps are not. They are not consumer “crypto wallets” or speculative trading platforms. Unlike crypto transfers, enterprise-grade payment apps are regulated, compliant, and built to integrate seamlessly with core systems like ERP, Treasury Management, and Finance. They are designed to meet the requirements of large organizations that include data security, auditability, and adherence to global compliance standards such as ISO 20022, GDPR, MiCA, and the FATF Travel Rule.

For enterprises, the benefits are immediate and measurable:

- Speed: Settlement times are reduced from days to minutes, enabling 24/7/365 operations.

- Cost Efficiency: Transaction fees can be cut by up to 80% by removing unnecessary intermediaries.

- Transparency: Every transaction is traceable and tamper-proof, improving trust and audit readiness.

- Compliance: Regulatory checks (KYC, AML, sanctions) are embedded directly into the app, reducing risk.

In short, a blockchain cross-border payment app is not just a faster way to move money. It is a strategic financial infrastructure upgrade, giving enterprises the ability to operate with agility, transparency, and compliance in the era of global digital trade.

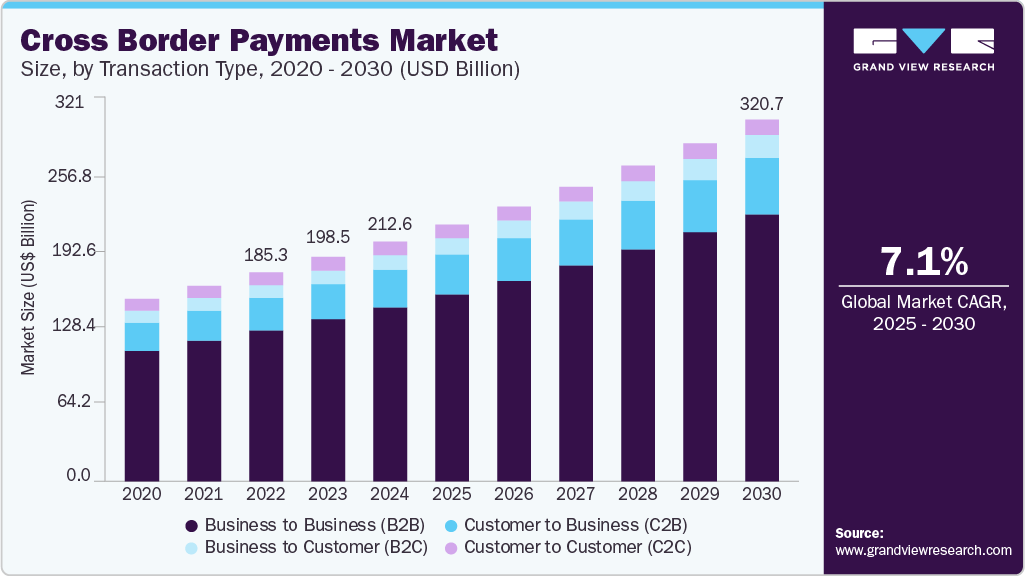

Key Takeaways of the Cross-Border Payments Market

The global cross-border payments market was valued at over USD 212 billion in 2024 and is projected to reach approximately USD 321 billion by 2030, growing at a compound annual growth rate (CAGR) of around 7.1%. This growth is driven by increasing demand for faster, more affordable, and transparent international money transfers.

- Blockchain can reduce transaction fees by up to 80%, turning multi-day settlements that often cost hundreds of dollars into near-instant transfers with minimal fees.

- Traditional cross-border payments take 2 to 5 business days, while blockchain cuts this time to seconds or minutes, enabling nonstop 24/7/365 operations.

- Businesses using blockchain for payments report operational cost savings of up to 35%, achieved by eliminating intermediaries and reducing fraud risks.

- In 2025, about 85% of U.S. banks and 60% of Asia-Pacific financial institutions are implementing blockchain solutions in payments, signaling strong institutional momentum.

- Blockchain-enabled smart contracts automate payment processing, reducing manual errors and cutting processing times by up to 65% for many enterprises.

