Visit-based models in virtual care have reached their limits. This is why healthcare leaders are rethinking how they deliver virtual care. One-time consultations help with access gaps, but they struggle to create continuity, predict demand, or provide stable returns at scale. This is where direct-to-consumer (DTC) subscription telehealth comes in. Instead of treating digital care as a series of separate encounters, it creates an ongoing relationship between patients and care teams.

Rush saw this shift early on. Through its subscription-based digital care model, it transformed telehealth into a door for continuous care instead of just a transactional service. The result is a system that addresses urgent needs, helps patients find the right level of care, and fits seamlessly into broader clinical operations.

At Intellivon, we design telehealth platforms that are ready for subscription, balancing access, clinical quality, and financial sustainability. With this hands-on experience, we are using this blog to explain how a Rush-inspired DTC subscription telehealth model works in practice and how we build it from the ground up.

Key Takeaways of the DTC Telehealth Services Market Trends

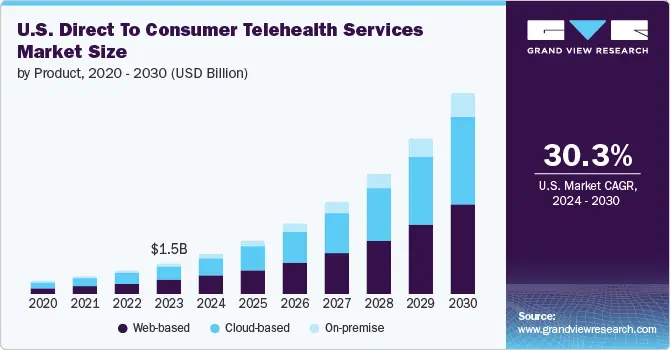

According to the Grand View Research, the U.S. direct-to-consumer telehealth market reached an estimated value of USD 1.47 billion in 2023 and is expected to expand rapidly through 2030, growing at an annual rate of over 30%.

Market Insights:

- Hims & Hers operates on flexible subscription plans typically ranging between USD 20 and USD 75 per month, with more than 80% of users remaining active beyond the first three months.

- The platform reports significantly faster onboarding through AI-driven matching, reducing wait times by roughly 40% while maintaining patient satisfaction levels close to 90%.

- Ro differentiates through deep personalization, using longitudinal health data to tailor treatment pathways and engagement.

- Amazon One Medical is expanding selectively into DTC care categories such as hair loss and erectile health, signaling growing interest from large-scale digital health incumbents.

Adoption Trends and Performance Indicators

- Younger demographics are driving adoption, with nearly 60% of Gen Z indicating a preference for telehealth-first care experiences.

- Leading DTC platforms report subscriber retention rates above 80% and satisfaction levels approaching 90%.

- Subscription fees account for more than 90% of total platform revenue, reinforcing the sustainability of the model.

- Web-based care delivery remains dominant, representing close to 46% of total DTC telehealth usage.

Primary Growth Catalysts

- The rising prevalence of chronic conditions alongside persistent clinician shortages is accelerating demand for scalable virtual care.

- Millennials and Gen Z increasingly favor digital-first healthcare that fits around daily life.

- Cost efficiency for both patients and providers continues to strengthen the business case

- AI-powered triage, remote monitoring, and wearable integrations are enabling more proactive care models.

- Expanding reimbursement coverage and improvements in network infrastructure, including 5G, are supporting broader adoption.

- These forces align closely with the shift toward hybrid care frameworks that combine digital and in-person services.

Challenges and Emerging Opportunities

- Inconsistent reimbursement policies and growing cybersecurity exposure remain operational concerns.

- Older populations show slower adoption due to trust and usability barriers.

- At the same time, high-growth opportunities are emerging in areas such as weight management, with the therapeutic segment projected to exceed USD 2 billion by 2025.

- White-label DTC platforms present a strategic opening for health systems seeking faster market entry without building from scratch.

What Is The DTC Subscription Telehealth Model Rush?

A DTC subscription telehealth model like Rush is a membership-based digital care approach that provides continuous virtual access, guided care navigation, and integrated follow-ups instead of per-visit telehealth consultations.

At its core, the model treats telehealth as a front door to the health system, not a standalone service. The subscription becomes the access layer, while clinical care, referrals, and in-person services operate behind it in a coordinated flow. This allows Rush to manage demand, guide patients to the right care setting, and maintain continuity across digital and physical touchpoints.

The appeal of this model lies in its balance. Patients get predictable access and pricing. Providers gain steadier demand signals and better care orchestration. The health system retains the relationship instead of losing patients to fragmented, third-party telehealth apps.

Why Rush’s DTC Subscription Telehealth Model Works

It works because the model turns telehealth into a system of access, routing, and continuity, not a collection of virtual visits. By anchoring care around subscriptions, always-on availability, and guided navigation, Rush reduces friction for patients while giving health systems predictable demand, stronger retention, and tighter operational control.

- Subscription-based access as the entry point: Care begins with a paid membership rather than a scheduled appointment. This unlocks 24/7 virtual urgent care and support, filters low-intent usage, improves demand predictability, and enables more effective workforce planning.

- Always-on virtual urgent care delivery: Members can initiate care through asynchronous assessments or live video visits at any time. Follow-ups, referrals, and next steps stay within the same system, reducing repeat visits and unnecessary clinical escalations.

- Human-guided care navigation built in: Real care assistants support subscribers with triage, scheduling, and coordination. This addresses self-triage limitations, prevents digital drop-offs in complex cases, and increases patient trust and follow-through.

- Virtual care as a routing mechanism, not the endpoint: Telehealth acts as a front door that directs patients to the appropriate level of care. When virtual care is insufficient, patients are seamlessly routed into in-person, primary, or specialty services.

- Integrated health system connectivity: The DTC telehealth experience connects directly with the broader Rush ecosystem, including diagnostics and specialty care. This prevents patient leakage and ensures digital interactions strengthen core clinical operations.

