FinTech enterprises are experiencing escalating fraud as cybercriminals increasingly use sophisticated AI tactics to topple security measures. Each breach erodes customer trust, triggers compliance penalties, and leaves lasting reputational damage. Preventing these risks enables enterprises to process transactions faster, lower false positives, and maintain regulatory compliance without friction. In short, it protects both revenue and resilience.

But the cost of AI fraud prevention software is never one-size-fits-all. It varies with enterprise KPIs, fraud typologies, compliance scope, and integration complexity.

At Intellivon, we’ve helped global banks and insurers deploy AI fraud-prevention software that reduces massive fraud losses while improving approval rates and compliance readiness. Each solution was tailored and aligned with business goals and regulatory landscapes. This blog breaks down the true cost of developing AI fraud-prevention software, from features and architecture to expenses, and demonstrates how we build it from the ground up.

Why Developing AI Fraud Prevention Software Costs $250K+

AI fraud prevention software protects trillions in global transactions. It uses adaptive machine learning and real-time scoring to stop evolving attacks. But this sophistication comes with a steep price. Enterprise projects cost $120,000 to $500,000, with overruns often exceeding $1 million.

To make these systems reliable, enterprises must adopt granular cost breakdowns. These breakdowns expose hidden drivers, like compute, compliance, data, and integration, that define ROI and resilience.

AI Fraud Prevention’s Hidden Development Risks

Traditional software has predictable budgets and standardized audits. Fraud prevention systems don’t. They must scan millions of transactions per second, retrain weekly, and meet strict banking regulations.

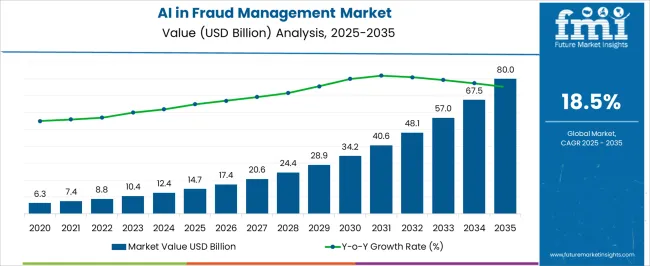

Of the $10.5 billion global AI fraud-detection market in 2025, only 15–20% of projects finish on budget. Over 80% face overruns from underestimated GPU cycles, mislabeled datasets, or compliance audits.

This isn’t a minor gap. One misstep, like an unoptimized training run, can trigger delays and expose firms to millions in extra annual fraud losses. Granular cost breakdowns bridge this gap. They map every line item so budgets scale safely, not blindly.

Where the $250K+ Development Budget Is Most at Risk

These vulnerabilities are recurring, measurable, and expensive.

1. Compute and Infrastructure Overheads

Training fraud models consumes 40–50% of budgets. A GNN-LSTM hybrid may need 21,000–27,000 GPU hours, costing $64,000–$100,000. Inefficient scaling adds 20–30% more.

Inference isn’t free. The Epoch AI 2024 study shows costs of $0.0024–$0.012 per transaction. For banks with billions of payments, this adds millions to annual spend.

2. Data Acquisition and Preprocessing Burdens

High-quality datasets drive detection accuracy. Building fraud sets of 12M+ transactions and 290+ features takes 25–35% of the total cost.

Annotation alone averages $1.8 per 1,000 samples. Synthetic data for rare exploits costs $50,000–$150,000. IEEE studies report that preprocessing consumes 43% of R&D budgets in anomaly detection.

3. Compliance and Model Validation Expenses

Banks must align with PCI-DSS, AML, and GDPR. Compliance modules inflate cost by 9–11%, or $20,000–$50,000 per feature.

Bias audits, explainability dashboards, and adversarial testing add more. Each test cycle costs $7,500–$10,000, with 2–4 runs per year. MDPI research shows regulated systems face a 6–9% governance premium on operating costs.

4. Integration and Maintenance Pitfalls

Legacy integration drains budgets. Middleware and API connectors cost $30,000–$70,000, while integration work consumes 22–35% of project spend.

Post-launch isn’t cheap. Retraining and cloud scaling add $3,500–$6,000 monthly. IBM’s 2025 report found 28–34% of IT budgets vanish in maintenance, with fixes priced at $14 per line of legacy code.

Why We Need Granular Cost Breakdowns

For AI fraud prevention to move from pilots to enterprise standards, trust demands cost clarity. Without it, budgets spiral and defenses fail.