- Blockchain adoption in emerging markets facilitates over $670 billion in annual remittances, lowering costs by up to 60% and advancing financial inclusion.

- Research indicates blockchain could increase cost savings in cross-border settlements by over 3,300% by 2030, showcasing its transformative potential.

- 92% of surveyed executives in 2025 believe blockchain will disrupt the financial sector, confirming its role as a strategic investment priority.

Blockchain use cases extend beyond payments, integrating with supply chains and treasury functions to drive broader efficiency and transparency gains.

How Does a Blockchain Cross-Border Payments App Work?

Traditional cross-border payments move through a long chain of correspondent banks, each adding time, cost, and risk of error. A blockchain cross-border payment app streamlines this by creating a direct, automated, and verifiable process that delivers funds faster, cheaper, and with full transparency.

1. Initiating the Payment

The process starts when a finance or treasury team creates a payment request in their ERP or Treasury Management System. Instead of being routed through multiple intermediaries, the request flows directly into the app.

2. Choosing the Best Rail

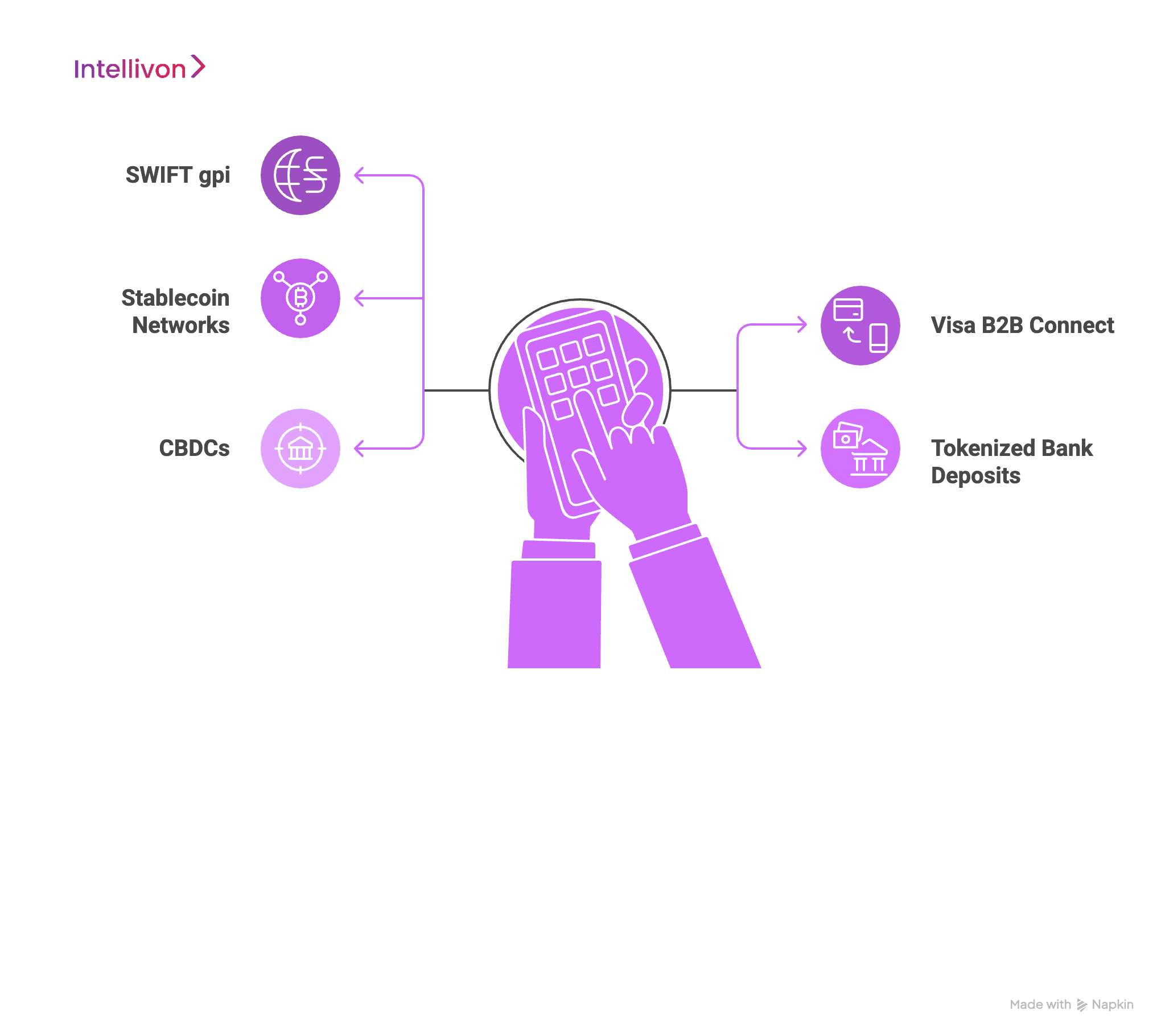

The app’s orchestration engine doesn’t rely on a single network. It evaluates multiple rails, from SWIFT gpi and Visa B2B Connect to stablecoins, tokenized deposits, and even CBDC pilots. Based on corridor, cost, and speed requirements, the app automatically selects the best option.

3. Embedding Compliance Checks

Before any transfer is made, the app runs embedded compliance checks. These include KYC, AML, sanctions screening, and Travel Rule requirements. This ensures every transaction carries the required verification data, reducing fraud risk and simplifying audits.

4. Executing Settlement

Once approved, the payment is transmitted across the chosen rail.

- On blockchain rails, settlement happens in minutes, with every transfer recorded immutably on the ledger.

- On enhanced bank rails like SWIFT gpi, the app still ensures real-time tracking and confirmation.

5. Generating Proof and Reconciliation

The app creates a digital proof of payment, whether an on-chain transaction hash, an ISO 20022 message, or a SWIFT confirmation code. This proof is automatically written back into ERP and Treasury systems, giving finance teams a single source of truth without manual reconciliation.

In practice, a blockchain cross-border payment app does far more than move money. It functions as a smart orchestration layer where payments are faster, compliance is built in, and transparency is guaranteed from start to finish.

