The pressure on financial enterprises is increasing with the growing number of fraud breaches and liquidity gaps. Yet within most institutions, the tools that power these insights remain siloed in custom scripts, legacy feeds, and brittle dashboards. They work until scaling the data eventually breaks them. And when compliance teams demand to know why a decision was made, the answers are often buried or unavailable. This fragility costs millions of dollars and causes enterprises to miss out on profit opportunities.

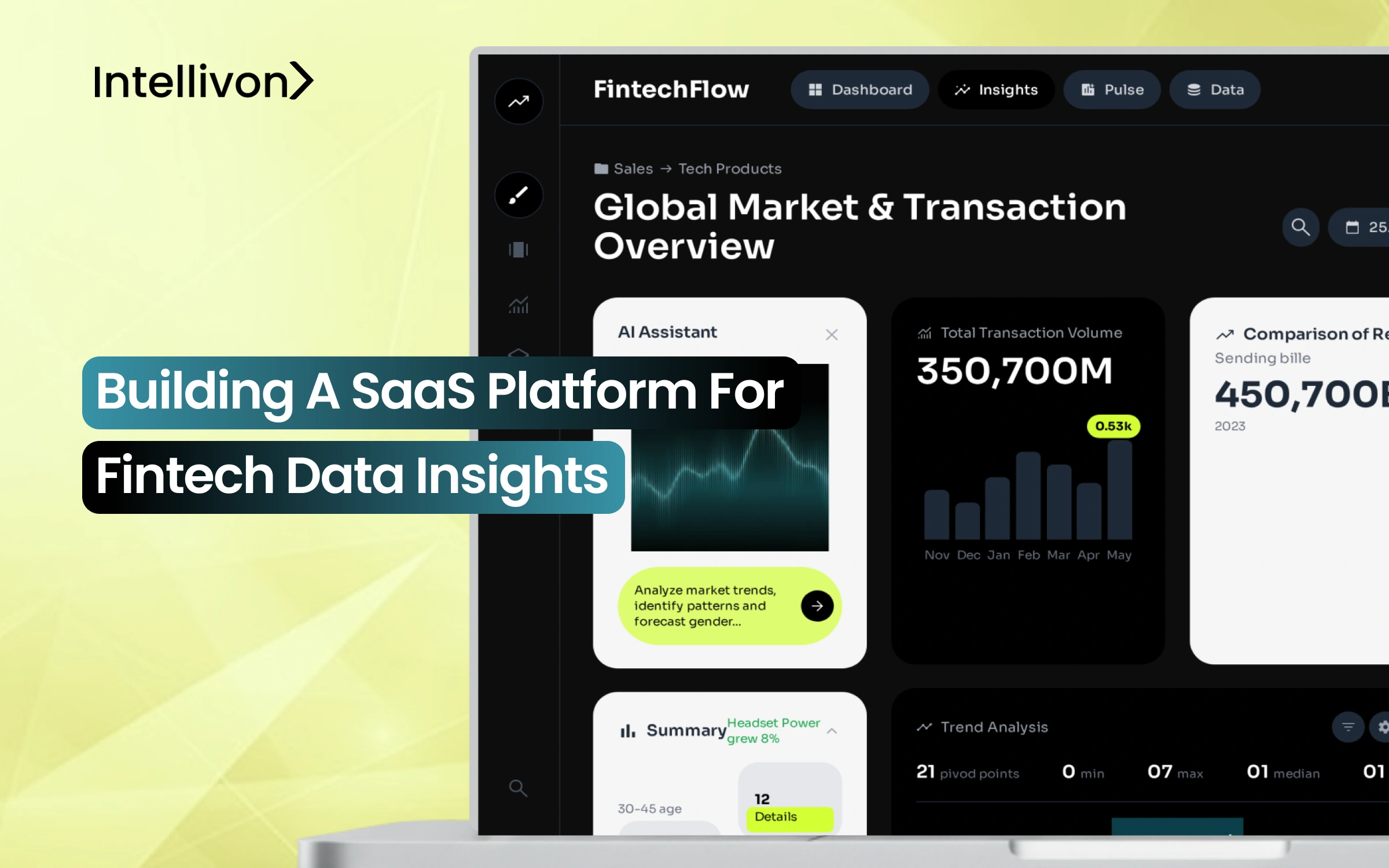

This is why SaaS fintech data insight platforms are gaining ground. They are built to deliver real-time analytics on top of governed, explainable data pipelines. Every fraud alert, credit score, or anomaly flag can be traced back to its source. And because the model is SaaS, enterprises do not have to bear the burden of constant rebuilds.

At Intellivon, we help banks, insurers, and fintechs build SaaS platforms that transform scattered financial data into governed, real-time insights. These platforms integrate data from multiple sources, embed compliance, and deliver AI-powered analytics at scale. In this blog, we’ll explore what a SaaS fintech data insights platform is, why enterprises are embracing it, and how Intellivon develops them to be secure, scalable, and future-ready.

Why Finance Is Being Forced to Standardize Its Data Insight Layer

Finance is already running on data-driven decisions, such as fraud flags, credit risk scores, liquidity alerts, and operational exceptions. But most of that is powered by custom internal tooling that’s fragile, ungoverned, and hard to explain to a regulator.

