Every year, businesses lose billions because they can’t see their cash flow clearly, access funding quickly enough, or work with tools that actually understand their needs. By the time many owners realize they are missing deadlines, unable to pivot when revenue dips, or overpaying on loans, the damage has already been done. Smart finance apps are closing this gap by combining AI, open banking, and real-time insights into one platform. Binq is one of the clearest success stories, which was launched just a year ago. It has already won strong adoption among UK SMEs, with 75% of its users choosing to work with its AI assistant, Ali.

This level of reliance shows how quickly businesses embrace technology that delivers real, daily value. For enterprises, Binq’s rise is a case study proving that intelligent finance apps can capture market share and deliver measurable ROI in record time.

We have experience building AI-powered finance platforms that cut through complexity, ensure compliance, and drive measurable growth. In this blog, we’ll break down what makes smart finance apps like Binq work, and how we can help you build one from the ground up.

Why Enterprises Should Invest In Smart Finance Apps Now

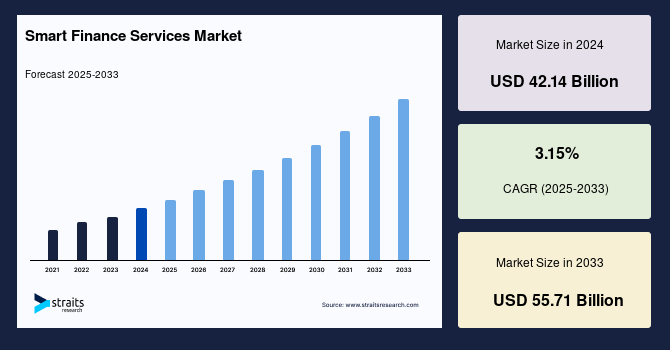

The global smart finance services market is expanding at a remarkable pace. Valued at USD 42.14 billion in 2024, it is expected to reach USD 55.71 billion by 2033, while some projections place the market at USD 125 billion by 2025, growing at a 14% CAGR through 2030. This clear trajectory shows that finance apps are no longer experimental add-ons but core enterprise tools delivering measurable outcomes.

Market Growth & Statistics

- The personal finance app sector grew to $167.09 billion in 2025 and is set to reach $412.22 billion by 2029 (25.3% CAGR).

- North America leads the market with $45 billion, followed by Asia-Pacific ($35 billion) and Europe ($30 billion), each posting double-digit growth.

- Fintech adoption for AI-driven cashflow management among large enterprises hit 61% in 2025.

- Expense management platforms saw a 33% increase in enterprise adoption.

- 68% of mid-sized firms in North America now use cloud-based accounting apps.

- 91% of brands with 10+ employees already rely on CRM or finance automation software.

- Subscription models now generate 50% of finance app revenue, underscoring strong recurring income potential.

- Regulatory initiatives like open banking APIs are fueling enterprise-grade integrations.

- Mobile-first adoption is rising with the shift to remote work.

In summary, the data makes it clear that smart finance apps deliver transformative performance and exceptional returns. Enterprises that move now can capture both market momentum and first-mover advantage, establishing new benchmarks in operational efficiency, compliance, and growth.

What Is A Smart Finance App Like Binq?

A smart finance app is more than a digital wallet or expense tracker. It acts as an intelligent financial companion, giving businesses and individuals real-time insights into cash flow, costs, and growth opportunities. Unlike traditional tools that only record data, these platforms interpret financial activity and recommend actions that can directly improve outcomes.

Binq is a strong example of this model. Within a year of launch, it established itself as a trusted solution for UK SMEs. At its core is Ali, an AI-powered assistant that helps businesses manage day-to-day finances. Users rely on Ali to flag important events, highlight risks, and suggest better deals on loans, insurance, and utilities. According to Binq’s release, more than 75% of users actively choose to work with Ali, showing how quickly smart finance tools can build trust and become indispensable.

For enterprises, this type of platform represents a shift from passive finance software to proactive, intelligence-driven ecosystems that can scale across departments and geographies.

