The global banking system processes trillions every year, yet the infrastructure behind it is struggling to keep up. Nearly nine out of ten modernization initiatives fail to scale as planned, leaving institutions vulnerable to rising fraud losses, regulatory fines, and customer churn. Traditional methods, such as manual reviews, static credit scoring, and reactive fraud checks, cannot keep pace in a world of instant digital transactions and real-time risk. Predictive analytics engines are emerging as a strategic answer to this dilemma. These systems continuously learn, forecast, and trigger interventions before risks or losses materialize.

At Intellivon, we have worked with global banks and insurers to deploy AI-driven predictive engines that cut fraud losses, improve approval rates, and strengthen compliance readiness. Each solution was tailored to align with business objectives and regulatory requirements, ensuring measurable ROI without compromising trust. In this blog, we break down what predictive analytics engines are and how Intellivon builds them from the ground up.

From Pilots to Proven ROI: Predictive Analytics Engines in Banking

Predictive analytics engines in banks are moving from pilots to enterprise-wide adoption to strengthen credit risk, fraud monitoring, and compliance. Here are some solid numbers that prove that this shift is not optional anymore.

1. $5 Billion+ Bank Investment in Data and AI

In 2023, banks invested over $5 billion into data and AI programs. Predictive analytics engines are now a modernization priority and not optional experiments.

2. 75% of Banks Already Use AI

By 2024, 75% of financial institutions had active AI adoption programs, up from 58% in 2022. Another 10% planned near-term integration, showing predictive analytics is moving mainstream

3. Only 25% Have Scaled Beyond Pilots

Despite adoption, just one in four banks scaled predictive analytics engines enterprise-wide. The remaining 75% are stuck in pilots, often limited by integration and compliance barriers.

Top Use Cases: Efficiency and Fraud Detection

- 41% of banks use predictive analytics for process optimization, like loan processing and regulatory reporting.

- 33% of banks deploy predictive engines for fraud detection, cutting false positives and strengthening trust.

Business Impact

Banks that scaled predictive analytics reported 48% efficiency gains and 40% stronger risk management. These outcomes align with enterprise priorities, such as lowering provisions, protecting ROE, and improving regulatory readiness.

Key Takeaway for Bank Executives

The data is clear that predictive analytics engines improve efficiency, reduce fraud risk, and strengthen credit decisioning in banking. The main challenge is scaling beyond pilots. The banks that succeed will embed predictive engines across credit risk, AML, compliance, and customer intelligence to secure a competitive advantage in 2025 and beyond.

What Is a Predictive Analytics Engine in Banking?

A predictive analytics engine in banking is a multi-layered enterprise system designed to ingest vast volumes of structured and unstructured data, detect hidden patterns, and generate actionable forecasts that improve decision-making across the institution. Unlike siloed tools, a predictive analytics engine integrates seamlessly with core banking systems, regulatory frameworks, and customer-facing channels to deliver real-time intelligence.

At its core, the engine is built to do three things, which include anticipating risk, optimizing decisions, and ensuring compliance. It continuously learns from historical and live data, such as transactions, credit histories, digital interactions, and external signals, to surface early warnings of fraud, predict credit deterioration, forecast liquidity gaps, and even personalize customer offers.

For banks operating in an environment of increasing fraud, regulatory scrutiny, and competition from digital challengers, these engines provide a way to protect profitability and build resilience.

How a Predictive Analytics Engine Works

Here is how a predictive analytics engine works in banks:

1. Data Ingestion & Integration

The engine aggregates data from multiple sources, including core banking systems, CRM systems, payment gateways, and third-party providers. Both batch and real-time streams are integrated to create a unified view.

2. Feature Engineering & Model Training

Data is cleaned, normalized, and transformed into features that power predictive models. Machine learning pipelines, including supervised, unsupervised, and deep learning, are trained on these features to identify risks and opportunities.

3. Real-Time Scoring & Decision Orchestration

When new data flows in, the engine scores it instantly. Decisions are orchestrated by combining predictive outputs with business rules, for example, flagging a high-risk transaction or adjusting a customer’s credit limit.

4. Compliance, Security & Monitoring

Every prediction is logged, auditable, and explainable. Governance layers ensure compliance with frameworks such as Basel III, PCI-DSS, and GDPR, while monitoring modules track model drift and trigger retraining.

Why Banks Need Predictive Analytics Engines in 2025

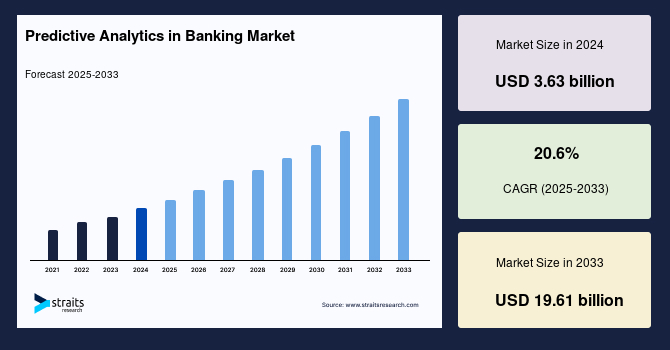

The global predictive analytics in banking market is projected to grow from USD 3.63 billion in 2024 to about USD 19.61 billion by 2033, at a CAGR of 20.6%.