That’s now a systemic weakness, and it’s exactly why finance is being pushed toward a unified, compliant SaaS platform for fintech data insights.

1. The Spend Signal

Banks are already treating data-insight infrastructure as core spend, and not as experimentation. In 2023 alone, banks planned to spend north of $5 billion on data initiatives, such as data platforms, governance, analytics pipelines, and AI enablement.

At the same time, banking leaders say data quality and access are now critical blockers, not nice-to-haves. They are admitting that they spend billions, but their data is still not reliable or usable at scale

A fintech data insights SaaS platform directly answers that. Instead of every bank wiring its own fragmented data lake and alerting layer, you deliver ingestion, normalization, scoring, alerting, and audit evidence as a product.

2. The Adoption Signal

AI is already embedded in live financial operations. Regulators report that about 75% of financial firms are using AI, and roughly another 10% plan to adopt it in the next three years, up from 58% two years earlier.

Firms report using AI for:

- Internal process optimization (41%)

- Cybersecurity threat monitoring (37%)

- Fraud detection (33%).

3. The Control Signal

Supervisors are now treating analytics/AI platforms as critical financial infrastructure. They’ve begun asserting direct oversight over key third-party tech providers because outages or model failures in these platforms could create systemic risk.

Regulators are also warning that while AI adoption is high, understanding is weak. Nearly half of firms say they only have a “partial understanding” of the AI they’re already using, which is now flagged as a governance problem.

That means black-box analytics is no longer acceptable. If you surface a fraud alert or a credit-risk alert, you have to prove why it fired, where the data came from, and who touched it. The SaaS platform solves this problem by embedding explainability and lineage into every alert. This means banks can not only act on insights in real time but also prove to regulators why the alert fired and who interacted with it, closing the trust gap.

These are all the reasons why a fintech data insights SaaS platform is the trust layer, the compliance layer, and the operational heartbeat that finance is being forced to standardize on.

What Is a Fintech Data Insights SaaS Platform?

A fintech data insights SaaS platform is an enterprise-grade system that ingests financial data from multiple sources, standardizes it, and delivers governed, real-time insights across fraud detection, credit risk, compliance, customer behavior, and operational efficiency.

Unlike traditional fintech apps, which often solve a single pain point in isolation, these platforms are built as end-to-end data environments designed for scale and regulatory scrutiny.

The “SaaS” model is what makes this approach powerful. Instead of enterprises building fragile internal data stacks, the platform is delivered as a managed service, continuously updated, elastic enough to handle transaction surges, and already embedded with compliance guardrails. This removes the heavy upfront investment while ensuring enterprises stay aligned with evolving regulations.

At its core, the value is threefold, including aggregation of fragmented data, governance to ensure trust and compliance, and AI-driven analytics that transform raw transactions into actionable intelligence. For banks, insurers, and fintechs, this means faster decision-making, lower risk, and measurable ROI without the complexity of managing their own infrastructure.

Market Opportunity & Adoption Trends

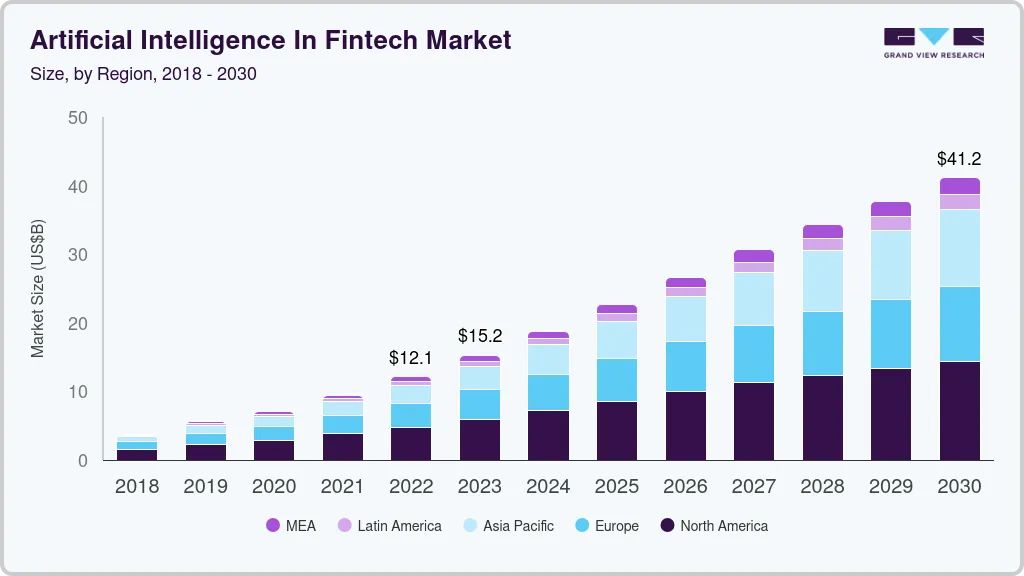

The global AI in fintech market was valued at USD 9.45 billion in 2021 and is forecasted to reach USD 41.16 billion by 2030, expanding at a CAGR of 16.5% between 2022 and 2030. Fintech applies modern digital technologies to improve or automate financial services like banking, investing, and payments.