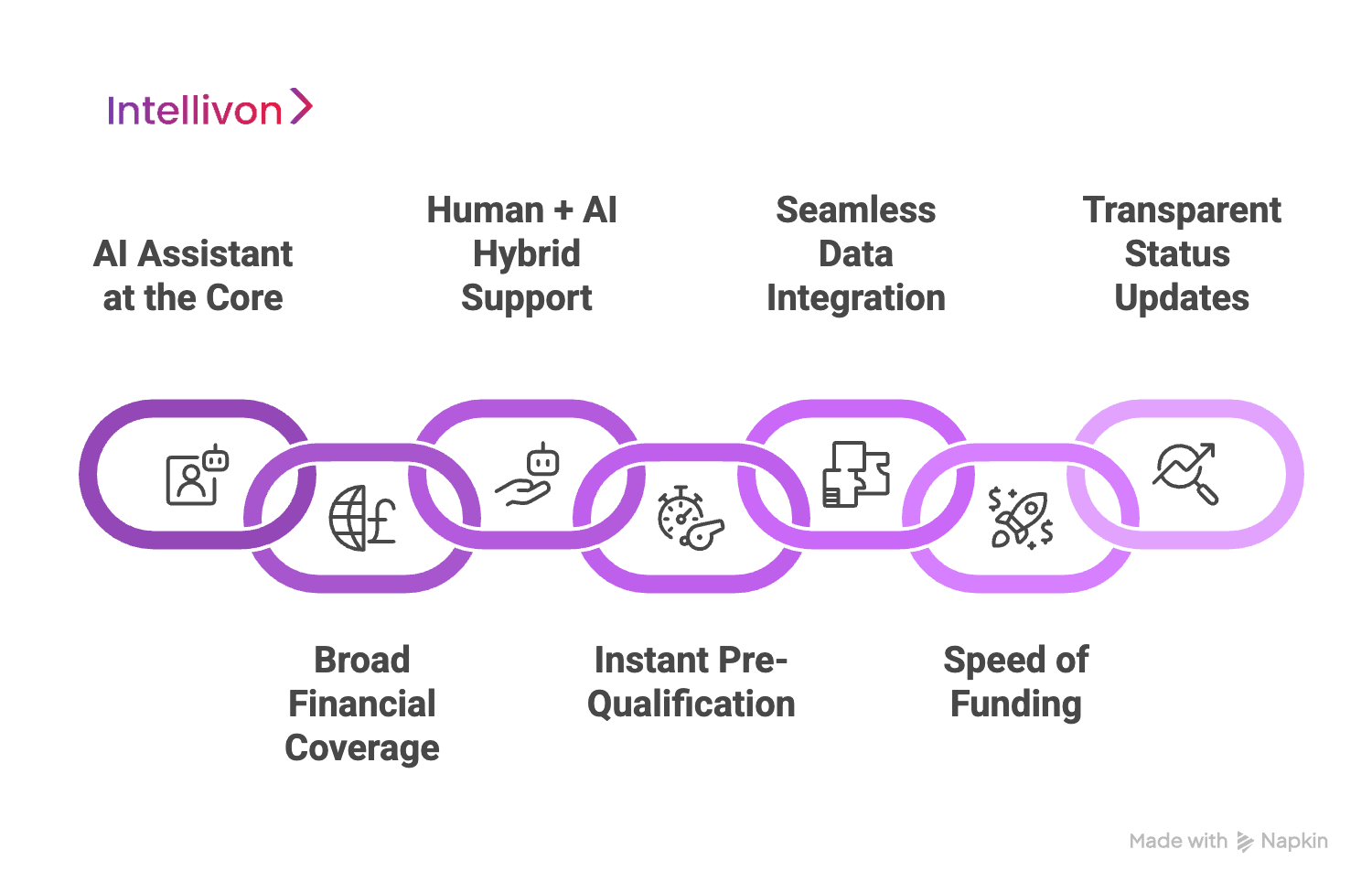

What Makes Binq Stand Out

Binq’s traction in just a year didn’t come from offering “another” finance app. Its adoption was driven by design choices that directly solved SME pain points while creating trust and efficiency. The following elements set it apart in a crowded fintech market.

1. AI Assistant at the Core

Binq’s AI assistant, Ali, is the centerpiece. It highlights what matters in real time, from cashflow risks to cost-saving opportunities. With 75% of users choosing to work with Ali daily, the app proves that enterprises will embrace AI when it delivers practical value.

2. Broad Financial Coverage

Most apps focus on a single vertical, like budgeting or lending. Binq goes wider, spanning loans, insurance, utilities, and everyday banking. This multi-domain reach means businesses manage critical financial functions in one platform, reducing the need for fragmented tools.

3. Human + AI Hybrid Support

Binq strengthens adoption by blending automation with human expertise. While Ali provides instant insights around the clock, users can access human advisors when decisions require nuance. This dual approach reassures businesses that they’re not relying on algorithms alone.

4. Instant Pre-Qualification

A major differentiator is speed. Binq delivers pre-qualified offers and live quotes immediately after account data is connected. This turns a traditionally slow process into an instant experience, saving businesses hours or even days.

5. Seamless Data Integration

Onboarding is simple. Users connect accounts securely within the app, enabling automatic eligibility checks and decisions without paperwork or manual uploads. This reduces friction, which is a critical factor in driving retention.

6. Speed of Funding

When liquidity is urgent, waiting days is not an option. Binq ensures that funds can be accessed in hours rather than weeks, addressing one of the most common pain points for SMEs.

7. Transparent Status Updates

Throughout any finance or product application, users can see progress through live status tracking. This eliminates uncertainty and builds confidence, a feature enterprises should recognize as vital for customer trust.

Binq’s standout features show why it has gained traction so quickly. But to understand its real impact, it’s important to look beneath the surface. Adoption at scale only happens when the underlying workflows are seamless, reliable, and easy to use. The question, then, is not just what makes Binq appealing, but how it actually works in practice.

How Does The Binq App Work?

Binq’s rapid adoption comes down to one thing: the way it makes complex financial processes feel simple. Its workflow is designed so that businesses can move from connection to action in a matter of hours, not weeks. Here’s how the flow unfolds in practice.

1. Secure Account Connection

Users connect their banking, accounting, and utility accounts through regulated open banking APIs. The app collects consent transparently and gives businesses full control over data sharing. Encryption and multi-factor authentication secure sensitive information at every step.

2. Data Normalization and Enrichment

After access is granted, Binq cleans and categorizes raw data. It matches payments to suppliers, links revenues to customers, and classifies spending like payroll, rent, or utilities. Its analytics detect seasonal trends, recurring liabilities, and revenue spikes that businesses might otherwise miss.

