Global banks constantly face outdated payment rails that slow capital movement and inflate costs. The European Central Bank estimates the value of global cross-border retail payments at nearly $200 trillion annually, with projections suggesting they will surge past $320 trillion by 2032. Yet much of this money still moves through legacy systems like SWIFT, taking days to settle and racking up billions in transaction fees and liquidity costs. These inefficiencies end up exposing banks and enterprises to compliance risks, reconciliation failures, and missed market opportunities in the long run.

A robust Central Bank Digital Currency (CBDC) infrastructure offers a strategic way forward. Acting as the digital backbone of money, it brings central bank trust into programmable, secure, and real-time settlement systems.

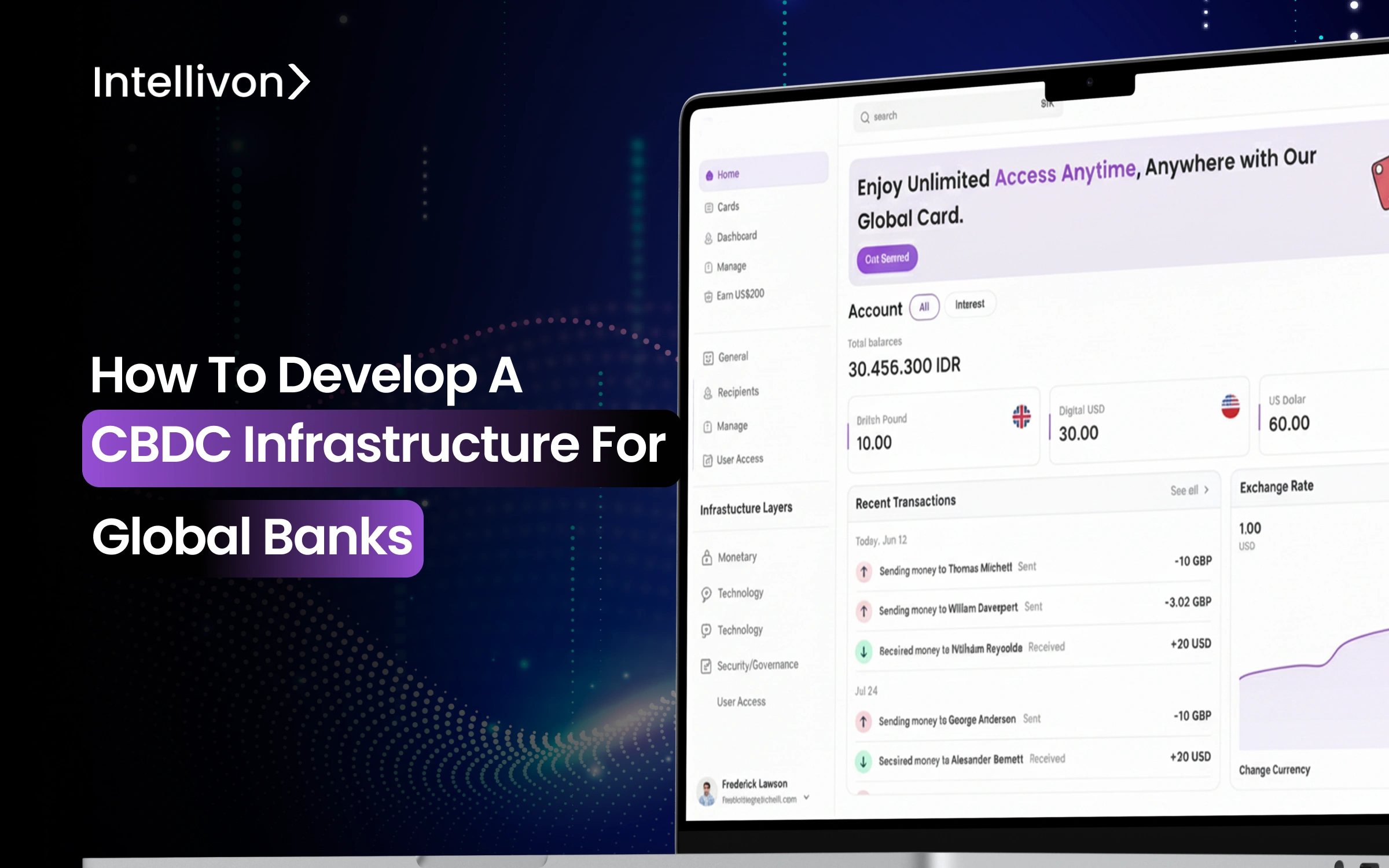

At Intellivon, we’ve helped global banks build CBDC infrastructures that cut settlement times by half, strengthened liquidity visibility, and enabled smart contract-driven finance in trade and treasury. This blog will uncover the building blocks of CBDC infrastructure and demonstrate how we deliver them to power global banking transformation.

The Right Time To Invest in Building CBDC Infrastructure

The global CBDC market is still in its early stages, but it is growing fast. Valued at just USD 0.4 billion in 2024, it is projected to surge to USD 3.0 billion by 2035, reflecting a strong 19.2% CAGR between 2025 and 2035.

More than 90 central banks worldwide, including those in the US, UK, Canada, and Australia, are now actively researching, piloting, or rolling out CBDCs. By 2030, the market is expected to reach at least USD 20 billion, with governments and financial institutions making significant investments in digital currency infrastructure.

- Major Banks Lead Pilots: Institutions like HSBC, JPMorgan, Citi, Barclays, Wells Fargo, and ANZ are working directly with central banks on CBDC pilots, proving their readiness to deploy digital cash at scale.

- Efficiency and Cost Gains: Pilots show settlement times reduced from days to seconds, cross-border costs cut by 20–40%, and liquidity requirements lowered by up to 40%.