- Revenue model anchored in recurring relationships: Subscription fees create a stable revenue foundation, while discounted visits and downstream services drive incremental value. This smooths revenue volatility, increases lifetime patient value, and aligns financial incentives with long-term care outcomes.

How the Rush-Style DTC Subscription Telehealth Model Works

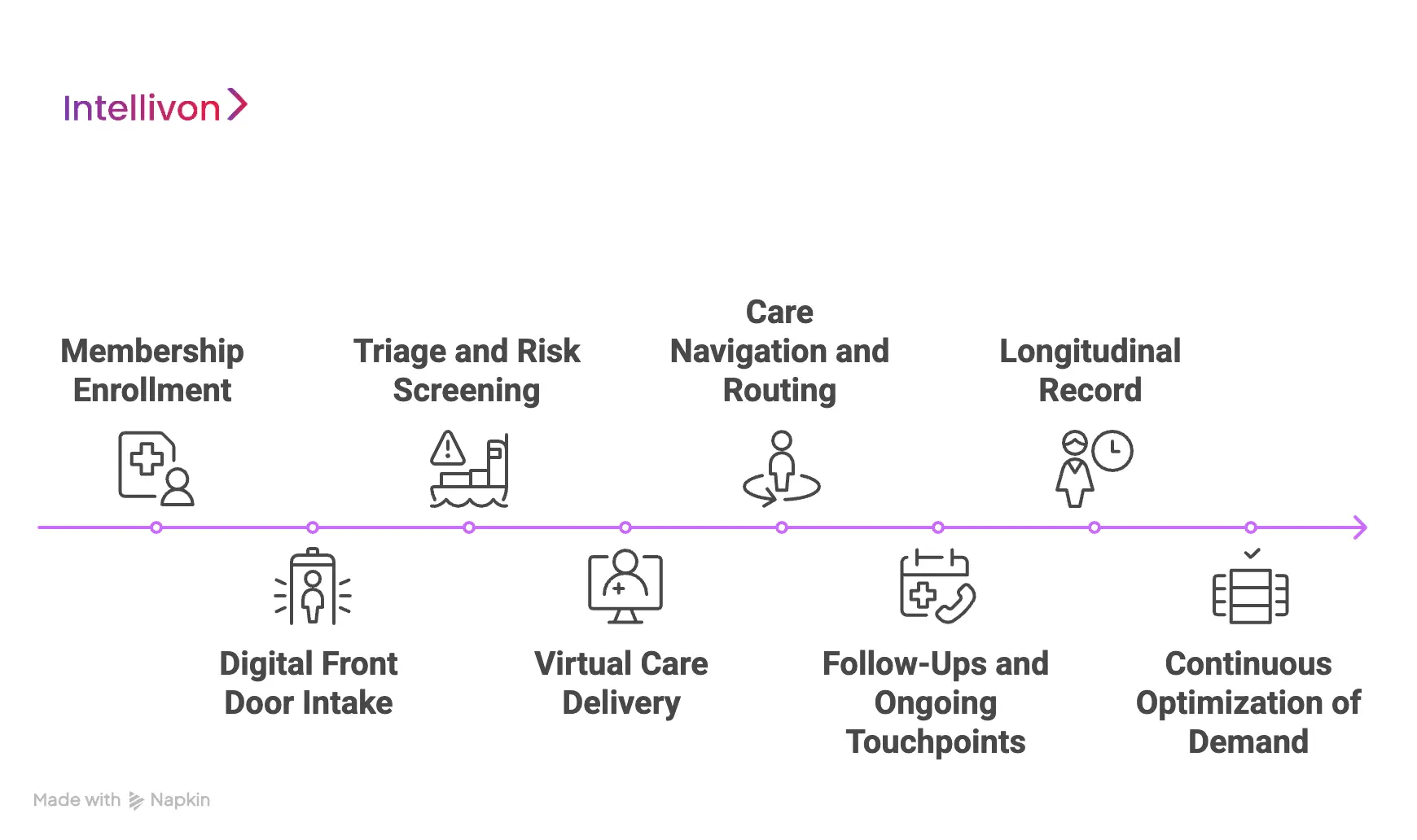

A Rush-style DTC subscription telehealth model works as a guided workflow: membership enrollment, always-on intake, clinician review, navigation-led routing, integrated follow-ups, and downstream conversion into in-person or specialty care.

Below is the step-by-step workflow you can use as an enterprise blueprint.

Step 1: Membership Enrollment

The patient joins a monthly or annual plan. This creates a predictable access layer and reduces friction at the moment of need.

On the enterprise side, this step also sets guardrails. You define what the subscription includes, which geographies are covered, and how utilization is governed.

Step 2: Digital Front Door Intake

When a patient needs care, they begin with a structured intake. This can be an asynchronous questionnaire, symptom flow, or smart form.

The intake captures enough detail to route correctly. It also reduces avoidable clinician time spent on basic information gathering.

Step 3: Triage and Risk Screening

The platform applies triage rules to flag urgency and risk. In mature models, AI assists by prioritizing cases, spotting red flags, and suggesting next steps.

However, governance stays clear. Clinical teams define thresholds and escalation policies, and the workflow logs each decision for audit readiness.

Step 4: Virtual Care Delivery

Based on triage, the patient receives an e-visit-style response or a live video consultation. The system chooses the channel that matches clinical complexity and response time needs.

This is where subscription models outperform visit-based telehealth. Care delivery fits into a broader pathway, not a standalone interaction.

Step 5: Care Navigation and Routing

After the interaction, the patient gets routed to the right next step. This is where the model becomes operationally powerful.

Care navigation can handle:

- Scheduling with primary or specialty care

- Coordinating diagnostics or labs

- Directing to in-person urgent care when required

- Resolving patient questions that would otherwise cause drop-off

This reduces leakage and keeps the journey inside the enterprise ecosystem.

Step 6: Follow-Ups and Ongoing Touchpoints

Subscription care wins in the space between visits. The model includes follow-ups, reminders, symptom check-ins, and adherence support.

These touchpoints prevent avoidable deterioration. They also create longitudinal data that improves personalization over time.