3. Real-Time Financial Visibility

The enriched data powers continuously updated dashboards. Users see live snapshots of cash position, receivables, liabilities, and working capital health. The app prioritizes alerts, surfacing urgent issues like overdraft risks or overdue customer payments first.

4. Decision Models in Action

Algorithms assess lending eligibility, insurance quotes, and utility tariffs using a company’s financial health. Risk scoring models evaluate creditworthiness, while cost-saving models highlight refinancing opportunities or cheaper service providers.

5. Actionable Recommendations

Binq delivers ranked, relevant suggestions instead of raw numbers. It might advise refinancing a loan to lower costs, switching to a cheaper energy provider, or adjusting payment terms to improve cash flow.

6. In-App Execution

Users act directly within the app, as Binq pre-fills loan or insurance applications with connected data, minimizing paperwork. Digital KYC checks, document uploads, and approvals all happen in one place, speeding up decisions.

7. Transparent Status Tracking

Once users initiate actions, the app provides live updates. They can track every stage, from lender approval to utility confirmation, building trust and eliminating uncertainty.

8. Continuous Learning and Refinement

The system learns from outcomes. If a user consistently chooses specific recommendations, Binq prioritizes similar options in the future. Over time, the app delivers insights that feel increasingly personalized.

This is the full step-by-step working model of Binq. It is a dynamic cycle that connects data, interprets it, recommends actions, enables execution, and improves continuously.

Features A Smart Finance App Like Binq Should Have

Smart finance apps succeed only when they solve real problems with precision. For enterprises, that means moving beyond surface-level budgeting into platforms that integrate, interpret, and act on financial data across multiple domains. Below are the features that define a strong finance app, with examples of how enterprises are already applying them.

1. AI-Driven Financial Assistant

The most valuable feature of a modern finance app is an AI assistant that functions less like a chatbot and more like a financial analyst. In Binq’s case, Ali is trusted by 75% of its users for daily guidance, demonstrating how enterprises can win confidence when intelligence is delivered in the right context.

An AI assistant can flag an upcoming cash shortfall weeks in advance, recommend refinancing, or highlight a surge in late payments before they spiral. For example, global banks are piloting assistants that auto-adjust credit scoring models in real time, cutting loan approval times by 40%. For enterprises, embedding this capability means clients or internal teams get proactive, relevant advice instead of static reports.

2. Open Banking Integration

Without integrations, finance apps remain siloed. Open banking APIs allow enterprises to securely connect multiple bank accounts, credit lines, and financial systems into a single dashboard. This gives a consolidated view of financial health, something SMEs and global corporations alike struggle to maintain.

Take the example of European insurers adopting open banking tools for premium collection. By aggregating policyholder accounts, they improved payment success rates. For an enterprise finance app, aggregation is not just a convenience; it’s the foundation for better decision-making, compliance, and customer trust.

3. Real-Time Cashflow Tracking

Businesses lose billions each year due to poor cash visibility. Real-time cashflow dashboards change this equation by surfacing receivables, liabilities, and liquidity in a continuously updated view. More importantly, alerts ensure users don’t just see the numbers.

For example, a US-based logistics giant reduced overdraft penalties after deploying a finance tool with predictive cash alerts. The system warned them of shortfalls five days in advance, allowing treasury teams to adjust payments. A smart finance app for enterprises must deliver that same immediacy, ensuring leaders never fly blind.

4. Automated Access to Loans

One of Binq’s strongest differentiators is its ability to connect users with better deals directly inside the app. Automating applications for loans, insurance, or utility contracts saves time and removes friction. Pre-filled applications using connected data reduce drop-offs and improve conversion rates.

Consider how SME lenders are adopting AI-driven loan applications: what once required weeks of paperwork now takes under 48 hours, with pre-qualification available instantly. For enterprises, embedding similar workflows creates a new revenue channel, stronger customer stickiness, and higher efficiency.

5. Multi-Domain Coverage

Enterprises often rely on multiple disconnected tools for banking, payroll, insurance, and utility management. Smart finance apps address this by consolidating these functions. A CFO can see payroll obligations, insurance premiums, and energy bills in the same interface as cash flow forecasts.

This multi-domain reach is where true enterprise value lies. For example, a European manufacturing group used an integrated finance app to manage supplier invoices, payroll cycles, and energy usage. The result is an improvement in working capital efficiency within months.

6. Hybrid Support Model

Trust is the cornerstone of adoption. While AI brings speed and scale, enterprises know that complex financial situations sometimes require a human advisor. Binq addresses this by blending automation with human support, ensuring users can escalate to expert help when needed.

This hybrid approach has been shown to reduce churn. A Canadian insurer offering both AI-based claims support and human escalation saw customer satisfaction scores soar. For enterprise-grade apps, the lesson is that automation alone isn’t enough, and human reassurance must remain part of the design.

7. Enterprise-Grade Security and Compliance

No finance app can succeed without security at its core. Encryption, multi-factor authentication, and real-time fraud detection are table stakes. Compliance with KYC, AML, GDPR, and region-specific banking regulations must be baked into the architecture from day one.

Take the case of automated KYC in European enterprises. By integrating AI-driven verification tools, companies cut onboarding costs and reduced compliance failures significantly. For global enterprises, building trust means ensuring every action inside the app meets the strictest regulatory standards.

In short, a smart finance app must anticipate problems, suggest solutions, and make execution seamless. From AI assistants and open banking to real-time alerts and secure compliance, these features are what turn a finance app into an indispensable enterprise growth tool.