- Compliance Automation: CBDC-enabled AML/KYC systems could save banks up to USD 5 billion annually by automating crime detection and enabling real-time regulatory reporting.

- Competitive and Regulatory Pressure: Over 70% of banking leaders now consider CBDC readiness “mission critical,” as regulators like BIS and IMF push for interoperability, privacy, and security standards.

- Broader Market Impact: Beyond banks, CBDCs could expand financial inclusion, drive digital payment adoption, and unlock tokenized asset markets, potentially onboarding 500 million new users by 2030.

For enterprise banks, CBDC infrastructure is becoming essential to future-proof operations, cut costs, and capture new digital markets.

How CBDC Works in Global Banks

When you strip away the jargon, CBDC infrastructure is simply the plumbing of digital money. It is the system that lets central banks issue digital currencies, and commercial banks distribute and use them across markets.

Without this infrastructure, a CBDC is just an idea on paper. With it, digital money becomes a trusted, functional asset that flows securely between institutions, businesses, and consumers.

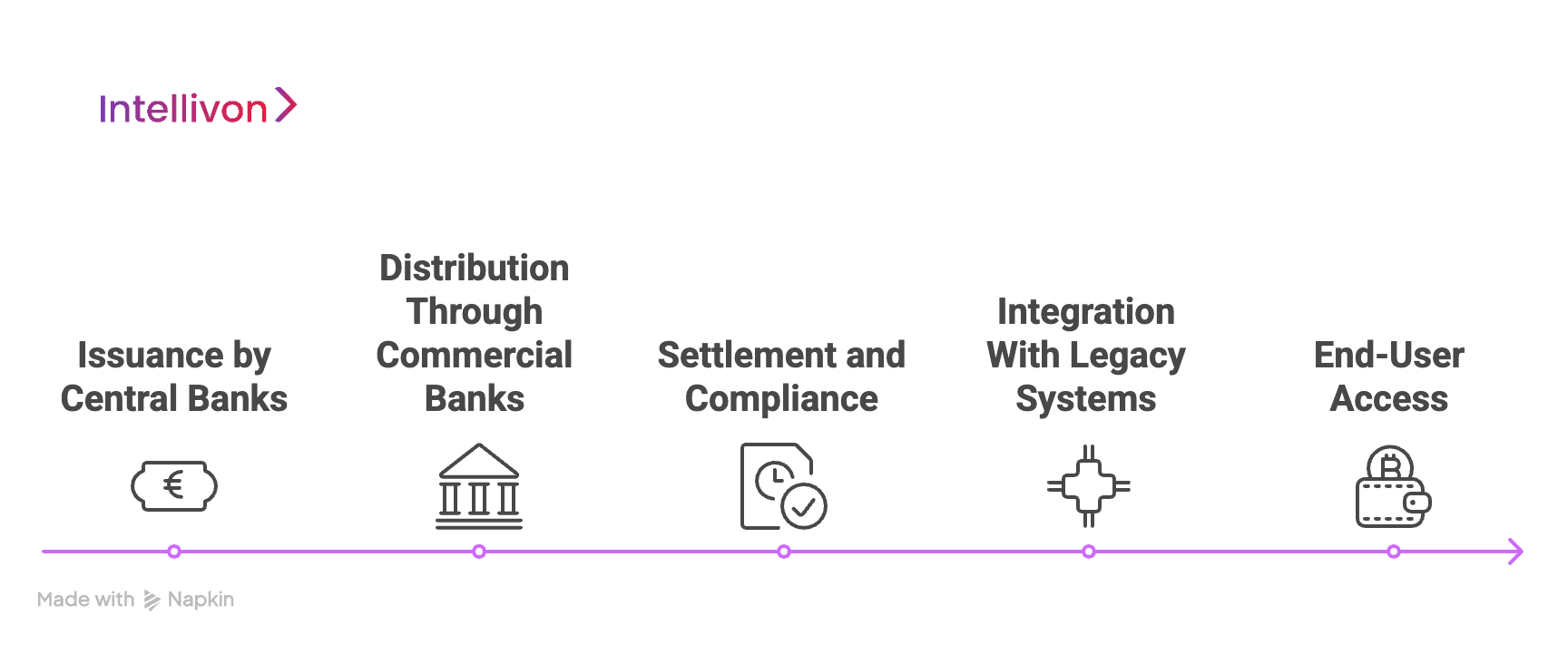

The Five Layers of CBDC Infrastructure

The architecture typically has five distinct layers, each carrying specific responsibilities.

- Monetary Layer: Central banks define issuance, redemption, and policy rules here.

- Technology Layer: Often powered by distributed ledgers or high-speed databases, this layer ensures transactions are tamper-proof and final.

- Banking and Payments Layer: Connects CBDCs to existing systems like SWIFT, RTGS, and ACH, ensuring interoperability with today’s rails.

- Security and Governance Layer: Embeds AML/KYC, fraud detection, privacy frameworks, and regulatory alignment.

- User Access Layer: Delivers wallets, APIs, and integration points, making CBDCs usable by banks, corporates, and customers.

How It Works:

1. Issuance by Central Banks

The process begins at the central bank. This is where CBDC is created, managed, and governed. Policy rules, such as limits, interest applications, or redemption conditions, are defined here to ensure stability and monetary control.

2. Distribution Through Commercial Banks

Once issued, CBDC is distributed to commercial banks. Here, global banks act as intermediaries, providing access to enterprises and customers. This keeps the familiar two-tier banking model intact, while making transactions faster and easier to reconcile.