Key Insights

- According to another source, the market was valued at USD 5.2 billion in 2024 and is expected to reach USD 19.9 billion by 2033, at a CAGR of 16.16%.

- Financial institutions implementing predictive analytics have achieved up to 60% reduction in fraud losses and a ~50% reduction in false positives.

- Only 7% of banks are reported to be fully leveraging analytics for critical processes, indicating a large gap between investment and enterprise-scale adoption. Ciklum

- In 2025, banks are operating in a landscape defined by surging digital transactions, increasingly sophisticated fraud methods, tighter regulatory oversight, and heightened customer expectations.

- The market metrics indicate the urgency for a predictive analytics engine, as institutions implementing predictive analytics have seen up to a 60% reduction in fraud losses and a 50% drop in false positives.

However, there remains a wide adoption gap, as churn-prediction research shows that banks leveraging analytics for customer attrition are still in early stages, leaving a major opportunity to move forward.

Banks that deploy predictive analytics engines are cutting losses, reducing the cost of risk, improving decision speed, and enhancing customer experience. With the right partner, you can move from pilot to production, from reactive to proactive, and from cost centre to growth driver.

Use Cases of Predictive Analytics Engines in Banks

Predictive analytics engines are not abstract AI concepts. They sit at the heart of a bank’s operations, driving practical outcomes leaders can measure. Below are real use cases where these engines change the economics of banking.

1. Fraud Detection and AML

Fraud monitoring has always been a balancing act, where these engines block threats quickly without drowning in false alarms. Engines trained on transaction patterns, device signals, and behavioral data detect anomalies in real time.

Instead of thousands of false positives, banks focus on high-risk activity that actually matters. The result is fewer blocked customers, lower losses, and stronger compliance standing.

2. Credit Risk Assessment

Traditional credit scoring looks backward, while predictive engines look forward and thrive in credit risk assessments. They use bureau data, cash flow signals, and alternative sources to update borrower profiles dynamically.

When a business shows early signs of stress, the engine flags it months in advance. This gives risk teams room to renegotiate, secure collateral, or restructure before defaults hit the books.

3. Customer Churn Prediction

Churn hurts quietly. Customers rarely announce they are about to leave, but there is a shift in their behaviour. These predictive analytics engines pick up on those shifts, which include fewer logins, lower balances, and slower repayment.

Banks then step in with proactive offers. A well-timed credit line increase or a personalized product recommendation can keep a valuable client from walking away.

4. Cash Flow Forecasting

Treasury leaders need accurate views of cash, not after-the-fact reports. Predictive engines run scenarios on inflows and outflows, factoring in seasonal cycles and customer behavior.

That foresight helps avoid liquidity crunches, plan funding strategies, and optimize working capital. Decisions that once took days can be made in minutes, with more confidence.

5. Personalized Marketing and Upselling

Customers expect banks to anticipate needs. Predictive engines analyze life events, spending patterns, and preferences to identify the right product at the right time.

Instead of broad campaigns, banks can deliver tailored credit, savings, or investment offers. The payoff is higher engagement, stronger retention, and a greater share of wallet.

These use cases show that predictive analytics engines are multi-layered systems that touch every major banking function. For leaders, the opportunity lies in embedding these engines across the enterprise to cut losses, unlock growth, and stay ahead of regulatory expectations.

Enterprises Winning With Predictive Analytics Engines

Predictive analytics engines are already driving measurable impact in leading financial institutions and enterprises across industries. These examples show how organizations are turning data into decisions, and decisions into ROI.

1. Capital One

Capital One integrates predictive models across its transaction monitoring systems. By analyzing thousands of signals per transaction, the bank blocks fraud in real time while keeping approval rates high. The result is stronger customer trust and lower operational drag.

- Built real-time fraud detection on AWS, analyzing billions of card swipes instantly

- Reduced customer friction by automating replacement cards and approvals without manual delays.

2. American Express

American Express uses predictive engines to identify when cardholders are likely to cancel. By spotting behavioral shifts, Amex offers targeted retention strategies, from loyalty rewards to personalized services.

- Reported 25% uplift in retention through churn-prediction models.

- Enhanced customer lifetime value by intervening before attrition became final.

3. JPMorgan Chase

JPMorgan Chase applies predictive analytics engines across portfolios, fraud, and treasury. The bank reports generating over $1.5 billion in business value annually from AI-driven models.

- AI-based portfolio management tools strengthen credit risk oversight.

- Predictive fraud engines flag anomalies before they escalate into major losses.