How Multi-Rail Blockchain Networks Improve Cross-Border Payments

Enterprises no longer have to rely on a single payment rail for every international transfer. A blockchain cross-border payment app introduces a multi-rail strategy, giving finance teams the ability to route each transaction through the rail that delivers the best combination of speed, cost, and compliance.

1. SWIFT gpi

Enhanced bank-to-bank payments that offer global reach and end-to-end tracking. While still operating within traditional banking structures, GPI has improved speed and visibility compared to legacy SWIFT transfers, making it a strong choice for high-value or compliance-sensitive payments.

2. Visa B2B Connect

A multilateral network designed for predictable, direct bank-to-bank settlements. By bypassing correspondent banks, Visa B2B Connect reduces friction, lowers intermediary costs, and gives enterprises more control over payment timing.

3. Stablecoin Networks

These are rails that enable near-instant settlement 24/7/365. Backed by fiat reserves, stablecoins allow enterprises to move value across borders quickly, with lower fees and stronger transparency than legacy systems. They are particularly effective for high-volume, lower-value payments such as supplier or marketplace payouts.

4. Tokenized Bank Deposits

Blockchain-based representations of traditional money issued by regulated banks. These provide the benefits of blockchain, like speed, auditability, and programmability, while retaining the trust and regulatory backing of established financial institutions.

5. Central Bank Digital Currencies (CBDCs)

Emerging corridors where central banks issue digital currencies for cross-border use. While still in pilot stages, CBDCs promise government-backed, real-time settlement and will play a major role in the future of enterprise payments.

By supporting all of these options, a blockchain cross-border payment app ensures that the rail adapts to the transaction, not the other way around. This flexibility transforms payments from a rigid cost center into a strategic financial advantage, giving enterprises lower costs today and future-proof capabilities for tomorrow.

Must Have Enterprise-Grade Features on A Blockchain Cross-Border Payments App

A blockchain cross-border payment app is only valuable if it can meet the complex demands of global enterprises. Beyond fast settlement, it must embed compliance, integrate with legacy systems, and scale securely. Below are the enterprise-grade features that transform these apps from experiments into mission-critical financial infrastructure.