3. Settlement and Compliance

CBDC transactions settle in real time. Instead of waiting days for cross-border transfers, funds move within seconds. Built-in AML/KYC and regulatory checks automate compliance, reducing fraud risks and easing reporting requirements for banks.

4. Integration With Legacy Systems

For CBDC to work in practice, it must connect with existing rails like SWIFT, RTGS, ACH, and UPI. APIs and middleware make this possible, allowing CBDCs to operate alongside, and eventually streamline, today’s systems.

5. End-User Access

Finally, banks provide access through wallets, APIs, and enterprise platforms. This makes CBDCs usable not only for customers but also for corporates handling treasury, trade finance, and payroll at scale.

For global banks, this flow reshapes the foundation of operations. Settlement becomes near-instant, liquidity is more transparent, and compliance costs fall. In short, CBDC infrastructure works inside the systems that global banks already run.

Choosing the Right CBDC Model When Developing Infrastructure

Every CBDC project starts with the question of which model to build on, which will result in the most robust and scalable platform. This transcends the question of design alone and moves over to deciding how money moves, where banks sit in the value chain, and how future-ready the infrastructure will be.

The wrong choice risks sidelining banks while the right one strengthens their role in global finance.

1. Retail vs. Wholesale

Retail CBDCs are valuable where governments want to digitize cash or improve financial inclusion. But for global banks, retail is secondary.

The bigger opportunity is wholesale CBDCs. These focus on interbank settlement and cross-border payments, which are the areas where today’s inefficiencies cost billions and slow down liquidity.

2. Direct vs. Two-Tier

A direct model puts central banks in charge of distribution. That strips banks of their client relationships and their role in daily operations.

The two-tier model, by contrast, keeps commercial banks at the center while allowing central banks to oversee issuance. For any serious infrastructure build, this is the workable choice.

3. Account-Based vs. Token-Based

An account-based system ties every transaction to verified identities. This makes AML/KYC easier to automate and integrates smoothly with existing compliance frameworks. Token-based systems mimic digital cash, but they raise fraud and privacy concerns that regulators are unlikely to accept at scale. For banks, account-based is the safer, more trusted path.

4. Domestic vs. Cross-Border

Domestic pilots are useful as a testing ground, but they don’t solve the bigger problem. Global banks move trillions across borders, and that’s where CBDCs unlock real value.

Cross-border models allow instant settlement across jurisdictions, removing layers of cost and reconciliation.

What Fits Global Banks Best

Put simply, the most practical fit for global banks is a wholesale, two-tier, account-based, cross-border model. This approach protects their place in the system, aligns with compliance needs, and unlocks faster, cheaper, more transparent global settlement. Once that choice is clear, the infrastructure can be built around it with purpose.

Core Technologies Behind a CBDC Infrastructure

Once the model is set, the next step is building the technology backbone. More than just being “digital money,” CBDCs are platforms that must be fast, secure, and compliant at a scale where trillions of dollars move every day. The choice of technologies decides whether the system can handle real-world pressure or collapse under it.

1. Distributed Ledgers and Databases

Most CBDC pilots use distributed ledger technology (DLT) or permissioned blockchains. These systems create a single, tamper-proof record of transactions that can be shared across banks and regulators.

Some central banks prefer high-speed centralized databases. The point is less about the label and more about reliability: whichever system is chosen, it must guarantee instant settlement and absolute finality.

2. Cryptography and Digital Signatures

Every transaction must be verified without exposing sensitive data, and cryptography underpins that trust.

Digital signatures ensure only authorized parties can move funds, while advanced techniques like multi-party computation prevent fraud. For banks, this means payments can flow securely even in hostile environments.

3. Digital Identity and Authentication

CBDCs won’t work without strong digital identity frameworks. To this effect, linking transactions to verified users allows real-time KYC and AML checks.

This gives banks a way to automate reporting, cut fraud losses, and streamline onboarding for enterprises and retail clients alike.

4. Smart Contracts and Programmability

One of CBDC’s biggest advantages is programmability, which allows smart contracts to enable banks to automate payouts, escrow, or settlement conditions.

Think of supply chain financing that triggers automatically when goods clear customs. For corporates, this means less paperwork, fewer intermediaries, and faster access to capital.

5. APIs and Payment Rails

CBDCs cannot risk existing in a vacuum. Because of this, they must connect with SWIFT, RTGS, ACH, UPI, and other payment systems already in use.

APIs and middleware make this integration possible, ensuring banks don’t need to rip out legacy systems to adopt digital currency. Interoperability is the bridge between old rails and new ones.

6. Cybersecurity and Resilience

CBDCs expand the attack surface, meaning security cannot be an afterthought. Infrastructure must include multi-signature controls, real-time anomaly detection, DDoS protection, and recovery frameworks.

For global banks, uptime and resilience are regulatory requirements and are not optional.

7. Cloud-Native and Scalable Architecture

A CBDC system must scale to millions of transactions per second. To aid this feature, cloud-native designs with geographic redundancy deliver that capacity.

Banks can expand without sacrificing performance, while regulators gain assurance that the system won’t fail during peak loads.

8. Compliance Automation (RegTech)

CBDC platforms can embed compliance directly into workflows. Automated AML/KYC, fraud monitoring, and real-time reporting save banks billions annually.

More importantly, they reduce the risk of regulatory penalties, which is something no global bank can afford to ignore.

For global banks, these technologies are the foundation of how CBDC infrastructure delivers value, which translates to faster settlements, automated compliance, and scalable global operations. The banks that invest in the right tech stack now will be the ones shaping how money flows in the next decade.

Global Banks Actively Engaging With CBDC Infrastructure

The shift to CBDCs is no longer confined to whitepapers and pilot sandboxes. Some of the world’s most influential banks are already experimenting with digital currency infrastructure alongside their central banks. These projects show how quickly CBDCs are moving from theory to practice, and why enterprises should be paying attention.