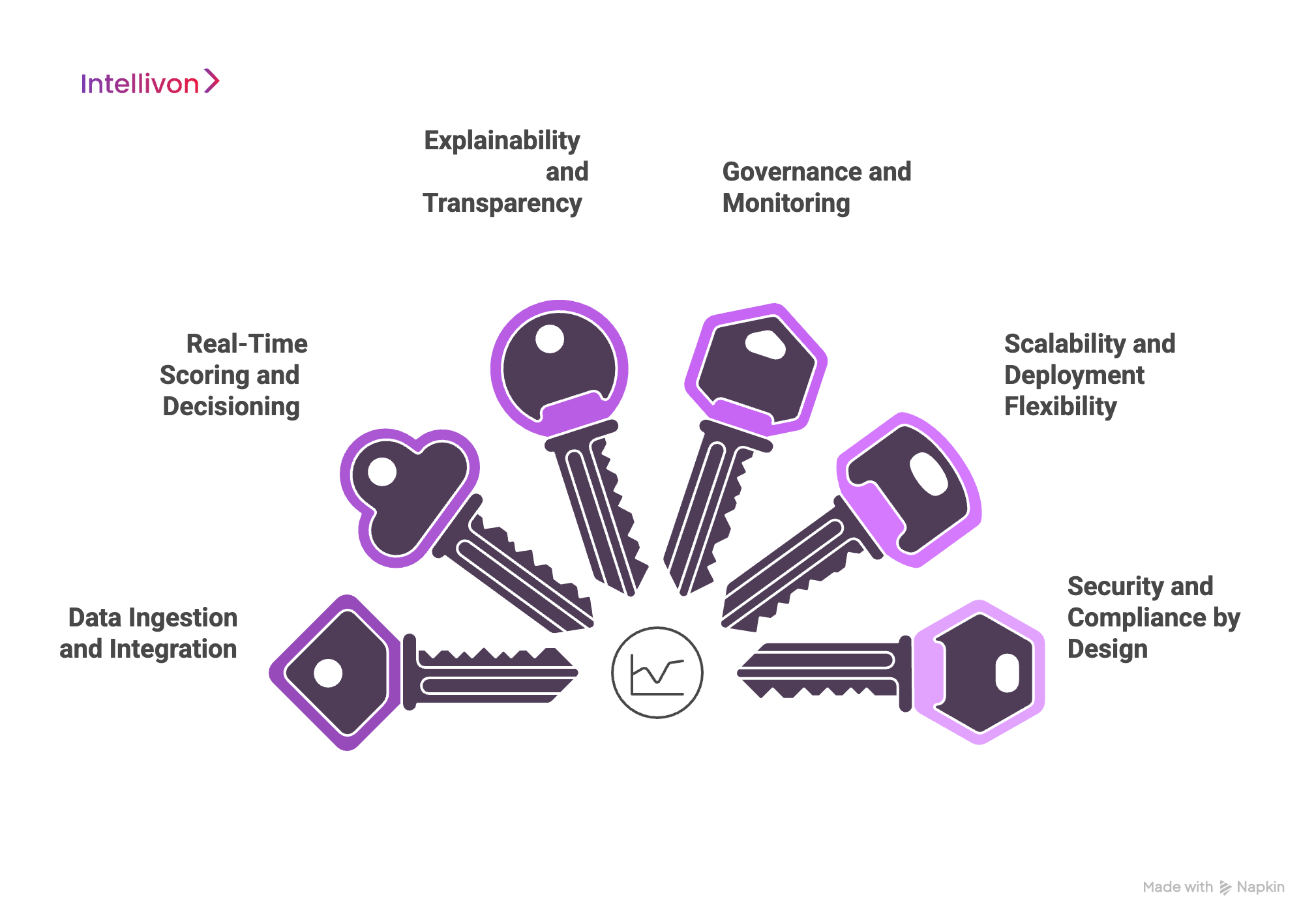

Core Features of a Predictive Analytics Engine

Predictive analytics engines are not just technical add-ons. They are enterprise-grade systems designed to handle the complexity of modern banking. Their features combine to give leaders faster insights, stronger compliance confidence, and scalable outcomes.

1. Data Ingestion and Integration

Banks produce enormous volumes of structured and unstructured data every second. A predictive engine connects to legacy cores, CRMs, payment gateways, and external feeds.

By unifying these sources into one platform, banks can finally break down silos and act on a single version of the truth.

2. Real-Time Scoring and Decisioning

Speed matters in digital banking. Engines run models that evaluate transactions, credit applications, and customer interactions in milliseconds.

This allows fraud to be blocked instantly, risks to be adjusted before exposure builds, and opportunities to be captured as they appear.

3. Explainability and Transparency

Black-box AI cannot survive regulatory audits. Predictive engines are built with interpretability so teams can see which variables shaped each decision.

When a credit score shifts or a transaction is flagged, the reasoning is traceable and auditable. This builds trust across risk, compliance, and customer teams.

4. Governance and Monitoring

Models must adapt as markets and behaviors evolve. Engines include governance layers that track accuracy, detect drift, and retrain models as needed.