Key Market Highlights

- Regional Trends: North America led the market in 2021, contributing over 40% of global revenue, while Asia Pacific is expected to see the fastest growth through 2030.

- By Component: The solutions segment dominated in 2021, accounting for more than 77.5% of total revenue.

- By Application: Business analytics and reporting was the largest application area, contributing over 32% of revenue.

- By Deployment: On-premise solutions held the majority share in 2021, generating more than 57% of global revenue.

Enterprise Adoption Metrics

- Banks: Adoption of SaaS fintech solutions is increasing across payments, lending, risk management, and customer experience platforms, with a focus on scalability, compliance, and data security.

- Insurers: Insurers are leveraging data insights, AI for underwriting and claims, and digital distribution via SaaS platforms, aiming for faster policy cycles and improved risk assessment.

- Wealth managers: Data-driven advisory platforms, portfolio analytics, and client experience tooling delivered as SaaS are gaining traction, enabling personalization at scale and improved regulatory reporting.

Key Features of a SaaS Fintech Data Insights Platform

A fintech data insights platform has to do more than display numbers. It must connect across fragmented systems, embed compliance by default, and deliver decisions at the speed finance demands. These are the capabilities that make SaaS models the foundation for modern financial infrastructure.

1. Data Aggregation and Connectivity

Enterprises deal with fragmented data from banks, card networks, ERP systems, payment processors, and external bureaus. Without a unified layer, every team builds its own reports, creating conflicting numbers and wasted time.

A SaaS platform solves this by ingesting structured and unstructured data from all sources into one governed pipeline. It normalizes feeds, applies quality checks, and makes them available in real time. This gives risk, compliance, and operations teams a common foundation for decisions.

2. Compliance and Security by Design

Financial services operate under some of the toughest regulatory environments in the world. Manual compliance checks not only slow down processes but also create blind spots.

SaaS platforms embed requirements like AML, KYC, PCI-DSS, and GDPR directly into workflows. This ensures that customer verification, transaction monitoring, and audit reporting happen automatically.

Security is layered in through end-to-end encryption, tokenization, and zero-trust access controls. The result is a platform where compliance is not an afterthought, but an always-on capability.

3. AI-Powered Analytics

Fraud, credit risk, and customer churn are challenges that evolve by the hour. Traditional rule-based systems cannot keep up.

SaaS platforms deploy machine learning models that learn continuously from historical and live data. They can flag anomalies within milliseconds, update risk scores instantly, and provide predictive insights on customer behavior.

Importantly, these analytics are explainable, where every alert or score comes with context, so leaders know why it fired. This shifts analytics from being reactive to becoming a strategic asset.

4. Dashboards and Visualization

Executives need clarity, not complexity. A well-designed SaaS platform translates billions of transactions into intuitive dashboards that highlight trends, forecasts, and outliers. Instead of wading through spreadsheets, decision-makers see key metrics in real time with drill-down capabilities.

For example, a fraud manager can spot rising anomalies in one region, while a CFO tracks liquidity forecasts across portfolios. By presenting complex data in simple, visual formats, dashboards enable faster, more confident decision-making across the enterprise.

5. API-First Microservices

Every financial institution runs on a unique mix of legacy and modern systems. Custom integration projects are costly and fragile. SaaS platforms built on an API-first, microservices architecture solve this problem.

Each capability, from payments integration to credit bureau checks, is delivered as a modular service that connects securely with existing stacks. This makes adoption faster, scaling easier, and upgrades seamless. Enterprises avoid vendor lock-in and retain flexibility to expand or pivot without rewriting their entire infrastructure.

6. Data Governance and Explainability

“Black-box” analytics are no longer acceptable. Regulators demand clarity on where data came from, how it was processed, and who had access.

SaaS platforms embed governance frameworks that provide complete lineage for every data point and decision. This means if a fraud alert fires, compliance teams can instantly trace the data sources, model logic, and review history.

Governance dashboards make oversight transparent, reducing regulatory risk and building trust with both supervisors and customers.

7. Scalability and Resilience

Finance operates at a massive scale, with millions of transactions daily, surges during market events, and continuous global demand. On-premise systems often buckle under this load.

SaaS platforms are designed to scale elastically, automatically allocating resources during peak usage. High-availability infrastructure ensures uptime above 99.9%, while built-in disaster recovery keeps operations running during outages.

This resilience means enterprises can grow and adapt without rebuilding infrastructure every few years.

The features are the baseline for running financial operations in a digital era. A SaaS data insights platform combines them into one service, turning fragmented data into a governed, scalable, and actionable asset.