1. Deutsche Bank (Germany)

Deutsche Bank has taken an active role in researching wholesale CBDCs. Its focus has been on how tokenized settlement could reduce friction in securities trading and interbank transfers. By testing wholesale CBDCs, Deutsche Bank is positioning itself to cut systemic costs and support large-scale asset tokenization.

Banks exploring wholesale CBDCs are building platforms that can directly lower settlement costs and improve liquidity efficiency for corporate clients.

2. UBS (Switzerland)

UBS participated in the Swiss National Bank’s Project Helvetia, a wholesale CBDC pilot on SIX Digital Exchange. The project successfully tested the atomic settlement of tokenized securities using central bank digital money. UBS proved that CBDCs could modernize post-trade processes while maintaining regulatory control.

Infrastructure built for wholesale CBDCs enables faster securities settlement, directly benefiting enterprises engaged in capital markets.

3. HSBC (UK/Global)

HSBC was among the banks involved in the Federal Reserve Bank of New York’s digital dollar pilot. The trial evaluated how CBDCs could improve cross-border and interbank payments. HSBC’s participation signals that top-tier institutions are preparing their systems for digital currency rails.

Banks piloting CBDCs for cross-border use cases are paving the way for corporates to access faster, more resilient international settlements.

4. JPMorgan Chase & Co. (USA)

JPMorgan has gone beyond pilots with its Deposit Token initiative, launched through its blockchain unit, Kinexys. The bank has also participated in BIS-led wholesale CBDC pilots. Together, these projects highlight JPMorgan’s commitment to integrating tokenized deposits and CBDCs into its infrastructure.

When the largest US bank actively builds CBDC-compatible systems, it’s a signal to enterprises that settlement frameworks are already changing.

These cases prove CBDCs are not a distant concept. Banks are re-architecting settlement systems, embedding compliance, and testing cross-border rails. For enterprises, this means the financial backbone they rely on is already evolving and aligning with CBDC infrastructure.

How We Develop a CBDC Infrastructure For Global Banks

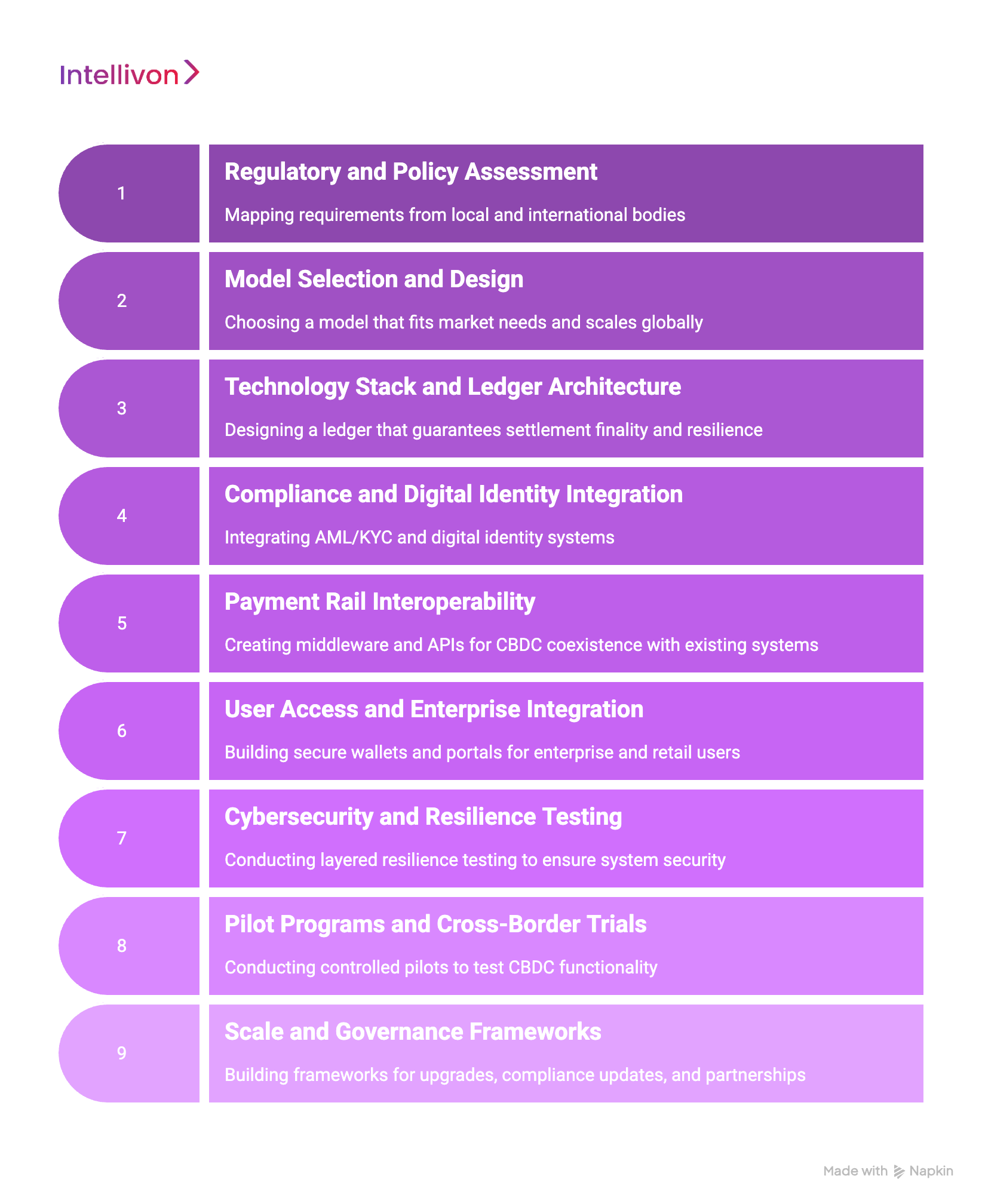

Building a CBDC infrastructure is less about technology and more about strategy. The real task is designing a system that balances central bank oversight with commercial bank participation, while also delivering enterprise usability at scale. At Intellivon, we approach this as a structured roadmap, guiding banks through each stage with a focus on compliance, resilience, and long-term growth.