How Smart Finance Apps Like Binq Make Money

A well-built smart finance app is designed as a profit engine. Monetization strategies are embedded into the workflows so that every user interaction has the potential to create revenue. For enterprises exploring this space, understanding the business models is critical to assessing ROI.

1. Subscription Tiers and Premium Plans

Most finance apps follow a freemium model, where basic features are free but advanced capabilities, such as in-depth analytics, multi-account integrations, or enterprise reporting, are paywalled. Subscription revenues provide predictable, recurring income and often account for more than half of total earnings in the finance app sector.

2. Transaction Fees and Interchange Revenue

Every time a user takes action, whether paying bills, transferring funds, or applying for loans, the platform can capture a small transaction fee. In some cases, apps also issue cards and generate interchange revenue when users spend.

3. Affiliate Commissions and Marketplace Referrals

Partnerships with lenders, insurers, and utility providers open a strong revenue stream. Apps like Binq integrate comparison marketplaces, earning commissions each time a user switches providers or secures financing through the app.

4. Data-Driven Value Services

Enterprises can also monetize anonymized, aggregated insights. When handled under strict compliance, financial data trends become highly valuable for banks, insurers, or regulators seeking market intelligence.

5. White-Labeling and Enterprise Licensing

Beyond consumers, finance apps can scale by offering their technology to banks, credit unions, or fintechs. Licensing and white-label partnerships allow enterprises to resell the platform under their own brand, expanding reach without increasing acquisition costs.

Binq’s Approach to Monetization

Binq applies several of these models in combination. Its affiliate marketplace drives revenue when SMEs accept loans, insurance, or utilities through the app. The AI assistant Ali strengthens daily engagement, which in turn increases conversion opportunities inside the marketplace. The company is also positioned to expand into subscription services for advanced analytics or premium advisory, a proven path across the fintech sector.

By aligning its monetization directly with user value, like saving money, improving cash flow, or securing funding faster, Binq ensures that revenue growth scales alongside adoption.

What Is The ROI Of Building A Smart Finance App Like Binq?

Return on investment is often the first consideration when enterprises evaluate new digital platforms. For smart finance apps, both financial and strategic returns are consistently strong.

1. Direct Financial Returns

Recurring revenues from subscriptions, affiliate partnerships, and transaction fees create predictable income streams.

- Binq’s growth demonstrates this clearly: with 75% of users actively working with its AI assistant, every interaction can convert into monetized activity.

- Across fintech, average revenue per user (ARPU) for finance apps has risen more than 20% year-on-year, placing them among the most profitable categories in digital services.

2. Operational Efficiency

Smart finance apps also deliver internal ROI. Automating compliance, reconciliations, and spend tracking significantly lowers costs.

Enterprises that rolled out AI-driven finance platforms in 2025 reported 33% faster expense processing and 40% lower onboarding costs thanks to automated KYC and AML workflows.

3. Customer Engagement and Retention

Daily engagement is a major return. Finance apps that provide personalized recommendations build trust and reduce churn. In Binq’s case, the AI assistant Ali has become a daily touchpoint, strengthening relationships and keeping users within its ecosystem.

4. Strategic ROI Beyond Revenue

The strategic upside is equally important. A finance app positions enterprises as innovators, enables new data-driven services, and creates resilience against shifting compliance requirements. The ROI here is future-proofing growth and securing competitive advantage.

Technology Stack Used To Build A Smart Finance App Like Binq

The success of a finance app depends heavily on its underlying technology. Enterprises require a stack that balances agility with compliance, scalability with security, and innovation with cost efficiency. Here’s how the technology stack typically comes together.

1. Frontend Frameworks

A seamless user experience starts at the frontend. Modern finance apps often use React Native or Flutter for cross-platform deployment, ensuring consistency across iOS, Android, and web. Native development in Swift (iOS) or Kotlin (Android) is chosen when performance is critical, especially for enterprise-grade apps handling real-time updates.

2. Backend Frameworks

On the server side, reliable frameworks such as Node.js, Java Spring Boot, or .NET Core enable modular, scalable development. Many enterprises also adopt Python (FastAPI or Django) for AI-driven features, given its strong machine learning ecosystem.

3. Databases and Caching

Financial data demands both speed and reliability. PostgreSQL and MongoDB are widely used for transactional and semi-structured data, while Redis provides low-latency caching to handle real-time dashboards and alerts.

4. AI and Machine Learning Infrastructure

AI assistants and predictive analytics rely on frameworks such as TensorFlow and PyTorch. Enterprises often integrate with cloud-native AI services (AWS SageMaker, Azure ML, or Google Vertex AI) for scalability, training, and compliance monitoring.

5. Third-Party Integrations

No finance app operates in isolation. APIs from providers like Plaid, Yodlee, or TrueLayer deliver open banking connectivity, while Stripe or Adyen enable payment processing. KYC/AML tools such as Trulioo or Onfido strengthen compliance.

6. Cloud Platforms and Infrastructure

Enterprise-grade deployment usually leverages AWS, Azure, or Google Cloud, with Kubernetes or serverless functions managing scalability. These platforms ensure apps can handle surges in transaction volume while meeting data residency requirements across regions.

7. Security Technologies

Security is non-negotiable. Encryption protocols (TLS 1.3, AES-256), tokenization, and secure authentication (OAuth 2.0, JWT, MFA) form the baseline. PCI-DSS compliance and GDPR alignment are baked into the architecture from the start to meet enterprise regulatory standards.