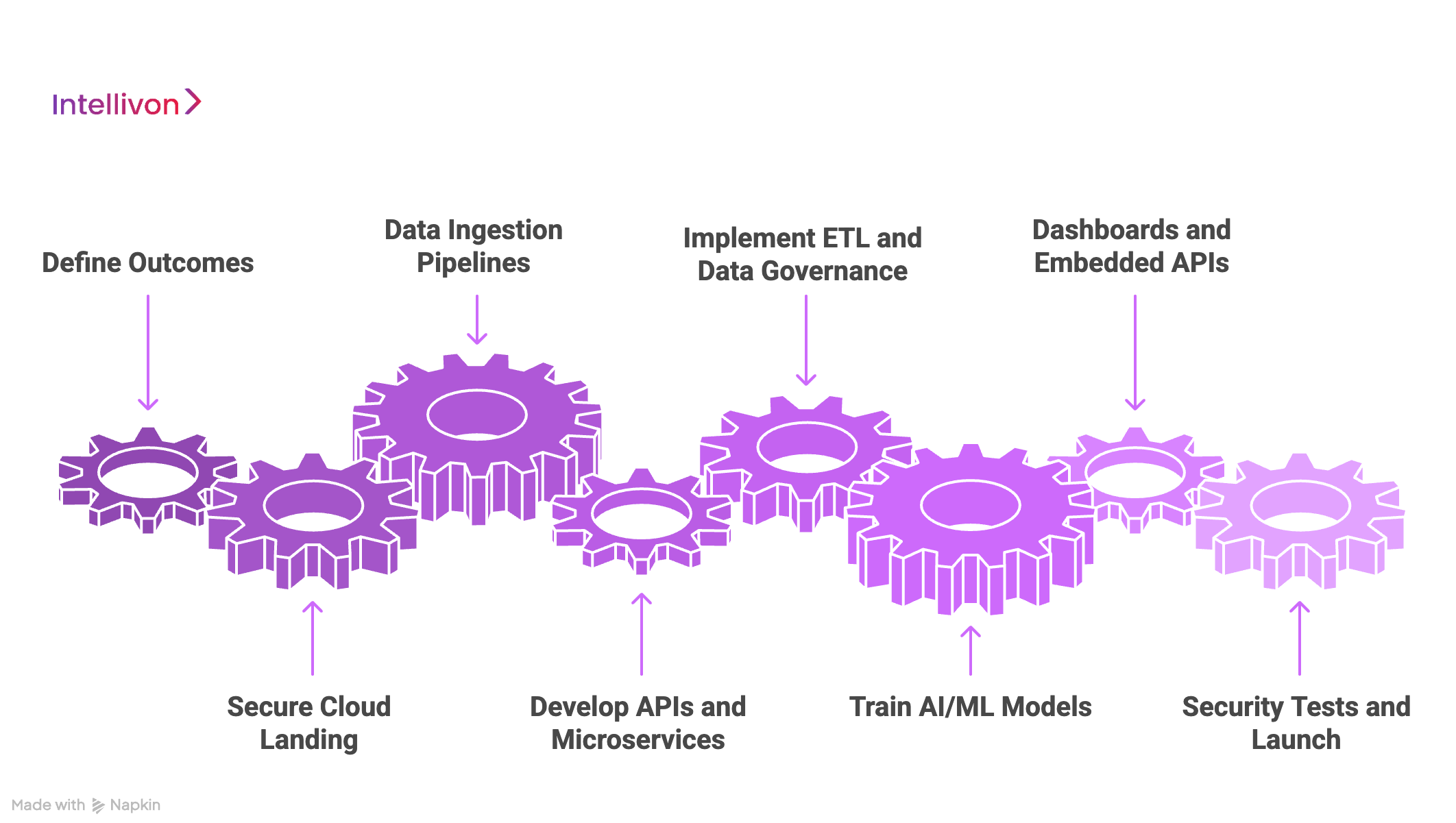

How We Develop SaaS FinTech Data Insights Platform

Building a SaaS fintech data insights platform surrounds creating an ecosystem that can handle sensitive financial data at scale, meet regulatory obligations, and deliver real-time intelligence that business leaders can act on. At Intellivon, our approach follows a clear eight-step framework designed to take enterprises from strategy to live deployment without disruption.

Step 1: Define Outcomes

Every build starts with alignment. We work with enterprise stakeholders to define business goals, risk appetite, and regulatory frameworks. Whether it’s PSD2 in Europe, OCC in the U.S., or APRA in Australia, compliance obligations shape the platform design from the outset.

This ensures that measurable outcomes, such as reducing fraud losses, accelerating credit approvals, or improving audit readiness, are linked directly to compliance-ready workflows.

Step 2: Secure Cloud Landing

Security cannot be retrofitted. The platform is deployed into a secure cloud landing zone tailored to the client’s infrastructure, whether AWS Financial Services Cloud, Azure Bank Cloud, or a hybrid on-prem environment.

Network segmentation, encryption policies, and access controls are embedded at this stage, ensuring the environment is hardened before any data enters.

Step 3: Data Ingestion Pipelines

The foundation of insights is clean data. We design ingestion pipelines that connect to banks, payment gateways, ERP systems, CRMs, and credit bureaus.

These pipelines handle structured and unstructured inputs, applying validation, deduplication, and enrichment. APIs and Kafka streams ensure real-time flow, giving the enterprise a unified and accurate view across all financial systems.

Step 4: Develop APIs and Microservices

To avoid monolithic architectures, we deliver capabilities as modular microservices. Each service, including fraud scoring, credit checks, and transaction monitoring, is API-driven, making it easier to integrate with existing systems.