1. Compliance-First Design

From KYC and AML to sanctions checks and the FATF Travel Rule, compliance is non-negotiable. Enterprise apps embed these rules at the core, ensuring that every transaction is screened, auditable, and aligned with global regulations such as MiCA and ISO 20022.

2. ERP and Treasury System Integration

Payment apps must connect seamlessly with ERP systems like SAP and Oracle and treasury platforms like Kyriba and Coupa. This integration allows finance teams to initiate, track, and reconcile payments within their existing workflows, reducing errors and eliminating silos.

3. Auditability and Transparency

Each transaction generates a tamper-proof digital record, from on-chain hashes to ISO 20022 message logs. These proofs are stored securely and linked back into ERP or Treasury systems, giving auditors and compliance officers a clear, verifiable trail.

4. Security and Custody

Enterprise-grade apps use multi-party computation (MPC) wallets, custodial partnerships, and encryption layers to secure funds. These safeguards ensure resilience against fraud, insider threats, and operational failures.

5. Treasury Automation

Beyond moving money, apps must optimize liquidity. Features like real-time FX conversion, automated hedging, and mint/redeem policies for stablecoins help enterprises protect margins and manage cash flows without manual intervention.

6. Rail-Agnostic Orchestration

One of the most powerful features is the ability to route each payment across the best available rail, whether SWIFT gpi, Visa B2B Connect, stablecoins, tokenized deposits, or CBDCs. The orchestration engine applies business rules to balance cost, speed, and compliance for every transaction.

7. Smart Contract Automation

For complex payments, such as supplier contracts or trade finance, smart contracts can trigger conditional settlements. Payments are automatically released once agreed conditions are met, reducing disputes and manual approvals.

8. Multi-Currency and FX Management

Cross-border payments often involve multiple currencies. Apps embed FX engines that quote and lock exchange rates, apply hedging strategies, and settle in the currency of choice, minimizing exposure to market volatility.

9. Role-Based Access and Governance

Large enterprises need strict controls. Apps provide granular role-based permissions, approval hierarchies, and full audit logs so CFOs and compliance teams can enforce governance without slowing down operations.

10. Scalability and High Availability

Cross-border payments can involve thousands of daily transactions. Apps are built on cloud-native, distributed architectures with disaster recovery and redundancy, ensuring high performance and zero downtime even in peak demand.

Taken together, these features make blockchain cross-border payment apps more than a faster way to move money. They become strategic platforms that lower costs, reduce risks, and integrate directly into the fabric of enterprise finance.

How We Develop a Blockchain Cross-Border Payments App

At Intellivon, we follow a structured system to design blockchain cross-border payment apps that are secure, compliant, and scalable. Every app is engineered to integrate with enterprise systems and prepare organizations for future innovations such as tokenized deposits and CBDCs.

1. Define Requirements and Map Corridors

We begin by identifying the countries, currencies, and payment corridors that are most critical for your business. Our team analyzes operational pain points like settlement delays, high intermediary fees, or compliance overhead. This ensures the app is designed around real business priorities.

2. Multi-Rail Strategy

We design an orchestration layer that supports SWIFT gpi, Visa B2B Connect, stablecoins, tokenized deposits, and CBDCs. This rail-agnostic approach gives enterprises the flexibility to route payments across the most efficient and compliant option.

3. Embed Compliance

Compliance frameworks are built into the core of our apps. We integrate AML, KYC/KYB, sanctions screening, the FATF Travel Rule, MiCA, and GDPR so every transaction is automatically verified and audit-ready.

4. Integrate with ERP

We ensure the app connects seamlessly with ERP systems like SAP and Oracle, as well as treasury platforms such as Kyriba and Coupa. Payment data, compliance proofs, and reconciliation records flow directly back into enterprise systems, eliminating silos and reducing manual effort.

5. Design Custody Models

Our apps include enterprise-grade safeguards for managing funds. We implement MPC wallets, custodial accounts, mint and redeem policies for stablecoins, liquidity tools, and FX engines, giving treasury teams security and full control.

