When the pandemic hit, hospitals scrambled to adopt virtual care apps. The goal was to get patients connected to care, fast. These tools filled critical gaps and brought medicine into people’s homes when they needed it most. But most of these solutions were built in isolation and were not designed to talk to each other, let alone integrate with the complex systems hospitals already run. Now, as virtual care becomes a permanent fixture rather than an emergency response, the cracks are starting to show.

Healthcare leaders are realizing they need a unified platform that can deliver multiple virtual services under one roof. That is where white-label virtual care marketplaces come in. Think of it as bringing all your virtual care offerings together in one branded space, where you still control the clinical standards, the data, and the patient experience. Virtual care scales up, but you don’t lose the reins.

At Intellivon, we build white-label virtual care marketplaces as enterprise operating layers and not stitched-together telehealth tools. Our platforms are architecture-first and compliance-led, specifically designed to integrate with existing hospital systems while supporting partner participation at scale. This blog explains how we can help launch a white-label virtual care marketplace that is scalable, secure, and fully owned by enterprises.

Key Takeaways Of the White Label Virtual Care Marketplace

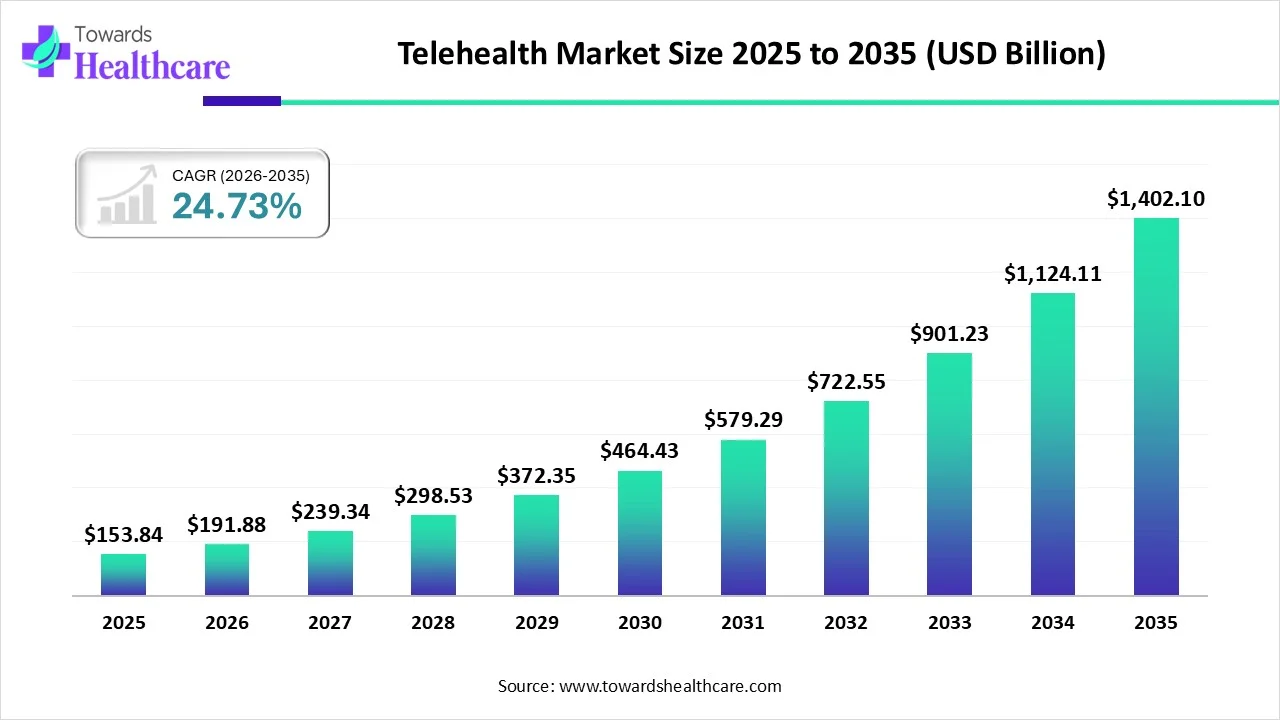

The global telehealth market is valued at approximately USD 153.84 billion in 2025 and is expected to reach USD 191.88 billion in 2026. Over the next decade, the market is projected to expand significantly, approaching USD 1,402.1 billion by 2035, growing at a CAGR of 24.73% from 2026 to 2035. This rising tide directly lifts white-label virtual care marketplaces.

Market Insights:

- White-label telehealth/healthcare marketplace apps cut time-to-market by roughly 30–60% compared with fully custom platforms, enabling health systems and MSOs to launch branded virtual care networks in months instead of years.

- Over 80% of healthcare organizations now offer some form of virtual care, and many are shifting from point telehealth tools to unified white-label platforms to standardize experience across states, brands, and acquired clinics.

- Virtual visits grew 51× between 2018 and 2020, and sustained demand has pushed providers to seek turnkey white-label solutions rather than building custom tech, especially for urgent care, employer clinics, and specialty marketplaces.

- Market analysts expect telehealth to grow 5–7× over the next decade, and a significant share of that volume is being captured by platforms that offer white-label APIs and multi-tenant architectures, allowing enterprises to spin up multiple branded marketplaces on a single core.

White-label virtual care marketplaces are emerging as strong growth drivers for healthcare enterprises. As virtual care adoption accelerates, hospitals and health systems are investing in marketplace models that support multiple digital services under one branded platform.

By adopting white-label marketplace models, hospitals retain ownership of patient relationships, data, and brand experience. Moreover, these platforms enable faster service expansion without rebuilding core infrastructure. For healthcare enterprises, this approach unlocks scalable revenue streams while maintaining governance, compliance, and operational control.