This modularity also means enterprises can adopt features incrementally and scale only what they need, reducing cost and complexity.

Step 5: Implement ETL and Data Governance

Data is processed through ETL workflows to transform it into usable formats. Feature stores are created for machine learning models, ensuring consistency across fraud detection, credit risk, and customer insights.

Governance layers are applied here, so every dataset has lineage, access policies, and audit trails, satisfying regulatory expectations.

Step 6: Train AI/ML Models

Machine learning models are trained on historical and live data to power fraud detection, risk scoring, and predictive analytics. These models are explainable by design, producing outputs that include reasoning and contributing variables.

Bias checks and fairness metrics are embedded to ensure decisions are both effective and defensible.

Step 7: Dashboards and Embedded APIs

Decision-makers need clarity at a glance. We build dashboards that visually present insights on fraud trends, risk exposures, and liquidity gaps, with the ability to drill down into root causes.

At the same time, insights are made available as APIs, so they can be embedded into loan origination systems, payment flows, or underwriting platforms.

Step 8: Security Tests and Launch

Before going live, the platform undergoes rigorous penetration testing, vulnerability scanning, and compliance audits. Certifications such as SOC 2, ISO 27001, or PCI DSS are obtained where required. Once validated, the platform is deployed with monitoring tools in place to track performance, detect anomalies, and ensure continuous compliance.

This process ensures enterprises get a platform that is secure, compliant, and capable of scaling with their growth. It’s a roadmap designed for long-term resilience, not short-term fixes.

Cost of Building a Fintech Data Insights SaaS Platform

At Intellivon, the goal is to help enterprises build fintech data insights platforms that are both scalable and future-ready. That’s why our pricing framework is flexible, aligned with business growth targets, compliance obligations, and data strategy, rather than forcing a rigid one-size-fits-all model.

When early projections exceed the available budget, the scope is refined collaboratively. The focus always remains on enterprise-grade resilience, uncompromising security, and regulatory assurance that withstands global audits.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement mapping, KPI definition, compliance setup (GDPR, PCI-DSS, AML/KYC, PSD2) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting SaaS stack (cloud landing zone, APIs, microservices, governance layer) | $8,000 – $15,000 |

| Data Integration & ETL Pipelines | Ingesting financial, payments, and bureau data, normalization, quality checks | $10,000 – $20,000 |

| AI/ML Analytics Engine | Fraud scoring, credit risk, anomaly detection, predictive insights | $12,000 – $20,000 |

| Dashboards & Enterprise Portals | Custom dashboards, analyst consoles, executive reports, embedded APIs | $8,000 – $15,000 |

| Security & Compliance Alignment | Encryption, tokenization, explainable AI, audit-ready evidence reporting | $6,000 – $12,000 |

| Testing & Quality Assurance | Stress testing, bias checks, latency optimization, scalability audits | $5,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, sandbox validation, elastic scaling, monitoring | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $100,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Integration Complexity: Legacy banking cores, ERPs, and payment systems often need custom connectors.

- Compliance Overhead: Continuous updates for GDPR, AML, PCI-DSS, and open banking rules require legal and audit support.

- Data Governance: Clean, high-quality financial datasets demand ongoing curation, labeling, and monitoring.

- Cloud & Compute Spend: AI pipelines and real-time analytics consume compute resources if not optimized.

- Change Management: Training analysts, compliance teams, and operations staff adds operational effort.

- Monitoring & Model Drift: Regular audits, retraining, and observability tools prevent performance and compliance gaps.

Best Practices to Avoid Budget Overruns

Drawing on Intellivon’s experience building enterprise-grade SaaS platforms, several practices consistently keep costs predictable:

- Start With a Focused Scope: Begin with one product line or risk area, validate ROI, then scale.

- Embed Compliance Early: Bake in AML, GDPR, PCI-DSS, and audit frameworks from day one.

- Adopt Modular Architecture: Use reusable microservices and AI models that scale across geographies and product lines.

- Optimize Infrastructure Spend: Deploy cloud-native scaling, batch analytics for non-critical tasks, and FinOps cost monitoring.

- Embed Observability at Launch: Monitor fraud detection accuracy, latency, and compliance metrics in real time.

- Plan for Continuous Improvement: Refresh ML models, compliance modules, and dashboards as risks and regulations evolve.

Request a tailored proposal from Intellivon’s enterprise AI team, and you’ll receive a roadmap aligned with your budget, data strategy, and growth targets. The outcome will result in a SaaS fintech data insights platform that is secure, compliant, and designed to scale with your business.

Monetization Models for SaaS Fintech Platforms

A fintech data insights platform needs to sustain itself as a business. The strength of the SaaS model lies in flexible monetization options that can align with different customer segments, transaction volumes, and use cases. Below are the leading approaches that enterprises can adopt when rolling out such platforms.

1. Subscription Tiers

The most common model is subscription-based pricing. Enterprises can offer tiered packages, such as basic insights for SMEs, advanced analytics for mid-size firms, and enterprise-grade features for banks and insurers. This creates predictable recurring revenue while giving customers clear upgrade paths.