Step 7: Longitudinal Record

Each interaction updates the patient timeline. Over weeks and months, this builds a usable longitudinal record for clinical decisions, risk stratification, and program measurement.

For enterprise leaders, this is where the model earns trust. You can track outcomes, utilization, escalation rates, and cost-to-serve by cohort.

Step 8: Continuous Optimization of Demand

Once the workflow runs at scale, leaders start tuning it. You refine triage rules, expand coverage, and adjust care-team capacity to match demand signals.

This is also where the subscription model compounds. Better workflows increase retention, reduce avoidable escalations, and improve lifetime value per patient.

A Rush-style DTC subscription telehealth model succeeds because it behaves like an enterprise operating system for access. Membership creates predictable demand. Intake and triage protect clinical capacity.

Rush’s Revenue and Business Model

Rush’s DTC subscription telehealth model blends membership-based access with hybrid care delivery and downstream service conversion to create predictable, enterprise-scale healthcare revenue.

Business Models of Rush

Rush’s business model focuses on how care is organized, accessed, and operationalized across digital and physical channels. Each element is designed to scale access without compromising clinical oversight.

1. Membership-Led Digital Front Door

The foundation of the model is a recurring membership that grants patients ongoing access to virtual urgent care and navigation support.

This approach reshapes patient behavior. Instead of waiting until a crisis or shopping across providers, members return to a single access point. For the enterprise, this creates predictable engagement patterns and reduces fragmentation across care settings.

2. Hybrid Care Operating Model

Rush integrates virtual care with in-person services rather than positioning them as separate offerings.

Digital touchpoints handle triage, follow-ups, and lower-acuity needs. Physical facilities focus on complex or procedural care. This balance expands reach while protecting high-cost clinical resources from unnecessary demand.

3. Centralized Care Navigation and Coordination

Human care navigation is embedded directly into the operating model.

Navigators help patients understand next steps, coordinate appointments, and move smoothly between virtual and physical care. Operationally, this reduces drop-offs, missed appointments, and care leakage to external providers.

4. Enterprise Governance and Clinical Oversight

All digital care flows operate under centralized clinical protocols and escalation rules.

This ensures consistency across providers, clear accountability, and audit-ready decision trails. For large organizations, governance is what allows digital care to scale without increasing regulatory or reputational risk.

Revenue Models of Rush

While the business model defines structure, the revenue model defines how value is captured and sustained over time. Rush uses layered revenue streams that reinforce one another.

1. Recurring Subscription Revenue

Membership fees are billed monthly or annually from the revenue base of the model.

This recurring layer smooths revenue volatility and improves financial predictability. It also aligns incentives toward long-term engagement rather than short-term visit volume.

2. Discounted Virtual Encounter Revenue

Subscribers pay reduced rates for e-visits and live video consultations.

These encounters generate incremental revenue without requiring repeated acquisition costs. At scale, this improves margins while keeping access affordable for members.

3. Downstream Care Conversion

Virtual care functions as a referral engine into higher-value services across the Rush system.

When patients need diagnostics, specialty consultations, or in-person treatment, they are routed internally. This increases lifetime value and strengthens continuity across care episodes.

4. Ancillary and Supporting Services

Additional services, such as prescription fulfillment, care coordination, and structured follow-up programs, extend the revenue lifecycle.

These services deepen engagement and expand value per member without adding significant access friction or operational overhead.

Rush’s DTC subscription telehealth model works because its business and revenue strategies reinforce each other. Membership stabilizes demand, hybrid care protects capacity, navigation preserves continuity, and layered revenue streams compound value over time.

DTC Telehealth Platforms Get $64 Average Monthly in Subscriptions

DTC subscription telehealth is no longer a low-ticket convenience play. Financial disclosures from leading platforms show that recurring care subscriptions are generating meaningful, predictable monthly revenue per user, on par with mature SaaS businesses.

In its 2024 annual filing, Hims & Hers reported an average monthly online revenue of USD 64 per subscriber, up from USD 54 the previous year. This increase reflects not pricing gimmicks, but deeper engagement, longer retention, and broader care adoption across subscriptions.

What the $64 Monthly Figure Actually Represents

This metric captures more than a subscription fee. It reflects the total recurring value generated from an active subscriber across medications, follow-ups, renewals, and care programs.

In practical terms, it shows that:

- Subscribers are staying engaged beyond initial treatment.

- Platforms are successfully expanding care over time.

- Revenue compounds without proportional increases in acquisition costs.

For enterprise leaders, this signals a shift from visit-based revenue volatility to durable monthly unit economics.

Why Subscription Revenue Scales Better

Traditional telehealth depends on constant demand generation. Subscription models behave differently.

With recurring billing:

- Revenue stabilizes month over month.

- Forecasting becomes more reliable.

- Care teams can be staffed against predictable demand.

Hims explicitly notes that a large portion of its online revenue is subscription-driven, reinforcing that the business is built on repeat usage, not one-time consults.

What This Means for Healthcare Enterprises

A USD 64 monthly average changes the strategic conversation.

For health systems and enterprise providers, this level of recurring revenue:

- Supports long-term care programs, not episodic services.

- Justifies investment in care coordination and AI-assisted workflows.

- Reduces reliance on high-volume, low-margin encounters.

More importantly, it aligns revenue with ongoing health outcomes, which is where enterprise healthcare is headed.

