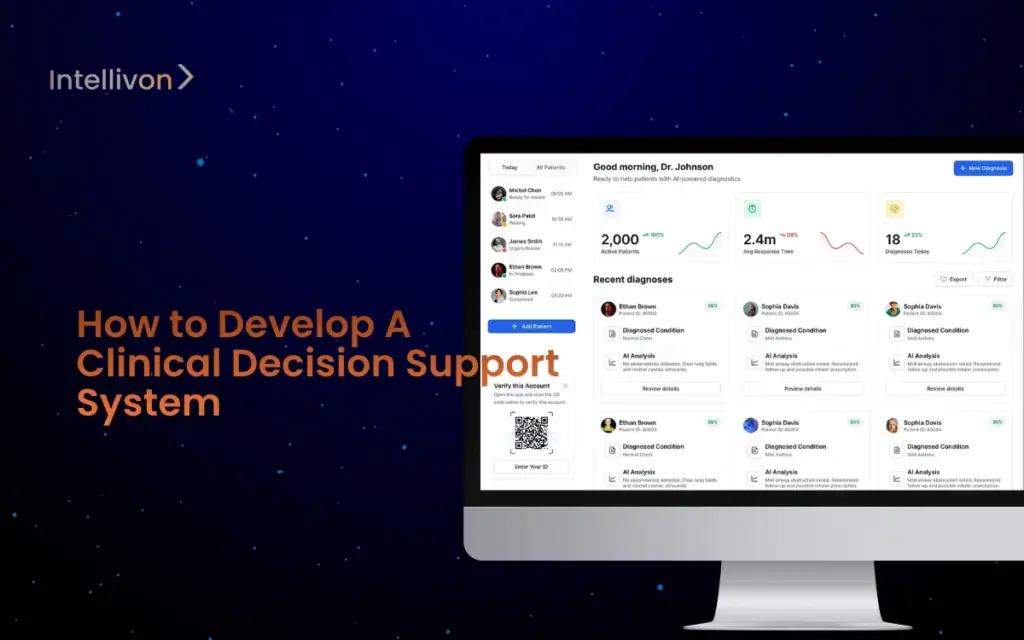

How to Develop a Clinical Decision Support System

Healthcare enterprises operate under constant scrutiny, where every decision carries financial, legal, and clinical weight. A single medication error or unflagged risk can trigger lawsuits,

Building a Secure Patient Data Analytics Platform

Hospitals and healthcare enterprises are drowning in patient data, yet remain exposed to security gaps. A single system failure can cost millions in downtime, while

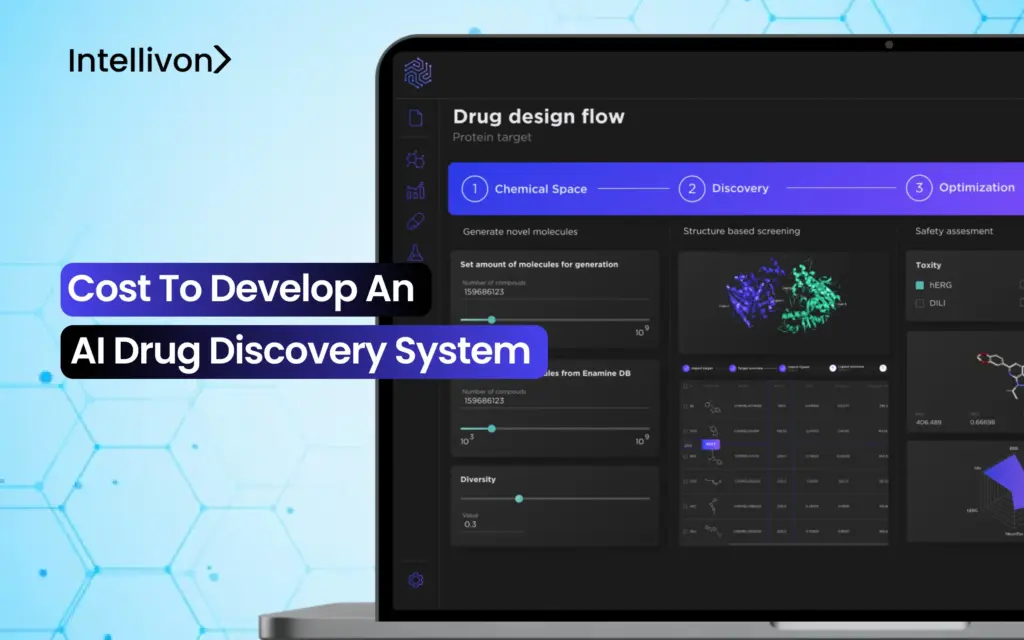

Cost to Develop an AI Drug Discovery System

The math of drug development no longer adds up. Spending billions to advance a single candidate over a 10–15 year timeline, only to see 9

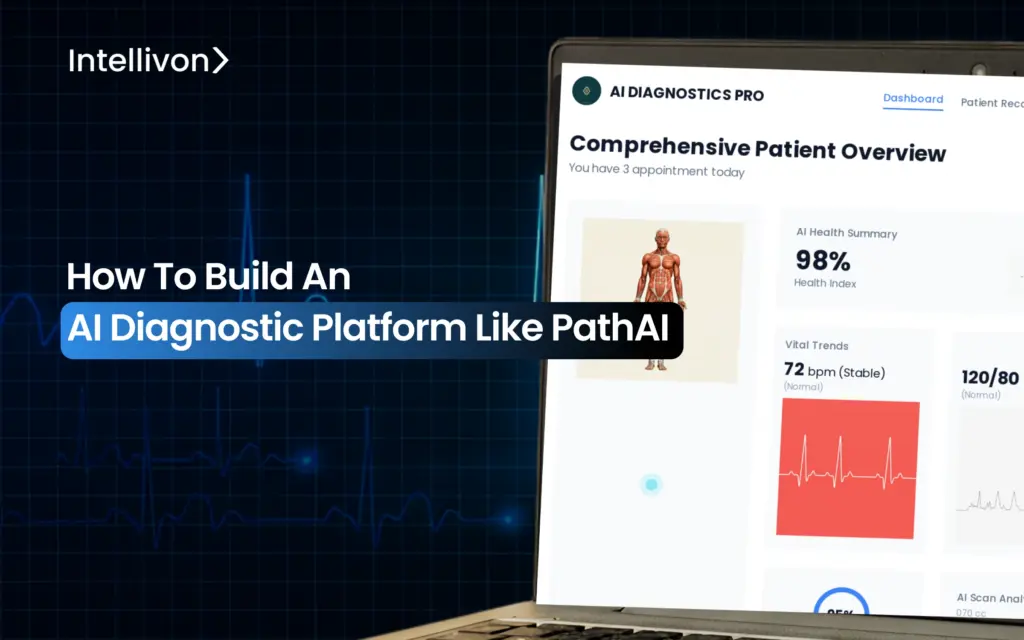

How to Build an AI Diagnostic Platform Like PathAI

When critical diagnoses sit unread in backlogged trays, care delivery grinds to a halt, and the risk grows. For large enterprises, this affects compliance, referral