This means predictions remain reliable long after the first deployment.

5. Scalability and Deployment Flexibility

A predictive engine has to serve thousands of users and billions of data points. Built cloud-native or hybrid, it can scale with demand without downtime.

API-driven integration ensures it strengthens existing systems rather than disrupts them.

6. Security and Compliance by Design

Every feature must meet strict regulatory standards. Engines embed encryption, tokenization, and RASP alongside compliance with Basel III, GDPR, and PCI-DSS.

Security is not bolted on later, since it is foundational from day one.

When combined, these features transform predictive analytics engines into enterprise infrastructure. They deliver accurate forecasts, real-time decisions, and audit-ready transparency while scaling with the business. For banks, this means building a secure, compliant system that turns data into measurable value.

Architectural Layers of a Predictive Analytics Engine

A predictive analytics engine is built on a layered architecture. Each layer has a specific role, moving data from raw input to actionable outcomes. Together, these layers ensure accuracy, compliance, and scalability in the demanding environment of modern banking.

1. Data Ingestion Layer

The process begins with pulling information from all available sources. Core banking systems, CRMs, payment processors, credit bureaus, and even external feeds stream into the engine. Both batch pipelines and real-time feeds are supported, which means banks gain a live view of transactions and risks rather than relying on outdated snapshots.

- APIs and Connectors

APIs connect directly with banking systems and third-party providers, ensuring seamless integration of structured and unstructured data.

-

Batch and Streaming Integration

Historical data flows through batch pipelines, while streaming integration captures live transactions in milliseconds for instant analysis.

2. Feature Engineering Layer

Raw data is rarely ready for analysis. This layer cleans, enriches, and transforms information into features that predictive models can understand. For example, millions of raw card swipes can be turned into behavioral spending profiles, while account balances can be converted into liquidity risk indicators.

3. Model Training Layer

This is where the predictive models are created and refined. Engines employ supervised learning for credit scoring, unsupervised learning for anomaly detection, and deep learning for complex behavior patterns. Training models evolve as new data arrives, adapting to changing fraud tactics and customer trends.

4. Model Serving Layer

Trained models must work at enterprise scale. This layer delivers predictions in real time, scoring transactions, loan applications, or claims within milliseconds. By doing so, banks can approve legitimate actions instantly while flagging or blocking potential risks.

5. Decision Orchestration Layer

Predictions only matter when they drive action. This layer combines predictive outputs with business rules to trigger decisions automatically. Examples include adjusting a credit limit, freezing a suspicious account, or offering a retention incentive to an at-risk customer.

6. Monitoring and Feedback Layer

Performance doesn’t end at deployment. Engines monitor accuracy continuously, identify when models begin to drift, and trigger retraining cycles automatically. Feedback loops ensure that the system learns over time and improves instead of deteriorating.

7. Security, Compliance, and Governance Layer

Every prediction must be defensible. This layer protects sensitive data through encryption and tokenization, while compliance frameworks align with Basel III, GDPR, PCI-DSS, and other regulations. Audit logs record every decision, ensuring transparency and accountability for regulators and internal teams.

8. Business Interface Layer

The final step is delivering insights to decision-makers. Dashboards, APIs, and reporting modules provide clarity to risk managers, compliance officers, and executives. The engine provides transparency and context for every prediction.

Each architectural layer plays a role in transforming raw data into reliable, auditable insights. From ingestion to governance, these layers make predictive analytics engines enterprise-ready.

For banks, this design means faster decisions, sharper forecasts, and compliance built into the foundation, turning predictive analytics into a core capability rather than an experiment.

How AI Powers Predictive Analytics Engines For Banks

Artificial intelligence is what transforms predictive analytics engines from static dashboards into living, adaptive systems. In banking, AI makes predictions sharper, decisions faster, and compliance more transparent. It works across several layers, each one designed to handle the scale and complexity of modern financial services.

1. Advanced Machine Learning Models

AI models drive the core of the engine. Supervised learning is used for credit scoring, unsupervised methods detect anomalies across millions of transactions, and deep learning captures complex patterns in customer behavior. These combined models allow banks to spot risk and opportunity long before traditional systems would.

2. Real-Time Anomaly Detection

Fraud evolves quickly, and manual checks cannot keep pace. AI engines analyze transactions in milliseconds, identifying unusual behaviors without interrupting approvals. This balance helps banks block real fraud while keeping genuine customers moving smoothly through their journey.

3. Continuous Learning and Adaptation

AI models are never static. They retrain as new data flows in, adapting to shifting fraud typologies, market conditions, or customer habits. This ensures predictions stay relevant, preventing the decline in accuracy that plagues legacy scoring systems.

4. Explainability Frameworks

Transparency is non-negotiable in banking. Modern AI engines come with explainability modules that show which variables drove each prediction. When a credit decision or fraud alert is questioned, risk teams can point to a clear rationale that satisfies Basel III, GDPR, or OCC requirements.