Architecture Of A Smart Finance App Like Binq

Behind every successful finance app is a carefully designed architecture that balances scalability, compliance, and user experience. Enterprises need systems that don’t just run smoothly today but can also expand to handle new integrations, regulatory changes, and global user bases tomorrow. Here’s how the architecture of a smart finance app like Binq typically comes together.

1. Client Applications (Mobile and Web)

The first layer is the user interface. Most smart finance apps provide both mobile apps and web dashboards to ensure accessibility. Mobile-first design ensures businesses can track and act on insights anywhere, while web portals often provide deeper analytics for decision-makers.

2. API Gateway and Microservices

The backbone of the system is a microservices architecture managed through an API gateway. Each service, such as account aggregation, AI recommendations, payments, and compliance, runs independently. This allows enterprises to scale parts of the system without disrupting the entire platform. It also simplifies updates and reduces downtime.

3. Account Aggregation and Data Layer

At the core is a secure data pipeline that connects to banks, insurers, utility providers, and accounting systems. Aggregator APIs such as Plaid or TrueLayer feed data into the system, where it is normalized, categorized, and stored in a secure, compliant database.

4. AI Recommendation Engine

This is where intelligence happens. The engine analyzes historical patterns, evaluates eligibility for credit or insurance, and runs predictive models for cashflow or savings opportunities. It continuously improves by learning from past outcomes and user behavior.

5. Marketplace and Service Integrations

Smart finance apps often embed marketplaces where users can compare loans, insurance policies, or utilities. These are powered by partner integrations and transaction flows that generate revenue while giving users immediate access to better financial products.

6. Event-Driven Notifications

To keep users engaged, the architecture relies on event-driven systems. For example, if cashflow dips below a threshold or a bill is overdue, the app pushes instant alerts. This requires lightweight messaging services that run in parallel with core data processing.

7. Compliance and Audit Logging

No finance app can operate without strict compliance controls. Every transaction, user action, and data flow is logged for auditing. AML and KYC checks are built into onboarding and transaction workflows, ensuring the platform remains regulator-ready.

The architecture of a smart finance app is the foundation that makes scalability, compliance, and intelligence possible. By combining microservices, AI engines, real-time notifications, and secure integrations, enterprises create platforms that are flexible enough to adapt and strong enough to earn user trust.