What Is a White-Label Virtual Care Marketplace?

A white-label virtual care marketplace is a hospital-owned digital platform that brings multiple virtual care services into one governed system. Unlike standalone telehealth tools, it operates as an extension of the hospital’s core care delivery model.

The platform carries the hospital’s brand, clinical standards, and governance rules across every service offered. Care delivery may involve internal teams, external partners, or hybrid models, but ownership remains centralized. As a result, patient journeys, data flows, and accountability stay within the hospital ecosystem. This approach allows hospitals to scale virtual care without losing operational or clinical control.

How Marketplaces Differ From Other Virtual Care Models

Hospitals often use multiple digital tools today. However, these tools serve different purposes and offer varying levels of control. The table below clarifies how white-label marketplaces differ from common alternatives.

| Model | Primary Purpose | Ownership & Control | Typical Limitations |

| Telehealth platforms | Enable virtual consultations | Vendor-led workflows and data | Limited scalability across services |

| Digital health apps | Support specific conditions or tasks | App-centric, not hospital-centric | Fragmented patient journeys |

| White-label care marketplaces | Deliver multiple virtual services | Hospital-owned and governed | Requires enterprise-grade planning |

In practice, marketplaces replace fragmentation with coordination.

Types Of Services Hosted In A Marketplace

White-label marketplaces support a wide range of virtual care services under one platform. Each service follows shared governance while retaining operational flexibility.

1. Virtual Consultations

Virtual consultations cover general medicine and specialty care delivered through hospital-branded digital channels. These services support scheduled visits, asynchronous follow-ups, and second opinions.

Clinical ownership remains clearly assigned, with documentation flowing into existing systems. As demand grows, hospitals can add specialties without introducing new patient entry points.

2. Chronic Care And Remote Patient Monitoring

Chronic care and RPM services focus on long-term condition management outside hospital walls. These services combine virtual check-ins, device data, and care coordination workflows.

Data feeds support proactive interventions rather than reactive visits. As a result, hospitals can manage larger patient populations with predictable oversight.

3. Behavioral And Mental Health Services

Behavioral health services include therapy, psychiatry, and ongoing counseling programs. Marketplaces allow these services to integrate with primary and specialty care workflows. Shared records improve continuity while preserving privacy controls.

This structure helps hospitals scale mental health access without isolating it from broader care delivery.

4. Diagnostics And Virtual Follow-Ups

Diagnostic services include virtual lab ordering, result interpretation, and follow-up consultations. These workflows reduce unnecessary in-person visits while maintaining clinical accountability.

Results remain linked to the ordering clinician and care pathway. Therefore, diagnostics become part of a coordinated virtual journey.

5. Post-Discharge And Continuity Care

Post-discharge services support patients after inpatient or outpatient treatment. Virtual check-ins, recovery monitoring, and escalation workflows reduce readmissions.

Care teams maintain visibility into patient progress without manual tracking. This approach extends hospital responsibility beyond discharge events.

Together, these services create a unified virtual care layer that hospitals can expand without losing control.

Hospital API for Patient Access Increased To 80% In Telehealth

Telehealth is no longer a single access channel hospitals use for convenience. It has evolved into a broad, reimbursable service layer that spans multiple specialties and care moments.

Federal data now shows more than 250 reimbursable Medicare telehealth codes. That volume reflects how virtual care has expanded beyond isolated consultations. As this surface area grows, delivery models must evolve with it.

1. Telehealth Has Become A Multi-Service Catalog

The increase in reimbursable telehealth codes signals a shift in how care is delivered. Hospitals now support behavioral health, chronic care, diagnostics, follow-ups, and specialty consults through virtual channels.

Each service introduces different workflows, clinical ownership, and reporting needs. When these services operate in silos, coordination becomes harder over time. Therefore, a structured delivery model becomes essential as the catalog expands.

2. Hospital APIs Are Already Built For Ecosystem Access

Hospitals have also invested in the technical foundation needed for broader digital ecosystems. In inpatient settings, API enablement for patient-facing apps increased from 68 percent in 2021 to 83 percent in 2023.

It stabilized at 80 percent in 2024, which signals maturity rather than a slowdown. These APIs allow controlled access to data and workflows. As a result, hospitals are already positioned to support multi-service virtual platforms.

3. Bulk Data Export Enables Cross-Service Intelligence

Data consolidation is advancing quietly across health systems. By 2021, 74 percent of hospitals had adopted bulk data export capabilities. Among those hospitals, 84 percent used bulk data for analytics and reporting.

In addition, 47 percent applied it to population health management. These capabilities matter because scaling virtual care requires shared insight across services.

Why These Signals Point To Marketplace Models

When telehealth offerings multiply, coordination becomes the limiting factor. White-label virtual care marketplaces help hospitals organize services, partners, and patient journeys within one governed system.

Instead of managing growth tool by tool, hospitals can scale through a single operating layer. This approach preserves brand control, data ownership, and clinical accountability as virtual care continues to expand.