5. Natural Language Processing

AI-powered natural language processing reads documents, emails, and KYC forms at scale since banking is not only based on numbers. This speeds up onboarding, accelerates claims reviews, and highlights hidden risks in unstructured data that manual processes would miss.

6. AI Copilots

The latest frontier is AI copilots that support bankers in real time. These copilots recommend the next step, whether to restructure a loan, offer a retention incentive, or escalate a suspicious activity. By combining predictive insights with human judgment, banks achieve faster and more confident decisions.

AI is the intelligence inside predictive analytics engines. It gives banks the ability to detect fraud instantly, predict credit deterioration, retain valuable customers, and streamline compliance. In 2025, the banks that scale AI within their predictive engines will be the ones moving from reactive problem-solving to proactive leadership in risk, growth, and customer trust.

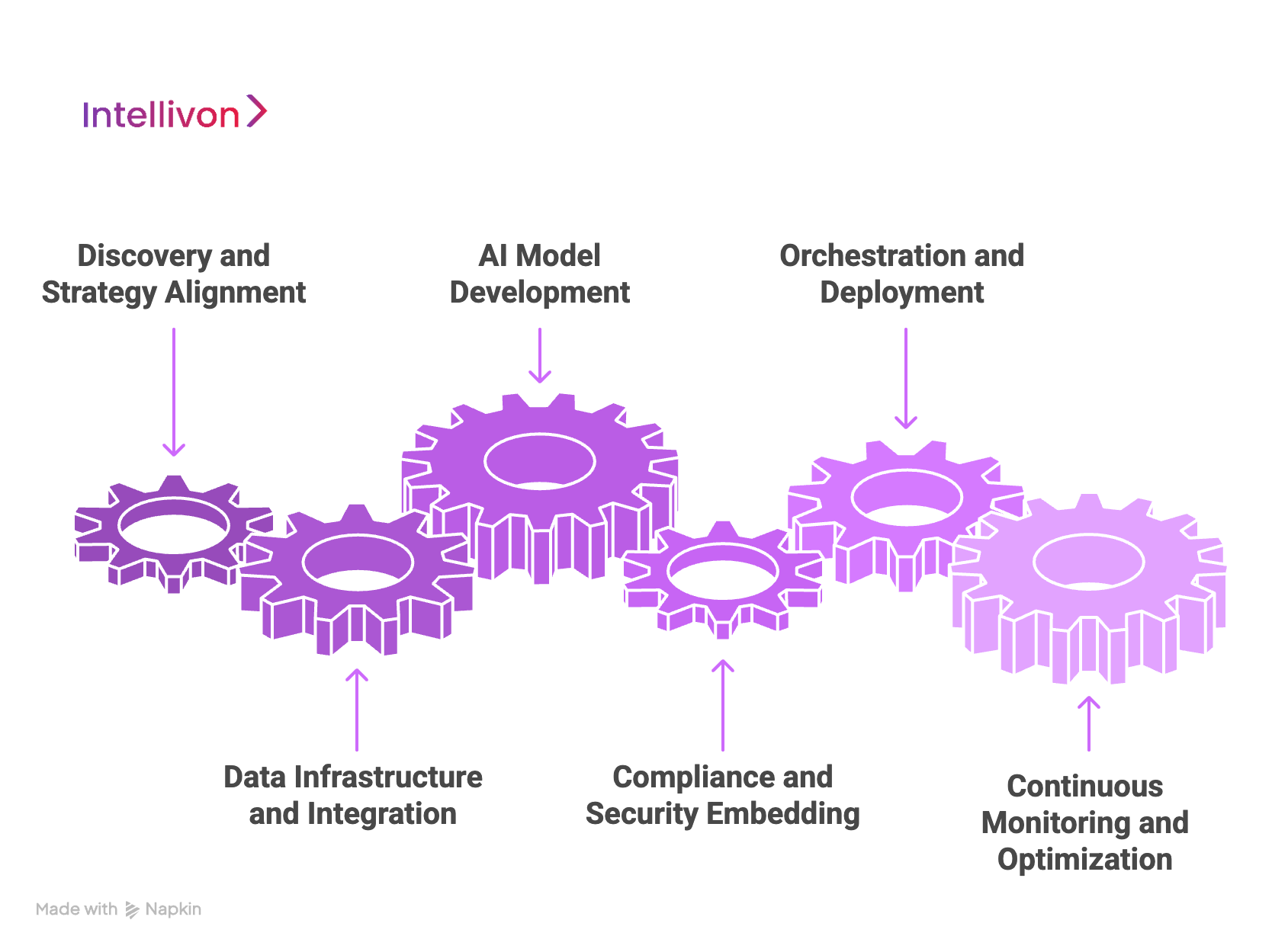

How We Build Predictive Analytics Engines for Banks

At Intellivon, building a predictive analytics engine for a bank is not about installing a single model or plugging in an off-the-shelf platform. It is a structured process that aligns strategy, data, compliance, and technology.