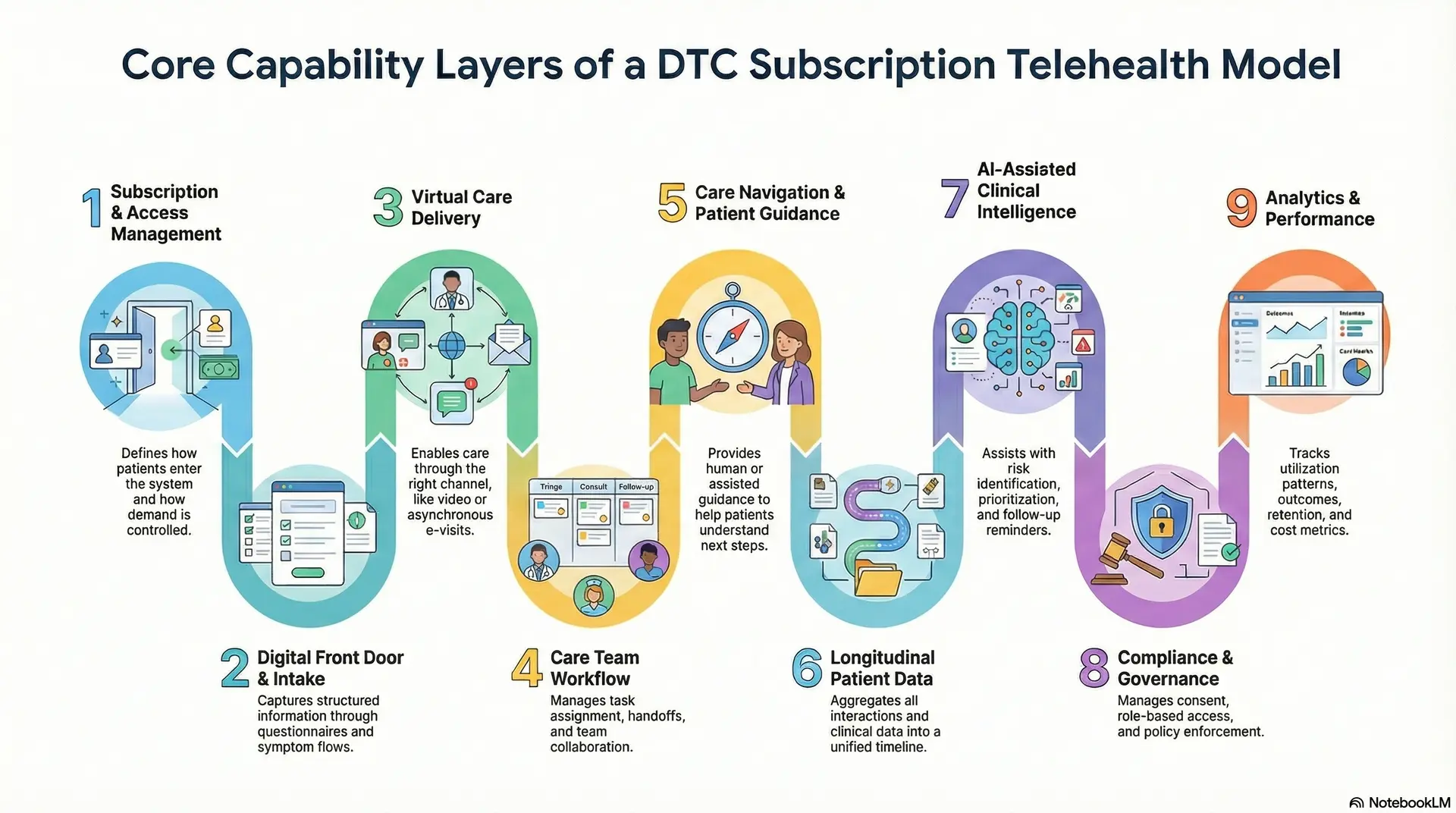

Core Capability Layers of a DTC Subscription Telehealth Model

A DTC subscription telehealth model relies on layered capabilities that manage access, deliver continuous care, coordinate teams, enforce compliance, and generate recurring value at enterprise scale.

Below are the core capability layers required to make this model scalable, controllable, and financially sustainable.

1. Subscription and Access Management

This layer defines how patients enter the system and how demand is controlled. It manages membership plans, eligibility criteria, geographic coverage, and usage limits. Without this layer, subscription models quickly collapse into unmanaged utilization.

For enterprises, access management ensures that recurring revenue does not translate into uncontrolled clinical load or rising cost-to-serve.

2. Digital Front Door and Intake Intelligence

The digital front door is where every care journey begins. This capability captures structured information through questionnaires, symptom flows, and contextual prompts.

A well-designed intake layer improves patient experience while gathering clinically relevant data upfront. It reduces back-and-forth with care teams and sets the foundation for accurate triage and routing.

3. Virtual Care Delivery

This layer enables care to be delivered through the right channel at the right time. It supports real-time video consultations for complex cases and asynchronous e-visits for lower-acuity needs.

Enterprises rely on this flexibility to scale volume without defaulting every interaction to high-cost live visits. The result is better margin control and more efficient clinician utilization.

4. Care Team Workflow

Subscription telehealth depends on coordinated teams working from shared workflows. This capability manages task assignment, escalation rules, handoffs, and collaboration across physicians, nurses, and care coordinators.

It ensures work is distributed intelligently rather than landing on individual providers. For enterprises, orchestration is essential to reducing burnout and maintaining consistent care quality.

5. Care Navigation and Patient Guidance

Navigation turns access into progress. This layer provides human or assisted guidance to help patients understand next steps, schedule follow-ups, and move smoothly between virtual and in-person services.

It addresses the reality that patients often struggle to self-direct care. For enterprises, navigation reduces leakage, missed appointments, and fragmented journeys.

6. Longitudinal Patient Data

Subscription care is built on continuity, not isolated encounters. This capability aggregates interactions, clinical notes, outcomes, vitals, labs, and self-reported data into a unified timeline.

Over time, this longitudinal view improves clinical decision-making and personalization. It also enables population-level analysis without fragmenting data across systems.

7. AI-Assisted Clinical Intelligence

AI plays a supporting role in mature subscription telehealth models. This layer assists with risk identification, prioritization, follow-up reminders, and engagement nudges. Importantly, it operates within defined clinical boundaries.

Enterprises use AI to enhance responsiveness and consistency while keeping clinicians accountable for final decisions.

8. Compliance and Governance Controls

Digital care cannot scale without embedded governance. This capability manages consent lifecycle, role-based access, audit logging, and policy enforcement across digital workflows. It ensures compliance is part of the architecture rather than an afterthought.