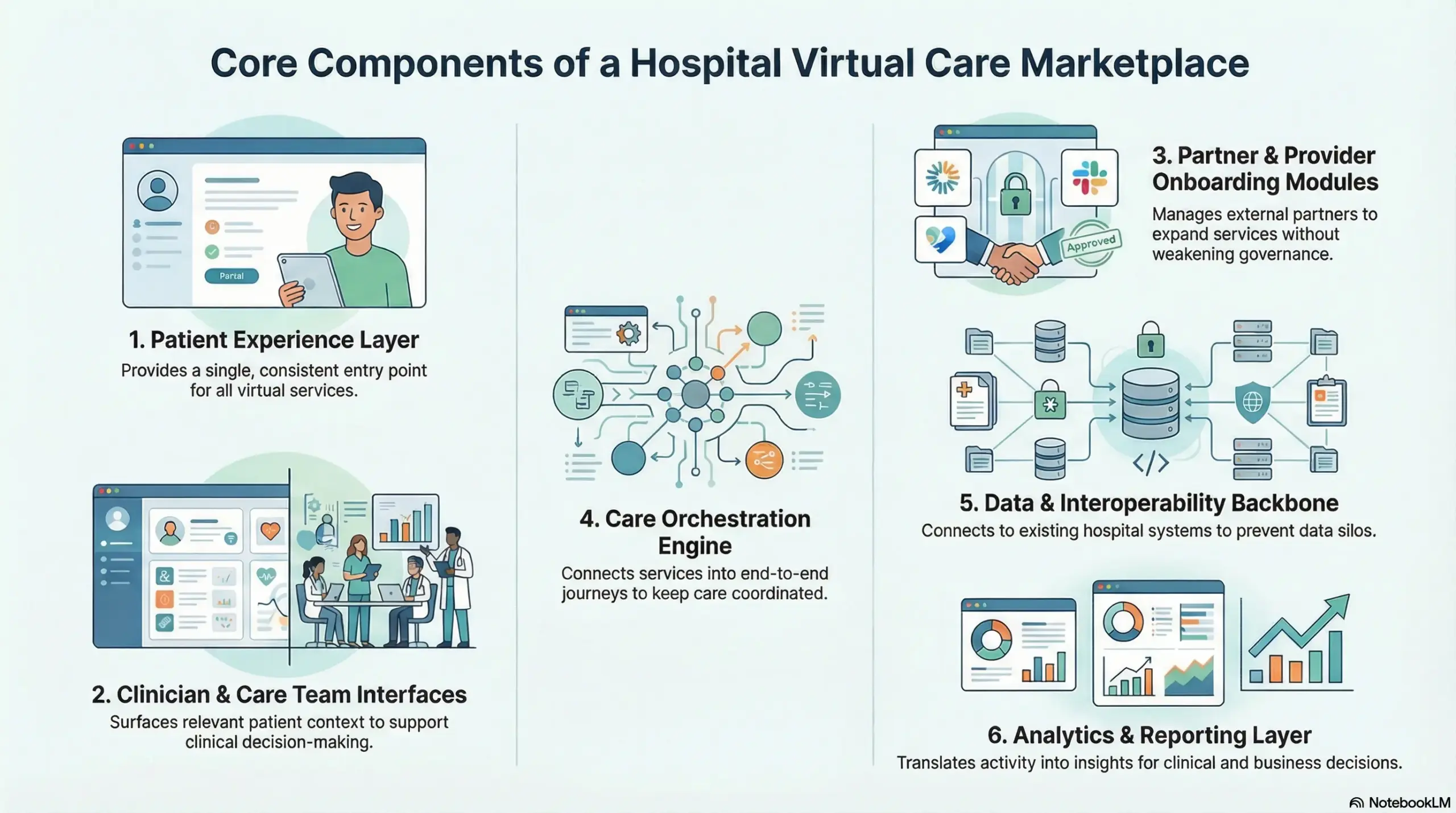

Core Components of a Hospital Virtual Care Marketplace

A virtual care marketplace only works when its foundation is designed for hospital-scale complexity. Point solutions often focus on one user or one workflow. Marketplaces, however, must support patients, clinicians, partners, and operations at the same time.

Each component plays a distinct role in keeping care coordinated, governed, and scalable. Together, they form a system hospitals can rely on as virtual care expands.

1. Patient Experience Layer

The patient experience layer defines how individuals access and move through virtual services. It provides a single entry point for appointments, follow-ups, and ongoing care. Navigation remains consistent across services, which reduces confusion.

As a result, patients engage with virtual care as part of the hospital, not a collection of apps.

2. Clinician And Care Team Interfaces

Clinician interfaces support decision-making, documentation, and follow-up actions. These views surface relevant patient context without overwhelming users.

Care teams can track responsibilities and next steps clearly. Therefore, clinicians spend less time managing tools and more time delivering care.

3. Partner And Provider Onboarding Modules

Virtual care marketplaces often involve external providers and service partners. Onboarding modules manage credentialing, access rights, and service scope.

Rules remain standardized even as partners vary. This structure allows hospitals to expand services without weakening governance.

4. Care Orchestration Engine

The orchestration engine connects services into end-to-end care journeys. It routes patients, assigns tasks, and manages escalations.

Workflows remain visible across services and teams. Consequently, care delivery stays coordinated as volume grows.

5. Data And Interoperability Backbone

The interoperability layer connects the marketplace with existing hospital systems. Clinical data, scheduling, and records flow securely between platforms.

This prevents data silos from forming. Therefore, virtual care remains part of the broader clinical ecosystem.

6. Analytics And Reporting Layer

Analytics translates activity into insight. Hospitals track utilization, outcomes, and operational performance across services.

Reporting supports both clinical oversight and business decisions. Over time, data guides smarter expansion and investment.

Together, these components turn a virtual care marketplace into a dependable hospital infrastructure rather than a collection of tools.

Advanced AI-Powered Features Of A White-Label Virtual Care Marketplace

As virtual care scales, manual coordination becomes a limiting factor. AI helps hospitals move from reactive management to proactive orchestration. In a marketplace model, AI does not replace clinicians or operators. Instead, it strengthens decision support, workflow prioritization, and system-wide visibility.