Banks won’t fund uninsured AI projects. With audited cost metrics, CFOs see efficiency gains of 67% after modernization and can justify investments worth $200–340 billion annually, per McKinsey.

Shared benchmarks prevent overruns from becoming systemic. Transparent cost models cut IT maintenance by 30–32% and stabilize adoption as fraud volumes rise.

Key Takeaways of the AI Fraud Software Market

Adoption Insights

- 75% of enterprises using AI report significant reductions in overall fraud losses.

- 64% of organizations have adopted AI fraud prevention within the past two years, according to Feedzai’s Global Fraud Survey 2025.

Detection Performance

- AI fraud detection tools achieve accuracy between 90 and 97%, outperforming legacy systems.

- False positives fall below 2%, compared to historic rates of 10–20%.

- Most enterprise-grade systems detect anomalies in milliseconds, blocking suspicious transactions in real time.

Sector Insights

- Identity theft protection represents 46.5% of the market in 2025, driven by synthetic and credential fraud.

- E-commerce accounts for 40% of fraud detection spending, as enterprises invest heavily to secure online transactions.

- 65% percent of FIUs globally now use AI tools for transaction monitoring and anti-money laundering compliance.

Impact Metrics

Enterprises using AI fraud prevention tools report 50–70% fewer manual reviews and faster resolution times. According to Stripe’s State of AI & Fraud 2025, AI identifies new fraud typologies much faster than rule-based systems, significantly strengthening enterprise security.

In summary, AI fraud prevention software in 2025 delivers over 95% precision, under 1% false positives, and 18% annual market growth. For enterprises, it has become indispensable to resilience and regulatory compliance.

What is an AI Fraud Prevention Software?

AI fraud prevention software is an enterprise-grade platform designed to detect, analyze, and stop fraudulent activities in real time. Unlike traditional systems that rely on static rules, it leverages machine learning, predictive analytics, and behavioral biometrics to adapt as fraudsters evolve their tactics.

A key strength lies in reducing false positives. Legacy fraud detection systems often block legitimate users, frustrating customers and damaging revenue. AI fraud-detection software, by contrast, continuously refines its models, lowering false-positive rates. In digital payment ecosystems, accuracy rates can reach 99.9%, making the platform both secure and customer-friendly.

For enterprises, the value of such a platform extends beyond defense. Faster transaction approvals, reduced manual reviews, and stronger customer trust translate into measurable ROI. In many cases, enterprises see a 40–60% reduction in fraud losses within the first year of deployment.

In short, AI fraud prevention software combines predictive analytics, automation, and regulatory intelligence into a single solution. It protects revenue, improves resilience, and positions enterprises to scale securely in a fraud-heavy digital economy.

How It Works

AI fraud prevention software functions as a layered enterprise system, combining data, models, compliance, and decisioning to detect and stop fraud in real time. Each layer strengthens accuracy, reduces false positives, and ensures compliance.

1. Data Ingestion and Preprocessing

The process begins with collecting data from multiple enterprise sources, like transactions, login attempts, devices, customer profiles, and third-party feeds. This raw data is cleansed, standardized, and stored in secure data lakes. Proper preprocessing reduces noise and ensures AI models can detect anomalies with higher precision.

2. AI Model Training and Detection

Machine learning models form the core of detection.

- Supervised models identify known fraud patterns by learning from historical cases.

- Unsupervised models detect new, previously unseen fraud typologies by spotting irregularities.

- NLP models analyze text in claims, emails, or support logs for hidden fraud signals.

Companies implementing machine-learning fraud detection systems have seen detection accuracy rates up to 90%

3. Real-Time Monitoring and Anomaly Detection

The system continuously monitors transactions and activities as they happen. Suspicious events are flagged within milliseconds, blocking fraudulent actions before completion.

Unlike static filters, anomaly detection engines adapt in real time, learning from new attack strategies. This ensures fraud rings or synthetic IDs are caught earlier in the lifecycle.

4. Orchestration and Case Management

Not all flagged events lead to automatic blocks. The orchestration layer routes high-risk cases for review by fraud analysts. Case management dashboards allow teams to track alerts, assign cases, and close investigations while maintaining full audit logs.

This blend of AI automation and human oversight balances accuracy with accountability.

5. Compliance and Reporting Integration

Every decision passes through compliance filters to align with frameworks such as PCI-DSS, GDPR, AML, or OCC guidelines.

Automated reporting tools make regulatory audits faster, cheaper, and less error-prone. For enterprises operating across jurisdictions, this built-in compliance is as critical as detection accuracy.