For enterprises, this layer protects trust, reduces regulatory exposure, and supports defensible care delivery.

9. Analytics and Performance Measurement

Subscription models require continuous visibility into performance. This layer tracks utilization patterns, outcomes, retention, escalation rates, and cost metrics.

Leaders use these insights to refine care pathways, staffing models, and pricing strategies over time. Without analytics, subscription telehealth becomes reactive rather than strategic.

A DTC subscription telehealth model succeeds when its capabilities work together as a system. Enterprises that invest in these layers move beyond transactional virtual care. They build a scalable operating model that supports predictable revenue, protected clinical capacity, and long-term patient relationships.

Architecture for a DTC Subscription Telehealth Platform Like Rush

A Rush-style DTC subscription telehealth architecture is a layered, cloud-native system that connects access management, care workflows, AI intelligence, integrations, and compliance into one governed enterprise platform.

Below is the reference architecture enterprises should follow when building a Rush-style model.

1. Patient and Provider Experience Layer

This layer includes all user-facing interfaces for patients, clinicians, and administrators. Patients interact through web or mobile experiences designed for speed, clarity, and low cognitive load. Providers use dedicated clinical consoles that surface only what is relevant for the current task.

Administrative teams rely on dashboards to manage subscriptions, care capacity, and performance metrics. Separation of experiences is intentional. It reduces friction, protects the clinician’s focus, and improves adoption across roles.

2. Subscription and Access Control Layer

This layer governs who can access care, when, and under what conditions. It manages memberships, plan entitlements, geographic eligibility, and usage limits.

Access rules are enforced before clinical workflows begin, which prevents uncontrolled demand. For enterprises, this layer is essential to aligning recurring revenue with clinical capacity and cost controls.

3. Care Workflow and Orchestration Layer

This is the operational core of the platform. It coordinates intake, triage, task routing, escalation paths, and handoffs across care teams. The orchestration layer ensures that each case follows a defined pathway instead of relying on manual judgment alone.

This reduces variability, improves safety, and allows care delivery to scale without overwhelming individual providers.

4. Virtual Care Delivery Layer

This layer enables both synchronous and asynchronous care interactions. It supports video consultations, provider-reviewed e-visits, secure messaging, and structured follow-ups. The platform selects the appropriate modality based on urgency and complexity.

Enterprises depend on this flexibility to handle large volumes efficiently while maintaining clinical quality and response time commitments.

5. AI and Clinical Intelligence Layer

AI operates as a decision-support engine within clearly defined boundaries. This layer assists with triage prioritization, risk flagging, follow-up reminders, and engagement nudges. Models are trained and governed to support clinicians rather than replace them.

For enterprises, this layer improves responsiveness and consistency while maintaining accountability and auditability.

6. Patient Timeline Layer

Subscription telehealth depends on continuity over time. This layer aggregates encounters, clinical notes, outcomes, vitals, labs, and patient-reported data into a unified timeline. It provides clinicians with context and enables personalization across months or years.

For leadership teams, it unlocks population insights without fragmenting data across systems.

7. Integration and Interoperability Layer

No DTC platform operates in isolation. This layer connects the telehealth platform with EHRs, labs, pharmacies, imaging systems, and remote monitoring devices.

Interoperability ensures digital care strengthens the broader health system instead of creating parallel workflows. For enterprises, integration is what turns telehealth into a true front door rather than a silo.

8. Compliance and Governance Layer

This layer enforces trust across the entire architecture. It manages consent lifecycle, role-based access, encryption, audit logs, and regulatory controls. Governance is embedded into every workflow rather than added later.

For enterprises, this layer is critical to scaling digital care without increasing legal, regulatory, or reputational risk.

A Rush-style DTC subscription telehealth platform succeeds because its architecture is built as enterprise infrastructure.

Each layer reinforces the others, creating a system that supports predictable access, safe care delivery, and long-term financial sustainability. For healthcare enterprises, this architectural approach transforms telehealth from a tactical solution into a scalable growth foundation.

Compliance, Governance, and Risk Management in Subscription Telehealth

Compliance in subscription telehealth requires embedded governance, continuous risk controls, and audit-ready workflows to safely scale recurring digital care across jurisdictions.

Below are the core governance and risk domains that must be addressed in a subscription-based telehealth platform.

1. Regulatory Compliance

Subscription telehealth platforms process sensitive clinical and behavioral data over long periods. This requires strict adherence to healthcare data protection regulations and regional privacy laws.

Encryption, secure storage, and controlled data sharing must be enforced consistently across all digital touchpoints. Enterprises also need clear policies for data retention and deletion as subscriptions evolve or end.

2. Consent Management and Patient Rights

Consent in subscription care is not a one-time event. Patients must be informed about how their data is used across virtual visits, follow-ups, analytics, and AI-assisted workflows.

The platform should track consent changes over time and apply them dynamically to care delivery. This ensures patient rights are respected while maintaining operational continuity.

3. Clinical Governance and Decision Accountability

Subscription models rely on standardized workflows, but clinical accountability remains essential.

Clear protocols define which cases can be handled virtually and when escalation is required. Every decision should be traceable to a clinician or policy. This protects patient safety and provides defensible records during audits or reviews.

4. Risk Stratification and Escalation Policies

Continuous access increases the risk of delayed escalation if warning signs are missed. Platforms must include defined thresholds for urgency and deterioration.

Automated alerts can support early detection, but escalation paths must be clear and enforced. Enterprises benefit from the consistent application of risk rules rather than ad hoc judgment.

5. Multi-Jurisdiction and Licensing Considerations

Subscription telehealth often crosses state or regional boundaries. Licensing, scope-of-practice rules, and prescribing regulations vary by jurisdiction.

The platform must enforce location-aware access and provider matching. This reduces regulatory exposure and ensures care delivery remains lawful across regions.

6. Cybersecurity and Platform Resilience

Recurring digital care expands the attack surface. Strong identity controls, role-based access, and continuous monitoring are essential.

Enterprises must plan for uptime, incident response, and recovery. Resilience is not optional when care access depends on digital infrastructure.