When applied correctly, AI improves speed, accuracy, and consistency across virtual care services.

1. Intelligent Patient Routing And Triage

AI-driven routing analyzes intake data, symptoms, risk signals, and service availability. Patients are directed to the right service or provider early in the journey.

This reduces unnecessary escalations and delays. As a result, care begins faster and with better clinical alignment.

2. Predictive Workload And Capacity Management

AI models forecast demand across services and time periods. Hospitals gain visibility into the upcoming workload before bottlenecks form.

Staffing and scheduling decisions become data-informed rather than reactive. Therefore, operations remain stable as virtual volumes fluctuate.

3. Clinical Decision Support And Risk Flagging

AI continuously monitors patient data for anomalies, contraindications, or risk patterns. Clinicians receive timely alerts without constant manual review.

This supports safer decisions while preserving clinical autonomy. Consequently, oversight improves without adding cognitive burden.

4. Automated Care Coordination

AI tracks incomplete tasks, missed follow-ups, and unresolved care actions. Automated nudges prompt care teams or patients when intervention is needed.

This reduces drop-offs across virtual journeys. Over time, outcomes improve through consistent follow-through.

5. Revenue And Utilization Intelligence

AI analyzes service usage, reimbursement patterns, and engagement trends. Hospitals identify which services perform well and where leakage occurs.

These insights guide expansion and optimization decisions. As a result, virtual care becomes financially smarter.

When embedded thoughtfully, AI transforms a virtual care marketplace from a delivery platform into an adaptive operating system for hospital-scale care.

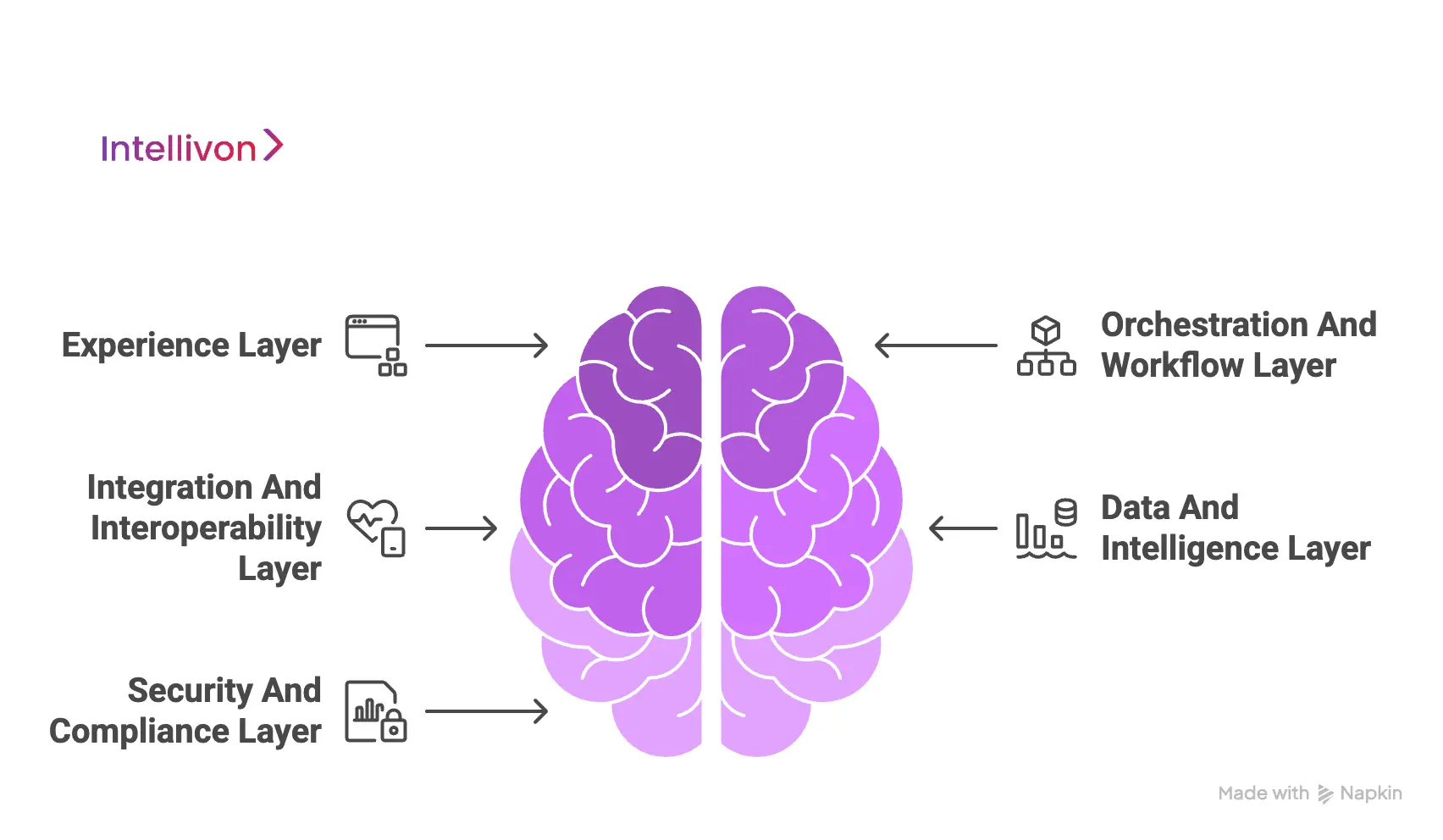

Architecture for a White-Label Virtual Care Marketplace

A hospital marketplace architecture must support scale, governance, and integration from day one. Each layer solves a specific operational problem. Together, they prevent virtual care from turning into a patchwork of tools.