AI fraud prevention software works by orchestrating multiple layers, like data ingestion, model detection, real-time anomaly monitoring, case management, and compliance reporting. Each stage reduces fraud risks while preserving business continuity. For enterprises, the result is a system that strengthens trust and positions the business for secure growth.

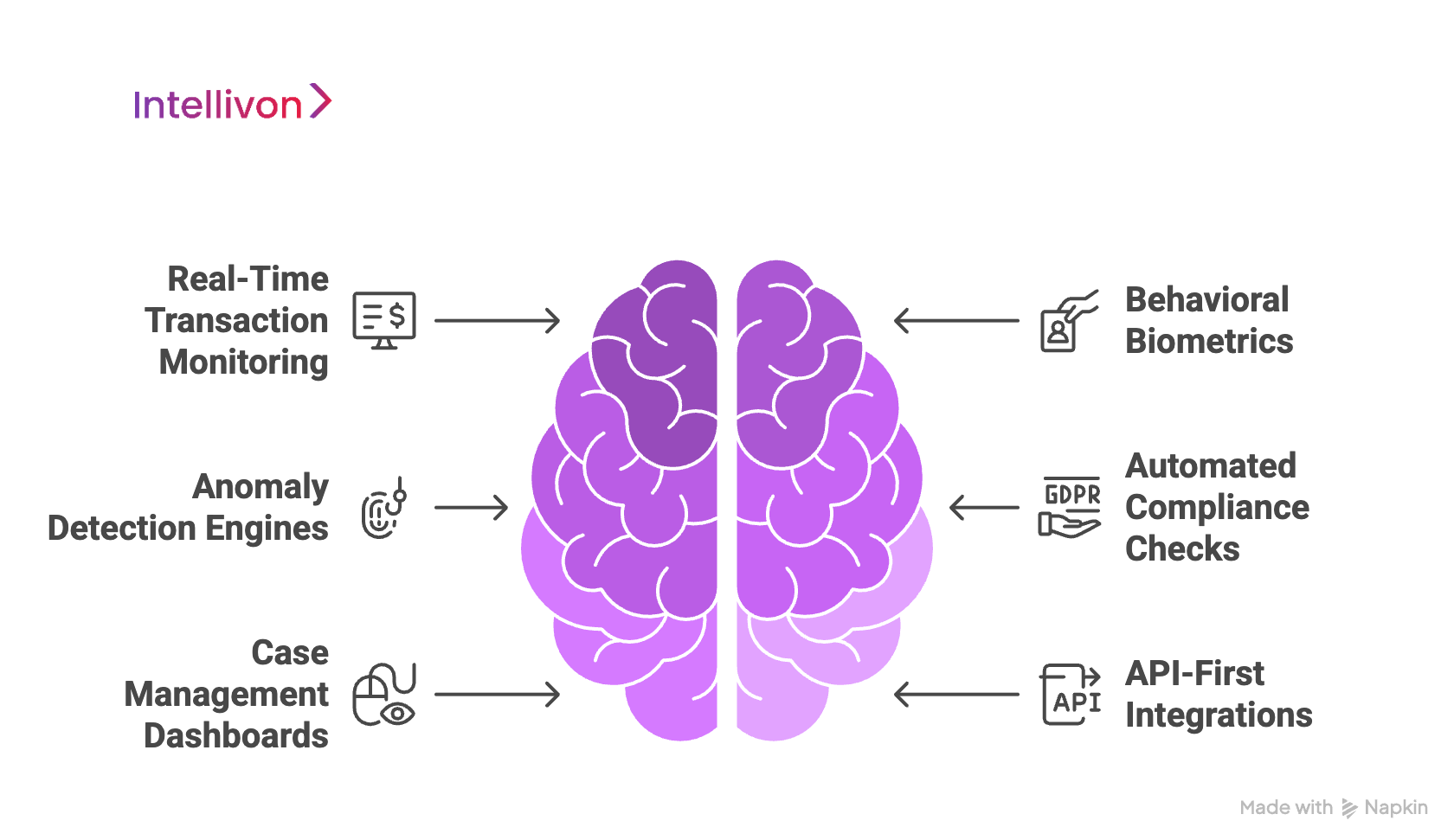

Core Features of AI Fraud Prevention Software

AI fraud prevention software delivers more than detection. It combines intelligence, automation, and compliance into a single platform designed for enterprises facing complex fraud risks.