Each step is designed to ensure the engine not only works but delivers measurable ROI under the realities of enterprise banking.

Step 1: Discovery and Strategy Alignment

Every project begins with understanding objectives. We work with leadership to define goals, risk appetite, and KPIs. For some banks, the priority is reducing fraud losses. For others, it is lowering default rates or improving customer retention.

By mapping these requirements early, we ensure the engine is designed around business outcomes, not abstract technology.

Step 2: Data Infrastructure and Integration

Data is the lifeblood of the engine. We set up secure pipelines that connect to core banking systems, CRMs, payment networks, and external providers.

Both structured and unstructured data are brought together in hybrid cloud or on-premises environments. This stage eliminates silos and prepares a unified dataset for predictive modeling.

Step 3: AI Model Development

With the data foundation in place, our teams design machine learning pipelines tailored to banking use cases. Credit scoring models analyze repayment behaviors, fraud detection models flag anomalies in transaction flows, and churn models anticipate customer exits.

These models are built using supervised, unsupervised, and deep learning methods, all tuned for enterprise scale.

Step 4: Compliance and Security Embedding

No banking engine can succeed without compliance. At this stage, we embed frameworks such as Basel III, GDPR, PCI-DSS, and the EU AI Act directly into the platform.

We also integrate advanced security controls, including encryption, tokenization, and runtime application self-protection (RASP). This makes the engine not just smart, but regulator-ready.

Step 5: Orchestration and Deployment

Deployment is about action. We integrate the predictive engine into core workflows, from fraud monitoring systems to CRM platforms. Predictions flow directly into business processes, triggering approvals, alerts, or offers in real time.

Banks see value immediately because the engine is not siloed, and it becomes part of daily operations.

Step 6: Continuous Monitoring and Optimization

The final step is ensuring the system improves with time. Engines are monitored for model drift, regulatory changes, and evolving fraud patterns.

When accuracy dips, retraining pipelines activate automatically. We also provide dashboards so executives can track KPIs like fraud reduction, loan loss provisioning, or retention uplift in real time.

Our approach to building predictive analytics engines is simple in principle but complex in execution. With over 500 AI projects delivered and 200+ experts across data, compliance, and enterprise integration, Intellivon ensures that banks deploy engines that create measurable competitive advantage.

How We Ensure Secure and Compliant Predictive Analytics Engines

In banking, no predictive system is deployable unless it is both secure and compliant. The smartest models are worthless if regulators block them or if they expose customer data. At Intellivon, we design every predictive analytics engine with compliance-first principles, embedding governance, auditability, and security into the foundation.

1. Encryption and Tokenization

Every piece of data that flows into the engine is encrypted at rest and in transit. Tokenization replaces sensitive identifiers with secure placeholders, reducing the risk of exposure in case of breaches. This protects customer privacy and satisfies requirements under frameworks like GDPR and PCI-DSS.

2. Explainability and Bias Audits

Predictive models in banking cannot be black boxes. Engines are built with explainability modules that show how each prediction was made.

This not only reassures internal stakeholders but also allows banks to demonstrate transparency to regulators. Regular bias audits ensure decisions remain fair across demographics, a requirement under emerging AI legislation.

3. DevSecOps Integration

Security is built into the development lifecycle and is not treated as an added layer. By applying DevSecOps practices, our teams ensure that every deployment pipeline includes automated vulnerability checks, penetration testing, and compliance verification. This reduces the risk of security flaws making it into production environments.

4. Runtime Application Self-Protection (RASP)

Traditional defenses operate at the perimeter. RASP, by contrast, protects the engine from within. It monitors application behavior in real time and blocks suspicious activity before damage occurs.

For banks, this means an additional safeguard that prevents exploitation even when external defenses are breached.

5. Auditability and Traceability

Every decision the engine makes is logged and traceable. This creates a complete audit trail of inputs, outputs, and actions.

Regulators can see why a loan was approved, why a transaction was blocked, or why a customer was flagged. Auditability not only satisfies compliance requirements but also strengthens trust with stakeholders.

Security and compliance are the foundation in banking systems. Predictive analytics engines designed without them fail before they reach production. By embedding encryption, explainability, DevSecOps, RASP, and auditability, Intellivon ensures that banks can deploy predictive engines with confidence. These systems are not just innovative; they are regulator-ready, secure, and sustainable at scale.