This structure also makes expansion predictable across services and partners. As a result, hospitals can add capabilities without breaking workflows or control.

1. Experience Layer

This layer defines how users interact with the marketplace. It provides consistent access across services, therefore reducing friction and confusion.

Patients enter through one branded front door instead of multiple apps. Clinicians view tasks and patient context without switching systems. Meanwhile, partners and operations teams see only what aligns with their roles.

Typical tech and components

- Web portal frameworks for patient access

- Mobile app frameworks for iOS and Android

- Clinician dashboard UI components

- Partner portal interfaces with scoped access

- Admin consoles for service and workflow management

- Notifications via email, SMS, and in-app messaging

2. Orchestration And Workflow Layer

This layer coordinates how care moves across services, teams, and partners. It routes patients based on context, eligibility, and service availability. Tasks and follow-ups remain visible across the care journey.

Escalations move to the right clinician or team with clear ownership. As virtual services multiply, this layer prevents missed handoffs and delays.

Typical tech and components

- Workflow engines for routing and task state

- Rules engines for eligibility, triage, and escalation logic

- Care pathway templates and service catalogs

- Scheduling and queue management modules

- Case management and task assignment systems

- Messaging and event-driven triggers for follow-ups

3. Integration And Interoperability Layer

This layer connects the marketplace to hospital systems and external networks. It pulls clinical context and pushes documentation back into core systems. Lab, imaging, and pharmacy workflows connect through secure interfaces.

In addition, RPM devices stream data through standardized ingestion pathways. Billing and claims integrations ensure services remain reimbursable and traceable.

Typical tech and components

- HL7 and FHIR interfaces for EHR and EMR integration

- API gateways for secure external connectivity

- Integration engines for routing messages across systems

- Lab interfaces for ordering and results delivery

- Pharmacy and ePrescribing connectivity modules

- Imaging interfaces for reports and attachments

- Billing and claims integration adapters

4. Data And Intelligence Layer

This layer brings together signals generated across virtual services. Instead of isolated reports, hospitals gain a shared view of patient activity and performance. Unified records support continuity across programs.

Operational and clinical analytics highlight trends and bottlenecks. Consequently, leaders can act on insight rather than assumptions.

Typical tech and components

- Master patient index and identity matching logic

- Data lakes or warehouses for cross-service reporting

- Real-time data pipelines for event and device streams

- Dashboards for clinical, operational, and financial metrics

- AI models for risk scoring and service prioritization

- Model monitoring and drift detection workflows

5. Security And Compliance Layer

This layer enforces control across every other layer. Identity and access management defines role-based permissions. Encryption protects data both in transit and at rest. Data segregation allows partner participation without exposure.

Audit logs capture actions across services for traceability. Therefore, compliance becomes enforceable through system behavior rather than policy alone.

Typical tech and components

- IAM systems with RBAC and optional ABAC

- Single sign-on and federation for enterprise identity

- Encryption services for data at rest and in transit

- Key management systems and secret vaults

- Consent management and purpose-based access controls

- Audit logging with immutable storage and retention rules

- Security monitoring and incident response tooling

When these layers work together, the virtual care marketplace operates as hospital infrastructure rather than a collection of digital features.

Compliance Considerations Of A White Label Virtual Care Marketplace

Compliance determines whether a virtual care marketplace can scale safely within a hospital environment.

A marketplace model makes this possible by embedding controls directly into workflows. As a result, growth does not introduce unmanaged risk.

1. Patient Consent And Data Protection

Consent is the foundation of digital care delivery. In a marketplace model, consent must travel with the patient across services. Systems should capture consent at the moment a service begins, not after care is delivered.

Access must align strictly with the stated purpose. When consent changes, enforcement must occur automatically across connected services.

1. Consent Capture At Service Entry

Each virtual service records patient consent before care begins. This establishes clarity around data use and care scope. It also reduces downstream ambiguity during audits. As a result, hospitals maintain consistent consent records across services.

2. Purpose-Based Access Control

Access permissions align with the specific purpose of care delivery. Clinicians and partners only see data required for their role. This limits unnecessary exposure across services. Therefore, data access remains tightly governed.

3. Consent Withdrawal Enforcement

When patients withdraw consent, systems update immediately. Data access adjusts across all services without manual intervention. This prevents accidental misuse of information. Over time, automated enforcement reduces compliance risk.

Strong consent controls protect both patients and institutions.

2. Clinical Accountability

Clear accountability preserves clinical quality in virtual environments. Marketplaces must make responsibility visible across services and partners. Every decision needs an identifiable owner. Follow-ups must remain traceable from initiation through resolution. This clarity supports safe scale.

1. Attribution Of Care Decisions

Each clinical action links to a specific clinician or care team. This linkage supports governance reviews and patient safety. It also simplifies dispute resolution. Therefore, accountability remains unambiguous.

2. Ownership Of Diagnostic Results

Diagnostic results stay tied to the ordering provider. Escalation rules define who acts next and when. This prevents results from going unmanaged. As a result, follow-through improves.

3. Follow-Up And Outcome Traceability

Systems track care actions until completion. Missed steps surface quickly through alerts. This visibility reduces delays. Consequently, outcomes remain measurable and defensible.

Accountability keeps virtual care clinically defensible at scale.

3. Third-Party Provider Governance

Marketplaces often involve external providers delivering care under hospital oversight. Governance ensures participation does not dilute clinical or operational standards.

Hospitals must control who delivers care and under what conditions. Performance must remain visible over time. This balance enables safe collaboration.