Step 1: Regulatory and Policy Assessment

Every project begins with policy. Global banks must align with the rules set by central banks and regulators. We start by mapping requirements from local authorities, as well as international bodies like the BIS, IMF, and FATF.

This ensures that every decision, from ledger design to identity verification, is compliant by design. Skipping this step risks expensive rework later and creates vulnerabilities in audits.

Step 2: Model Selection and Design

The model is the blueprint for the system. Whether wholesale, two-tier, account-based, or cross-border, this choice determines how banks stay relevant in the CBDC era. For example, a wholesale, two-tier design ensures banks remain essential intermediaries while central banks keep monetary control.

We guide institutions through trade-offs, helping them select a model that fits their markets while still scaling globally. Once this is set, every technical and operational decision flows from it.

Step 3: Technology Stack and Ledger Architecture

The ledger is the heart of CBDC infrastructure. Some regulators prefer permissioned blockchains for transparency, while others lean toward high-speed centralized databases for performance.

We design architectures that guarantee settlement finality, resilience under peak loads, and compatibility with global standards. A poorly chosen ledger risks bottlenecks when billions of dollars need to clear in seconds.

Step 4: Compliance and Digital Identity Integration

Compliance cannot be bolted on later. Because of this, we integrate AML/KYC, fraud detection, and digital identity systems into the core infrastructure from day one. This gives banks real-time visibility and reduces costs tied to manual compliance processes.

More importantly, it builds regulator trust by showing that every transaction is verifiable, reportable, and aligned with global standards. For enterprises, this translates to faster onboarding and lower risk.

Step 5: Payment Rail Interoperability

CBDCs will not replace existing systems overnight. Banks still rely on SWIFT, RTGS, ACH, and UPI. Our role is to create middleware and APIs that allow CBDCs to coexist with these systems. This way, banks can gradually transition without disrupting daily operations.

For example, a treasury department can move between fiat and CBDC settlement seamlessly, giving corporates flexibility as adoption grows.

Step 6: User Access and Enterprise Integration

CBDCs must reach the end users who matter most, which are enterprises and retail customers. We build secure wallets, API layers, and enterprise-facing portals that integrate with treasury, payroll, and trade finance systems.

This endeavor rests on creating a reliable interface that enterprises can trust to move billions securely. By designing user access as part of the infrastructure, we make CBDCs usable in practice, not just in pilots.

Step 7: Cybersecurity and Resilience Testing

CBDCs expand the attack surface. To test its resilience, we conduct layered resilience testing that covers DDoS attacks, fraud scenarios, and insider threats. Multi-signature controls, anomaly detection, and geographic redundancy are built into the system.

Banks cannot afford downtime, so resilience is as much a business requirement as it is a security one. This step ensures the infrastructure is not just compliant but operationally unbreakable.

Step 8: Pilot Programs and Cross-Border Trials

CBDCs must be tested before they scale. For this, we design controlled pilots where banks can trial wholesale transfers, liquidity management, and cross-border corridors.

For example, working with a partner central bank, a pilot might focus on real-time trade settlement between two regions. These programs generate data, build regulator confidence, and provide enterprises with proof that the system delivers on its promises.

Step 9: Scale and Governance Frameworks

Scaling a CBDC system requires governance as much as technology. To enhance this, we build frameworks that allow for upgrades, compliance updates, and ecosystem partnerships.

This ensures the infrastructure evolves alongside regulatory changes and market needs. Governance structures also protect banks from fragmentation, allowing them to collaborate with central banks, fintechs, and other stakeholders without losing control.

This roadmap is the difference between leading the next wave of finance or being left behind. By aligning policy, choosing the right model, embedding compliance, and designing scalable systems, banks can move from pilot to production without disruption.

Cost of Getting a CBDC Infrastructure Developed

At Intellivon, the goal is to help enterprises build CBDC infrastructure that is both scalable and sustainable. That’s why our pricing framework is flexible, because it aligns with growth goals, compliance obligations, and risk appetite rather than forcing a rigid, one-size-fits-all package.

If early projections stretch beyond your budget, the scope is refined collaboratively. The focus always remains on preserving what matters most: enterprise-grade reliability, regulatory compliance, and uncompromising security.

Estimated Phase-Wise Cost Breakdown

| Phase | Description | Estimated Cost Range (USD) |

| Discovery & Strategy Alignment | Requirement gathering, risk modeling workshops, KPI definition, compliance readiness (GDPR, SOC 2, AML/KYC, FATF alignment) | $6,000 – $12,000 |

| Architecture & Design | Blueprinting layered architecture (DLT, APIs, compliance layer, digital identity, reporting dashboards) | $8,000 – $15,000 |

| Core Ledger & Transaction Layer | Building a core settlement engine, payment flows, token issuance/redemption, and modular upgrade paths | $12,000 – $25,000 |

| Cross-Border & Interoperability Frameworks | Integration with SWIFT, RTGS, UPI, ACH, and APIs for multi-currency corridors | $10,000 – $20,000 |

| Compliance & Digital Identity Layer | Automated AML/KYC, fraud detection, digital ID frameworks, and real-time regulatory reporting | $10,000 – $22,000 |

| Platform Development & Customization | Enterprise dashboards, wallet APIs, treasury portals, and integration with ERP/CRM systems | $12,000 – $25,000 |

| Security & Audit Controls | Smart contract audits, encryption, anomaly detection, and compliance monitoring | $8,000 – $15,000 |

| Testing & Quality Assurance | End-to-end validation, compliance checks, scalability testing, and resilience benchmarking | $6,000 – $10,000 |

| Deployment & Scaling | Cloud rollout, sandbox onboarding, monitoring dashboards, governance frameworks | $6,000 – $12,000 |