7. Auditability and Enterprise Reporting

Governance requires visibility. Every access, decision, and data exchange should be logged and reviewable.

Audit-ready reporting supports internal oversight and external compliance reviews. For enterprise leaders, this transparency is what allows digital care to scale with confidence.

Compliance, governance, and risk management define whether subscription telehealth can operate safely at scale. They build trust, protect clinicians, and create a stable foundation for long-term digital care growth.

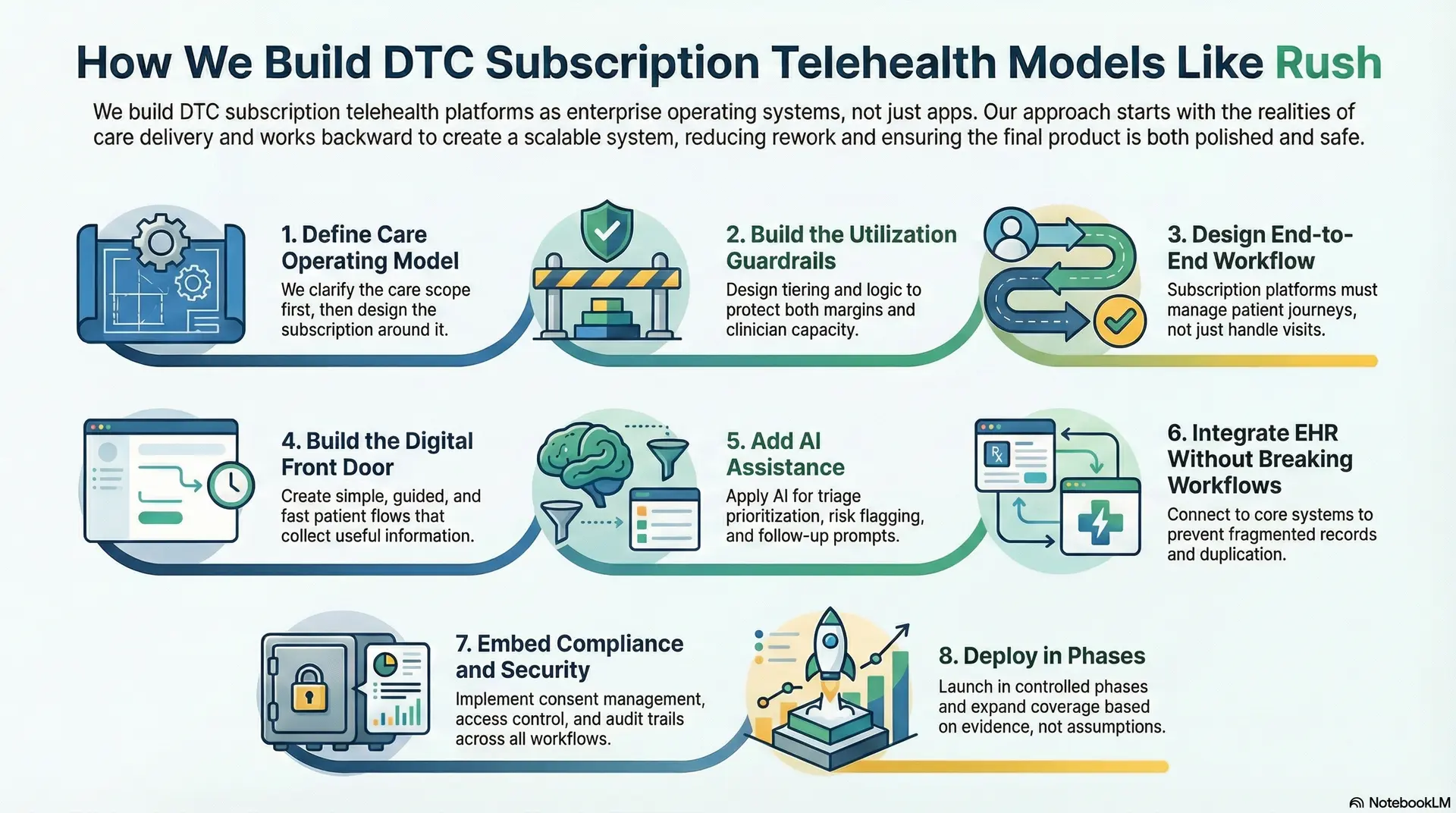

How We Build DTC Subscription Telehealth Models Like Rush

At Intellivon, we build DTC subscription telehealth platforms as enterprise operating systems, not standalone apps. We start with care delivery realities and work backward into architecture, governance, and unit economics. That approach reduces rework, shortens time-to-value, and prevents the common trap of launching a product that looks polished but cannot scale safely.

Below is our step-by-step build approach. This is the same structure we use when working with healthcare enterprises that want a Rush-inspired model with their own clinical strategy, brand, and governance standards.

Step 1: Define Care Operating Model

We begin by mapping what the subscription actually promises. Many organizations start with pricing and then force care to fit. We clarify the care scope first, then design the subscription around it.

This step covers the practical questions leaders care about. Which conditions will you serve first? What is the expected response time? Which interactions are asynchronous vs live? When do you escalate to in-person care? We also define what “always-on” means operationally, including staffing expectations and coverage boundaries.

By the end of this phase, you have a clear care blueprint that can be executed consistently across teams.

Step 2: Build the Utilization Guardrails

Subscription telehealth can create unmanaged demand if access rules are vague. Our experts also design tiering and entitlement logic to protect both margins and clinician capacity.

We define membership tiers based on care intensity. We also design usage boundaries that still feel patient-friendly. This includes eligibility by geography, limits for certain high-cost services, and rules for escalation.

At the same time, we implement policy-aware access controls early so the platform enforces these rules automatically rather than relying on manual intervention later. This is where enterprises avoid surprise cost-to-serve spikes after launch.

Step 3: Design End-to-End Workflow

Most telehealth platforms handle visits. Subscription platforms must manage journeys. That requires workflow orchestration.