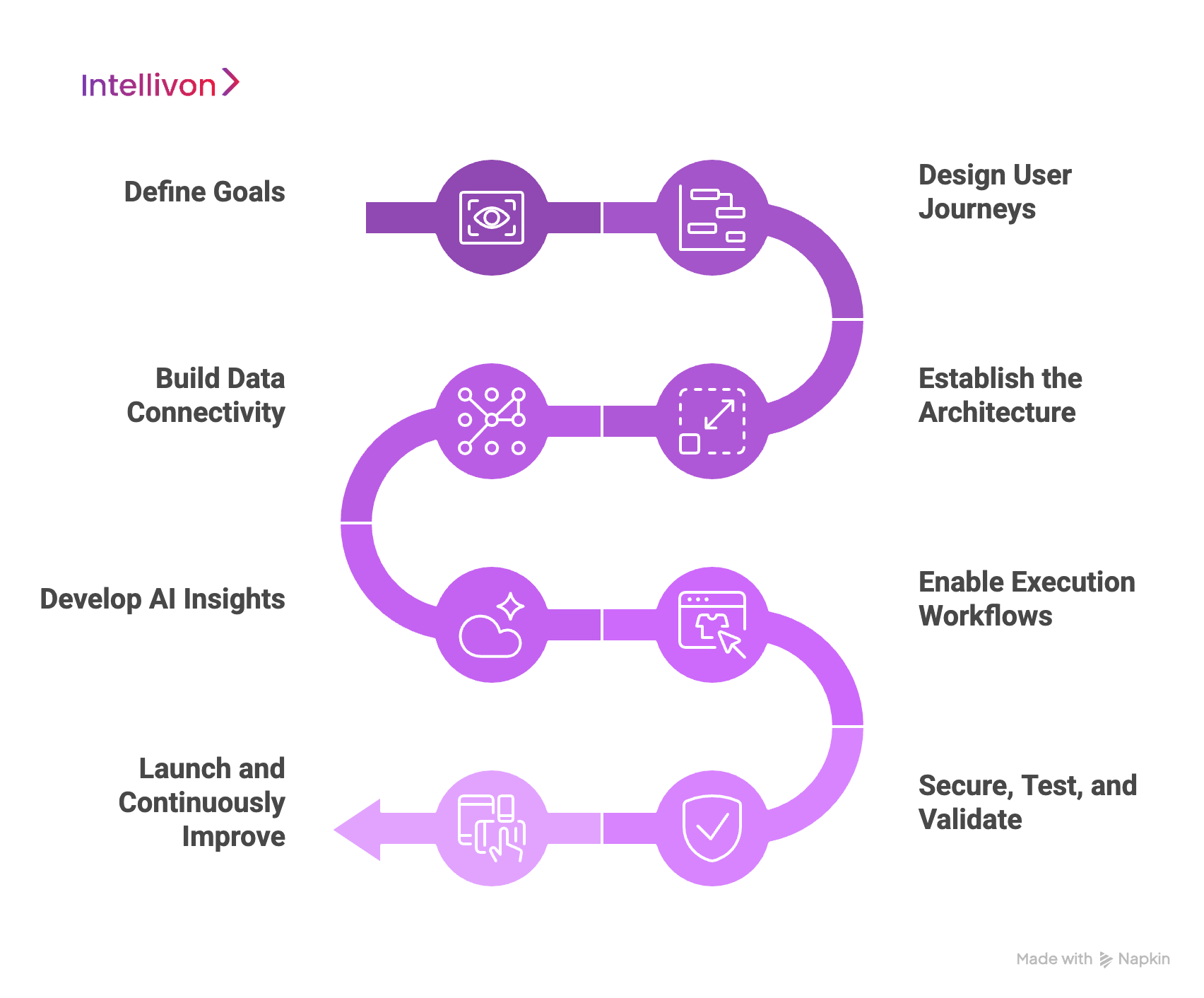

How We Build A Smart Finance App Step-By-Step

At Intellivon, we treat finance app development as a structured journey. Each phase builds on the last, ensuring security, compliance, and measurable value at every stage. Here’s how we take an idea from concept to enterprise-ready platform.

Step 1: Define Goals

Every build begins with clarity. We work with you to set measurable objectives, whether it’s reducing onboarding costs, improving customer retention, or opening new revenue channels. At the same time, we map the regulatory environment across regions to make sure compliance is baked into the design, not bolted on later.

Step 2: Design User Journeys

Financial apps succeed when workflows are simple. We design the user journeys first, connecting accounts, reviewing insights, comparing offers, and applying for products. Once flows are clear, we create intuitive interfaces that keep adoption high and friction low.

Step 3: Establish the Architecture

We then define the architecture that will carry the platform forward. This includes microservices boundaries, secure APIs, and data models built for scalability. Setting up CI/CD pipelines and secure environments at this stage ensures the system can evolve without disruption.

Step 4: Build Data Connectivity

Next, we integrate with banks, insurers, utilities, and accounting systems through trusted APIs. Transactions are cleaned, categorized, and enriched with business logic so the data is ready for analysis. This creates a single source of truth that enterprises can rely on.

Step 5: Develop AI Insights

With data flowing in, we layer intelligence. Our models forecast cash flow, assess risk, and surface actionable recommendations like refinancing or switching suppliers. Every recommendation is explainable, giving leaders confidence in the insights they act on.

Step 6: Enable Execution Workflows

We build the action layer, which is an embedded marketplace for loans, insurance, or utilities. Users can act immediately, with applications pre-filled from verified data. Digital KYC and AML checks run in the background, keeping compliance seamless.

Step 7: Secure, Test, and Validate

Before launch, we harden security with encryption, MFA, and audit logging. Rigorous testing covers performance, compliance, and user experience. Pilot programs validate KPIs like time-to-offer, savings realized, and adoption rates, ensuring the app delivers on its promises.

Step 8: Launch and Continuously Improve

Finally, we roll out the app in controlled stages. Once stable, we expand integrations, scale across geographies, and refine models with real-world feedback. Continuous monitoring and quarterly reviews keep the platform aligned with business goals and market shifts.

Cost Of Building A Smart Finance App Like Binq

At Intellivon, we know enterprises need finance platforms that are powerful yet sustainable to build and run. That’s why our pricing framework is flexible, aligning with your goals and compliance needs rather than forcing a one-size-fits-all package.

If initial projections stretch your budget, we work alongside your teams to refine scope while keeping the core value intact, like productivity, compliance, and operational efficiency, which remain non-negotiable.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Business requirement gathering, workflow mapping, KPI definition, and compliance readiness (GDPR, SOC 2, regional finance regulations) | $6,000 – $12,000 |

| Architecture & Design | System blueprinting, layered architecture planning (client, services, AI, governance), and integration mapping | $8,000 – $15,000 |

| Core Feature Development | Building modular, reusable enterprise functions (account aggregation, dashboards, transaction processing) | $12,000 – $25,000 |

| AI & Analytics Integration | ML/AI model selection, training pipelines, and decision logic for forecasting and recommendations | $10,000 – $20,000 |

| Workflow Orchestration | Business logic, task automation, validation, and compliance-focused audit trails | $10,000 – $22,000 |

| Platform Development & Customization | Dashboards, ERP/CRM connectors, and tailored user-facing experiences (mobile, web, enterprise portals) | $12,000 – $25,000 |

| Security & Compliance Alignment | Encryption, role-based access, KYC/AML enforcement, and continuous audit monitoring | $8,000 – $15,000 |

| Testing & Quality Assurance | Scenario testing, compliance checks, workflow simulations, and stress/performance optimization | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, data residency setup, monitoring dashboards, and enterprise-wide embedding | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

Even with a clear breakdown, certain costs often surface later in the process:

- Integration Complexity: Connecting legacy ERP, CRM, and accounting systems often requires custom middleware and additional validation.

- Data Preparation: Cleaning, normalizing, and labeling enterprise-grade financial data adds time and effort.

- Compliance Overhead: Regional regulations (GDPR, SOX, AML) require continuous monitoring and reporting.

- Cloud Usage and Model Costs: AI model training or API usage can increase recurring expenses if not optimized.

- Change Management: Structured onboarding, training, and adoption programs ensure teams actually use the system.

- Maintenance and Monitoring: Continuous patching, observability, and model updates keep the platform reliable.