2. Usage-Based Billing

In fast-scaling fintech ecosystems, usage can vary widely. A usage-based model charges clients for what they actually consume, such as API calls, the number of users, or transaction volume. This keeps entry costs low for smaller firms while still capturing value from heavy enterprise usage.

3. Transaction Margin Fees

For platforms embedded into payment or lending workflows, a small transaction fee is a natural fit. This aligns the platform’s growth with the client’s success, meaning the more transactions processed, the more value is generated on both sides.

4. Freemium to Enterprise Upgrade

Many fintech SaaS providers attract adoption by offering a free entry-level product. Core features are free, but advanced analytics, compliance dashboards, or integration modules are unlocked through paid enterprise upgrades. This model accelerates adoption while nurturing long-term enterprise clients.

5. White-Label Licensing

Some enterprises prefer to rebrand solutions as their own. White-label licensing allows banks, insurers, or fintechs to deliver the platform under their branding, while the SaaS provider benefits from recurring licensing revenue.

6. Embedded Finance Monetization

Data insights platforms can generate additional revenue by embedding financial products such as payments, credit, or insurance. This creates a new revenue stream while enhancing the stickiness of the platform for end-users.

Comparison Table of Monetization Options

| Model | How It Works | Advantages | Best-Fit Audience |

| Subscription Tiers | Fixed monthly/annual pricing based on feature bundles | Predictable revenue, easy to budget | SMEs, mid-size fintechs, enterprises needing steady access |

| Usage-Based Billing | Charges linked to API calls, transactions, or active users | Flexible entry point, scales with adoption | Startups, fast-growing fintechs, enterprises with fluctuating usage |

| Transaction Margin Fees | Small fee per transaction processed through the platform | Growth aligned with client success, recurring income | Payment processors, lending platforms, digital wallets |

| Freemium → Enterprise Upgrade | Basic version free, advanced features unlocked via paid upgrade | Rapid adoption, smooth conversion path to enterprise clients | Smaller fintechs, retail-facing apps, early-stage adopters |

| White-Label Licensing | Clients rebrand the platform under their own identity | High-value contracts, long-term partnerships | Banks, insurers, enterprises with customer-facing services |

| Embedded Finance Monetization | Embeds payments, credit, or insurance into workflows | Creates new revenue streams, high stickiness | Large fintechs, neobanks, enterprise ecosystems |

The right monetization model depends on the enterprise’s strategy and customer base. What matters most is flexibility, which is the ability to scale from low-barrier adoption to enterprise-grade packages, while aligning growth with measurable value.