We design structured workflows for intake, triage, clinician review, follow-ups, messaging, and care navigation. We also define task routing across roles, so the right person does the right work.

Here, nurses and coordinators handle structured steps, and physicians focus on decision-making and exception handling. We also build escalation paths that are consistent and audit-ready. This prevents gaps in continuity and reduces variation across providers and locations.

Step 4: Build the Digital Front Door

The front door determines conversion, experience, and safety. We build patient flows that are simple, guided, and fast, while still collecting clinically useful information.

Intake captures structured symptoms, relevant history, and contextual data. Navigation is built as a core experience, not an add-on. Patients get clarity on what happens next, why it happens, and how to complete the next step.

Where human navigation is part of the model, we integrate navigator workflows into the same platform so they can coordinate care without jumping between systems. This step directly impacts retention and downstream service conversion.

Step 5: Add AI Assistance

We introduce AI only when it has a clear operational purpose. Our experts apply AI for triage prioritization, risk flagging, follow-up prompts, and adherence nudges. We also use AI to support care teams with summarization and structured documentation where appropriate.

Every AI output remains governed by clinical rules, and humans retain accountability for final decisions. This approach improves responsiveness while keeping the platform defensible under regulatory scrutiny.

Step 6: Integrate EHR Without Breaking Workflows

A subscription telehealth model cannot operate as a silo. It must connect to core healthcare systems and workflows.

We build interoperability for EHR, lab ordering and results, pharmacy workflows, imaging where needed, and remote monitoring device streams. We also ensure data flows back into the longitudinal patient timeline in a usable format.

This prevents fragmented records and reduces duplication across teams. Enterprises benefit because digital care becomes part of the system, not a parallel service.

Step 7: Embed Compliance and Security

Compliance cannot be bolted on at the end. Subscription care increases data volume, duration, and touchpoints, which increases exposure.

We implement consent lifecycle management, role-based access control, encryption, and detailed audit trails across all workflows. We also design escalation and clinical governance policies so decisions are traceable to a provider, a rule, or a protocol.

Security monitoring and incident response processes are built into the operating plan, not just the infrastructure. This phase protects trust and reduces enterprise risk as adoption grows.

Step 8: Deploy in Phases

We do not recommend a big-bang launch. Subscription telehealth must be tuned against real demand patterns.

Our experts deploy in controlled phases, starting with a defined population, a limited set of conditions, and measurable service-level targets. At the same time, we monitor response times, escalation rates, clinician load, and patient satisfaction.

Then, we expand coverage and capabilities based on evidence rather than assumptions. This approach improves adoption and prevents operational failure during the first scaling wave.

At Intellivon, we bring the engineering depth and healthcare AI expertise required to build this model safely at enterprise scale. If you want to launch a subscription telehealth offering that drives growth, improves retention, and protects clinical capacity, we can help you design, build, and deploy it with confidence.

Cost To Build DTC Subscription Telehealth Models Like Rush

Building a Rush-style DTC subscription telehealth model does not require a massive upfront investment if approached correctly. The cost is driven less by feature volume and more by how deliberately the platform is phased around care workflows, subscription economics, and governance.

At Intellivon, we align cost planning with leadership budget cycles, regulatory readiness, and measurable ROI. Our focus is to build a subscription-ready digital care core that can scale across populations, conditions, and geographies without rework.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost (USD) |

| Clinical & Business Discovery | Subscription model definition, care scope mapping, workflow analysis, and regulatory scoping | 8,000 – 15,000 |

| Platform Architecture & Subscription Blueprint | Access control design, care orchestration, tiering logic, system architecture | 10,000 – 18,000 |

| Core Subscription Telehealth Platform Development | Membership management, intake, async care, video consults, navigation workflows | 20,000 – 45,000 |

| Care Workflow & Orchestration Engine | Triage logic, task routing, escalation paths, care team coordination | 12,000 – 25,000 |

| Integrations & Interoperability | EHR, labs, pharmacy, RPM devices, identity, and SSO | 10,000 – 20,000 |

| Security, Compliance & Governance Controls | Consent management, audit logs, access control, compliance validation | 8,000 – 15,000 |

| Testing, QA & Clinical Validation | Workflow testing, performance validation, and clinician review | 6,000 – 10,000 |

| Pilot Deployment & Team Enablement | Controlled launch, staff onboarding, operational tuning | 8,000 – 12,000 |

Total Initial Investment Range: USD 75,000 – 160,000

This investment supports a subscription-ready DTC telehealth platform deployed for one or two high-impact care categories, operating with enterprise-grade security, compliance, and governance.

Annual Maintenance and Optimization: Ongoing costs focus on keeping the platform secure, compliant, and optimized as usage grows.

- Cloud infrastructure and hosting

- Security monitoring and patching

- Integration maintenance

- Workflow and performance optimization

Estimated Annual Cost: 10–15% of initial build cost

Approx. USD 8,000 – 25,000 per year

Predictability is highest when interoperability and compliance are engineered correctly from the start.

Cost Variables to Plan for During Scale

As adoption increases, additional costs may arise from:

- Expanding subscriptions across more conditions or populations

- Adding chronic care, weight management, or behavioral health programs

- Increased RPM device usage and data volume

- Multi-state or multi-region regulatory requirements

- Advanced analytics and AI-assisted care optimization

Planning for these variables early prevents budget pressure during expansion.

How Enterprises Stay Within the USD 75K–160K Range

Healthcare organizations that control subscription telehealth costs typically:

- Start with a narrowly defined care scope and target population

- Avoid multi-region complexity in the first phase

- Design subscription tiers and access rules upfront

- Use modular architecture to expand incrementally

- Measure retention, utilization, and cost-to-serve within the first 90 days

This approach ensures the platform demonstrates both clinical and financial value before larger capital deployment.

Talk to Intellivon’s healthcare platform architects to receive a phased cost estimate aligned with your enterprise growth strategy and subscription care roadmap.