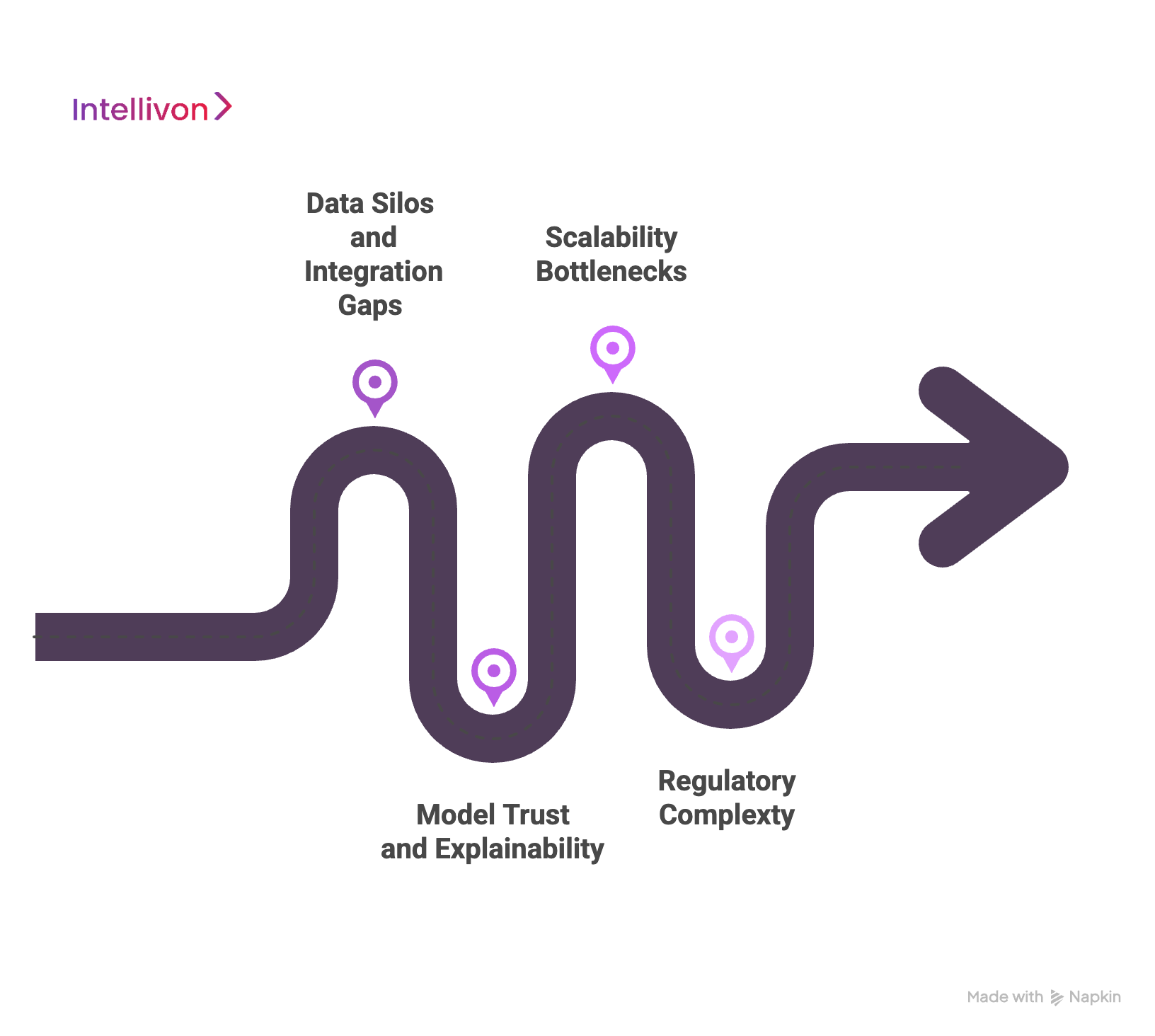

Overcoming Challenges in Building Predictive Analytics Engines

Building a predictive analytics engine is not as simple as installing new software. Banks face real obstacles that can delay or even derail adoption. At Intellivon, we design our approach to anticipate these challenges and turn them into opportunities for long-term resilience.

1. Data Silos and Integration Gaps

Most banks run on fragmented systems, often built decades apart. Customer information, credit histories, payment data, and risk records sit in different environments. This makes it difficult to generate a unified view.

We solve this with hybrid data integration, using APIs, cloud connectors, and secure streaming pipelines that break down silos without disrupting legacy cores.

2. Model Trust and Explainability

Leaders hesitate to rely on predictions they cannot explain. Black-box AI raises concerns with regulators and executives alike.

Our engines include explainability dashboards that show how each variable influenced a decision, and bias audits that prove fairness across demographics. This builds confidence inside the bank and satisfies external oversight.

3. Scalability Bottlenecks

Even when predictive models work in pilots, scaling them to enterprise volumes is another story. Transaction loads run into billions per day, and engines must deliver millisecond decisions.

We design cloud-native architectures that expand automatically with demand, ensuring performance remains steady across business lines and geographies.

4. Regulatory Complexity

Compliance is one of the largest hurdles to deploying AI in banking. Basel III, GDPR, PCI-DSS, and emerging AI acts all demand careful alignment.

Intellivon embeds compliance into the design itself, mapping jurisdictional rules to engine workflows so banks don’t need costly retrofits later.

Challenges are inevitable, but they are not insurmountable. By addressing data silos, explainability, scalability, and compliance from the start, banks can deploy predictive analytics engines with confidence. The result is not just a working platform but a sustainable, regulator-ready system that delivers measurable ROI.