1. Credential Verification

Providers complete credential checks before onboarding. Access depends on verified qualifications and approvals. This reduces onboarding risk. Therefore, only authorized providers deliver care.

2. Scope-Of-Practice Enforcement

Systems restrict providers to approved services and roles. This prevents unauthorized care delivery. Boundaries remain consistent across services. As a result, compliance stays intact.

3. Performance And Compliance Monitoring

Activity, outcomes, and adherence are monitored continuously. Underperformance triggers a structured review. This creates accountability over time. Consequently, standards remain consistent.

Governance enables safe partner participation without loss of control.

4. Audit And Regulatory Readiness

Audit readiness must be continuous rather than reactive. Marketplaces should generate evidence as care occurs. Data separation supports reporting clarity. This reduces disruption during reviews. Therefore, audits become manageable events.

1. Immutable Activity Logs

All actions generate tamper-resistant records. Logs support investigations and compliance reviews. They also preserve historical context. As a result, traceability improves.

2. Report-Ready Compliance Trails

Reports assemble quickly from system data. Manual reconstruction becomes unnecessary. This saves time during audits. Consequently, teams stay focused on operations.

3. Separation Of Clinical, Operational, And Financial Data

Data domains remain logically distinct. This simplifies audits and protects sensitive information, and reporting remains clear. Therefore, regulatory responses are faster.

When compliance is built into the platform, scale becomes sustainable rather than risky.

Governance Models for Virtual Care Marketplaces

Governance defines how a virtual care marketplace operates at scale. Without it, growth introduces confusion, risk, and diluted accountability. Hospitals must balance flexibility with control as services and partners expand.

A clear governance model provides that balance. It sets expectations, enforces standards, and protects institutional ownership over care delivery.

1. Centralized Governance With Distributed Care Delivery

This model places governance authority at the hospital level. Clinical standards, access rules, and escalation paths remain centrally defined. However, care delivery can occur across internal teams and external partners.

This approach supports scale without fragmenting accountability. As a result, hospitals retain control while expanding service reach.

2. Service-Level Governance

In this model, governance aligns with specific service lines. Each domain follows shared platform rules but maintains tailored protocols. Clinical leaders oversee standards relevant to their specialty.

This structure works well when services vary significantly in risk or workflow. Therefore, hospitals can adapt governance without losing consistency.

3. Partner Governance And Oversight Frameworks

Partner participation requires defined governance boundaries. Hospitals control onboarding, scope of practice, and performance benchmarks. Ongoing monitoring ensures partners meet clinical and operational expectations.

When issues arise, predefined actions guide resolution. Consequently, partnerships remain productive and compliant.

4. Escalation And Decision Rights Models

Escalation models define how responsibility shifts when care becomes complex. Rules determine when cases move between services or teams.

Decision rights remain visible at each step. This clarity prevents delays and confusion. Over time, it improves response quality across virtual journeys.

5. Governance For Scale And Change

Governance must evolve as marketplaces grow. New services, regions, or partners introduce fresh risks. Adaptive governance models allow updates without disruption.

This flexibility ensures long-term viability. As a result, hospitals scale confidently.

Effective governance turns a virtual care marketplace into a controlled, resilient operating model rather than an unmanaged network of services.