Best Practices to Avoid Budget Overruns

From our work with large-scale enterprise deployments, several practices consistently reduce long-term costs:

- Start Narrow, Expand Later: Pilot one high-value workflow, then scale after ROI is proven.

- Optimize AI Usage: Route lightweight models for routine tasks and cache frequent queries.

- Embed Compliance Early: Designing with policy enforcement upfront avoids costly redesigns.

- Modular Feature Design: Build reusable modules so the same code powers multiple functions.

- Observability from Day One: Monitor task latency, costs per transaction, and error rates continuously.

- Human-in-the-Loop as Value: Position human oversight as a trust feature, not a fallback.

- Continuous Learning: Regularly retrain models and refine workflows with feedback to prevent drift.

Request a tailored quote from Intellivon today, and we’ll design a smart finance app that aligns with your budget, enforces compliance, and scales smoothly with your organization’s growth.

Overcoming Challenges Of Building A Smart Finance App Like Binq

Smart finance apps like Binq deliver real value, but building one is never straightforward. Enterprises must navigate technical, regulatory, and operational hurdles before they can see returns. Here are the major challenges, and how Intellivon helps enterprises solve them.

Challenge 1: Complex Data Integration

Finance apps rely on connections to banks, insurers, ERP platforms, and third-party APIs. Each integration comes with different standards, formats, and uptime guarantees. Without a robust framework, data flows become unreliable, undermining user trust.

We deploy a modular integration layer that uses adaptors for each provider, combined with real-time monitoring to detect failures instantly. Our approach includes fallback pathways, so if one bank API is down, data is rerouted through cached ledgers or secondary providers. This ensures enterprises never face blind spots in financial visibility.

Challenge 2: Regulatory and Compliance Overhead

Every region has different rules, like GDPR in Europe, SOC 2 in North America, and AML/KYC globally. Many enterprises underestimate the cost of ongoing compliance, leading to delays or failed audits.

Our experts embed compliance-by-design into the architecture. Our apps come with automated consent capture, tamper-proof audit logs, and configurable rule engines that adjust workflows for different jurisdictions. Enterprises can deploy in multiple regions without rebuilding the compliance stack from scratch.

Challenge 3: Building Trust with AI Recommendations

An AI assistant only works if users trust its guidance. Poorly explained recommendations or opaque scoring models lead to skepticism and low adoption.

We build explainable AI models with reason codes for every recommendation. For example, if the system suggests refinancing, it shows the interest savings, risk profile, and eligibility criteria. This transparency gives executives confidence in acting on AI insights, increasing adoption rates.

Challenge 4: Security and Fraud Risks

Finance apps are high-value targets for attackers. Weak access controls or poor encryption can expose sensitive financial data, leading to reputational and legal damage.

Intellivon implements multi-layered enterprise security: AES-256 encryption, MFA, role-based access, and anomaly detection models that identify suspicious patterns before fraud occurs. Beyond technology, we also run continuous penetration tests and security audits so enterprises can prove resilience to regulators and customers alike.

Challenge 5: Driving Adoption Across the Enterprise

Even the best app fails if employees or customers don’t use it. Enterprises often struggle with onboarding, training, and embedding new tools into existing workflows.

We design adoption strategies into the product itself. Guided onboarding, contextual explainers, and in-app tutorials ensure teams understand the value from day one. We also run pilot programs with success metrics (like connect-rate and time-to-first-insight) to prove ROI early, building momentum across the enterprise.

Challenge 6: Scaling Without Losing Performance

As usage grows, finance apps must handle spikes in transactions, global expansions, and complex multi-region data residency requirements. Many systems fail at this stage.

Intellivon builds the app on cloud-native microservices with Kubernetes orchestration. This allows independent scaling of services like transaction processing, AI models, or notifications. Data residency is managed regionally, ensuring compliance without compromising speed. Enterprises can expand globally without architectural rewrites.

Smart finance apps succeed when challenges are anticipated and solved at the design stage. At Intellivon, we engineer platforms that meet enterprise standards in data, compliance, adoption, and scale.

How We Ensure Compliance and Security in Smart Finance Apps

For data-heavy enterprises, compliance is the backbone. Financial organizations know the weight of regulations: a single breach or oversight can mean not only fines but also the erosion of market trust built over decades. At Intellivon, we design platforms with that principle front and center, offering enterprises relief from the burden of regulatory uncertainty.

1. Regulatory Alignment by Region

Global enterprises must juggle overlapping frameworks. In Europe, GDPR, PSD2, and MiFID II govern data privacy, payments, and financial advice. In the US, firms face SOX, GLBA, and PCI-DSS, while Asia-Pacific markets enforce MAS, APRA, and RBI-specific norms.

Intellivon engineers apps with region-aware compliance engines, ensuring workflows adapt dynamically to the jurisdiction. That means when expanding across geographies, enterprises don’t need to rebuild compliance, because it scales with them.

2. Zero-Trust Security Principles

Traditional perimeter security is not enough for finance apps. Intellivon applies zero-trust frameworks, verifying every user, device, and request continuously. Services are microsegmented, so a breach in one area cannot spread across the system. Policy enforcement runs in real time, meaning compliance isn’t checked quarterly. Instead, it’s verified with every single transaction.

3. Data Residency and Sovereignty

For enterprises managing sensitive financial data, knowing where it lives is as important as how it’s secured. Intellivon enables region-specific data residency, ensuring EU data stays in Europe, US data remains stateside, and APAC workloads run in-region. Workload routing policies enforce compliance with cross-border transfer restrictions, while dashboards give CISOs visibility into where every byte resides at any time.