How To Monetize A DTC Subscription Telehealth Model

DTC subscription telehealth monetization combines recurring memberships, paid virtual encounters, downstream care conversion, and ancillary services to build predictable, scalable healthcare revenue.

Below are the monetization levers that consistently work in enterprise-grade DTC subscription telehealth, supported by real, primary-source data.

1. Subscription Membership as the Revenue Foundation

The primary monetization layer is the recurring membership fee.

Rush Connect+ is priced at USD 19 per month or USD 189 per year, positioning the subscription as a low-friction entry point while establishing predictable recurring revenue. At scale, even modest pricing becomes meaningful. For example, 100,000 subscribers at USD 19 per month translate to approximately USD 22.8 million in annual recurring revenue, before any care encounters or downstream services are added.

For enterprises, this baseline revenue improves forecasting accuracy and reduces dependence on episodic demand spikes.

2. Per-Encounter Virtual Care Revenue

Subscriptions rarely include unlimited live care. Instead, members pay reduced rates for specific encounters.

Rush offers USD 18 asynchronous e-visits and USD 40 video visits for members, compared to significantly higher self-pay rates in non-member scenarios. This structure balances access and utilization control. It generates incremental revenue without re-acquisition costs and preserves clinician capacity for higher-acuity cases.

If even 25–30% of subscribers complete one paid virtual visit per quarter, this layer alone adds several million dollars annually at a moderate scale.

3. Downstream Care Conversion

This is the most powerful monetization lever for healthcare enterprises.

Virtual care acts as a routing layer into primary care, specialty consults, diagnostics, imaging, and in-person procedures. By positioning telehealth as the front door, health systems retain the patient relationship instead of losing it to third-party providers.

While Rush does not publicly disclose conversion percentages, health systems consistently report that downstream in-person services generate multiples of virtual visit revenue, often 5–10x higher per patient once diagnostics and procedures are involved.

This is where subscription telehealth shifts from access cost to growth engine.

4. Medication, Programs, and Ongoing Care Plans

Leading DTC platforms demonstrate how subscription revenue expands over time. Hims & Hers reported average monthly online revenue per subscriber of USD 64 in 2024, up from USD 54 in 2023

This figure reflects subscriptions combined with medications, renewals, and ongoing care programs. It shows that users are willing to pay more as care becomes continuous and personalized.

For healthcare enterprises, similar expansion opportunities exist in:

- Chronic condition management

- Weight management and metabolic health

- Behavioral health follow-ups

- Post-acute and recovery programs

These offerings increase lifetime value without increasing acquisition spend.

Beyond pure DTC, many health systems layer employer or partner distribution on top of the same subscription platform. Per-member-per-month pricing in employer-sponsored virtual care programs commonly ranges between USD 10 and USD 30, depending on scope and service depth.

While margins per user may be lower, retention and volume are typically higher. This channel further stabilizes revenue and expands reach without diluting the consumer-facing experience.

Conclusion

DTC subscription telehealth represents a structural shift in how healthcare organizations deliver access, manage demand, and build lasting patient relationships. Models like Rush prove that when subscriptions anchor care delivery, telehealth becomes predictable, governable, and financially sustainable at scale.

For enterprises, this is not a cost-saving tactic. It is a growth strategy. With the right operating model, architecture, and governance, subscription telehealth strengthens retention, expands downstream revenue, and protects clinical capacity. Intellivon helps healthcare leaders design and build these platforms with confidence, from strategy to scalable execution.

Develop A DTC Subscription Telehealth Model With Intellivon

At Intellivon, we build DTC subscription telehealth platforms as enterprise operating systems, not consumer-facing apps stitched onto legacy workflows. Our platforms are designed to function as a governed digital front door, connecting subscription access, virtual care delivery, navigation, and downstream services into one controlled system.

Each solution is engineered for healthcare enterprises that need scale without chaos. Platforms are infrastructure-first, compliance-led, and built to handle continuous demand while delivering predictable revenue, protected clinical capacity, and measurable ROI as digital care expands across populations and regions.

Why Partner With Intellivon?

- Subscription-first care architecture aligned with real clinical workflows, access governance, and demand management

- Deep interoperability expertise across EHRs, identity systems, HL7, FHIR, pharmacy, labs, and RPM ecosystems

- Compliance-by-design platforms supporting HIPAA, consent lifecycle management, role-based access, and audit-ready workflows

- AI-enabled care orchestration for triage support, routing intelligence, follow-ups, and engagement optimization

- Enterprise-scale delivery model with phased rollout control, cost predictability, and continuous performance optimization

Talk to Intellivon’s healthcare platform architects to explore how a Rush-style DTC subscription telehealth model can drive growth, strengthen retention, and scale digital care with confidence.

FAQs

Q1. What is a DTC subscription telehealth model?

A1. A DTC subscription telehealth model provides patients with ongoing access to virtual care through a monthly or annual membership. Instead of paying per visit, users receive continuous access, guided care navigation, and follow-ups, improving retention and care continuity for healthcare enterprises.

Q2. How does a Rush-style subscription telehealth model work?

A2. A Rush-style model uses a paid membership as the entry point, followed by structured intake, virtual care delivery, human navigation, and seamless routing into in-person or specialty services. Telehealth acts as a front door, not a standalone endpoint.

Q3. Is DTC subscription telehealth profitable for healthcare enterprises?

A3. Yes, when designed correctly. Enterprises generate recurring subscription revenue, paid virtual visit fees, and downstream revenue from diagnostics and in-person care. Models like Rush show that subscriptions stabilize demand while increasing lifetime value per patient.

Q4. What regulations apply to DTC subscription telehealth platforms?

A4. DTC subscription telehealth platforms must comply with HIPAA, data privacy laws, consent management requirements, clinical governance standards, and provider licensing rules across jurisdictions. Compliance must be embedded into workflows, not added after deployment.

Q5. How long does it take to build a DTC subscription telehealth platform?

A5. For most healthcare enterprises, an initial subscription-ready platform can be built and piloted in 3 to 6 months, depending on scope, integrations, and regulatory complexity. Phased deployment allows early ROI while scaling capabilities over time.