6. Pilot with a Controlled Rollout

We deploy through a measured pilot, starting with one high-priority corridor such as USD to Asia. We monitor settlement times, exceptions, cost savings, and compliance effectiveness. Once validated, the app is expanded to other corridors, currencies, and payment types such as payroll and supplier settlements.

7. Scale with Governance and Automation

As adoption grows, we add role-based governance, automated treasury functions, and advanced audit controls. This ensures the app scales globally without losing compliance, visibility, or security.

Our development system transforms blockchain cross-border payment apps into enterprise-grade infrastructure. By combining rail-agnostic orchestration, compliance-first design, ERP integration, and scalable governance, we deliver applications that are faster, safer, and smarter.

Cost To Develop A Blockchain Cross-Border Payments App

At Intellivon, we understand that enterprises need cross-border payment apps that are both secure and cost-effective. That’s why our pricing model is flexible and aligned with your requirements, not a one-size-fits-all package.

If projected costs risk exceeding your planned budget, we work closely with your teams to refine the scope while safeguarding the core value of cost savings, compliance, and operational efficiency.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, stakeholder interviews, corridor and currency mapping, KPI alignment, compliance readiness (MiCA, GDPR, ISO 20022, FATF Travel Rule) | $10,000 – $18,000 |

| Architecture & Rail Design | App blueprint, multi-rail orchestration framework (SWIFT, Visa, stablecoins, CBDCs), ERP/TMS integration planning, data pipeline setup | $15,000 – $25,000 |

| Core Feature Development & Integration | Payment initiation modules, orchestration engine, compliance automation (AML/KYC/KYB), sanctions checks, Travel Rule gateway | $25,000 – $45,000 |

| Platform Development & Customization | Dashboards, ERP/Treasury connectors (SAP, Oracle, Kyriba), multi-currency support, FX engines, liquidity management features | $30,000 – $50,000 |

| Security & Compliance Alignment | Encryption, MPC/custodial wallets, role-based access controls, GDPR/MiCA validation, audit trails, ISO 20022 message handling | $12,000 – $20,000 |

| Testing & Validation | Transaction simulations, compliance stress-testing, corridor-specific pilots, performance tuning, reconciliation checks | $10,000 – $18,000 |

| Deployment & Scaling | Cloud rollout, regional data residency setup, enterprise-wide integration, 24/7 monitoring dashboards, disaster recovery setup | $8,000 – $15,000 |

Total Initial Investment Range: $110,000 – $190,000

Ongoing Optimization (Annual): $12,000 – $25,000

Factors That Influence Cost

- Integration Depth: The number and complexity of ERP, Treasury, HR, Finance, and banking systems the app must connect with.

- Feature Scope: Whether the app is limited to core payments or expanded with advanced orchestration, liquidity automation, and real-time FX.

- Regulatory Requirements: Coverage for MiCA, GDPR, ISO 20022, and jurisdiction-specific compliance obligations.

- Deployment Model: Cloud-native, hybrid, or on-premises architecture, depending on enterprise security and data residency needs.

- Customization Needs: Choice between leveraging pre-built Intellivon modules vs. developing bespoke workflows for global subsidiaries.

- Advanced Capabilities: Smart contract automation, predictive FX analytics, AI-driven rail selection, and global-scale reporting.

Request a tailored quote from Intellivon today, and we’ll design a blockchain cross-border payment app that aligns with your budget, enforces compliance, and scales seamlessly with your organization’s growth.

Real-World Enterprise Use Cases

Blockchain cross-border payment apps are no longer experimental. Enterprises across industries are already deploying them to solve real bottlenecks in finance, supply chains, and operations. Below are practical scenarios, backed by real-world examples, that show how these apps deliver measurable impact at scale.

1. Global Supply Chain Vendor Payouts

A multinational manufacturer with thousands of small suppliers in Asia faces high banking fees and settlement delays that often take 3–5 days. By using a blockchain cross-border payment app, the enterprise can settle invoices in hours instead of days, while reducing transaction costs by up to 60%.