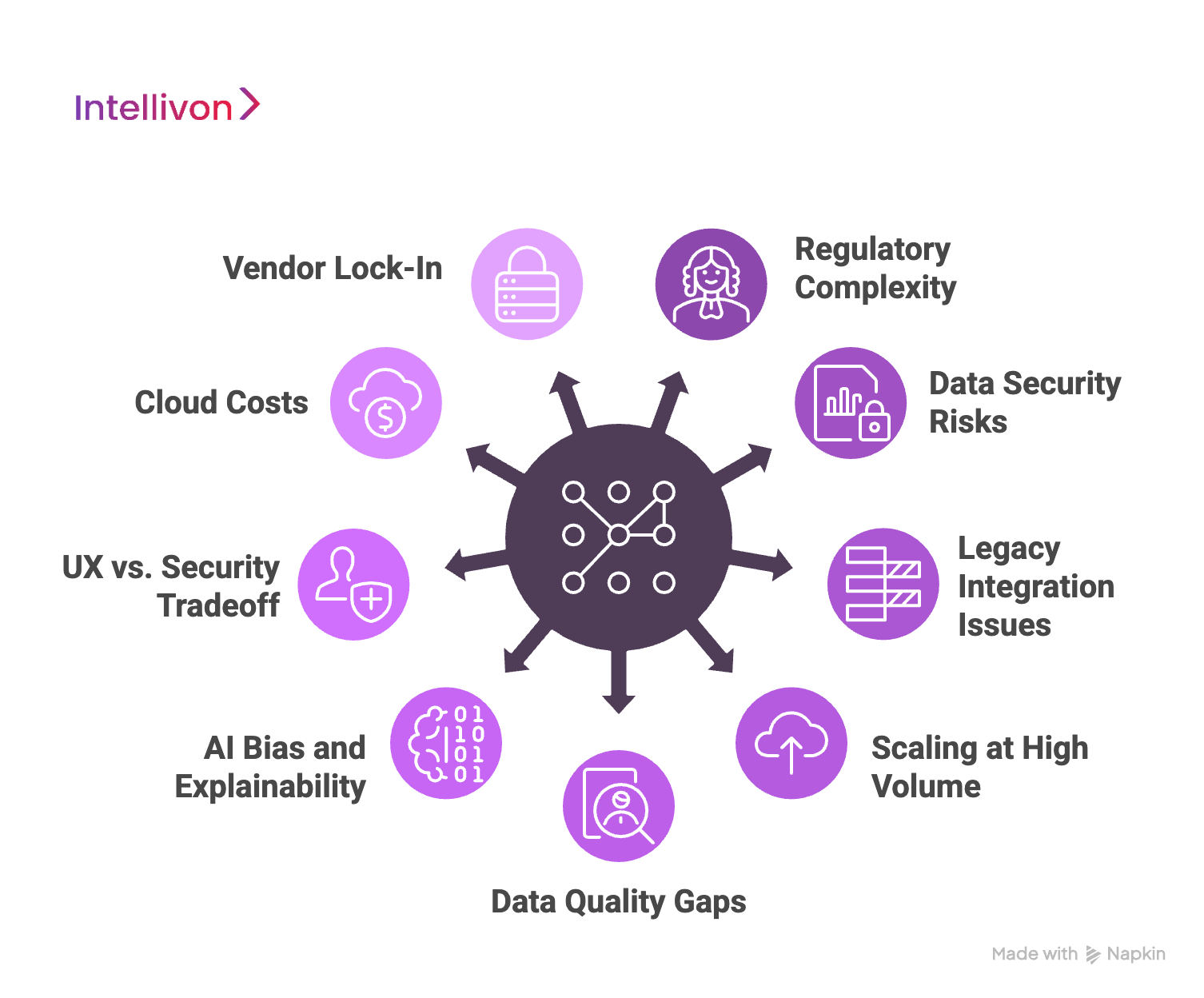

Overcoming Challenges to Building SaaS FinTech Data Insights Platforms

Every financial institution knows the pain of modernizing data systems. Regulations shift constantly, legacy cores don’t play well with new tech, and cloud costs creep up. At Intellivon, we’ve helped enterprises tackle these hurdles by building SaaS platforms that are secure, compliant, and resilient from the ground up.

1. Regulatory Complexity

Regulation isn’t slowing down. From GDPR in Europe to PSD2, PCI-DSS, and AML mandates worldwide, financial services face a moving target. The mistake most enterprises make is treating compliance as an add-on.

At Intellivon, we flip that. Our platforms embed RegTech automation, KYC/AML modules, and audit-ready dashboards right into the core architecture. This ensures compliance is live, not retrofitted, and ready for regulator review at any time.

2. Data Security Risks

Every transaction is a potential target, and breaches are existential. We’ve seen too many institutions suffer because security was layered in late. Intellivon takes the opposite approach.

We engineer platforms with zero-trust access, end-to-end encryption, and independent audits as standard. Security isn’t a feature. It’s the foundation.

3. Legacy Integration Issues

Most financial cores were never designed to integrate with modern analytics. Forcing connections creates brittle systems that break at scale.

Intellivon solves this with API-first, microservices-based connectors that sit on top of legacy cores. This means data flows cleanly without requiring a costly rip-and-replace, giving enterprises modern capabilities on proven infrastructure.

4. Scaling at High Volume

Market surges, fraud spikes, and high-volume payment days don’t wait for IT capacity. On-prem systems often buckle under pressure.

Intellivon builds cloud-native platforms that scale elastically, maintain uptime, and carry disaster recovery protocols. Enterprises get resilience that flexes with demand, without managing infrastructure themselves.

5. Data Quality Gaps

Poor data quality ruins trust in analytics. Duplicate entries, mismatched formats, or incomplete feeds create noise instead of insight.

We design ETL pipelines that clean, validate, and enrich data as it enters the system. That means risk scores, fraud alerts, and customer insights are always powered by accurate, governed data.

6. AI Bias and Explainability

Regulators now want proof that AI models are explainable and fair. Black-box analytics are no longer defensible.

Our experts address this by embedding model cards, lineage tracking, and explainability dashboards into every build. When an alert fires, decision-makers can show not only what triggered it, but also why.

7. UX vs. Security Tradeoff

Enterprises often face a tough tradeoff: tighten security and frustrate users, or loosen it and increase risk. Intellivon eliminates that choice.

We use adaptive MFA, biometrics, and contextual authentication that flex security levels to the situation, delivering both seamless user experiences and enterprise-grade protection.

8. Cloud Costs

Cloud spend can spiral fast when AI pipelines run around the clock.

Intellivon applies FinOps practices from the start, including elastic compute, observability dashboards, and workload cost prioritization. This results in predictable budgets without compromising performance.

9. Vendor Lock-In

No enterprise wants to be tied to one vendor’s ecosystem.

Intellivon builds platforms on open-source frameworks like Kubernetes, Kafka, and Postgres. This keeps architectures portable, flexible, and future-ready, giving enterprises full ownership of their tech stack.

The obstacles to building a fintech data insights platform are real, but they’re not roadblocks. With the right partner, they become design opportunities. At Intellivon, we make sure every platform we build is compliant by default, secure at scale, and resilient enough to grow with the enterprise.

Real-World Examples of SaaS fintech data insight platforms

The best way to understand the power of SaaS data insight platforms is to see how leading fintechs are already applying them. Below are platforms that have successfully turned complex financial data into actionable intelligence at scale.

1. Ramp

Ramp is a SaaS platform built around finance automation. Its Ramp Intelligence module delivers real-time spend insights, automated expense categorization, and cash-flow visibility. By consolidating expense data across teams, Ramp helps enterprises reduce wasted spend and improve decision-making speed.