This software detects anomalies with up to 99.2% precision and cuts fraud response times from hours to milliseconds. These are the core features that make it effective at scale:

1. Real-Time Transaction Monitoring

Fraud happens in seconds, and prevention has to be faster. Real-time monitoring continuously scans every transaction, login, or account change as it happens. By analyzing device fingerprints, payment patterns, and customer histories instantly, the software blocks fraudulent actions before they are completed.

This proactive approach not only saves money but also prevents customer dissatisfaction caused by post-transaction investigations.

2. Behavioral Biometrics

Passwords and one-time codes are no longer enough. Behavioral biometrics add a frictionless layer of defense by studying how users type, swipe, or navigate systems.

These unique patterns are almost impossible for fraudsters to replicate, making it harder to hijack accounts. For enterprises, the benefit includes stronger fraud protection and a seamless customer experience that avoids unnecessary authentication hurdles.

3. Anomaly Detection Engines

Fraudsters rarely follow the same playbook. That’s why AI fraud prevention software uses anomaly detection models that identify activity outside a customer’s normal behavior.

Unsupervised learning models analyze millions of data points to flag unusual purchases, transfers, or claims that legacy rules would miss. IBM reports that it preemptively detects fraud before human agents, increasing efficiency by up to 43% and reducing false positives by over 30%.

This feature ensures enterprises stay ahead of emerging fraud tactics rather than reacting to them too late.

4. Automated Compliance Checks

Compliance failures can cost more than fraud itself. AI fraud detection software integrates with frameworks like PCI-DSS, GDPR, AML, OCC, and HIPAA to ensure every transaction meets regulatory standards.

Automated compliance checks streamline reporting, reduce audit fatigue, and minimize the chance of regulatory fines. For global enterprises, this feature makes scaling across jurisdictions safer and faster.

5. Case Management Dashboards

Even the best AI models need human oversight. Case management dashboards bring transparency to fraud detection by displaying alerts, case histories, and investigative workflows in one place.

Fraud teams can review flagged transactions, assign cases, and close investigations with full audit trails. This visibility helps enterprises improve decision-making, speed up fraud resolution, and maintain compliance documentation effortlessly.

6. API-First Integrations

Enterprises rely on diverse systems, like banking cores, ERPs, CRMs, and e-commerce platforms. Fraud prevention software built with a microservices API-first architecture integrates seamlessly with these environments.

This ensures fraud checks become part of daily workflows without disrupting operations. Enterprises can extend protection across digital channels while maintaining a unified fraud strategy.

The core features of AI fraud prevention software embed fraud defense into the fabric of enterprise systems. By combining real-time monitoring, behavioral biometrics, anomaly engines, compliance filters, dashboards, and integrations, enterprises can reduce losses, lower false positives, and build safer digital ecosystems.

Architecture of Enterprise-Grade Fraud Prevention Software

Enterprise-grade AI fraud prevention software runs on a multi-layered architecture. These systems process over a billion transactions daily, with sub-millisecond latency, reducing ample fraud losses. Platforms like PayPal’s AI framework show what is possible by integrating ingestion with anomaly detection to achieve 99% accuracy while meeting GDPR and PCI-DSS obligations.

This design moves enterprises away from siloed fraud tools. It creates unified ecosystems where fraud intelligence is embedded directly into business workflows, ensuring scalable and compliant risk management.

1. Data Ingestion Layer

Fraud defense begins with ingestion. Modern platforms use Apache Kafka to stream millions of events per second with zero data loss. APIs connect to third-party feeds, capturing signals such as device fingerprints or geolocation anomalies. This approach uncovers 42% more fraud patterns than batch systems.

At Intellivon, ingestion layers support hybrid cloud deployments and preprocess inputs for compliance with sovereignty rules like eIDAS 2.0. Clean, complete data ensures that downstream AI models work with reliable signals.

2. Data Lake and Preprocessing

Enterprise fraud platforms rely on centralized data lakes, often built on Azure or AWS, to store petabyte-scale transaction histories. ETL pipelines normalize and enrich data, improving the accuracy of fraud signals.

Preprocessing uses federated learning to manage sensitive datasets without centralizing them. This reduces compliance risks in multi-tenant environments by almost half, while uncovering hidden fraud indicators that legacy systems miss up to 60% of the time.

3. AI/ML Detection Engine

The detection engine combines multiple model types. Supervised models like XGBoost identify known typologies, while unsupervised methods such as Isolation Forests capture anomalies.

NLP modules, powered by transformer networks, scan claims, emails, and logs. They identify synthetic identities with 18% greater precision than rules-based systems. In enterprise deployments, this layer outperforms legacy fraud setups by 43%, protecting against a trillion dollars in annual global fraud attempts.