4. AI Governance and Model Compliance

AI-driven recommendations add new risks: bias, lack of explainability, and model drift. Intellivon addresses this with model governance frameworks. Reason codes back every recommendation, bias audits are embedded into pipelines, and model versioning ensures regulators can see which dataset and logic informed a decision at any point in time. For enterprises deploying finance copilots, this ensures that AI-driven insights meet compliance standards and can withstand regulatory audits.

5. Incident Response

In finance, downtime is a regulatory event. Intellivon designs systems with strict RTO (Recovery Time Objective) and RPO (Recovery Point Objective) commitments, ensuring services recover within minutes and no critical data is lost. Automated failover across regions keeps services available even during outages, and regulator-ready notification workflows mean enterprises can meet 72-hour breach reporting requirements under GDPR or DORA without scrambling.

6. Third-Party Risk Management

Smart finance apps rely on banking APIs, SaaS connectors, and data providers. Each is a potential weak point. Intellivon embeds continuous third-party monitoring, enforcing SLAs with alerts if integrations fail compliance checks. Vendor risk scoring dashboards give executives clear oversight into external partners, reducing exposure to hidden vulnerabilities.

7. Proactive Compliance Monitoring

Compliance cannot be a retrospective exercise. Intellivon enables continuous controls monitoring (CCM), where dashboards track regulatory adherence in real time. Automated regulatory change alerts update workflows when laws shift, for example, embedding new EU AML checks without reengineering the app. With predictive compliance modeling, enterprises can identify risks before regulators do.

For financial institutions and large enterprises, this depth of compliance and security design is a relief. And it means enterprises can focus on growth, innovation, and customer value, knowing the foundations of trust are firmly in place. With Intellivon, compliance is not a burden. It becomes a competitive advantage, turning regulation into resilience and security into customer trust.

Conclusion

Smart finance apps like Binq prove that the future of financial management is intelligent, automated, and customer-first. For enterprises, the opportunity lies not only in building tools but in creating platforms that drive revenue, efficiency, and trust at scale.

Achieving that outcome requires more than code. It takes a solution partner who understands compliance, architecture, and enterprise adoption, ensuring the app is both secure and future-ready. Working with the right provider helps enterprises move faster, control costs, and deliver platforms that are built to grow with the business.

Build Your Smart Finance App With Intellivon

At Intellivon, we design enterprise-grade smart finance platforms that are secure, compliant, and engineered to meet the demands of global organizations. Our solutions are built for measurable ROI, helping enterprises unlock new revenue streams, reduce compliance burdens, and deliver superior financial experiences at scale.

Why Partner With Intellivon?

- Compliance-First Engineering: Every build aligns with GDPR, PSD2, SOX, AML, and global banking regulations from day one, giving you regulator-ready confidence across regions.

- AI With Explainability: Our recommendation engines are fully auditable, with reason codes for every decision. That means executives can trust insights, not just view them.

- Enterprise-Grade Integrations: We connect seamlessly with ERP, CRM, core banking, insurance systems, and utilities, ensuring data flows reliably across the business without manual effort.

- Scalable Architecture: Built on cloud-native microservices with multi-region deployment, our platforms grow with your business and remain resilient during demand surges.

- Security That Reassures Boards: From zero-trust frameworks to real-time fraud detection and third-party risk monitoring, our apps are designed to meet the strictest enterprise security standards.

- Proven Global Expertise: With hundreds of enterprise deployments, we bring tested playbooks, reusable compliance modules, and frameworks that accelerate time-to-market without sacrificing trust.

Book a discovery call with Intellivon today and see how we can design a smart finance app that not only strengthens compliance and security but also creates new growth opportunities for your enterprise.

FAQs

Q1. What is a smart finance app, and how is it different from traditional finance software?

A1. A smart finance app doesn’t just record transactions. Still, it analyzes them in real time, provides AI-driven recommendations, and enables direct execution of financial actions like applying for loans or switching providers. Unlike traditional tools, it adapts continuously and integrates across banking, insurance, utilities, and enterprise systems.

Q2. How much does it cost to build a smart finance app like Binq?

A2. Costs vary based on scope and features. A minimum viable product typically starts around $50,000, while enterprise-scale platforms with AI engines, compliance frameworks, and multi-domain coverage can range from $150,000 to $300,000+. Ongoing maintenance adds roughly 15–20% annually.

Q3. What industries benefit most from smart finance apps?

A3. While banking and financial services are obvious beneficiaries, industries like retail, logistics, healthcare, and insurance are rapidly adopting them. These apps help enterprises streamline expense management, strengthen compliance, and unlock cash flow visibility, all of which improve operational resilience.

Q4. How do smart finance apps ensure compliance with regulations like GDPR, SOX, or AML?

A4. Compliance is embedded into the design. The apps log every data action in tamper-proof audit trails, enforce KYC/AML during onboarding, and adapt workflows dynamically to region-specific regulations. This ensures enterprises remain regulator-ready across markets.

Q5. Can smart finance apps integrate with legacy ERP or CRM systems?

A5. Yes. Modern platforms are built on API-driven microservices, which makes it possible to integrate with older ERP and CRM systems. Middleware layers and custom connectors bridge gaps, ensuring financial data flows seamlessly across new and legacy infrastructure.