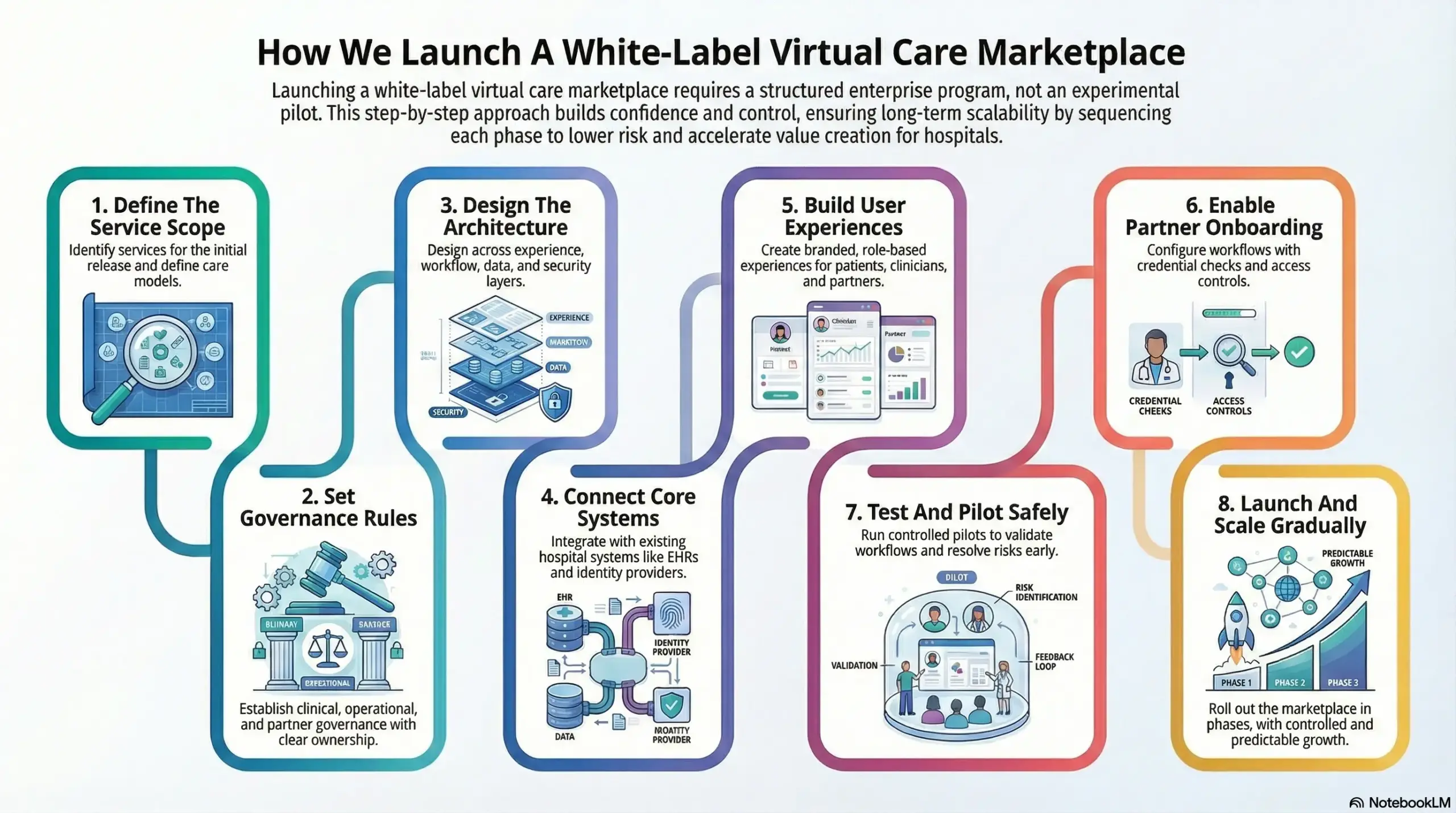

How We Launch A White-Label Virtual Care Marketplace

Launching a virtual care marketplace demands structure, not experimentation. Hospitals need clarity on ownership, integration, and compliance before scale begins.

At Intellivon, teams run marketplace launches as enterprise programs, not pilots. Each step builds directly on the previous one. This sequencing lowers risk and accelerates value creation.

Step 1: Define The Service Scope

The process begins by identifying services for the initial release. Clinical areas, care models, and delivery boundaries receive a clear definition. Teams also decide where partners will participate. As a result, the scope stays focused, and execution remains achievable.

Step 2: Set Governance Rules

The next step establishes governance across clinical, operational, and partner layers. Teams define decision rights, escalation paths, and accountability early. This clarity prevents confusion as services expand. Therefore, ownership remains visible even as complexity grows.

Step 3: Design The Architecture

Architects design the marketplace across experience, workflow, data, and security layers. Identity controls, access rules, and audit requirements shape the foundation from day one. This approach avoids retrofitting compliance later. In addition, the platform stays ready for scale.

Step 4: Connect Core Systems

Integration teams connect the marketplace to existing hospital systems. EHRs, identity providers, and documentation workflows come first. Teams then integrate labs, pharmacy, and devices where required. As a result, virtual care aligns naturally with hospital operations.

Step 5: Build User Experiences

Design teams create branded experiences for patients, clinicians, partners, and administrators. Each role sees only relevant information at the right time. Navigation stays consistent across services. Therefore, adoption improves without adding training burden.

Step 6: Enable Partner Onboarding

Operational teams configure partner onboarding workflows with credential checks and access controls. Systems enforce scope-of-practice rules automatically. Teams activate performance tracking from the start. This structure supports safe service expansion.

Step 7: Test And Pilot Safely

Teams run controlled pilots to validate workflows, escalations, and reporting. Selected services go live first to surface issues early. Feedback cycles remain short and focused. As a result, teams resolve risks before wider rollout.

Step 8: Launch And Scale Gradually

Launch teams roll out the marketplace in phases. New services, regions, or partners join incrementally. Governance rules and analytics guide each expansion decision. This discipline keeps growth controlled and predictable.

This step-by-step approach helps hospitals launch white-label virtual care marketplaces with confidence, control, and long-term scalability.

Monetization Models for Hospital-Owned Marketplaces

A virtual care marketplace must deliver financial value alongside clinical and operational benefits. Hospitals cannot treat digital care as a cost center indefinitely. The right monetization model turns virtual services into predictable revenue streams.

It also protects long-term control over pricing and growth. When designed correctly, monetization supports sustainability without compromising care quality.

1. Per-Consult And Service-Based Revenue

Many marketplaces start with direct revenue tied to consultations or discrete services. Hospitals set pricing based on specialty, urgency, and delivery model.

Internal teams and partners follow the same commercial structure. This creates transparency across services. As volumes grow, revenue scales in line with utilization.

2. Subscription And Program-Based Models

Marketplaces support bundled care programs delivered over time. Hospitals package services such as chronic care, mental health, or post-discharge support into subscriptions.

Patients or payers pay for continuity rather than individual visits. This model improves retention and revenue predictability. Therefore, financial planning becomes more stable.

3. Post-Discharge And Continuity Care Monetization

Hospitals can monetize care beyond the point of discharge. Marketplaces enable follow-ups, monitoring, and recovery support through virtual channels.

These services reduce readmissions while generating incremental revenue. As a result, continuity of care aligns with financial incentives.

4. Employer And Enterprise Contracts

Hospital-owned marketplaces can serve employers and institutional clients directly. Services may include preventive care, virtual clinics, or condition-specific programs.

Contracts generate recurring revenue at scale. In addition, hospitals expand their reach beyond traditional patient acquisition channels.

5. Partner Revenue Sharing Models

Marketplaces allow hospitals to onboard external providers under defined commercial terms. Revenue sharing applies consistently across services.

Hospitals retain pricing authority and oversight. Consequently, partner participation drives growth without surrendering control.

When monetization aligns with governance and care delivery, hospital-owned marketplaces become long-term growth engines rather than short-term digital experiments.