4. Real-Time Orchestration Layer

Speed matters as much as accuracy. Microservices evaluate risks in under 8 milliseconds, applying business rules with policy-as-code tools like Open Policy Agent.

Low-risk transactions are approved instantly, and most of the time, require no human touch. High-risk events, about 4%, are routed to analysts. This balance reduces false positives and cuts fraud response times from hours to milliseconds.

5. Compliance and Security Layer

Enterprises cannot separate fraud detection from compliance, which is why this layer automatically enforces PCI-DSS, GDPR, AML, HIPAA, and OCC standards. Built-in reporting creates audit trails that lower non-compliance fines.

Security controls include runtime encryption, zero-trust access models, and RASP for application integrity. With breaches averaging $4.88 million annually, these protections are as critical as detection itself.

6. Dashboard and API Integration

Fraud teams need full visibility. API-first dashboards, similar to Grafana, provide real-time insights and triage tools. Machine learning summaries help analysts close cases 50% faster.

RESTful APIs integrate seamlessly with ERPs, CRMs, and payment cores. These connections scale to over 2 billion requests without latency spikes. Enterprises benefit from unified workflows, lowering integration costs by 60% while improving cross-platform decision-making.

The architecture of enterprise-grade AI fraud prevention software combines speed, intelligence, and compliance in a unified ecosystem. By aligning ingestion, AI models, orchestration, compliance, and dashboards, enterprises protect revenue, reduce regulatory risk, and scale operations securely. This layered design makes fraud prevention a growth enabler, not just a defensive measure.