2. Personetics

Personetics powers personalized banking experiences for global institutions through its SaaS platform Engage. It turns raw banking data into insights that improve customer engagement and financial wellness.

Banks use Personetics to deliver predictive savings tips, cash-flow forecasts, and personalized advice directly in their apps, boosting both retention and customer trust.

3. Tink (Visa)

Acquired by Visa, Tink has become a central SaaS platform for open banking insights. Its modules provide affordability checks, income verification, and cash-flow prediction for lenders and banks. Tink’s ability to connect to thousands of banks across Europe makes it a trusted choice for enterprises seeking scalable, compliant data-driven decisions.

4. TrueLayer

TrueLayer specializes in payments and financial data APIs that give enterprises deep insights into consumer affordability and spending behavior. Its SaaS platform enables faster onboarding, streamlined credit decisions, and lower fraud rates. With coverage across the UK and EU, TrueLayer has become a backbone for fintechs building payment and lending products.

These platforms show that SaaS data insight platforms are live, proven, and shaping how enterprises manage risk, compliance, and customer engagement. For financial institutions, adopting such platforms is quickly becoming essential infrastructure.

5. Ocrolus

Ocrolus is a SaaS platform that analyzes financial documents (like bank statements, pay stubs, and tax filings) and converts them into decision-ready insights. Lenders use it to automate risk scoring, detect fraud, and accelerate approvals. Its core strength lies in document intelligence that powers underwriting and compliance decisions.

6. Trovata

Trovata offers a SaaS platform for enterprise treasury and liquidity management. It connects directly to bank APIs to aggregate cash balances, forecast liquidity needs, and model cash-flow scenarios in real time. CFOs and treasurers use it to optimize working capital and reduce liquidity risk.

7. Featurespace

Featurespace runs on a SaaS model, delivering adaptive behavioral analytics for fraud and AML. Its ARIC Risk Hub uses machine learning to detect anomalies in transaction patterns. Banks and payment processors rely on it for real-time monitoring that reduces false positives while catching sophisticated fraud.

Conclusion

The shift toward SaaS fintech data insights platforms reflects a deeper reality: finance cannot operate effectively with fragmented tools and opaque analytics anymore. Enterprises need speed, accuracy, and compliance built into their core systems, not bolted on as an afterthought.

By unifying data pipelines, embedding explainability, and offering elastic scale, these platforms provide the foundation modern finance depends on. They are not just improving fraud detection, credit scoring, or liquidity management, they are setting the standard for how financial decisions will be governed in the years ahead.

Build Your SaaS FinTech Platform With Intellivon

At Intellivon, we design enterprise SaaS platforms that turn fragmented financial data into governed, real-time insights. Our solutions blend AI analytics, explainability, and compliance-first architecture to cut risk, speed decisions, and improve customer outcomes without disruption.

Why Partner With Intellivon?

- Tailored Enterprise Platforms: Built around your model, KPIs, and compliance needs for measurable ROI.

- Proven Global Expertise: 11+ years, 500+ AI builds, and 200+ specialists across banking, fintech, and insurance.

- Compliance First: Aligned with GDPR, PCI DSS, AML and regional banking rules from day one.

- Future Ready Architecture: Cloud-native and API-first. Works with cores, ERPs, CRMs, and payment systems.

- Security and Reliability: Multi-layer controls, encryption, audits, and continuous monitoring protect sensitive data.

- Data Governance and Explainability: Full lineage, model cards, and audit-ready logs for every decision.

- Faster Time to Value: Prebuilt connectors and modular services reduce cost and launch timelines.

- Continuous Optimization: Ongoing model retraining, cost tuning, and compliance updates as your needs evolve.

Book a free strategy call today to scope a platform that is secure, compliant, and built to scale.

FAQs

Q1. What is a SaaS fintech data insights platform?

A1. A SaaS fintech data insights platform is a cloud-based system that aggregates financial data, applies AI analytics, and delivers real-time insights for fraud detection, credit risk, liquidity management, and customer behavior—all while embedding compliance and explainability.

Q2. Why are financial enterprises adopting SaaS for data insights?

A2. Enterprises adopt SaaS for elasticity, compliance, and speed. Unlike fragile internal tools, SaaS platforms provide governed pipelines, real-time monitoring, and cost efficiency, allowing banks and insurers to scale insights without constant rebuilds.

Q3. How much does it cost to build a SaaS fintech data insights platform?

A3. The cost typically ranges between $50,000 and $100,000 for an enterprise-ready MVP. Expenses vary depending on data integration complexity, AI model development, compliance alignment, and customization needs.

Q4. What challenges come with building these platforms?

A4. Key challenges include regulatory complexity, data security risks, legacy system integration, and scaling at high volumes. Successful builds overcome these with compliance-by-design, zero-trust models, API-first integration, and cloud-native orchestration.

Q5. What are some real-world examples of SaaS fintech data insight platforms?

A5. Successful examples include Ramp (finance automation), Personetics Engage (banking insights), Tink (open-banking analytics), and TrueLayer (payments and affordability checks). These show how SaaS is reshaping enterprise data strategy.