Common Pitfalls to Avoid While Launching A White-Label Virtual Care

Many hospitals approach marketplace launches with strong intent but fragmented execution. Early decisions often focus on speed rather than structure.

These choices rarely fail immediately. Instead, issues surface once volume, partners, and services increase. Knowing these pitfalls early helps teams design for resilience rather than recovery.

1. Treating the Marketplace as a Front-End Project

Some initiatives prioritize portals, branding, and surface-level experience. Teams underestimate the operational complexity that follows real clinical usage. Over time, weak workflow design leads to delays, manual work, and clinician frustration. Scale exposes gaps that visuals alone cannot hide.

Our teams approach marketplaces as enterprise operating layers. Experience, workflows, and governance evolve together from the start. This alignment ensures growth does not outpace operational readiness.

2. Expanding Services Without Governance First

Hospitals sometimes add services before defining ownership and escalation. Early success masks the issue. However, accountability breaks down when outcomes require follow-up across teams or partners. This creates risk and slows response times.

Our approach anchors expansion to clear governance models. Decision rights, escalation paths, and accountability remain defined before new services go live. As a result, growth stays controlled.

3. Letting Vendors Shape Patient Journeys

Vendor-led workflows often dictate how patients move through care. Data fragments across systems. Hospitals lose visibility into engagement and outcomes. Long-term strategy weakens as control shifts outward.

We design platforms that keep patient journeys hospital-owned. Control lives at the platform level, not inside vendor tools. This preserves data continuity and strategic ownership.

4. Retrofitting Compliance After Launch

Some teams treat compliance as documentation instead of system behavior. Gaps appear once audits or scale begin. Fixing them later disrupts workflows and delays progress.

Our architecture embeds compliance into workflows from day one. Consent, access, and audit controls operate automatically. This allows teams to scale without repeated remediation.

5. Scaling Without Operational Visibility

Rapid expansion without insight creates blind spots. Teams react to problems instead of planning ahead. Costs rise while performance becomes harder to predict.

Our platforms surface operational and clinical signals early. Leaders make informed expansion decisions based on real data rather than assumptions.

Avoiding these pitfalls turns a marketplace launch into a controlled transformation rather than a costly correction cycle.

Conclusion

White-label virtual care marketplaces represent a structural shift in how hospitals deliver and scale digital care. They bring services, partners, and data into one governed operating model. This approach protects clinical accountability while supporting operational efficiency and financial growth. More importantly, it gives hospitals control over how virtual care evolves.

The opportunity now lies in execution. Architecture, governance, and compliance must align from the start. When built correctly, marketplaces become growth enablers rather than cost centers. Our teams help hospitals move from fragmented tools to resilient platforms designed for scale. The next phase of virtual care belongs to organizations that build with ownership, clarity, and long-term intent.

Launch a Hospital-Owned Virtual Care Marketplace With Us

At Intellivon, we build hospital-owned virtual care marketplaces as enterprise operating platforms, not collections of digital services stitched together over time. Our platforms govern how patients access care, how services connect across specialties, and how accountability remains intact as virtual care expands. Every marketplace is designed to keep ownership with the hospital, even as partners and services scale.

Each solution supports healthcare organizations operating at enterprise scale. Platforms follow an architecture-first, compliance-led approach, with virtual services embedded into EHR workflows, identity controls, data governance, and orchestration layers. As marketplaces grow in service breadth, patient volume, and partner participation, clinical oversight, operational stability, and financial control remain predictable.

Why Partner With Intellivon?

- Enterprise-grade marketplace architecture aligned with multi-service expansion and long-term hospital ownership

- Deep interoperability expertise across EHRs, diagnostics, pharmacy, identity systems, analytics, and enterprise infrastructure

- Compliance-by-design delivery supporting HIPAA, regional regulations, audit readiness, and clinical accountability

- Governance-first platform design that maintains control across internal teams and third-party providers

- AI-assisted orchestration and analytics that improve coordination, utilization, and performance without reducing clinician authority

- Proven enterprise delivery model with phased rollout, validation, and controlled scale across care models

Talk to Intellivon’s healthcare platform architects to explore how a hospital-owned virtual care marketplace can integrate into your ecosystem, reduce fragmentation, and support growth without compromising governance or care quality.

FAQs

Q1. What is a white-label virtual care marketplace for hospitals?

A1. A white-label virtual care marketplace is a hospital-owned digital platform that delivers multiple virtual services under one brand. It allows hospitals to govern patient journeys, providers, data, and revenue while integrating virtual care directly into existing clinical and operational systems.

Q2. How is a virtual care marketplace different from a telehealth platform?

A2. Telehealth platforms usually support isolated virtual visits. A virtual care marketplace supports multiple services, providers, and workflows through one governed system. It enables hospitals to scale services without adding fragmented tools or losing control over data and accountability.

Q3. Why are hospitals adopting marketplace models for virtual care?

A3. Hospitals adopt marketplace models to manage growing virtual service catalogs, reduce vendor sprawl, and retain ownership of patient relationships. Marketplaces also support new revenue models, improve care coordination, and align virtual care with long-term enterprise strategy.

Q4. How do hospitals ensure compliance in a virtual care marketplace?

A4. Hospitals enforce compliance by embedding consent, access control, audit logging, and accountability directly into platform workflows. A compliance-by-design marketplace ensures regulatory requirements operate automatically rather than relying on manual policies or after-the-fact reviews.

Q5. How long does it take to launch a hospital-owned virtual care marketplace?

A5. Launch timelines vary by scope, integrations, and governance readiness. Most hospitals begin with a phased rollout, starting with a limited service set. This approach enables faster launches while maintaining clinical oversight, compliance, and operational stability.