Total Initial Investment Range: $50,000 – $150,000

Ongoing Maintenance & Optimization (Annual): 15–20% of initial build cost

Hidden Costs Enterprises Should Plan For

- Integration Complexity: Connecting with legacy ERP, treasury, and settlement systems often requires middleware.

- Liquidity Management: Planning initial liquidity pools or settlement reserves is critical for adoption.

- Compliance Overhead: Global regulations (GDPR, AML, FATF, SOC 2) require continuous audit and legal costs.

- Infrastructure Costs: Cloud compute and database performance at the CBDC scale can add significant overhead.

- Change Management: Training teams, treasury units, and partners on new workflows creates operational costs.

- Monitoring & Maintenance: Regular audits, security patches, and compliance updates are non-negotiable to prevent downtime.

Best Practices to Avoid Budget Overruns

From Intellivon’s experience delivering enterprise-scale CBDC platforms, several practices help keep costs predictable:

- Start with Focused Scope: Pilot wholesale or cross-border corridors before expanding.

- Design for Compliance Early: Embed AML/KYC and regulatory frameworks from day one to avoid rework.

- Use Modular Architecture: Reusable components for wallets, APIs, and settlement modules accelerate scaling.

- Optimize Infrastructure Spend: Balance blockchain/DLT layers with cloud scaling strategies.

- Embed Observability: Monitor settlement flows, liquidity, and compliance in real time.

- Plan for Iteration: Regularly update identity systems, compliance modules, and resilience frameworks.

Request a tailored proposal from Intellivon’s enterprise blockchain team, and you’ll receive a roadmap that fits your budget, enforces compliance, and scales with your long-term growth.

Overcoming Challenges in Developing CBDC Infrastructure

CBDC infrastructure isn’t a plug-and-play solution. It sits at the crossroads of regulation, technology, and enterprise operations, which makes its development inherently complex. At Intellivon, we see these challenges not as barriers but as opportunities to build platforms that are stronger, faster, and more resilient than legacy systems. Here’s how we address the biggest hurdles.

1. Scalability Versus Central Control

A CBDC must settle millions of transactions per second without compromising central bank oversight. This is one of the toughest design challenges: how do you create throughput comparable to Visa or Mastercard while maintaining a regulator’s fine-grained control?

At Intellivon, we solve this with hybrid architectures, which are permissioned distributed ledgers for transparency and auditable records, combined with high-speed databases for bulk transaction processing. This layered design allows us to deliver both performance and control, ensuring no trade-off between efficiency and governance.

2. Cybersecurity and Operational Resilience

CBDCs are high-value targets for cyberattacks, insider fraud, and even geopolitical disruption. A single breach could undermine trust at the national level.

We address this by embedding security into the core rather than layering it on at the end. Multi-signature approval flows, AI-powered anomaly detection, DDoS-resistant infrastructure, and geographic redundancy make systems resilient under real-world threats. Beyond preventing attacks, we ensure banks can recover instantly from disruptions, keeping the system continuously available.

3. Privacy Versus Compliance

Central banks want auditability, while users demand privacy, and striking this balance is a central challenge. If compliance is too heavy, adoption falters. If privacy is too loose, regulators step in.

Our approach uses selective disclosure protocols and zero-knowledge proofs, allowing transactions to be validated without exposing unnecessary data. This way, regulators get real-time reporting, but end users retain confidence that their financial data isn’t being over-exposed.

4. Integration With Legacy Systems

No global bank can scrap its core systems overnight. The challenge lies in weaving CBDCs into decades-old infrastructure like SWIFT, RTGS, ACH, or proprietary treasury systems.

We tackle this with API-driven middleware that acts as a bridge. CBDC flows run in parallel with legacy systems, allowing phased adoption. This reduces disruption for banks and enterprises, while making it possible to test digital rails without risking daily operations.

5. Cross-Border Interoperability

Perhaps the greatest challenge is that money doesn’t stop at borders, while regulation does. Every country has its own frameworks, yet global trade demands seamless movement of funds.

Intellivon designs interoperability layers that allow CBDCs to “talk” across jurisdictions. By using token bridges, standardized APIs, and settlement protocols aligned with BIS recommendations, we make sure banks can transact globally without being locked into national silos.

Every one of these challenges, if left unresolved, would block CBDC adoption. But when approached deliberately, they transform into strengths: scalable rails, ironclad security, regulatory trust, enterprise usability, and cross-border reach. At Intellivon, our job is to turn them into the competitive edge that defines the next generation of banking infrastructure.