How We Build AI Fraud Prevention Software for Enterprises

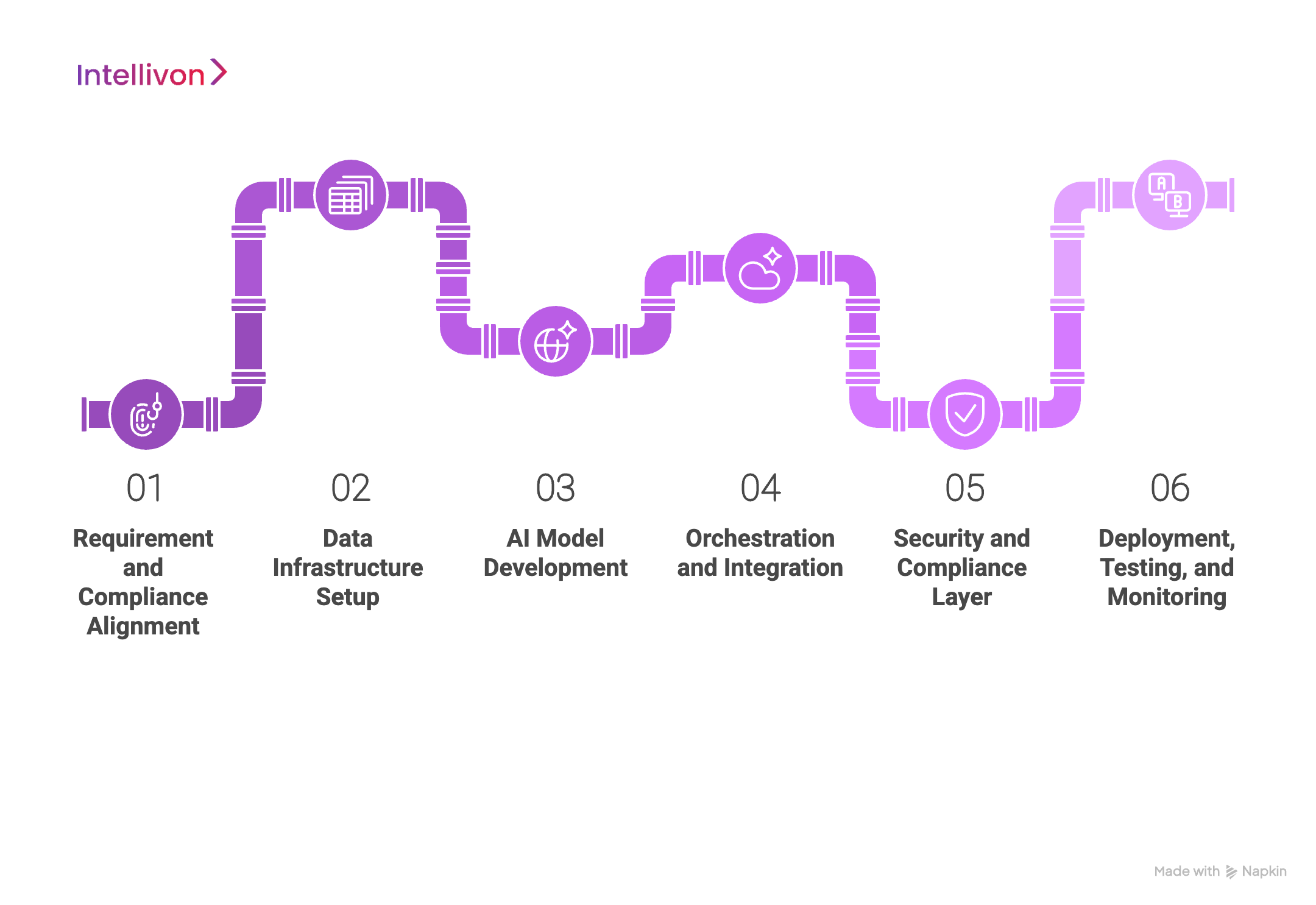

At Intellivon, we approach fraud prevention as a structured journey rather than a one-time deployment. Our process ensures that every system is designed to align with enterprise KPIs, regulatory requirements, and long-term resilience.

Step 1: Requirement and Compliance Alignment

We begin by working closely with leadership teams to define fraud typologies, operating jurisdictions, and compliance obligations. This step ensures the platform is not just technically sound but legally and strategically aligned with business goals. By clarifying KPIs upfront, we prevent costly redesigns later in the build.

Step 2: Data Infrastructure Setup

Fraud detection relies on complete, high-quality data. We design ingestion pipelines, set up hybrid cloud data lakes, and establish preprocessing frameworks. This guarantees clean, deduplicated, and compliant data flows into the AI models. Proper infrastructure design at this stage sets the foundation for accuracy and scalability.

Step 3: AI Model Development

Next, we build supervised, unsupervised, and NLP-driven models to detect fraud across channels. Each model is trained on relevant datasets and optimized for precision while minimizing false positives. By using modular design, enterprises can add new fraud detection capabilities as threats evolve.

Step 4: Orchestration and Integration

The orchestration layer connects AI decisions to enterprise workflows. We integrate the fraud engine with ERP, CRM, and payment systems through API-first frameworks. This enables real-time decisioning while ensuring fraud prevention does not disrupt legitimate customer activity.

Step 5: Security and Compliance Layer

Security is built into every layer of the software. For this, we apply encryption, role-based access controls, and runtime application self-protection. Compliance is embedded by design, covering frameworks like PCI-DSS, GDPR, AML, HIPAA, and OCC, so enterprises meet audit standards effortlessly.

Step 6: Deployment, Testing, and Monitoring

Before full rollout, we run pilot tests with simulated fraud scenarios to validate performance. Deployment is phased to avoid operational disruptions, with continuous monitoring dashboards providing visibility across teams. Post-deployment, we enable ongoing retraining pipelines so the system stays adaptive as fraud patterns change.

Intellivon’s build process is designed for resilience, compliance, and scalability. By moving from requirements to deployment through a structured framework, we ensure enterprises receive fraud prevention software that is reliable today and adaptable for tomorrow.

Phase-Wise Cost Breakdown for AI Fraud Prevention Software

Building AI fraud prevention software requires strategic budgeting. While costs vary by enterprise goals and compliance obligations, most projects fall within $50,000 to $150,000.

This range represents the combined investment across phases, from planning to deployment, and ensures enterprises can achieve both security and compliance without overspending.

Phase-Wise Cost Estimate

| Phase | Description | Estimated Cost (USD) |

| Discovery & Compliance | Requirement mapping, fraud typology analysis, and compliance scoping | $8,000 – $15,000 |

| Data Infrastructure Setup | Pipelines, data lakes, and preprocessing frameworks | $10,000 – $20,000 |

| AI Model Development | Supervised, unsupervised, and NLP-driven models | $15,000 – $40,000 |

| Integration & Orchestration | ERP, CRM, and payment API integrations, orchestration engines | $7,000 – $20,000 |

| Security & Compliance Layer | Encryption, IAM, regulatory frameworks (PCI-DSS, AML, GDPR) | $5,000 – $15,000 |

| Testing & Deployment | Pilot simulations, phased rollout, monitoring dashboards | $5,000 – $10,000 |