Example: Santander’s One Pay FX app, built on RippleNet, enables same-day international supplier payments across Europe. It proved that blockchain rails can co-exist with banking systems while cutting both delays and costs.

2. Cross-Border Payroll Disbursements

Global enterprises with distributed teams often face delays and currency conversion inefficiencies in payroll cycles. With a blockchain payment app, salaries are disbursed in local currencies instantly, FX is automated, and compliance records are generated in real time.

Example: Visa has piloted stablecoin settlement on USDC (Ethereum/Solana) with partners like Worldpay and Nuvei, allowing businesses to send global payouts faster and more predictably.

3. Marketplace and Gig-Economy Payouts

Platforms that serve freelancers or digital sellers often manage thousands of micro-payments daily. Using legacy Rails, this is expensive and slow. Blockchain apps allow bulk, near-instant payouts over stablecoin networks or bank-linked rails.

Example: MoneyGram, in partnership with Stellar, enables USDC-powered payouts with global cash-in and cash-out access, which are particularly valuable for gig workers in emerging markets.

4. Treasury Liquidity Management

Large enterprises frequently rebalance liquidity across regions. Traditional transfers tie up capital for days. With blockchain apps, funds can be shifted in near real time, with full audit trails.

Example: Partior, backed by DBS, Standard Chartered, and J.P. Morgan, processes multi-currency settlements using tokenized deposits, enabling real-time liquidity between banks.

5. Compliance-Heavy Industries

Regulated industries need payments that meet strict audit requirements. Blockchain apps embed KYC, AML, and sanctions screening into the workflow, ensuring that global payments are both fast and compliant.

Example: SWIFT’s gpi rail now delivers 90% of payments within an hour, with end-to-end visibility. When combined with blockchain rails, enterprises can meet compliance obligations while improving speed.

These examples show that blockchain cross-border payment apps are already live in global enterprises. Whether it’s Santander’s supplier payments, Visa’s stablecoin payroll pilots, MoneyGram’s gig-economy payouts, or Partior’s liquidity settlement, the shift is real..

Overcoming Challenges in Deploying Blockchain Cross-Border Payment Apps

Rolling out a blockchain cross-border payment app is not as simple as connecting a new API. Large enterprises face structural, regulatory, and operational barriers that can stall adoption. At Intellivon, we anticipate these challenges and design solutions that make deployment seamless, secure, and future-ready.

1. Integration with Legacy ERP

Most enterprises run complex financial stacks with ERP (SAP, Oracle), Treasury (Kyriba, Coupa), and Procurement systems. Adding a blockchain app risks creating another silo if not integrated properly.

Intellivon’s Solution: We build native connectors and APIs that sync directly with ERP and TMS systems. Payments, compliance proofs, and reconciliations flow automatically, so finance teams keep a single dashboard of truth.

2. Navigating Regulatory Complexity

Regulations differ across corridors, from MiCA in Europe to strict FX rules in Asia. Enterprises fear non-compliance, fines, or constant re-engineering.

Intellivon’s Solution: We embed compliance-first frameworks into the app. Our modular compliance engine updates with regulatory changes, so enterprises stay aligned globally without downtime.

3. Ensuring Liquidity and Settlement Reliability

Stablecoins, tokenized deposits, and CBDCs introduce liquidity risks. Enterprises worry about funds getting stuck or delays in mint/redeem processes.

Intellivon’s Solution: We design multi-rail orchestration with automated fallback routes. If liquidity dries up on one rail, the app reroutes payments via alternatives like SWIFT gpi or Visa B2B Connect. Custodial partnerships and liquidity SLAs safeguard enterprise funds.

4. Data Privacy and Security Concerns

Cross-border payments involve sensitive data. Through these, enterprises fear breaches, compromised wallets, or data residency violations.

Intellivon’s Solution: We apply enterprise-grade security: MPC wallets, encryption, role-based access, and zero-trust architecture. We also configure regional data residency and GDPR-compliant data handling to meet strict local laws.

5. Managing Multi-Currency FX and Treasury Operations

Enterprises need to handle multiple currencies, optimize FX rates, and rebalance liquidity across subsidiaries. Doing this manually is costly and error-prone.