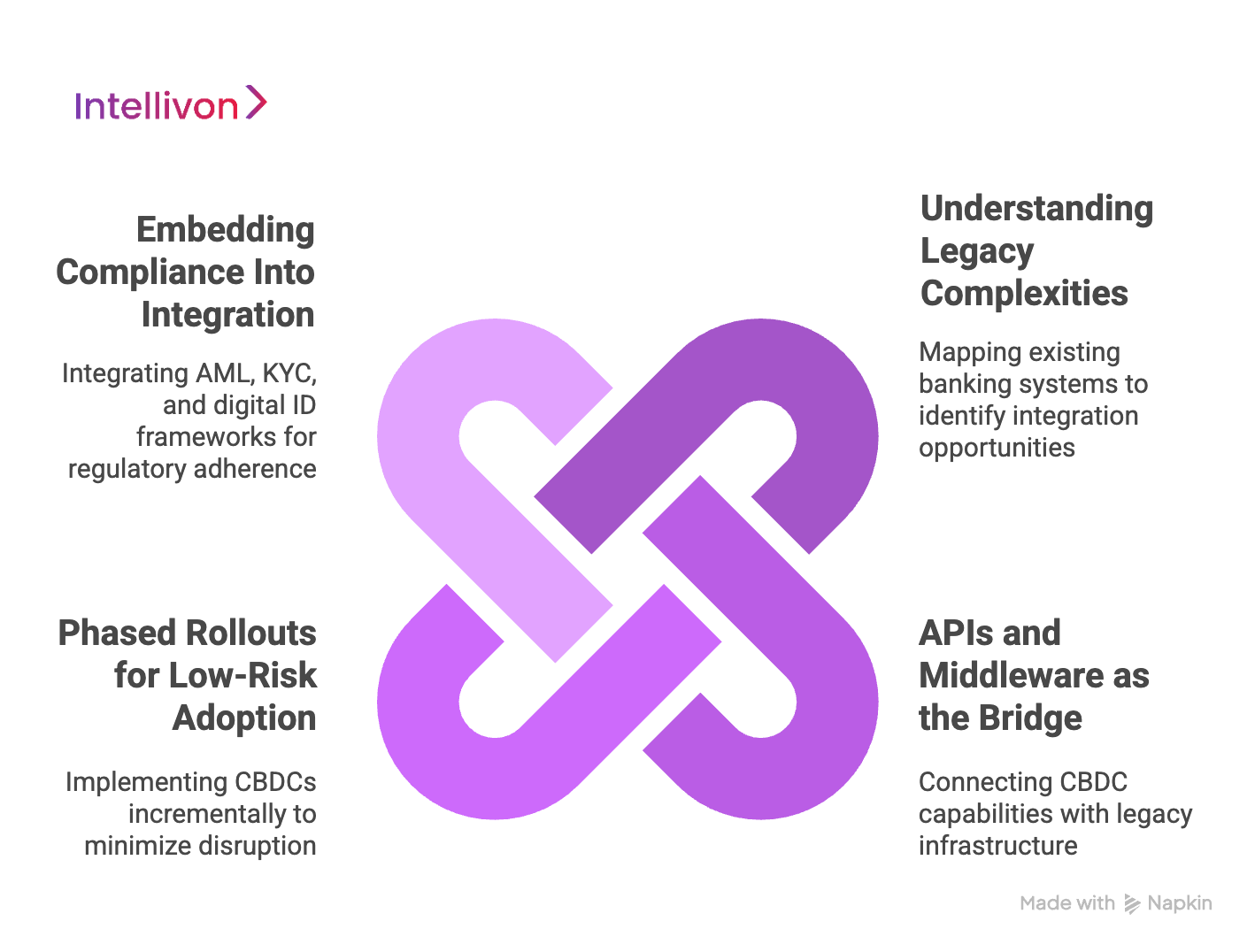

How We Integrate CBDC Infrastructure With Legacy Banking Systems

CBDC infrastructure cannot exist in a vacuum. Global banks have spent decades building and refining systems like SWIFT, RTGS, ACH, and core treasury platforms. These systems are deeply embedded, moving trillions every day, and they cannot be switched off overnight.

The question is not whether CBDCs will replace them, but how they will connect. At Intellivon, we design this connection so banks can modernize confidently without disrupting daily operations.

1. Understanding Legacy Complexities

Most legacy systems were built for stability, and not for speed. Core ledgers still run on batch processes, and compliance tools are siloed, making reporting slow. Additionally, payment rails like SWIFT are secure but notoriously inefficient for cross-border transfers.

Before any integration begins, we map these dependencies to understand where CBDCs can enhance workflows immediately, and where a gradual transition makes more sense.

2. APIs and Middleware as the Bridge

Our integration approach is to build a bridge, not force a replacement. Middleware and APIs expose CBDC capabilities, like issuance, settlement, and redemption, while linking them to existing banking infrastructure.

This allows CBDCs to operate in parallel, with transactions moving seamlessly between legacy rails and new digital ones. As adoption grows, more volume naturally shifts to CBDC rails without putting stability at risk.

2. Phased Rollouts for Low-Risk Adoption

Large-scale system changes in banking must be incremental. We help institutions start with controlled pilots, such as using CBDCs for inter-branch settlement or intraday liquidity management.

Once proven, the rollout extends to cross-border corridors and, finally, enterprise-facing services like payroll or trade finance. This phased approach reduces operational risk while demonstrating value at every stage.

3. Embedding Compliance Into Integration

Legacy systems have been compliance-heavy from the start. Any new rail that bypasses them creates risk.

That’s why we embed automated AML, KYC, and digital ID frameworks directly into the CBDC integration layer. This enhances compliance workflows, giving regulators better visibility while reducing manual workload for banks.

For enterprises, this work is largely invisible, and that’s the point. Treasury teams don’t need to overhaul ERP platforms or learn entirely new workflows. CBDC settlement happens in the background, making payments faster, cross-border transfers cheaper, and reconciliation easier. By ensuring continuity, we make CBDCs usable from day one.

Compliance and Regulatory Frameworks in CBDC Infrastructure

No bank will move serious money through a CBDC system unless it is fully compliant. Unlike consumer fintechs that can “move fast and break things,” CBDCs operate at the core of the global economy.