- Total Range: $50,000 – $150,000

- ROI Window: 6–12 months

Cost by Architectural Layer

| Architectural Layer | Key Deliverables | Estimated Cost (USD) |

| Data Ingestion Layer | Real-time pipelines, API connectors, cloud setup | $10,000 – $25,000 |

| Data Lake & Preprocessing | Centralized storage, ETL pipelines, federated preprocessing | $7,000 – $20,000 |

| AI/ML Detection Engine | Ensemble models, anomaly detection, NLP modules | $15,000 – $40,000 |

| Real-Time Orchestration | Policy-as-code, decisioning microservices | $6,000 – $15,000 |

| Compliance & Security | Encryption, access controls, regulatory audit modules | $5,000 – $15,000 |

| Dashboards & Integrations | Case management dashboards, ERP/CRM/payment APIs | $5,000 – $10,000 |

Conclusion and CTA

Understanding cost at both the project phase and architecture layer helps enterprises create realistic budgets. The investment, kept between $50,000 and $150,000, covers every component from data ingestion to compliance, ensuring measurable fraud reduction and regulatory confidence.

To scope a solution tailored to your KPIs, compliance environment, and transaction volumes, contact Intellivon. Our team will map your fraud typologies, design the right architecture, and provide a custom quote aligned with your enterprise growth roadmap.

Hidden Costs Enterprises Must Plan For

Even with a defined budget, enterprises often underestimate recurring and situational costs that surface after deployment. Below are the eight most critical hidden expenses leaders need to plan for.

1. Continuous Model Retraining

Fraud evolves constantly, which means models must evolve too. Retraining requires fresh datasets, skilled data scientists, and regular validation cycles. Without this, accuracy drops and new fraud patterns escape detection.

2. Data Labeling and Annotation

Supervised learning depends on labeled data. Preparing and annotating transactions, claims, and documents is resource-intensive, especially across multiple industries and regions. Poor labeling directly weakens model performance and increases fraud exposure.

3. Cloud Infrastructure and Scaling

Real-time fraud detection consumes significant compute, storage, and bandwidth. Costs grow with transaction volume, and redundancy is essential for resilience. If not budgeted carefully, cloud expenses can rise faster than expected.

4. Compliance Audits and Certifications

Fraud systems must align with frameworks like PCI-DSS, AML, GDPR, and HIPAA. Each certification requires audits, documentation, and updates across jurisdictions. These recurring costs are unavoidable and critical to regulatory trust.

5. Integration, Maintenance, and API Changes

Fraud platforms integrate with ERPs, CRMs, and payment systems. As vendors release new APIs or change schemas, enterprises must adjust integrations. This ongoing work consumes engineering hours and creates unexpected costs.

6. Observability, Logging, and Storage Growth

Real-time detection generates massive logs, alerts, and traces. Enterprises must store and index them for audits and investigations. Over time, monitoring and long-term storage create continuous operational expenses.

7. Incident Response and Risk Coverage

Even advanced fraud platforms face edge cases and breaches. Enterprises need funding for drills, forensic analysis, and escalation playbooks. Many also invest in cybersecurity insurance, which adds recurring premiums.

8. Team Training and Change Management

Fraud teams, analysts, and operations staff must stay current with evolving threats. Ongoing training, onboarding, and refreshers add indirect costs. Without proper preparation, even the best technology underperforms.

These costs rarely appear in initial budgets, but they define long-term success. Retraining, infrastructure scaling, audits, integration upkeep, and human factors all add weight to ownership. Enterprises that account for them early protect ROI, avoid operational surprises, and sustain compliance as fraud threats evolve.

ROI of AI Fraud Prevention Software

AI fraud prevention software is a strategic investment for measurable gains. Enterprises that deploy it effectively reduce losses, speed transactions, and improve both operational and regulatory efficiency.

1. Reduction in Fraud Losses

Deploying advanced AI-driven detection systems leads to major savings. For example, one financial institution avoided US$47 million in fraud with an AI solution showing 94% accuracy. Detection accuracy up to 90% is now reported widely, and false positives drop accordingly.

2. Lower Compliance and Operational Costs

AI systems embed regulatory frameworks like PCI-DSS, AML, and GDPR, reducing manual audit effort and non-compliance risk. McKinsey found that fraud detection AI can lower operational costs by up to 25% while boosting detection rates.

3. Faster Approvals and Reduced Friction

When fraud detection auto-approves low-risk cases in milliseconds and flags only high-risk ones, customer satisfaction improves, and legitimate transactions flow. Machine learning model-driven platforms reduce false positive removals by 30% and shorten detection time from days to minutes.