Intellivon’s Solution: Our apps integrate real-time FX engines, automated hedging strategies, and liquidity management tools. Treasury teams gain agility to move funds instantly, lock FX rates, and improve working capital efficiency.

Deploying a blockchain cross-border payment app is not without challenges, but with the right partner, those challenges become opportunities. At Intellivon, we bridge the gap between cutting-edge blockchain rails and the realities of enterprise operations. From legacy integration to global compliance, from liquidity assurance to user adoption, we design apps that deliver immediate value while preparing enterprises for the future of digital finance.

Conclusion

Cross-border payments have always been the backbone of global commerce, yet for too long, enterprises have relied on a system riddled with delays, hidden costs, and compliance bottlenecks. Blockchain cross-border payment apps change that equation by combining multi-rail orchestration, embedded compliance, real-time settlement, and ERP integration. Through this, they deliver what legacy rails cannot, which is speed, transparency, cost efficiency, and nonstop global availability.

These apps are fast becoming the new standard for global payments. Early adopters have already seen measurable benefits, like supplier invoices settled in hours instead of days, payroll disbursed instantly across borders, treasury liquidity optimized in real time, and compliance costs reduced through automation.

Build Your Blockchain Cross-Border Payments Platform with Intellivon

At Intellivon, we design cross-border payment apps that unify legacy banking rails with blockchain innovation. Our platforms are secure, compliance-ready, and engineered to integrate seamlessly with your ERP, treasury, and finance systems. With 11+ years of enterprise expertise and 500+ successful deployments, we know how to transform blockchain payments from pilot projects into enterprise-grade applications.

Why Partner with Intellivon?

Seamless Integration: Connect directly with ERP, Treasury, and Procurement systems, eliminating silos and manual reconciliation.

Compliance-First Design: Built to align with MiCA, ISO 20022, GDPR, and the FATF Travel Rule from day one.

Rail-Agnostic Orchestration: Route payments intelligently across SWIFT, Visa B2B Connect, stablecoins, tokenized deposits, and CBDCs.

Scalable Architecture: Cloud-native, high-availability models proven to support global transaction volumes.

Enterprise-Grade Security: MPC wallets, role-based access, and encryption safeguards built into the core.

Book a discovery call today to see how Intellivon can help you reduce settlement times, cut costs, and future-proof your global payment operations.

FAQs

Q1. What is a blockchain cross-border payment app?

A1. A blockchain cross-border payment app is an enterprise-grade platform that uses blockchain rails to move money across countries faster, cheaper, and with greater transparency than traditional banking systems. Unlike consumer crypto wallets, these apps are regulator-ready, integrated with ERP and treasury systems, and built for compliance.

Q2. How does a blockchain payment app reduce cross-border transaction costs?

A2. By eliminating multiple intermediaries, blockchain payment apps can cut fees by up to 80%. They intelligently route payments across the most cost-efficient rails, whether SWIFT gpi, Visa B2B Connect, stablecoins, or CBDCs, and automate compliance checks to reduce manual costs and operational overhead.

Q3. Can blockchain cross-border payment apps integrate with ERP and treasury systems?

A3. Yes. Modern enterprise apps are designed to integrate directly with ERP systems (SAP, Oracle) and Treasury Management platforms (Kyriba, Coupa). This ensures that payments, compliance proofs, and reconciliation data flow seamlessly into existing financial workflows, avoiding silos.

Q4. Are blockchain cross-border payments compliant with global regulations?

A4. Yes. Enterprise-grade apps embed compliance features from day one, including AML, KYC/KYB, sanctions screening, the FATF Travel Rule, MiCA in Europe, ISO 20022, and GDPR. This ensures that cross-border payments remain fast, secure, and legally compliant across jurisdictions.

Q5. What benefits do enterprises gain from adopting blockchain cross-border payment apps?

A5. Enterprises gain measurable results: settlement times reduced from days to minutes, up to 35% savings on operational costs, automated compliance reporting, improved liquidity management, and 24/7/365 global payment capability. These apps transform payments from a cost burden into a strategic advantage.