That means every design decision, from the ledger structure to user access, must satisfy regulators before a single dollar flows. At Intellivon, we treat compliance not as a box to check but as the backbone of CBDC infrastructure.

1. Global Standards That Set the Rules

CBDCs must meet requirements that span multiple jurisdictions. These include:

- Frameworks from the Financial Action Task Force (FATF) set global anti-money laundering (AML) and counter-terrorist financing (CFT) standards.

- GDPR governs personal data protection across the EU.

- SOC 2 and ISO 27001 provide benchmarks for operational and information security.

- Bank for International Settlements (BIS) pushes for interoperability and shared reporting frameworks during cross-border payments.

We build systems to comply with all of these from the ground up, so banks don’t run into regulatory walls later.

2. Embedding AML and KYC by Design

AML and KYC are no longer separate layers bolted onto banking processes. In CBDC infrastructure, they must be embedded directly into transaction flows.

At Intellivon, we integrate automated KYC verification, transaction monitoring, and suspicious activity flagging into the ledger itself. This ensures compliance is real-time, not retrospective, reducing both risk and operational cost.

3. Balancing Data Privacy With Regulatory Oversight

One of the toughest challenges in CBDC development is walking the line between user privacy and regulatory visibility. Regulators want full traceability, while users expect confidentiality.

We use selective disclosure protocols and zero-knowledge proofs to achieve this balance. Regulators get the data they need for audits and investigations, but user-level information remains protected unless explicitly required. This builds trust without weakening compliance.

4. Real-Time Regulatory Reporting

Traditional compliance reporting is slow and batch-driven. CBDCs allow for real-time regulatory reporting instead.

Our systems stream compliance data directly to supervisory dashboards, giving central banks and regulators a live view of transactions. For banks, this means less paperwork, faster audits, and lower risk of penalties.

5. Cross-Border Regulatory Alignment

Every jurisdiction has its own rules, but money moves across them freely. This creates friction when CBDCs are deployed internationally.

Intellivon addresses this by building regulatory “translation layers,” interoperability modules that apply local rules while still harmonizing with BIS recommendations. This ensures a transaction that starts in Europe can be completed in Asia without triggering compliance failures along the way.

Compliance is not a feature of CBDC infrastructure; it is the foundation that allows adoption to happen. Without regulatory trust, banks will never move real value through these systems. At Intellivon, we don’t just design for compliance; we design for audit readiness, privacy protection, and cross-border alignment, giving banks and regulators confidence that CBDCs can operate at scale without creating new risks.

Conclusion

Central Bank Digital Currencies are no longer concepts on the horizon. They are fast becoming the operating system for global payments, settlement, and liquidity. The infrastructure choices made now will decide who leads and who lags in this shift.

By selecting the right models, embedding compliance from the start, and integrating smoothly with legacy systems, CBDCs can deliver faster settlement, lower costs, and programmable financial services. For decision-makers, the message is clear: the time to prepare is today. Early adopters will not just reduce costs, they will define the standards for the future of finance.

Get a Robust CBDC Infrastructure Built By Intellivon

At Intellivon, we design enterprise-grade CBDC infrastructure that is secure, compliant, and built to scale. Our platforms combine DLT reliability, AI-driven monitoring, and compliance-first design. The result: faster settlement, better liquidity visibility, and programmable services that fit how global institutions operate today.

Why Partner With Intellivon?

- Tailored CBDC Architecture: We align the model, whether that is wholesale, two-tier, account-based, or cross-border, to your markets, workflows, and growth plan.

- Compliance and Regulatory Alignment: Built for AML/KYC, FATF, GDPR, SOC 2, and central bank oversight with audit-ready reporting.

- Proven Enterprise Delivery: A track record of shipping mission-critical AI and blockchain platforms that reduce friction and speed time to value.

- Resilient Security: Independent audits, multi-sig controls, anomaly detection, and recovery playbooks to protect operations and trust.

- Interoperability and Legacy Integration: API-driven bridges to SWIFT, RTGS, ACH, UPI, ERP, and treasury systems for smooth adoption.

- Programmable Finance and Tokenization: Smart-contract rails for escrow, trade finance, and securities workflows that unlock new products.

- Scalable Architecture: Cloud-native, geo-redundant, and performance-tuned for high-volume settlement across regions.

Book a discovery call to explore a roadmap that fits your budget, enforces compliance, and positions your organization to lead in the digital currency economy.

FAQs

Q1. What is a CBDC infrastructure in banking?

A1. CBDC infrastructure is the technology and policy framework that allows central banks and commercial banks to issue, manage, and settle digital currencies securely at scale. It combines distributed ledgers, compliance systems, and integration with existing payment rails.

Q2. How does CBDC infrastructure differ from the blockchain used in crypto?

A2. While crypto blockchains are open, public, and often decentralized, CBDC infrastructure uses permissioned ledgers designed for compliance, scalability, and regulatory oversight. The goal is not speculation but secure, real-time settlement of money across institutions.

Q3. How much does it cost to build a CBDC infrastructure?

A3. The cost of a CBDC infrastructure ranges between $50,000–$150,000 for initial development, depending on scope, model choice, and integrations. Ongoing maintenance usually adds 15–20% annually to keep systems updated and compliant.

Q3. What are the biggest challenges in CBDC infrastructure development?

A4. Challenges include balancing scalability with central control, ensuring privacy while meeting AML/KYC obligations, integrating with legacy systems, and creating cross-border interoperability. Each requires careful design and advanced technology to overcome.

Q4. Why should global banks adopt CBDCs now?

A3. Early adoption allows banks to reduce settlement costs, automate compliance, and access new digital markets. More importantly, it positions them at the center of the next generation of cross-border financial systems, rather than leaving them behind.