The return on investing in enterprise-grade AI fraud prevention software includes reduced fraud losses, lower compliance costs, faster approvals, and stronger trust. The metrics show the scale of impact. For enterprises, this means turning fraud prevention into a growth enabler rather than just a cost line.

Future Trends Impacting Costs

Fraud tactics evolve quickly. To stay ahead, enterprises need fraud prevention systems that are adaptive, transparent, and globally compliant. The next decade will see AI move beyond static detection into dynamic, enterprise-ready ecosystems that deliver both protection and trust.

1. Adaptive and Self-Learning Models

Rule-based fraud detection is too rigid for modern risks. Future platforms will use self-learning AI that updates models in near real time.

By continuously training on fresh data, these systems identify new fraud typologies before they spread. Enterprises benefit from faster response times and reduced reliance on manual tuning.

2. Explainable AI in Fraud Decisions

Enterprises can no longer afford “black box” fraud decisions. Regulators and customers want to know why a transaction was blocked.

Explainable AI will make detection models transparent, providing clear reasoning for each flag. This builds confidence and reduces disputes during audits or customer escalations.

3. Blockchain Integration for Transparency

Blockchain will strengthen fraud defenses by creating tamper-proof records of transactions. When combined with AI, it provides both predictive analytics and verifiable transparency.

This approach is especially valuable for cross-border payments and digital identities, where trust is critical. Enterprises gain both security and credibility in high-risk environments.

4. Global Compliance-First Design

Compliance obligations will only increase. From the EU AI Act to stricter AML and data protection rules, enterprises must prove alignment across jurisdictions.

Future systems will come with pre-built compliance modules and automated audit reporting. This reduces the cost of maintaining certifications and keeps enterprises ahead of regulatory pressure.

The future of AI fraud prevention software lies in adaptability, transparency, and compliance. Enterprises that invest in self-learning models, explainable AI, blockchain-backed trust, and compliance-ready frameworks will not only block fraud but also strengthen resilience, scale securely, and protect customer trust in a digital-first economy.

Conclusion

AI fraud prevention software is central to enterprise resilience. With adaptive models, transparent decisioning, and compliance-first design, organizations can protect revenue while maintaining trust.

The real value lies in shifting fraud prevention from a cost center into a growth enabler. Enterprises that plan strategically today will be better prepared for tomorrow’s complex fraud landscape.

Build an AI Fraud Preventive Software With Us

At Intellivon, our mission is to design enterprise-grade fraud prevention platforms that combine scale, compliance, and security. Every solution is tailored to the unique risk landscape, regulatory requirements, and growth trajectory of the enterprise it serves.

Why Partner with Intellivon?

- Tailored Fraud Solutions: Platforms are designed to address industry-specific fraud challenges, from retail banking and fintech to e-commerce, insurance, and healthcare.

- Compliance-First Design: Every build embeds AML, PCI-DSS, GDPR, PSD2, HIPAA, and other global standards from the outset, reducing audit exposure and regulatory overhead.

- Proven Enterprise Delivery: With 500+ AI projects delivered worldwide, our track record includes measurable fraud loss reduction, improved approval rates, and faster compliance readiness.

- Future-Ready Architecture: Cloud-native, API-first, and built with adaptive AI, our platforms scale seamlessly as transaction volumes grow and fraud patterns evolve.

- Analyst Empowerment: Explainable AI, real-time dashboards, and automated case workflows give fraud teams the tools to investigate, act, and resolve issues decisively.

Book a strategy call today to explore how Intellivon can help you design an AI fraud prevention platform that reduces risk, strengthens customer trust, and delivers long-term business resilience.

FAQs

Q1. How much does it cost to build AI fraud prevention software?

A1. The cost ranges between $50,000 and $150,000, depending on enterprise goals, fraud typologies, compliance scope, and integration needs.

Q2. What factors influence the cost of AI fraud detection platforms?

A2. Key factors include transaction volume, complexity of AI models, compliance requirements, data infrastructure, and integration with existing enterprise systems.

Q3. How long does it take to see ROI from AI fraud prevention software?

A3. Most enterprises see measurable ROI in 6–12 months, driven by reduced fraud losses, faster approvals, and lower compliance overhead.

Q4. Can AI fraud detection integrate with legacy banking or ERP systems?

A4. Yes. API-first design allows seamless integration with ERP, CRM, banking cores, and payment systems without disrupting daily workflows.

Q5. Why is AI fraud prevention better than rule-based systems?

A5. AI fraud prevention platforms achieve 90%+ detection accuracy with fewer false positives, while legacy systems miss emerging fraud patterns and create customer friction.