With Intellivon’s experience across AI projects, we turn adoption risks into competitive advantages.

Future of Predictive Analytics Engines in Banking

The role of predictive analytics in banking is only beginning. In the next five years, these engines will evolve from decision-support tools into intelligent systems that reshape how banks manage risk, serve customers, and comply with regulations.

1. Shift Toward Agentic AI

Predictive engines will move beyond static scoring into autonomous decision loops. Agentic AI models will not only forecast risks but recommend or even trigger responses with human oversight.

This will allow banks to manage portfolios and fraud risks in near real time without manual intervention, speeding up the process.

2. AI Copilot Risk Officers

Risk officers and compliance teams will work alongside AI copilots that summarize insights, highlight anomalies, and recommend next-best actions.

Instead of digging through dashboards, leaders will receive conversational briefings powered by predictive analytics, making strategic decisions faster and more informed.

3. Blockchain-Enabled Compliance

As regulatory demands increase, engines will integrate blockchain-based compliance trails. Each prediction and decision can be logged immutably, creating a tamper-proof record for audits. This approach reduces manual interventions and strengthens trust with regulators who demand transparency.

4. Global Regulation Tightening

Frameworks such as the EU AI Act, U.S. OCC guidelines, and evolving Basel III standards will tighten expectations around explainability, fairness, and accountability. Engines that embed compliance from the ground up will win adoption. Those that cannot prove fairness and security will not survive audits.

In the future of predictive analytics in banking, engines will become smarter, more autonomous, and deeply embedded in daily operations. Predictive analytics will no longer be an advantage, but it will be the foundation of resilient, profitable banking.

Conclusion

Banks face a landscape where fraud evolves daily, credit risk intensifies, and regulatory oversight grows tighter. Traditional scorecards and manual reviews can’t keep pace with the demands of real-time digital systems. Predictive analytics engines provide the infrastructure to anticipate problems before they escalate, transforming raw data into timely, auditable decisions.

The future belongs to institutions that act now. Engines powered by AI deliver measurable results: reduced losses, stronger compliance, and higher customer retention. In 2025 and beyond, predictive analytics will be the backbone of resilient, profitable, and forward-looking financial institutions.

Build Your Predictive Analytics Engine With Intellivon

We design AI-powered predictive analytics engines that are secure, compliant, and scalable. Our platforms turn raw data into timely, auditable decisions across fraud, credit risk, liquidity, and customer growth. You get faster decisions, lower losses, and regulator-ready transparency without disrupting core operations.

Why Partner With Intellivon?

- Tailored Enterprise Platforms: Every engine is custom-built around your business model, risk appetite, and jurisdictions. The result is relevance, speed to value, and measurable ROI.

- Proven Global Expertise: We bring 11+ years of delivery, 500+ AI solutions, and 200+ domain experts. Banking, fintech, and insurance programs move from pilot to production with confidence.

- Compliance-First Design: Aligned from day one with Basel III, IFRS 9 or CECL, GDPR, SOC 2, PCI-DSS, and AML/KYC. Explainability and audit trails are built in.

- Future-Ready Architecture: Cloud-native and API-first. Integrates with core banking systems, CRMs, ERPs, underwriting, and payment rails. Scales as volumes grow.

- Security and Reliability: End-to-end encryption, tokenization, and runtime protection. Independent audits and continuous monitoring keep data and decisions safe.

- Continuous Optimization and Support: MLOps, drift detection, and scheduled retraining keep models sharp. We ship dashboards that track KPIs, compliance status, and model health.

Book a free strategy call today to see how Intellivon can help you turn predictive analytics into a lasting competitive advantage.

FAQs

Q1. What is a predictive analytics engine in banking?

A1. A predictive analytics engine is a multi-layered system that ingests banking data, applies AI models, forecasts outcomes, and triggers real-time decisions. Unlike static scorecards, it adapts continuously to fraud, credit risk, compliance, and customer behavior.

Q2. How do predictive analytics engines reduce fraud in banks?

A2. Engines analyze millions of transactions in real time, spotting anomalies within milliseconds. This helps banks block fraud before losses occur, while reducing false positives that frustrate customers.

Q3. Why do banks need predictive analytics engines in 2025?

A3. By 2025, fraud is projected to cost banks over $65 billion annually. Regulatory pressures are increasing, and digital transactions continue to surge. Predictive analytics engines provide scalable, compliant infrastructure to manage these risks proactively.

Q4. What are the key features of a predictive analytics engine for banks?

A4. Core features include data ingestion, real-time scoring, explainability dashboards, compliance-first governance, model retraining, and API-driven integration with existing banking cores and CRMs. These ensure accuracy, scalability, and regulator-ready transparency.

Q5. How much ROI can banks expect from predictive analytics engines?

A5. Institutions that have scaled predictive analytics report reductions of up to 60% in fraud losses, 35% in defaults, and 25% in customer retention within 2 years of deployment.